Académique Documents

Professionnel Documents

Culture Documents

MyPay PDF

Transféré par

Paul BeznerTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

MyPay PDF

Transféré par

Paul BeznerDroits d'auteur :

Formats disponibles

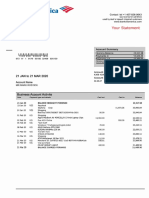

MyPay 1/23/18, 12(50 PM

myPay

Printer Friendly Version View other LESs 1711 Go

DEFENSE FINANCE AND ACCOUNTING SERVICE MILITARY LEAVE AND EARNINGS STATEMENT

NAME (Last, First, MI) SOC. SEC. NO. GRADE PAY DATE YRS SVC ETS BRANCH ADSN/DSSN PERIOD COVERED

ID BEZNER PAUL LEE *****8680 E3 160802 01 220801 AF 4069 1-31 DEC 17

ENTITLEMENTS DEDUCTIONS ALLOTMENTS SUMMARY

Type Amount Type Amount Type Amount +Amt Fwd .00

A BASE PAY 1885.80 FEDERAL TAXES 215.22 +Tot Ent 2261.84

B BAS 368.29 FICA-SOC SECURITY 116.92 -Tot Ded 1535.82

C BAH 7.80 FICA-MEDICARE 27.34 -Tot Allt .00

D REFUND MEDICARE -.05 SGLI 29.00 =Net Amt 726.02

E STATE TAXES 85.85 -Cr Fwd .00

F AFRH .50

=EOM Pay 726.02

G MEAL DEDUCTION 323.95

H MID-MONTH-PAY 737.04

I

J

K

L

M

N

DIEMS RETPLAN

O

160623 CHOICE

TOTAL 2261.84 1535.82 .00

LEAVE BF Bal Ernd Used Cr Bal ETS Bal Lv Lost Lv Paid Use/Lose FED Wage Period Wage YTD M/S Ex Add'l Tax Tax YTD

11.0 7.5 4 14.5 152.5 .0 .0 .0 TAXES 1885.80 21829.60 S 00 .00 2462.64

FICA Wage Period Soc Wage YTD Soc Tax YTD Med Wage YTD Med Tax YTD STATE St Wage Period Wage YTD M/S Ex Tax YTD

TAXES 1885.80 21829.60 1353.44 21829.60 316.53 TAXES GA 1885.80 21829.60 S 00 982.20

PAY BAQ Type BAQ Depn VHA Zip Rent Amt Share Stat JFTR Depns 2D JFTR BAS Type Charity YTD TPC PACIDN

DATA PARTIAL 00000 .00 0 0 .00

TRADITIONAL Base Pay Rate Base Pay Current Spec Pay Rate Spec Pay Current Inc Pay Rate Inc Pay Current Bonus Pay Rate Bonus Pay Current

PLAN (TSP) 0 .00 0 .00 0 .00 0 .00

Base Pay Rate Base Pay Current Spec Pay Rate Spec Pay Current Inc Pay Rate Inc Pay Current Bonus Pay Rate Bonus Pay Current

ROTH PLAN

0 .00 0 .00 0 .00 0 .00

CM AGCY AGCY-AUTO AGCY-MATCH

CONTR .00 .00

CONTRIBUTIONS YTD Deductions YTD TSP Deferred YTD TSP Exempt YTD ROTH YTD TSP AGCY-AUTO YTD TSP AGCY-MATCH

TOTALS .00 .00 .00 .00 .00 .00

REMARKS: YTD ENTITLE 27265.35 YTD DEDUCT 9926.26

IF TSP ELECTION AMT EXCEEDS NET AMT & W2 FASTER AND MORE SECURELY BY LOGGING ONTO

DUE, TSP WILL NOT BE DEDUCTED. MYPAY AT HTTPS://MYPAY.DFAS.MIL AND SELECTING

-THE BLENDED RETIREMENT SYSTEM OPT-IN COURSE THE TURN ON/OFF HARD COPY 1095 & W2 OPTION TO

(2 HRS; COURSE #J3OP-US1332) IS NOW AVAILABLE ELECT ELECTRONIC ONLY.

VIA JKO AT HTTPS://JKODIRECT.JTEN.MIL/ THE -PLEASE SUPPORT THE COMBINED FEDERAL

COURSE IS DESIGNED TO PROVIDE ELIGIBLE CAMPAIGN. MAKE PLEDGES ELECTRONICALLY AT

SERVICE MEMBERS INFORMATION FOR MAKING A HTTPS://CFCGIVING.OPM.GOV. THE CAMPAIGN IS

DECISION ABOUT WHICH DOD RETIREMENT SYSTEM GOING ON NOW THROUGH 12 JAN 2018.

