Académique Documents

Professionnel Documents

Culture Documents

Fee Structure For A N A

Transféré par

muthuanandaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Fee Structure For A N A

Transféré par

muthuanandaDroits d'auteur :

Formats disponibles

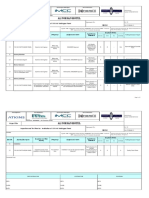

New FEE STRUCTURE

(w.e.f. August 15, 2017)

1. For Registration – applicable to all institutions i.e., recognized / not recognized

u/s 12B of UGC Act

Process Total amount of A&A Fee

Amount to be paid by the Institution

Institutional Information Rs. 25,000/- + G S T 18%

Quality Assessment (IIQA) (Non-refundable) *

* In case of rejection of IIQA application, HEIs may resubmit IIQA applications for maximum

of three attempts without IIQA fees, including the rejection attempt, within the period of two

consecutive windows.

2. For Universities and Professional Institutions

Type Total amount of A&A Fee Amount to be paid by the

Institution

1 to 10 departments Rs.1,87,500/-** + GST18%

Rs. 3,75,000/-**+ GST18% (50% of Total fee along with the SSR)

(Non-refundable)

> 10 departments Rs.3,75,000/-** + GST18%

Rs. 7,50,000/-** + GST18% (50% of Total fee along with the

SSR)

(Non-refundable)

The accreditation fee will be limited to a maximum amount of Rs. 7,50,000/-+ GST18%, per institution.

** Balance 50% of total fees along with 18% GST before 15 days from the date of visit.

Professional Institutions: Fees will be charged as per the fee structure applicable to Universities, i.e.

Engineering and Technology, Management, Law, Health Sciences (Allopathy, Homoeopathy, Ayurveda,

Dental, Pharmacy, Nursing etc.)

3. For Colleges (Grant-in-Aid, Private and Government)

Type Total amount of A&A Fee Amount to be paid by the

Institution

a. General College Rs.92,500/-** + GST18%

with multi faculties (50% of Total fee along with the SSR)

Rs. 1,85,000/-**+ GST18%

i.e., Arts, Commerce (Non-refundable)

and Science

b. General College with Rs.62,500/-** + GST18%

mono faculty viz., (50% of Total fee along with the SSR)

Rs. 1,25,000/-**+ GST18%

Arts/Commerce/Science/or (Non-refundable)

any other

Rs.62,500/-** + GST18%

c. Teacher (50% of Total fee along with the SSR)

Rs. 1,25,000/-**+ GST18%

Education/Physical Education (Non-refundable)

** Balance 50% of total fees along with 18% GST before 15 days from the date of visit.

4. Appeals Mechanism:

Review of Accreditation (grievance) Rs. 1,00,000/- + GST 18% as applicable from time to

time. Institution shall pay TA/DA and honorarium to Peer Team Members through

NAAC.

5. In view of the changed scenario in the process of Assessment and Accreditation the

following pattern needs to be followed for Peer team visit logistics:

i. 50% of the stipulated fee+ applicable taxes along with Self-study Report (SSR) (Non-

refundable).

ii. The pre-qualified HEIs will be asked to pay balance 50% of the stipulated fees+ taxes

applicable as shown in column 3 above before 15 days from the visit date If the

institution does not pay the fee within 15 days, the SSR will not be processed. They

have to apply again in the next window.

Mandatory Taxes/GST will not be refunded.

iii. If the Institution does not take up the accreditation process within the stipulated

window the fee (at Sl. No. 2) will not be returned to the institution. However, the

same will be adjusted when accreditation process is taken up.

(The Maximum time limit up to which it can be carried forward shall be one year

from the date of submission of SSR).

iv. In addition to above, the institution has to pay an advance, towards logistic expenses

for Colleges Rs.1,50,000/- + GST 18% and for Universities & Professional Institution

Rs.3,00,000/- + GST 18% to NAAC prior to the arrangement of Peer Team Visit, after

clearing Pre-qualifier stage for peer team visit.

6. For subsequent cycles of Accreditation:

The fee structure proposed above applies for all cycles of Accreditation and Re-

assessment.

7. Provision for UGC 2f & 12B Institutions

Institutions which are recognized under section 2(f) and 12B of UGC Act and

receiving the developmental grants from UGC should also pay the assessment

and accreditation fees. The A&A fees and expenses on TA and logistics expenses

of peer team would be reimbursed as per NAAC guidelines on submission of the

latest development grant sanction letter of UGC with an attestation by the Head

of the Institution and other necessary documents, as and when NAAC receives

grants from UGC.

