Académique Documents

Professionnel Documents

Culture Documents

Ya Four

Transféré par

ezzularabDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Ya Four

Transféré par

ezzularabDroits d'auteur :

Formats disponibles

Retail Sector in Syria

Commercial Malls and Center

Alaa Alazem Jammal

March 2010

Page 1 of 17 Retail Sector Report March 31, 2010

Alaa Alazem Jammal

Independent Financial Consultant

BSc Finance, American University of Sharjah, UAE

Alaa Alazem Jammal has acquired six years of professional experience in Corporate Finance field

through her career as Financial Analyst in a major Telecom Corporation and a financial services firm

in Syria. Her skills include and not limited to: Developing budgets, financial reports & projections;

Assessing risks of different projects & companies; Interpreting and analyzing accounting & financial

data; and Utilizing computer software for analysis, reports, presentations, and archiving. In addition,

she has conducted several business plans, valuations, and financial reports for different clients in

several industries.

Mobile +963 98 80 80 864

Telephone +963 11 31 35 788

Email alaa.alazem@gmail.com

Page 2 of 17 Retail Sector Report March 31, 2010

Table of Contents

Real Estate & Construction .............................................................................................................................. 4

Retail Sector Analysis ........................................................................................................................................ 7

I. Market Boom: ...................................................................................................................................... 7

II. Demand for international brands: ................................................................................................. 8

III. Challenges: ....................................................................................................................................... 8

IV. Current & upcoming Shopping Malls in Syria: ..................................................................... 9

V. Proposed designs for some projects: ..........................................................................................13

Page 3 of 17 Retail Sector Report March 31, 2010

Real Estate & Construction

Before discussing the Retail sector in Syria, we have to explore the current situation of real estate

and construction industry. According to Oxford Business Group report about Syria in 2009, the

supply shortfall for residential, office, retail and tourism real estate has fuelled both a surge in

construction and a rise in prices. For the residential sector, Syria’s population growth rate of 3%,

coupled with a large-scale influx of Iraqi refugees, contributed to housing shortages. The residential

market has traditionally been driven by the public sector and despite opening up to private

investment; the state is still very much the dominant player. By far the majority of demand is from

the affordable housing segment, although private developers mainly focused on the luxury projects

in 2008. A number of projects are in the works, many of which seek to offer an escape for wealthy

Syrians looking for homes outside Damascus. New developments include the Palmyra Real Estate

Development’s Jasmine Hills and Emerald Hills, the projects in Yafour and the Saudi Binladin

Group’s Palm Village in Sabboura. The residential market forms the backbone of Syrian real estate,

but there is also room for development of office and retail space. The shortage of office space has

made Damascus the eighth-most expensive city to rent in worldwide, but new projects should help

to add supply and bring down costs. As the economy has begun to open up retail has also become

an important segment, with increasing numbers of foreign brands entering the market. Consumer

demand is strong and a number of new mall projects are in the works at present.

Although real estate prices were estimated to have fallen by up to 20% in the second half of 2008.

However, the market faced a shortage in liquidity and of cash inflows from expatriates and from

Gulf countries in 2009. After a boom in demand in the period 2006-2008, the market slowed down

sharply in 2009 with large supplies and little demand. Some areas still posted price increases; others

saw a decline, and some saw prices remain stable. The government has made significant progress in

its efforts to improve the investment climate for real estate development, including reforms that

allow developers freer range over their master plans and zoning, but obtaining all the necessary

permits and licenses to start work can still be time consuming. Rising labor costs and volatile raw

materials costs have also put some pressure on the sector in recent years.

Despite of the global financial crisis, no cancellation of any mega project was announced in Syria.

