Académique Documents

Professionnel Documents

Culture Documents

Corporation Law Title VII

Transféré par

anon_418627889Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Corporation Law Title VII

Transféré par

anon_418627889Droits d'auteur :

Formats disponibles

STOCKHOLDERS AND SHAREHOLDERS b.

Covered Warrant: entitles holders to the right to purchase from the

issuer a pre-determined number of shares that are already issued

PRE INCORPORATION SUBCRIPTION c. Warrant Certificate: certificate representing the right to a Warrant,

• Irrevocable for at least 6 months from subscription date. which may be detachable or not, duly issued by the Issuer to the

• Revocation: (1) all other subscribers consent to the revocation before 6 Warrant holder.

months or (2) the incorporation of said corporation fails to materialise d. Warrant Instrument: document or deed containing the terms and

within said period or a longer period as stipulated in the contract conditions of the issue and exercise of a warrant which includes the:

• A pre-incorporation subscription may be revoked after the submission (1) maximum underlying shares that can be produced; (2) exercise

of the AOI to the SEC. period and (c) other terms and conditions SEC may require

• In this case, one of the parties is still non-existent so not all can given e. Detachable Warrant: warrant that may be sold, transferred or

consent. Despite this, the subscription contract before incorporation is assigned to any person by Warrant holder separate from and

valid and binding; and irrevocable for a period of 6 months and after the independent of the corresponding beneficiary securities.

filing of the AOI to the SEC. If the SEC released the Certificate of f. Non Detachable Warrant: warrant that may be sold transferred or

Incorporation, there can be no revocation since they are already covered assigned to any person by Warrant holder separate from and

by the TFD. independent of the beneficiary securities.

g. Beneficiary Securities: shares of stock and other securities of the

SUBSCRIPTION CONTRACT: any contract for the acquisition of issuer which form the basis of the entitled in a Warrant

unissued stock in an existing corporation or a corporation still to be h. Underlying Shares: unissued shares of a corporation that may be

formed. Notwithstanding the fact that the parties refer to it as a purchase purchased by a warrant holder upon the exercise of a right granted

or some other contract. A contract by which the subscriber agrees to take under the warrant.

a certain number of shares of the capital stock, paying the consideration

or expressly or impliedly promising to pay he same. Parties:

1. Subscriber

Stock Option and Warrant: hybrid securities that should be distinguished 2. Corporation: owner of the subject matter of the transaction

from subscription contracts. NOTE: in a sent, the subscription contract is also a contract among

• Stock Option: a privilege granted to a party to subscribe to a certain subscribers. An original subscriber cannot withdraw from the pre-

portion of unissued capital stock of a corporation within a specified incorporation subscription agreement without the consent of all

period and under the terms and conditions of the grant, exercisable by shareholders.

the grantee at any time within the period granted.

• Warrant: a type of security which entitles the holders the right to Agreement to form a corporation in a JVA may be an agreement between

subscribe to the unissued capital stock or to purchase issued shares in the parties only, while the terms and conditions may involve the

the future, evidence by a warrant certificate which may be sold but corporation, the corporation is not a party thereto.

does not apply to a right granted under an option plan duly approved by

the SEC for the benefit of the employees, officers and/or directors of the The shares may be issued in trust for another person. The shares may be

issuing corporation. The period to subscribe is not less than one year, registered in the name of one person, but the beneficial ownership may

but not more than 5 years. belong to another. The trustee may even be a nominee who holds the

shares for another to qualify said nominee as director. A nominee is a

a. Subscription Warrant: right to subscribe pre-determined number of person whose name a stock certificate is registered but who is not the

shares out of the unissued capital stock of the issuer actual owner thereof.

stockholders, regardless of full payment of their subscriptions, may be

Number of Shares Covered: reached by the creditor in satisfaction of its claim.

• It may cover one or more shares; the subscription agreement is

considered an indivisible contract.

• A subscriber need not enter into only one subscription agreement if he

will take two or more shares. He may subscribe to the capital stock NOTE: money received for subscription of increase of authorised capital

under several subscription contracts. is not covered by the TFD prior to the approval of such increase by the

SEC.

