Académique Documents

Professionnel Documents

Culture Documents

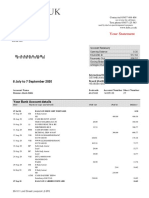

Everyday Current Account: Your Account Summary For

Transféré par

Ghassan MousaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Everyday Current Account: Your Account Summary For

Transféré par

Ghassan MousaDroits d'auteur :

Formats disponibles

09012856019482 BX0098

Everyday Current Account

Telephone Banking, enquiries or lost or

MR GHASSAN MOUSA ADAM EISSA stolen cards 0800 9 123 123, open 24

3 FITZWILLIAM STREET hours a day 7 days a week, person to

BELFAST person calls 7am to 11pm Monday to

Saturday

BT9 6AW

To help us maintain and improve our

customer service we may monitor or record

your calls.

%%SSC For the hard of hearing and/or speech

impaired, Text Relay service available 18001

0800 9 123 123

?

Online Banking service and information

available at www.santander.co.uk

Santander, 9 Nelson Street, Bradford, West

Yorkshire, BD1 5AN.

Online, Mobile and Telephone Banking

ID 3398120754 G EISSA

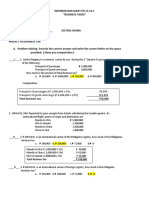

Your account summary for

6th Apr 2017 to 5th May 2017

Account name MR GHASSAN MOUSA ADAM EISSA

Account number: 56019482 Sort Code: 09 01 28 Statement number: 05/2017

BIC: ABBYGB2LXXX IBAN: GB17 ABBY 0901 2856 0194 82

Balance brought forward from 5th Apr Statement -£89.45

Total money in: £988.00

Total money out: -£388.87

News and information

Your balance at close of business 5th May 2017 £509.68 Statement changes

In March, we let you know that we are changing

Interest and charges incurred this period

how often we send paper statements. Please read

Date Why we're charging you Amount the enclosed leaflet for more information.

5th May UNARRANGED OVERDRAFT USAGE FEE -£95.00

If you need to complete a

Total this amount will be deducted from your account on 27th May -£95.00 self-assessment tax return

You have incurred charges. Contact us to talk about tools and information that could help Your Account Summary provides all the

you avoid charges and manage your account. We also have alternative products including information about the interest earned on your

our Choice Current Account which has no unarranged overdraft usage fees. To find out personal savings and current accounts in one

more visit santander.co.uk, call us or visit a branch. place. It’s available through Online Banking – just

Interest and refunds paid this period log in and click on ‘eDocuments’.

Date Why we are paying you Amount Protect yourself against scams

22nd Apr Interest on your credit balance £0.00 It’s essential that you make sure your banking

details stay private and secure. To find out

more visit santander.co.uk/uk/help-

support/security-centre

1. Never share a Santander One Time Passcode

(OTP) with another person, not even a

Santander employee.

2. Never download software onto your

computer following or during a cold call.

3. Never enter your online banking details after

clicking on a link in an email or SMS.

Your Current Account annual summary

Every year, we send you an annual summary of

fees, interest and charges for the previous 12

months. Going forward, you will receive this at

least once a year, usually with your May

statement. Included this month is your annual

summary covering the last 12 months.

BX0098010101_24042017 Continued on reverse....

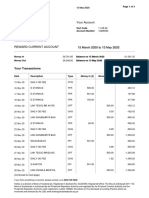

Page number: 1 of 3

Account name: MR GHASSAN MOUSA ADAM EISSA

Account number: 56019482 (Sort Code 09 01 28)

Statement number: 05/2017 Page number: 2 of 3

001578983000005350

Important Messages

Important information about compensation arrangements: We are covered by the Financial Services Compensation Scheme (“FSCS”).

The FSCS can pay compensation to depositors if a bank is unable to meet its financial obligations. The account(s) shown in this statement are

eligible for compensation under the scheme. Santander UK plc is an authorised deposit taker and accepts deposits under this name and the

cahoot and Santander Corporate & Commercial Bank trading names.

Further details can be found in the FSCS Information Sheet and Exclusions List, a copy of which is available in your local Santander branch.

