Académique Documents

Professionnel Documents

Culture Documents

Eskom Downgrade

Transféré par

GarethvanZylCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Eskom Downgrade

Transféré par

GarethvanZylDroits d'auteur :

Formats disponibles

Research Update:

Utility Eskom Downgraded To 'CCC+'

On Ongoing Liquidity Concerns And

Insufficient Government Support;

Outlook Negative

Primary Credit Analyst:

Omega Collocott, Johannesburg +27 11 214 4854; omega.collocott@spglobal.com

Secondary Contact:

Matan Benjamin, London +44 207 176 0106; matan.benjamin@spglobal.com

Table Of Contents

Overview

Rating Action

Rationale

Outlook

Related Criteria And Research

Ratings List

Regulatory Disclosures

Glossary

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT FEBRUARY 27, 2018 1

1999335 | 302569358

Research Update:

Utility Eskom Downgraded To 'CCC+' On Ongoing

Liquidity Concerns And Insufficient Government

Support; Outlook Negative

Overview

• Eskom remains at risk of facing a distressed exchange situation or default in the

next six months despite securing South African rand (ZAR) 30 billion in short-term

funding from local and international funders so far this year.

• We now believe there is a lower likelihood that Eskom would receive extraordinary

support from the government, reflecting our view that government support for the

utility over the past few months has been insufficient given that the utility's

liquidity concerns persist.

• We are therefore downgrading Eskom to 'CCC+' and 'zaB' from 'B-' and 'zaBB-'.

• The negative outlook points to uncertainty regarding the extent and timeliness of

government support for Eskom over the coming six months, considering the magnitude

of the utility's funding deficit and refinancing risks.

Rating Action

On Feb. 27, 2018, S&P Global Ratings lowered its long-term foreign and local

currency issuer credit ratings on South Africa-owned utility ESKOM Holdings SOC Ltd.

to 'CCC+' from 'B-'. The outlook is negative.

At the same time, we lowered our long-term South Africa national scale rating on

Eskom to 'zaB' from 'zaBB-', and affirmed our 'zaB' short-term national scale

rating.

Rationale

The downgrade reflects our view that the possibility of a distressed exchange or

default in the next six months continues to hang over Eskom despite the utility

having secured South African rand (ZAR) 30 billion (around $2.5 billion) in short-

term funding commitments from local and international funders over January-February

of this year. The rating action also incorporates our view that the support provided

by the government to Eskom over the past few months has been insufficient. This has

led us to reassess the likelihood of extraordinary government support for Eskom to

high from very high.

We note that Eskom has so far this year secured an additional gross ZAR30 billion in

short-term funding, of which only ZAR20 billion will be available beyond March 1,

2018. These recently concluded facilities are in the form of short-term bridging

finance.

Despite the near-term improvement in cash balances, Eskom has monthly debt service

of ZAR2 billion-ZAR6 billion over the six months ending Aug. 31, 2018, excluding

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT FEBRUARY 27, 2018 2

1999335 | 302569358

Research Update: Utility Eskom Downgraded To 'CCC+' On Ongoing Liquidity Concerns And Insufficient

Government Support; Outlook Negative

refinancing of its short-term bridge funding and recurring negative free cash flow.

Furthermore, the 5.2% sub-inflation tariff increase awarded by the regulator (NERSA)

in fiscal year 2019 (ending March 31, 2019), against a budgeted 10.5% increase, is

likely to exacerbate negative cash flow generation and weigh on already low investor

sentiment. We therefore anticipate pronounced pressure on Eskom's fiscal 2019

financing plans, which include capital expenditures (capex) of around ZAR55 billion

and negative free cash flow, as well as refinancing ZAR20 billion in bridge

financing due Aug. 31, 2018, and about ZAR20 billion in scheduled debt maturities.

Consequently, Eskom remains at risk of facing a distressed exchange situation or

default in the next six months.

We acknowledge that Eskom is addressing its structural and liquidity challenges,

including reducing its fiscal 2018 funding requirements by ZAR14 billion to ZAR54

billion, with the debt issuance reduction compensated by lower capex and operational

cash outflows. However, given that the company has already rationalized its capital

and operating expenditures significantly, we see limited additional scope for cost

cuts in fiscal 2019.

