Académique Documents

Professionnel Documents

Culture Documents

Ibef

Transféré par

Miloni BagadiaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Ibef

Transféré par

Miloni BagadiaDroits d'auteur :

Formats disponibles

UNITED

PHOSPHORUS

UPL has sucessfully transformed itself froma UPL's history of acquisitions and registrations

domestic insecticide player to a global generic

1994 Acquired MTM Agrochem, UK

agrochemicals player. 1996 Acquired Agrodan a/s Denmark

1996 Acquired ‘Devrinol’ from Zeneca for USA

1999 Acephate registration in USA

Background 1999 ALP fumigation patent in USA

2000 Acquired ‘Devrinol’ from Zeneca for Japan

UPL Limited (UPL), incorporated in 1969 as a 2000 Permethrin registration in USA

2002 Cypermethrin registration in USA

domestic insecticide company, has successfully 2002 Acquired Midland Fumigants in Europe

established itself as a global agrochemical player. It 2003 Acquired Oryzalin a herbicide from DOW

has reduced its dependence on the ageing 2003 Acquired Aciflurofen a herbicide from BASF

2004 2 new registrations in Europe;

organophosphates-based insecticides and increased Acquired Agrahe Inc., USA

the range of pyrethroid based insecticides and has 2005 Acquired Cequisa, Spain and Shaw Wallace

made a foray into the fast growing herbicides Agrochem, India

2006 Acquired Advanta (seed business),

segment.Today it is one of the largest agrochemical The Netherlands

companies in the domestic market and the world's .Source: Research reports, IMaCS Research

sixth largest generic agrochemical player and the

largest producer of Aluminium Phosphide and different applications (i.e. by widening usage) and in

Napropamide. different countries the company has achieved a

market share of 15-20 per cent in its key products.

Through acquisitions, strategic alliances and Some of UPL's important products in the global

subsidiaries, UPL has built a global network spanning market and their market shares are impressive -

86 countries. It has also assiduously built its Aciflurofen (100 per cent),Acephate (23 per cent),

distribution network, which has helped the company Oryazalin (24 per cent) and Napropamide (67 per

grow substantially in the international market. cent). In 2005, UPL made three strategic acquisitions.

Availability of a large product basket is a key success It acquired CEQUISA (Spanish Agrochem Company

factor in the generics market. UPL has about 15-20 with 400 registrations world-wide), SWAL

registrations to its name, with 12 registrations in Corporation Limited (oldest agrochemical player in

USA and 9 in Europe, the two most important India) and REPOSO (Argentine company with more

markets. By registering the same products for than 30 registrations in Argentina).

Company Products Established Founder Distribution Production plants

United Agrochemicals 1969 Lalit Sharma India, Americas, India, UK

Phosphorus & Associates, Europe, Middle East,

D. Shekhawat Asia Pacific, Africa

175

UPL's approach of forward and backward

integration helped in reliable supply of raw

materials for multi-site manufacturing through an

extensive downstream range of products and

services. UPL pioneered 'backward integration' in

agrochemicals and is one of the world's few

companies to manufacture complex organo-

phosphorus compounds starting from the basic raw

material. It has eight manufacturing plants (seven in

India and one in UK) all of which are ISO

compliant.

The promoters hold around 33 per cent of the

equity and the foreign institutional investor holding

is around 20 per cent. Non-resident Indians and

overseas corporate bodies hold close to 12 per

cent of the equity capital. Indian financial

institutions hold about hold 20 per cent of the

equity.The Indian public holds around 12 per cent

shares of the company and corporate entities hold

about 3 per cent shares.

UPL has also focused on reducing its dependence

Products and Brands on insecticides (particularly organophosphates),

which has can be traced to UPL's foundations in

UPL is the largest producer in India of crop phosphorous chemistry and the nature of the

protection products with a wide range of products Indian agrochemical market.The recent acquisitions

that include fumigants, fungicides, insecticides, have helped UPL in increasing the share of

rodenticides and herbicides and has established a herbicides in its turnover sharply since the year

broad product line that caters to the crop 2002.

protection needs of a plant during all stages of

growth. UPL offers 'total crop protection' with a Financial Analysis

comprehensive product range and a sales support

operation in every continent. With the globalisation of the operations, the

company witnessed a 42.1 per cent CAGR in its

Its strong product portfolio includes proprietary gross sales between 1999 and 2005, with gross

brands like Surflan, SAAF, Ultra Blazer, Storm, sales reaching US$ 253 million in 2005. It has

Devrinol, Quickphos, Starthene and Sterameal. In witnessed 101 per cent CAGR in its exports

the global agrochemicals business, generic players between 1999 and 2005, with exports reaching

require a large portfolio of products and the US$ 136 million in 2005. Close to 55 per cent of

lengthy registration process poses a major barrier the turnover is from exports.The company, which

to entry. UPL is well positioned on this front as it was loss making till 2002, was able to achieve a

has diligently built its product portfolio over the turnaround in the year 2004 due to better

last decade. realisations, mainly from exports. Gross margins on

176

exports are of the order of 75 per cent, which is characterised by stagnating markets and stricter

significantly higher than the 30 per cent margins in regulatory requirements. It is therefore essential

the domestic market. UPL shifted some of its for agrochemical players to have a strong R&D

production from its UK plant to India that also base. UPL has four development centres in India

helped reduce cost. The domestic demand in the and UK and has been successful in developing new

year 2005 has been extremely good due to good process technology and new formulations.With

rainfall throughout the country. over 50 per cent of the revenues from exports and