For further information about the compensation provided by the FSCS, refer to the FSCS website at

www.FSCS.org.uk.

For Customers with an Overdraft. If you have a problem with your agreement, please try to resolve it with us in the first instance. If you are

not happy with the way in which we handled your complaint or the result, you may be able to complain to the Financial Ombudsman Service. If

you do not take up your problem with us first you will not be entitled to complain to the Ombudsman. We can provide details of how to

contact the Ombudsman.

Details of rates and charges can be found in your Interest Rates and Fees Information.

If you need another copy, please call into your local branch or visit www.santander.co.uk. Interest or fees will be calculated daily on any

outstanding overdrawn balance.

Santander UK plc. Registered Office: 2 Triton Square, Regent's Place, London, NW1 3AN, United Kingdom. Registered Number 2294747.

Registered in England and Wales. www.santander.co.uk. Telephone 0800 389 7000. Calls may be recorded or monitored. Authorised by the

Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Our Financial

Services Register number is 106054. Santander and the flame logo are registered trademarks.

Date Average balance for the month Amount

5th May Average credit balance £258.02

5th May Average debit balance £-53.67

Your transactions 6th Apr 2017 to 5th May 2017

Date Description Money in Money out £ Balance

6th Apr Balance brought forward from previous statement -89.45

24th Apr TRANSFER FROM MOUSA ADAM EISSA CIF: 1392029000. REF: 0015 7898 988.00 898.55

696 0014044

27th Apr UNARRANGED OVERDRAFT USAGE FEE 36.00 862.55

27th Apr PAID TRANSACTION CARD PAYMENT TO CENTRA STRANMILLIS,5.34 GBP, RATE 1.00/GBP 10.00 852.55

ON 27-03-2017

27th Apr PAID TRANSACTION CARD PAYMENT TO WWW.JUST EAT.CO.UK,15.48 GBP, RATE 10.00 842.55

1.00/GBP ON 26-03-2017

27th Apr PAID TRANSACTION DIRECT DEBIT PAYMENT TO QUB TUITION FEES REF 216140131410, 10.00 832.55

MANDATE NO 0008

27th Apr PAID TRANSACTION CARD PAYMENT TO SUBWAY,4.90 GBP, RATE 1.00/GBP ON 10.00 822.55

29-03-2017

27th Apr UNPAID STANDING ORDER 10.00 812.55

28th Apr CARD PAYMENT TO AERLING 2DKX8W EISSA,265.99 GBP, RATE 1.00/GBP ON 25-04-2017 265.99 546.56

1st May CARD PAYMENT TO ONAIR INTERNET SERVICE,5.00 USD, RATE 0.77/GBP ON 27-04-2017 3.99 542.57

NON-STERLING TRANSACTION FEE 0,11/GBP

1st May NON-STERLING PURCHASE FEE 1.25 541.32

2nd May CASH WITHDRAWAL AT ULSTER BANK ATM BEL UNIVERSITY, BELFAST,20.00 GBP , ON 20.00 521.32

01-05-2017

2nd May CARD PAYMENT TO ONAIR INTERNET SERVICE,5.00 USD, RATE 0.77/GBP ON 27-04-2017 3.99 517.33

NON-STERLING TRANSACTION FEE 0,11/GBP

2nd May NON-STERLING PURCHASE FEE 1.25 516.08

4th May CARD PAYMENT TO SUBWAY,6.40 GBP, RATE 1.00/GBP ON 02-05-2017 6.40 509.68

5th May Balance carried forward to next statement: 509.68

Account name: MR GHASSAN MOUSA ADAM EISSA

Account number: 56019482 (Sort Code 09 01 28)

Statement number: 05/2017 Page number: 3 of 3

001578983000005350

Annual Summary of Interest and Fees

5th Apr 2016 to 4th Apr 2017

Type of interest and fees Credit Number of Amount of

interest charges charges

Interest you have earned £0.00

Cash back you have earned £0.00

Arranged Overdraft Interest 0 £0.00

Unarranged Overdraft Interest 0 £0.00

Paid Transaction Fees 1 £10.00

Unpaid Transaction Fees 0 £0.00

Unarranged Overdraft Usage Fees (monthly) 0 £0.00

Arranged Overdraft Usage Fee (daily)* 0 £0.00

Unarranged Overdraft Usage Fee (daily)* 2 £170.00

Account Fees 0 £0.00

Underfunding Fees 0 £0.00

Overall Total £0.00 3 £180.00

*Total amount of charges is calculated daily and charged once a month. As a result, the total number of charges reflects the number of

months an Arranged or Unarranged Overdraft Usage Fee has been charged.