Furthermore, the qualified opinion issued to ESKOM on its fiscal 2017 financial

statements triggered a covenant in its ZAR15 billion facility from the Development

Bank of Southern Africa (DBSA). While the DBSA has provided a contingent waiver

(predicated on actions to be taken to ensure Eskom receives an unqualified audit

opinion for its fiscal 2018 financial statements), if the fiscal 2018 financial

statements are qualified, a covenant waiver breach could occur on or before June 30,

2018. Moreover, despite the bridging finance recently committed by local and

international market participants, we think market sentiment of international and

domestic investors is weak, implying that Eskom's ability to attract senior

unsecured debt funding in line with its requirements presents a significant

challenge. These factors underpin our 'ccc-' assessment of Eskom's stand-alone

credit profile (SACP).

Although the South African government has taken measures to help Eskom, we think

that government support to the utility over the past few months has been

insufficient. Nevertheless, of the government's actions to support Eskom, we note:

• The appointment of a new board, replacing the executives who had been allegedly

implicated in impropriety, and undertaking to appoint permanent executives in key

positions by March 2018; and

• Provision of explicit assistance in securing short-term bridging funding

commitments of ZAR30 billion from market participants (including a guarantee).

We recognize that the government's support in obtaining the aforementioned bridge

funding commitments played a key role in enabling the publication of Eskom's

(reviewed, unqualified) interim financial statements on Jan. 30, 2018, ahead of the

Johannesburg Securities Exchange (JSE) deadline of Jan. 31, 2018. Had this funding

not been secured, Eskom's reviewed interim financial statements for the six months

ended Sep. 30, 2017, would most likely have contained a going-concern qualification.

Also, in the event that the publication of the financial statements had been delayed

beyond Jan. 31, 2018, the JSE would have had the right to suspend trading in Eskom's

domestic bonds.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT FEBRUARY 27, 2018 3

1999335 | 302569358

Research Update: Utility Eskom Downgraded To 'CCC+' On Ongoing Liquidity Concerns And Insufficient

Government Support; Outlook Negative

Still, in our view, the government support made available in recent months provided

insufficient evidence of the government's ability and willingness to address severe

and imminent liquidity stresses in a timely or sustainable manner. Despite recent

events indicating that the government would adopt a more constructive attitude

toward supporting its state-owned enterprises, including statements by the President

in his State of the Nation address, the support framework set forth in the budget

speech on Feb. 21, 2018, fell short of our expectations. In our view, the budget

does not adequately address the amount and timing of financial support given Eskom's

imminent forthcoming liquidity requirements, and focused instead on previously-

announced planned strategic asset sale initiatives, extensions to the guarantee

framework, and changes to management structure.

Furthermore, current levels of government support follow diminished issuances in the

local bond and commercial paper markets after negative news concerning financial

impropriety in South African state-owned enterprises came to light in the State of

Capture report in October 2016, which was followed by resignations and suspensions

of members of Eskom's senior executive team. Despite these circumstances, during

2017 the government and national treasury did not provide meaningful additional

support beyond planned issuances under the government-guarantee framework (GSF).

While Eskom's total utilization of GSF guarantees appears to be broadly on track, we

note that only ZAR72 billion of the ZAR350 billion remains unutilized, of which

ZAR59 billion is currently under negotiation.

We believe that, cumulatively, the government has provided an insufficient response

to both the closure of local bond markets to Eskom in 2017, and, more recently, the

utility's acute liquidity challenges so far this year. Although we still believe

that Eskom will benefit from considerable government support, the circumstances

under which such support will be forthcoming have become less predictable, as has

the amount, nature, and timeliness.

Our 'ccc-' assessment of Eskom's SACP is based on our view of the utility's weak

liquidity, taking into account continuing and sizable negative free cash flow,

combined with the company's unsustainable capital structure (without government

support).

Liquidity

Our assessment of Eskom's liquidity as weak reflects the pressure Eskom faces, since

its revenues are insufficient to compensate for higher costs, significant capex

commitments, and the difficult operating environment which has constrained growth in

electricity demand. In addition, we think the company has a relatively high

dependence on what we consider to be uncommitted sources of funding. For example, as

of Jan. 30, 2018, the company was still negotiating approximately 46% of its ZAR55

billion of funding requirements for fiscal year ending March 31, 2018. We forecast

that Eskom's liquidity sources will cover its uses by materially less than 1.0x over

the 12 months started Dec. 31, 2017.

