Académique Documents

Professionnel Documents

Culture Documents

5G PPP Automotive WG White Paper Feb.2018

Transféré par

epidavriosDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

5G PPP Automotive WG White Paper Feb.2018

Transféré par

epidavriosDroits d'auteur :

Formats disponibles

5G-PPP Automotive Working Group

A study on 5G V2X Deployment

Version 1.0, February 2018

Date: 2018-02-22 Version: 1.0

5G-PPP Automotive Working Group 5G Automotive White Paper

Executive Summary

Although the key technology enablers for 5G Vehicle-to-anything (V2X) communication are

meanwhile well-understood in the cellular community and standardization of 3GPP Rel. 16

V2X is about to start, there is still lack on insights into the required rollout investments,

business models and expected profit for future Intelligent Transportation Services (ITS). It is

foreseen that these advanced services, including HD maps, platooning, highway chauffeur,

teleoperated driving, highly and ultimately fully autonomous driving, will be enabled through

next-generation 5G vehicular networks, starting with 3GPP Rel. 16 New Radio (NR).

This white paper is a first outcome of the 5G-PPP Automotive working group and has the

objective to trigger discussions and provide first insights into the deployment costs for 5G V2X

and revenue analysis for financially and socially beneficial commercialization. The modelling

framework for cost and revenue analysis is generic and is exemplarily applied for highways. It

is further pointed out that advanced driving solutions will be most likely first applied on

highways, as these scenarios are easier to handle, users’ mobility behaviour is more predictable

and the technical solutions less complex.

As a first approach to this problem, this work aims at drawing the 5G ITS landscape, including

main stakeholders and relationships. Moreover, an investment and business model is proposed,

describing the cash flow.

On the technical side, the way to achieve the ultimate goal is to deploy the so-called 5G

digitalized highways, which is a prerequisite for a large number of 5G-based Connected and

Automated Driving (CAD) solutions. The exemplary highway environment considered through

this work includes 5G sites, digital infrastructure, fibre connections, stationary sensors, radars,

lidars, video cameras etc. In order to provide some practical reference values, it is assumed that

services are fully provided over the network infrastructure, meaning that the V2V interface is

not taken in account. It is further assumed that this investment is used to a certain extent to

provide enhanced Mobile Broadband (eMBB) services in parallel to CAD services. The overall

costs are standard-wise formed by CAPEX and OPEX including maintenance and service

overhead and excluding On-Board Unit (OBU) costs, while estimates for Bill-Of-Material

(BOM) and auxiliary services for CAD services as HD map services are considered. For more

realistic revenue estimation, a growth rate over time for 5G CAD service penetration has been

taken into account. We aim at showing under which conditions a good return on investments for

the 5G-digitalized highway can be expected, depending on exact costs, charged fees and

percentage of investment usage for ITS services. Overall, a positive business case can be

observed, enabling a positive profit over a horizon of ten years.

Dissemination Level: Public Page 2 / 14

5G-PPP Automotive Working Group 5G Automotive White Paper

Table of Contents

1 Introduction........................................................................................................................... 5

2 Stakeholders and Business Models...................................................................................... 7

2.1 Stakeholders and relationships....................................................................................... 7

2.2 Investment and business models .................................................................................... 8

3 Costs and Profit Calculations ............................................................................................ 10

3.1 Techno-economic model and key factors .................................................................... 10

3.2 Investment profit for connected and automated driving .............................................. 10

4 Conclusions.......................................................................................................................... 13

5 List of Contributors ............................................................................................................ 14

Dissemination Level: Public Page 3 / 14

5G-PPP Automotive Working Group 5G Automotive White Paper

List of Acronyms and Abbreviations

3GPP 3rd Generation Partnership Project

5G-PPP 5G Infrastructure Public Private Partnership

ACC Adaptive Cruise Control

ARPC Average Return Per Car

BOM Bill Of Materials

CAD Connected and Automated Driving

CAM Cooperative Awareness Messaging

CLM Cooperative Lane Merging

DCC Decentralized Congestion Control

DSRC Dedicated Short Range Communications

DL Downlink

EC European Commission

EPC Engineering, Procurement and Construction

EU European Union

eMBB enhanced Mobile Broadband

eNB evolved Node B

ETSI European Telecommunications Standards Institute

FCC Federal Communications Commission

FCW Forward Collision Warning

GPS Global Positioning System

ITS Intelligent Transport System

LTE Long Term Evolution

MNO Mobile Network Operator

MSP Mobile Service Provider

NR New Radio

OBU On-Board Unit

OEM Original Equipment Manufacturer

PC5 Proximity Communication 5

PLMN Public Land Mobile Network

QoS Quality of Service

RSU Road Side Unit

SDO Standards Developing Organisations

SL Sidelink

TCO Total Cost of Ownership

UL Uplink

V2I Vehicle-to-Infrastructure

V2P Vehicle-to-Pedestrian

V2V Vehicle-to-Vehicle

V2X Vehicle-to-Everything

VAI Vehicle as Infrastructure

VRU Vulnerable Road User

Dissemination Level: Public Page 4 / 14

5G-PPP Automotive Working Group 5G Automotive White Paper

1 Introduction

The objective of this white paper is to provide first insights and trigger discussions about the

deployment costs for 5G V2X and profit analysis for its financially and socially beneficial

commercialization. The conducted modelling approach is generic for both cost and revenue

analysis. Advanced driving solutions are foreseen to most likely be applied on highways first (or

at least in an earlier stage), as these scenarios are simpler due to more predictable mobility

behaviour and with easier to handle algorithmic complexity. Therefore, we chose to conduct this

study in a highway setting. One benefit of the V2X communications technology is to enable safe

transportation, which is foreseen to be available in some countries within a few years. An early

5G Automotive Vision insight was provided already in 2015 by 5G-PPP1.