Form:

• No requirement written under law Trust Fund Doctrine Violation

• If a person accepts a certificate of stock in his name or if he exercises (1) when the corporation releases or condones payment of the unpaid

the rights of shareholders, he is liable for unpaid subscription even if subscription and the stockholder has not right to demand the refund

there was no express contract of his investment

(2) when there is payment of dividends without unrestricted retained

Kinds: earnings

• Pre Incorporation Subscription Contract (3) when properties are transferred in fraud of creditors

• Post Incorporation Subscription Contract (4) when properties are disposed or undue preference is given to some

• May pertain to shares that are part of the original Authorised Capital creditors even if the corporation is insolvent

Stock in the AOI or those which involve the increase of capital stock (5) when the capital stock is decreased which has the effect of relieving

• Conditional: subscription upon a condition precedent is a subscription the stockholders of the obligation to pay their respective subscription

that does not take effect so as to make the subscriber a stockholder or

confer rights until the condition is satisfied Under the TFD, a corporation has no legal capacity to release an original

• Unconditional subscriber to its capital stock from the obligation of paying for his shares,

in whole or in part, without a valuable consideration or fraudulently, to

TRUST FUND DOCTRINE: the subscribed capital stock of a the prejudice of creditors.

corporation is a trust fund for the payment of debts of the corporation

which the creditors have the right to look up to satisfy their credits. The TFD provides that subscriptions to the capital stock of a corporation

corporation may not dissipate this and the creditors may sue stockholders constitutes a fund to which the creditors have a right to look for the

directly for the unpaid subscriptions. satisfaction of their claims.

• Not limited to the unpaid portion of the subscribed capital. The capital (1) Procedure for the distribution of capital assets embodied in the

stock, property and other assets of the corporation are regarded as equity Corporation Code which allows the distribution of corporate capital

in trust for the payment of the corporate creditors. only in three instances: (a) amendment of AOI to reduce the

• The scope of the doctrine when the corporation is insolvent authorised capital stock; (b) purchase of redeemable shares; (c)

encompasses not only the capital stock, but also other property and dissolution and eventual liquidation.

assets generally regarded in equity as a trust fund for the payment of (2) Power of a corporation to acquire its own shares

corporate debts. (3) The distribution of corporate assets and property cannot be made to

• All assets and property belonging to the corporation held in trust for the depend on the whims and caprices of the corporation, or even for that

benefit of creditors that were distributed or in the possession of the matter in the earnest desire of the court a quo to prevent further

squabbles and future litigations unless indispensable conditions and (1) Procedure for the distribution of capital asserts embodied in the

procedures for the protection of corporate creditors are followed. Corporation Code which allows the distribution of corporate capital

in three instances:

A subscription contract is formed by an offer by one of the parties, the (1) Amendment of AOI to reduce ACS

corporation or subscriber as the case may be and an acceptance of this (2) Purchase of redeemable shares

offer by the other. There is binding contract as soon as the offer to take (3) Dissolution and eventual liquidation of the corporation

shares made by a person (2) Power of a corporation to acquire own shares

(3) Power of a corporation to acquire its own shares

Acquisition of Shares by Stockholders (4) The distribution of corporate assets and property cannot be made to

Voluntary Onerous Acquisition of Shares depend on the whims and caprices of the corporation, or even for that

A. Purchase: may be by corporation or other shareholders matter in the earnest desire of the court a quo to prevent further

B. Subscription squabbles and future litigations unless indispensable conditions and

procedures for the protection of corporate creditors are followed.

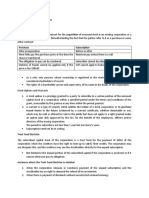

Purchase Subscription

• A stockholder has no right to demand for the rerun of his investment

Entered after incorporation Entered before or after incorporation (his investment is locked in until liquidation)

• It cannot compel the corporation to return his investments without the

Must fully pay at the time the shares Payment need not be made unless consent of all stockholders

are transferred there is a call if there is no time

• Neither does he have the right to withdraw even when all stockholders

agreed upon

assent if there is prejudice to creditors

A stockholder who sells his can Cannot be released from his

condone the obligation to pay obligation to pay Alternative to TFD: Fraud Theory: if shares are issued to shareholders

who have not yet pad the subscription price, the corporate creditors have

SOF applies if the price is not less No SOF the right to go after the shareholders in case of insolvency. If this is

than P500

applied, the liability of the shareholder is explained by submitting to the

proposition that there is deemed to be representation to the creditor to the

effect that the shares were paid before their issuance.

