Académique Documents

Professionnel Documents

Culture Documents

565 Aboute

Transféré par

Denis KoriTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

565 Aboute

Transféré par

Denis KoriDroits d'auteur :

Formats disponibles

About the EBRD

We invest in changing lives

January 2018

The EBRD invests to build up effective market economies across

three continents and to make a positive impact on people’s lives.

At a glance

With a focus on private sector investment and support for policy reform, Number of projects (since 1991)

we work to ensure that economies in our regions are competitive, 5,035

inclusive, well-governed, sustainable, resilient and integrated.

Cumulative business volume

€119.6 billion

Background Investment Cumulative disbursements

The EBRD is the largest single investor

in many of the countries where it

Every EBRD investment must:

►► support the further development

€91.5 billion

operates. It is active in 38 economies of sound market economies EBRD projects 2010-17

from central Europe to Central Asia, Volume (€ billions) Number of projects

►► take risk that supports 10.0 400

the Western Balkans and the southern

private investors

and eastern Mediterranean and more

recently Lebanon, West Bank and ►► follow sound banking principles

Gaza. The Bank’s investments also 7.5 300

►► strengthen sustainability.

mobilise significant foreign direct

investment into the economies where Through its investments

5.0 200

we operate. It invests mainly in private the EBRD promotes:

enterprises, usually together with ►► economic growth in its

commercial partners. It provides project countries of operations

2.5 100

financing for the financial sector and

►► entrepreneurship, competition

the real economy, both new ventures

and privatisation

and investments in existing companies.

0.0 0

It also works with publicly-owned ►► stronger financial institutions

'10 '11 '12 '13 '14 '15 '16 '17

companies to support privatisation, the and legal systems

restructuring of state-owned firms and Capital

►► infrastructure development

improvement of municipal services.

►► adoption of strong corporate €30 billion

The Bank is owned by 66 countries

governance, including Shareholders (countries,

and two intergovernmental institutions

environmental sensitivity and the EU and EIB)

(the European Union and the European

Investment Bank). It maintains a close ►► structural and sectoral reforms. 68

political dialogue with governments, Economies where the EBRD invests

The EBRD:

authorities and representatives of

civil society to promote its goals.

►► promotes co financing and 38

foreign direct investment Regional offices

It also works in cooperation with

international organisations such as

the OECD, the IMF, the World Bank

►► mobilises domestic capital 52

►► provides technical assistance. Staff

and UN specialised agencies.

In all its operations the EBRD follows 3,185

the highest standards in corporate What we do

governance and sustainable www.ebrd.com/what-we-do.html

development. As a public institution Where we are

the EBRD is committed to a rigorous www.ebrd.com/where-we-are.html

public information policy. Who we are

www.ebrd.com/who-we-are.html

Who we work with

www.ebrd.com/work-with-us.html

How to obtain EBRD financing

Strategic focus Financing Large private sector projects

Private sector projects range from €5 million to

The EBRD’s strategic priority is to The EBRD uses a broad range of €250 million; the average amount is €25 million.

support and sustain the continuing financing instruments, tailored to

Small projects

recovery in the region in the aftermath specific projects. The main instruments The EBRD also supports financial intermediaries,

of the global financial crisis. Strong are loans, equity investments and such as local commercial banks, micro‑business

banks, equity funds and leasing facilities.

emphasis is being placed in this recovery guarantees, and the Bank’s charter

Trade finance

period on ‘re-energising transition’, stipulates that at least 60 per cent A range of products to facilitate intra‑regional and

particularly the development of local of lending shall be provided to the international trade in its countries of operations.

capital markets and the reduction of private sector. The EBRD applies sound Complementary schemes

The Small Business Support team works

foreign currency lending to unhedged banking and investment principles directly with individual enterprises,

borrowers. Fostering and strengthening in all its operations. It is also able to providing industry‑specific advice.

local currency and capital markets is borrow on global capital markets. Finance application form

www.ebrd.com/work-with-us.html

also a main pillar of the Bank’s strategy

The capital strength of the EBRD

for the financial institutions sector.