Your account is an Everyday Current Account, no credit interest is paid on this account.

Fees apply when you use your debit card abroad. These fees are not included in the above annual summary but are as follows:

You will be charged a Non-Sterling transaction fee (of 2.75% of the value) plus a Non-Sterling Purchase Fee (£1.25 per transaction) for making

a purchase.

You will be charged a Non-Sterling transaction fee (of 2.75% of the value) plus a Non-Sterling cash fee of 1.5% of the value (at least £1.99)

for withdrawing money or purchasing travellers cheques.

Non-Sterling transactions are converted to sterling by Visa using the Visa Exchange rate. Visa Exchange rates can be found at

www.visaeurope.com

AER stands for Annual Equivalent Rate and shows what the interest rate would be if we paid interest and added it to your account each year.

The gross rate is the interest rate that we pay where no income tax has been deducted. The net rate is the interest rate we pay after deduction

of income tax at the rate specified by law. Interest payments made on or before 5 April 2016 will be paid net of income tax, unless you've

registered to receive interest gross. Interest payments made on or after 6 April 2016 will be paid using the gross rate. This means all the

interest we pay you will be without tax deducted. If the total amount of interest you receive exceeds any personal savings allowance to which

you’re entitled, you may have to pay tax at the applicable rate. This would need to be paid directly to HMRC. For more information, please visit

gov.uk/hmrc/savingsallowance. We work out interest daily and pay it monthly.

Please note that the level of interest rates and fees may have changed throughout the period of your annual summary. For details of our

previous interest rates and fees (including any non-standard account service fees) please visit www.santander.com or visit your local branch.

For details of our latest rates and fees please see reverse.

Any non-standard account services fees you may have incurred during the year are not included in this summary but can be

found on your monthly statement.

For overdrafts, we will give you at least two months’ personal notice if:

(i) we increase an overdraft fee or introduce a new overdraft fee.

(ii) we increase the interest rate we charge on overdrafts and the interest rate does not track a specified external independent rate.

We do not need to notify you if any overdraft fee or interest rate is reduced.

Vous aimerez peut-être aussi

- SANTANDER STATEMENtDocument1 pageSANTANDER STATEMENtАнечка Бужинская100% (1)

- Kangqi PDFDocument4 pagesKangqi PDFle lanPas encore d'évaluation

- SantanderDocument2 pagesSantanderDORIS TRAVISPas encore d'évaluation

- SCC COMUNICADOS PI Batch0100151115e8f50a18381100Document4 pagesSCC COMUNICADOS PI Batch0100151115e8f50a18381100salaPas encore d'évaluation

- 3rd Jan - 2nd FebDocument4 pages3rd Jan - 2nd FebPrajakta JoshiPas encore d'évaluation

- Santander 1-2-3 Lite WoolheadDocument2 pagesSantander 1-2-3 Lite WoolheadJohnPas encore d'évaluation

- 2019 April StatementDocument2 pages2019 April Statementkumar samyappanPas encore d'évaluation

- NationwideDocument1 pageNationwideЮлия ПPas encore d'évaluation

- Statement 28nov2014Document3 pagesStatement 28nov2014Daisy-May ParsonsPas encore d'évaluation

- Halifax Print Friendly Statement PDFDocument1 pageHalifax Print Friendly Statement PDFcelina celundPas encore d'évaluation

- Statement Date 13 Feb 2018Document4 pagesStatement Date 13 Feb 2018tom arthur0% (1)