• Stockholders of Record: only persons registered in the stock and

transfer book; the rights accrue upon the entry of his name in the books Treasury Shares: are not subject to subscription contracts because

of the corporation. Section 60 of the Corporation Code covers only acquisition of unissued

• Mere inclusion in the GIS is insufficient shares. However, when treasury shares are re-issued the shareholders are

• Original stockholders in the AOI even if not reflected in the Stock and entitled to exercise their pre-emptive right.

Transfer Book are entitled to such rights

• One can become an owner by succession through gratuitous means like Escrow Shares: corporation may impose the conditions that the shares to

donation. (Acquisition under the CC) be issued shall be held in escrow until actual payment is receiver by

corporation. Title does not pass to the subscriber until the performance of

This doctrine is the underlying principle and/or articulated in the the condition. A holder of escrow shares does not become entitled to the

following: rights pertaining to a stockholder until the conditions for the release of

such shares are fully met. The subscriber is not yet the owner of the said

shares and consequently he cannot be accorded the rights belonging to a • Paid Up Capital: that portion of the authorised capital stock that has

regular shareholder. been subscribed and actually paid.

• Initial capital of the corporation at its birth: Paid Up Capital. If the

Balancing Interests authorised capital and the subscribed capital remain constant, the paid

Manning: provisions of corporation law on legal capital are addressed to up capital the subscribed capital remain constant, the paid up capital

resolving or at least accommodating the combination of the creditors may be increased by making the subscriber make additional payment or

perspective and the shareholder’s perspective namely: price may be made voluntary without need of call.

(1) the creditors of the company desires that the enterprise have large NOTE: issuance of unsubscribed shares only need BOD approval.

quantities of assets against which only other claimants are those who

rank junior to him. The shareholders, by contract, would like to have The advantages of debts include:

as little aspkossible of their own assets tied up in the enterprise and (1) current shareholders (who cannot exercise their pre-emptive right) do

exposed to the jeopardy of creditors claim. not have to dilute or surrender their control of the corporation when

(2) The creditor does not ordinary welcome the creation of additional funds are obtained by borrowing rather than issuing more shares of

creditor’s claim against the limited assets of the enterprise. The stocks

shareholder investor will often (not always) be willing for the for the (2) Depending on the current tax law, it may be less expnsive to issue

incorporated enterprise to incur further debt in order to benefit from debt rather than additional stock if the interest payments made to

leverage, especially when his own equity investment position is small. bondholders are tax deductible while dividends are not

(3) The creditor would prefer that the junior investment claimant, the (3) The issue of bonds may increase the earnings of the corporation

shareholder, receiver nothing as a return on his investment for so long through favourable financial leverage; a corporation has favourable

as time as the creditor’s claim has not been paid. The shareholder, on financial leverage when the borrowed funds are used to increase the

the other hand, would prefer a concurrent return paid out to him as earnings per share of common stock

the enterprise earns profits.

(4) The creditor wants protection against all manner of asset distributions The disadvantages of obtaining funds by borrowing include the folloing:

to shareholders— particularly since he sees the board of directors as (1) The borrower has a fixed interest payment that must be met each

a creature of shareholders. The shareholder wants maximum freedom period to avoid default

to receive such distribution (2) The use of debt may reduce a company’s ability to withstand a major

(5) Each shareholder wants assurance that each other shareholder has loss (compared to a situation where there is more equity to meet the

contribution to the corporate pot a proprietorship investment losses)

proportionate to his shareholdings. (3) It also causes the company to experience unfavourable financial

leverage when income from operation falls below a certain level

Sources of Capital: unfavourable financial leverage results when the cost of borrowing

• Capital includes all properties and assets of the corporation that are used funds exceeds the revenue they generate

for its business or operate. (4) Loan agreement usually require maintenance of a certain amount of

• Authorized Capital Stock: amount fixed in the AOI to be subscribed and working capital and place limitations on dividend and additional

paid by the stockholders. borrowings

• Subscribed Capital: portion of authorised capital stock that is covered

by subscription agreements whether fully paid or not. Increase: (1) by Creditors: those who supply additional funds to the corporation.

issuing the raining balance of ACS, or (2) by increasing the ACS that

necessarily involves additional subscription.

