Académique Documents

Professionnel Documents

Culture Documents

LEASE Problem Word

Transféré par

SayeedMdAzaharulIslamCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

LEASE Problem Word

Transféré par

SayeedMdAzaharulIslamDroits d'auteur :

Formats disponibles

1 (Loan and Rental both Beg)

Rabbi International is considering the acquisition of an equipment costing Taka 350,000. The

equipment has an economic life of 5 years. The company can purchase the equipment by borrowing

at 12 percent. Loan installments are equal and payable at the beginning of every year. Under the

lease alternative, a rental of Taka 85,190 should be paid annually (beginning). The rental includes

maintenance expense of Taka 3000 annually. The estimated salvage value is Taka 35,000. Tax rate is

30 percent. The company charges depreciation in straight line method. WACC is 14 percent. Which

alternative should the firm choose? Estimate the break even rental.

1. (revised) Loan end rental beginning)

Rabbi International is considering the acquisition of an equipment costing Taka 350,000. The

equipment has an economic life of 5 years. The company can purchase the equipment by borrowing

at 12 percent. Loan installments are equal and payable at the end of every year. Under the lease

alternative, a rental of Taka 85,190 should be paid annually (beginning). The rental includes

maintenance expense of Taka 3000 annually. The estimated salvage value is Taka 35,000. Tax rate is

30 percent. The company charges depreciation in straight line method. WACC is 14 percent. Which

alternative should the firm choose? Estimate the break even rental.

2.Shantanu International is considering the acquisition of an equipment costing Taka 150,000. The

equipment has an economic life of 5 years. The company can purchase the equipment by borrowing

at 10 percent. If the loan is taken, Taka 30,000 plus interest (on outstanding loan) should be repaid

annually (at the year end). Government provides 5% tax credit for purchasing new industrial

equipments. Under the lease alternative, a rental of Taka 44,500 should be paid annually. The rental

includes maintenance expense of Taka 2000 annually. Tax rate is 30% and WACC is 13% for the firm.

The company charges depreciation in straight line method. Which alternative should the firm

choose?

What if the lease rental includes a maintenance expense of Taka 5,000 annually?

3.Shujan International is considering the acquisition of an equipment costing Taka 550,000. The

equipment has an economic life of 5 years. The company can purchase the equipment by borrowing

at 14 percent. Loan instalments are equal and payable at the end of every period. Government

provides 5% tax credit (Cost x tax rate) for purchasing new industrial equipments. Under the lease

alternative, a rental of Taka 138,000 should be paid at the beginning of every year. The rental

includes maintenance expense of Taka 12000 annually. Tax rate is 30% and WACC is 15% for the

firm. The company charges depreciation in straight line method. Which alternative should the firm

choose?

Vous aimerez peut-être aussi

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Standard Chartered Bank BDDocument1 pageStandard Chartered Bank BDshahid2opuPas encore d'évaluation

- Case 16 Group 56 FinalDocument54 pagesCase 16 Group 56 FinalSayeedMdAzaharulIslamPas encore d'évaluation

- Case 16 Group 56 AnannaDocument44 pagesCase 16 Group 56 AnannaSayeedMdAzaharulIslamPas encore d'évaluation

- Annual ReportDocument398 pagesAnnual ReportSayeedMdAzaharulIslamPas encore d'évaluation

- Aramitcem 2017 PDFDocument64 pagesAramitcem 2017 PDFSayeedMdAzaharulIslam0% (1)

- Aramit Cement Limited: Rights Share Offer DocumentDocument70 pagesAramit Cement Limited: Rights Share Offer DocumentSayeedMdAzaharulIslamPas encore d'évaluation

- Industry Analysis of Banking Sector of BDDocument5 pagesIndustry Analysis of Banking Sector of BDSayeedMdAzaharulIslam100% (1)

- La-1l:,zru, I LL Raka LL Raka: AccountantsDocument4 pagesLa-1l:,zru, I LL Raka LL Raka: AccountantsSayeedMdAzaharulIslamPas encore d'évaluation

- Accounting 12 17 PDFDocument441 pagesAccounting 12 17 PDFSayeedMdAzaharulIslamPas encore d'évaluation

- 3 - Liquidity ManagementDocument5 pages3 - Liquidity ManagementParbon AcharjeePas encore d'évaluation