However, some delays are expected. The below table shows the main mega real estate development

projects going on currently:

Page 4 of 17 Retail Sector Report March 31, 2010

Developer Description Cost Area Location Start date

USD sqm Completion

Abraj Souria Souria Holding Hotel, offices and 319 m 260,000 Baramkeh, September 2014

commercial space Damascus 2009

Aleppo Gate Souria Holding Hotel, offices and 64 m 300,000 Ballermoun, 2009 2011

commercial space Aleppo

Cordoba Hills Akar Development, Al Mixed-use development 680 m 1.4 m Kfarjoum, Aleppo July 2006 2011

Zaim Holding

Al Markaz Tower Markaz Real Estate High-rise office tower 30 m 5,000 Baramkeh, Suspended in 3 years

Development Co. Damascus

Eighth Gate (1st Phase) Emaar-Invest Group Master-planned 500 m 300,000 Yaafour, Damascus February 2012

Overseas business community 2008

Ibn Hani Resort Qatari Diar Real Estate Residential and tourist 350 m 244,000 Ibn Hani, Lattakia February End of

Investment Co resort 2008 2011

Garden City United Contracting and Leisure, residential & 250 m 300,000 Damascus Airport 2006 2010

Engineering Co commercial Highway

development

Jasmine Hills Palmyra Real Estate Residential and leisure 30 m 200,000 Yaafour, Damascus March 2010

Development 2008

Murooj Valley Invest Group Overseas Residential N/A 19,000Jdeidet Al Wadi, August 2011

Damascus 2008

Majed Al Futtaim Majid Al Futtaim Mixed-use 1 bn 1.5 m Yaafour, Damascus 2009 Partially in

2012

Naser Gardens Al Naser Gardens Syrian Residential compound 168 m 452,000 Kafar Qouq, 2009 N/A

Joint Stock Co. Damascus

Porto Tartous Wahoud Group and Hotel, leisure and 560 m 480,000 Tartous May 2008 2011

other partners commercial space

Page 5 of 17 Retail Sector Report March 31, 2010

Developer Description Cost Area Location Start date

USD sqm Completion

Tareq Bin Ziad Bena Properties, Cham Hotel, leisure and 137 m 186,000 Aleppo city 2009 2014

Holding commercial spaces

Yafour Gardens Urban Development a hotel, furnished 135 m 60,000 Yaafour, Damascus 2009 2012

Group apartments, sporting

facilities, shopping mall

and supermarket

Damascus Hills Cham Holding Mixed-use development 3b 5 m Damascus Homs

High way

N/A Alaa Ksado 5-star hotel, shopping 50 m 21,000 Aleppo’s Industrial 2010 2014

mall, a parking, cinema and Agricultural

halls, swimming pools, Fairground, located

ice rings, a dolphins in the centre of

aquarium, a conference Aleppo

hall, restaurants, 3 multi-

purpose halls

Page 6 of 17 Retail Sector Report March 31, 2010

Retail Sector Analysis

I. Market Boom:

The retail sector is becoming an increasingly important driver in the national economy, estimated

to employ 27% of the country’s workforce and standing as the third largest contributor to GDP

at 17%. It is also one of the main reasons 4.8 million day-visitors from neighboring Arab

countries, including 1.8 million from Lebanon, cross into Syria annually.

Hence, Syria is experiencing a huge rise in the number of shopping malls, changing the face of

the country’s retail market. The arrival of international brands, more local spending by affluent

Syrians and a rise in investment dollars flowing in from the Gulf is fuelling growth in the retail

sector despite a global economic downturn.

Last year the volume of gross leasable area (GLA) of retail space in Damascus was estimated at

55,000 square meters (sqm) by Retail International, a shopping centre consultancy firm. The

British company, which provides specialist coverage of the Middle East, currently estimates this

figure has almost doubled in 2009 and now sits at 100,000sqm at least in Damascus. The below

table compares Damascus GLA to other main cities in the MENA area:

City GLA

Abu Dhabi 655,000

Amman 200,000

Beirut 550,000

Cairo 600,000

Damascus 100,000

Doha 520,000

Dubai 2.5 m

Jeddah 1.9 m

Kuwait City 500,000

Manama 590,000

Muscat 300,000

Riyadh 1.2 m

According to Cushman & Wakefield, an international real state consultancy, Damascus is the 3rd

most expensive retail rents in the Middle East. It is also the eighth most expensive city in the

world for office rental cost. The report expected rents in Damascus to increase in the medium to

long-term because of a lack of supply. The below table shows the average retail rent cost in

several malls across the Middle East:

City Retail location Cost (EUR/sqm/year)

Tel Aviv Ramat Aviv 1,452

Beirut City Centre (BCD) 1,281

Page 7 of 17 Retail Sector Report March 31, 2010

Tel Aviv Ayalon Shopping Centre 1,025

Beirut ABC Centre Achrafieh 997

Beirut Rue Verdun 925

Kuwait City Raya Mall 886

Beirut Kaslik 854

Damascus Cham City Centre 854

Dubai Mall of the Emirates 834

Manama Seef - Bahrain city centre 747

II. Demand for international brands:

So far, mall owners claim that there has been no issue with retailers pulling out of the market due

to the global credit crisis because Syria is such a virgin market and shoppers are still spending.