1. Commercial Creditors: short-term creditors including banks and • The right over the property must actually be transferred to the

and other institutional leaders who extend revolving lines of short corporation and no creditors of the property held in common shall be

term credit. prejudiced

2. Investment Creditors: those who acquire bonds or debentures by a • There must be waiver of rights signed by all possible co-owners stating

corporation. that they waive their right of redemption or pre-emption in relation to

the transfer. Co-owner transferring shall execute an affidavit that he

The consideration for bonds are also limited to the considerations that the gave notice to other co-owners and the 30 day redemption period had

CC allows for subscription agreements. already expired

CONSIDERATION FOR STOCKS Conversion: the corporation may accept as consideration the outstanding

Consideration: not the same as in the Civil Code which refers to the value. shares exchange for stocks in the event of reclassification or

Here, it is the property or right or service to be actually exchanged or reconsideration. It also includes conversion of a single proprietor or

received. partnership into a corporation or vice versa or spin off or one or more

divisions. [Required: Articles of Dissolution and Deed of Assignment;

Rule: It may be any or a combination of: List of Debtors with amount and consent]

(1) Actual cash paid

(2) Property, tangible or intangible, received by the corporation and (4) Previously incurred indebtedness rendered

necessary for its use and lawful purpose at a fair valuation equal • Acknowledged by the board

to the par or issued value of the stock issue • Subject to approval by the SEC

(3) Labor performed for or services actually rendered to the • To prevent watering of stocks, the amount of indebtedness or

corporation [bonus takes form of additional expenses on the part of liabilities to be settled should be at least equal to the par value of

the paying coporation for services rendered by the grantee] * cannot shares of stock which the corporation intends to issue

be future contracts * • It is legally acceptable for one block of shareholders to be allowed

to pay through a previously incurred indebtedness while other pay

Intangible Properties: in cash. The set off debt is equivalent to the payment of stock in

• Must be submitted with a copy of the certificate of registration of the cash.

intellectual property right together with an appraisal report by an (5) Amounts transferees from unrestricted retained earnings to

accredited appraisal company that is not more than 6 months old and a stated capital [occurs when there is declaration of stock dividends]

deed of assignment. (6) Outstanding shares exchanged for stocks in the event of

• Mining claim must be with a mining permit; the actual value of the reclassification or conversion

mining claim must appraised and determined by the Bureau of Mines • It cannot be paid only through dividends that will be declared later

and Geo Sciences and confirmed directly to the SEC (will operate as fraud)

Undivided Interest: Conditions:

• Something that the corporation may acquire and hold in carrying out its (1) Cannot be issued for a consideration less than the par or issued price.

purpose or reasonable necessary or convenient in the business (2) If not cash: the valuation shall be determined by the BOD subject to

• Interest of the co-ownership must have a peculiars value capable of the approval of the SEC

ascertaining (at fair valuation equal to par or issued value of the stock) (3) Cannot be issued in exchange for PN’s or future service (applicable

to bonds)

NOTE: A bank certificate in the form prescribed by the BSP to prove the

existence of inward remittance is required but only with respect to those

corporations with foreign subscribers who want to registered their

investments with the BSP.

Requirements for Tangible or Intangible Property:

a. The property is actually received by the corporation

b. Necessary and convenient for its use and lawful purpose

c. Subject to a fair valuation equal to the par value or issued value of

stock issued

d. The valuation shall initially be determined by the incorporators or the

board of directors

e. Valuation shall be subject to the approval of the SEC (prevent’s

watering of stocks)

• Watered Stocks: stocks issued for a consideration less than the par

value or issued price thereof

• Issued Price of No Par Value: (1) fixed in the AOI or (2) fixed by

the BOD pursuant to the bylaws or in the absence, (3) by the

stockholders representing at least a majority of the outstanding capital

stock at a meeting duly called for that purpose.

• The issued value may be higher than the par value; FMV may be

greater than the par value.

• If the shares have no par value, no authorised capital stock is stated

and the stated capital is fixed by the issuance of no-par value shares

with fixed issued value.

Deposit on Subscription: an amount of money received by the

corporation as a deposit with the possibility of applying the same as

payment for the future issuance of capital stock. It is not subject to

documentary stamp tax. The depositor is not standing as a stockholder and

he is not entitled to dividends, voting rights or other prerogatives and

attributes of a stockholder.