In this context, automated driving is seen as a technological highlight that will shape the future

mobility concept and improve quality of modern life. In technological terms, the advance

towards fully automated driving is understood as an evolutionary process and is mainly driven

by the corresponding stakeholders in the automotive industry. From the communication

technology point of view, it is meanwhile widely accepted that future ITS services, ultimately

leading to autonomous driving, will require a high level of connectivity of vehicles through an

advanced communication technology as 5G V2X. The multitude of ITS services with

heterogeneous requirements calls for a flexible radio air interface with the coexistence of

multiple radio access technologies and automotive software virtualization.

For what concerns future radio access, after several years of research driven by academia and

industry, and the delivery of mature technology enablers for 5G, 3GPP is now drafting the

standard for 5G V2X, starting with Rel. 16. Efforts and discussions on 5G between stakeholders

have created high expectations at the market and have put large pressure for the delivery of 5G

to the industry. In order to accelerate the deployment of 5G, a first version of the standard will

be released, with a focus on eMBB services, operating at frequencies below 6 GHz and

probably co-existing with legacy LTE systems. It is expected that this first release of 5G will

enable a significant set of advanced ITS services and provide the basis for the second wave of

even more challenging services.

The roadmap to 5G V2X, which is currently assumed to begin with 3GPP Rel. 16, also includes

standards and V2X technologies which are (almost) available, as e.g. LTE V2X and IEEE

802.11p. Their main role is seen in providing enhanced data rates and basic ITS services and are

therefore considered as part of the future landscape of vehicular telecommunication.

Similar as for any new technology, the establishment and success of 5G V2X will strongly

depend on the required investment costs and expected revenue, especially during its first years

of deployment. As the level of required investment has not been yet clarified, there is reluctance

by the Mobile Network Operators (MNOs) and other possible road infrastructure investors

against 5G deployment. To cope with the large investment costs and to support the natural need

for multi-operator vehicular communication, MNOs also consider solutions of sharing network

infrastructure and other resources – especially in the first deployment phase.

At the same time, the automotive industry is seeking for ways to reduce the costs for On-Board

Units (OBUs) supporting 5G V2X to avoid increase of the vehicles’ prices on the market.

Considering the life cycle of cars, legacy cars will need to be supported by non-5G

infrastructure along highways (e.g. stationary highway video cams for old cars to generate HD

maps). In the current study is assumed that cars are equipped with an OBU providing both

communication functionalities as well as running software applications. The processor of the

1 https://5g-ppp.eu/wp-content/uploads/2014/02/5G-PPP-White-Paper-on-Automotive-Vertical-Sectors.pdf

Dissemination Level: Public Page 5 / 14

5G-PPP Automotive Working Group 5G Automotive White Paper

OBU, which is powered by the vehicle’s battery, is sufficiently strong to execute all functions of

the 5G modem, as well as the CAD-related applications run by the vehicle.

The OBUs allow vehicles to have a role as part of the communication infrastructure, since they

can take over functionalities of the network such as relaying of data or coverage extension. This

is made possible thanks to their continuously growing hardware capabilities enabling to

consider vehicles as part of the communication infrastructure. Additionally, from the

automotive software point of view, concurrent execution of multiple applications along with

Connected and Automated Driving (CAD) functions is today made possible by virtualization

and powerful OBUs. To this end, vehicles can execute third party applications and in particular

5G V2X functions, referred in this document as Vehicle-as-Infrastructure (VAI) applications.

As a consequence, VAI applications are going to play an important role for the V2X business

models and are becoming a strong requirement in the automotive market to satisfy a user

experience derived by the one of mobile devices.

The scope of this work includes following:

• Discussion on possible investment and business models for advanced ITS services and

VAI applications.

• Modeling and estimation of investment costs and expected revenues, as well as

prediction of accumulative profit from 5G highway digitization for a horizon of ten

years.

• Identification of the most influential factors and analysis of their impact.

• Conclusions on the required 5G V2X investments, the estimated payback period and the

potential for profit through ITS services.

• Definition of the Average Return Per Car (ARPC), which is required to cover the

investment and service costs and to expect a reasonable return of investment time.

The remaining part of this paper is organized as follows. Section 2 introduces the business

model and stakeholders. In Section 3, the investment costs and profits are estimated, providing

critical information about the payback period. Finally, conclusions are summarized in Section 4.

Dissemination Level: Public Page 6 / 14

5G-PPP Automotive Working Group 5G Automotive White Paper

2 Stakeholders and Business Models

2.1 Stakeholders and relationships

We have identified some main stakeholder categories involved in 5G V2X: 5G industry,

automotive industry, Standards Developing Organisations (SDOs), road infrastructure operators,

policy makers, and users. The relationship between them are depicted in Figure 1.

Figure 1: Main stakeholders and relationships.

The end users could be either the drivers, or the passenger or the service providers. This is due

to the decoupling of the traditional “owner-driver” vs newer models of “service provider-

passenger” paradigm that autonomous vehicles shall support and even encourage. All interact

with the corresponding road infrastructure operator. Each European country has its own

regulation about road infrastructures. Some of them are operated by public entities, while others

are operated by private companies. In some cases, these private companies are partially owned

by the local government.

