Académique Documents

Professionnel Documents

Culture Documents

Lease Accounting Sap Landscapes Whitepaper Protiviti

Transféré par

aximeCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Lease Accounting Sap Landscapes Whitepaper Protiviti

Transféré par

aximeDroits d'auteur :

Formats disponibles

Implementing

the New Lease

Accounting Standard

in SAP Landscapes

The Road to Compliance

Internal Audit, Risk, Business & Technology Consulting

Introduction

A new lease accounting standard will become a requirement for companies starting on

January 1, 2019. This paper provides background on the standard and recommends a

specific technological solution, SAP Lease Administration by NAKISA, for lessees, to allow

for process automation, consistent controls, transparency for lease reporting, and analysis of

asset utilization.

Asset leasing is a common business practice among and ensure consistency in financial reporting, the

companies in all industries. It allows businesses to Financial Accounting Standards Board (FASB) and

utilize real estate, equipment, transportation assets the International Accounting Standards Board (IASB)

and technology to support operations and functions jointly developed a new standard, ASC 842, as part of

on a day-to-day basis while providing flexibility and a global convergence effort. This new standard will

control over working capital. Traditional accounting require lessees to recognize a lease liability and a right-

rules require leases to be classified as financial (cap- of-use asset for all leases (except those with a duration

italized on the balance sheet) or operating (expensed of less than one year) when the underlying asset

in the profit and loss [P&L] statement), based on the becomes available to the lessee. The introduction of

intended use and ownership of the underlying asset. the new standard requires both lessees and lessors to

Historically, this provided a structure that allowed evaluate its effect on the business processes, policies,

off-balance sheet financing, affecting the company’s financial statements, technology and internal controls

debt and liability posture. To help address this issue within their company.

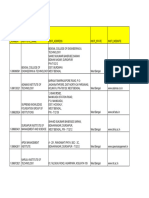

Lease Accounting Standard Effective Dates

ASC 842 issued Effective Date:

2016 2017 2018 2019

February 25, 2016 January 1, 2019*

Financial Reporting Current Standard New Standard

* Note: Non-public companies have until January 1, 2020 to comply with the new standard.

protiviti.com Implementing the New Lease Accounting Standard in SAP Landscapes · 1

Lease Accounting Compliance Considerations

In order to comply with the new lease accounting rules, companies must define a comprehensive approach

and compliance road map that not only include the policies and procedures for processing assets, but also the

technology and automated controls to support the updated accounting practices and comply with reporting

requirements. The table below outlines the key considerations along this process, with guiding questions to

address each consideration.

COMPLIANCE CONSIDERATIONS KEY QUESTIONS

• Do you have a documented accounting policy for leases?

• Do you understand the impact of the accounting standards on your business,

including statutory reporting considerations?

• Have you started to address the new leasing standard?

Understand the new regulation

• Have you evaluated the need for new judgments, estimates and calculation

requirements under the new standard?

• Do you regularly lease property, plant or equipment?

• Approximately how many leases do you have at any given point in time for

each of these categories — property, plant, equipment type (e.g., copiers,

computers, vehicles)?

• Do you know the locations of your current leases?

• Are the majority of the lease terms longer than a year?

• Do you engage in financing arrangements?

• Do you have all the required lease data electronically?

Create an inventory of leases

• Do you have supplier arrangements or service contracts that provide the right

to use certain assets?

• Do you have revenue arrangements with embedded leases where you are

required to separate lease and non-lease components?

• Are the majority of your leases accounted for as operating leases?

• Do you have sale leaseback arrangements?

• Is your existing leasing tool compatible with the new standards?

• Does your existing leasing tool integrate fully with your ERP system?

Assess the technology

Continued...

protiviti.com Implementing the New Lease Accounting Standard in SAP Landscapes · 2

COMPLIANCE CONSIDERATIONS KEY QUESTIONS

• What changes are required for forecasting and budgeting under the new standard?

• What communication plans are required for stakeholders?

• What will be the reporting differences for multi-jurisdictional reporting?

Evaluate reporting implications

• Have you evaluated the process and internal control implications

of the new standard?

Evaluate other implications

• Are you a private or a public company?