Vous aimerez peut-être aussi

- PSSA - With Addendum ReferenceDocument8 pagesPSSA - With Addendum ReferenceMark Alvin EspirituPas encore d'évaluation

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyD'EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyPas encore d'évaluation

- Crowdfunding on SteroidsD'EverandCrowdfunding on SteroidsÉvaluation : 3 sur 5 étoiles3/5 (1)

- General Solicitation under New Rule 506: Crowd Funding on SteroidsD'EverandGeneral Solicitation under New Rule 506: Crowd Funding on SteroidsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Reyes v. CA 216 SCRA 25 (1993)Document7 pagesReyes v. CA 216 SCRA 25 (1993)Karla KanashiiPas encore d'évaluation

- DebenturesDocument28 pagesDebenturesdeepaksinghalPas encore d'évaluation

- Doctrine of Indivisibility of Subscription ContractDocument18 pagesDoctrine of Indivisibility of Subscription ContractAngelaPas encore d'évaluation

- Borrowing Powers of A CompanyDocument5 pagesBorrowing Powers of A CompanyimadPas encore d'évaluation

- Corporation Law After Midterms ReviewerDocument140 pagesCorporation Law After Midterms ReviewerJoseph Plazo, Ph.D100% (6)

- Notice of Appeal Criminal Case MTC To RTCDocument3 pagesNotice of Appeal Criminal Case MTC To RTCLex Dagdag100% (1)

- Equitable Leasing Corp. v. SuyomDocument2 pagesEquitable Leasing Corp. v. SuyomMitch BarandonPas encore d'évaluation

- Stocks and StockholdersDocument4 pagesStocks and StockholdersCleinJonTiuPas encore d'évaluation

- Corporation: Title ViiDocument13 pagesCorporation: Title ViiDarrel SapinosoPas encore d'évaluation

- Revised Corporation Code Part3Document6 pagesRevised Corporation Code Part3not funny didn't laughPas encore d'évaluation

- Borrowing Powers (Debentures and Charges) : Dr. Bharat G. KauraniDocument25 pagesBorrowing Powers (Debentures and Charges) : Dr. Bharat G. Kauranishubham kumarPas encore d'évaluation

- Dark Cyan White Minimalist English Functions of Communication PresentationDocument52 pagesDark Cyan White Minimalist English Functions of Communication PresentationJamaira CruzPas encore d'évaluation

- Class 4 - Co. Law Notes Crash Course - 16.07.2020Document59 pagesClass 4 - Co. Law Notes Crash Course - 16.07.2020Shubham SarkarPas encore d'évaluation

- E. Power To Acquire Own Shares: Inc., G.R. No. 216130, August 3, 2016Document26 pagesE. Power To Acquire Own Shares: Inc., G.R. No. 216130, August 3, 2016Al PaglinawanPas encore d'évaluation

- Ix. Rights of Stockholders and Members 1. Pre-Emptive Right SEC. 38. Power To Deny Preemptive Right.Document9 pagesIx. Rights of Stockholders and Members 1. Pre-Emptive Right SEC. 38. Power To Deny Preemptive Right.Maisie ZabalaPas encore d'évaluation

- Corporation For Final - Docx 2Document3 pagesCorporation For Final - Docx 2Marygrace MalilayPas encore d'évaluation

- 7 Bonus Right IssueDocument17 pages7 Bonus Right IssueKaram SinghPas encore d'évaluation

- Subscription ContractDocument11 pagesSubscription ContractDJ ULRICHPas encore d'évaluation

- Business Law and Regulations - Notes - FinalsDocument20 pagesBusiness Law and Regulations - Notes - FinalsChenary Magne FetalsanaPas encore d'évaluation

- MOM February 15, 2022Document4 pagesMOM February 15, 2022Vedia Genon IIPas encore d'évaluation

- Corporation Law After Midterms ReviewerDocument181 pagesCorporation Law After Midterms Reviewericeiceice023Pas encore d'évaluation

- Corp Code FinalDocument3 pagesCorp Code FinalEunice HPas encore d'évaluation

- Corporation Law 3 Exam Reviewer IhipnghanginDocument12 pagesCorporation Law 3 Exam Reviewer IhipnghanginJohn SanchezPas encore d'évaluation

- Part II Incorporation and Corporate ExistenceDocument7 pagesPart II Incorporation and Corporate ExistenceMeAnn TumbagaPas encore d'évaluation

- Merc ReviewerDocument44 pagesMerc ReviewerJude ChicanoPas encore d'évaluation

- Chapter 12 - Share CapitalDocument18 pagesChapter 12 - Share CapitalK59 Vo Doan Hoang AnhPas encore d'évaluation

- Borrowing Powers of CompanyDocument25 pagesBorrowing Powers of CompanySai PhaniPas encore d'évaluation

- Convertible Debentures: Convert Debt Into EquityDocument4 pagesConvertible Debentures: Convert Debt Into EquityPrateek MishraPas encore d'évaluation