The road infrastructure operator shall offer 5G connectivity on their roads. They could act as

tenant from the perspective of Mobile Service Provider (MSP). In that case, the road

infrastructure acts as a business supplier for the drivers.

Another model is also possible, where the road infra-structure is seen as a part of the 5G

infrastructure and the business relationship is set-up between the drivers and the automotive

industry. In that case, the automotive industry acts as a tenant from MSP perspective.

In fact, the 5G industry has identified the following roles:

• The tenant is usually a business entity that rents and leverages a 5G connectivity

provided by the MSP. It can be a road infrastructure, automotive industry or other

organisation that requires a connectivity and computing service for their business

operations. This is done via network slicing technology.

• The MSP provides various services to end users. Furthermore, the MSP sells dedicated

mobile network instances (e.g. “network slices”), each realizing a specified service (e.g.

V2X), to tenants. The MSP leases all needed physical and virtual resources from one or

multiple 5G infrastructure providers (5GInPs) to deploy the end-to-end mobile network.

• The 5GInP own and manage parts of or all infrastructure of the network. It can be

further distinguished between RAN infrastructure provider and cloud infrastructure

provider. The latter owns and manages local and central datacentres providing the

virtual resources such as computing, storage and networking. The former owns the

physical infrastructure such as the antenna sites and the HW equipment for the antenna

which could be managed by the road infrastructure.

Dissemination Level: Public Page 7 / 14

5G-PPP Automotive Working Group 5G Automotive White Paper

• Passenger targeted business models. For instance, models that sell connectivity (at

various “grades”) or higher services based on connectivity from the MSP to the

passenger, with the involvement of VAI or without it. Examples: higher grade

infotainment (e.g. four streams of 4K full size TV or AR services), mobile office,

remote assisted driving or teleoperations in various levels, location-based data-intensive

services, or others.

It is also clear to us that additional business models may rise since it is expected that the whole

traditional ecosystem will be disrupted and changed, as well as new use cases and societal

impact could appear.

The 5G industry must collaborate with the Automotive industry to design a 5G V2X technology

that meets their needs in terms of required components to be supported by the MSP and

consumed by the tenant. In the automotive industry, the component manufacturers supply

components to the Tier 1s, so that they can integrate them and build a higher-level component.

Tier 1 companies are direct suppliers to OEMs, which are the ones making the final product for

the consumer marketplace. This traditional chain has been extended with the advent of advanced

driver assistance systems and autonomous driving. Now high definition map providers are also

necessary, together with technology providers consisting of start-ups, SMEs, research institutes

and the academia.

The 5G industry and the automotive industry would need to work hand in hand with

standardisation organisations. In addition, policy makers would regulate across the whole

stakeholder chain. The three profit-oriented stakeholders, thus the 5G industry, automotive

industry and road infrastructure operators, will ask for their share in the 5G V2X business.

2.2 Investment and business models

Advanced ITS use cases will require very high performance for both connectivity and

applications. As for the latter, in-vehicle applications today focus mainly on infotainment (e.g.,

audio/video streaming), however they are expected to cover, through virtualization and artificial

intelligence, other use cases requiring isolated software execution environments and a secure

interaction between applications and vehicle’s smart devices, sensors and actuators. This

translates into new business model opportunities for municipalities, companies, insurances, as

well as road and connectivity infrastructure owners.

The main drivers to generate revenues from automotive applications are advertising, one-time

payment and subscription, which is similar to what happens in the mobile market. Standard

business models are well-known and are based on the assumption that the user pays for a service

provided by the application developer. However, the computing power made available by car

electronics today can be also used in a different way, that is, the vehicle owner can in fact be

rewarded (e.g., with money or fees discount) for providing computing resources and data.

Similarly, a vehicle can be rewarded for forwarding data to nearby vehicles, i.e. serving as a

mobile relay. In this way, connectivity and reliability can be enhanced, whereas such data and

resources can be used by the driver for personal applications (e.g., infotainment) as well as they

can be made available for VAI applications to serve the V2X and connectivity infrastructure in

exchange for a reward. Such scenario can be enabled manually by the vehicle owner, installing

specific applications, or in an automated way, with V2X enablers provisioning functions to be

executed in vehicles. This approach can boost the adoption of smart-connected vehicles and

reduce operational costs of V2X enablers.

We have identified three VAI application business models:

1. Vehicle owner provides resources/data to the infrastructure

Dissemination Level: Public Page 8 / 14

5G-PPP Automotive Working Group 5G Automotive White Paper

◦ CAD infrastructure monitoring can be done by standard vehicles on the road: e.g.,

high definition maps creation and update, environment monitoring (traffic, road,

whether, road surroundings like bridges, mountains, etc.).

◦ Support to the connectivity: e.g., mobile relay/hotspot service for vehicles out of

network coverage (or that lack of a specific connectivity), etc.

2. Vehicle owner provides resources/data to other vehicles

◦ CAD services: the front vehicle in a platooning configuration needs more fuel and

faces higher risks of accidents (insurance), V2V interactions,

◦ other support: e.g., traffic information, content caching (maps, etc.).

3. Vehicle owner gets rewards/discount fees from advertisement

◦ Through mobile location-based advertising, V2X enablers can lower access fees to

the CAD technology, therefore boosting its adoption starting from the beginning.