During the first few weeks of operations in Damasquino, 3,000 people visited the centre every

day and now the number reaches 4,500 on average per day.

The loosening of government controls on international brands since 2003 has affected

dramatically the demand for international brands. People now are keen to shop at international

brand stores and these companies in turn are only willing to open in centers with facilities such

as security and parking.

Another reason is the high prices of oil over the past couple of years, generating extra funds for

Arab investors. Investors in oil-rich are constantly looking around the region for investment

opportunities at a time when the Syrian government has been working hard to increase the

amount of foreign direct investment in the country.

So far the shopping centers are not changing the way Syrians shop; the traditional souks are still

bustling with Syrians keen to pick up a bargain. Those involved with the new malls say they do

not pose a threat to the country’s souks because they target a wealthier clientele. The main target

for mall developers is shoppers who used to go to Lebanon to shop. Usually, middle-to upper-

middle-class shoppers in the 14 to 40 age range who don’t usually go to the souks.

III. Challenges:

Syria’s retail sector faces several challenges. A lack of diversification of brands in shopping

centers may limit future growth. How many malls the country can support is also up for question

– the 100,000 sqm of mall space in Damascus is still far below the 200,000 sqm found in

neighboring Amman, the 600,000 sqm on offer in Cairo or the 2.5m sqm available in Dubai.

Another challenge for the sector is a lack of retail management expertise in the local market.

Syrian companies will have to invest in retail management courses if they are to compete in the

country’s expanding investment market with firms from the Gulf.

And while laws have been loosened, international brands still face high taxes and countless

regulations when opening in Syria. The recent dispute as to whether Carrefour supermarket can

trade under its own name or will have to be called Shahba Mall Hypermarket is illustrative of

what deters foreign companies from launching in Syria.

Despite the challenges, foreign retail companies are beginning to look more seriously at Syria.

And Syria is beginning to see the advantages shopping centers bring to the economy.

Page 8 of 17 Retail Sector Report March 31, 2010

IV. Current & upcoming Shopping Malls in Syria:

The below table illustrates a list of current or coming soon malls in Damascus and other cities:

Page 9 of 17 Retail Sector Report March 31, 2010

Cost Average Rent

Developer Description Area sqm Location Start date Completion

USD SYP/sqm/Year

Eighth Gate Emaar IGO Souk, food court, *80 m *30,000-50,000 Beirut Road under 2012

Mall cinema complex 55,000 construction

Mövenpick Toumeh Tourism Complex 30 m Kafarsouseh Signed off 2010

Hotel and Mall International 49,000

recently

Damasquino 3 Businessmen 52 shops, 10 food 30,000-50,000 Kafarsouseh Open

Mall court, 4D cinema, 5 40,000

restaurants and cafes

furniture section,

Entertainment and

hypermarket

Cham City 85 shops, gym, 13 30,000-50,000 Kafarsouseh Open

Center restaurants, 50,000

entertainment and

hypermarket

Town Center shops, restaurants, Syria-Jordan Open

entertainment and 35,000 highway

hypermarket south of

Damascus

Skiland shops, restaurants and Airport Open

entertainment 10,000 Road

Queen Center shops and restaurants Mazzeh Open

Page 10 of 17 Retail Sector Report March 31, 2010

Cost Average Rent

Developer Description Area sqm Location Start date Completion

USD SYP/sqm/Year

Salam Mall IBDAA 200 shops, a food 40 m 45,000 40,000 – 50,000 Damascus August 2010

