Académique Documents

Professionnel Documents

Culture Documents

US - OHIO Form IT-4

Transféré par

PedroDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

US - OHIO Form IT-4

Transféré par

PedroDroits d'auteur :

Formats disponibles

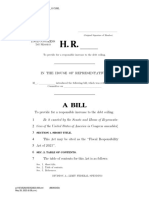

IT 4

Rev. 5/07

Notice to Employee

1. For state purposes, an individual may claim only natural de- For further information, consult the Ohio Department of Taxa-

pendency exemptions. This includes the taxpayer, spouse tion, Personal and School District Income Tax Division, or

and each dependent. Dependents are the same as defined your employer.

in the Internal Revenue Code and as claimed in the taxpayer’s

federal income tax return for the taxable year for which the 3. If you expect to owe more Ohio income tax than will be

taxpayer would have been permitted to claim had the tax- withheld, you may claim a smaller number of exemptions;

payer filed such a return. or under an agreement with your employer, you may have

an additional amount withheld each pay period.

2. You may file a new certificate at any time if the number of your

exemptions increases. 4. A married couple with both spouses working and filing a

joint return will, in many cases, be required to file an indi-

You must file a new certificate within 10 days if the number of vidual estimated income tax form IT 1040ES even though

exemptions previously claimed by you decreases because: Ohio income tax is being withheld from their wages. This

(a) Your spouse for whom you have been claiming exemp- result may occur because the tax on their combined in-

tion is divorced or legally separated, or claims her (or his) come will be greater than the sum of the taxes withheld

own exemption on a separate certificate. from the husband’s wages and the wife’s wages. This

(b) The support of a dependent for whom you claimed ex- requirement to file an individual estimated income tax form

emption is taken over by someone else. IT 1040ES may also apply to an individual who has two

(c) You find that a dependent for whom you claimed exemp- jobs, both of which are subject to withholding. In lieu of

tion must be dropped for federal purposes. filing the individual estimated income tax form IT 1040ES,

the individual may provide for additional withholding with

The death of a spouse or a dependent does not affect your

his employer by using line 5.

withholding until the next year but requires the filing of a new

certificate. If possible, file a new certificate by Dec. 1st of the

year in which the death occurs.

✁ please detach here

hio

IT 4

Department of Rev. 5/07

Taxation

Employee’s Withholding Exemption Certificate

Print full name Social Security number

Home address and ZIP code

Public school district of residence School district no.

(See The Finder at tax.ohio.gov.)

1. Personal exemption for yourself, enter “1” if claimed ...............................................................................................................

2. If married, personal exemption for your spouse if not separately claimed (enter “1” if claimed) ............................................

3. Exemptions for dependents .......................................................................................................................................................

4. Add the exemptions that you have claimed above and enter total ...........................................................................................

5. Additional withholding per pay period under agreement with employer .................................................................................. $

Under the penalties of perjury, I certify that the number of exemptions claimed on this certificate does not exceed the number to which I am entitled.

Signature Date

Vous aimerez peut-être aussi

- US Internal Revenue Service: fw4 - 1993Document2 pagesUS Internal Revenue Service: fw4 - 1993IRSPas encore d'évaluation

- Edd AfDocument4 pagesEdd Afcsl K360Pas encore d'évaluation

- Clear Form: Enter Personal InformationDocument4 pagesClear Form: Enter Personal InformationreddymspPas encore d'évaluation

- Emp WitholdingDocument4 pagesEmp WitholdingJohn A MerlinoPas encore d'évaluation

- Generic Form Preview DocumentDocument4 pagesGeneric Form Preview Documentelena.69.mxPas encore d'évaluation

- Form W-4 GuideDocument4 pagesForm W-4 GuideDettleffPas encore d'évaluation

- Instructions For Form 1040NR-EZ: Pager/SgmlDocument15 pagesInstructions For Form 1040NR-EZ: Pager/SgmlIRSPas encore d'évaluation

- Form W-4 (2018) : Specific InstructionsDocument4 pagesForm W-4 (2018) : Specific InstructionsPavan Kumar VadlamaniPas encore d'évaluation

- California DE-4Document4 pagesCalifornia DE-4Tuğrul SarıkayaPas encore d'évaluation

- fw4 PDFDocument2 pagesfw4 PDFbikash PrajapatiPas encore d'évaluation

- Form W-5 Advanced EIC PaymentsDocument3 pagesForm W-5 Advanced EIC PaymentsSami HartsfieldPas encore d'évaluation

