Académique Documents

Professionnel Documents

Culture Documents

An Introduction To Investment

Transféré par

Balasingam PrahalathanDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

An Introduction To Investment

Transféré par

Balasingam PrahalathanDroits d'auteur :

Formats disponibles

Handout – 01

Programme : Bachelor of Commerce (Special) Degree

Fourth Examination in Commerce – 2008/2009

2nd Semester

Course Title : Investment and Portfolio Management

Course Code : BCOM 42542

Course Status : Elective

Handout Title : An Introduction to Investment

Prepared By : B.Prahalathan, Dept.of Commerce & Financial Management

Issue Date : 3rd May 2010

Learning Objectives:

define investment

understand characteristics of the investment

study the objectives of the investment

differentiate speculation, gambling and investment

Introduction

Investment involves employment of funds with the aim of achieving

additional income or growth in values. The essential quality of an

investment is that it involves waiting for a reward. Numerous avenues of

investment are available today, such as, non marketable financial assets,

bonds, mutual fund schemes, real assets, equity shares, money market

instruments, life insurance policies, financial derivatives and precious

objects.

Investment

Investment may be defined as “a commitment of funds made in the

expectation of some positive rate of return” or it can be defined as “a

sacrifice of current money or other resources for future benefits”.

Financial and Economic Meaning of Investment

In the financial sense, investment is the commitment of a person’s funds

to derive future income or appreciation in the value of their capital.

In the economic sense, investment means the net addition to the

economy’s capital stock which consists of goods and services that are

used in the production of other goods and services.

Department of Commerce & Financial Management

University of Kelaniya. Page 1

Characteristics of Investment

All investments are characterised by certain features. The followings are

characteristics features of investments.

1. Returns

2. Risk

3. Safety

4. Liquidity

5. Tax Shelter

Return

The return from an investment depends upon the nature of the

investment, the maturity period and a host of other factors.

Risk

Risk is inherent in any investment. Risk and return of an investment

are related. Normally, the higher the risk, the higher is the return.

Safety

The safety of an investment implies the certainty of return of capital

without loss of money or time.

Liquidity

An investment which is easily saleable or marketable without loss of

money without loss of money and without loss of time is said to be

possess liquidity.

Tax Shelter

Some investments provide tax benefits; others do not.

Objectives of Investment

Each investor tries to maximise his welfare by choosing the optimum

combination of risk and expected return in accordance with his preference

and capacity. The objective of an investor can be stated as:

1. Maximisation of return

2. Minimisation of risk

3. Hedge against inflation

Investment & Speculation

Investment and speculation are two terms which are closely related. Both

involve purchase of assets like shares and securities. Traditionally,

investment is distinguished from speculation with respect to three factors.

1. Risk

2. Capital Gain

3. Time period

Investment & Gambling

Department of Commerce & Financial Management

University of Kelaniya. Page 2

Gambling is quite the opposite of investment. Typical examples of

gambling are horse races, card games, lotteries, etc. Gambling consists in

taking high risks not only for high returns, but also for thrill and

excitement.

Investment Alternatives (Avenues)

There is large number of investment avenues for savers. Some of them

are marketable and liquid while others are non marketable. Some of them

are highly risky while some others are almost riskless. The investor has to

choose proper avenues from among them depending on his preferences,

needs, and ability to assume risk. The investment avenues can be

categorised as follows;

1. Non marketable Financial Assets

2. Bonds

3. Mutual Fund Scheme

4. Real Estate

5. Equity Shares

6. Money Market Instruments

7. Life Insurance Policies

8. Precious Objects

9. Financial Derivatives

Types of Investors

Investors may be individuals and institutions. Individual investors operate

alongside institutional investors in the investment arena. However, Their

characteristics are different.

Individual investors are large in number but their investable resources are

comparatively smaller. Institutional investors, on the other hand, are the

organizations with surplus funds who engage in investment activities.