- Capital StructureDocument60 pagesCapital StructureSayeedMdAzaharulIslamPas encore d'évaluation

- 3-Classified Loans and RecoveryDocument7 pages3-Classified Loans and RecoverySayeedMdAzaharulIslamPas encore d'évaluation

- BRAC Internship ReportDocument82 pagesBRAC Internship ReportSayeedMdAzaharulIslamPas encore d'évaluation

- Annual Report 2017Document408 pagesAnnual Report 2017ghosthostPas encore d'évaluation

- DUCSU ConstitutionDocument19 pagesDUCSU ConstitutionSayeedMdAzaharulIslam0% (1)

- Confidcem 2014 Annual (Audit)Document43 pagesConfidcem 2014 Annual (Audit)SayeedMdAzaharulIslamPas encore d'évaluation

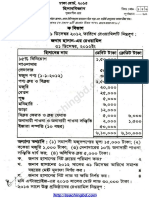

- SSC Accounting Question 2015 Dhaka Board PDFDocument7 pagesSSC Accounting Question 2015 Dhaka Board PDFSayeedMdAzaharulIslamPas encore d'évaluation

- SSC Accounting Question 2015 Sylhet Board PDFDocument7 pagesSSC Accounting Question 2015 Sylhet Board PDFSayeedMdAzaharulIslamPas encore d'évaluation

- Apex Spinning Annual Report-2016-17Document50 pagesApex Spinning Annual Report-2016-17SayeedMdAzaharulIslamPas encore d'évaluation

- SSC Accounting Question 2015 Chittagong Board PDFDocument7 pagesSSC Accounting Question 2015 Chittagong Board PDFSayeedMdAzaharulIslamPas encore d'évaluation

- টোটেম ও ট্যাবু - সিগমুন্ড ফ্রয়েডDocument148 pagesটোটেম ও ট্যাবু - সিগমুন্ড ফ্রয়েডhjjjhd2132100% (1)

- GQ Ball Pen Produces Two Categories of Pens Super Gel and Standard Ball Point Using Two Equipments P1 and P2Document2 pagesGQ Ball Pen Produces Two Categories of Pens Super Gel and Standard Ball Point Using Two Equipments P1 and P2SayeedMdAzaharulIslamPas encore d'évaluation

- Solution For Chapter 16,17 PDFDocument33 pagesSolution For Chapter 16,17 PDFSayeedMdAzaharulIslamPas encore d'évaluation

- Chapter 1Document23 pagesChapter 1SayeedMdAzaharulIslamPas encore d'évaluation

- Application PDF Manob - Deho PDFDocument8 pagesApplication PDF Manob - Deho PDFSayeedMdAzaharulIslamPas encore d'évaluation

- ShowtimeDocument4 pagesShowtimeSayeedMdAzaharulIslamPas encore d'évaluation

- Risk and Return)Document1 pageRisk and Return)SayeedMdAzaharulIslamPas encore d'évaluation

- Aprojectreportontrainingdevelopmentopportunitiesintextile 141124062032 Conversion Gate02Document184 pagesAprojectreportontrainingdevelopmentopportunitiesintextile 141124062032 Conversion Gate02SayeedMdAzaharulIslamPas encore d'évaluation

- Application PDF Islam Science MeditationDocument127 pagesApplication PDF Islam Science MeditationSayeedMdAzaharulIslamPas encore d'évaluation

- Application PDF Quantum - Konica PDFDocument370 pagesApplication PDF Quantum - Konica PDFSayeedMdAzaharulIslamPas encore d'évaluation

- Ak MCQDocument130 pagesAk MCQanand vishwakarmaPas encore d'évaluation

- Chapter 12Document38 pagesChapter 12Nguyễn Vinh QuangPas encore d'évaluation

- Chapter C:4 Corporate Nonliquidating Distributions Discussion QuestionsDocument29 pagesChapter C:4 Corporate Nonliquidating Distributions Discussion QuestionsYang LiPas encore d'évaluation

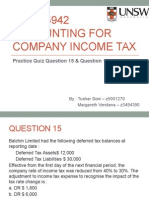

- ACCT5942 Week4 PresentationDocument13 pagesACCT5942 Week4 PresentationDuongPhamPas encore d'évaluation

- Saving Union BankDocument3 pagesSaving Union BankSonu F1Pas encore d'évaluation

