Académique Documents

Professionnel Documents

Culture Documents

A Project Report

Transféré par

Mona BahetiCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

A Project Report

Transféré par

Mona BahetiDroits d'auteur :

Formats disponibles

STRUCTURE OF INDIAN BANKING SYSTEM

A PROJECT REPORT

ON

“STRUCTURE OF INDIAN BANKING

SYSTEM”

Bachelor of Commerce

(Banking & Insurance)

Semester – V

(2017-2018)

Submitted by

ROHIT MANOJ BAHETI

Roll No.- 3

Under Guidance of

PROF. RACHANA MEHTA

K.P.B HINDUJA COLLEGE OF

COMMERCE

315, New Charni Road,

Mumbai- 04

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

Smt. P.D. Hinduja

Trust’s

K.P.B.HINDUJA COLLEGE OF COMMERCE

315, New Charni Road, Mumbai 400 004 Tel.: 022- 40989000 Fax: 2385 93 97. Email:

COMMERCE hindujacollege@gmail.com

NAAC Re-Accredited

ISO 9001:2008 THE BEST COLLEGE OF UNIVERSITY‘A’

COMMERCE OF MUMBAI FOR THE ACADEMIC YEAR 2010-2011

Prin. Dr. Minu Madlani (M. Com., Ph. D.)

vCOMMERCE

CERTIFICATE

COMMERCE

COMMERCE

This is to certify that Mr. ROHIT MANOJ BAHETI of B.Com (Banking &

COMMERCE

Insurance) Semester

COMMERCE 5th [2017-2018] has successfully completed the Project

cccCOMMERCE

on “STRUCTURE OF INDIAN BANKING SYSTEM” under the guidance

of PROF. RACHANA MEHTA

________________ ________________

Project Guide Co-ordinator

________________ ________________

Internal Examiner External Examiner

________________ ________________

Principal College Seal

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

DECLRATION

I ROHIT MANOJ BAHETI studying in T.Y. Banking & Insurance hereby

declare that I have done this project on

“ STRUCTURE OF INDIAN BANKING SYSTEM”. As required by the

university rules.

The information submitted is true and original to the best of my knowledge, has

not been submitted so far to any other university.

Signature of Student

(ROHIT MANOJ BAHETI)

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

ACKNOWLEDGEMENT

The project on structure of Indian banking system is a result of co-operation,

hard work and good wishes of many people. I student of K.P.B. HINDUJA

COLLEGE OF COMMERCE would like to thank. The principal and the vice

principal of our college.

I would like thank MISS.RACHANA MEHTA for his involvement in my

project work and timely assessment that provided me inspiration and valued

guidance throughout my study.

I own my debt to PROF. NITIN BHARASKAR course coordinator for her

friendly guidance and constant encouragement.

I also take this opportunity to express my sincere gratitude to the library

staff,which provided me with right information and right material at the right

time

I express my deep gratitude to all my college friends and my family members

whose efforts and creativity has helped me in giving me the final structure to the

project work

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

EXECUTIVE SUMMARY

Banking system occupies an important place in nation's economy. A banking

institution is indispensable in a modern society. It plays a pivotal role in the

economic development of a country. Thus, economic development of a country

depends upon success of banking industry and success of banking Industry is

determined to a large extent by now well then needs of its customers have been

understood and satisfied.

The Indian banking industry has come a long way from being a sleepy business

institution to a highly proactive and dynamic entity. The liberalization and

economic reforms have largely brought about this transformation. The entry of

private banks has revamped the services and product portfolio of nationalized

banks. With efficiency being the major focus, the private banks are leveraging

on their strengths.

To compete with the private banks, the public sector banks are now going in for

major image changes and customer friendly schemes. Increasing competition

and technology driven products are some of the trends which the banking

industry is currently experiencing. The technology oriented banking has

become one of the latest success mantra in market especially to win over the

customers. Due to entry of private banks which are known for technical and

financial innovation their professional management has gained a remarkable

position in banking sector.

The dissertation entitled “Structure of Indian Banking System” is focused to

study:

The structure of Indian banking system by which the working of Indian

banks is done.

Research on Central Bank of India (i.e. Reserve Banks of India ) to

study its history and functions.

All the types of banks working in India are included in this project to

study the proper structure of Indian Banking System.

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

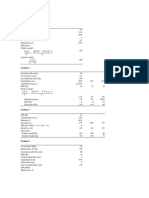

INDEX

Sr. TOPIC PAGE

No.

No.

CHAPTER-1

(INTRODUCTION)

1.1 Objectives of the Study

1.2 Scope of the Study

1.3 Limitations of the Study

1.4 Problems

CHAPTER-2

(BANKING IN INDIA)

2.1 Introduction

2.2 History

2.3 Banking- a need of time

CHAPTER-3

(STRUCTURE OF INDIAN BANKING

SYSTEM)

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

3.1 Reserve Bank of India

3.2 Commercial Banks

3.3 Regional Rural Banks

3.4 Cooperative Banks

CHAPTER-4

4.1 Different types of Products

4.2 Loans & Advances

4.3 Other Services

Investment / Development

Government Initiative

Career in Banking

Conclusion

Bibliography

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

CHAPTER-1

1.1 OBJECTIVES OF THE STUDY:-

To study the complete structure of Indian Banking System.

To study the role of bank in Indian Market.

To study the current bank scenario and its problems.

To study about the different types of banks in India.

To study different types of services provided by banks in India.

To study the function of banks in Indian Market.

To understand the importance of banking sector.

To study various banks in India: Central, Commercial, Cooperate.

1.2 SCOPE OF THE STUDY:-

A healthy banking system is essential for any economy striving to

achieve good growth and yet remain stable in an increasingly global

business environment. The Indian Banking System, with one of the

largest banking networks in the world, has witnessed a series of reforms

over the past few years like the deregulation of interest rates, dilution of

the government stake in Public Sector Banks (PSBs), and the increased

participants of private sector banks.

The growth of the retail financial services sector has been a key

development on the market front. Indian banks have not only been keen

to tap the domestic market but also to compete in the global market place.

Studying the increasing business scope of the bank.

Market segmentation to find the potential customers for the bank.

The corporate sector has stepped up its demand for credit to funds its

expansion plans; there has also been growth in retail banking.

The report seeks to present a comprehensive picture of various types of

bank. The bank can broadly classified into two categories:-

i. Nationalize Bank.

ii. Private Bank.

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

1.3 LIMITATIONS OF THE STUDY:-

Every work has its own limitation. Limitations are extent to which process

should not exceed. Limitations of this project are:-

Each bank, in conforming to the RBI guidelines, may develop its own

methods for measuring and managing risk.

Due to the ongoing process of globalization and increasing competition,

no one model or method will stay over a long period of time and constant

up gradation will be required. As such the project can be considered as an

overview of the various banks prevailing in the Banking Industy.

The major limitation of this study shall be data availability as the datais

proprietary and not readily shared for dissemination.

The project study is restricted to banking sector used in India only.

The conclusion made is based on a sample study and does not apply to all

the individuals.

In India, the banks are being segregated in different groups. Each group

has their own benefits and limitations in operating in India.

All banks are not included.

1.4 PROBLEMS:-

The corporate sector has stepped up its demand for credit to fund its expansion

plans, there has also been a growth in retail banking. However, even as the

opportunities increase, there are some issues and challenges that Indian Banking

will have to contend with if they are to emerge successful in the medium of long

term.