8. Mode of Payment:

The fee should be remitted through a Demand Draft (DD) drawn in favour of

“Director, NAAC” payable at Bengaluru.

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- 35 - Motion For More Definite StatementDocument18 pages35 - Motion For More Definite StatementRipoff Report100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Internship Confidentiality AgreementDocument5 pagesInternship Confidentiality AgreementMonique AcostaPas encore d'évaluation

- Hse MomDocument4 pagesHse MomSamar Husain100% (2)

- Sbi Call LetterDocument2 pagesSbi Call LetterSparsh Mahajan0% (3)

- Tumey V Ohio (Judge Compensation Issue) HTMDocument18 pagesTumey V Ohio (Judge Compensation Issue) HTMlegalmattersPas encore d'évaluation

- Itp Installation of 11kv HV Switchgear Rev.00Document2 pagesItp Installation of 11kv HV Switchgear Rev.00syed fazluddin100% (1)

- Higher Education Vision 2030Document84 pagesHigher Education Vision 2030muthuanandaPas encore d'évaluation

- Korea Technologies Co, Ltd. v. LermaDocument1 pageKorea Technologies Co, Ltd. v. Lermadwight yuPas encore d'évaluation

- Manila Banking Co. vs. University of BaguioDocument2 pagesManila Banking Co. vs. University of BaguioMarianne Andres100% (2)

- VMware VSphere ICM 6.7 Lab ManualDocument142 pagesVMware VSphere ICM 6.7 Lab Manualitnetman93% (29)

- f2 Fou Con Sai PL Qa 00002 Project Quality Plan Rev 00Document52 pagesf2 Fou Con Sai PL Qa 00002 Project Quality Plan Rev 00Firman Indra JayaPas encore d'évaluation

- GO ERD Policy 2021 26Document42 pagesGO ERD Policy 2021 26muthuanandaPas encore d'évaluation

- Dasarahalli AssemblyDocument121 pagesDasarahalli AssemblymuthuanandaPas encore d'évaluation

- SampleDocument1 pageSamplemuthuanandaPas encore d'évaluation

- Checklist For Academic and Administrative Audit: November 2019Document83 pagesChecklist For Academic and Administrative Audit: November 2019muthuanandaPas encore d'évaluation

- NbaDocument2 pagesNbamuthuanandaPas encore d'évaluation

- 1.65 Investment PlanDocument18 pages1.65 Investment PlanmuthuanandaPas encore d'évaluation

- Package in Word 1Document5 pagesPackage in Word 1muthuanandaPas encore d'évaluation

- Strategy Guide: Bull Call SpreadDocument14 pagesStrategy Guide: Bull Call SpreadworkPas encore d'évaluation

- Credit Transfer RecommendationsDocument13 pagesCredit Transfer RecommendationsmuthuanandaPas encore d'évaluation

- Indian National Congress Party ConstitutionDocument104 pagesIndian National Congress Party ConstitutionmuthuanandaPas encore d'évaluation

- AICTE Initiatives & SchemesDocument25 pagesAICTE Initiatives & SchemesmuthuanandaPas encore d'évaluation

- Over 90 Engineering Colleges in TN Face Risk of De-Recognition - DTNext - inDocument2 pagesOver 90 Engineering Colleges in TN Face Risk of De-Recognition - DTNext - inmuthuanandaPas encore d'évaluation

- Flow Rates: 0.5 BAR 1.0 BAR 2.0 BAR 3.0 BAR S.No. Cat. No. ParticularDocument8 pagesFlow Rates: 0.5 BAR 1.0 BAR 2.0 BAR 3.0 BAR S.No. Cat. No. ParticularmuthuanandaPas encore d'évaluation

- Registration Certificate of Real Estate Agent Form HDocument2 pagesRegistration Certificate of Real Estate Agent Form HmuthuanandaPas encore d'évaluation

- Renewal Application FormDocument2 pagesRenewal Application FormmuthuanandaPas encore d'évaluation

- Application FormDocument4 pagesApplication FormmuthuanandaPas encore d'évaluation

- 30 X40 Ground Floor Plan R4Document1 page30 X40 Ground Floor Plan R4muthuanandaPas encore d'évaluation

- 30X40 West Facing HomeDocument1 page30X40 West Facing HomemuthuanandaPas encore d'évaluation

- Status of International Students in India For Higher Education PDFDocument102 pagesStatus of International Students in India For Higher Education PDFmuthuanandaPas encore d'évaluation

- Grading System of NAAC: Grade Qualifiers For HEI'sDocument2 pagesGrading System of NAAC: Grade Qualifiers For HEI'smuthuanandaPas encore d'évaluation