Dissemination Level: Public Page 9 / 14

5G-PPP Automotive Working Group 5G Automotive White Paper

3 Costs and Profit Calculations

3.1 Techno-economic model and key factors

To handle the complex problem of cost and revenue estimation, some basic assumptions and

parameter choices are taken. First, a business period of ten years is considered, e.g. from 2020

to 2030. Since 3GPP Rel.16 is expected to be completed by the year 2019, the standard and

enabling technology will be available by 2020. Total Cost of Ownership (TCO) includes

CAPEX and OPEX, with OPEX being equal to 10% of CAPEX per year. The main cost

contributions include:

• Site infrastructure: gNBs, containers, antenna mass (CAPEX).

• Digital road infrastructure: cameras, radars, sensors, cables, fibre (CAPEX).

• OPEX costs.

• HD map service fees as part of required data traffic costs.

The required costs for 5G OBUs for vehicles shall be covered by the vehicle owner and are

therefore not considered in the current cost analysis. However, these costs may influence the

expected user penetration rate and need to be reasonable and in general as low as possible.

Moreover, spectrum costs and Engineering, Procurement and Construction (EPC) are not

considered either, as not necessarily specific for CAD services.

Regarding data traffic costs, HD maps updating (include object information and raw data) will

be necessary for some use cases and is estimated to require 1 Mbyte/min per vehicle on average

in UL and DL. Although not applicable to all CAD services, HD maps will be required for the

main ITS services related to autonomous driving. For instance, a one-hour trip of 100 km

highway at a speed of 100 km/h will result into 120 Mbytes data volume per vehicle, which is

foreseen to be provided by the 5G network. This service includes connection fees and map

creation, a rough cost estimate would be 0.5 Euro per 100 km. The traffic density numbers are

based on measurements provided by the German Federal Highway Research Institute2. It is

worth noting that a certain discount, e.g. in the order of 10%, could be optionally provided to

vehicles implementing VAI applications. These could support the road real-time monitoring and

updating of HD maps.

3.2 Investment profit for connected and automated

driving

In this study, an estimation of the deployment costs, income and revenue is provided for a

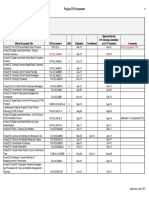

horizon of ten years. The deployment costs presented in Table 1 are considered as our baseline

scenario. Note that these deployment costs only are coarse estimates.

To estimate the potential income, a 100 km highway segment is considered, with a traffic

density of 100,000 vehicles/100 km per day, a CAD service fee of 1 Euro/hour per vehicle,

which shall also cover the connection and estimated HD map fees of 0.5 Euro/hour per vehicle.

As a realistic market behavior, a 10% yearly penetration of new CAD users of is assumed.

Considering all above, it is then straightforward to calculate the investment costs, income

(revenue) and profit for the period of ten years. It is noteworthy that in the fifth year after the

2 http://www.bast.de/DE/Verkehrstechnik/Fachthemen/v2-verkehrszaehlung/Aktuell/zaehl_aktuell_node.html

Dissemination Level: Public Page 10 / 14

5G-PPP Automotive Working Group 5G Automotive White Paper

initial investment a (accumulated) profit can be expected, whereas after ten years, a total profit

of almost 70 MEuro can be expected.

Table 1: Estimation of deployment costs for the baseline scenario.

Parameter Value

5G site (CAPEX) 40 kEuro

Digital infrastructure (CAPEX) 35 kEuro / km

Fibre (CAPEX) 100 kEuro / km

OPEX 17.5 kEuro / km / year

Inter-site-distance (ISD) 1 km

To gain more insight into the influence of individual parameters on the overall profit, four

different scenarios are considered. Besides the first (baseline) scenario, three more scenarios

with different values of CAD service fee, traffic density and CAPEX/OPEX costs are

considered, with the full list of parameters shown in Table 2. For each scenario, the change with

respect to the baseline scenario is highlighted in red. Specifically, the second scenario considers

a higher traffic density, while in the third scenario a 50% lower connectivity and HD map fee is

assumed, allowing the operator to also reduce the CAD service fee to 0.5 Euro / 100 km.

Finally, the fourth scenario corresponds to the case where the investment is assumed to be used

e.g. by ITS and other services,as eMBB, to the same extent. This also reduces the OPEX costs

to the half.

Table 2: Deployment costs and parameter values for different scenarios.

Parameter \ Scenarios 1 (Baseline) 2 3 4

CAPEX – 100 km 8,750

17,500 17,500 17,500

(kEuro) (-50%)

OPEX – 100 km 8,750

17,500 17,500 17,500

(kEuro for 10 years) (-50%)

CAD service fee

1 1 0.5 1

(Euro per 100 km)

Income (% of the CAD

50% 50% 50% 50%

service fee)

Traffic density

100,000 200,000 100,000 100,000

(vehicles/100 km/day)

Evaluation results for the accumulated profit are depicted in Figure 2 for a fixed user

penetration rate of 10% per year. As observed, a payback period between three to eight years is

expected, depending on the traffic density, service fees and deployment costs. As a general rule,

the profit growth rate depends on the total income, which is formed by the product of CAD

service fee (excluding HD maps fees) per vehicle and the number of vehicles. At the same time,

a smaller initial investment, i.e. lower CAPEX/OPEX costs results into a shift of the curves to

the left which could be interpretated as shorter payback periods.

Dissemination Level: Public Page 11 / 14

5G-PPP Automotive Working Group 5G Automotive White Paper

Figure 2: Accumulated profit for different scenarios and 10% penetration rate yearly.

For further reference and as an upper bound, calculation results for a 100% penetration of

vehicles using CAD services from the first year are provided. For the baseline scenario, already

from the second year the accumulated profit is positive, whereas after 10 years a profit of 154 M

Euro will have been generated, which is more than double than for the case of 10% yearly

penetration.