In addition, we consider that prospects for liquidity improvements continue to be

slim given the current depressed local issuance activity, and recent approval by the

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT FEBRUARY 27, 2018 4

1999335 | 302569358

Research Update: Utility Eskom Downgraded To 'CCC+' On Ongoing Liquidity Concerns And Insufficient

Government Support; Outlook Negative

regulator of sub-inflation tariff increases, which exacerbate the level of negative

cashflow generation.

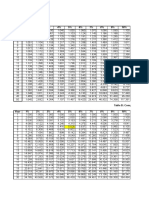

We calculate that Eskom had the following liquidity sources as of Dec. 31, 2018, and

over the subsequent 12 months, assuming that the ZAR30 billion committed bridge

funding is raised and repaid (ie, not refinanced) within the coming 12 months:

• Cash and marketable securities of about ZAR4.4 billion at the company level;

• Revolving credit lines of about ZAR3.2 billion; and

• Cash funds from operations of ZAR8 billion-ZAR9 billion.

We calculate the following liquidity uses for the same period:

• Capex of about ZAR45 billion-ZAR55 billion in the next 12 months; and

• Principal debt maturities of ZAR18 billion-ZAR20 billion.

Outlook

The negative outlook on Eskom reflects uncertainty regarding the government's

commitment and ability to provide timely support to cover any of the company's

funding shortfalls over the coming six months, and the risk of further deterioration

of the company's SACP.

Downside Scenario

We could lower our long-term rating on Eskom by one or more notches if we consider

that the likelihood of extraordinary government support has weakened further. We may

conclude that the likelihood of government support has reduced if we see further

weakness in the predictability and level of such support. This may be indicated by a

further deterioration of Eskom's financial position without offsetting measures

taken by the government. Such a scenario could occur, for example, if we were to

consider default or distressed exchange conditions were to become inevitable over a

less than three months horizon while the government was not providing any additional

support to the entity.

We could also lower the long-term rating by one notch if we downgrade the sovereign,

all other factors remaining unchanged.

Upside Scenario

We would consider revising the outlook to stable if pressure on Eskom's liquidity

eased sustainably, and the government provides additional funding to offset the

company's large negative free cash flow.

Related Criteria And Research

Related Criteria

• Criteria - Corporates - General: Reflecting Subordination Risk In Corporate Issue

Ratings - September 21, 2017

• General Criteria: S&P Global Ratings' National And Regional Scale Mapping Tables -

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT FEBRUARY 27, 2018 5

1999335 | 302569358

Research Update: Utility Eskom Downgraded To 'CCC+' On Ongoing Liquidity Concerns And Insufficient

Government Support; Outlook Negative

August 14, 2017

• General Criteria: Methodology For Linking Long-Term And Short-Term Ratings - April

07, 2017

• General Criteria: Rating Government-Related Entities: Methodology And Assumptions

- March 25, 2015

• Criteria - Corporates - General: Methodology And Assumptions: Liquidity

Descriptors For Global Corporate Issuers - December 16, 2014

• Criteria - Corporates - Utilities: Key Credit Factors For The Regulated Utilities

Industry - November 19, 2013

• Criteria - Corporates - General: Corporate Methodology: Ratios And Adjustments -

November 19, 2013

• General Criteria: Methodology: Industry Risk - November 19, 2013

• Criteria - Corporates - General: Corporate Methodology - November 19, 2013

• General Criteria: Country Risk Assessment Methodology And Assumptions - November

19, 2013

• General Criteria: Group Rating Methodology - November 19, 2013

• General Criteria: Ratings Above The Sovereign--Corporate And Government Ratings:

Methodology And Assumptions - November 19, 2013

• General Criteria: Methodology: Management And Governance Credit Factors For

Corporate Entities And Insurers - November 13, 2012

• General Criteria: Criteria For Assigning 'CCC+', 'CCC', 'CCC-', And 'CC' Ratings -

October 01, 2012

• General Criteria: Stand-Alone Credit Profiles: One Component Of A Rating - October

01, 2010

• General Criteria: Use Of CreditWatch And Outlooks - September 14, 2009

Related Research

• Research Update: South African Utility ESKOM Downgraded To 'B-' On Weaker

Liquidity And Reduced Likelihood Of Support; Outlook Negative, Nov. 28, 2017

Ratings List

Rating

To From

ESKOM Holdings SOC Ltd.