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

CHAPTER-2

2.1 INTRODUCTION

Banking in India, in the modern sense, originated in the last decades of the

18th century. Among the first banks were the Bank of Hindostan, which was

established in 1770 and liquidated in 1829-32; and the General Bank of India,

established in 1786 but failed in 1791.[1][2][3][4]

The largest bank, and the oldest still in existence, is the State Bank of India

(S.B.I). It originated as the Bank of Calcutta in June 1806. In 1809, it was

renamed as the Bank of Bengal. This was one of the three banks funded by a

presidency government, the other two were the Bank of Bombay and the Bank

of Madras. The three banks were merged in 1921 to form the Imperial Bank of

India, which upon India's independence, became the State Bank of India in

1955. For many years the presidency banks had acted as quasi-central banks, as

did their successors, until the Reserve Bank of India was established in 1935,

under the Reserve Bank of India Act, 1934.[5][6]

In 1960, the State Banks of India was given control of eight state-associated

banks under the State Bank of India (Subsidiary Banks) Act, 1959. These are

now called its associate banks.[5] In 1969 the Indian government nationalised 14

major private banks. In 1980, 6 more private banks were nationalised.[7] These

nationalised banks are the majority of lenders in the Indian economy. They

dominate the banking sector because of their large size and widespread

networks.[8]

The Indian banking sector is broadly classified into scheduled banks and non-

scheduled banks. The scheduled banks are those included under the 2nd

Schedule of the Reserve Bank of India Act, 1934. The scheduled banks are

further classified into: nationalised banks; State Bank of India and its associates;

Regional Rural Banks (RRBs); foreign banks; and other Indian private sector

banks.[6] The term commercial banks refers to both scheduled and non-

scheduled commercial banks regulated under the Banking Regulation Act,

1949.[9]

Generally banking in India is fairly mature in terms of supply, product range

and reach-even though reach in rural India and to the poor still remains a

challenge. The government has developed initiatives to address this through the

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

State Bank of India expanding its branch network and through the National

Bank for Agriculture and Rural Development with facilities like microfinance.

The banking sector is the lifeline of any modern economy. It is one of the

important financial pillars of the financial sector, which plays a vital role in the

functioning of an economy. It is very important for economic development of a

country that its financing requirements of trade, industry and agriculture are met

with higher degree of commitment and responsibility. Thus, the development of

a country is integrally linked withthe development of banking. In a modern

economy, banks are to be considered not as dealers in money but as the leaders

of development. They play an important role in the mobilization of deposits and

disbursement of credit to various sectors of the economy.

The banking system reflects the economic health of the country. The strength of

an economy depends on the strength and efficiency of the financial system,

which in turn depends on a sound and solvent banking system. A sound banking

system efficiently mobilized savings in productive sectors and a solvent banking

system ensures that the bank is capable of meeting its obligation to the

depositors.

In India, banks are playing a crucial role in socio-economic progress of the

country after independence. The banking sector is dominant in India as it

accounts for more than half the assets of the financial sector. Indian banks have

been going through a fascinating phase through rapid changes brought about by

financial sector reforms, which are being implemented ina phased manner.

The current process of transformation should be viewed as an opportunity to

convert Indian banking into a sound, strong and vibrant system capable of

playing its role efficiently and effectively on their own without imposing any

burden on government.

After the liberalization of the Indian economy, the Government has announced a

number of reform measures on the basis of the recommendation of the

Narasimhan Committee to make the banking sector economically viable and

competitively strong.

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

2.2 HISTORY OF BANKING IN INDIA

Ancient India

The Vedas (2000-1400 BCE) are earliest Indian texts to mention the concept of

usury. The word kusidin is translated as usurer. The Sutras (700-100 BCE) and

the Jatakas (600-400 BCE) also mention usury. Also, during this period, texts

began to condemn usury. Vasishtha forbade Brahmin and Kshatriya varnas from

participating in usury. By the 2nd century CE, usury seems to have become

more acceptable.[10] The Manusmriti considers usury an acceptable means of

acquiring wealth or leading a livelihood.[11] It also considers money lending

above a certain rate, different ceiling rates for different caste, a grave sin.[12]

The Jatakas also mention the existence of loan deeds. These were called

rnapatra or rnapanna. The Dharmashastras also supported the use of loan

deeds. Kautilya has also mentioned the usage of loan deeds.[13] Loans deeds

were also called rnalekhaya.[14]

Later during the Mauryan period (321-185 BCE), an instrument called adesha

was in use, which was an order on a banker directing him to pay the sum on the

note to a third person, which corresponds to the definition of a modern bill of

exchange. The considerable use of these instruments has been recorded[citation

needed]

. In large towns, merchants also gave letters of credit to one another.[14]

Medieval era

The use of loan deeds continued into the Mughal era and were called dastawez.

Two types of loans deeds have been recorded. The dastawez-e-indultalab was

payable on demand and dastawez-e-miadi was payable after a stipulated time.

The use of payment orders by royal treasuries, called barattes, have been also

recorded. There are also records of Indian bankers using issuing bills of

exchange on foreign countries. The evolution of hundis, a type of credit

instrument, also occurred during this period and remain in use.[14]

Colonial era

During the period of British rule merchants established the Union Bank of

Calcutta in 1829,[15] first as a private joint stock association, then partnership. Its

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

proprietors were the owners of the earlier Commercial Bank and the Calcutta

Bank, who by mutual consent created Union Bank to replace these two banks.

In 1840 it established an agency at Singapore, and closed the one at Mirzapore

that it had opened in the previous year. Also in 1840 the Bank revealed that it

had been the subject of a fraud by the bank's accountant. Union Bank was

incorporated in 1845 but failed in 1848, having been insolvent for some time

and having used new money from depositors to pay its dividends.[16]

The Allahabad Bank, established in 1865 and still functioning today, is the

oldest Joint Stock bank in India, it was not the first though. That honour belongs

to the Bank of Upper India, which was established in 1863 and survived until

1913, when it failed, with some of its assets and liabilities being transferred to

the Alliance Bank of Simla.

Foreign banks too started to appear, particularly in Calcutta, in the 1860s. The

Comptoir d'Escompte de Paris opened a branch in Calcutta in 1860, and another

in Bombay in 1862; branches followed in Madras and Pondicherry, then a

French possession. HSBC established itself in Bengal in 1869. Calcutta was the

most active trading port in India, mainly due to the trade of the British Empire,

and so became a banking centre.

The first entirely Indian joint stock bank was the Oudh Commercial Bank,

established in 1881 in Faizabad. It failed in 1958. The next was the Punjab

National Bank, established in Lahore in 1894, which has survived to the present

and is now one of the largest banks in India.

Around the turn of the 20th Century, the Indian economy was passing through a

relative period of stability. Around five decades had elapsed since the Indian

rebellion, and the social, industrial and other infrastructure had improved.

Indians had established small banks, most of which served particular ethnic and

religious communities.

The presidency banks dominated banking in India but there were also some

exchange banks and a number of Indian joint stock banks. All these banks

operated in different segments of the economy. The exchange banks, mostly

owned by Europeans, concentrated on financing foreign trade. Indian joint stock

banks were generally under capitalised and lacked the experience and maturity

to compete with the presidency and exchange banks. This segmentation let Lord

Curzon to observe, "In respect of banking it seems we are behind the times. We

are like some old fashioned sailing ship, divided by solid wooden bulkheads

into separate and cumbersome compartments."[citation needed]

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

The period between 1906 and 1911 saw the establishment of banks inspired by

the Swadeshi movement. The Swadeshi movement inspired local businessmen

and political figures to found banks of and for the Indian community. A number

of banks established then have survived to the present such as The South Indian

Bank, Bank of India, Corporation Bank, Indian Bank, Bank of Baroda, Canara

Bank and Central Bank of India.