- Your Everyday Saver StatementDocument2 pagesYour Everyday Saver StatementDoris Zhao100% (3)

- Clydesdale Bank Nov20 Lukasik UkDocument1 pageClydesdale Bank Nov20 Lukasik Ukjulien feuillet100% (1)

- Preview PDFDocument5 pagesPreview PDFGabriel TalosPas encore d'évaluation

- Your Statement: Mr. Dominic Abeita Dabb 77 Ballogie Avenue London NW10 1SUDocument3 pagesYour Statement: Mr. Dominic Abeita Dabb 77 Ballogie Avenue London NW10 1SUmeu pau100% (1)

- 2019 January StatementDocument3 pages2019 January StatementDeclan Robertson33% (3)

- Statement: Branch Details Your Current Details Period 10 May 2019 To 10 June 2019Document2 pagesStatement: Branch Details Your Current Details Period 10 May 2019 To 10 June 2019Ali RAZAPas encore d'évaluation

- Statement 31-JUL-20 AC 33211541Document6 pagesStatement 31-JUL-20 AC 33211541meu pau67% (3)

- Halifax - Print Friendly Statement PDFDocument2 pagesHalifax - Print Friendly Statement PDFAnonymous 2FybjkA50% (1)

- Your Barclays Bank Account StatementDocument4 pagesYour Barclays Bank Account StatementAli RAZA100% (1)

- Utility Bil Mihails KoturovsDocument4 pagesUtility Bil Mihails KoturovsKris TheVillainPas encore d'évaluation

- 2014 December Statement PDFDocument1 page2014 December Statement PDFMishaal ShaukatPas encore d'évaluation

- Nationwide Bank StatementDocument5 pagesNationwide Bank StatementZheng YangPas encore d'évaluation

- Statement 20150506Document6 pagesStatement 20150506saeed shamiPas encore d'évaluation

- Your Basic Banking Plan Account Summary: Here's What Happened in Your Account This Statement PeriodDocument5 pagesYour Basic Banking Plan Account Summary: Here's What Happened in Your Account This Statement PeriodLao TruongPas encore d'évaluation

- Barclays Bank Credit Card PDFDocument3 pagesBarclays Bank Credit Card PDFMax Tan100% (1)

- UK Natwest Statement - 2 - 3Document2 pagesUK Natwest Statement - 2 - 3shahid2opu33% (3)

- Halifax StatementDocument4 pagesHalifax StatementЮлия П100% (1)

- Halifax - Print Friendly Statement PDFDocument1 pageHalifax - Print Friendly Statement PDFAnonymous Pa3LMMgPas encore d'évaluation

- Statement Standarter 1231Document1 pageStatement Standarter 1231SW ProjectPas encore d'évaluation

- Statements PDFDocument6 pagesStatements PDFEdi ȘtefanPas encore d'évaluation

- Statement Standarter 1523Document1 pageStatement Standarter 1523SW Project100% (1)

- Nat WestDocument1 pageNat WestЮлия П0% (1)

- Bank of Ireland 1 PDFDocument2 pagesBank of Ireland 1 PDFpaulius50% (2)

- Business Account Statement: MR John Doe 20 Sherwood ST, London W1F 7edDocument5 pagesBusiness Account Statement: MR John Doe 20 Sherwood ST, London W1F 7edOmar BouayadPas encore d'évaluation

- Your Business Current Account: at A GlanceDocument5 pagesYour Business Current Account: at A GlanceAhsan ShabirPas encore d'évaluation

- Statement: Branch Details Your Current Details PeriodDocument2 pagesStatement: Branch Details Your Current Details Periodxxalias100% (2)

- AddressDocument2 pagesAddressDom LimbagaPas encore d'évaluation

- PDFDocument2 pagesPDFAnonymous 5M2AZYHZg4Pas encore d'évaluation

- Statement 31-MAR-20 AC 33211541Document7 pagesStatement 31-MAR-20 AC 33211541meu pau100% (1)

- Statement 20150506Document6 pagesStatement 20150506Anastasia Sandu100% (2)

- Your Annual Summary - 08092016 PDFDocument2 pagesYour Annual Summary - 08092016 PDFAnonymous r9H4ebc100% (1)