Department of Commerce & Financial Management

University of Kelaniya. Page 3

Vous aimerez peut-être aussi

- Finance Investment ManagementDocument72 pagesFinance Investment Managementvinod maddikeraPas encore d'évaluation

- Ecm620t - Invest MGT MaterialDocument88 pagesEcm620t - Invest MGT Materialnivantheking123Pas encore d'évaluation

- Investment ManagementDocument82 pagesInvestment ManagementSabita LalPas encore d'évaluation

- Investment Analysis & Portfolio ManagementDocument65 pagesInvestment Analysis & Portfolio ManagementKaran Kumar100% (1)

- Mod1 ImDocument36 pagesMod1 ImSattagouda PatilPas encore d'évaluation

- Investment Management: 16MBA FM303Document55 pagesInvestment Management: 16MBA FM303Priya PriyaPas encore d'évaluation

- Unit 1 SAPM NoteDocument18 pagesUnit 1 SAPM NoteNikita ShekhawatPas encore d'évaluation

- Inv. Ch-1 (Ma in PP&M)Document50 pagesInv. Ch-1 (Ma in PP&M)Mahamoud HassenPas encore d'évaluation

- Meaning of InvestmentDocument10 pagesMeaning of InvestmentAbhishek MishraPas encore d'évaluation

- The Road to Financial Freedom: A Guide to Investing WiselyD'EverandThe Road to Financial Freedom: A Guide to Investing WiselyPas encore d'évaluation

- Investment Mangement 1Document55 pagesInvestment Mangement 1Shabnam HabeebPas encore d'évaluation

- Securities Analysis and Portfolio Management PDFDocument64 pagesSecurities Analysis and Portfolio Management PDFShreya s shetty100% (1)

- II M.com. - 18PCO7 - Dr. R. Sathru Sankara VelsamyDocument80 pagesII M.com. - 18PCO7 - Dr. R. Sathru Sankara Velsamykiruthika2010Pas encore d'évaluation

- Investment Analysis AND Portfolio ManagementDocument35 pagesInvestment Analysis AND Portfolio ManagementpradeepaPas encore d'évaluation

- Mba III Investment Management (14mbafm303) SolutionDocument55 pagesMba III Investment Management (14mbafm303) Solutionjanardhanvn83% (6)

- 1 ModuleDocument17 pages1 ModuleRakesh VetkuriPas encore d'évaluation

- A Course Material On Security Analysis and Portfolio ManagementDocument22 pagesA Course Material On Security Analysis and Portfolio Managementabid hussainPas encore d'évaluation

- A Course Material On Security Analysis and Portfolio ManagementDocument22 pagesA Course Material On Security Analysis and Portfolio ManagementMantosh SharmaPas encore d'évaluation

- V Meaning of Investment and Its Features: ManagementDocument4 pagesV Meaning of Investment and Its Features: ManagementElabdallaoui AbdelghafourPas encore d'évaluation

- Introduction To Investment Management: Bond, Real Estate, Mortgages EtcDocument25 pagesIntroduction To Investment Management: Bond, Real Estate, Mortgages EtcRavi GuptaPas encore d'évaluation

- Security AnalysisDocument21 pagesSecurity AnalysisCharishma KarumanchiPas encore d'évaluation

- Investing Made Easy: Finding the Right Opportunities for YouD'EverandInvesting Made Easy: Finding the Right Opportunities for YouPas encore d'évaluation

- Avenues of InvestmentDocument11 pagesAvenues of InvestmentAlpa GhoshPas encore d'évaluation

- A Comparative Study On Investment PatterDocument46 pagesA Comparative Study On Investment Patterprudhvi rajPas encore d'évaluation

- IAPM (Unit 1 & 2)Document38 pagesIAPM (Unit 1 & 2)Kelvin SavaliyaPas encore d'évaluation