- Volatality in Indian Stock MarketDocument79 pagesVolatality in Indian Stock Marketmuthuananda0% (1)

- 10 Ideas for 21st Century EducationDocument17 pages10 Ideas for 21st Century EducationBenjie Moronia Jr.Pas encore d'évaluation

- Grading System of NAAC: Grade Qualifiers For HEI'sDocument2 pagesGrading System of NAAC: Grade Qualifiers For HEI'smuthuanandaPas encore d'évaluation

- Karnataka Technology Promotion and Technology CentreDocument21 pagesKarnataka Technology Promotion and Technology CentremuthuanandaPas encore d'évaluation

- Accreditation Manual for Business SchoolsDocument117 pagesAccreditation Manual for Business SchoolsMohan N GowdaPas encore d'évaluation

- Navagraha Temple MapDocument1 pageNavagraha Temple MapmuthuanandaPas encore d'évaluation

- HTTP WWW - Business-Standar...Document1 pageHTTP WWW - Business-Standar...muthuanandaPas encore d'évaluation

- Motion For Reconsideration Memorandum of Appeal Alvin AlcontinDocument3 pagesMotion For Reconsideration Memorandum of Appeal Alvin AlcontinFrancis DinopolPas encore d'évaluation

- Heirs of Marcelino Doronio, Petitioners v. Heirs of Fortunato Doronio, RespondentsDocument2 pagesHeirs of Marcelino Doronio, Petitioners v. Heirs of Fortunato Doronio, RespondentsMichael DonascoPas encore d'évaluation

- File No. AI 22Document8 pagesFile No. AI 22Lori BazanPas encore d'évaluation

- Amazon Order 19-1-22Document4 pagesAmazon Order 19-1-22arunmafiaPas encore d'évaluation

- Apsrtc Bus PassDocument1 pageApsrtc Bus Passcoc fansPas encore d'évaluation

- Companies View SampleDocument4 pagesCompanies View Samplesuresh6265Pas encore d'évaluation

- Superscope, Inc. v. Brookline Corp., Etc., Robert E. Lockwood, 715 F.2d 701, 1st Cir. (1983)Document3 pagesSuperscope, Inc. v. Brookline Corp., Etc., Robert E. Lockwood, 715 F.2d 701, 1st Cir. (1983)Scribd Government DocsPas encore d'évaluation

- LabReport2 Group6Document7 pagesLabReport2 Group6RusselPas encore d'évaluation

- UOP BUS 2204 Personal Finance Written AssignmentDocument3 pagesUOP BUS 2204 Personal Finance Written AssignmentFeven MezemirPas encore d'évaluation

- LOG-2-3-PROCUREMENT-SAMPLE-Purchase Contract - SampleDocument4 pagesLOG-2-3-PROCUREMENT-SAMPLE-Purchase Contract - SampleAthena GarridoPas encore d'évaluation

- MC 2021-086 General Guidelines On The International Organization For Standardization ISO Certification of The PNP Office Units Revised 2021Document10 pagesMC 2021-086 General Guidelines On The International Organization For Standardization ISO Certification of The PNP Office Units Revised 2021Allysa Nicole OrdonezPas encore d'évaluation

- Materi 5: Business Ethics and The Legal Environment of BusinessDocument30 pagesMateri 5: Business Ethics and The Legal Environment of BusinessChikita DindaPas encore d'évaluation

- MediamintDocument1 pageMediamintKaparthi GujjarPas encore d'évaluation

- United States v. Walter Swiderski and Maritza de Los Santos, 548 F.2d 445, 2d Cir. (1977)Document9 pagesUnited States v. Walter Swiderski and Maritza de Los Santos, 548 F.2d 445, 2d Cir. (1977)Scribd Government DocsPas encore d'évaluation

- Business Law Midterm ExamDocument6 pagesBusiness Law Midterm ExammoepoePas encore d'évaluation

- (RBI) OdtDocument2 pages(RBI) OdtSheethal HGPas encore d'évaluation

- Bloomberg Businessweek USA - March 25 2024 Freemagazines TopDocument76 pagesBloomberg Businessweek USA - March 25 2024 Freemagazines Topkyc7c87qf7Pas encore d'évaluation

- LNS 2003 1 241 Ag02Document64 pagesLNS 2003 1 241 Ag02kish7385Pas encore d'évaluation

- Wrongful Detention Claim Over Missing Cows DismissedDocument12 pagesWrongful Detention Claim Over Missing Cows DismissedA random humanPas encore d'évaluation

- Seminarski Rad - My Favourite FilmDocument11 pagesSeminarski Rad - My Favourite FilmMartin StarčevićPas encore d'évaluation