Académique Documents

Professionnel Documents

Culture Documents

Planning/Analysis Functions in Market Risk Management

Transféré par

Minakshi SanapTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Planning/Analysis Functions in Market Risk Management

Transféré par

Minakshi SanapDroits d'auteur :

Formats disponibles

Planning/Analysis Functions in Market Risk

Management

The topics in this section describe the planning and analysis functions offered by Market Risk

Management, including:

incorporation of fictitious transactions in the real position of financial transactions and

transactions from operating business.

identification of impact of different trading and hedging strategies on the net present

value, effective interest rate/effective rate of the real position of financial and operative

transactions by incorporating fictitious transactions.

simulation, i.e. calculation based on assumptions about future market trends.

identification of cash flows, currency exposure and interest rate exposure taking

account of fictitious transactions and various market data scenarios.

The planning/analysis functions are divided into two sections:

Planning/Analysis of Treasury Positions without Underlying Transactions

These functions cover financial transactions in your Treasury position.

Planning/Analysis of Treasury Positions with Underlying Transactions

These functions cover the transactions in your Treasury position in addition to the

transactions resulting from your company’s everyday operating business.

Unlike the analysis/planning part of the application, the evaluation area offers purely reporting

functions on the basis of real transactions (see Information System: Evaluation Functions in

Market Risk Management).

Vous aimerez peut-être aussi

- Introduction - SAP Treasury and Risk ManagementDocument2 pagesIntroduction - SAP Treasury and Risk ManagementJoao Marcelo100% (1)

- Use of Vectors in Financial Graphs: by Dr Abdul Rahim WongD'EverandUse of Vectors in Financial Graphs: by Dr Abdul Rahim WongPas encore d'évaluation

- Scope of Financial Supply Chain ManagementDocument10 pagesScope of Financial Supply Chain ManagementDillip Kumar mallickPas encore d'évaluation

- Engineering Economics & Accountancy :Managerial EconomicsD'EverandEngineering Economics & Accountancy :Managerial EconomicsPas encore d'évaluation

- TRM Config Manual 1678819055Document18 pagesTRM Config Manual 1678819055rajesh_popatPas encore d'évaluation

- Business Plan Checklist: Plan your way to business successD'EverandBusiness Plan Checklist: Plan your way to business successÉvaluation : 5 sur 5 étoiles5/5 (1)

- Help Doc 1 PDFDocument101 pagesHelp Doc 1 PDFGopal KrishnanPas encore d'évaluation

- Financial Statement Analysis: Business Strategy & Competitive AdvantageD'EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantageÉvaluation : 5 sur 5 étoiles5/5 (1)

- Aims and Uses of SAP TreasuryDocument9 pagesAims and Uses of SAP Treasuryganesanmani1985Pas encore d'évaluation

- Financial & Ratio AnalysisDocument46 pagesFinancial & Ratio AnalysisParvej KhanPas encore d'évaluation

- Meaning of Accounting RatiosDocument12 pagesMeaning of Accounting RatiosAkash PradhanPas encore d'évaluation

- Meaning of Accounting RatiosDocument12 pagesMeaning of Accounting RatiosAkash PradhanPas encore d'évaluation

- Process of Fundamental Analysis PDFDocument8 pagesProcess of Fundamental Analysis PDFbharti khandelwalPas encore d'évaluation

- Ratio Analysis Meaning of Accounting RatiosDocument7 pagesRatio Analysis Meaning of Accounting RatiosShirsendu MondolPas encore d'évaluation

- A Study On Ratio Analysis in Tata MotorsDocument63 pagesA Study On Ratio Analysis in Tata MotorsMeena Sivasubramanian100% (3)

- #$%& &'# (M $") # M) 'M) ", $#&$M &-$M $ M '.$ $' : M M M MMM !!Document12 pages#$%& &'# (M $") # M) 'M) ", $#&$M &-$M $ M '.$ $' : M M M MMM !!Mehmood Zubair WarraichPas encore d'évaluation

- Process of Fundamental Analysis PDFDocument8 pagesProcess of Fundamental Analysis PDFajay.1k7625100% (1)

- TRM, New Instruments, Accounting Enhancements, ReportingDocument8 pagesTRM, New Instruments, Accounting Enhancements, ReportingGK SKPas encore d'évaluation