is reflected in its triple-A rating or

In its recent activities the EBRD has equivalent, with a stable outlook, Sectors supported by the EBRD

Agribusiness

also paid special attention to a number which all three major rating Energy efficiency

of strategic initiatives, deepening and agencies reaffirmed in 2017. Financial institutions

Manufacturing

widening the activities in the lesser- Municipal and environmental infrastructure

For the EBRD, 2017 was another year

developed countries and tackling the Natural resources

of rising investment and delivery – Power and energy

challenges of energy security and energy Property and tourism

the fourth since 2014. Total annual

efficiency in the region where it works. Small and medium-sized enterprises

EBRD financing across all economic Telecommunications, information technology

and media

sectors rose to a new record of Transport

€9.7 billion in 2017, from €9.4 billion The EBRD does not finance

in 2016. The number of individual Defence-related activities

Tobacco industry

EBRD projects in 2017 rose to a new Selected alcoholic products

high of 412, from 378 in 2016. Substances banned by international law

Stand-alone gambling facilities

Financing for the green economy rose

from €2.8 billion in 2016 to €4.1 billion,

accounting for 43 per cent of total

financing in 2017. The Bank had pledged,

ahead of the 2015 Paris Agreement,

to devote 40 per cent of its financing

to green investment by 2020. This

goal has been met three years early.

Where we invest Contacts

02

European Bank for Reconstruction and Development

37

One Exchange Square

04

London EC2A 2JN

37 05

United Kingdom

19

Switchboard/central contact

06

Tel: +44 20 7338 6000

07

22

23

Fax: +44 20 7338 6100

21

08

01

03

15

25

Project enquiries/proposals

10 16 Tel: +44 20 7338 7168

14 12

11

20 28 24

Fax: +44 20 7338 7848

13

09

36 38

17 18

27

Email: newbusiness@ebrd.com

18 26

33

35 31

32 34

30

Central Europe and

the Baltic states

South-eastern Europe

09 Albania

Eastern Europe and

the Caucasus

Central Asia

23 Kazakhstan

Find us on

01 Croatia 10 Bosnia and Herzegovina 17 Armenia 24 Kyrgyz Republic

29

02 Estonia

03 Hungary

11 Bulgaria

12 FYR Macedonia

18 Azerbaijan

19 Belarus

25 Mongolia

26 Tajikistan

www.facebook.com/ebrdhq

04 Latvia 13 Kosovo 20 Georgia 27 Turkmenistan

05 Lithuania

06 Poland

14 Montenegro

15 Romania

21 Moldova

22 Ukraine

28 Uzbekistan www.linkedin.com/company/ebrd

07 Slovak Republic 16 Serbia

08 Slovenia twitter.com/ebrd

Southern and eastern Mediterranean

35 Cyprus 37 Russia

29 Egypt

30 Jordan

32 Morocco

33 Tunisia 36 Greece 38 Turkey

www.youtube.com/user/ebrdtv

31 Lebanon 34 West Bank and Gaza

instagram.com/ebrd_official

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- DEED OF ABSOLUTE SALE OF MEMORIAL LOT'bienvenido SanchezDocument2 pagesDEED OF ABSOLUTE SALE OF MEMORIAL LOT'bienvenido SanchezJaime Gonzales73% (15)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Physics 2 - Starts Heat JULY 2017Document282 pagesPhysics 2 - Starts Heat JULY 2017Irah Mae Escaro CustodioPas encore d'évaluation

- The Lion of Judah PDFDocument19 pagesThe Lion of Judah PDFMichael SympsonPas encore d'évaluation

- Peoria County Jail Booking Sheet For Oct. 4, 2016Document7 pagesPeoria County Jail Booking Sheet For Oct. 4, 2016Journal Star police documents0% (1)

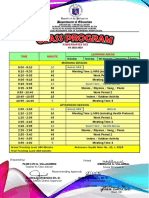

- Class Program 2022 2023Document6 pagesClass Program 2022 2023Flor Lyn VillagomezPas encore d'évaluation