Corporate Credit Rating

Foreign and Local Currency CCC+/Negative/-- B-/Negative/--

South Africa National Scale zaB/--/zaB zaBB-/--/zaB

Senior Secured

Local Currency CCC+ B-

Senior Unsecured

Foreign Currency CCC+ B-

Local Currency CCC+ B-

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT FEBRUARY 27, 2018 6

1999335 | 302569358

Research Update: Utility Eskom Downgraded To 'CCC+' On Ongoing Liquidity Concerns And Insufficient

Government Support; Outlook Negative

Regulatory Disclosures

• Primary Credit Analyst: Omega Collocott, Director

• Rating Committee Chairperson: Matan Benjamin

• Date initial rating assigned: Nov. 21, 1995

• Date of previous review: Nov. 28, 2017

Disclaimers

This rating has been determined by a rating committee based solely on the

committee's independent evaluation of the credit risks and merits of the issuer or

issue being rated in accordance with S&P Global Ratings published criteria and no

part of this rating was influenced by any other business activities of S&P Global

Ratings.

This credit rating is solicited. The rated entity did participate in the credit

rating process. S&P Global Ratings did have access to the accounts, financial

records and other relevant internal, non-public documents of the rated entity or a

related third party. S&P Global Ratings has used information from sources believed

to be reliable but does not guarantee the accuracy, adequacy, or completeness of any

information used.

Glossary

• Anchor: The starting point for assigning an issuer a long-term rating, based on

its business risk profile assessment and its financial risk profile assessment.

• Acceleration event: The means the right--as set out in the documentation--by which

bank lenders or bondholders could demand early prepayment of loans or bonds,

respectively.

• Business risk profile: This measure comprises the risk and return potential for a

company in the market in which it participates (its industry risk), the country

risks within those markets, the competitive climate, the company's competitive

advantages and disadvantages (its competitive position).

• Capital: The sum of equity and debt.

• Competitive advantage: The strategic positioning and attractiveness to customers

of the company's products or services, and the fragility or sustainability of its

business model.

• Competitive position: Our assessment of a company's: competitive advantage;

operating efficiency; scale, scope, and diversity; and profitability.

• Country risk: This measures a country's influence on the overall credit risks for

a rated company with regards to a country's economic, institutional and governance

effectiveness, financial system, and payment culture/rule of law risks.

• CreditWatch: This highlights the potential direction of a short- or long-term

rating over the short term, typically less than three months. Ratings may be

placed on CreditWatch where, in our view, an event or a deviation from an expected

trend has occurred or is expected and additional information is necessary to

determine the rating impact.

• Creditworthiness: Ability and willingness of a company to meet its debt and debt-

like obligations; measured by assessing the level current and future resources

relative to the size and timing of its commitments.

• Earnings: Proxy for profit or surplus yielded by an entity after production and

overhead costs have been accounted for in a given period.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT FEBRUARY 27, 2018 7

1999335 | 302569358

Research Update: Utility Eskom Downgraded To 'CCC+' On Ongoing Liquidity Concerns And Insufficient

Government Support; Outlook Negative

• EBITDA margin: This is EBITDA as a fraction of revenues.

• EBITDA: This is earnings before interest, tax, depreciation, and amortization.

• Economies of scale: This is the cost advantage that arises with increased size or

output of a product.

• Efficiency gains: Cost improvements.

• Financial headroom: Measure of deviation tolerated in financial metrics without

moving outside or above a predesignated band or limit typically found in loan

covenants (as in a debt-to-EBITDA multiple that places a constraint on leverage)

or set for the respective rating level. Significant headroom would allow for

larger deviations.

• Financial risk profile: This measure comprises our assessment of a company's cash

flow/leverage analysis. It also takes into account the relationship of the cash

flows the organization can achieve given its business risk profile. The measure is

before assessing other financial drivers such as capital structure, financial

policy, or liquidity.

• Free operating cash flow: Cash flow from operations minus capital expenditure.

• Funds from operations: EBITDA minus interest expense minus current tax.

• Government-related entity: An entity that could, under stress, benefit from

extraordinary government support in order to meet its financial obligations; or

conversely an entity controlled by a government that could be subject to negative

extraordinary government intervention if the government is under stress.