BEST MEETS THEIR NEEDS. THIS IS MANDATORY FOR MEMBER'S SGLI COVERAGE AMOUNT IS $400,000

ALL OPT-IN ELIGIBLE SERVICE MEMBERS AND MUST CORRECT FICA WAGES/DEDTN YTD (349)

BE COMPLETED BY 31 DEC 17. CORRECT MEDICARE WAGES/DEDTN YTD (349)

-GET READY FOR TAX SEASON NOW. GET YOUR 1095 BANK NAVY FEDERAL CREDIT UNION

WWW.DFAS.MIL

DFAS Form 702, Jan 02

https://mypay.dfas.mil/LES_DJMSA.Aspx?AccessString=DJMSFA%7eBR…lesgroup=1&lesgroupitem=1&gcCurPySy=DJMSFA&dttm=01232018125011 Page 1 of 1

Vous aimerez peut-être aussi

- Defense Finance and Accounting Service Military Leave and Earnings Statement IDDocument1 pageDefense Finance and Accounting Service Military Leave and Earnings Statement IDAmaryPas encore d'évaluation

- MyfileDocument1 pageMyfileanon-302065Pas encore d'évaluation

- My Pay PDFDocument1 pageMy Pay PDFbuckwheat122507Pas encore d'évaluation

- Les DJMS 31 PDFDocument1 pageLes DJMS 31 PDFBennie ReidPas encore d'évaluation

- JF PaycheckDocument1 pageJF Paycheckapi-285511542Pas encore d'évaluation

- USBank2 PDFDocument3 pagesUSBank2 PDFempower93 empower93Pas encore d'évaluation

- Loan Rein Ex InfoDocument5 pagesLoan Rein Ex InfoGomezLiliPas encore d'évaluation

- December StatementDocument3 pagesDecember StatementNoriely Altagracia Paulino RivasPas encore d'évaluation

- Get Payslip by OffsetDocument1 pageGet Payslip by OffsetDarryl WhiteheadPas encore d'évaluation

- Resume of Msnetty42Document2 pagesResume of Msnetty42api-25122959Pas encore d'évaluation

- METABANKDocument1 pageMETABANKdae ChoPas encore d'évaluation

- Frazier0224 PDFDocument1 pageFrazier0224 PDFshani ChahalPas encore d'évaluation

- Screenshot 2020-03-13 at 4.33.54 PMDocument6 pagesScreenshot 2020-03-13 at 4.33.54 PMJordan Leigh AuriemmaPas encore d'évaluation

- STMT CASH 001 CACU014499 Oct2021-1Document5 pagesSTMT CASH 001 CACU014499 Oct2021-1Shaya NielsenPas encore d'évaluation

- 04 17 2022 Paystub - 1Document1 page04 17 2022 Paystub - 1Destiny SmithPas encore d'évaluation

- Profit or Loss From Business: Edwin Der 353-46-3457 PhotographerDocument2 pagesProfit or Loss From Business: Edwin Der 353-46-3457 PhotographerJames100% (1)

- W 2Document6 pagesW 2prads1259Pas encore d'évaluation

- PaystubDocument1 pagePaystubDorothy ShellPas encore d'évaluation

- October, 2023Document3 pagesOctober, 2023Nestor MartinezPas encore d'évaluation

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-NegotiableSrilatha YagniPas encore d'évaluation

- ListDocument2 pagesListRichrad SmithPas encore d'évaluation

- Non-Negotiable: Nvidia CorporationDocument1 pageNon-Negotiable: Nvidia CorporationSteven LinPas encore d'évaluation

- Statement BOA 21.01.2020-21.03.2020Document1 pageStatement BOA 21.01.2020-21.03.2020Viktoria DenisenkoPas encore d'évaluation

- PayStatement D0655147Document1 pagePayStatement D0655147Anonymous O61KvPgPas encore d'évaluation

- Pay Stub 6.1to6.30Document1 pagePay Stub 6.1to6.30Lorin WagnerPas encore d'évaluation

- Iesha Indi July Statement 2021Document1 pageIesha Indi July Statement 2021Sharon JonesPas encore d'évaluation

- StatementDocument4 pagesStatementjoan manuel100% (1)

- Master Promissory Note (MPN) Direct Subsidized Loans and Direct Unsubsidized Loans William D. Ford Federal Direct Loan ProgramDocument15 pagesMaster Promissory Note (MPN) Direct Subsidized Loans and Direct Unsubsidized Loans William D. Ford Federal Direct Loan Programodontologia unibePas encore d'évaluation