- Investement Analysis and Portfolio Management Chapter 1Document8 pagesInvestement Analysis and Portfolio Management Chapter 1Oumer Shaffi100% (3)

- Investing for the Future: A Beginner's Guide: Investment, #1D'EverandInvesting for the Future: A Beginner's Guide: Investment, #1Pas encore d'évaluation

- Final Avenues of Investments1Document55 pagesFinal Avenues of Investments1Mukesh ManwaniPas encore d'évaluation

- Investment ManagementDocument20 pagesInvestment Managementsunita agrawalPas encore d'évaluation

- Investment and Portfolio ManagementDocument30 pagesInvestment and Portfolio ManagementSampada ShelarPas encore d'évaluation

- Module 1Document34 pagesModule 1bharath100% (1)

- Risk & Return Simplified PDFDocument292 pagesRisk & Return Simplified PDFDevikaPas encore d'évaluation

- Module 1-Introduction-MergedDocument99 pagesModule 1-Introduction-MergedKevin MehtaPas encore d'évaluation

- CH1 Overview of InvetmentDocument12 pagesCH1 Overview of Invetmenttame kibruPas encore d'évaluation

- IAPM I IntroductionDocument23 pagesIAPM I IntroductionSuresh Vadde100% (2)

- Chapter-4 Investment and Risk: Investment: The Changing Framework and Methods of Investment ManagementDocument27 pagesChapter-4 Investment and Risk: Investment: The Changing Framework and Methods of Investment ManagementSiva MohanPas encore d'évaluation

- A COMPARATIVE STUDY ON INVESTMENT PATTERjkjkjkDocument45 pagesA COMPARATIVE STUDY ON INVESTMENT PATTERjkjkjkDance on floorPas encore d'évaluation

- IPM - Unit-1 - Introduction To InvestmentDocument22 pagesIPM - Unit-1 - Introduction To InvestmentManshi AhirPas encore d'évaluation

- Chap 01 Understanding InvestmentDocument32 pagesChap 01 Understanding InvestmentRifat AnjanPas encore d'évaluation

- Basics of InvestingDocument22 pagesBasics of InvestingopulencefinservPas encore d'évaluation

- Investing Demystified: A Beginner's Guide to Building Wealth in the Stock MarketD'EverandInvesting Demystified: A Beginner's Guide to Building Wealth in the Stock MarketPas encore d'évaluation

- FEIA Unit-2 NewDocument15 pagesFEIA Unit-2 NewMansi VatsPas encore d'évaluation

- Cement Industry Data Analysis and InterpretationDocument35 pagesCement Industry Data Analysis and InterpretationRaghuram SeshabhattarPas encore d'évaluation

- Real Estate Investment and Marketing Chapter 3 - 5Document57 pagesReal Estate Investment and Marketing Chapter 3 - 5Firaol Nigussie100% (1)

- Introduction (UNIT.1) : Investment Analysis and Portfolio ManagementDocument24 pagesIntroduction (UNIT.1) : Investment Analysis and Portfolio Managementramesh.kPas encore d'évaluation

- Sapm - NotesDocument136 pagesSapm - NotesShabanaPas encore d'évaluation

- Investment Management UNIT-1Document17 pagesInvestment Management UNIT-1Aravind Rajpurohit67% (3)

- 21BSPHH01C0084 AKSHITASK PMMFDocument4 pages21BSPHH01C0084 AKSHITASK PMMFAkshita SkPas encore d'évaluation

- Ion of Mutual Funds With Other Investment OptionsDocument76 pagesIon of Mutual Funds With Other Investment OptionsDiiivya100% (1)

- Portfolio Management Project Submitted by WASIF MAHOOD 1806Document13 pagesPortfolio Management Project Submitted by WASIF MAHOOD 1806Daniyal WahabPas encore d'évaluation

- INSIGHT Potfolio MGNTDocument35 pagesINSIGHT Potfolio MGNTHari NairPas encore d'évaluation