Figure 3 shows the accumulated profit for a 100% user penetration rate from the first year. Due

to the full penetration, constant income and costs for every year lead to a linear growth of the

accumulated profit. The influence of traffic density, service fees and deployment costs are the

same as for the case of 10% yearly penetration. However, in relative terms, the accumulated

profit after ten years is between two and ten times higher than for the case of 10% penetration.

Figure 3: Accumulated profit for different scenarios and 100% penetration rate from the first year.

Dissemination Level: Public Page 12 / 14

5G-PPP Automotive Working Group 5G Automotive White Paper

4 Conclusions

The first part of this study provided an overview of the stakeholders and business models for

providing advanced ITS services such as CAD services on highways. New business models,

considering a more active role of the vehicle implementing a subset of infrastructure features

were considered. To this direction, resource sharing and providing of connectivity and services

to other nearby vehicles were introduced and described.

In terms of the investment costs, the role of different parameters and scenarios for providing 5G

CAD services over the network infrastructure and their impact on the profit was analysed. One

of the main findings is that key parameters influencing the profit of CAD services are the

OPEX/CAPEX costs, which also depend on the percentage of usage of the infrastructure for ITS

services. Other key parameters are the fees for CAD services and the number of users, defining

the growth rate of the profit. Therefore, a positive business case shall be – at least in the early

phase of 5G deployment – expected for roads with a high density of vehicles. Of course, as the

number of users that can be served is limited by the road capacity, the success of investment

will also depend on the affordable charging level for CAD services. Hence, a positive business

case enabling profit has been observed.

Although the above findings are more qualitative, rather than quantitative, the overall message

is that a positive business case can be expected, even if CAD services shall be fully provided

over the network infrastructure and the user penetration rate grows slowly over time. Obviously,

including the PC5 interface for selected use cases (e.g. platooning, see-through) would allow

offloading data traffic and release some of the network resources.

A more detailed modelling and analysis of the investment, which will be required to derive

more concrete and quantitative conclusions, shall be considered by the authors for further study.

Dissemination Level: Public Page 13 / 14

5G-PPP Automotive Working Group 5G Automotive White Paper

5 List of Contributors

Editors

Mikael Fallgren, Konstantinos Manolakis

Contributors

Konstantinos Manolakis, Mohamed Gharba, Markus Dillinger (Huawei), Leonardo

Gomes Baltar (Intel), Michele Paolino (Virtual Open Systems), Gorka Vélez

(Vicomtech), Bessem Sayadi (Nokia Bell-Labs), Mikael Fallgren, Andrés Laya

(Ericsson), Jose F. Monserrat (Universitat Politècnica de València).

Dissemination Level: Public Page 14 / 14

Vous aimerez peut-être aussi

- Sensors: 5G Beyond 3GPP Release 15 For Connected Automated Mobility in Cross-Border ContextsDocument19 pagesSensors: 5G Beyond 3GPP Release 15 For Connected Automated Mobility in Cross-Border ContextsashishsinghchouhanPas encore d'évaluation

- Research Article An Overall Research On Industry Ecological and Technical Solutions For 5G-V2X in Port Park ScenarioDocument8 pagesResearch Article An Overall Research On Industry Ecological and Technical Solutions For 5G-V2X in Port Park Scenarioمصعب جاسمPas encore d'évaluation

- 1 Vehicular Connectivity: C-V2X & 5G - September 2021Document34 pages1 Vehicular Connectivity: C-V2X & 5G - September 2021dn007Pas encore d'évaluation

- Comparison of Itsg5 With CellularDocument8 pagesComparison of Itsg5 With CellularLeviPas encore d'évaluation

- Sensors: A 5G V2X Ecosystem Providing Internet of VehiclesDocument20 pagesSensors: A 5G V2X Ecosystem Providing Internet of VehiclesMohammad Wafin IrsaliahPas encore d'évaluation

- Markus Mueck - Networking Vehicles To Everything - Evolving Automotive Solutions-Deg Press (2018)Document234 pagesMarkus Mueck - Networking Vehicles To Everything - Evolving Automotive Solutions-Deg Press (2018)Javier IzquierdoPas encore d'évaluation

- SZALAY Et Al-ICTINROADVEHICLESOBDvsCANDocument8 pagesSZALAY Et Al-ICTINROADVEHICLESOBDvsCANKunal AhiwalePas encore d'évaluation

- Reserch Paper (023 & 112)Document6 pagesReserch Paper (023 & 112)Vineet JainPas encore d'évaluation

- AIOTI IoT Relation and Impact On 5G - V1a 1Document74 pagesAIOTI IoT Relation and Impact On 5G - V1a 1rajibulecePas encore d'évaluation

- IOT HA - PaperDocument10 pagesIOT HA - PaperPratik DixitPas encore d'évaluation

- Talking Cars: Field Talking Cars: Field Test Results Comparing DSRC & C-V2X TechnologyDocument39 pagesTalking Cars: Field Talking Cars: Field Test Results Comparing DSRC & C-V2X TechnologyrobertabbasPas encore d'évaluation

- Quectel Connected Car White PaperDocument11 pagesQuectel Connected Car White Papermuskan beePas encore d'évaluation

- Redefining Metro Networks For Scale Simplicity and SustainabilityDocument13 pagesRedefining Metro Networks For Scale Simplicity and SustainabilitySholy AugustinePas encore d'évaluation

