Académique Documents

Professionnel Documents

Culture Documents

5dFAQ Travel Tax PDF

Transféré par

Benjo Fausto0 évaluation0% ont trouvé ce document utile (0 vote)

33 vues2 pagesTitre original

5dFAQ.Travel.Tax.pdf

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

33 vues2 pages5dFAQ Travel Tax PDF

Transféré par

Benjo FaustoDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

Philippine Embassy

Berlin

Frequently Asked Questions on Philippine Travel Tax Exemption

What is the Philippine Travel Tax and who are required to pay it?

The Philippines levies a travel tax on the following persons who are leaving the

Philippines:

(1) Filipino citizens,

(2) Foreigners who are permanently residing or immigrants in the

Philippines, and

(3) Foreigners who have stayed in the Philippines for more than one year.

How much is the Philippine Travel Tax?

PHP 2,700. - for first class passengers and PHP 1,620.- for economy class

passengers. The standard reduced rate for minors is (PHP 1,350.- / PHP 810.-),

and the privileged reduced rate for dependents of overseas Filipino contract

workers is (PHP 400.- / PHP 300.-).

Who are exempted from paying the Travel Tax?

Filipino citizens who are permanent residents abroad and Balikbayan visitors,

who have stayed in the Philippines for less than one year (under Sec. 2 (1) of

Executive Order No. 283, which amended P.D. No. 1183, as amended). Also

exempted are Overseas Filipino Contract Workers.

What documents do I need to apply for travel tax exemption?

For Filipino permanent residents in Germany:

1. Proof of permanent residence, which can be either:

a) An official document issued by the German government (for example,

Aufenthaltstitel that is unbefristet) showing that the Filipino citizen has

permanent resident status, or

b) Appropriate entries in the Philippine passports showing five years’

residence abroad.

2. Copy of passport, the identification page (with picture and personal data)

and the page showing the latest arrival date in the Philippines.

For Overseas Filipino Contract Workers:

1. If the Filipino overseas contract worker is hired on-site by foreign or Filipino

principals - Certification of Work from the Philippine Embassy or

Consulate. The exemption is valid only for travel to the place of work.

2. If the Filipino overseas contract worker registered with the Philippine

Overseas Employment Administration (POEA) – the Overseas

Employment Certificate (OEC) issued by POEA serves as travel tax

exemption certificate. There is no need to secure an exemption certificate.

For Dependents of Overseas Filipino Contract Workers:

1. For the legitimate spouse:

a) Passport

b) Marriage Contract

c) Overseas Employment Certificate / Balik Manggagawa form from POEA.

FAQs on Travel Tax Exemption 1/2

Philippine Embassy

Berlin

2. For legitimate unmarried children below 21 years of age

a) Passport

b) Overseas Employment Certificate / Balik Manggagawa form from POEA.

How do I apply for Travel Tax Exemption?

1. Secure original documents specified above and make one (1) copy of each.

2. Go to the nearest Tourism Infrastructure and Enterprise Zone Authority (TIEZA)

(formerly Philippine Travel Authority PTA) Travel Tax Field Office in the

Philippines - in the airports, or in TIEZA provincial field offices (see

http://www.tieza.com.ph/pages-provincial-offices.php) and

• Show original documents and submit photocopies. (Note: some documents

may have to be submitted in original).

• Pay a processing fee (around PHP 200.-) per person.

• Wait for the Travel Tax Exemption Certificate / official receipt to be

released to you. Below is a sample:

3. Present the Travel Tax Exemption Certificate to the authorities at the airport

upon demand.

For detailed information on Travel Tax Exemption, please visit:

Tourism Infrastructure and Enterprise Zone Authority

www.tieza.com.ph

As of 12 January 2012

FAQs on Travel Tax Exemption 2/2

Vous aimerez peut-être aussi

- MBL Limit 75K: COMPANY XY Strategic Management PaperDocument137 pagesMBL Limit 75K: COMPANY XY Strategic Management PaperStef Tanhueco100% (1)

- 10 000 Reasons SATBDocument10 pages10 000 Reasons SATBJohncarl deninaPas encore d'évaluation

- Bi Form V Ni 007 Rev 1Document1 pageBi Form V Ni 007 Rev 1D Del SalPas encore d'évaluation

- Engineering Development/Quality Inspection Test Plan (ITPDocument13 pagesEngineering Development/Quality Inspection Test Plan (ITPPageduesca RouelPas encore d'évaluation