The fervour of Swadeshi movement led to the establishment of many private

banks in Dakshina Kannada and Udupi district, which were unified earlier and

known by the name South Canara (South Kanara) district. Four nationalised

banks started in this district and also a leading private sector bank. Hence

undivided Dakshina Kannada district is known as "Cradle of Indian

Banking".[citation needed]

The inaugural officeholder was the Britisher Sir Osborne Smith(1 April 1935),

while C. D. Deshmukh(11 August 1943) was the first Indian governor.On

September 4, 2016, Urjit R Patel begins his journey as the new RBI Governor,

taking charge from Raghuram Rajan.[17]

During the First World War (1914–1918) through the end of the Second World

War (1939–1945), and two years thereafter until the independence of India were

challenging for Indian banking. The years of the First World War were

turbulent, and it took its toll with banks simply collapsing despite the Indian

economy gaining indirect boost due to war-related economic activities. At least

94 banks in India failed between 1913 and 1918 as indicated in the following

table:

Number of banks Authorised Capital Paid-up Capital

Years

that failed (₹ Lakhs) (₹ Lakhs)

1918 7 209 1

1917 9 76 25

1916 13 231 4

1915 11 56 5

1914 42 710 109

1913 12 274 35

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

Post-Independence

The partition of India in 1947 adversely impacted the economies of Punjab and

West Bengal, paralysing banking activities for months. India's independence

marked the end of a regime of the Laissez-faire for the Indian banking. The

Government of India initiated measures to play an active role in the economic

life of the nation, and the Industrial Policy Resolution adopted by the

government in 1948 envisaged a mixed economy. This resulted in greater

involvement of the state in different segments of the economy including

banking and finance. The major steps to regulate banking included:

The Reserve Bank of India, India's central banking authority, was

established in April 1935, but was nationalised on 1 January 1949 under

the terms of the Reserve Bank of India (Transfer to Public Ownership)

Act, 1948 (RBI, 2005b).[18]

In 1949, the Banking Regulation Act was enacted, which empowered the

Reserve Bank of India (RBI) "...to regulate, control, and inspect the banks

in India."

The Banking Regulation Act also provided that no new bank or branch of

an existing bank could be opened without a license from the RBI, and no

two banks could have common directors.

Nationalisation in the 1960s

Despite the provisions, control and regulations of the Reserve Bank of India,

banks in India except the State Bank of India (SBI), remain owned and operated

by private persons. By the 1960s, the Indian banking industry had become an

important tool to facilitate the development of the Indian economy. At the same

time, it had emerged as a large employer, and a debate had ensued about the

nationalisation of the banking industry. Indira Gandhi, the then Prime Minister

of India, expressed the intention of the Government of India in the annual

conference of the All India Congress Meeting in a paper entitled "Stray

thoughts on Bank Nationalization."[19] The meeting received the paper with

enthusiasm.

Thereafter, her move was swift and sudden. The Government of India issued an

ordinance ('Banking Companies (Acquisition and Transfer of Undertakings)

Ordinance, 1969') and nationalised the 14 largest commercial banks with effect

from the midnight of 19 July 1969. These banks contained 85 percent of bank

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

deposits in the country.[19] Jayaprakash Narayan, a national leader of India,

described the step as a "masterstroke of political sagacity." Within two weeks

of the issue of the ordinance, the Parliament passed the Banking Companies

(Acquisition and Transfer of Undertaking) Bill, and it received the presidential

approval on 9 August 1969.

A second dose of nationalisation of 6 more commercial banks followed in 1980.

The stated reason for the nationalisation was to give the government more

control of credit delivery. With the second dose of nationalisation, the

Government of India controlled around 91% of the banking business of India.

Later on, in the year 1993, the government merged New Bank of India with

Punjab National Bank.[20] It was the only merger between nationalised banks

and resulted in the reduction of the number of nationalised banks from 20 to 19.

Until the 1990s, the nationalised banks grew at a pace of around 4%, closer to

the average growth rate of the Indian economy.

Liberalisation in the 1990s

In the early 1990s, the then government embarked on a policy of liberalisation,

licensing a small number of private banks. These came to be known as New

Generation tech-savvy banks, and included Global Trust Bank (the first of such

new generation banks to be set up), which later amalgamated with Oriental

Bank of Commerce, UTI Bank (since renamed Axis Bank), ICICI Bank and

HDFC Bank. This move, along with the rapid growth in the economy of India,

revitalised the banking sector in India, which has seen rapid growth with strong

contribution from all the three sectors of banks, namely, government banks,

private banks and foreign banks.

The next stage for the Indian banking has been set up, with proposed relaxation

of norms for foreign direct investment. All foreign investors in banks may be

given voting rights that could exceed the present cap of 10% at present. It has

gone up to 74% with some restrictions.

The new policy shook the Banking sector in India completely. Bankers, till this

time, were used to the 4–6–4 method (borrow at 4%; lend at 6%; go home at 4)

of functioning. The new wave ushered in a modern outlook and tech-savvy

methods of working for traditional banks. All this led to the retail boom in

India. People demanded more from their banks and received more.

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

2.3 BANKING - A NEED OF TIME

Although using a bank is the most common method of storing and accessing

your money, there are some alternatives you should consider. If you feel that

your bank isn't giving you what you want, then perhaps it is time for a change.

Here are some banking alternatives that might be able to offer you the features

and services that you require.

Of course, the main reason to use a bank is the fact that banks are widely

available, and they are the first option that comes to mind when dealing with

finances. In fact, some people aren't even aware that there are alternatives to

banking apart from keeping your money at home. Although banking has its

uses, it can cost you money for day-to-day financial matters that you can get for

less. Bank fees can be extremely expensive, but there are some alternatives.

Credit unions are one alternative to using conventional banks. Unlike banks,

credit unions are not for profit organisations that are run by their members.

Credit unions are used by people who share a workplace or occupation, or even

a religion. They offer many of the same services as banks, but because profit is

not their main function they can offer lower fees and higher interest rates on

savings than normal banks. Credit unions can be fairly large and organisations,

and some offer similar levels of convenience to a regular bank. If you are

looking for cheaper fees and better interest rates on savings then a credit union

might be right for you. However, credit unions are still small compared to

banks, and you cannot simply join the credit union of your choice. You have to

meet their specific requirements or be related to someone who is already a

member in order to join. Also, you generally have to save money with a credit

union before you can have access to other financial products

Perhaps the best alternative to traditional banking is online banking. There are

many banks that operate solely online, and there are a lot of benefits to this sort

of bank. Although you might not be able to get money as easily as you could

with a normal bank, you can transfer funds and pay bills much more efficiently.

Also, online banks usually operate all day every day, meaning that you can

access your account and carry out transactions whenever you want. For paying

bills and transferring money, you can't really beat online banking.