- Current Account 19 January 2021 To 18 February 2021Document4 pagesCurrent Account 19 January 2021 To 18 February 2021Ghulam GhousPas encore d'évaluation

- Statment PDFDocument1 pageStatment PDFAnonymous oPpOqo100% (1)

- Statement 2019 10Document1 pageStatement 2019 10Eve PawleyPas encore d'évaluation

- Statement: Select AccountDocument5 pagesStatement: Select AccountPamela Dickinson0% (1)

- Statement 2018 09 20 130948278 PDFDocument2 pagesStatement 2018 09 20 130948278 PDFEmanuale0% (1)

- 01/01/2021 - 27/01/2021 Statement: Contact Tel +44 (0) 207 930 4450Document1 page01/01/2021 - 27/01/2021 Statement: Contact Tel +44 (0) 207 930 4450RanaPas encore d'évaluation

- Bitwala Bank StatamentDocument1 pageBitwala Bank StatamentPritom NasirPas encore d'évaluation

- Alex Roman XfiDocument1 pageAlex Roman XfiyanizlePas encore d'évaluation

- Captura de Pantalla 2019-11-13 A La(s) 4.58.49 P. M PDFDocument1 pageCaptura de Pantalla 2019-11-13 A La(s) 4.58.49 P. M PDFmaritza hernadezPas encore d'évaluation

- Lyndsie Barnes BankDocument4 pagesLyndsie Barnes BankJaram JohnsonPas encore d'évaluation

- Business Bank Statement Lloyds BankDocument2 pagesBusiness Bank Statement Lloyds Bankben tenPas encore d'évaluation

- Aprilie 2020Document6 pagesAprilie 2020Ciprian BujanPas encore d'évaluation

- Current Account Statement 28042023Document4 pagesCurrent Account Statement 28042023rwhvz5mqwmPas encore d'évaluation

- CurrentAccountStatement 07102023Document4 pagesCurrentAccountStatement 07102023caraleighjanePas encore d'évaluation

- CurrentAccountStatement 07112023Document4 pagesCurrentAccountStatement 07112023caraleighjanePas encore d'évaluation

- Currentaccountstatement 18102023-S33iujDocument4 pagesCurrentaccountstatement 18102023-S33iujjuliaechardhqa85Pas encore d'évaluation

- CurreDocument2 pagesCurrewpoulePas encore d'évaluation

- SCC Comunicados Pi Batch01001511179c5be3ce710500Document2 pagesSCC Comunicados Pi Batch01001511179c5be3ce710500Sagal HusseinPas encore d'évaluation

- Constraints2 (1) 1148Document9 pagesConstraints2 (1) 1148Ghassan MousaPas encore d'évaluation

- Design Methodology of Steering System For All-Terrain VehiclesDocument7 pagesDesign Methodology of Steering System For All-Terrain VehiclesAnonymous kw8Yrp0R5rPas encore d'évaluation

- Bonding Essay: IFP Engineering and Science January IntakeDocument6 pagesBonding Essay: IFP Engineering and Science January IntakeGhassan MousaPas encore d'évaluation

- Reading Journal 1: Student: Ghassan Mousa Adam Eissa Teacher: Monika Szelag IFP ES Group 1Document6 pagesReading Journal 1: Student: Ghassan Mousa Adam Eissa Teacher: Monika Szelag IFP ES Group 1Ghassan MousaPas encore d'évaluation

- Faa RegulationsDocument3 pagesFaa RegulationsGhassan MousaPas encore d'évaluation

- Reading Journal 1: Student: Ghassan Mousa Adam Eissa Teacher: Monika Szelag IFP ES Group 1Document6 pagesReading Journal 1: Student: Ghassan Mousa Adam Eissa Teacher: Monika Szelag IFP ES Group 1Ghassan MousaPas encore d'évaluation

- Thermal and Flammability Properties of Polypropylene-Carbon Nanotubes Nano CompositesDocument13 pagesThermal and Flammability Properties of Polypropylene-Carbon Nanotubes Nano CompositesrenebarreiroPas encore d'évaluation

