Académique Documents

Professionnel Documents

Culture Documents

Furnishing of Report of An Accountant

Transféré par

Rohanpawer Pawar0 évaluation0% ont trouvé ce document utile (0 vote)

5 vues2 pagesFURNISHIING

Titre original

Furnishing of Report of an Accountant

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentFURNISHIING

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

5 vues2 pagesFurnishing of Report of An Accountant

Transféré par

Rohanpawer PawarFURNISHIING

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

2.

10 Furnishing of Report of an Accountant [Section I15JB(4) and Rule40B|

Every company to which this section applies, shall furnish a report in Form No. 29B from a

chartered accountant certifying that the book profit has been computed in accordance with the provisions

of this section along with the return of income filed under section 139(1) or along with the return of

income furnished in response to a notice under section 142(!)(/).

It may however, be noted that the company shall have to file such report even if it furnishes the

return of-income under section 139(4) instead’of section 139(1) or in response to a which notice section

142(!)(/).

2.11 Unabsorbed depreciation or losses which can be carried forward [Section I15JP(3)|

Although, the assessee is liable to pay tax @ 18.5% (plus surcharge if applicable) of the book

profits if its total income computed as per Income-tax Act is less but it is entitled to determine

unabsorbed depreciation u/s 32(2), business loss u/s 72(1), speculation loss u/s 73 and capital loss u/s 74

and loss u/s 74A and shall be allowed to carry forward such unabsorbed depreciation or losses to the

subsequent years(s) for claiming set off as per the normal provisions of Income-tax Act.

Illustration 2.2: The business income of the assessee before claiming depreciation, for the

financial year 2015-16 is 715,00,000. The book profit of the company as per provisions

of section II5JB is 78,00,000. The other details are as under:

(1) Current year depreciation 2,80,000

(2) Brought forward business loss 8,00,000

(3) Brought forward unabsorbed depreciation 5,20,000

Compute the tax payable by the company for the assessment year 2016-17.

Solution 7 7

Business income 15,00,000

Less: Current year depreciation 2,80,000

Brought forward business loss 8,00,000

Unabsorbed depreciation to the extent of balance business income 4,20,000

Total income 15,00,000

Book profit _____ N

Tax on 78,00,000 @ 18.5%

il

Add: Surcharge

Add: Education cess & SHEC - @ 3% 8.00,000

1,48,000

Nil

Unabsorbed depreciation to be carried forward 75,20,000 - 4.20.000 = 71,00.000 4,440

2.12 Are the provisions of section I I5.1B applicable to foreign companies 1,52,440

In the connection of old section 115J (the provisions of section 115JB are similar

in this case) the Authority for Advance Rulings held that such provisions are applicable

to foreign companies also and the foreign companies shall calculate its Indian profits

separately for the purpose of minimum alternate tax [P No. 14 of 1997 In re (1998) 234 ITR 828

(AAR)]. However, where a non-resident’s income is assessed on the basis of presumptive income uifder

sections 44B, 44BB, 44BBA, etc. or at a flat rate under section II5A on royalty and technical fee, the

book profit becomes immaterial for regular assessment and the presumptive income tax will prevail.

[Timken India Ltd., In re AAR 836 of 2009 (AAR)]

Vous aimerez peut-être aussi

- Front SheetDocument1 pageFront SheetRohanpawer PawarPas encore d'évaluation

- SL - No Date Name of The Agency Time SingDocument1 pageSL - No Date Name of The Agency Time SingRohanpawer PawarPas encore d'évaluation

- English PaperDocument8 pagesEnglish PaperRohanpawer PawarPas encore d'évaluation

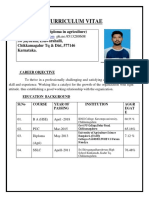

- Curriculum Vitae: DARSHAN E.J (Diploma in Agriculture)Document3 pagesCurriculum Vitae: DARSHAN E.J (Diploma in Agriculture)Rohanpawer PawarPas encore d'évaluation