The return on capital employed has increased over a significant manufacturing and research presence

the years due to a debt repayment, which will also overseas, UPL clearly established itself as a strong

help in bring down the interest cost by more than Indian player in the highly competitive global

50 per cent over the next two years.The debt- agrochemicals market dominated by giants such as

equity ratio has reduced from 1.1 in the year 1999 Dow Chemicals, Syngenta, Bayer, BASF and DuPont.

to 0.84 in the year 2005, and is expected to reduce

further to 0.40 over the next two years, which will UPL's global presence is backed by its subsidiaries

provide UPL significant financial flexibility to raise across 20 countries outside India in Argentina,

resources. Australia, Bangladesh, Brazil, Canada, China,

Denmark, Hong Kong, Indonesia, Japan, Korea,

UPL's contribution in making 'Made in Mexico, New Zealand, Russia, South Africa,Taiwan,

India” global USA, UK,Vietnam and Zambia. It also has

representative offices in France, Germany, Sri Lanka

UPL started its international operations by and Vietnam. Its key international markets are USA,

acquiring smaller products and increasing product Europe, Australia and Japan.The mission of UPL's

registrations in newer markets.The company US subsidiary is to become the premier supplier of

started exports in early 1990s, which were post-patent technologies for the agricultural and

primarily to the Middle East and East Asia initially. speciality products industries throughout the

Through acquisitions (of MTM, Agrodan and United States and Canada. It offers a strong

Midland Fumigants) in the second half of 1990s, the portfolio of agronomic tools such as post-patent

company has established a strong foothold in metribuzin, cypermethrin, bifenthrin and acephate

Europe and USA. UPL has undergone a ten year products, and sugar beet herbicides, as well as

gestation process in the industry; it currently has proprietary branded products including Surflan,

15-20 registrations in the US and EU markets and Devrinol, Storm and Ultra Blazer herbicides. Its

strong relationships with most global distribution most recent acquisition is Ag Value, a major

majors.With improving cashflows and the recent marketer of post-patent products, located in Visalia,

capital raising (US$ 70 million through the Foreign California.

Currency Convertible Bonds [FCCB]) the company

is looking for more acquisitions. The company has a strong presence in Europe as

well. Apart from having offices and distribution

UPL continued its strategy of acquisitions coupled network, the majority of UK products are

with new registrations with good effect to ensure a formulated at its plant in UK.The plant is capable

large basket of product offering. UPL's strategy is of producing a wide range of sophisticated

to initially focus on products with a market of less formulations both for its own needs and as a toll

than US$ 50 million enabling it to increase its formulator for many other multinational

portfolio.The global agrochemical market is companies

177

UPL Australia was incorporated in 1994 and has agrochemical. UPL has excellent track record in

obtained several registrations for the Group's this area, which enables it to manufacture off-

products. Its initial focus was on the niche grain patent/ generic products with the lowest cost.

storage and horticulture market, though in the The development of new formulations is another

recent years UPL Australia is expanding its activities priority, with the company having a strong

in cotton and other broad acre crops. UPL portfolio of greater than 100 products.

Australia expects to launch three products each

year in different crop segments and is also working • Strong product pipeline: UPL has a large

on obtaining agency agreements from other product basket in the generics market and a

multinational companies into Australia. Besides the strong history of registrations in USA and

domestic Australian market, UPL Australia also Europe, the two most important markets. Having

markets its products in New Zealand and Papua a large product portfolio has helped UPL in

New Guinea and is expecting to expand into building strong relationships with global

specific markets in the Asia Pacific region. Its aim is distribution companies which is critical in the

to rank among the top five Crop Protection and highly competitive global agrochemical business.

Specialty Chemicals supplier in the region.

• Ability to acquire brands and make new

Headquartered in Tokyo, UP-Japan is a joint venture registrations: Over the years, UPL has acquired

of UPL Ltd, India with Mitsui & Co in Japan. UP- various products and companies in developed

Japan markets speciality crop protection products. markets in order to expand its presence in these

Its products include herbicides, insecticides, grain countries. UPL is likely to continue its policy of

fumigants, fungicides and rodenticides. UP-Japan is acquisitions and expand its market reach.

pursuing an aggressive growth strategy with plans

to introduce new products every year.