- The Wonderful World - Of-: Carbon NanotubesDocument31 pagesThe Wonderful World - Of-: Carbon NanotubesGhassan MousaPas encore d'évaluation

- Steering CalculationsDocument3 pagesSteering CalculationsGhassan MousaPas encore d'évaluation

- Electrical and Thermal Properties of Poly (P-Phenylene Sulfide) Reduced Graphite Oxide NanocompositesDocument5 pagesElectrical and Thermal Properties of Poly (P-Phenylene Sulfide) Reduced Graphite Oxide NanocompositesGhassan MousaPas encore d'évaluation

- Research Article: Ultra Wideband Planar Microstrip Array Antennas For C-Band Aircraft Weather Radar ApplicationsDocument9 pagesResearch Article: Ultra Wideband Planar Microstrip Array Antennas For C-Band Aircraft Weather Radar ApplicationsGhassan MousaPas encore d'évaluation

- HGTSB6 2012 v13n4 221Document5 pagesHGTSB6 2012 v13n4 221Ghassan MousaPas encore d'évaluation

- Design and Stress Analysis of A General Aviation ADocument8 pagesDesign and Stress Analysis of A General Aviation AGhassan MousaPas encore d'évaluation

- Literature ReviewDocument8 pagesLiterature ReviewGhassan MousaPas encore d'évaluation

- Boundary Layer ProjectDocument6 pagesBoundary Layer ProjectGhassan MousaPas encore d'évaluation

- Gu Et Al-2014-Polymer CompositesDocument6 pagesGu Et Al-2014-Polymer CompositesGhassan MousaPas encore d'évaluation

- Thermoplastic Nanocomposites With Carbon NanotubesDocument43 pagesThermoplastic Nanocomposites With Carbon NanotubesGhassan MousaPas encore d'évaluation

- Nanomaterials 04 00844Document12 pagesNanomaterials 04 00844Ghassan MousaPas encore d'évaluation

- Utilization of Excel in Solving Structural Analysis ProblemsDocument13 pagesUtilization of Excel in Solving Structural Analysis ProblemsGnkds100% (1)

- GRPD - Aircraft Structures ReportDocument27 pagesGRPD - Aircraft Structures ReportGhassan MousaPas encore d'évaluation

- Project Proposal FormDocument3 pagesProject Proposal FormGhassan MousaPas encore d'évaluation

- Materials 03 01593Document27 pagesMaterials 03 01593Ghassan MousaPas encore d'évaluation

- Management Assignment: Stage 3 Professional StudiesDocument4 pagesManagement Assignment: Stage 3 Professional StudiesGhassan MousaPas encore d'évaluation

- Task 6 - OptimizationDocument1 pageTask 6 - OptimizationGhassan MousaPas encore d'évaluation

- Management Case Study: MEE3002-Professional Studies 3Document4 pagesManagement Case Study: MEE3002-Professional Studies 3Ghassan MousaPas encore d'évaluation

- Boundary Layer ProjectDocument6 pagesBoundary Layer ProjectGhassan MousaPas encore d'évaluation

- 1556 276X 6 334Document15 pages1556 276X 6 334Ghassan MousaPas encore d'évaluation

- Injection-Molded Hybrid Polymer Composites With Improved Thermal IsotropyDocument3 pagesInjection-Molded Hybrid Polymer Composites With Improved Thermal IsotropyGhassan MousaPas encore d'évaluation

- 1556 276X 6 334Document15 pages1556 276X 6 334Ghassan MousaPas encore d'évaluation

- Numis PresentationDocument20 pagesNumis PresentationthenumiscoinPas encore d'évaluation

- ENVYSION Commodity Strategy Fund PresentationDocument17 pagesENVYSION Commodity Strategy Fund PresentationNicky TsaiPas encore d'évaluation

- 2 Bac - Sustainable Development CollocationsDocument2 pages2 Bac - Sustainable Development CollocationsmimiPas encore d'évaluation

- Career Guidance and Employment CoachingDocument19 pagesCareer Guidance and Employment Coachingmark gatusPas encore d'évaluation