• Group rating methodology: The assessment of the likelihood of extraordinary group

support (or conversely, negative group intervention) that is factored into the

rating on an entity that is a member of a group.

• Industry risk: This addresses the major factors that affect the risks that

companies face in their respective industries.

• Issue credit rating: This is a forward-looking opinion about the creditworthiness

of an obligor with respect to a specific class of financial obligations or a

specific financial program.

• Issuer credit rating: This is a forward-looking opinion of an obligor's overall

creditworthiness.

• Leverage: The level of a company's debt in relation to its earnings before

interest, tax, depreciation, and amortization.

• Liquidity: This is the assessment of a company's monetary flows, assessed over a

12 to 24 month period. It also assesses the risk and potential consequences of a

company's breach of covenant test, typically tied to declines in EBITDA.

• Management and governance: This addresses how management's strategic competence,

organizational effectiveness, risk management, and governance practices shape the

issuer's competitiveness in the marketplace, the strength of its financial risk

management, and the robustness of its governance.

• Operating efficiency: The quality and flexibility of the company's asset base and

its cost management and structure.

• Outlook: This is the assessment of the potential direction of a long-term issuer

rating over the short to intermediate term (typically six months to two years).

• Profitability ratio: Commonly measured using return on capital and EBITDA margins,

but can be measured using sector-specific ratios.

• Stand-alone credit profile (SACP): S&P Global Ratings' opinion of an issue's or

issuer's creditworthiness, in the absence of extraordinary intervention or support

from its parent, affiliate, or related government or from a third-party entity

such as an insurer.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT FEBRUARY 27, 2018 8

1999335 | 302569358

Research Update: Utility Eskom Downgraded To 'CCC+' On Ongoing Liquidity Concerns And Insufficient

Government Support; Outlook Negative

Certain terms used in this report, particularly certain adjectives used to express

our view on rating relevant factors, have specific meanings ascribed to them in our

criteria, and should therefore be read in conjunction with such criteria. Please see

Ratings Criteria at www.standardandpoors.com for further information. Complete

ratings information is available to subscribers of RatingsDirect at

www.capitaliq.com. All ratings affected by this rating action can be found on S&P

Global Ratings' public website at www.standardandpoors.com. Use the Ratings search

box located in the left column. Alternatively, call one of the following S&P Global

Ratings numbers: Client Support Europe (44) 20-7176-7176; London Press Office (44)

20-7176-3605; Paris (33) 1-4420-6708; Frankfurt (49) 69-33-999-225; Stockholm (46)

8-440-5914; or Moscow 7 (495) 783-4009.

Additional Contact:

Industrial Ratings Europe; Corporate_Admin_London@spglobal.com

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT FEBRUARY 27, 2018 9

1999335 | 302569358

Copyright © 2018 by Standard & Poor’s Financial Services LLC. All rights reserved.

No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part

thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval

system, without the prior written permission of Standard & Poor's Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be

used for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or

agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not

responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for

the security or maintenance of any data input by the user. The Content is provided on an "as is" basis. S&P PARTIES DISCLAIM ANY AND ALL

EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR

A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT'S FUNCTIONING

WILL BE UNINTERRUPTED, OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no

event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential

damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by

negligence) in connection with any use of the Content even if advised of the possibility of such damages.

Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and

not statements of fact. S&P's opinions, analyses, and rating acknowledgment decisions (described below) are not recommendations to purchase,

hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to

update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment

and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P does

not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be

reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives.

To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain

regulatory purposes, S&P reserves the right to assign, withdraw, or suspend such acknowledgement at any time and in its sole discretion. S&P

Parties disclaim any duty whatsoever arising out of the assignment, withdrawal, or suspension of an acknowledgment as well as any liability for any

damage alleged to have been suffered on account thereof.

S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective

activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established

policies and procedures to maintain the confidentiality of certain nonpublic information received in connection with each analytical process.

S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P

reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites,

www.standardandpoors.com (free of charge), and www.ratingsdirect.com and www.globalcreditportal.com (subscription) and www.spcapitaliq.com

(subscription) and may be distributed through other means, including via S&P publications and third-party redistributors. Additional information

about our ratings fees is available at www.standardandpoors.com/usratingsfees.