Investments court, a ski slope, a International

large interior Fairgrounds

entertainment place as

well as a parking for

some 3,000 cars

Concord Concord Al-Sham hypermarket, 80 m Dareyya, 2009

commercial International furniture store, 40 150,000 near the

complex Investment outlets, health center, highway

Company a gym, roof pool, and leading to

a spa, chill out lounge Jordan

and roof restaurant

Doha Mall Al Baraa Real Shops, a bowling 17,500 -35,000 Saydnaya- 2010

Estate & centre, 3 cinema 14,000 Maaraba

Development theatres, ice skating Highway

area, a children

recreation area,

Supermarket

Jasmine Mall Al Kadri Industry Shops, cafes and 17,000 -20,000 motorway early 2010

and Trading restaurants 3,000 leading to

Company Daraa, next

to Town

Centre

Orient Trade Abou Arab Haider specialized in 25,000 -35,000 motorway Sale of units

Tower Group furniture and home 22,500 leading to

appliances, office Daraa

spaces

Page 11 of 17 Retail Sector Report March 31, 2010

Cost Average Rent

Developer Description Area sqm Location Start date Completion

USD SYP/sqm/Year

Al Kheyr 300 shops, 7 Open

Markets restaurants, a 55,000

bookstore, a

kindergarten, a games

city, Adonis

Hypermarket

Shahba Mall Sabbagh Group shops, 36 restaurants, 50 m highway under

and Jordan’s Al a hotel, 8 cinema and 125,000 heading to construction

Kurdi Group French hypermarket Turkey from

Carrefour Aleppo

New City Mall Syrian-Kuwaiti Al- 40 shops, food court 24 m Aleppo Sale of

Jaz Group and restaurant 32,000 shops

N/A Syrian-Kuwaiti Al- Furnished apartments 7.97 m Reqqa end of 2009 Mid of 2012

Jaz Group and commercial space 25,000

Trans Mall Tarif Akhras 140 shops Homs End of 2009

Group 45,000

Damascus Four Season Hotel Shops, cafes and Tajheaz Open

Boulevard restaurants 2,500 Damascus

Al-Mounchieh Addoumieh Group 98 shops, a 12.76 m 25,000 - 40,000 Aleppo Mid 2010

supermarket, a service 33,000

area

Majed Al Majed Al Futtaim Carrefour Yaafour, 2009 2013

Futtaim hypermarket, 14 200,000 Damascus

cinemas, Magic

Planet, 350 shops,

food court and

restaurants

Page 12 of 17 Retail Sector Report March 31, 2010

Cost Average Rent

Developer Description Area sqm Location Start date Completion

USD SYP/sqm/Year

Dimas Center Al Ruken for Real Wholesaler Market, 150 m 154,000 30,000 – 50,000 Dimas 2010 2014

Estate shops, food court and

Development restaurants, bowling,

wood skating,

entertainment,

business center, SPA

V. Proposed designs for some projects:

a. Garden City Project

Page 13 of 17 Retail Sector Report March 31, 2010

b. Cordoba Hills Project

c. Yafour Gardens Project

Page 14 of 17 Retail Sector Report March 31, 2010

d. Eighth Gate Project

e. Damasquino Mall

Page 15 of 17 Retail Sector Report March 31, 2010

f. Abraj Souria

g. Salam Mall

Page 16 of 17 Retail Sector Report March 31, 2010

Page 17 of 17 Retail Sector Report March 31, 2010

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Marketing Analysis: Army Institute of Business Administration (AIBA)Document13 pagesMarketing Analysis: Army Institute of Business Administration (AIBA)Sakif Ryhan100% (2)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- MANAGEMENT OF TEMP WORKSDocument14 pagesMANAGEMENT OF TEMP WORKSezzularab100% (1)

- Construction FormworkDocument60 pagesConstruction FormworkDev Bhangui100% (5)

- Mabey Propping and Jacking Brochure WebDocument27 pagesMabey Propping and Jacking Brochure WebezzularabPas encore d'évaluation

- Section 2: Procedural Control of Temporary Works: 6 ProceduresDocument38 pagesSection 2: Procedural Control of Temporary Works: 6 Proceduresezzularab100% (3)

- Chapter 3 - Leisure in Different SectorsDocument23 pagesChapter 3 - Leisure in Different SectorsMary Pauline AlincastrePas encore d'évaluation