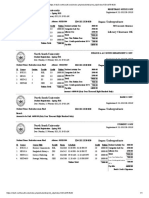

- Payroll Dec With 13th MonthDocument8 pagesPayroll Dec With 13th MonthchippaiUSAPas encore d'évaluation

- Ministry of Corporate Affairs: Only For Pay Later Payment. Not For Payment at Branch Counter E-Challan For Paying LaterDocument2 pagesMinistry of Corporate Affairs: Only For Pay Later Payment. Not For Payment at Branch Counter E-Challan For Paying LaterPrakashPas encore d'évaluation

- Reservation Form enDocument1 pageReservation Form enfederbarPas encore d'évaluation

- GST Implications On Sale of Developed Plots and JDA For Plotted Development of Land CA Yashwant KasarDocument23 pagesGST Implications On Sale of Developed Plots and JDA For Plotted Development of Land CA Yashwant KasarShashikant WadkarPas encore d'évaluation

- GROUP 10 (Corporation Income Taxation - Regular Corporation)Document16 pagesGROUP 10 (Corporation Income Taxation - Regular Corporation)Denmark David Gaspar NatanPas encore d'évaluation

- North South University: ID# 181 1530 030 DegreeDocument1 pageNorth South University: ID# 181 1530 030 DegreeRashaduzzaman RiadPas encore d'évaluation

- 1999 68 ITD 95 Mumbai 03 10 1997Document9 pages1999 68 ITD 95 Mumbai 03 10 1997shubhit shokeenPas encore d'évaluation

- SAP Business One Tables - Business One - SCN WikiDocument7 pagesSAP Business One Tables - Business One - SCN WikiMaicon Macedo100% (1)

- Summary of Collections and Remittances - BTDocument18 pagesSummary of Collections and Remittances - BTSt. Veronica Learning CenterPas encore d'évaluation

- Gul BargaDocument916 pagesGul BargaShihan Ali KhanPas encore d'évaluation

- Welcome To CIMB Clicks MalaysiaDocument2 pagesWelcome To CIMB Clicks MalaysiaabgutihPas encore d'évaluation

- Bangiya Gramin Vikash Bank Exam ChallanDocument2 pagesBangiya Gramin Vikash Bank Exam Challananaga1982Pas encore d'évaluation

- Gmail - Booking Confirmation On IRCTC, Train - 22691, 28-May-2022, 3A, GTL - NZMDocument1 pageGmail - Booking Confirmation On IRCTC, Train - 22691, 28-May-2022, 3A, GTL - NZMkridddhPas encore d'évaluation

- Pre-Midterm Examination - TaxationDocument5 pagesPre-Midterm Examination - TaxationCarla Jane ApolinarioPas encore d'évaluation

- Chapter 8 Class Discussion Problems: Situation If Consolidated Return Is Filed If Separate Returns Are FiledDocument10 pagesChapter 8 Class Discussion Problems: Situation If Consolidated Return Is Filed If Separate Returns Are FiledJoel Christian MascariñaPas encore d'évaluation

- InvoiceDocument2 pagesInvoiceJagat PapaPas encore d'évaluation

- 23 UgsthbDocument84 pages23 UgsthbChawla DimplePas encore d'évaluation

- 2.5 Cash Books: Two Column Cash BookDocument6 pages2.5 Cash Books: Two Column Cash Bookwilliam koechPas encore d'évaluation

- Position PaperDocument1 pagePosition PaperAlvy Faith Pel-eyPas encore d'évaluation

- TAX-5.0 - Individual Income TaxDocument65 pagesTAX-5.0 - Individual Income TaxCharmaine RosalesPas encore d'évaluation

- Tax FinalsDocument48 pagesTax FinalsAthena SalasPas encore d'évaluation

- Direct Tax Laws & International Taxation Mock Test Paper SeriesDocument11 pagesDirect Tax Laws & International Taxation Mock Test Paper SeriesDeepsikha maitiPas encore d'évaluation

- Bangladesh Electronic Funds Transfer Network (Beftn) : Presented By: Central BACH, Payment Service Department, (PSD)Document19 pagesBangladesh Electronic Funds Transfer Network (Beftn) : Presented By: Central BACH, Payment Service Department, (PSD)Tanvir MahmudPas encore d'évaluation

- ConsolidateStatement Mar 20Document5 pagesConsolidateStatement Mar 20Coid CekPas encore d'évaluation