- Engineering Development/Quality Inspection Test Plan (ITPDocument13 pagesEngineering Development/Quality Inspection Test Plan (ITPPageduesca RouelPas encore d'évaluation

- Lesson 11 The Global Demography: ConnectingDocument15 pagesLesson 11 The Global Demography: ConnectingJOEY MEAD ARUGAYPas encore d'évaluation

- 2016 Revised POEA Rules and Regulations For Land BasedDocument71 pages2016 Revised POEA Rules and Regulations For Land BasedCindy Grace Manuel AgbisitPas encore d'évaluation

- What Is The Philippine Travel Tax and Who Are Required To Pay It?Document2 pagesWhat Is The Philippine Travel Tax and Who Are Required To Pay It?Ymon TuallaPas encore d'évaluation

- Legal Aspect in Tourism and HospitalityDocument41 pagesLegal Aspect in Tourism and HospitalityMars MaguenPas encore d'évaluation

- Measuring International Migration in The PhilippinesDocument23 pagesMeasuring International Migration in The PhilippinesBrod LenamingPas encore d'évaluation

- Notification On Travel Ban Endorsement/exemption RequestsDocument1 pageNotification On Travel Ban Endorsement/exemption RequestsAngelica MariePas encore d'évaluation

- Philippine Travel Tax GuideDocument2 pagesPhilippine Travel Tax GuideWolfwood ManilagPas encore d'évaluation

- VAT Exemption Guide for Foreign MissionsDocument10 pagesVAT Exemption Guide for Foreign MissionsXhris ChingPas encore d'évaluation

- Oec Requirement For Vacationing Ofws: News Release May 07, 2011Document2 pagesOec Requirement For Vacationing Ofws: News Release May 07, 2011phpfoxgPas encore d'évaluation

- Required Documents To Be Submitted Under The Following FormDocument3 pagesRequired Documents To Be Submitted Under The Following FormRafae ShahidPas encore d'évaluation

- Car Importation RequirementsDocument6 pagesCar Importation Requirementsbfac2024Pas encore d'évaluation

- Japan Visa ApplicationDocument3 pagesJapan Visa ApplicationJaydison AniwerPas encore d'évaluation

- PermitDocument4 pagesPermitฮันนี่ คริสPas encore d'évaluation

- Ethiopia-Country-Guide-IAM PetDocument4 pagesEthiopia-Country-Guide-IAM PetMastika GebrehiewotPas encore d'évaluation

- Travel Requirements: Home FaqsDocument11 pagesTravel Requirements: Home FaqsKieron Ivan M. GutierrezPas encore d'évaluation

- Goods Documents Required Customs Prescriptions Remarks: ChinaDocument11 pagesGoods Documents Required Customs Prescriptions Remarks: ChinaKelz YouknowmynamePas encore d'évaluation

- Individual Income TaxDocument9 pagesIndividual Income TaxCharmaine RosalesPas encore d'évaluation

- OAS Protocol Manual: Visas, Accreditations, Driver's LicensesDocument15 pagesOAS Protocol Manual: Visas, Accreditations, Driver's LicensesLasha ChakhvadzePas encore d'évaluation

- Administrative Policies and Guidelines Governing The Accreditation of All Foreign RepresentativesDocument6 pagesAdministrative Policies and Guidelines Governing The Accreditation of All Foreign RepresentativesstacyPas encore d'évaluation

- Travel Documentation: Unit IIIDocument18 pagesTravel Documentation: Unit IIIeyaanPas encore d'évaluation

- Visa Application and Requirement) '23.08Document20 pagesVisa Application and Requirement) '23.084businesscorrespPas encore d'évaluation

- VISA Options PhilippinesDocument20 pagesVISA Options Philippinesokaenaok100% (1)

- Guidelines On Baggage, BB, and ParcelsDocument11 pagesGuidelines On Baggage, BB, and ParcelsGMA News OnlinePas encore d'évaluation

- VisaDocument19 pagesVisakalangtPas encore d'évaluation

- Ib Passport 23 01 2023Document44 pagesIb Passport 23 01 2023Mahru Laine ParumogPas encore d'évaluation

- Apostile ConventionDocument5 pagesApostile Conventionjanbryle.cardenas.21Pas encore d'évaluation

- Filipino Travel RequirementsDocument6 pagesFilipino Travel RequirementsRuther CapituloPas encore d'évaluation