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

2.4 DIFFERENT TYPES OF BANKS

1. CENTRAL BANK

A central bank, reserve bank, or monetary authority is a public institution that

usually issues the currency, regulates the money supply, and controls the

interest rates in a country. Central banks often also oversee the commercial

banking system of their respective countries. In contrast to a commercial bank, a

central bank possesses a monopoly on printing the national currency, which

usually serves as the nation's legal tender.

The primary function of a central bank is to provide the nation's money supply,

but more active duties include controlling interest rates, and acting as a lender

of last resort to the banking sector during times of financial crisis. It may also

have supervisory powers, to ensure that banks and other financial institutions do

not behave recklessly or fraudulently.

Central banks in most developed nations are independent in that they operate

under rules designed to render them free from political interference. Examples

include the European Central Bank (ECB), the Bank of England, and

the Federal Reserve System of the United States

2. ADVISING BANK

An advising bank (also known as a notifying bank) advises

a beneficiary (exporter) that a letter of credit (L/C) opened by an issuing

bank for anapplicant (importer) is available. Advising Bank's responsibility is to

authenticate the letter of credit issued by the issuer to avoid fraud. The advising

bank is not necessarily responsible for the payment of the credit which it

advises the beneficiary of.

The advising bank is usually located in the beneficiary's country. It can be (1) a

branch office of the issuing bank or a correspondent bank, or (2) a bank

appointed by the beneficiary. Important point is the beneficiary has to be

comfortable with the advising bank.

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

3. COMMERCIAL BANK

A commercial bank (or business bank) is a type of financial

institution and intermediary. It is a bank that provides transactional, savings,

and money market accounts and that accepts time deposits Commercial banks

engage in processing of payments by way of telegraphic transfer, EFTPOS,

internet banking, or other means, issuing bank drafts and bank cheques,

accepting money on term deposit, lending money by overdraft, installment loan,

or other means, providing documentary and standby letter of credit,

guarantees, performance bonds, securities underwriting commitments and other

forms of off balance sheet exposures, safekeeping of documents and other items

in safe deposit boxes, distribution or brokerage, with or without advice,

of insurance, unit trusts and similar financial products as a “financial

supermarket”, cash management and treasury, merchant banking and private

equity financing

Traditionally, large commercial banks also underwrite bonds, and make

markets in currency, interest rates, and credit-related securities, but today large

commercial banks usually have an investment bank arm that is involved in the

mentioned activities.

4. COMMUNITY DEVELOPMENT BANK

In the United States, community development banks (CDBs or CDFI Banks)

are commercial banks that operate with a mission to generate economic

development in low- to moderate-income (LMI) geographical areas and serve

residents of these communities. In the United States, community development

banks are certified as such by the Community Development Financial

Institutions Fund, a department within the U.S. Department of the Treasury.

In order to become a certified CDFI, CD Banks must apply to the United

States Community Development Financial Institutions Fund. Successful

applicants will have a primary mission of promoting community development

and principally serve under served markets and provide development services,

in addition to meeting other requirements

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

5. CREDIT UNION

A credit union is a cooperative financial institution that is owned and controlled

by its members and operated for the purpose of promoting thrift,

providing credit at competitive rates, and providing other financial services to

its members. Many credit unions exist to further community development or

sustainable international development on a local level.

Worldwide, credit union systems vary significantly in terms of total system

assets and average institution asset size, ranging from volunteer operations with

a handful of members to institutions with several billion dollars in assets and

hundreds of thousands of members. Credit unions are typically smaller than

banks; for example, the average U.S. credit union has $93 million in assets,

while the average U.S. bank has $1.53 billion, as of 2007.

6. CUSTODIAN BANK

A Custodian bank, or simply custodian, is a specialized financial

institution responsible for safeguarding a firm's or individual's financial assets

and is not likely to engage in "traditional" commercial or consumer/retail

banking such as mortgage or personal lending, branch banking, personal

accounts, ATMs and so forth.

The role of a custodian in such a case would be to hold in safekeeping

assets/securities such as stocks, bonds, commodities such as precious

metals and currency (cash), domestic and foreign, arrange settlement of any

purchases and sales and deliveries in/out of such securities and currency, collect

information on and income from such assets (dividends in the case of

stocks/equities and coupons (interest payments) in the case of bonds) and

administer related tax withholding documents and foreign tax reclamation,

administer voluntary and involuntary corporate actions on securities held such

as stock dividends, splits, business combinations (mergers), tender offers, bond

calls, etc.

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

7. DEPOSITORY BANK

A depository bank (U.S. usage) is a bank organized in the United States which

provides all the stock transfer and agency services in connection with

a depository receipt program. This function includes arranging for

a custodian to accept deposits of ordinary shares, issuing the negotiable receipts

which back up the shares, maintaining the register of holders to reflect all

transfers and exchanges, and distributing dividends in U.S. dollars.

8. EXPORT CREDIT AGENCY

An export credit agency (known in trade finance as ECA) or Investment

Insurance Agency, is a private or quasi-governmental institution that act as an

intermediary between national governments and exporters to issue export

financing. The financing can take the form of credits (financial support) or

credit insurance and guarantees (pure cover) or both, depending on the mandate

the ECA has been given by its government. ECAs can also offer credit or cover

on their own account. This does not differ from normal banking activities. Some

agencies are government-sponsored, others private, and others a bit of both.

9. INVESTMENT BANKING

An investment bank is a financial institution that assists individuals,

corporations and governments in raising capital by underwriting and/or acting

as the client's agent in the issuance of securities. An investment bank may also

assist companies involved in mergers and acquisitions, and provide ancillary

services such as market making, trading of derivatives, fixed

income instruments, foreign exchange, commodities, and equity securities.

Unlike commercial banks and retail banks, investment banks do not take

deposits. From 1933 (Glass–Steagall Act) until 1999 (Gramm–Leach–Bliley

Act), the United States maintained a separation between investment banking

and commercial banks. Other industrialized countries, including G8countries,

have historically not maintained such a separation.

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

10. INDUSTRIAL BANK

An industrial loan company (ILC) or industrial bank is a financial

institution in the United States that lends money, and may be owned by non-

financial institutions. Though such banks offer FDIC-insured deposits and are

subject to FDIC and state regulator oversight, a debate exists to allow parent

companies such as Wal-Mart to remain unregulated by the financial regulators.

11. MERCHANT BANK

A merchant bank is a financial institution which provides capital to companies

in the form of share ownership instead of loans. A merchant bank also provides

advisory on corporate matters to the firms they lend to.

Today, according to the US Federal Deposit Insurance Corporation (acronym

FDIC), "the term merchant banking is generally understood to mean negotiated

private equity investment by financial institutions in the unregistered securities

of either privately or publicly held companies."[1] Bothcommercial

banks and investment banks may engage in merchant banking activities.

Historically, merchant banks' original purpose was to facilitate and/or finance

production and trade of commodities, hence the name "merchant". Few banks

today restrict their activities to such a narrow scope.

12. MUTUAL SAVINGS BANK

A mutual savings bank is a financial institution chartered through a state or

federal government to provide a safe place for individuals to save and

toinvest those savings in mortgages, loans, stocks, bonds and other securities.

Mutual savings banks were designed to stimulate savings by individuals; the

exclusive function of these banks is to protect deposits, make limited, secure

investments, and provide depositors with interest. Unlikecommercial banks,

savings banks have no stockholders; the entirety of profits beyond the upkeep of

the bank belongs to the depositors of the mutual savings bank. Mutual savings

banks prioritize security, and as a result, have historically been characteristically

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

conservative in their investments. This conservatism is what allowed mutual

savings banks to remain stable throughout the turbulent period of the Great

Depression, despite the failing of commercial banks and savings and loan

associations.