- Fundamental Analysis - WikipediaDocument21 pagesFundamental Analysis - WikipediaNaman JindalPas encore d'évaluation

- Fundamental and Technical AnalysisDocument17 pagesFundamental and Technical AnalysisdhanendrapardhiPas encore d'évaluation

- Class12 Accountancy2Document42 pagesClass12 Accountancy2Arunima RaiPas encore d'évaluation

- Accounting Ratios Accounting Ratios Accounting Ratios Accounting Ratios Accounting RatiosDocument47 pagesAccounting Ratios Accounting Ratios Accounting Ratios Accounting Ratios Accounting Ratiosviswa100% (1)

- Accounting Ratios: Inancial Statements Aim at Providing FDocument45 pagesAccounting Ratios: Inancial Statements Aim at Providing FNIKK KICKPas encore d'évaluation

- Accounting Ratios: Inancial Statements Aim at Providing FDocument47 pagesAccounting Ratios: Inancial Statements Aim at Providing Fabc100% (1)

- Project Report of Business PlanDocument8 pagesProject Report of Business PlanRavi SatyapalPas encore d'évaluation

- SAP FICO Interview QuestionsDocument4 pagesSAP FICO Interview Questionsnagasuresh nPas encore d'évaluation

- Module 2: Smart Task 02: Vce Summer Internship Program 2020 (PROJECT FINANCE-Modelling and Analysis)Document5 pagesModule 2: Smart Task 02: Vce Summer Internship Program 2020 (PROJECT FINANCE-Modelling and Analysis)vedant100% (1)

- AccountsDocument4 pagesAccountsAnita YadavPas encore d'évaluation

- Unit IvDocument26 pagesUnit Ivthella deva prasadPas encore d'évaluation

- Transaction ManagerDocument52 pagesTransaction Managersatya_avanigadda69Pas encore d'évaluation

- D. Marketable Securities PSPDocument9 pagesD. Marketable Securities PSPamgvicente29Pas encore d'évaluation

- Treasury MGTDocument34 pagesTreasury MGTZzhoustonPas encore d'évaluation

- Business Valuation: Economic ConditionsDocument10 pagesBusiness Valuation: Economic ConditionscuteheenaPas encore d'évaluation

- Treasurymgt 140612112636 Phpapp02Document34 pagesTreasurymgt 140612112636 Phpapp02Casimiro HernandezPas encore d'évaluation

- R2R Unit 1Document16 pagesR2R Unit 1Bhavika ChughPas encore d'évaluation

- Cfa L1 Fsa CH6Document25 pagesCfa L1 Fsa CH6anarghanayakPas encore d'évaluation

- Fundamental AnalysisDocument4 pagesFundamental Analysisgabby209Pas encore d'évaluation

- Business Architecture ModelingDocument31 pagesBusiness Architecture ModelingSamirkPas encore d'évaluation

- Fama - Unit 1Document10 pagesFama - Unit 1Shivam TiwariPas encore d'évaluation

- Functional Information SystemDocument8 pagesFunctional Information SystemHimanshu RaikwarPas encore d'évaluation

- The Role of Financial Information in Decision Making ProcessDocument6 pagesThe Role of Financial Information in Decision Making ProcesscoehPas encore d'évaluation

- Accounting Notes XIIDocument47 pagesAccounting Notes XIIAdarshPas encore d'évaluation

- GayathriRamesh 121045 AccountingDocument12 pagesGayathriRamesh 121045 AccountingGayathri RameshPas encore d'évaluation

- 2016 P5 JJ16 - Hybrid - P5 - AnsDocument11 pages2016 P5 JJ16 - Hybrid - P5 - AnsMota Tess TheressaPas encore d'évaluation

- Smart Task-2: Project Finance - Modeling and AnalysisDocument4 pagesSmart Task-2: Project Finance - Modeling and Analysissandhya rani100% (1)

- Module 2....Document15 pagesModule 2....AnimeliciousPas encore d'évaluation

- Financial Ratios - Growth Potential RatiosDocument2 pagesFinancial Ratios - Growth Potential RatiosBhaskar MukherjeePas encore d'évaluation