- Va Tech ReportDocument260 pagesVa Tech Reportbigcee64Pas encore d'évaluation

- Senior Accounts Payable Receivable in Salt Lake City UT Resume Carrie Lee McElrathDocument3 pagesSenior Accounts Payable Receivable in Salt Lake City UT Resume Carrie Lee McElrathCarrieLeeMcElrathPas encore d'évaluation

- Doctrine of Liberality of Technical ProceduresDocument18 pagesDoctrine of Liberality of Technical ProceduresLou Nonoi TanPas encore d'évaluation

- SOP Regulation Rate Charges and Terms&ConditionDocument12 pagesSOP Regulation Rate Charges and Terms&ConditionSPIgroupPas encore d'évaluation

- Role of Ethics in Corporate GovernanceDocument11 pagesRole of Ethics in Corporate GovernancepranjalPas encore d'évaluation

- Commercial Law Case Digest: List of CasesDocument57 pagesCommercial Law Case Digest: List of CasesJean Mary AutoPas encore d'évaluation

- Agael Et - Al vs. Mega-Matrix (Motion For Reconsideration)Document5 pagesAgael Et - Al vs. Mega-Matrix (Motion For Reconsideration)John TorrePas encore d'évaluation

- Critical Construction Contract ClausesDocument12 pagesCritical Construction Contract Clausesjoy100% (1)

- Comprimise, Arrangement and Amalgamation NotesDocument6 pagesComprimise, Arrangement and Amalgamation Notesitishaagrawal41Pas encore d'évaluation

- TOPIC 2 - Topic 2 - Consolidated and Separate Financial StatementsDocument6 pagesTOPIC 2 - Topic 2 - Consolidated and Separate Financial Statementsduguitjinky20.svcPas encore d'évaluation

- Annexure-I: Check List For Application FormDocument4 pagesAnnexure-I: Check List For Application FormShubham ShuklaPas encore d'évaluation

- Exercises of Analytical Exposition TextDocument2 pagesExercises of Analytical Exposition TextSovie UnyilPas encore d'évaluation

- Tertiary ActivitiesDocument5 pagesTertiary Activitieshimanshu singhPas encore d'évaluation

- SFA HANDBOOK 201-280 Registration ProceduresDocument80 pagesSFA HANDBOOK 201-280 Registration ProceduresGraeme NichollsPas encore d'évaluation

- Spec Contract Appointment Letter.Document5 pagesSpec Contract Appointment Letter.zeeshan100% (1)

- Professional Liability Proposal Form - EditableDocument4 pagesProfessional Liability Proposal Form - EditableJun FalconPas encore d'évaluation

- STF Final Rule Summary & User Guide WEB 2.0Document11 pagesSTF Final Rule Summary & User Guide WEB 2.0AfnanParkerPas encore d'évaluation

- Lucidchart OctubreDocument2 pagesLucidchart OctubreHenry M Gutièrrez SPas encore d'évaluation

- FTP Port 20Document2 pagesFTP Port 20RajaRajan ManickamPas encore d'évaluation

- Employer Employee SchemeDocument22 pagesEmployer Employee SchemeMaruthi RaoPas encore d'évaluation

- Eutropije-Breviarium Historiae RomanaeDocument95 pagesEutropije-Breviarium Historiae RomanaeedinjuvePas encore d'évaluation

- What Are Some of The Most Notable Pharmaceutical Scandals in History?Document6 pagesWhat Are Some of The Most Notable Pharmaceutical Scandals in History?benePas encore d'évaluation

- 4 - Cruz v. Tuason - AbdulrashidDocument1 page4 - Cruz v. Tuason - AbdulrashidJay CezarPas encore d'évaluation

- WRWBM96 GST InvoiceDocument1 pageWRWBM96 GST InvoiceSIDDESWAR MANOJ ChikkaPas encore d'évaluation

- How To Set The N+M Function of NVR?: Equipment Model Firmware Course Version DateDocument10 pagesHow To Set The N+M Function of NVR?: Equipment Model Firmware Course Version DateFrankis MarcanoPas encore d'évaluation