13. NATIONAL BANK

In banking, the term national bank carries several meanings:

especially in developing countries, a bank owned by the state

an ordinary private bank which operates nationally (as opposed to

regionally or locally or even internationally)

In the United States, an ordinary private bank operating within a specific

regulatory structure, which may or may not operate nationally, under the

supervision of the Office of the Comptroller of the Currency.

In the past, the term "national bank" has been used synonymously with "central

bank", but it is no longer used in this sense today. Some central banks may have

the words "National Bank" in their name; conversely if a bank is named in this

way, it is not automatically considered a central bank. For example, National-

Bank AG in Essen, Germany is a privately owned commercial bank, just

like National Bank of Canada of Montreal, Canada. On the other side, National

Bank of Ethiopia is the central bank of Ethiopia and National Bank of

Cambodia is the central bank of Cambodia.

14. OFFSHORE BANK

An offshore bank is a bank located outside the country of residence of the

depositor, typically in a low tax jurisdiction (or tax haven) that provides

financial and legal advantages. These advantages typically include

greater privacy (see also bank secrecy, a principle born with the 1934 Swiss

Banking Act), low or no taxation (i.e. tax havens), easy access to deposits (at

least in terms of regulation) and protection against local political or financial

instability

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

15. POSTAL SAVINGS SYSTEM

Many nations' post offices operated, or continue to operate postal savings

systems, to provide depositors who did not have access to banks a safe,

convenient method to save money and to promote saving among the poor.

16. PRIVATE BANK

Private banks are banks that are not incorporated. A private bank is owned by

either an individual or a general partner(s) with limited partner(s). In any such

case, the creditors can look to both the "entirety of the bank's assets" as well as

the entirety of the sole-proprietor's/general-partners' assets.

These banks have a long tradition in Switzerland, dating back to at least

the revocation of the Edict of Nantes (1685). However most have now become

incorporated companies, so the term is rarely true anymore. There are a few

private banks remaining in the U.S. One is Brown Brothers Harriman & Co., a

general partnership with about 30 members. Private banking also has a long

tradition in the UK where Coutts & Co has been in business since 1692.

17. RETAIL BANK

Retail banking refers to banking in which banking institutions execute

transactions directly with consumers, rather than corporations or other banks.

Services offered include: savings and transactional

accounts, mortgages, personal loans, debit cards, credit cards, and so forth.

18. SAVINGS AND LOAN ASSOCIATION

A savings and loan association (or S&L), also known as a thrift, is a financial

institution that specializes in accepting savings deposits and

making mortgage and other loans. The terms "S&L" or "thrift" are mainly used

in the United States; similar institutions in the United Kingdom, Ireland and

some Commonwealth countries include building societies and trustee savings

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

banks. They are often mutually held (often called mutual savings banks[citation

needed]

), meaning that the depositors and borrowers are members with voting

rights, and have the ability to direct the financial and managerial goals of the

organization, similar to the policyholders of a mutual insurance company. It is

possible for an S&L to be a joint stock companyand even publicly traded.

However, this means that it is no longer truly an association, and depositors and

borrowers no longer have managerial control.

19. SAVINGS BANK

A savings bank is a financial institution whose primary purpose is

accepting savings deposits. It may also perform some other functions.

In Europe, savings banks originated in the 19th or sometimes even the 18th

century. Their original objective was to provide easily accessible savings

products to all strata of the population. In some countries, savings banks were

created on public initiative, while in others, socially committed individuals

created foundations to put in place the necessary infrastructure.

20. UNIVERSAL BANK

A universal bank participates in many kinds of banking activities and is both a

commercial bank and an investment bank as well as providing other financial

services such as insurance.[1] These are also called full-service financial firms,

although there can also be full-service investment banks which provide wealth

and asset management, trading, underwriting, researching as well as financial

advisory.

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

CHAPTER-3

STRUCTURE OF INDIAN BANKING SYSTEM

The organised banking system in India can be classified as given below:

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

3.1 RESERVE BANK OF INDIA

The Reserve Bank of India (RBI, Hindi: भारतीय ररज़र्व बैंक) is India's central

banking institution, which controls the monetary policy of the Indian rupee. It

commenced its operations on 1 April 1935 during the British Rule in

accordance with the provisions of the Reserve Bank of India Act, 1934.[5] The

original share capital was divided into shares of 100 each fully paid, which were

initially owned entirely by private shareholders.[6] Following India's

independence on 15 August 1947, the RBI was nationalised on 1 January 1949.

The RBI plays an important part in the Development Strategy of the

Government of India. It is a member bank of the Asian Clearing Union. The

general superintendence and direction of the RBI is entrusted with the 21-

member Central Board of Directors: the Governor, 4 Deputy Governors, 2

Finance Ministry representatives, 10 government-nominated directors to

represent important elements from India's economy, and 4 directors to represent

local boards headquartered at Mumbai, Kolkata, Chennai and New Delhi. Each

of these local boards consists of 5 members who represent regional interests,

and the interests of co-operative and indigenous banks.

The bank is often referred to by the name Mint Street.[8]

HISTORY

1935–1950

Reserve Bank of India-10 Rupees (1938), first year of banknote issue.

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

The Reserve Bank of India was founded on 1 April 1935 to respond to

economic troubles after the First World War.[9] The Reserve Bank of India was

conceptualized based on the guidelines presented by the Central Legislative

Assembly passed these guidelines as the RBI Act 1934.[10] RBI was

conceptualized as per the guidelines, working style and outlook presented by Dr

B R Ambedkar in his book. It was titled “The Problem of the Rupee – Its origin

and its solution” and presented to the Hilton Young Commission. The bank was

set up based on the recommendations of the 1926 Royal Commission on Indian

Currency and Finance, also known as the Hilton–Young Commission.[11] The

original choice for the seal of RBI was The East India Company Double Mohur,

with the sketch of the Lion and Palm Tree. However it was decided to replace

the lion with the tiger, the national animal of India. The Preamble of the RBI

describes its basic functions to regulate the issue of bank notes, keep reserves to

secure monetary stability in India, and generally to operate the currency and

credit system in the best interests of the country.[12] The Central Office of the

RBI was established in Calcutta (now Kolkata), but was moved to Bombay

(now Mumbai) in 1937. The RBI also acted as Burma's central bank, except

during the years of the Japanese occupation of Burma (1942–45), until April

1947, even though Burma seceded from the Indian Union in 1937. After the

Partition of India in 1947, the bank served as the central bank for Pakistan until

June 1948 when the State Bank of Pakistan commenced operations.

1950–1960

In the 1950s, the Indian government, under its first Prime Minister Jawaharlal

Nehru, developed a centrally planned economic policy that focused on the

agricultural sector. The administration nationalized commercial banks[14] and

established, based on the Banking Companies Act of 1949 (later called the

Banking Regulation Act), a central bank regulation as part of the RBI.

Furthermore, the central bank was ordered to support economic plan with

loans.[15]

1960–1969

As a result of bank crashes, the RBI was requested to establish and monitor a

deposit insurance system. It should restore the trust in the national bank system

and was initialized on 7 December 1961. The Indian government found funds to

promote the economy and used the slogan "Developing Banking". The

government of India restructured the national bank market and nationalized a lot

of institutes. As a result, the RBI had to play the central part of control and

support of this public banking sector.