- Cooperative Autonomous Driving Oriented MEC-Aided 5G-V2X: Prototype System Design, Field Tests and AI-Based Optimization ToolsDocument15 pagesCooperative Autonomous Driving Oriented MEC-Aided 5G-V2X: Prototype System Design, Field Tests and AI-Based Optimization Toolsz2412952949Pas encore d'évaluation

- Vehicular Ad-Hoc Networks: An Information-Centric PerspectiveDocument17 pagesVehicular Ad-Hoc Networks: An Information-Centric Perspectiveopiez89Pas encore d'évaluation

- Business Feasibility Study For 5G V2X Deployment - 1553855796Document24 pagesBusiness Feasibility Study For 5G V2X Deployment - 1553855796Zoran KehlerPas encore d'évaluation

- Conn Car Project ReportDocument21 pagesConn Car Project ReportAbhishek VermaPas encore d'évaluation

- Connected Vehicle Technologies - Forecasts To 2035 - 2020 Q4 Edition 5G Networking The Effect On AutomotiveDocument3 pagesConnected Vehicle Technologies - Forecasts To 2035 - 2020 Q4 Edition 5G Networking The Effect On AutomotiveAngel ChiangPas encore d'évaluation

- C CCCCCCCCCCCCCCC C C CCCCCCDocument27 pagesC CCCCCCCCCCCCCCC C C CCCCCCSri PeddibotlaPas encore d'évaluation

- Utilization of 5G in IoVs For Road Traffic Management: A SurveyDocument13 pagesUtilization of 5G in IoVs For Road Traffic Management: A SurveyInternational Journal of Innovative Science and Research TechnologyPas encore d'évaluation

- 5G For The Automotive DomainDocument2 pages5G For The Automotive DomainShyam PrabhuPas encore d'évaluation

- Enabling The Connected Vehicle-White Paper V5Document12 pagesEnabling The Connected Vehicle-White Paper V5Abhishek Verma100% (1)

- Low Latency Vehicular Edge A Vehicular Infr 2020 Simulation Modelling PractDocument17 pagesLow Latency Vehicular Edge A Vehicular Infr 2020 Simulation Modelling Practmohamed albasunyPas encore d'évaluation

- Vehicular Fog Computing: Enabling Real-Time Traffic Management For Smart CitiesDocument7 pagesVehicular Fog Computing: Enabling Real-Time Traffic Management For Smart CitiesVaryan AnubarakPas encore d'évaluation

- Intelligent Vehicular Networks and Communications: Fundamentals, Architectures and SolutionsD'EverandIntelligent Vehicular Networks and Communications: Fundamentals, Architectures and SolutionsÉvaluation : 1 sur 5 étoiles1/5 (1)

- Sensors: Smart Parking System With Dynamic Pricing, Edge-Cloud Computing and LoraDocument22 pagesSensors: Smart Parking System With Dynamic Pricing, Edge-Cloud Computing and LoraZahara175Pas encore d'évaluation

- Smart Vehicle - To-Vehicle Communication With 5G TechnologyDocument4 pagesSmart Vehicle - To-Vehicle Communication With 5G TechnologyEditor IJRITCCPas encore d'évaluation

- Vehicle To Vehicle Communication WhitepaperDocument13 pagesVehicle To Vehicle Communication WhitepaperArunShan100% (1)

- Etsi wp28 Mec in 5G FINALDocument28 pagesEtsi wp28 Mec in 5G FINALLinYcPas encore d'évaluation

- DBI2021 - Group 2 How 5G Impact TransportationDocument12 pagesDBI2021 - Group 2 How 5G Impact TransportationTham SriswatPas encore d'évaluation

- 5g TechnologyDocument36 pages5g TechnologyDeepeshSinghPas encore d'évaluation

- Medium Access in Cloud-Based For The Internet of Things Based On Mobile Vehicular InfrastructureDocument10 pagesMedium Access in Cloud-Based For The Internet of Things Based On Mobile Vehicular InfrastructureTELKOMNIKAPas encore d'évaluation

- C-V2X - A Communication Technology For Cooperative, Connected and Automated MobilityDocument6 pagesC-V2X - A Communication Technology For Cooperative, Connected and Automated MobilityIshan DarwhekarPas encore d'évaluation

- Connected Vehicle Technologies - Forecasts To 2033 - 2019 Q2 Edition SPECIAL REPORT 5G The Effect On AutomotiveDocument3 pagesConnected Vehicle Technologies - Forecasts To 2033 - 2019 Q2 Edition SPECIAL REPORT 5G The Effect On AutomotiveAngel ChiangPas encore d'évaluation

- AnalysysMason Report For 5GAA On Socio Economic Benefits of Cellular V2XDocument86 pagesAnalysysMason Report For 5GAA On Socio Economic Benefits of Cellular V2XFarhat BajryPas encore d'évaluation

- 5g Technology Seminar ReportDocument28 pages5g Technology Seminar Reportankit20750% (1)

- Sensors 21 00843Document14 pagesSensors 21 00843SafaPas encore d'évaluation

- Futureinternet 15 00175Document32 pagesFutureinternet 15 00175Pekka KorhonenPas encore d'évaluation

- Jsa D 22 00211Document14 pagesJsa D 22 00211marcoskonzenPas encore d'évaluation

- How 5G Will Influence Autonomous Driving SystemsDocument9 pagesHow 5G Will Influence Autonomous Driving Systemsjohn BronsonPas encore d'évaluation

- Sensors 21 07744 v2Document18 pagesSensors 21 07744 v2SamPas encore d'évaluation

- 5g Mobile Services and Networks-QualcommDocument20 pages5g Mobile Services and Networks-QualcommMobiObie Online,LLCPas encore d'évaluation