- LC ConfigDocument22 pagesLC ConfigRajeev MenonPas encore d'évaluation

- SAP FICO Interview Questions and Answers: Learning IT Courses Has Never Been This EasyDocument20 pagesSAP FICO Interview Questions and Answers: Learning IT Courses Has Never Been This EasykhaledPas encore d'évaluation

- Financial Statement Spreading - Pre Process Manual - EditedDocument3 pagesFinancial Statement Spreading - Pre Process Manual - EditedChandan Kumar ShawPas encore d'évaluation

- Financial AnalysisDocument17 pagesFinancial AnalysistonyPas encore d'évaluation

- Note On Mergers and AcquisitionsDocument3 pagesNote On Mergers and AcquisitionsTamim HasanPas encore d'évaluation

- Jawaban Assigment CH 1Document5 pagesJawaban Assigment CH 1AjiwPas encore d'évaluation

- Course OutlineDocument3 pagesCourse Outlinemdarafathossaen89Pas encore d'évaluation

- Framework For Business Analysis and Valuation Using Financial StatementsDocument18 pagesFramework For Business Analysis and Valuation Using Financial StatementsFarhat987Pas encore d'évaluation

- Bbac 142 - Managerial Accounting 2022Document8 pagesBbac 142 - Managerial Accounting 2022sipanjegivenPas encore d'évaluation

- Essentials of Financial Accounting - 1st SEMDocument10 pagesEssentials of Financial Accounting - 1st SEMParichay PalPas encore d'évaluation

- Accounting RatiosDocument42 pagesAccounting RatiosApollo Institute of Hospital AdministrationPas encore d'évaluation

- Object Oriented Analysis and Programming For A Working Capital Management SystemDocument6 pagesObject Oriented Analysis and Programming For A Working Capital Management SystemNikunj RanaPas encore d'évaluation

- Unique Features of E-Commerce TechnologyDocument4 pagesUnique Features of E-Commerce TechnologySonu Tandukar100% (4)

- Ias 2Document5 pagesIas 2FarrukhsgPas encore d'évaluation

- 8 Step GemDocument5 pages8 Step GemDhananjay YarrowsPas encore d'évaluation

- Articles of Organization: United StatesDocument2 pagesArticles of Organization: United Stateshasan jamiPas encore d'évaluation

- Mohammed - C.V 2023 NewDocument1 pageMohammed - C.V 2023 NewAli AlharbiPas encore d'évaluation

- Introduction To Monetary PolicyDocument1 pageIntroduction To Monetary PolicyCocoPas encore d'évaluation

- Corporate Personality Assignment 1Document12 pagesCorporate Personality Assignment 1Gareth Wilcox100% (1)

- Organizational StructureDocument2 pagesOrganizational StructureSinthya Chakma RaisaPas encore d'évaluation

- Introduction To DerivativesDocument34 pagesIntroduction To Derivativessalil1285100% (2)

- IESE GlovoDocument17 pagesIESE GlovoBill Jason Duckworth100% (1)

- MBA Time TableDocument2 pagesMBA Time Tablekuppai396Pas encore d'évaluation

- Consulting Bootcamp NotesDocument16 pagesConsulting Bootcamp NotesPrashant Khorana100% (2)

- SIP Soumik BhattacharyaDocument93 pagesSIP Soumik BhattacharyaSoumik BhattacharyaPas encore d'évaluation

- Star Bazaar IntroductionDocument24 pagesStar Bazaar IntroductionRavi Singh0% (4)

- Hmt801-Travel Agency and Tour OperationDocument1 pageHmt801-Travel Agency and Tour Operationhemant patidar NkmwgcZCKvPas encore d'évaluation

- Groz ToolsDocument71 pagesGroz ToolsAnil BatraPas encore d'évaluation

- Accounting For Business TransactionsDocument13 pagesAccounting For Business TransactionsAkp Wewen GensayaPas encore d'évaluation

- GI Book 6e-170-172Document3 pagesGI Book 6e-170-172ANH PHAM QUYNHPas encore d'évaluation

- Leadership Blindspots SurveyDocument6 pagesLeadership Blindspots SurveyRoed RPas encore d'évaluation

- Final Report of Pakistan State OilDocument18 pagesFinal Report of Pakistan State OilZia UllahPas encore d'évaluation

- CASE STUDY Contract Act AggrementDocument4 pagesCASE STUDY Contract Act Aggrementpagal78Pas encore d'évaluation