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

1969–1985

In 1969, the Indira Gandhi-headed government nationalized 14 major

commercial banks. Upon Gandhi's return to in 1980, a further 6 banks were

nationalized.[11] The regulation of the economy and especially the financial

sector was reinforced by the Government of India in the 1970s and 1980s.[16]

The central bank became the central player and increased its policies for a lot of

tasks like interests, reserve ratio and visible deposits.[17] These measures aimed

at better economic development and had a huge effect on the company policy of

the institutes. The banks lent money in selected sectors, like agri-business and

small trade companies.[18]

The branch was forced to establish two new offices in the country for every

newly established office in a town.[19] The oil crises in 1973 resulted in

increasing inflation, and the RBI restricted monetary policy to reduce the

effects.[20]

1985–1991

A lot of committees analysed the Indian economy between 1985 and 1991.

Their results had an effect on the RBI. The Board for Industrial and Financial

Reconstruction, the Indira Gandhi Institute of Development Research and the

Security & Exchange Board of India investigated the national economy as a

whole, and the security and exchange board proposed better methods for more

effective markets and the protection of investor interests. The Indian financial

market was a leading example for so-called "financial repression" (Mackinnon

and Shaw).[21] The Discount and Finance House of India began its operations on

the monetary market in April 1988; the National Housing Bank, founded in July

1988, was forced to invest in the property market and a new financial law

improved the versatility of direct deposit by more security measures and

liberalisation.[22]

1991–2000 the new century

The national economy contracted in July 1991 as the Indian rupee was

devalued.[23] The currency lost 18% relative to the US dollar, and the

Narsimham Committee advised restructuring the financial sector by a temporal

reduced reserve ratio as well as the statutory liquidity ratio. New guidelines

were published in 1993 to establish a private banking sector. This turning point

should reinforce the market and was often called neo-liberal.[24] The central

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

bank deregulated bank interests and some sectors of the financial market like

the trust and property markets.[25] This first phase was a success and the central

government forced a diversity liberalisation to diversify owner structures in

1998.[26]

The National Stock Exchange of India took the trade on in June 1994 and the

RBI allowed nationalized banks in July to interact with the capital market to

reinforce their capital base. The central bank founded a subsidiary company—

the Bharatiya Reserve Bank Note Mudran Private Limited—on 3 February 1995

to produce banknotes.[27]

Since 2000

The Foreign Exchange Management Act from 1999 came into force in June

2000. It should improve the item in 2004–2005 (National Electronic Fund

Transfer).[28] The Security Printing & Minting Corporation of India Ltd., a

merger of nine institutions, was founded in 2006 and produces banknotes and

coins.[29]

FUNCTIONS OF RESERVE BANK OF INDIA:-

1. Monopoly Power of Note Issue:

Like any other central bank, the RBI acts as a sole currency authority of the

country, ft issues notes of every denomination except one-rupee note and coins

and small coins—through the Issue Department of the Bank.

One-rupee notes and coins and small coins are issued by the Government of

India. In actuality, the RBI also issues these coins on behalf of the Government

of India.

2. Bankers’ Bank:

As a regulator and supervisor of the country’s financial system, the RBI

prescribes the broad parameters of banking operations within which the entire

banking and financial system operates in the country. The basic objective of this

activity of the RBI is to (i) maintain public confidence in the country’s banking

system, (ii) protect the interests of depositors, and (iii) provide cost- effective

banking services to the public.

As a bankers’ bank, the RBI holds a part of the cash reserves of commercial

banks and lends them funds for short periods. All banks are required to maintain

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

a certain percentage (lying between 3 p.c. and 20 p.c.) of their total liabilities.

The main objective of changing this cash reserve ratio by the RBI is to control

credit.

3. Banker to the Government:

The RBI acts as the banker to the Government of India and State Governments

(except Jammu and Kashmir). As such, it transacts all merchant banking

functions for these Governments.The RBI accepts and pays money on behalf of

the Government and carries out exchange remittances and other banking

operations.

As the Government’s banker, the RBI provides short-term credit to the

Government of India. This short-term credit is obtainable through the sale of the

treasury bills. Not only this, the RBI also provides ways and means of advances

(repayable within 90 days) to State governments. It may be noted that the Cen-

tral Government is empowered to borrow any amount it likes from the RBI.

4. Controller of Credit:

As an apex bank of the country, the RBI has been empowered to formulate,

implement and monitor its monetary policy with the objective of maintaining

price stability (both internal and external) and ensuring adequate flow of credit

to the productive sectors.

The RBI controls the total supply of money and bank credit to subserve the

country’s interest. The RBI controls credit to ensure price and exchange rate

stability. To achieve this, the RBI uses all types of credit control instruments

quantitative, qualitative, and selective. The most extensively used credit instru-

ment of the RBI is the bank rate and now repo rate, cash, reserve ratio, etc. The

RBI also relies on the selective methods of credit control. But, it has fallen into

disuse during the reform era.

5. Exchange Management and Control:

One of the essential central banking functions performed by the RBI is that of

maintaining the external value of rupee. The RBI has the authority to enter into

foreign exchange transactions both on its own account and on behalf of the

Government. The official external reserve of the country consists of monetary

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

gold and foreign assets of the Reserve Bank, besides (Special Drawing Rights

or) SDR holdings.

The Reserve Bank, as the custodian of the country’s foreign exchange reserves,

is vested with the duty of managing the investment and utilisation of the

reserves in the most advantageous manner. Being a manager of foreign

exchange, it manages the Foreign Exchange Management Act, (FEMA) 1999.

As a manager of foreign exchange, the RBI helps in facilitating trade (external)

and payment and aims at promoting orderly development and maintenance of

the foreign exchange market in India.

6. Miscellaneous Functions:

The RBI collects, collates and publishes all monetary and banking data

regularly in its weekly statements, in the RBI Bulletin (monthly), and in the

Report on Currency and Finance (annually).

7. Promotional and Developmental Functions:

Apart from these traditional functions, the RBI performs various activities of

promotional and developmental nature. It attempts to mobilise savings for

productive purposes. This is done in various ways. For instance, the RBI has

helped a lot in building the huge financial infrastructure that we see now.

This consists of such institutions as the Deposit Insurance and Guarantee

Corporation (DIGC) (to safeguard the interests of depositors against bank

failure), the Agriculture Refinance and Development Corporation (to meet the

needs of agriculturists), IFCI, SFCs, IDBI, UTI (to meet the long and medium-

term needs of industry), etc. As for cooperative credit movement, the RBI’s

performance is really commendable. This has resulted in curbing the activities

of moneylenders in the rural economy.

8. Licensing Authority

The Reserve Bank of India is empowered to grant license to commence banking

business in India, including the power to cancel a license granted to a banking

company.

A petition was filed under Article 226 of the Constitution, challenging the

constitutional validity of section 22 of the Banking Companies Act, 1949.

Section 22 empowers, Reserve Bank of India to grant license to Banks and

banks which were already in existence on the commencement of the Act have to

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

apply for license before the expiry of six months from commence.The petitioner

contended that the section 22 of the Banking Regulating Act, 1949 is in restraint

of trade and business hence unconstitutional. The writ was dismissed and the

High Court declared section 22 of the Banking Regulating Act, 1949 as

constitutionally valid and cherished the role of Reserve Bank of India in the

economic development of the country.