STANDARD & POOR'S, S&P and RATINGSDIRECT are registered trademarks of Standard & Poor's Financial Services LLC.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT FEBRUARY 27, 2018 10

1999335 | 302569358

Vous aimerez peut-être aussi

- Spiva South Africa Mid Year 2018Document11 pagesSpiva South Africa Mid Year 2018GarethvanZylPas encore d'évaluation

- About #MyGivingStoryDocument1 pageAbout #MyGivingStoryGarethvanZylPas encore d'évaluation

- TMF NDRDocument30 pagesTMF NDRPrimedia BroadcastingPas encore d'évaluation

- SARB Project KhokhaDocument80 pagesSARB Project KhokhaGarethvanZylPas encore d'évaluation

- Government Gazette: Changes To Investment ActDocument40 pagesGovernment Gazette: Changes To Investment ActGarethvanZylPas encore d'évaluation

- Illegal CigaretteDocument3 pagesIllegal CigaretteeNCA.comPas encore d'évaluation

- Joubert Letter To Kroon June 2015Document8 pagesJoubert Letter To Kroon June 2015GarethvanZylPas encore d'évaluation

- Imperial HoldingsDocument2 pagesImperial HoldingsGarethvanZylPas encore d'évaluation

- Jack-Ma BioDocument1 pageJack-Ma BioGarethvanZylPas encore d'évaluation

- Hogan Lovells' SARS ReportDocument88 pagesHogan Lovells' SARS ReportGarethvanZylPas encore d'évaluation

- Steinhoff Lenders PresentationDocument40 pagesSteinhoff Lenders PresentationGarethvanZylPas encore d'évaluation

- Alibaba in Africa Fact SheetDocument5 pagesAlibaba in Africa Fact SheetGarethvanZylPas encore d'évaluation

- Infographics 05 July 2018Document3 pagesInfographics 05 July 2018GarethvanZylPas encore d'évaluation

- TISA IPSOS Media Presentation 05 July 2018Document25 pagesTISA IPSOS Media Presentation 05 July 2018GarethvanZylPas encore d'évaluation

- Letter To RSA Information RegulatorDocument6 pagesLetter To RSA Information RegulatorGarethvanZylPas encore d'évaluation

- Tom Moyane's Suspension LetterDocument4 pagesTom Moyane's Suspension LetterGarethvanZyl100% (1)

- GS Report On SA 'New Deal'Document18 pagesGS Report On SA 'New Deal'GarethvanZylPas encore d'évaluation

- Jooste Won't Attend Letter To Parliament 23.03.201822Document2 pagesJooste Won't Attend Letter To Parliament 23.03.201822eNCA.comPas encore d'évaluation

- Futuregrowth SOE Governance UnmaskedDocument47 pagesFuturegrowth SOE Governance UnmaskedGarethvanZylPas encore d'évaluation

- Letter To DPCI & NPA From ex-SARS TrioDocument8 pagesLetter To DPCI & NPA From ex-SARS TrioGarethvanZylPas encore d'évaluation

- Valuing The Rand: Dawie RoodtDocument3 pagesValuing The Rand: Dawie RoodtGarethvanZylPas encore d'évaluation

- David MabuzaDocument38 pagesDavid MabuzaGarethvanZyl100% (6)

- Public Protector JudgmentDocument74 pagesPublic Protector JudgmentGarethvanZylPas encore d'évaluation

- Siu Owp Investgation Report FinalDocument173 pagesSiu Owp Investgation Report FinalGarethvanZylPas encore d'évaluation

- The Inclusive Development Index 2018 Summary and Data HighlightsDocument14 pagesThe Inclusive Development Index 2018 Summary and Data HighlightsGarethvanZylPas encore d'évaluation

- Fairtree Capital Viceroy ResponseDocument2 pagesFairtree Capital Viceroy ResponseGarethvanZylPas encore d'évaluation

- Viceroy CapitecDocument33 pagesViceroy CapitecPrimedia Broadcasting100% (5)

- NDPP Memorandum 2016-04-12Document2 pagesNDPP Memorandum 2016-04-12GarethvanZylPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5782)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- PROBLEMS Page-202Document2 pagesPROBLEMS Page-202Anonymous YhAvdEdRPas encore d'évaluation

- FMI AssignmentDocument5 pagesFMI Assignmentdestaw getu0% (1)