- Form W-4 (2018) : Specific InstructionsDocument4 pagesForm W-4 (2018) : Specific InstructionsRony MartinezPas encore d'évaluation

- Pro SourceDocument18 pagesPro Sourcejenny100% (2)

- US Internal Revenue Service: fw4 - 1997Document2 pagesUS Internal Revenue Service: fw4 - 1997IRSPas encore d'évaluation

- US Internal Revenue Service: fw4s07 AccessibleDocument2 pagesUS Internal Revenue Service: fw4s07 AccessibleIRSPas encore d'évaluation

- US Internal Revenue Service: fw4 - 1994Document2 pagesUS Internal Revenue Service: fw4 - 1994IRSPas encore d'évaluation

- De 4Document4 pagesDe 4fschalkPas encore d'évaluation

- Form IL-W-4: Employee's and Other Payee's Illinois Withholding Allowance Certificate and InstructionsDocument2 pagesForm IL-W-4: Employee's and Other Payee's Illinois Withholding Allowance Certificate and InstructionsBetty WeissPas encore d'évaluation

- US Internal Revenue Service: F1040es - 2003Document7 pagesUS Internal Revenue Service: F1040es - 2003IRSPas encore d'évaluation

- DineroDocument4 pagesDineroValeria Amaya Burgos0% (1)

- Federal Electronic Filing Instructions: Tax Year 2018Document13 pagesFederal Electronic Filing Instructions: Tax Year 2018Adonis TorrefielPas encore d'évaluation

- Mi-W4 370050 7Document1 pageMi-W4 370050 7yaposiPas encore d'évaluation

- Tax Impact of Job LossDocument7 pagesTax Impact of Job LossbullyrayPas encore d'évaluation

- US Internal Revenue Service: p501 - 1994Document21 pagesUS Internal Revenue Service: p501 - 1994IRSPas encore d'évaluation

- Withholding Certificate For Pension or Annuity Payments: Personal Allowances WorksheetDocument4 pagesWithholding Certificate For Pension or Annuity Payments: Personal Allowances WorksheetIRSPas encore d'évaluation

- TFN Declaration Form N3092Document6 pagesTFN Declaration Form N3092Randhawa SukhmanPas encore d'évaluation

- Employment Eligibility Verification: U.S. Citizenship and Immigration ServicesDocument2 pagesEmployment Eligibility Verification: U.S. Citizenship and Immigration ServicesAnonymous xnDtZ93LPas encore d'évaluation

- US Internal Revenue Service: p2188Document4 pagesUS Internal Revenue Service: p2188IRSPas encore d'évaluation

- Form W-4 (2019) : Specific InstructionsDocument5 pagesForm W-4 (2019) : Specific Instructionsjok mongPas encore d'évaluation

- STC Reimbursement GuidanceDocument8 pagesSTC Reimbursement GuidanceJhomer Claro100% (1)

- Caution - Guidance For Use of The 2009 Form 1040-ES, Estimated Tax For IndividualsDocument8 pagesCaution - Guidance For Use of The 2009 Form 1040-ES, Estimated Tax For Individualsezra242Pas encore d'évaluation

- Making Work Pay Tax Credit: What Is Federal Income Tax?Document2 pagesMaking Work Pay Tax Credit: What Is Federal Income Tax?Vita Volunteers Webmaster100% (2)

- US Internal Revenue Service: F1040es - 2004Document7 pagesUS Internal Revenue Service: F1040es - 2004IRSPas encore d'évaluation

- Tax Dec Le Ration FormDocument9 pagesTax Dec Le Ration Formruby.matas83Pas encore d'évaluation

- US Internal Revenue Service: fw4 - 1998Document2 pagesUS Internal Revenue Service: fw4 - 1998IRSPas encore d'évaluation

- US Internal Revenue Service: fw4 - 2002Document2 pagesUS Internal Revenue Service: fw4 - 2002IRSPas encore d'évaluation

- I 1040 NreDocument24 pagesI 1040 NreNagendra ReddyPas encore d'évaluation

- Form 1041-ES: Pager/XmlDocument7 pagesForm 1041-ES: Pager/XmlMario A. MckinleyPas encore d'évaluation

- US Internal Revenue Service: fw4s - 1994Document2 pagesUS Internal Revenue Service: fw4s - 1994IRSPas encore d'évaluation

- Tax File Number Declaration - RuviniDocument6 pagesTax File Number Declaration - RuviniruviniogodapolaPas encore d'évaluation