- Exchange Board of India (Prohibition of Insider Trading) Regulations, 1992 ( SEBIDocument14 pagesExchange Board of India (Prohibition of Insider Trading) Regulations, 1992 ( SEBIRohanpawer PawarPas encore d'évaluation

- Resume: Avesha N D/o Nagaraj Kanagalasara Umblebylu Post Shivamogga TQ and Dist Pin 577115 Phone No: 6360901109Document2 pagesResume: Avesha N D/o Nagaraj Kanagalasara Umblebylu Post Shivamogga TQ and Dist Pin 577115 Phone No: 6360901109Rohanpawer PawarPas encore d'évaluation

- In Sid e R T Rad in G-An Alysin G T H e Ind Ian Persp Ect I Ve - Arjun Nihal SinghDocument14 pagesIn Sid e R T Rad in G-An Alysin G T H e Ind Ian Persp Ect I Ve - Arjun Nihal SinghRohanpawer PawarPas encore d'évaluation

- Experimental ResearchDocument6 pagesExperimental ResearchRohanpawer PawarPas encore d'évaluation

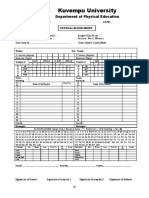

- Kuvempu University: Department of Physical EducationDocument2 pagesKuvempu University: Department of Physical EducationRohanpawer PawarPas encore d'évaluation

- Mass Wasting2Document45 pagesMass Wasting2Rohanpawer PawarPas encore d'évaluation

- Project 22Document3 pagesProject 22Rohanpawer PawarPas encore d'évaluation

- University Grants Commission Bahadur Shah Zafar Marg NEW DELHI - 110002 Final Project Report From 1/7/2012 To 31/12/2015Document2 pagesUniversity Grants Commission Bahadur Shah Zafar Marg NEW DELHI - 110002 Final Project Report From 1/7/2012 To 31/12/2015Rohanpawer PawarPas encore d'évaluation

- Tissues of The Body That Occurs As A Result of Sport or Exercise" - The International Classification ofDocument7 pagesTissues of The Body That Occurs As A Result of Sport or Exercise" - The International Classification ofRohanpawer PawarPas encore d'évaluation

- Provogue: Gama' Is A Study in Leadership and Resourcefulness in Your Interest LaysDocument2 pagesProvogue: Gama' Is A Study in Leadership and Resourcefulness in Your Interest LaysRohanpawer PawarPas encore d'évaluation

- Certificate 1111Document1 pageCertificate 1111Rohanpawer PawarPas encore d'évaluation

- Soniya H. S.: ObjectiveDocument2 pagesSoniya H. S.: ObjectiveRohanpawer PawarPas encore d'évaluation

- Unit - 2 Multimedia Building Blocks: Thontadari C., Dept. of B.C.A., S.M.R.F.G College 1Document1 pageUnit - 2 Multimedia Building Blocks: Thontadari C., Dept. of B.C.A., S.M.R.F.G College 1Rohanpawer PawarPas encore d'évaluation

- LerrtDocument1 pageLerrtRohanpawer PawarPas encore d'évaluation

- A Comparative Study of Co-Ordinate Abilities of Kabbadi and Kho-Kho Female Players at College LevelDocument4 pagesA Comparative Study of Co-Ordinate Abilities of Kabbadi and Kho-Kho Female Players at College LevelRohanpawer PawarPas encore d'évaluation

- Laboratory Certificate: Kuvempu UniversityDocument1 pageLaboratory Certificate: Kuvempu UniversityRohanpawer PawarPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Berkshire Hathaway Inc.: United States Securities and Exchange CommissionDocument48 pagesBerkshire Hathaway Inc.: United States Securities and Exchange CommissionTu Zhan LuoPas encore d'évaluation

- A Midsummer's Night Dream Script (FULL)Document74 pagesA Midsummer's Night Dream Script (FULL)prahuljosePas encore d'évaluation

- SLP Application For Withdrawal of Case From Supreme Court On SettlementDocument2 pagesSLP Application For Withdrawal of Case From Supreme Court On SettlementharryPas encore d'évaluation