Thus, it is clear that the RBI is not a typical central bank as is traditionally

understood. It is something more than a central bank. It regulates not only

currency and credit but aids the development of the Indian economy by con-

ducting various types of promotional activities. As such, in the RBI we see

many activities combined into one.

3.2 COMMERCIAL BANKS:-

Commercial banks form a significant part of the country’s Financial Institution

System. Commercial Banks are those profit seeking institutions which accept

deposits from general public and advance money to individuals like household,

entrepreneurs, businessmen etc. with the prime objective of earning profit in the

form of interest, commission etc. The operations of all these banks are regulated

by the Reserve Bank of India, which is the central bank and supreme financial

authority in India. The main source of income of a commercial bank is the

difference between these two rates which they charge to borrowers and pay to

depositers. Examples of commercial banks – ICICI Bank, State Bank of India,

Axis Bank, and HDFC Bank.

CLASSIFICATION OF COMMERCIAL BANKS IN INDIA:-

Scheduled banks :- Banks which have been included in the Second

Schedule of RBI Act 1934. They are categorized as follows:

Public Sector Banks :- are those banks in which majority of stake is held

by the government. Eg. SBI, PNB, Syndicate Bank, Union Bank of India

etc.

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

Private Sector Banks :- are those banks in which majority of stake is

held by private indivisuals. Eg. ICICI Bank, IDBI Bank, HDFC Bank,

AXIS Bank etc.

Foreign Banks :- are the banks with Head office outside the country in

which they are located. Eg. Citi Bank, Standard Chartered Bank, Bank of

Tokyo Ltd. etc.

Non scheduled commercial banks :- Banks which are not included in the

Second Schedule of RBI Act 1934.

Commercial Banks in India: Role and Importance:-

Banks help in accelerating the economic growth of a country in the

following ways:

1. Accelerating the Rate of Capital Formation:

Commercial banks encourage the habit of thrift and mobilise the savings of

people. These savings are effectively allocated among the ultimate users of

funds, i.e., investors for productive investment. So, savings of people result in

capital formation which forms the basis of economic development.

2. Provision of Finance and Credit:

Commercial banks are a very important source of finance and credit for trade

and industry. The activities of commercial banks are not only confined to

domestic trade and commerce, but extend to foreign trade also.

3. Developing Entrepreneurship:

Banks promote entrepreneurship by underwriting the shares of new and existing

companies and granting assistance in promoting new ventures or financing

promotional activities. Banks finance sick (loss-making) industries for making

them viable units.

4. Promoting Balanced Regional Development:

Commercial banks provide credit facilities to rural people by opening branches

in the backward areas. The funds collected in developed regions may be

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

channelised for investments in the under developed regions of the country. In

this way, they bring about more balanced regional development.

5. Help to Consumers:

Commercial banks advance credit for purchase of durable consumer items like

Vehicles, T.V., refrigerator etc., which are out of reach for some consumers due

to their limited paying capacity. In this way, banks help in creating demand for

such consumer goods.

Structure of Commercial Banks in India:

The commercial banks can be broadly classified under two heads:

1. Scheduled Banks:

Scheduled Banks refer to those banks which have been included in the Second

Schedule of Reserve Bank of India Act, 1934.

In India, scheduled commercial banks are of three types:

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

(i) Public Sector Banks:

These banks are owned and controlled by the government. The main objective

of these banks is to provide service to the society, not to make profits. State

Bank of India, Bank of India, Punjab National Bank, Canada Bank and

Corporation Bank are some examples of public sector banks.

Public sector banks are of two types:

(a) SBI and its subsidiaries;

(b) Other nationalized banks.

(ii) Private Sector Banks:

These banks are owned and controlled by private businessmen. Their main

objective is to earn profits. ICICI Bank, HDFC Bank, IDBI Bank is some

examples of private sector banks.

(iii) Foreign Banks:

These banks are owned and controlled by foreign promoters. Their number has

grown rapidly since 1991, when the process of economic liberalization had

started in India. Bank of America, American Express Bank, Standard Chartered

Bank are examples of foreign banks.

2. Non-Scheduled Banks:

Non-Scheduled banks refer to those banks which are not included in the Second

Schedule of Reserve Bank of India Act, 1934.

Till today India has only four non-scheduled banks in existence. These four

Non-scheduled banks under operation in India are:

1. Akhand Anand Co-operative Bank Limited

2. Alavi Co-Operative Bank Limited

3. Amarnath Co-Operative Bank Limited

4. Amod Nagrik Sahakari Bank Limited

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

Public sector banks in India

Public Sector Banks (PSBs) are banks where a majority stake (i.e. more than

50%) is held by a government.[1] The shares of these banks are listed on stock

exchanges. There are a total of 27 PSBs in India [21 Nationalized banks + 6

State bank group (SBI + 5 associates) ].

In 2011, IDBI bank and in 2014 Bharatiya Mahila Bank were nationalized with

a minimum capital of Rs 500 crore.

Emergence of public sector banks

The Central Government entered the banking business with the nationalization

of the Imperial Bank Of India in 1955. A 60% stake was taken by the Reserve

Bank of India and the new bank was named as the State Bank of India. The

seven other state banks became the subsidiaries of the new bank when

nationalised on 19 July 1960.[2] The next major nationalisation of banks took

place in 1969 when the government of India, under prime minister Indira

Gandhi, nationalised an additional 14 major banks. The total deposits in the

banks nationalised in 1969 amounted to 50 crores. This move increased the

presence of nationalised banks in India, with 84% of the total branches coming

under government control.[3]

The next round of nationalisation took place in April 1980. The government

nationalised six banks. The total deposits of these banks amounted to around

200 crores. This move led to a further increase in the number of branches in the

market, increasing to 91% of the total branch network of the country. The

objectives behind nationalisation were:

To break the ownership and control of banks by a few business families,

To prevent the concentration of wealth and economic power,

To mobilize savings from masses from all parts of the country,

To cater to the needs of the priority sectors......

Total public sector banks in India are 27 including IDBI and BMB.

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

Private-sector banks in India

The private-sector banks in India represent part of the indian banking sector

that is made up of both private and public sector banks. The "private-sector

banks" are banks where greater parts of state or equity are held by the private

shareholders and not by government.

Banking in India has been dominated by public sector banks since the 1969

when all major banks were nationalised by the Indian government They have

grown faster & bigger over the two decades since liberalisation using the latest

technology, providing contemporary innovations and monetary tools and

techniques.[1]

The private sector banks are split into two groups by financial regulators in

India, old and new. The old private sector banks existed prior to the

nationalisation in 1969 and kept their independence because they were either

too small or specialist to be included in nationalisation. The new private sector

banks are those that have gained their banking license since the liberalisation in

the 1990s.

New private-sector banks

The banks, which came in operation after 1991, with the introduction of

economic reforms and financial sector reforms are called "new private-sector

banks". Banking regulation act was then amended in 1993, which permitted the

entry of new private-sector banks in the Indian banking s sector. However, there

were certain criteria set for the establishment of the new private-sector banks,

some of those criteria being:#The bank should have a minimum net worth of Rs.

200 crores.

1. The promoters holding should be a minimum of 25% of the paid-up

capital.

2. Reliance Capital, India Post, Larsen & Toubro, Shriram Transport

Finance are companies pending a banking license with the RBI under the

new policy, while IDFC & Bandhan were given a go ahead to start

banking services for 2015.