- Buslaw Finals Part 3Document3 pagesBuslaw Finals Part 3ikeu ikuePas encore d'évaluation

- Corporate Law Lecture No. 4Document3 pagesCorporate Law Lecture No. 4omar hashmiPas encore d'évaluation

- Sample Trustee Trust DeclarationDocument9 pagesSample Trustee Trust DeclarationShahrani KassimPas encore d'évaluation

- Revised Corporation Code of The PhilippinesDocument25 pagesRevised Corporation Code of The PhilippinescarabaldovinoPas encore d'évaluation

- Capital StructureDocument5 pagesCapital StructureKristine SacatropezPas encore d'évaluation

- Corporation Code NotesDocument2 pagesCorporation Code NotesRish DalePas encore d'évaluation

- Share Capital and SharesDocument8 pagesShare Capital and SharesmathibettuPas encore d'évaluation

- 4 Powers LiabilitiesDocument5 pages4 Powers LiabilitiesMirai KuriyamaPas encore d'évaluation

- MIDTERMSDocument6 pagesMIDTERMSMekaella Reu HermosoPas encore d'évaluation

- Borrowing Powers of A Company - PDFDocument23 pagesBorrowing Powers of A Company - PDFDrRupali GuptaPas encore d'évaluation

- Raising of CapitalDocument40 pagesRaising of CapitalIsh ChitranshiPas encore d'évaluation

- Module 3Document22 pagesModule 3Noel S. De Juan Jr.Pas encore d'évaluation

- Notes: Right of Pre-Emption of StockholdersDocument17 pagesNotes: Right of Pre-Emption of Stockholdersfrancis abogadoPas encore d'évaluation

- RCCP WK8-PT2 Watered StocksDocument3 pagesRCCP WK8-PT2 Watered StocksReen DomingoPas encore d'évaluation

- Securities of Company - SharesDocument27 pagesSecurities of Company - SharesDavid OPas encore d'évaluation

- Constitution For A Private Company Limited by Shares. Companies Act 2019 (Act 992)Document13 pagesConstitution For A Private Company Limited by Shares. Companies Act 2019 (Act 992)sharonreich114Pas encore d'évaluation

- RCC - Power of CorpDocument8 pagesRCC - Power of CorpStefhanie Khristine PormanesPas encore d'évaluation

- Law On Private Corporation (Title 12)Document4 pagesLaw On Private Corporation (Title 12)Dahyun DahyunPas encore d'évaluation

- Borrowing Powers DebenturesDocument9 pagesBorrowing Powers DebenturesNeha ShahPas encore d'évaluation

- Group 3 Corporate StocksDocument64 pagesGroup 3 Corporate StocksElain RagosPas encore d'évaluation

- Company Law and Secreterial Practice-IIDocument31 pagesCompany Law and Secreterial Practice-IIraghavsairam39Pas encore d'évaluation

- CA Shubham Singhal Chapter 5 - Acceptance of Deposit 1655947030Document10 pagesCA Shubham Singhal Chapter 5 - Acceptance of Deposit 1655947030Priyanshu DewanganPas encore d'évaluation

- Company Law ProjectDocument11 pagesCompany Law ProjectJyotsna AggarwalPas encore d'évaluation

- 1.nationality of CorporationDocument10 pages1.nationality of CorporationMark John Borreros CabanPas encore d'évaluation

- Chapter 5 - Deposit VfinalDocument9 pagesChapter 5 - Deposit VfinalAryan KapoorPas encore d'évaluation

- CourseMat Issue and Redemption of Debentures (Along With Solution)Document31 pagesCourseMat Issue and Redemption of Debentures (Along With Solution)chaityashahPas encore d'évaluation

- DEBENTURESDocument9 pagesDEBENTURESKajal RaiPas encore d'évaluation

- Unit Allotment of Shares: ObjectivesDocument16 pagesUnit Allotment of Shares: ObjectivesAbhimanyu SinghPas encore d'évaluation

- CorpoDocument4 pagesCorpoIrish AlonzoPas encore d'évaluation

- Chapter Vi: Rights of Stockholders and MembersDocument7 pagesChapter Vi: Rights of Stockholders and MembersAlvin Aparijado EmolagaPas encore d'évaluation

- Constitution of India - SyllabusDocument1 pageConstitution of India - SyllabusDavidPas encore d'évaluation