- Introduction To AccountingDocument39 pagesIntroduction To AccountingVikash HurrydossPas encore d'évaluation

- Att 1382407162073Document30 pagesAtt 1382407162073yagami RPas encore d'évaluation

- 8th Mode of FinancingDocument30 pages8th Mode of FinancingYaseen IqbalPas encore d'évaluation

- ROASTED RICE FLAKES PROJECT PROFILEDocument7 pagesROASTED RICE FLAKES PROJECT PROFILEPrafulla ChandraPas encore d'évaluation

- A Project Report On Contracts of Indemnity & Guarantee: Features and Distinctiveness'Document21 pagesA Project Report On Contracts of Indemnity & Guarantee: Features and Distinctiveness'Mandira Prakash100% (1)

- MCQ For SNVM PDFDocument23 pagesMCQ For SNVM PDFAnonymous xN0cuz68yw100% (3)

- Opening Case - Dilemma of Vishal JhulkaDocument2 pagesOpening Case - Dilemma of Vishal JhulkaSurbhi SabharwalPas encore d'évaluation

- BEKS - Annual Report - 2017 - Revisi PDFDocument596 pagesBEKS - Annual Report - 2017 - Revisi PDFWilliam WongPas encore d'évaluation

- Financial Markets and InstrumentDocument30 pagesFinancial Markets and InstrumentAbdul Fattaah Bakhsh 1837065Pas encore d'évaluation

- Rights and Obligations in Pledge AgreementsDocument6 pagesRights and Obligations in Pledge AgreementsKath LeynesPas encore d'évaluation

- YEAR 10 COMMERCE Yearly Exam NotificationDocument2 pagesYEAR 10 COMMERCE Yearly Exam NotificationHugo BarnesPas encore d'évaluation

- This Study Resource WasDocument2 pagesThis Study Resource WasikhsanPas encore d'évaluation

- The Tip of Indian Banking - Part 4Document424 pagesThe Tip of Indian Banking - Part 4ambujchinuPas encore d'évaluation

- Media Statement On Student Funding by The Minister of Higher Education and TrainingDocument5 pagesMedia Statement On Student Funding by The Minister of Higher Education and TrainingeNCA.comPas encore d'évaluation

- Redemption of DebenturesDocument11 pagesRedemption of Debenturesadeeba_kaziiPas encore d'évaluation

- Idbi McomDocument82 pagesIdbi McomShweta GuptaPas encore d'évaluation

- Malayan Insurance V Emma Concepcion - GR 207277Document2 pagesMalayan Insurance V Emma Concepcion - GR 207277JiesaPas encore d'évaluation

- BARRY HOLT/Honda Default NoticeDocument3 pagesBARRY HOLT/Honda Default Noticestanley evris deyPas encore d'évaluation

- PPSADocument2 pagesPPSAchrislee81Pas encore d'évaluation

- Moa Aoa DraftDocument17 pagesMoa Aoa DraftAniruddha NayakPas encore d'évaluation

- Axis Bank History, Services and Why Choose Axis BankDocument2 pagesAxis Bank History, Services and Why Choose Axis BankAyush LohiaPas encore d'évaluation

- The Impact of Recent Global Economic Slump On Indian Capital MarketDocument25 pagesThe Impact of Recent Global Economic Slump On Indian Capital MarketKalpeshjini50% (2)

- E-BANKING FEATURES, BENEFITS AND IMPACT OF DIGITAL TRANSFORMATIONDocument4 pagesE-BANKING FEATURES, BENEFITS AND IMPACT OF DIGITAL TRANSFORMATIONMir AqibPas encore d'évaluation

- RFBT Comprehensive Exam On Obligations Feb 25 2020Document25 pagesRFBT Comprehensive Exam On Obligations Feb 25 2020Hazel Marie De GuzmanPas encore d'évaluation

- List of Ledgers and It's Under Group in TallyDocument5 pagesList of Ledgers and It's Under Group in Tallyrachel KujurPas encore d'évaluation

- RKG-NCLT Case Analysis On IBCDocument34 pagesRKG-NCLT Case Analysis On IBCranjusanjuPas encore d'évaluation

- TVM TablesDocument13 pagesTVM TablesSaurabh ShuklaPas encore d'évaluation

- ENBDDocument1 pageENBDpvr2k1Pas encore d'évaluation