- AEP, PWP and 9G Visa ProceduresDocument5 pagesAEP, PWP and 9G Visa ProceduresGerard Nelson ManaloPas encore d'évaluation

- TravelDocument44 pagesTravelSean PInedaPas encore d'évaluation

- Filipinos Are Required To Have A Schengen Visa When Traveling To A Country Within The Schengen Area in EuropeDocument5 pagesFilipinos Are Required To Have A Schengen Visa When Traveling To A Country Within The Schengen Area in EuropeErnesto NeriPas encore d'évaluation

- V NI 007 Rev - 1Document1 pageV NI 007 Rev - 1robi.emaptaPas encore d'évaluation

- Tax Reform Act of 1997Document2 pagesTax Reform Act of 1997Eleia Cruz 吳玉青Pas encore d'évaluation

- Visa Information and RequirementsDocument20 pagesVisa Information and RequirementsGanda SihotangPas encore d'évaluation

- Philippine Laws on Foreign InvestmentsDocument14 pagesPhilippine Laws on Foreign InvestmentsKentDemeterioPas encore d'évaluation

- 9g Pre-Arranged Employment Visa What Is A 9g Visa?Document2 pages9g Pre-Arranged Employment Visa What Is A 9g Visa?Jee JeePas encore d'évaluation

- Travel Requirements and ProcessingDocument23 pagesTravel Requirements and ProcessingRA GuntanPas encore d'évaluation

- BI FORM P-002-Rev 1 PDFDocument1 pageBI FORM P-002-Rev 1 PDFSamae KandaPas encore d'évaluation

- Overview AEPDocument3 pagesOverview AEPTheodore DolarPas encore d'évaluation

- Non-Quota Immigrant Visas: Re: Relocation For Family Members of Expatriates Requirements: Immigrant VisaDocument2 pagesNon-Quota Immigrant Visas: Re: Relocation For Family Members of Expatriates Requirements: Immigrant VisaMarvie FrandoPas encore d'évaluation

- Duty-Free Shipment of Personal Effects Into The Philippines: Letters@dof - Gov.ph WWW - Dof.gov - PHDocument3 pagesDuty-Free Shipment of Personal Effects Into The Philippines: Letters@dof - Gov.ph WWW - Dof.gov - PH4t4t4t 44545Pas encore d'évaluation

- BI FORM V-NI-026-Rev 1.1 PDFDocument1 pageBI FORM V-NI-026-Rev 1.1 PDFkokatuPas encore d'évaluation

- Restrictions To TravelDocument7 pagesRestrictions To TravelTess De LeonPas encore d'évaluation

- Special Resident Retirees Visa SRRVDocument6 pagesSpecial Resident Retirees Visa SRRVHsk MiaoPas encore d'évaluation

- RTIDocument14 pagesRTILatisha SmithPas encore d'évaluation

- Income TaxationDocument19 pagesIncome TaxationDaphnie BoloPas encore d'évaluation

- Balik Manggagawa Guidelines 29may2008Document6 pagesBalik Manggagawa Guidelines 29may2008Glenn100% (2)

- OEC RequirementsDocument2 pagesOEC RequirementsmhergonzalesPas encore d'évaluation

- English Professional Card VisaDocument3 pagesEnglish Professional Card VisaBijoy babuPas encore d'évaluation

- Individual Income Tax GuideDocument8 pagesIndividual Income Tax GuideMai RuizPas encore d'évaluation

- Waiver of Exclusion GroundDocument4 pagesWaiver of Exclusion GroundLouieLimcoliocPas encore d'évaluation

- Question-And-Answer and Infographics On Authentication Through ApostilleDocument12 pagesQuestion-And-Answer and Infographics On Authentication Through ApostilleRica AggabaoPas encore d'évaluation

- Intro. To Income Tax FTDocument52 pagesIntro. To Income Tax FTJOANA GRACE ALLORINPas encore d'évaluation

- Military Service (For Greek Citizens Only)Document2 pagesMilitary Service (For Greek Citizens Only)Nikos StavropoulosPas encore d'évaluation

- Income TaxationDocument21 pagesIncome TaxationJune Baricanosa AlvarezPas encore d'évaluation

- Income TaxationDocument21 pagesIncome TaxationElyssa Mariz PevidalPas encore d'évaluation

