Académique Documents

Professionnel Documents

Culture Documents

CredTrans - Case 14

Transféré par

ces ereseTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

CredTrans - Case 14

Transféré par

ces ereseDroits d'auteur :

Formats disponibles

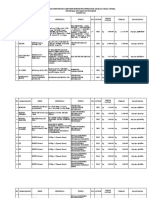

SECURITY BANK AND TRUST COMPANY VS.

RTC OF MAKATI, MAGTANGGOL

EUSEBIO AND LEILA VENTURA

G.R. No. 113926, October 23, 1996

FACTS: On April 27, 1983, Eusebio executed a promissory note (PN) in favour of

Security Bank and Trust Company (bank) in the amount of P100, 000.00 payable in 6

monthly instalments with a stipulated interest of 23% per year up to the 5 th instalments.

On July 28, 1983, Eusebio again executed a promissory note in favour of the

bank. He bound himself to pay P100, 000.00 in 6 monthly instalments plus 23% interest

per year.

On August 31, 1983, Eusebio executed another promissory note in the amount of

P65, 000.00. He agreed to pay this note in 6 monthly instalments plus interest of 23%

per year.

On all the 3 promissory notes, Ventura had signed as a co-maker. Upon maturity

which fell on different dates, the principal balance remaining on the notes stood at:

1st PN: P16, 665.00 as of September 1983

2nd PN: P83, 333.00 as of August 1983

3rd PN: P65, 000.00 as of August 1983

Eusebio failed and refused to pay the balance payable, and so the bank filed a

case in court against him.

The lower court rendered a decision in favour of the bank and ordered Eusebio to

pay all the remaining balance plus 12% interest per year each, pay 20% of the total

amount due and payable to the bank as and by way of attorneys fees; and pay the cost

of the suit.

A motion for partial reconsideration was filed by the bank contending that the

interest rate agreed upon by them during the signing of the PNs was 23% per year; that

the interests awarded should be compounded quarterly from due date; that Ventura

should likewise be held liable to pay the balance. The lower court denied the motion to

grant the interest beyond 12% per year and held that Ventura is also liable.

ISSUE: W/N the 23% rate of interest per year agreed upon by the parties is allowed

against the Usury Law.

HELD: All the 3 promissory notes were signed in 1983 and, therefore, were already

covered by the Central Bank Circular No. 905. Contrary to the claim of the lower court,

this circular did not repeal nor amend the Usury Law but simply suspended its effectivity.

The rate of interest was agreed upon by the parties freely. Eusebio did not

question that rate. The New Civil Code provides that contracting parties may establish

such stipulations, clauses, terms and conditions as them may deem convenient,

provided they are not contrary to law, morals, good customs, public order, or public

policy. The SC held that it finds no valid reason for the lower court to impose a 12% rate

of interest on the principal balance owing to the bank by Eusebio in the presence of a

valid stipulation.

Central Bank Circular No. 905 provides that in a loan or forbearance of money,

the interest due should be that stipulated in writing, and in the absence thereof, the rate

shall be 12% per year. Only in the absence of a stipulation can the court impose the

12% rate of interest.

Therefore, the SC modified the decision of the lower court and that the rate of

interest that should be imposed be 23% per year.

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- 03-F10 Planned Job ObservationDocument1 page03-F10 Planned Job ObservationSn Ahsan100% (1)

- Flowchart PDFDocument1 pageFlowchart PDFces eresePas encore d'évaluation

- 2011-11-09 Diana and AtenaDocument8 pages2011-11-09 Diana and AtenareluPas encore d'évaluation

- Thesis On Retail Management of The Brand 'Sleepwell'Document62 pagesThesis On Retail Management of The Brand 'Sleepwell'Sajid Lodha100% (1)

- CreditTrans - Case 44Document2 pagesCreditTrans - Case 44ces eresePas encore d'évaluation

- Stochastic ProcessesDocument264 pagesStochastic Processesmanosmill100% (1)

- DIGESTSDocument24 pagesDIGESTSces eresePas encore d'évaluation

- Rule 110: Prosecution of Offenses QuestionsDocument1 pageRule 110: Prosecution of Offenses Questionsces eresePas encore d'évaluation

- RafolDocument1 pageRafolces eresePas encore d'évaluation

- People of The Philippines, Plaintiff-Appellee vs. Julian Sumicad, Defendant Appellant. G.R. No. L-35524, March 18, 1932 Street, J.: FactsDocument2 pagesPeople of The Philippines, Plaintiff-Appellee vs. Julian Sumicad, Defendant Appellant. G.R. No. L-35524, March 18, 1932 Street, J.: Factsces eresePas encore d'évaluation

- University of The Philippines College of Law Block F2022 Criminal LawDocument3 pagesUniversity of The Philippines College of Law Block F2022 Criminal Lawces eresePas encore d'évaluation