- Wilts & Berks Canal Trust Temporary Works ProcedureDocument21 pagesWilts & Berks Canal Trust Temporary Works ProcedureezzularabPas encore d'évaluation

- Appendix L Temporary Works Coordinator Training Course Aug19Document14 pagesAppendix L Temporary Works Coordinator Training Course Aug19ezzularabPas encore d'évaluation

- Strategic Management On Dreamworld (Final)Document23 pagesStrategic Management On Dreamworld (Final)Ammar Navid Rizvi80% (5)

- TWf2019.03 - Temporary Works Procedure - 8 December 2019 - FINAL1Document22 pagesTWf2019.03 - Temporary Works Procedure - 8 December 2019 - FINAL1ezzularabPas encore d'évaluation

- Gray House WhangamataDocument3 pagesGray House WhangamataAmbienti Team ArchitectsPas encore d'évaluation

- Tunnel System DokaCCDocument104 pagesTunnel System DokaCCezzularabPas encore d'évaluation

- 01 Soldier SystemDocument26 pages01 Soldier SystemezzularabPas encore d'évaluation

- Lafarge Handbook PDFDocument92 pagesLafarge Handbook PDFezzularabPas encore d'évaluation

- Lafarge Handbook PDFDocument92 pagesLafarge Handbook PDFezzularabPas encore d'évaluation

- Solaire Resort and Casino PhilippinesDocument3 pagesSolaire Resort and Casino PhilippinesJailyn NovedaPas encore d'évaluation

- Japan by Train 2017Document192 pagesJapan by Train 2017el_nakdjoPas encore d'évaluation

- 5d2dbd383497c-Home Buying Checklist 2019Document1 page5d2dbd383497c-Home Buying Checklist 2019ezzularabPas encore d'évaluation

- Technical Characteristics 2020 ENDocument1 pageTechnical Characteristics 2020 ENezzularabPas encore d'évaluation

- Load Capacity of Alkus Sheets Based on Span LengthDocument3 pagesLoad Capacity of Alkus Sheets Based on Span LengthezzularabPas encore d'évaluation

- EngiLab Frame.2D User ManualDocument234 pagesEngiLab Frame.2D User ManualezzularabPas encore d'évaluation

- FDP D Euro PropsDocument6 pagesFDP D Euro PropsezzularabPas encore d'évaluation

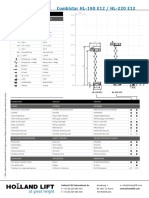

- Holland Lift 220 ElectricDocument3 pagesHolland Lift 220 ElectricezzularabPas encore d'évaluation

- Flyer PASCHAL Ident ENDocument2 pagesFlyer PASCHAL Ident ENezzularabPas encore d'évaluation

- Doka Circular Formwork enDocument2 pagesDoka Circular Formwork enezzularabPas encore d'évaluation

- Visa Security Infographic 102314 JC v30Document1 pageVisa Security Infographic 102314 JC v30ezzularabPas encore d'évaluation

- Airlines GraphicDocument1 pageAirlines GraphicezzularabPas encore d'évaluation

- RMD Kwikform India: Formwork ServicesDocument10 pagesRMD Kwikform India: Formwork ServicesezzularabPas encore d'évaluation

- Rapid Column ArmDocument4 pagesRapid Column ArmezzularabPas encore d'évaluation

- Welding ProcedureDocument2 pagesWelding ProcedurefallalovaldesPas encore d'évaluation

- Firmenflyer Blickle-ENDocument2 pagesFirmenflyer Blickle-ENezzularabPas encore d'évaluation

- Abu Dhabi To Dubai Link Bridges: Case StudyDocument1 pageAbu Dhabi To Dubai Link Bridges: Case StudyezzularabPas encore d'évaluation

- Bringing Luxury Residential Complex to Life with FormworkDocument1 pageBringing Luxury Residential Complex to Life with FormworkezzularabPas encore d'évaluation

- Al Baleed Resort: Case StudyDocument1 pageAl Baleed Resort: Case StudyezzularabPas encore d'évaluation

- Alcoa Insert 5052and6061 FINALDocument2 pagesAlcoa Insert 5052and6061 FINALezzularabPas encore d'évaluation