- Checklist PT National Residency Independent Activity EntrepreneursDocument2 pagesChecklist PT National Residency Independent Activity EntrepreneursMara MatosPas encore d'évaluation

- TravelPass ChecklistDocument1 pageTravelPass ChecklistJia YapPas encore d'évaluation

- What Is Emigration Clearance CertificateDocument2 pagesWhat Is Emigration Clearance CertificateYssa De Leon LeePas encore d'évaluation

- Menu enDocument1 pageMenu enBenjo FaustoPas encore d'évaluation

- Amacc Grade 11 12 Gas - 2017Document16 pagesAmacc Grade 11 12 Gas - 2017Benjo FaustoPas encore d'évaluation

- Last September To OctoberDocument6 pagesLast September To OctoberBenjo FaustoPas encore d'évaluation

- Benilde AntipoloProspectus2019-Website PDFDocument17 pagesBenilde AntipoloProspectus2019-Website PDFBenjo FaustoPas encore d'évaluation

- Java Operators: GeneralDocument20 pagesJava Operators: GeneralBenjo FaustoPas encore d'évaluation

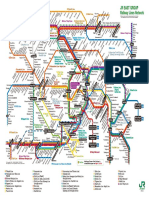

- Map A4olDocument1 pageMap A4olBenjo FaustoPas encore d'évaluation

- Payment at The Japanese Language Proficiency Testing Convenience Store (FamilyMart)Document3 pagesPayment at The Japanese Language Proficiency Testing Convenience Store (FamilyMart)Benjo FaustoPas encore d'évaluation

- CreateSpace Java Mar 2016 ISBN 1530669170Document107 pagesCreateSpace Java Mar 2016 ISBN 1530669170Benjo FaustoPas encore d'évaluation

- CreateSpace Java Mar 2016 ISBN 1530669170Document107 pagesCreateSpace Java Mar 2016 ISBN 1530669170Benjo FaustoPas encore d'évaluation

- Rough Carpentry Spec for 150 MW Power PlantDocument2 pagesRough Carpentry Spec for 150 MW Power PlantBenjo FaustoPas encore d'évaluation

- やさしい日本語Document61 pagesやさしい日本語supeinanheru0% (1)

- Fun With Language Book 1 Part 1Document62 pagesFun With Language Book 1 Part 1KatPas encore d'évaluation

- Selected Statistics On Agriculture 2016Document68 pagesSelected Statistics On Agriculture 2016IjLoriaMaderaPas encore d'évaluation

- Intro To KanjiDocument14 pagesIntro To Kanjikin100% (2)

- Reasons LarsonDocument5 pagesReasons LarsonronPas encore d'évaluation

- 2e966019 PDFDocument279 pages2e966019 PDFBenjo FaustoPas encore d'évaluation

- Conduct ResearchDocument1 pageConduct ResearchKho Kent JohnPas encore d'évaluation

- Dialnet EnglishTextbooksForTeachingAndLearningEnglishAsAFo 3646379 PDFDocument20 pagesDialnet EnglishTextbooksForTeachingAndLearningEnglishAsAFo 3646379 PDFBenjo FaustoPas encore d'évaluation

- Classroom Observation Form SamplDocument2 pagesClassroom Observation Form Samplpaolo furio0% (1)

- Classroom Observation Form SamplDocument2 pagesClassroom Observation Form Samplpaolo furio0% (1)

- JPN 101Document8 pagesJPN 101Benjo FaustoPas encore d'évaluation

- Fun With Language Book 1 Part 1Document62 pagesFun With Language Book 1 Part 1KatPas encore d'évaluation

- After 2017Document2 pagesAfter 2017NonoyTaclino100% (1)

- (1980) - Sentence Coordination in Japanese and EnglishDocument8 pages(1980) - Sentence Coordination in Japanese and EnglishBenjo FaustoPas encore d'évaluation

- CFO Guidance Counseling ProgramDocument2 pagesCFO Guidance Counseling ProgramBenjo FaustoPas encore d'évaluation

- Second Edition 2 - French Translation PDFDocument1 pageSecond Edition 2 - French Translation PDFBenjo FaustoPas encore d'évaluation

- NamehireDocument3 pagesNamehireBenjo FaustoPas encore d'évaluation

- Maquiso, Jane Maxeil D.Document1 pageMaquiso, Jane Maxeil D.Jane Maxeil D. MaquisoPas encore d'évaluation