- Perpetua.: Cralaw Virtua1aw LibraryDocument9 pagesPerpetua.: Cralaw Virtua1aw Libraryces eresePas encore d'évaluation

- Bills in Set: 1. Issue of Negotiability 2. Issue of ValidityDocument3 pagesBills in Set: 1. Issue of Negotiability 2. Issue of Validityces eresePas encore d'évaluation

- Furnace Temperature & PCE ConesDocument3 pagesFurnace Temperature & PCE ConesAbdullrahman Alzahrani100% (1)

- List of HTML TagsDocument5 pagesList of HTML TagsdorinadidPas encore d'évaluation

- Taxation Law 1Document7 pagesTaxation Law 1jalefaye abapoPas encore d'évaluation

- Rab Sikda Optima 2016Document20 pagesRab Sikda Optima 2016Julius Chatry UniwalyPas encore d'évaluation

- PNGRB - Electrical Safety Audit ChecklistDocument4 pagesPNGRB - Electrical Safety Audit ChecklistKritarth SrivastavPas encore d'évaluation

- JBF Winter2010-CPFR IssueDocument52 pagesJBF Winter2010-CPFR IssueakashkrsnaPas encore d'évaluation

- What Is A Fired Heater in A RefineryDocument53 pagesWhat Is A Fired Heater in A RefineryCelestine OzokechiPas encore d'évaluation

- Jurnal Vol. IV No.1 JANUARI 2013 - SupanjiDocument11 pagesJurnal Vol. IV No.1 JANUARI 2013 - SupanjiIchsan SetiadiPas encore d'évaluation

- Effect of Plant Growth RegulatorsDocument17 pagesEffect of Plant Growth RegulatorsSharmilla AshokhanPas encore d'évaluation

- Zambia National FormularlyDocument188 pagesZambia National FormularlyAngetile Kasanga100% (1)

- SRS Document Battle Royale Origins - V2Document36 pagesSRS Document Battle Royale Origins - V2Talha SajjadPas encore d'évaluation

- Uts Cmo Module 5Document31 pagesUts Cmo Module 5Ceelinah EsparazPas encore d'évaluation

- 7 ElevenDocument80 pages7 ElevenakashPas encore d'évaluation

- Induction Motor Steady-State Model (Squirrel Cage) : MEP 1422 Electric DrivesDocument21 pagesInduction Motor Steady-State Model (Squirrel Cage) : MEP 1422 Electric DrivesSpoiala DragosPas encore d'évaluation

- Dept & Sem: Subject Name: Course Code: Unit: Prepared byDocument75 pagesDept & Sem: Subject Name: Course Code: Unit: Prepared by474 likithkumarreddy1Pas encore d'évaluation

- AAR Shell ProgrammingDocument13 pagesAAR Shell ProgrammingMarimuthu MuthaiyanPas encore d'évaluation

- Asu 2019-12Document49 pagesAsu 2019-12janinePas encore d'évaluation

- Modified Airdrop System Poster - CompressedDocument1 pageModified Airdrop System Poster - CompressedThiam HokPas encore d'évaluation

- Wins Salvacion Es 2021Document16 pagesWins Salvacion Es 2021MURILLO, FRANK JOMARI C.Pas encore d'évaluation

- ICU General Admission Orders: OthersDocument2 pagesICU General Admission Orders: OthersHANIMPas encore d'évaluation

- Risha Hannah I. NazarethDocument4 pagesRisha Hannah I. NazarethAlpaccino IslesPas encore d'évaluation

- A Process Reference Model For Claims Management in Construction Supply Chains The Contractors PerspectiveDocument20 pagesA Process Reference Model For Claims Management in Construction Supply Chains The Contractors Perspectivejadal khanPas encore d'évaluation

- Heirs of Vinluan Estate in Pangasinan Charged With Tax Evasion For Unsettled Inheritance Tax CaseDocument2 pagesHeirs of Vinluan Estate in Pangasinan Charged With Tax Evasion For Unsettled Inheritance Tax CaseAlvin Dela CruzPas encore d'évaluation

- Friday 25 Mar 12:15 AM Friday 25 Mar 5:30 AM: Emirates CGK DXBDocument3 pagesFriday 25 Mar 12:15 AM Friday 25 Mar 5:30 AM: Emirates CGK DXBDONI ARTAPas encore d'évaluation

- Weg CFW500 Enc PDFDocument32 pagesWeg CFW500 Enc PDFFabio Pedroso de Morais100% (1)

- June 2014 (v3) QP - Paper 3 CIE Physics IGCSEDocument20 pagesJune 2014 (v3) QP - Paper 3 CIE Physics IGCSECole KhantPas encore d'évaluation