- High-Frequency Trading - Reaching The LimitsDocument5 pagesHigh-Frequency Trading - Reaching The LimitsBartoszSowulPas encore d'évaluation

- Rr310106 Managerial Economics and Financial AnalysisDocument9 pagesRr310106 Managerial Economics and Financial AnalysisSRINIVASA RAO GANTAPas encore d'évaluation

- Rental ApplicationDocument1 pageRental Applicationnicholas alexanderPas encore d'évaluation

- Chapter 14 Firms in Competitive Markets PDFDocument38 pagesChapter 14 Firms in Competitive Markets PDFWasiq BhuiyanPas encore d'évaluation

- Echavez v. Dozen Construction PDFDocument3 pagesEchavez v. Dozen Construction PDFCathy BelgiraPas encore d'évaluation

- Nestle Multinational CompanyDocument3 pagesNestle Multinational CompanyShebel AgrimanoPas encore d'évaluation

- On Nontraditional TrademarksDocument80 pagesOn Nontraditional Trademarksshivanjay aggarwalPas encore d'évaluation

- Company Law - Lecture Notes Definition of A "Company"Document105 pagesCompany Law - Lecture Notes Definition of A "Company"namukuve aminaPas encore d'évaluation

- TC1848 OmniPCX Enterprise Installation Procedure For Version J1.410.60 en Ed02Document44 pagesTC1848 OmniPCX Enterprise Installation Procedure For Version J1.410.60 en Ed02Asnake TegenawPas encore d'évaluation

- DCRIMPRO - G.R. No. 208404, February 24, 2016Document90 pagesDCRIMPRO - G.R. No. 208404, February 24, 2016Joseph DimalantaPas encore d'évaluation

- Domestic ViolenceDocument27 pagesDomestic Violenceparvinshaikh9819Pas encore d'évaluation

- Civil Procedure CaseDocument3 pagesCivil Procedure CaseEarl Ian DebalucosPas encore d'évaluation

- 5 Engineering - Machinery Corp. v. Court of Appeals, G.R. No. 52267, January 24, 1996.Document16 pages5 Engineering - Machinery Corp. v. Court of Appeals, G.R. No. 52267, January 24, 1996.June DoriftoPas encore d'évaluation

- Quotation For Am PM Snack and Lunch 100 Pax Feu Tech 260Document3 pagesQuotation For Am PM Snack and Lunch 100 Pax Feu Tech 260Heidi Clemente50% (2)

- 001 History Chapter 8 Class 6Document2 pages001 History Chapter 8 Class 6Basveshwara RisawadePas encore d'évaluation

- Basis of Institutional Capacity Building of Rural-Local Government in Bangladesh: A Brief DiscussionDocument9 pagesBasis of Institutional Capacity Building of Rural-Local Government in Bangladesh: A Brief DiscussionA R ShuvoPas encore d'évaluation

- Orthorectification ModuleDocument22 pagesOrthorectification ModuleCatalino CastilloPas encore d'évaluation

- Adjusting Entries For Merchandising (4 Step) : Merchandising Concern Manufacturing ConcernDocument1 pageAdjusting Entries For Merchandising (4 Step) : Merchandising Concern Manufacturing ConcernyzaPas encore d'évaluation

- Eng Vs LeeDocument2 pagesEng Vs LeeRon AcePas encore d'évaluation

- Abayan, Angela Christine M. Bsba-Ma 4 SAP 6:31-8:01 TTHDocument16 pagesAbayan, Angela Christine M. Bsba-Ma 4 SAP 6:31-8:01 TTHarbejaybPas encore d'évaluation

- Roman EmperorsDocument10 pagesRoman EmperorsAbdurrahman Shaleh ReliubunPas encore d'évaluation

- Banking SystemDocument5 pagesBanking SystemAdewole calebPas encore d'évaluation

- 5 Challenges in SG's Social Compact (Tham YC and Goh YH)Document5 pages5 Challenges in SG's Social Compact (Tham YC and Goh YH)Ping LiPas encore d'évaluation

- Inter Regional Transfer FormDocument2 pagesInter Regional Transfer FormEthiopian Best Music (ፈታ)Pas encore d'évaluation

- Project Cerberus Processor Cryptography SpecificationDocument16 pagesProject Cerberus Processor Cryptography SpecificationabcdefghPas encore d'évaluation

- Global GovernanceDocument2 pagesGlobal GovernanceRosee D.Pas encore d'évaluation