• Do you know the deadlines for your type of company?

Develop an • Do you plan on being an early adopter of the standard?

implementation timeline • Are you allocating enough time to the transition in order to meet the deadline?

• How prepared are your third-party vendors for the new regulation?

• Are the leases with your smaller third-party vendors properly formalized?

Recognize data ownership and

third-party involvement

• Do you have the right talent and expertise to manage the transition?

• What training is required for finance and non-finance personnel, including

Manage your resources the board, audit committee, senior management and investors?

• Do you understand the implications of not accurately complying with

the new standard?

Avoid the risk of noncompliance

protiviti.com Implementing the New Lease Accounting Standard in SAP Landscapes · 3

SAP Lease Administration by NAKISA® (SLAN)

To effectively address the new lease accounting standards, companies are turning to SAP Lease Administration by

NAKISA (SLAN) because it is the only solution that can effectively manage all types of leases.1 The SLAN solution

is integrated with the SAP core application and manages the full lease lifecycle for lessees, from initiation to

termination of the lease. This includes:

•• Lease determination •• Classification, amortization, accruals and payments*

•• Data capturing •• Event management and workflows

•• Lease agreement and contract management* •• Equipment tracking

•• Assignment of lender, supplier and fixed assets* •• Standard lease-related reporting and

disclosure reporting

* Integrated with SAP

SLAN Solution Offerings

• Designed to provide visibility into your lease and revenue contract exposure

• Single repository for all leases and contracts

End-to-End Lease Management

• Full lease accounting capabilities, from classification, accruals and payments to

disclosure reporting

• Consolidates and captures all lease data, including data necessary for audit trails, in

Accounting and Compliance order to increase efficiency and provide higher return on lease management processes

• Disclosure reporting is compliant with IFRS 16 and ASC 842

• Provides view of the entire lease portfolio from multiple perspectives with dynamic

Analytics and Reporting search and dashboards

SLAN is part of SAP’s package of automated lease solutions, which includes SAP Real Estate Management and SAP Leasing.

1

protiviti.com Implementing the New Lease Accounting Standard in SAP Landscapes · 4

Why SLAN?

Using a comprehensive end-to-end solution has a

number of benefits. It allows companies to be scalable

and consistent as they grow and handle complex leases

(e.g., multiple schedules), reduces the risk of penalties

due to noncompliance, provides a global view of all

lease data and the associated impact on financial

statements, and supports statutory lease reporting.

A few of the key reasons companies are choosing SAP

Lease Administration by NAKISA®:

•• Product was developed jointly with SAP with

leases in mind: The solution provides a central

repository for lease contract administration

and lease reporting, thus enabling end-to-end

management and accounting for all leases on

a single platform.

•• Meets SAP premium qualification requirement:

Though there are a number of lease accounting

software products on the market, only a few meet this

requirement, which tests and validates programs for

security, performance, supportability, accessibility

and documentation.

•• Integrates with SAP ERP Central Component (ECC):

The solution provides native integration to the SAP

ECC environment with real-time connectivity.

This eliminates the need to build and support

custom integrations.

•• Is sold and supported by SAP: This ensures that the

product will be supported long-term.

protiviti.com Implementing the New Lease Accounting Standard in SAP Landscapes · 5

Why Protiviti?

Protiviti supports companies in meeting their staff on these changes, and generate new types

lease accounting standard requirements beyond of reporting based on each company’s business

the capabilities that traditional contractors, system requirements. Protiviti is a leader in financial

integrators or accounting firms provide. We and business process optimization, and our SAP

bring deep cross-functional expertise in financial visualization technical experts can support

accounting, business process improvement and reporting requirements of any complexity.

systems implementation, among other competencies.

This, combined with our SAP expertise and NAKISA

System Implementation

partner status and access to Robert Half resources

and staffing, allows us to create a uniquely qualified, As a Gold partner with SAP and a leader in the SAP

comprehensive approach to projects to comply with compliance and finance community, Protiviti can be

the new lease accounting standard and achieve the your single qualified partner in the implementation of

necessary business transformation. SAP Lease Administration by NAKISA®.