- 4 - Hierarchy of Effects ModelDocument13 pages4 - Hierarchy of Effects ModelRobertRaisbeckPas encore d'évaluation

- The Compact For Responsive and Responsible Leadership: A Roadmap For Sustainable Long-Term Growth and OpportunityDocument1 pageThe Compact For Responsive and Responsible Leadership: A Roadmap For Sustainable Long-Term Growth and OpportunityMiguel AugustoPas encore d'évaluation

- Sub: Purchase Order For Supply of 50 MT Dalmia OPC-43 CementDocument1 pageSub: Purchase Order For Supply of 50 MT Dalmia OPC-43 CementVimal SinghPas encore d'évaluation

- 001 FundamentalsDocument30 pages001 FundamentalsTutuch NidonatoPas encore d'évaluation

- Revenue Cycle Self-TestDocument10 pagesRevenue Cycle Self-TestPeachyPas encore d'évaluation

- 6 Operations ImprovementDocument30 pages6 Operations ImprovementAnushaBalasubramanya100% (1)

- OLIP Immigration StrategyDocument124 pagesOLIP Immigration StrategyAmfiePas encore d'évaluation

- Request For EOI - Corporate Re-BrandingDocument1 pageRequest For EOI - Corporate Re-BrandingteetoszPas encore d'évaluation

- CH 1 EntrepreneurshipDocument19 pagesCH 1 EntrepreneurshipGursahib Singh JauraPas encore d'évaluation

- Challenges and Pathways For Brazilian Mining Sustainability - 2021Document12 pagesChallenges and Pathways For Brazilian Mining Sustainability - 2021MariaLuciaMendiolaMonsantePas encore d'évaluation

- A Beginner's Guide To Altcoin Day TradingDocument16 pagesA Beginner's Guide To Altcoin Day Tradingblowinzips67% (6)

- PDF DocumentDocument2 pagesPDF DocumentNavya RaiPas encore d'évaluation

- Green Architecture ResearchDocument4 pagesGreen Architecture ResearchJeffered TadeoPas encore d'évaluation

- AMFI Question & AnswerDocument67 pagesAMFI Question & AnswerVirag67% (3)

- TEST 2 (Chapter 16& 17) Spring 2013: Intermediate Accounting (Acct3152)Document5 pagesTEST 2 (Chapter 16& 17) Spring 2013: Intermediate Accounting (Acct3152)Mike HerreraPas encore d'évaluation

- Death of Big LawDocument55 pagesDeath of Big Lawmaxxwe11Pas encore d'évaluation

- Enron ReflectionDocument2 pagesEnron ReflectionRanie MonteclaroPas encore d'évaluation

- Discuss The Nexus Between Corporate Governance and Prevention of Corporate FraudDocument14 pagesDiscuss The Nexus Between Corporate Governance and Prevention of Corporate FraudLindiwe Makoni100% (4)

- Project in Business TaxDocument5 pagesProject in Business TaxJemalyn PiliPas encore d'évaluation

- The Political Economy of Gross Domestic Product Accounting and The Philippine Case BulatlatDocument14 pagesThe Political Economy of Gross Domestic Product Accounting and The Philippine Case BulatlatStephen VillantePas encore d'évaluation

- Fishing Industry PPT FULL NEWDocument50 pagesFishing Industry PPT FULL NEWZainab KabeerPas encore d'évaluation

- Quality Cost SummaryDocument2 pagesQuality Cost SummaryirfanPas encore d'évaluation

- 28 Recruitment & Selection - Laxmi HyundaiDocument71 pages28 Recruitment & Selection - Laxmi HyundaiRakesh Kolasani Naidu100% (1)

- Calcutta High Court - Penny Stock OrderDocument150 pagesCalcutta High Court - Penny Stock OrderpksPas encore d'évaluation

- Fringe BenefitsDocument5 pagesFringe Benefitspawan bathamPas encore d'évaluation

- RI 01-External Provider Evaluation FormDocument2 pagesRI 01-External Provider Evaluation FormISO CERTIFICATIONPas encore d'évaluation