- Financial Accounting For Managers Author: Sanjay Dhamija Financial Accounting For Managers Author: Sanjay DhamijaDocument23 pagesFinancial Accounting For Managers Author: Sanjay Dhamija Financial Accounting For Managers Author: Sanjay Dhamijashweta sarafPas encore d'évaluation

- Final Boa Mulualem23Document66 pagesFinal Boa Mulualem23DamtewPas encore d'évaluation

- For Sample MCQ ISCADocument19 pagesFor Sample MCQ ISCAsaraPas encore d'évaluation

- Ch13 HintsDocument3 pagesCh13 HintsEric ChenPas encore d'évaluation

- AFM Important QuestionsDocument2 pagesAFM Important Questionsuma selvarajPas encore d'évaluation

- Millward Brown Methodology - For WebDocument5 pagesMillward Brown Methodology - For WebAnkit VermaPas encore d'évaluation

- Pan African Resources: Exceeding Expectations (As Usual)Document11 pagesPan African Resources: Exceeding Expectations (As Usual)Owm Close CorporationPas encore d'évaluation

- SWAD 3D Printing Challenge GatewayDocument2 pagesSWAD 3D Printing Challenge GatewayMuhammad AdilPas encore d'évaluation

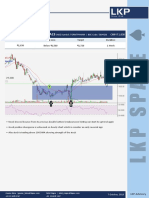

- LKP Spade - Torrent Pharma - 7octDocument3 pagesLKP Spade - Torrent Pharma - 7octpremPas encore d'évaluation

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisD'EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisÉvaluation : 5 sur 5 étoiles5/5 (6)

- Creating Shareholder Value: A Guide For Managers And InvestorsD'EverandCreating Shareholder Value: A Guide For Managers And InvestorsÉvaluation : 4.5 sur 5 étoiles4.5/5 (8)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (14)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSND'Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingD'EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingÉvaluation : 4.5 sur 5 étoiles4.5/5 (17)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialD'EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialÉvaluation : 4.5 sur 5 étoiles4.5/5 (32)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 3.5 sur 5 étoiles3.5/5 (8)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthD'EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthÉvaluation : 4 sur 5 étoiles4/5 (20)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelD'Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelPas encore d'évaluation

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursD'EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursÉvaluation : 4.5 sur 5 étoiles4.5/5 (8)

- Value: The Four Cornerstones of Corporate FinanceD'EverandValue: The Four Cornerstones of Corporate FinanceÉvaluation : 4.5 sur 5 étoiles4.5/5 (18)

- Finance Basics (HBR 20-Minute Manager Series)D'EverandFinance Basics (HBR 20-Minute Manager Series)Évaluation : 4.5 sur 5 étoiles4.5/5 (32)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamD'EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamPas encore d'évaluation

- Mind over Money: The Psychology of Money and How to Use It BetterD'EverandMind over Money: The Psychology of Money and How to Use It BetterÉvaluation : 4 sur 5 étoiles4/5 (24)

- Financial Risk Management: A Simple IntroductionD'EverandFinancial Risk Management: A Simple IntroductionÉvaluation : 4.5 sur 5 étoiles4.5/5 (7)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsD'EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsÉvaluation : 5 sur 5 étoiles5/5 (1)

- The Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsD'EverandThe Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsPas encore d'évaluation

- Product-Led Growth: How to Build a Product That Sells ItselfD'EverandProduct-Led Growth: How to Build a Product That Sells ItselfÉvaluation : 5 sur 5 étoiles5/5 (1)

- Finance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)D'EverandFinance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)Évaluation : 4 sur 5 étoiles4/5 (5)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistD'EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistÉvaluation : 4 sur 5 étoiles4/5 (32)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursD'EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursÉvaluation : 4.5 sur 5 étoiles4.5/5 (34)

- How to Measure Anything: Finding the Value of Intangibles in BusinessD'EverandHow to Measure Anything: Finding the Value of Intangibles in BusinessÉvaluation : 3.5 sur 5 étoiles3.5/5 (4)

- Valley Girls: Lessons From Female Founders in the Silicon Valley and BeyondD'EverandValley Girls: Lessons From Female Founders in the Silicon Valley and BeyondPas encore d'évaluation