We assist companies in the following areas:

Control and Process Documentation and Training

Impact Assessment and Solution Design Large-scale changes to processes and controls require

retraining of individuals and significant amounts of

We perform a gap analysis to understand your current

new documentation and training materials. Protiviti

state and design the road map for implementing SAP

can assist with the development of these materials,

Lease Administration by NAKISA®.

including online learning scenarios, and facilitate

employee training sessions.

Lease Discovery and Data Collection

The initial discovery of all the leases can be a significant Project Management

task depending on the number, locations and variety

The timelines for adoption of the new lease accounting

of leases; whether they exist electronically or on paper;

standard are firm, and companies increasingly are

and other factors. Our proven methodology, combined

becoming aware that the complexity is higher than

with access to experienced resources from our parent

expected. Protiviti can provide project management

company Robert Half, allows us to efficiently identify

expertise and the required compliance, financial and

and capture all data from leases globally.

systems implementation knowledge to successfully

assist companies in meeting the deadline.

Process and Reporting Optimization

To maintain the lease accounting standard over the

long term, companies will need to implement new

financial policies and processes, train accounting

protiviti.com Implementing the New Lease Accounting Standard in SAP Landscapes · 6

ABOUT PROTIVITI

Protiviti is a global consulting firm that delivers deep expertise, objective insights, a tailored approach and unparalleled collaboration to help leaders

confidently face the future. Protiviti and our independently owned Member Firms provide consulting solutions in finance, technology, operations, data,

analytics, governance, risk and internal audit to our clients through our network of more than 70 offices in over 20 countries.

We have served more than 60 percent of Fortune 1000 ® and 35 percent of Fortune Global 500 ® companies. We also work with smaller, growing

companies, including those looking to go public, as well as with government agencies. Protiviti is a wholly owned subsidiary of Robert Half (NYSE: RHI).

Founded in 1948, Robert Half is a member of the S&P 500 index.

N A K I S A LO G O S - P R O D U C TS H O R I Z O N TA L

CONTACTS

Toni Lastella Aric Quinones Steve Cabello

Managing Director, New York Managing Director, Atlanta Managing Director, Phoenix

+1.212.399.8602 +1.404.240.8376 +1.213.327.1470

toni.lastella@protiviti.com aric.quinones@protiviti.com steve.cabello@protiviti.com

protiviti.com Implementing the New Lease Accounting Standard in SAP Landscapes · 7

© 2017 Protiviti Inc. An Equal Opportunity Employer. M/F/Disability/Vet. PRO-0417

THE AMERICAS UNITED STATES Indianapolis Sacramento ARGENTINA* COLOMBIA*

Alexandria Kansas City Salt Lake City Buenos Aires Bogota

Atlanta Los Angeles San Francisco

Baltimore Milwaukee San Jose BRAZIL* MEXICO*

Boston Minneapolis Seattle Rio de Janeiro Mexico City

Sao Paulo

Charlotte New York Stamford

PERU*

Chicago Orlando St. Louis CANADA Lima

Cincinnati Philadelphia Tampa Kitchener-Waterloo

Cleveland Phoenix Washington, D.C. Toronto VENEZUELA*

Dallas Pittsburgh Winchester Caracas

Fort Lauderdale Portland Woodbridge CHILE*

Houston Richmond Santiago

EUROPE FRANCE NETHERLANDS KUWAIT* SAUDI ARABIA* UNITED ARAB

MIDDLE EAST Paris Amsterdam Kuwait City Riyadh EMIRATES*

AFRICA Abu Dhabi

GERMANY UNITED KINGDOM OMAN* SOUTH AFRICA* Dubai

Frankfurt London Muscat Johannesburg

Munich

BAHRAIN* QATAR*

ITALY Manama Doha

Milan

Rome

Turin

ASIA-PACIFIC CHINA JAPAN INDIA* AUSTRALIA

Beijing Osaka Bangalore Brisbane

Hong Kong Tokyo Hyderabad Canberra

Shanghai Kolkata Melbourne

Shenzhen SINGAPORE Mumbai Sydney

Singapore New Delhi

*MEMBER FIRM

© 2017 Protiviti Inc. An Equal Opportunity Employer M/F/Disability/Veterans. PRO-1017-103112

Protiviti is not licensed or registered as a public accounting firm and does not issue opinions on financial statements or offer attestation services.