- Beauty and Personal Care in The PhilippinesDocument20 pagesBeauty and Personal Care in The Philippinesellochoco0% (1)

- SLI 2020 Annual ReportDocument335 pagesSLI 2020 Annual Reportjam linganPas encore d'évaluation

- Tumanda GEC 109Document5 pagesTumanda GEC 109Maria AngelaPas encore d'évaluation

- Lakas Kampi CMD PlatformDocument12 pagesLakas Kampi CMD PlatformcoolyuulllPas encore d'évaluation

- Activity 1 CONDUCTING AN INTERVIEW WITH AN OFWDocument5 pagesActivity 1 CONDUCTING AN INTERVIEW WITH AN OFWSammuel De BelenPas encore d'évaluation

- Coca-Cola Criticizes Worker ExploitationDocument3 pagesCoca-Cola Criticizes Worker ExploitationKatrina FermocilloPas encore d'évaluation

- Labor Law Review Midterm PDFDocument269 pagesLabor Law Review Midterm PDFRonic TreptorPas encore d'évaluation

- Philippine Private Sector Response Strategies and State Business Relations Toward Economic Recovery and Growth Post Covid 19Document18 pagesPhilippine Private Sector Response Strategies and State Business Relations Toward Economic Recovery and Growth Post Covid 19Carmela AlfonsoPas encore d'évaluation

- So Far Yet Home - The Impact of Colonization and Globalization OnDocument12 pagesSo Far Yet Home - The Impact of Colonization and Globalization OnJoselitoDegomaPas encore d'évaluation

- Computer Lab Rules and RegulationsDocument5 pagesComputer Lab Rules and RegulationsArvin Barrientos BernestoPas encore d'évaluation

- Supreme Court upholds ban on deployment of Filipina domestic workers abroadDocument5 pagesSupreme Court upholds ban on deployment of Filipina domestic workers abroadIanBiagtanPas encore d'évaluation

- Illegal Recruitment PDFDocument6 pagesIllegal Recruitment PDFirditch100% (1)

- The Labor Code of The PhilipphinesDocument81 pagesThe Labor Code of The PhilipphinesMarx AndreiOscar Villanueva YaunPas encore d'évaluation

- The Alligator River Story: A Marxist ApproachDocument6 pagesThe Alligator River Story: A Marxist ApproachJosh F. AlmontePas encore d'évaluation

- Living in The Time of Tok Hang 2018Document21 pagesLiving in The Time of Tok Hang 2018reynald_ecijaPas encore d'évaluation

- R.A. 8042Document16 pagesR.A. 8042Erly MaePas encore d'évaluation

- of RA 10022 or The Migrant Workers ActDocument140 pagesof RA 10022 or The Migrant Workers ActAlbert ValdezPas encore d'évaluation

- 2 TCW Chapter 2 Globalization of Markets and Economic RelationsDocument12 pages2 TCW Chapter 2 Globalization of Markets and Economic RelationsMiya LaidePas encore d'évaluation

- BOC CM0 04-2017 - Guidelines On Implementation of CAO 05-2016 On Balikbayan Boxes With Revised Information SheetDocument23 pagesBOC CM0 04-2017 - Guidelines On Implementation of CAO 05-2016 On Balikbayan Boxes With Revised Information SheetPortCallsPas encore d'évaluation

- Meet Your Money GurusDocument15 pagesMeet Your Money GurusLomyna MorrePas encore d'évaluation

- Philippine Canadian Inquirer #531Document32 pagesPhilippine Canadian Inquirer #531canadianinquirerPas encore d'évaluation

- Life Challenges of Overseas Filipino Workers: Alvin Gino M. Bautista, Vladimir T. TamayoDocument9 pagesLife Challenges of Overseas Filipino Workers: Alvin Gino M. Bautista, Vladimir T. TamayoMahvrick De LeonPas encore d'évaluation

- Labor Laws PDFDocument173 pagesLabor Laws PDFTrem GallentePas encore d'évaluation

- Philippine Macroeconomic Issues and Their Causes: Gerardo P. SicatDocument30 pagesPhilippine Macroeconomic Issues and Their Causes: Gerardo P. SicatJoanna AbreaPas encore d'évaluation

- Patricia Evangelista's SpeechDocument1 pagePatricia Evangelista's SpeechStef Bernardo50% (2)

- 2014 Annual ReportDocument78 pages2014 Annual ReportRia DumapiasPas encore d'évaluation