- Estmt - 2023 03 21Document6 pagesEstmt - 2023 03 21phillip davisPas encore d'évaluation

- Estmt - 2019 07 22 3Document8 pagesEstmt - 2019 07 22 3blackson knightson0% (1)

- Carissa Baker: Employee Info Tax DataDocument2 pagesCarissa Baker: Employee Info Tax Datawhat is thisPas encore d'évaluation

- Va Invoice To Be Paid TomorrowDocument2 pagesVa Invoice To Be Paid TomorrowmikePas encore d'évaluation

- Cook 4Document1 pageCook 4Renee MillerPas encore d'évaluation

- Pro Forma: 04/29/2020 42222 Rancho Las Palmas DR., #2141, Rancho Mirage, CA 92270Document1 pagePro Forma: 04/29/2020 42222 Rancho Las Palmas DR., #2141, Rancho Mirage, CA 92270maxwell onyekachukwuPas encore d'évaluation

- Elite Audit 4Document1 pageElite Audit 4arinzeshedrack30Pas encore d'évaluation

- Estmt - 2018 10 15Document8 pagesEstmt - 2018 10 15Luis RodriguezPas encore d'évaluation

- Vba 21 4192 AreDocument2 pagesVba 21 4192 AreGene GloverPas encore d'évaluation

- Cost SheetDocument15 pagesCost SheetSandeep SinghPas encore d'évaluation

- Profit or Loss From Business: Schedule C (Form 1040) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040) 09John Bean100% (1)

- f1040 - Schedule - C - 2019-00-00-ED SNIDER YOUTH HOCKEY FOUNDATIONDocument2 pagesf1040 - Schedule - C - 2019-00-00-ED SNIDER YOUTH HOCKEY FOUNDATIONKeller Brown Jnr50% (2)

- TD Ameritrade TRADEKEEPER PROFIT-LOSS FOR 2004 TRADES and 2017 FULTON STOCK January 9, 2017Document18 pagesTD Ameritrade TRADEKEEPER PROFIT-LOSS FOR 2004 TRADES and 2017 FULTON STOCK January 9, 2017Stan J. CaterbonePas encore d'évaluation

- CONNIE STAUFFER Chime Bank StatementDocument3 pagesCONNIE STAUFFER Chime Bank StatementFrank MaldonadoPas encore d'évaluation

- USAA HackingDocument6 pagesUSAA Hackingayina100% (1)

- SSPUSADVDocument1 pageSSPUSADVJamesPas encore d'évaluation

- Invoice INV-8100Document2 pagesInvoice INV-8100Mubashir AsifPas encore d'évaluation

- January 09, 2018Document6 pagesJanuary 09, 2018Monina JonesPas encore d'évaluation

- Pyw219s Ee PDFDocument1 pagePyw219s Ee PDFBeyoncePas encore d'évaluation

- Ka/Lfh: Lee A Vinal Inc 401 Aiken Ave DRACUT, MA 01826Document4 pagesKa/Lfh: Lee A Vinal Inc 401 Aiken Ave DRACUT, MA 01826Jonathan Seagull LivingstonPas encore d'évaluation

- M. Giraldo PDFDocument3 pagesM. Giraldo PDFMayken GiraldoPas encore d'évaluation

- Copart Wire IntructionsDocument1 pageCopart Wire IntructionsGeorge PlishkoPas encore d'évaluation

- You Got 'Em. Let The Anticipation Begin.: Wicked (NY)Document2 pagesYou Got 'Em. Let The Anticipation Begin.: Wicked (NY)xxPas encore d'évaluation

- Receipt: Order # Order Date DeliveryDocument1 pageReceipt: Order # Order Date DeliveryAnonymous cUZS10Pas encore d'évaluation

- Invoice 42010Document1 pageInvoice 42010ragiphani karthikPas encore d'évaluation

- Rejoice The Lord Church 681 Mckenzie ST Lewisville, TX 75057Document6 pagesRejoice The Lord Church 681 Mckenzie ST Lewisville, TX 75057dae ChoPas encore d'évaluation

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-Negotiablesivajyothi1973Pas encore d'évaluation

- COLLINS N OKONKWO Paystub Feb 12 2024Document1 pageCOLLINS N OKONKWO Paystub Feb 12 2024ellamaekitchensPas encore d'évaluation

- May 2021Document4 pagesMay 2021Negasi PenaPas encore d'évaluation

- E ReceiptDocument1 pageE ReceiptSampathPas encore d'évaluation

- Statement of Account: Total SharesDocument7 pagesStatement of Account: Total Sharesking Jorex ComedyPas encore d'évaluation