Vous aimerez peut-être aussi

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsD'EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsPas encore d'évaluation

- SAP Funds Management - Funded ProgramDocument5 pagesSAP Funds Management - Funded ProgramKathiresan NagarajanPas encore d'évaluation

- Funds Management (FI-FM) V1Document22 pagesFunds Management (FI-FM) V1Tushar KohinkarPas encore d'évaluation

- Unit 6: Asset AccountingDocument22 pagesUnit 6: Asset AccountingJose Rengifo LeonettPas encore d'évaluation

- SD Fi Copa Reconciliation Part 1Document10 pagesSD Fi Copa Reconciliation Part 1BAble996Pas encore d'évaluation

- FM PresentationDocument35 pagesFM Presentationprchari1980Pas encore d'évaluation

- FI - Contract AP and ARDocument8 pagesFI - Contract AP and ARAnanthakumar APas encore d'évaluation

- Report Painter COPADocument24 pagesReport Painter COPAmiriam lopezPas encore d'évaluation

- SAP - Leased AssetConfigDocument22 pagesSAP - Leased AssetConfigPrem PrakashPas encore d'évaluation

- SAP RE FX v1Document16 pagesSAP RE FX v1harikrishna0% (1)

- Depreciation KeysDocument54 pagesDepreciation KeysVinod NairPas encore d'évaluation

- Real EstateDocument481 pagesReal EstatePedroPas encore d'évaluation

- Overhead Management Through TemplateDocument5 pagesOverhead Management Through TemplateBalanathan VirupasanPas encore d'évaluation

- SAP CO: Variance Analysis in Product CostingDocument12 pagesSAP CO: Variance Analysis in Product CostingBilly BmnPas encore d'évaluation

- Internal Orders (CO OM OPA)Document3 pagesInternal Orders (CO OM OPA)Ivica999Pas encore d'évaluation

- SAP Budgetary Control SolutionsDocument32 pagesSAP Budgetary Control SolutionsKathiresan NagarajanPas encore d'évaluation

- Base Method-FI AADocument4 pagesBase Method-FI AAGanesh RameshPas encore d'évaluation

- Configuration For SAP Leasing - SAP DocumentationDocument3 pagesConfiguration For SAP Leasing - SAP DocumentationEduardo Alonso Martinez Medina0% (3)

- SAP Interest Calculation Configuration PDFDocument8 pagesSAP Interest Calculation Configuration PDFRajeev MenonPas encore d'évaluation

- Introduction To Migration To New General LedgerDocument18 pagesIntroduction To Migration To New General LedgerGurpreet Singh100% (1)

- Work Instruction Funds Commitment: Create Fmz1: When To UseDocument11 pagesWork Instruction Funds Commitment: Create Fmz1: When To UseAnonymous 7CVuZbInUPas encore d'évaluation

- 002 Business Consolidation (SEM-BCS) PDFDocument170 pages002 Business Consolidation (SEM-BCS) PDFparivijjiPas encore d'évaluation

- Project SystemDocument45 pagesProject Systemprashanti shetty0% (1)

- SAPCO Universal Cost Allocation S - 4HANADocument46 pagesSAPCO Universal Cost Allocation S - 4HANAPrateek Mohapatra100% (1)

- Inv Accountignwith MLDocument14 pagesInv Accountignwith MLSamik BiswasPas encore d'évaluation

- Assessment Cycle in SapDocument9 pagesAssessment Cycle in SapSunando Narayan BiswasPas encore d'évaluation

- Shailendra FICO-TRM-BW-BPC-REFX ConsultantDocument3 pagesShailendra FICO-TRM-BW-BPC-REFX ConsultantTrainer SAPPas encore d'évaluation

- Test 1809Document26 pagesTest 1809sundarsap100% (1)

- Rar CoceptsDocument18 pagesRar CoceptsMoorthy EsakkyPas encore d'évaluation

- Report Painter1Document15 pagesReport Painter1kumarkrishna.grPas encore d'évaluation