Within 3 years of the starting of the operations, the bank should offer shares to

public and their net worth must increased to 300 crores

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

List of new Private-Sector Banks in India

Name Year

1. Axis Bank (earlier UTI Bank) 1994

2. Bank of Punjab (actually an old generation private bank since it was not

1989

founded under post-1993 new bank licensing regime)

3. Centurion Bank Ltd. (Merged Bank of Punjab in late 2005 to become

1994

Centurion Bank of Punjab, acquired by HDFC Bank Ltd. in 2008)

4. Development Credit Bank (Converted from Co-operative Bank, now

1995

DCB Bank Ltd.)

5. ICICI Bank (previously ICICI and then both merged;total merger

1996

SCICI+ICICI+ICICI Bank Ltd)

6. IndusInd Bank 1994

7. Kotak Mahindra Bank 2003

8. Yes Bank 2005

10. Times Bank (Merged with HDFC Bank Ltd.) 2000

11. Global Trust Bank (India) (Merged with Oriental Bank of Commerce) 1994

12. Balaji Corporation Limited - Private Loan Company, not a Bank 2010

13. HDFC Bank 1994

14. Bandhan Bank 2015

15. IDFC Bank 2015

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

Foreign banks

Foreign banks have brought latest technology and latest banking practices in

India. They have helped made Indian Banking system more competitive and

efficient. Government has come up with a road map for expansion of foreign

banks in India The road map has two phases. During the first phase between

March 2005 and March 2009, foreign banks may establish a presence by

way of setting up a wholly owned subsidiary (WOS) or conversion of

existing branches into a WOS. The second phase will commence in April

2009 after a review of the experience gained after due consultation with all

the stake holders in the banking sector. The review would examine issues

concerning extension of national treatment to WOS, dilution of stake and

permitting mergers/acquisitions of any private sector banks in India by a

foreign bank.

3.3 Regional Rural Bank:-

Regional Rural Banks (also RRBs) are local level banking organizations

operating in different States of India. They have been created with a view to

serve primarily the rural areas of India with basic banking and financial

services. However, RRBs may have branches set up for urban operations and

their area of operation may include urban areas too.

The area of operation of RRBs is limited to the area as notified by Government

of India covering one or more districts in the State. RRBs also perform a variety

of different functions. RRBs perform various functions in following heads •

Providing banking facilities to rural and semi-urban areas. Carrying out

government operations like disbursement of wages of MGNREGA workers,

distribution of pensions etc. • Providing Para-Banking facilities like locker

facilities, debit and credit cards.

History

Regional Rural Banks were established under the provisions of an Ordinance

passed on September 1975 and the RRB Act. 1976 to provide sufficient banking

and credit facility for agriculture and other rural sectors. These were set up on

the recommendations of The M. Narasimham Working Group[1] during the

tenure of Indira Gandhi's government with a view to include rural areas into

economic mainstream since that time about 70% of the Indian Population was

of Rural Orientation. The development process of RRBs started on 2 October

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

1975 with the forming of the first RRB, the Prathama Bank with authorised

capital of Rs. 5 crore at its starting. Also on 2 October 1976 five regional rural

banks were set up with a total authorised capital Rs. 100 crore ($10 Million)

which later augmented to 500 crore ($50 Million). The Regional Rural Bank

were owned by the Central Government, the State Government and the Sponsor

Bank(There were five commercial banks, Punjab National Bank, State Bank of

India, Syndicate Bank, United Bank of India and United Commercial Bank,

which sponsored the regional rural banks) who held shares in the ratios as

follows Central Government-50%, State Government- 15% and Sponsor Banks-

35[2]%.. Earlier, Reserve Bank of India had laid down ceilings on the rate of

interest to be charged by these RRBs.

List of Regional Rural banks :-

NABARD is the regulatory authority of Regional Rural Banks

1. Allahabad UP Gramin Bank,

2. Andhra Pradesh Grameena Vikas Bank,

3. Andhra Pragathi Grameena Bank,

4. Arunachal Pradesh Rural Bank,

5. Assam Gramin Vikash Bank,

6. Bangiya Gramin Vikash Bank,

7. Baroda Gujarat Gramin Bank,

8. Baroda Rajasthan Ksethriya Gramin Bank,

9. Baroda UP Gramin Bank,

10.Bihar Gramin Bank,.

Objectives of Regional Rural Banks

The RBBs Act has made various provisions regarding the incorporation,

regulation and working of RRBs. According to this Act, the RRBs are to be set-

up mainly with a view to develop rural economy by providing credit facilities

for the purpose of development of agriculture, trade, commerce, industry and

other productive activities in the rural areas.

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

Such facility is provided particularly to the small and marginal farmers,

agricultural labourers, artisans, and small entrepreneurs and for other related

matters.

The objectives of RRBs can be summarized as follows:

(i) To provide cheap and liberal credit facilities to small and marginal farmers,

agriculture labourers, artisans, small entrepreneurs and other weaker sections.

(ii) To save the rural poor from the moneylenders.

(iii) To act as a catalyst element and thereby accelerate the economic growth in

the particular region.

(iv) To cultivate the banking habits among the rural people and mobilize

savings for the economic development of rural areas.

(v) To increase employment opportunities by encouraging trade and commerce

in rural areas.

(vi) To encourage entrepreneurship in rural areas.

(vii) To cater to the needs of the backward areas which are not covered by the

other efforts of the Government?

(viii) To develop underdeveloped regions and thereby strive to remove

economic disparity between regions.

Other special features of these banks are:

(i) their area of operation is limited to a specified region,

comprising one or more districts in any state;

(ii) their lending rates cannot be higher than the prevailing lending

rates of cooperative credit societies in any particular state;

(iii) the paid-up capital of each rural bank is Rs. 25 lakh, 50 percent

of which has been contributed by the Central Government, 15

percent by State Government and 35 percent by sponsoring

public sector commercial banks which are also responsible for

actual setting up of the RRBs.

These banks are helped by higher-level agencies: the sponsoring banks lend

them funds and advise and train their senior staff, the NABARD (National Bank

K P B HINDUJA COLLEGE OF COMMERCE

STRUCTURE OF INDIAN BANKING SYSTEM

for Agriculture and Rural Development) gives them short-term and medium,

term loans: the RBI has kept CRR (Cash Reserve Requirements) of them at 3%

and SLR (Statutory Liquidity Requirement) at 25% of their total net liabilities,

whereas for other commercial banks the required minimum ratios have been

varied over time.

Regulation of RRBs :-

Regional Rural Banks are regulated by National Bank for Agriculture and

Rural Development (NABARD). Please note that currently seven states viz.

Tripura, Nagaland, Manipur, Mizoram, Arunachal Pradesh Meghalaya and

Puducherry, have state-level RRBs. Gujarat and Karnataka too have demanded

formation of state level RRB.

3.4 Cooperative Banks:

Cooperative banks are so-called because they are organised under the provisions

of the Cooperative Credit Societies Act of the states. The major beneficiary of

the Cooperative Banking is the agricultural sector in particular and the rural

sector in general.

The cooperative credit institutions operating in the country are mainly of two

kinds: agricultural (dominant) and non-agricultural. There are two separate

cooperative agencies for the provision of agricultural credit: one for short and

medium-term credit, and the other for long-term credit. The former has three

tier and federal structure.

At the apex is the State Co-operative Bank (SCB) (cooperation being a state