- Security Analysis and Portfolio ManagementDocument54 pagesSecurity Analysis and Portfolio ManagementAnonymous qEeH6SlPas encore d'évaluation

- Quick RevisionDocument51 pagesQuick RevisionvishwajeetPas encore d'évaluation

- Project Report On Portfolio ManagementDocument6 pagesProject Report On Portfolio Managementanunazanu100% (1)

- Sapm 1Document21 pagesSapm 1Divya BhadriPas encore d'évaluation

- Investment PatternDocument74 pagesInvestment PatternAshish KhatterPas encore d'évaluation

- Strategic Analysis Evaluating A Company's External EnvironmentDocument27 pagesStrategic Analysis Evaluating A Company's External EnvironmentBalasingam PrahalathanPas encore d'évaluation

- Vision, Mission, Objectives, and Strategy: Session - 02Document67 pagesVision, Mission, Objectives, and Strategy: Session - 02Balasingam PrahalathanPas encore d'évaluation

- Microfinance - 1Document47 pagesMicrofinance - 1Balasingam PrahalathanPas encore d'évaluation

- An Empirical Analysis of The Impact of Total Debt On The Economic Growth of Sri LankaDocument31 pagesAn Empirical Analysis of The Impact of Total Debt On The Economic Growth of Sri LankaBalasingam PrahalathanPas encore d'évaluation

- Main Market Forms and Revenue TheoryDocument48 pagesMain Market Forms and Revenue TheoryBalasingam PrahalathanPas encore d'évaluation

- Cost of Production/Theory of CostDocument55 pagesCost of Production/Theory of CostBalasingam PrahalathanPas encore d'évaluation

- Business Information System - 4Document8 pagesBusiness Information System - 4Balasingam PrahalathanPas encore d'évaluation

- Introduction To International TradeDocument46 pagesIntroduction To International TradeBalasingam PrahalathanPas encore d'évaluation

- Multinational CorporationsDocument43 pagesMultinational CorporationsBalasingam PrahalathanPas encore d'évaluation

- Business Information SystemDocument10 pagesBusiness Information SystemBalasingam PrahalathanPas encore d'évaluation

- Introduction To MacroeconomicsDocument48 pagesIntroduction To MacroeconomicsBalasingam Prahalathan100% (2)

- Business Information System - 3Document9 pagesBusiness Information System - 3Balasingam PrahalathanPas encore d'évaluation

- Floating (Flexible) Exchange Rate SystemDocument2 pagesFloating (Flexible) Exchange Rate SystemBalasingam PrahalathanPas encore d'évaluation

- Handout-13: Learning ObjectivesDocument4 pagesHandout-13: Learning ObjectivesBalasingam PrahalathanPas encore d'évaluation

- 8.foreign Direct Investment and Foreign AidDocument7 pages8.foreign Direct Investment and Foreign AidBalasingam PrahalathanPas encore d'évaluation

- Scope of EconomicsDocument46 pagesScope of EconomicsBalasingam Prahalathan100% (2)

- Marginal Utility AnalysisDocument47 pagesMarginal Utility AnalysisBalasingam PrahalathanPas encore d'évaluation

- 1 HandoutDocument46 pages1 HandoutBalasingam PrahalathanPas encore d'évaluation

- 5.matrix AlgebraDocument31 pages5.matrix AlgebraBalasingam PrahalathanPas encore d'évaluation

- 5.matrix AlgebraDocument7 pages5.matrix AlgebraBalasingam PrahalathanPas encore d'évaluation

- Financing Mining Projects PDFDocument7 pagesFinancing Mining Projects PDFEmil AzhibayevPas encore d'évaluation

- Assignment - LCA - MarriottDocument4 pagesAssignment - LCA - MarriottPrashant100% (1)

- Elliott Pairs TradingDocument7 pagesElliott Pairs TradingkabinskyPas encore d'évaluation