- Environment Impact Assessment Notification, 1994Document26 pagesEnvironment Impact Assessment Notification, 1994Sarang BondePas encore d'évaluation

- Upsc 1 Year Study Plan 12Document3 pagesUpsc 1 Year Study Plan 12siboPas encore d'évaluation

- Sir Gawain and The Green Knight: A TranslationDocument39 pagesSir Gawain and The Green Knight: A TranslationJohn AshtonPas encore d'évaluation

- Art. 19 1993 P.CR - LJ 704Document10 pagesArt. 19 1993 P.CR - LJ 704Alisha khanPas encore d'évaluation

- Pip Assessment GuideDocument155 pagesPip Assessment Guideb0bsp4mPas encore d'évaluation

- The Importance of Connecting The First/Last Mile To Public TransporDocument14 pagesThe Importance of Connecting The First/Last Mile To Public TransporLouise Anthony AlparaquePas encore d'évaluation

- SCRIPT IRFANsDocument2 pagesSCRIPT IRFANsMUHAMMAD IRFAN BIN AZMAN MoePas encore d'évaluation

- Islam and PatriarchyDocument21 pagesIslam and PatriarchycarolinasclifosPas encore d'évaluation

- Sharmila Ghuge V StateDocument20 pagesSharmila Ghuge V StateBar & BenchPas encore d'évaluation

- 10 Types of Innovation (Updated)Document4 pages10 Types of Innovation (Updated)Nur AprinaPas encore d'évaluation

- Priyanshu Mts Answer KeyDocument34 pagesPriyanshu Mts Answer KeyAnima BalPas encore d'évaluation

- Assessment Task-2Document7 pagesAssessment Task-2Parash RijalPas encore d'évaluation

- Coding Decoding 1 - 5311366Document20 pagesCoding Decoding 1 - 5311366Sudarshan bhadanePas encore d'évaluation

- BiratchowkDocument2 pagesBiratchowkdarshanPas encore d'évaluation

- Foundations of Special and Inclusive Education: A Learning ModuleDocument12 pagesFoundations of Special and Inclusive Education: A Learning ModuleDensiel Jude OrtegaPas encore d'évaluation

- Gillette vs. EnergizerDocument5 pagesGillette vs. EnergizerAshish Singh RainuPas encore d'évaluation

- Chapter 11 Accounting PrinciplesDocument45 pagesChapter 11 Accounting PrinciplesElaine Dondoyano100% (1)

- Risk AssessmentDocument11 pagesRisk AssessmentRutha KidanePas encore d'évaluation

- Construction Companies in MauritiusDocument4 pagesConstruction Companies in MauritiusJowaheer Besh100% (1)

- Differences Between Old and New GenerationDocument7 pagesDifferences Between Old and New GenerationJopie ArandaPas encore d'évaluation

- GCTADocument5 pagesGCTAPatty CabañaPas encore d'évaluation

- Alembic LTD.,: International Standards Certifications (South Asia) Pvt. LTDDocument7 pagesAlembic LTD.,: International Standards Certifications (South Asia) Pvt. LTDJamil VoraPas encore d'évaluation

- Randy Rowles: HAI's 2021-22 Chairman Keeps Moving ForwardDocument76 pagesRandy Rowles: HAI's 2021-22 Chairman Keeps Moving Forwardnestorin111Pas encore d'évaluation

- 175 Mendoza V GomezDocument2 pages175 Mendoza V GomezAnonymous bOncqbp8yiPas encore d'évaluation

- Ciplaqcil Qcil ProfileDocument8 pagesCiplaqcil Qcil ProfileJohn R. MungePas encore d'évaluation

- Updated 2 Campo Santo de La LomaDocument64 pagesUpdated 2 Campo Santo de La LomaRania Mae BalmesPas encore d'évaluation

- Running Head: Problem Set # 2Document4 pagesRunning Head: Problem Set # 2aksPas encore d'évaluation