- Beckley Motorsports Park: Application For EmploymentDocument4 pagesBeckley Motorsports Park: Application For EmploymentNRG WEB DESIGNS100% (1)

- US Internal Revenue Service: p4128Document6 pagesUS Internal Revenue Service: p4128IRSPas encore d'évaluation

- Withholding Certificate For Pension or Annuity Payments: General InstructionsDocument6 pagesWithholding Certificate For Pension or Annuity Payments: General InstructionsАндрей КрайниковPas encore d'évaluation

- Request For Abatement of InterestDocument3 pagesRequest For Abatement of InterestShannanAdamsPas encore d'évaluation

- Form 1040-ES: Purpose of This PackageDocument12 pagesForm 1040-ES: Purpose of This Packagetarles666Pas encore d'évaluation

- US Internal Revenue Service: I1040as3Document4 pagesUS Internal Revenue Service: I1040as3IRSPas encore d'évaluation

- Instructions For Form 1040NR-EZ: Pager/SgmlDocument25 pagesInstructions For Form 1040NR-EZ: Pager/SgmlkishoreaeroPas encore d'évaluation

- 2023 DD and Tax FormsDocument5 pages2023 DD and Tax FormselantobbyPas encore d'évaluation

- US Internal Revenue Service: I1040sse - 2006Document4 pagesUS Internal Revenue Service: I1040sse - 2006IRSPas encore d'évaluation

- US Internal Revenue Service: fw4p - 1996Document3 pagesUS Internal Revenue Service: fw4p - 1996IRSPas encore d'évaluation

- US Internal Revenue Service: fw4p - 1993Document3 pagesUS Internal Revenue Service: fw4p - 1993IRSPas encore d'évaluation

- California Employee Withholding Allowance Certificate FormDocument4 pagesCalifornia Employee Withholding Allowance Certificate FormAmandaPas encore d'évaluation

- Claim For Refund and Request For Abatement: See Separate InstructionsDocument1 pageClaim For Refund and Request For Abatement: See Separate InstructionsYang JeanPas encore d'évaluation

- It2104 Fill inDocument7 pagesIt2104 Fill inAlberto R. JuarezPas encore d'évaluation

- Form 1040-ES: Purpose of This PackageDocument12 pagesForm 1040-ES: Purpose of This PackageBill ChenPas encore d'évaluation

- Ca De-4Document4 pagesCa De-4Kevin Marcos FelicianoPas encore d'évaluation

- FW 11Document1 pageFW 11nolsterPas encore d'évaluation

- 1040 Exam Prep: Module I: The Form 1040 FormulaD'Everand1040 Exam Prep: Module I: The Form 1040 FormulaÉvaluation : 1 sur 5 étoiles1/5 (3)

- Doing Your Own Taxes is as Easy as 1, 2, 3.D'EverandDoing Your Own Taxes is as Easy as 1, 2, 3.Évaluation : 1 sur 5 étoiles1/5 (1)

- FE Other CBT Specs 1Document4 pagesFE Other CBT Specs 1Syed AhmedPas encore d'évaluation

- HW 5 SolDocument10 pagesHW 5 SolPedroPas encore d'évaluation

- The Art & Science of Protective Relaying - C. Russell Mason - GEDocument357 pagesThe Art & Science of Protective Relaying - C. Russell Mason - GEAasim MallickPas encore d'évaluation

- Comma Use:, But, Yet, SoDocument6 pagesComma Use:, But, Yet, SoPedroPas encore d'évaluation

- Ejercicios Pruebas de Hip.Document7 pagesEjercicios Pruebas de Hip.PedroPas encore d'évaluation

- Formulas Exam 3Document1 pageFormulas Exam 3PedroPas encore d'évaluation

- 1.4 IRS Form 1040VDocument1 page1.4 IRS Form 1040VBenne James100% (1)

- Fiscal Responsibility ActDocument99 pagesFiscal Responsibility ActRyan KingPas encore d'évaluation

- Excel 14 - Lexi WolfeDocument8 pagesExcel 14 - Lexi Wolfeapi-272607231Pas encore d'évaluation

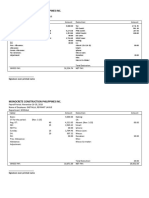

- Payroll SampleDocument6 pagesPayroll Samplepedpalina100% (15)