- Chapter 7 FinmarDocument2 pagesChapter 7 FinmarNathalie GetinoPas encore d'évaluation

- The Cost of Trigger Happy InvestingDocument4 pagesThe Cost of Trigger Happy InvestingBrazil offshore jobsPas encore d'évaluation

- The Determinant Factors of Indonesian Government Bond ReturnsDocument2 pagesThe Determinant Factors of Indonesian Government Bond Returnsdebby pratiwiPas encore d'évaluation

- Working of Kotak Securities in Comparision of Other Broking Agencies.Document69 pagesWorking of Kotak Securities in Comparision of Other Broking Agencies.Anonymous V9E1ZJtwoEPas encore d'évaluation

- Cash 2018 1 Q PDFDocument4 pagesCash 2018 1 Q PDFLorraine Mae RobridoPas encore d'évaluation

- We WorkDocument169 pagesWe WorkDinheirama.comPas encore d'évaluation

- Mutual Fund AnalysisDocument53 pagesMutual Fund AnalysisVijetha EdduPas encore d'évaluation

- Chapter 5 9eDocument80 pagesChapter 5 9eRahil VermaPas encore d'évaluation

- Syllabus BWRR3063 StudentDocument5 pagesSyllabus BWRR3063 StudentSyai GenjPas encore d'évaluation

- Tariff of Charges 11022016Document15 pagesTariff of Charges 11022016minek121Pas encore d'évaluation

- GSK PharmaDocument10 pagesGSK PharmaSasidharan Sajeev ChathathuPas encore d'évaluation

- Hull: Options, Futures, and Other Derivatives, Ninth Edition Chapter 13: Binomial Trees Multiple Choice Test Bank: Questions With AnswersDocument9 pagesHull: Options, Futures, and Other Derivatives, Ninth Edition Chapter 13: Binomial Trees Multiple Choice Test Bank: Questions With AnswersShivansh Agarwal100% (1)

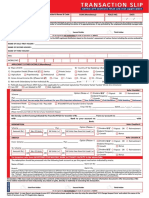

- Kotak - Transaction SlipDocument2 pagesKotak - Transaction SlipJephiasPas encore d'évaluation

- Devyani ArDocument313 pagesDevyani ArAnirudh AgarwalPas encore d'évaluation

- Do You Know Your Cost of CapitalDocument10 pagesDo You Know Your Cost of CapitalRodiannePas encore d'évaluation

- LevDocument6 pagesLevYaseen SaleemPas encore d'évaluation

- Capital Market TheoryDocument14 pagesCapital Market TheorySaiyan VegetaPas encore d'évaluation

- Financial Accounting Standards BoardDocument12 pagesFinancial Accounting Standards BoardNoor HossainPas encore d'évaluation

- Infosys Sources of FinanceDocument6 pagesInfosys Sources of FinanceyargyalPas encore d'évaluation

- Nomura Research TeamDocument20 pagesNomura Research TeamYeli LiuPas encore d'évaluation

- List of Stock Exchanges in IndiaDocument7 pagesList of Stock Exchanges in Indiasadanand100% (5)

- Jodhpur Vidyut Vitaran Nigam Limited A Govt. of Rajasthan Undertaking (For E-Tendering)Document19 pagesJodhpur Vidyut Vitaran Nigam Limited A Govt. of Rajasthan Undertaking (For E-Tendering)Santhosh V RaajendiranPas encore d'évaluation

- Kings College Jan2020Document75 pagesKings College Jan2020qwsx098Pas encore d'évaluation

- International FinanceDocument2 pagesInternational FinanceMian Hidayat ShahPas encore d'évaluation

- OptionsDocument49 pagesOptionssacos16074Pas encore d'évaluation

- REACTIONDocument3 pagesREACTIONVhia ParajasPas encore d'évaluation

- Lehman's Chapter 11 Reorganization PlanDocument93 pagesLehman's Chapter 11 Reorganization PlanDealBook100% (3)