- LTE Self-Organising Networks (SON): Network Management Automation for Operational EfficiencyD'EverandLTE Self-Organising Networks (SON): Network Management Automation for Operational EfficiencySeppo HämäläinenPas encore d'évaluation

- Annex J - Case Study On Smart RoadsDocument30 pagesAnnex J - Case Study On Smart RoadsbubuhomePas encore d'évaluation

- Approaches For In-Vehicle Communication - An Analysis and OutlookDocument17 pagesApproaches For In-Vehicle Communication - An Analysis and Outlookkrishna prasathPas encore d'évaluation

- Own 5G. Own The Edge Feb 21 - Layout - For TransDocument3 pagesOwn 5G. Own The Edge Feb 21 - Layout - For TransNg Phạm Anh KhoaPas encore d'évaluation

- 2G-3G Conversion HuaweiDocument19 pages2G-3G Conversion HuaweiemailbasirPas encore d'évaluation

- 5G Strategy For Luxembourg: Roadmap For The 5 Generation of Mobile Communication in LuxembourgDocument20 pages5G Strategy For Luxembourg: Roadmap For The 5 Generation of Mobile Communication in LuxembourgLoyde W MitchellPas encore d'évaluation

- A New Platform For Rail Communications - Adopting 5G For RailwaysDocument17 pagesA New Platform For Rail Communications - Adopting 5G For RailwaysShashikant ChaudhariPas encore d'évaluation

- Blockchain-Based Secure and Trustworthy Internet of Things in Sdn-Enabled 5G-VanetsDocument11 pagesBlockchain-Based Secure and Trustworthy Internet of Things in Sdn-Enabled 5G-Vanetsمحمد الحدادPas encore d'évaluation

- Overview On 5G and 6G Wireless Communication With Iot TechnologyDocument11 pagesOverview On 5G and 6G Wireless Communication With Iot TechnologyGokarala Triveni9119Pas encore d'évaluation

- Applied Sciences: Efficient Multi-Player Computation Offloading For VR Edge-Cloud Computing SystemsDocument19 pagesApplied Sciences: Efficient Multi-Player Computation Offloading For VR Edge-Cloud Computing SystemsjuanluisPas encore d'évaluation

- 5G Transformation: 7 Streams For SuccessDocument15 pages5G Transformation: 7 Streams For SuccessHiểu Minh NguyễnPas encore d'évaluation

- The Road Beyond 5G: A Vision and Insight of The Key TechnologiesDocument7 pagesThe Road Beyond 5G: A Vision and Insight of The Key TechnologiesSaurav SarkarPas encore d'évaluation

- Road Asset Management and The Vehicles of The Future: An Overview, Opportunities, and ChallengesDocument18 pagesRoad Asset Management and The Vehicles of The Future: An Overview, Opportunities, and ChallengesbvivPas encore d'évaluation

- ArunSampath - 5G - MEC - ConnectedVehicles WireDocument4 pagesArunSampath - 5G - MEC - ConnectedVehicles WireGalbraith AndrewsPas encore d'évaluation

- Ihs Technology Whitepaper Cellular Vehicle To Everything C v2x ConnectivityDocument3 pagesIhs Technology Whitepaper Cellular Vehicle To Everything C v2x ConnectivitysavyPas encore d'évaluation

- Throughput Improvement in Vehicular Communication by Using Low Density Parity Check (LDPC) CodeDocument9 pagesThroughput Improvement in Vehicular Communication by Using Low Density Parity Check (LDPC) CodeNguyen Thuan TinPas encore d'évaluation

- Vehicle To Infrastructure Communication Different Methods and Technologies Used For ItDocument3 pagesVehicle To Infrastructure Communication Different Methods and Technologies Used For ItBargavi SrinivasPas encore d'évaluation

- Voice Over IP - A Beginners GuideDocument107 pagesVoice Over IP - A Beginners GuideepidavriosPas encore d'évaluation

- Nokia White Paper The 3GPP Enhanced Voice Services (EVS) CodecDocument19 pagesNokia White Paper The 3GPP Enhanced Voice Services (EVS) CodecepidavriosPas encore d'évaluation

- FraunhoferIIS Technical-Paper EVSDocument9 pagesFraunhoferIIS Technical-Paper EVSepidavriosPas encore d'évaluation

- Push To Talk White PaperDocument11 pagesPush To Talk White PaperepidavriosPas encore d'évaluation

- Issi White Paper - FinalDocument20 pagesIssi White Paper - FinalepidavriosPas encore d'évaluation

- Approved Project 25 StandardsDocument5 pagesApproved Project 25 StandardsepidavriosPas encore d'évaluation

- Uxpin Mobile Ui Design Patterns 2014 PDFDocument135 pagesUxpin Mobile Ui Design Patterns 2014 PDFepidavrios100% (2)

- 5G PPP Use Cases and Performance Evaluation Modeling v1.0Document39 pages5G PPP Use Cases and Performance Evaluation Modeling v1.0epidavriosPas encore d'évaluation

- Addressing Big Data Telecom Requirements For Real Time AnalyticsDocument0 pageAddressing Big Data Telecom Requirements For Real Time AnalyticsepidavriosPas encore d'évaluation

- 3gpp 3210-730Document21 pages3gpp 3210-730epidavriosPas encore d'évaluation

- LTE Protocol SignalingDocument11 pagesLTE Protocol SignalingKhåïrul Akmar TiminPas encore d'évaluation