- US Internal Revenue Service: I1040 - 1995Document84 pagesUS Internal Revenue Service: I1040 - 1995IRS67% (3)

- FPSC Exam Fee Payment ChalanDocument1 pageFPSC Exam Fee Payment ChalanDaniyal ArifPas encore d'évaluation

- US Internal Revenue Service: p51 - 2004Document56 pagesUS Internal Revenue Service: p51 - 2004IRSPas encore d'évaluation

- Monocrete Construction Philippines Inc.: - Signature Over Printed NameDocument1 pageMonocrete Construction Philippines Inc.: - Signature Over Printed NameCherish Gale B. BoloPas encore d'évaluation

- Solved Carmen and Carlos Who Have Filed Joint Tax Returns For PDFDocument1 pageSolved Carmen and Carlos Who Have Filed Joint Tax Returns For PDFAnbu jaromiaPas encore d'évaluation

- Chapter 4 Payroll Acct.Document54 pagesChapter 4 Payroll Acct.Yang XuanPas encore d'évaluation

- Scan 0001Document5 pagesScan 0001Monica Padilla70% (20)

- ECONOMIC BENEFIT THEORY - BIR Ruling No. 123-97 (Retirement and Separation Benefits Paid To Employees)Document2 pagesECONOMIC BENEFIT THEORY - BIR Ruling No. 123-97 (Retirement and Separation Benefits Paid To Employees)KriszanFrancoManiponPas encore d'évaluation

- FORM MO-1040A: Missouri Individual Income Tax Return Single/Married (Income From One Spouse) - Short FormDocument2 pagesFORM MO-1040A: Missouri Individual Income Tax Return Single/Married (Income From One Spouse) - Short Formpixel986Pas encore d'évaluation

- Updated List No. 347 Offers Various Financial InstrumentsDocument15 pagesUpdated List No. 347 Offers Various Financial InstrumentsJuan Pablo ArangoPas encore d'évaluation

- JaamesDocument1 pageJaamesesteysi775Pas encore d'évaluation

- US Internal Revenue Service: I1040 - 2004Document128 pagesUS Internal Revenue Service: I1040 - 2004IRS100% (1)

- Solved in January Ms NW Projects That Her Employer Will WithholdDocument1 pageSolved in January Ms NW Projects That Her Employer Will WithholdAnbu jaromiaPas encore d'évaluation

- Instructions For Form 945: Annual Return of Withheld Federal Income TaxDocument4 pagesInstructions For Form 945: Annual Return of Withheld Federal Income TaxIRSPas encore d'évaluation

- CBO Cost Estimate of H.R. 5779Document2 pagesCBO Cost Estimate of H.R. 5779Daily Caller News FoundationPas encore d'évaluation

- Or Wcomp 0.72 or Wcomp 0.72Document1 pageOr Wcomp 0.72 or Wcomp 0.72aaronPas encore d'évaluation

- Form 1040A Tax Credit DetailsDocument3 pagesForm 1040A Tax Credit DetailsYosbanyPas encore d'évaluation

- Western Federal Taxation 2018 Comprehensive 41st Edition by William H. Hoffman - Test BankDocument56 pagesWestern Federal Taxation 2018 Comprehensive 41st Edition by William H. Hoffman - Test Bankroseyoung0Pas encore d'évaluation

- Paid Preparer's Earned Income Credit ChecklistDocument4 pagesPaid Preparer's Earned Income Credit Checklistanon_294216815Pas encore d'évaluation

- SMN 2013 03 20 B 007Document1 pageSMN 2013 03 20 B 007Swift County Monitor NewsPas encore d'évaluation

- Instructions For Student: CorrectedDocument1 pageInstructions For Student: CorrectedBipal GoyalPas encore d'évaluation

- Audit Reconsideration Memorandum Baker SCRIBDDocument7 pagesAudit Reconsideration Memorandum Baker SCRIBDMichael AlaoPas encore d'évaluation

- Manuel Medel Paystubs PDFDocument7 pagesManuel Medel Paystubs PDFSantiago ManuelPas encore d'évaluation

- W9 FormDocument1 pageW9 FormChris GreenePas encore d'évaluation

- Schedule 1 For 2019 Form 1040Document1 pageSchedule 1 For 2019 Form 1040CNBC.comPas encore d'évaluation

- Please Take A Moment To Read and Acknowledge The Following Terms and ConditionsDocument1 pagePlease Take A Moment To Read and Acknowledge The Following Terms and ConditionsMary MurphyPas encore d'évaluation