- Jason Matheson Paystub 2Document1 pageJason Matheson Paystub 2wadewilliamsperling1992Pas encore d'évaluation

- Form PDFDocument7 pagesForm PDFPaul BeznerPas encore d'évaluation

- Everlasting God (Chords)Document1 pageEverlasting God (Chords)Paul BeznerPas encore d'évaluation

- Beyond WonderlandDocument2 pagesBeyond WonderlandPaul BeznerPas encore d'évaluation

- 2018 01 06 PDFDocument12 pages2018 01 06 PDFPaul BeznerPas encore d'évaluation

- Day Zero and OneDocument2 pagesDay Zero and OnePaul BeznerPas encore d'évaluation

- Do, Lord (Chords)Document1 pageDo, Lord (Chords)Paul BeznerPas encore d'évaluation

- Taylor & Corey: The Web SeriesDocument3 pagesTaylor & Corey: The Web SeriesPaul BeznerPas encore d'évaluation

- Abstract Senior SeminarDocument1 pageAbstract Senior SeminarPaul BeznerPas encore d'évaluation

- Additional Problems On Differentiable FunctionsDocument2 pagesAdditional Problems On Differentiable FunctionsPaul BeznerPas encore d'évaluation

- Sample Problems 2 Math 5151 Fall 2015Document5 pagesSample Problems 2 Math 5151 Fall 2015Paul BeznerPas encore d'évaluation

- Sample Problems 2 Math 5151 Fall 2015Document5 pagesSample Problems 2 Math 5151 Fall 2015Paul BeznerPas encore d'évaluation

- ( ) The Course May Not Be Offered Regularly As Projected. The Offer of Number Theory Depends On The Demand and EnrollmentDocument2 pages( ) The Course May Not Be Offered Regularly As Projected. The Offer of Number Theory Depends On The Demand and EnrollmentPaul BeznerPas encore d'évaluation

- Sample Problems 2 Math 5151 Fall 2015Document5 pagesSample Problems 2 Math 5151 Fall 2015Paul BeznerPas encore d'évaluation

- TVM Review and Excel Intro - SDocument5 pagesTVM Review and Excel Intro - SPaul BeznerPas encore d'évaluation

- 2011 Spring FIN 331-007 2nd-Solution KeyDocument4 pages2011 Spring FIN 331-007 2nd-Solution KeyBrendan GitauPas encore d'évaluation

- T IS Well: Overcoming Paul BeznerDocument2 pagesT IS Well: Overcoming Paul BeznerPaul BeznerPas encore d'évaluation

- Corpreview 3 BDocument5 pagesCorpreview 3 BPaul BeznerPas encore d'évaluation

- Exercise 2 - Solution PDFDocument8 pagesExercise 2 - Solution PDFyumenashi2Pas encore d'évaluation

- Chapter 10 - QDocument32 pagesChapter 10 - Qmohammedakbar88Pas encore d'évaluation

- Abstract Algebra Notes V04Document7 pagesAbstract Algebra Notes V04Paul BeznerPas encore d'évaluation

- 2010-02-17 003531 Susan1Document4 pages2010-02-17 003531 Susan1Paul BeznerPas encore d'évaluation

- Hosea 1-14Document1 pageHosea 1-14Paul BeznerPas encore d'évaluation

- Stop PrayingDocument1 pageStop PrayingPaul BeznerPas encore d'évaluation

- Ezekiel 41-48 Daniel 1-12 Study GuideDocument1 pageEzekiel 41-48 Daniel 1-12 Study GuidePaul BeznerPas encore d'évaluation

- Ezekiel 21-40 Study GuideDocument1 pageEzekiel 21-40 Study GuidePaul BeznerPas encore d'évaluation

- The Acts of The ApostlesDocument1 pageThe Acts of The ApostlesPaul BeznerPas encore d'évaluation

- Worthy Is The LambDocument1 pageWorthy Is The LambPaul BeznerPas encore d'évaluation

- Sunday School ActivityDocument1 pageSunday School ActivityPaul BeznerPas encore d'évaluation

- Lovely: Chris Tomlin and Jason Ingram Key of (A)Document1 pageLovely: Chris Tomlin and Jason Ingram Key of (A)Paul BeznerPas encore d'évaluation

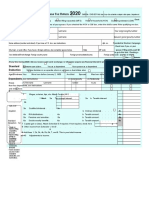

- For Individual Citizens and Resident Aliens Earning Purely Compensation Income and Individuals Engaged in Business and Practice of ProfessionDocument2 pagesFor Individual Citizens and Resident Aliens Earning Purely Compensation Income and Individuals Engaged in Business and Practice of ProfessionLhyraPas encore d'évaluation