- GTP PrimerDocument16 pagesGTP PrimerepidavriosPas encore d'évaluation

- Sip RFCDocument24 pagesSip RFCepidavriosPas encore d'évaluation

- Wimax: Opportunity or Hype?: AuthorsDocument37 pagesWimax: Opportunity or Hype?: AuthorsSteveihPas encore d'évaluation

- BI Trends 2016Document27 pagesBI Trends 2016epidavriosPas encore d'évaluation

- M2M PDFDocument5 pagesM2M PDFepidavriosPas encore d'évaluation

- Variable-Stride Multi-Pattern Matching For Scalable Deep Packet InspectionDocument9 pagesVariable-Stride Multi-Pattern Matching For Scalable Deep Packet InspectionepidavriosPas encore d'évaluation

- Decision MakingDocument8 pagesDecision MakingepidavriosPas encore d'évaluation

- AT&T Cloud ServicesDocument4 pagesAT&T Cloud ServicesepidavriosPas encore d'évaluation

- GTP 29281 b30Document26 pagesGTP 29281 b30epidavriosPas encore d'évaluation

- 3G TutorialDocument126 pages3G Tutorialanon-721936100% (1)

- Backhauling-X2 0Document13 pagesBackhauling-X2 0epidavriosPas encore d'évaluation

- IPv6TF Report Transition Challenges July 2007 FinalDocument53 pagesIPv6TF Report Transition Challenges July 2007 FinalepidavriosPas encore d'évaluation

- Jaaskelainen Overview of ITS Initiatives in EuropeDocument33 pagesJaaskelainen Overview of ITS Initiatives in EuropeepidavriosPas encore d'évaluation

- HGST Partitioning and Formatting GuideDocument21 pagesHGST Partitioning and Formatting GuidejaylorbenPas encore d'évaluation

- MAXvent OwletDocument66 pagesMAXvent Owletemanuelluca@yahoo.comPas encore d'évaluation

- Dietmar Hildenbrand-Foundations of Geometric Algebra ComputingDocument199 pagesDietmar Hildenbrand-Foundations of Geometric Algebra ComputingGuillermo Osuna100% (2)

- Spare Parts Supply ChainDocument8 pagesSpare Parts Supply ChainRaj ChoudharyPas encore d'évaluation

- Game Maker Book 1 - New EditionDocument299 pagesGame Maker Book 1 - New EditionBen Tyers100% (2)

- 1VET954910-910 Arc EliminatorDocument4 pages1VET954910-910 Arc EliminatorprotectionworkPas encore d'évaluation

- ASNZS1576 Scaffolding+General+RequirementsDocument69 pagesASNZS1576 Scaffolding+General+RequirementsMuhammad AfiqPas encore d'évaluation

- Panasonic PT-AE2000U LCD Projector ManualDocument58 pagesPanasonic PT-AE2000U LCD Projector Manualspock_cowPas encore d'évaluation

- Hyundai ManualDocument25 pagesHyundai ManualDavor Profesor89% (18)

- 2801 Pep CL01 10001Document77 pages2801 Pep CL01 10001mileperez78100% (2)

- 40RUM 60Hz PDC V6Document36 pages40RUM 60Hz PDC V6hgogoriyaPas encore d'évaluation

- CFD - Driving Engineering ProductivityDocument5 pagesCFD - Driving Engineering ProductivityBramJanssen76Pas encore d'évaluation

- Suffolk Library Consultation ResponsesDocument3 050 pagesSuffolk Library Consultation ResponsesjehargravePas encore d'évaluation

- Warranty Clause: Manual #986-003 Rev HDocument84 pagesWarranty Clause: Manual #986-003 Rev HMarcelo P C SouzaPas encore d'évaluation

- Note Number Frequency TableDocument7 pagesNote Number Frequency TablemreijPas encore d'évaluation

- Futuristic NursingDocument3 pagesFuturistic NursingDeerpraj CmPas encore d'évaluation

- Notes Collection Related With OopsDocument135 pagesNotes Collection Related With OopsPervasivetech BangalorePas encore d'évaluation

- MTPT ItsDocument1 pageMTPT Itsone borneoPas encore d'évaluation

- Conveyor Belt Fire SafetyDocument14 pagesConveyor Belt Fire SafetyFeno0% (1)

- HRISDocument13 pagesHRISAkash BansalPas encore d'évaluation

- Analysis PhaseDocument63 pagesAnalysis PhaseJoseph Josef0% (1)

- Preca Catalog - Read ViewDocument9 pagesPreca Catalog - Read ViewAnyaWestmorelandPas encore d'évaluation

- Chapter - 1 Condenser PerformanceDocument21 pagesChapter - 1 Condenser PerformanceAhmed HelmyPas encore d'évaluation

- Lauda E200Document63 pagesLauda E200Sepehr SaPas encore d'évaluation

- Aix Interview QuestionsDocument86 pagesAix Interview Questionssumit6in100% (1)

- Blue-Raydisc - Projectreport PDFDocument78 pagesBlue-Raydisc - Projectreport PDFmanuieeePas encore d'évaluation

- XK3101 (HL-2065) IndicatorDocument20 pagesXK3101 (HL-2065) IndicatorEliana Cristina100% (1)

- Site Preparation and Earth WorkDocument31 pagesSite Preparation and Earth WorkGerobak Gaya100% (2)

- Qame Form 2Document6 pagesQame Form 2Gen Li Togy100% (2)

- Plant Visit and Seminar 2017Document3 pagesPlant Visit and Seminar 2017Borje DelonPas encore d'évaluation