- Welding ProcedureDocument2 pagesWelding ProcedurefallalovaldesPas encore d'évaluation

- Check-in counters at airports will now close 1 hour before departure. Please plan your arrival accordinglyDocument4 pagesCheck-in counters at airports will now close 1 hour before departure. Please plan your arrival accordinglySantosh RajvanshiPas encore d'évaluation

- Revised SWOT With ExplanationDocument6 pagesRevised SWOT With ExplanationJomar ViconiaPas encore d'évaluation

- Memory Nata 2009Document4 pagesMemory Nata 2009Nikhil ThakraniPas encore d'évaluation

- The Best 9 Days in GeorgiaDocument3 pagesThe Best 9 Days in GeorgiaInstitute of National EducationPas encore d'évaluation

- Univerzitet U Tuzli Mašinski Fakultet Poslovni Engleski 2 NAME - SCOREDocument5 pagesUniverzitet U Tuzli Mašinski Fakultet Poslovni Engleski 2 NAME - SCOREElmin OmicPas encore d'évaluation

- Hotel industry stats - 600B+ value, 129 ADR, 66% occupancyDocument5 pagesHotel industry stats - 600B+ value, 129 ADR, 66% occupancySamarth MishraPas encore d'évaluation

- Ingles 3Document47 pagesIngles 3leidyjohanasanabria100% (1)

- Faiz Hospitality AssignmenttDocument9 pagesFaiz Hospitality AssignmenttFaizPas encore d'évaluation

- Metro Van PDFDocument1 pageMetro Van PDFStephen OlsonPas encore d'évaluation

- Guidebook enDocument22 pagesGuidebook enRaisu96Pas encore d'évaluation

- Coliving Pgs in Kondapur - Google SearchDocument1 pageColiving Pgs in Kondapur - Google SearchiamvarasPas encore d'évaluation

- Five Star Hotel History EvolutionDocument2 pagesFive Star Hotel History EvolutionSowmya MaraganiPas encore d'évaluation

- Cattle Baron's Ball 2012Document10 pagesCattle Baron's Ball 2012PeopleNewspapersDallasPas encore d'évaluation

- Imec 24 First AnnouncementDocument6 pagesImec 24 First AnnouncementMYANMAR SEAMEN UNIONPas encore d'évaluation

- Evaluation of The Service Quality For Hotel Industry - A Case StudyDocument6 pagesEvaluation of The Service Quality For Hotel Industry - A Case StudyAbhinandanPas encore d'évaluation

- Pantheon Comics #13 Love Me TenderDocument67 pagesPantheon Comics #13 Love Me TenderLauraHensonPas encore d'évaluation

- Migrations and Other Stories by Lisa HernandezDocument177 pagesMigrations and Other Stories by Lisa HernandezArte Público PressPas encore d'évaluation

- Motivate Corporate Brochure (Lo-Res)Document92 pagesMotivate Corporate Brochure (Lo-Res)motivatepublishingPas encore d'évaluation

- Laser B2 Companion 092010 GLOSSARYDocument70 pagesLaser B2 Companion 092010 GLOSSARYgeova29Pas encore d'évaluation

- Web Summit 2021 Support - VP ApprovalDocument2 pagesWeb Summit 2021 Support - VP ApprovalPiripireowoPas encore d'évaluation

- Internship report 2022: My experience at Hotel Sonesta PereiraDocument35 pagesInternship report 2022: My experience at Hotel Sonesta PereiraAngeles DiazzPas encore d'évaluation

- What You Don't Know About Cameron Highlands: Teng Ky-GanDocument11 pagesWhat You Don't Know About Cameron Highlands: Teng Ky-GanJoyce ChuaPas encore d'évaluation

- MEDIA RELEASE DOT, TIEZA, GRAT Conduct Sustainable Tourism WorkshopsDocument3 pagesMEDIA RELEASE DOT, TIEZA, GRAT Conduct Sustainable Tourism WorkshopsRommel Añonuevo NatanauanPas encore d'évaluation

- Toponymic Guidelines For SloveniaDocument30 pagesToponymic Guidelines For SloveniaSlovenian Webclassroom Topic ResourcesPas encore d'évaluation