- COPA Planning SAP BlogsDocument19 pagesCOPA Planning SAP BlogsGuillermo Vallejo SauraPas encore d'évaluation

- SAP PS-Availability ControlDocument17 pagesSAP PS-Availability ControlElena Puscu100% (3)

- Top Down DistributionDocument2 pagesTop Down DistributionJuluri Syam MaheshPas encore d'évaluation

- Introduction To SAP Grantor Management - Part I - SAP Blogs PDFDocument10 pagesIntroduction To SAP Grantor Management - Part I - SAP Blogs PDFTrainer SAPPas encore d'évaluation

- Uploading Plans & Forecasts To SAP v1.0Document3 pagesUploading Plans & Forecasts To SAP v1.0FurqanPas encore d'évaluation

- COPA in Simple FinanceDocument36 pagesCOPA in Simple FinancemadhuPas encore d'évaluation

- Trading Partner Company SetupDocument2 pagesTrading Partner Company SetupamaravatiPas encore d'évaluation

- Results Analysis IAS EDocument22 pagesResults Analysis IAS Efazal509acd100% (1)

- 20 FICO Tips - Series 3 - SAP BlogsDocument17 pages20 FICO Tips - Series 3 - SAP BlogsManish BalwaniPas encore d'évaluation

- All About S4Hana CODocument9 pagesAll About S4Hana COPrakash PrakyPas encore d'évaluation

- Sap S/4 Hana Finance - Summary of Controlling Changes - Management AccountingDocument15 pagesSap S/4 Hana Finance - Summary of Controlling Changes - Management AccountingmonaPas encore d'évaluation

- SAP Simple Finance IBP Steps For Working With IBPDocument7 pagesSAP Simple Finance IBP Steps For Working With IBPmrudrabhPas encore d'évaluation

- SAP RE FX v3 PDFDocument16 pagesSAP RE FX v3 PDFharikrishnaPas encore d'évaluation

- Actual Values Flowing To CODocument3 pagesActual Values Flowing To COSUDIPTADATTARAYPas encore d'évaluation

- Multiple Valuation Approaches Transfer Prices PDFDocument9 pagesMultiple Valuation Approaches Transfer Prices PDFmaheshPas encore d'évaluation

- Change Fiscal Year VariantDocument2 pagesChange Fiscal Year VariantWalid MetwallyPas encore d'évaluation

- Sap Financials - Interest CalculationDocument3 pagesSap Financials - Interest CalculationSuresh ParamasivamPas encore d'évaluation

- FI Asset Configuration - S4 Hana Enterprise Mangement PDFDocument83 pagesFI Asset Configuration - S4 Hana Enterprise Mangement PDFbrcraoPas encore d'évaluation

- Settlement Management + COPADocument24 pagesSettlement Management + COPArameshPas encore d'évaluation

- Funds Management Configuration and DesignDocument148 pagesFunds Management Configuration and DesignAhmed AdelPas encore d'évaluation

- Finance ExtenDocument15 pagesFinance Extensmile1alwaysPas encore d'évaluation

- Sample SAP Liquidity PlannerDocument13 pagesSample SAP Liquidity Plannerapl16Pas encore d'évaluation

- Configuration and Design Document Funds: Management Page 1 of 146Document146 pagesConfiguration and Design Document Funds: Management Page 1 of 146Reddaveni Nagaraju100% (1)

- Cost Center1Document47 pagesCost Center1hossainmz0% (1)

- TRM Q&aDocument35 pagesTRM Q&aReal PlayerPas encore d'évaluation

- Exp 0009Document39 pagesExp 0009tushar2001Pas encore d'évaluation

- S4HANA OP 1511 Learning Journey BetaDocument9 pagesS4HANA OP 1511 Learning Journey BetaJorge Santillan0% (1)

- Sap Lease Administration Compliance What You Need To Know NowDocument14 pagesSap Lease Administration Compliance What You Need To Know NowaximePas encore d'évaluation

- 7TH Maths F.a-1Document1 page7TH Maths F.a-1Marrivada SuryanarayanaPas encore d'évaluation