- Federal Income Tax 1040 Activity PDFDocument14 pagesFederal Income Tax 1040 Activity PDFRobert Brant100% (1)

- Paula Atkins 17881 Thelma Ave Apt A Jupiter, FL 33458 Claimant ID: 226330Document2 pagesPaula Atkins 17881 Thelma Ave Apt A Jupiter, FL 33458 Claimant ID: 226330Natural Beauty LaserPas encore d'évaluation

- 2018 TSP Catch-Up Contributions and Effective Date ChartDocument1 page2018 TSP Catch-Up Contributions and Effective Date ChartAnonymous O6Pgmls4Pas encore d'évaluation

- Proviso PPP DatabaseDocument8 pagesProviso PPP DatabaseMichaelRomainPas encore d'évaluation

- F 8288 ADocument5 pagesF 8288 AIRSPas encore d'évaluation

- US Internal Revenue Service: f13206Document2 pagesUS Internal Revenue Service: f13206IRSPas encore d'évaluation

- United States Gift (And Generation-Skipping Transfer) Tax ReturnDocument4 pagesUnited States Gift (And Generation-Skipping Transfer) Tax ReturnHazem El SayedPas encore d'évaluation

- Chapter 14 PDFDocument14 pagesChapter 14 PDFJay BrockPas encore d'évaluation

- US Internal Revenue Service: I8801Document4 pagesUS Internal Revenue Service: I8801IRSPas encore d'évaluation

- Instructions For Schedule B (Form 941) : (Rev. January 2017)Document3 pagesInstructions For Schedule B (Form 941) : (Rev. January 2017)gopaljiiPas encore d'évaluation

- Instructions For Form 2210: Underpayment of Estimated Tax by Individuals, Estates, and TrustsDocument5 pagesInstructions For Form 2210: Underpayment of Estimated Tax by Individuals, Estates, and TrustsIRSPas encore d'évaluation

- Form - 6251Document2 pagesForm - 6251Anonymous JqimV1EPas encore d'évaluation

- Excel Demo 2Document2 pagesExcel Demo 2api-210465108Pas encore d'évaluation

- Percent (2) - (Pankaj - Pkj1@gmail - Com)Document4 pagesPercent (2) - (Pankaj - Pkj1@gmail - Com)Balaji GuruPas encore d'évaluation

- Computation of Income TaxDocument10 pagesComputation of Income TaxPageduesca RouelPas encore d'évaluation

- State-Local General Sales TaxDocument176 pagesState-Local General Sales TaxWeaverRoxPas encore d'évaluation

- US Internal Revenue Service: f1040 - 1996Document2 pagesUS Internal Revenue Service: f1040 - 1996IRSPas encore d'évaluation

- Glacier Tax User GuideDocument5 pagesGlacier Tax User Guideinter4ever77Pas encore d'évaluation

- U.S. Individual Income Tax Return: Filing StatusDocument3 pagesU.S. Individual Income Tax Return: Filing StatuspyatetskyPas encore d'évaluation

- CPA Reg Practice Individual TaxationDocument2 pagesCPA Reg Practice Individual TaxationMatthew AminiPas encore d'évaluation

- The American Taxpayer Relief Act of 2012Document2 pagesThe American Taxpayer Relief Act of 2012Janet BarrPas encore d'évaluation

- Schedule C Scenario 5: Mary JonesDocument5 pagesSchedule C Scenario 5: Mary JonesCenter for Economic ProgressPas encore d'évaluation

- RMC No. 134-2019Document1 pageRMC No. 134-2019cris gerard trinidadPas encore d'évaluation

- SF-181 Ethnicity and Race Identification Standard Form 181Document26 pagesSF-181 Ethnicity and Race Identification Standard Form 181Sistar Makkah94% (16)

- RMC No. 122 2019 PDFDocument2 pagesRMC No. 122 2019 PDFJoshua FortunoPas encore d'évaluation

- MorrisBreann Fall 2020 MGMT 343 Exam #1Document4 pagesMorrisBreann Fall 2020 MGMT 343 Exam #1Breann MorrisPas encore d'évaluation

- Tax Slabs FY 2020-21 - by AssetYogiDocument2 pagesTax Slabs FY 2020-21 - by AssetYogiSarang AgrawalPas encore d'évaluation

- TaxExemptWorld 329525 459c06d60Document1 pageTaxExemptWorld 329525 459c06d60Sarah SportingPas encore d'évaluation

- Multiple Choice Questions 1 Jamison Is A Single Dad With TwoDocument1 pageMultiple Choice Questions 1 Jamison Is A Single Dad With TwoTaimour HassanPas encore d'évaluation