- SOL LogicDocument21 pagesSOL LogicJa RiveraPas encore d'évaluation

- Lecture 2 Effects of Operating Conditions in VCCDocument9 pagesLecture 2 Effects of Operating Conditions in VCCDeniell Joyce MarquezPas encore d'évaluation

- HatfieldDocument33 pagesHatfieldAlex ForrestPas encore d'évaluation

- Kiritsis SolutionsDocument200 pagesKiritsis SolutionsSagnik MisraPas encore d'évaluation

- Wner'S Anual: Led TVDocument32 pagesWner'S Anual: Led TVErmand WindPas encore d'évaluation

- Guyana and The Islamic WorldDocument21 pagesGuyana and The Islamic WorldshuaibahmadkhanPas encore d'évaluation

- 1 - 2020-CAP Surveys CatalogDocument356 pages1 - 2020-CAP Surveys CatalogCristiane AokiPas encore d'évaluation

- Scholastica: Mock 1Document14 pagesScholastica: Mock 1Fatema KhatunPas encore d'évaluation

- Eggermont 2019 ABRDocument15 pagesEggermont 2019 ABRSujeet PathakPas encore d'évaluation

- Physics Blue Print 1 Class XI Half Yearly 23Document1 pagePhysics Blue Print 1 Class XI Half Yearly 23Nilima Aparajita SahuPas encore d'évaluation

- Shakespeare Sonnet EssayDocument3 pagesShakespeare Sonnet Essayapi-5058594660% (1)

- Sept Dec 2018 Darjeeling CoDocument6 pagesSept Dec 2018 Darjeeling Conajihah zakariaPas encore d'évaluation

- postedcontentadminuploadsFAQs20for20Organization PDFDocument10 pagespostedcontentadminuploadsFAQs20for20Organization PDFMohd Adil AliPas encore d'évaluation

- NCP - Major Depressive DisorderDocument7 pagesNCP - Major Depressive DisorderJaylord Verazon100% (1)

- Man and Historical ActionDocument4 pagesMan and Historical Actionmama.sb415Pas encore d'évaluation

- Evs ProjectDocument19 pagesEvs ProjectSaloni KariyaPas encore d'évaluation

- Dwnload Full Principles of Economics 7th Edition Frank Solutions Manual PDFDocument35 pagesDwnload Full Principles of Economics 7th Edition Frank Solutions Manual PDFmirthafoucault100% (8)

- IMCI Chart BookletDocument43 pagesIMCI Chart Bookletmysticeyes_17100% (1)

- Sem4 Complete FileDocument42 pagesSem4 Complete Fileghufra baqiPas encore d'évaluation

- WBDocument59 pagesWBsahil.singhPas encore d'évaluation

- Algoritm BackTracking EnglezaDocument6 pagesAlgoritm BackTracking Englezaionutz_67Pas encore d'évaluation

- Progressive Muscle RelaxationDocument4 pagesProgressive Muscle RelaxationEstéphany Rodrigues ZanonatoPas encore d'évaluation

- Antena TelnetDocument4 pagesAntena TelnetMarco PiambaPas encore d'évaluation

- Kyle Pape - Between Queer Theory and Native Studies, A Potential For CollaborationDocument16 pagesKyle Pape - Between Queer Theory and Native Studies, A Potential For CollaborationRafael Alarcón Vidal100% (1)

- Student Exploration: Inclined Plane - Simple MachineDocument9 pagesStudent Exploration: Inclined Plane - Simple MachineLuka MkrtichyanPas encore d'évaluation

- Friction: Ultiple Hoice UestionsDocument5 pagesFriction: Ultiple Hoice Uestionspk2varmaPas encore d'évaluation

- Subject Manual Tle 7-8Document11 pagesSubject Manual Tle 7-8Rhayan Dela Cruz DaquizPas encore d'évaluation

- 2016 Closing The Gap ReportDocument64 pages2016 Closing The Gap ReportAllan ClarkePas encore d'évaluation

- Heimbach - Keeping Formingfabrics CleanDocument4 pagesHeimbach - Keeping Formingfabrics CleanTunç TürkPas encore d'évaluation