Factors fuelling UPL's global initiatives

UPL's growth in the global markets has been driven

by various factors:

• Strong R&D set up: UPL operates four

development centres in India and UK and has

access to Agrodan's (Danish company acquired

by UPL in 1997) formulation development facility

in Denmark. In addition, the company has direct

access to the Jai Research Foundation (JRF)

established by the promoters of UPL, which

operates independently. JRF specialises in

providing research data for agrochemical

registration requirements and has achieved Good

Laboratory Practices (GLP) status.The company

devotes much of its research effort to developing

new process technology for manufacturing

178

• Diversification into newer products and company expects the financial year 2005-06 to end

segments: In the last few years, UPL has reduced its with a record performance in terms of enhanced

dependence on its ageing insecticide range based market presence in the formulation space with a

on organophosphates.The company has increased big lead in its industry ranking”.

its range of pyrethroid based insecticides along

with increased focus on the herbicides segment

where it had weak presence.The acquisition of two

new products in 2003 from global majors has

helped UPL expand its presence in the herbicides

market- particularly the Specialty crops segment.

UPL has also recently started focusing on more

profitable and fast growing non-crop segment.

Future plans

Consumption of agrochemicals in India is very low

and a huge growth potential exists.The Specialty

chemicals and chlor-alkali businesses of UPL are

expected to do well on account of growing

demand from down stream industries. Off-patent /

generic products, the mainstay of UPL's portfolio,

constitutes the most lucrative segment of the US$

28 billion agrochemicals space.The products are

highly profitable and their share is increasing in an

otherwise stagnant market. By 2007, off-patent /

generics are expected to account for 70 per cent

of the total market. UPL has raised around US$

140 million in the month of December 2005

through FCCBs, the proceeds of which will be used

mainly for expansion, modernisation and

acquisitions. Globalisation at a glance

• Subsidiaries in 20 countries outside India, including

UPL pioneered 'backward integration' in the the large markets of US, Europe, Australia and

agrochemical space and is one of the world's few Japan, and the growing markets of Latin America

companies to manufacture complex Organo- • Representative offices in France, Germany, Sri

phosphorus compounds starting from the basic raw Lanka and Vietnam

material, rock phosphate ore. UPL is now planning • Manufacturing plants in UK and Argentina

to extend this strategy to other products, the most • Development centre in UK

recent being an integrated caustic chlorine plant • Strong history of growth in global markets through

using the latest membrane technology, creating acquisitions

basic building blocks for agrochemical and Specialty • Exports constitute nearly 55 per cent of sales

chemicals. According to Bhupen Dubey,Vice

President - Sales & Marketing (Formulations), “The www.uplonline.com

179

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Project Report On Gems and Jewelry IndustryDocument61 pagesProject Report On Gems and Jewelry IndustryAmy Sharma53% (15)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- 2016 Search Fund Primer (Final) PDFDocument88 pages2016 Search Fund Primer (Final) PDFmeriyenyPas encore d'évaluation

- Economics Instrument in International RelationsDocument11 pagesEconomics Instrument in International RelationsHutomoDanuS100% (1)

- Ch-12 Recommending Model Portfolios and Financial PlansDocument8 pagesCh-12 Recommending Model Portfolios and Financial PlansrishabhPas encore d'évaluation

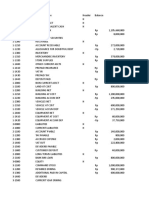

- Baker TallyDocument16 pagesBaker TallyAkash79Pas encore d'évaluation

- FCCB Project by - Ankit BhansaliDocument39 pagesFCCB Project by - Ankit BhansaliAnkit BhansaliPas encore d'évaluation

- Fina1003abc - Hw#4Document4 pagesFina1003abc - Hw#4Peter JacksonPas encore d'évaluation

- GE MatrixDocument6 pagesGE MatrixManish JhaPas encore d'évaluation

- Privatization and Privatization in KenyaDocument26 pagesPrivatization and Privatization in Kenyaelinzola92% (12)

- Coa MyobDocument4 pagesCoa Myobalthaf alfadliPas encore d'évaluation

- Trading Companies: Rating MethodologyDocument31 pagesTrading Companies: Rating Methodologychandrakala007Pas encore d'évaluation

- Internship ReportDocument69 pagesInternship Reportshaolin Sifat60% (5)

- Theory of Accounts With AnswersDocument14 pagesTheory of Accounts With Answersralphalonzo100% (1)

- MDCM (B)Document13 pagesMDCM (B)VinayKumarPas encore d'évaluation

- Network of Global Corporate Control. Swiss Federal Institute of Technology in ZurichDocument36 pagesNetwork of Global Corporate Control. Swiss Federal Institute of Technology in Zurichvirtualminded100% (2)

- Accounting - The Ultimate TemplateDocument8 pagesAccounting - The Ultimate TemplateNatashaZaPas encore d'évaluation

- Chapter 01Document10 pagesChapter 01ShantamPas encore d'évaluation

- Jeff BezosDocument22 pagesJeff BezosKadiripuram ArjunPas encore d'évaluation

- Chapter 12 (Income Tax On Corporations)Document10 pagesChapter 12 (Income Tax On Corporations)libraolrackPas encore d'évaluation

- How Bank Makes MoneyDocument2 pagesHow Bank Makes MoneyudaykumarPas encore d'évaluation

- Business Finance PDFDocument372 pagesBusiness Finance PDFNguyen Binh Minh100% (1)

- Kota Fibres ExhibitsDocument13 pagesKota Fibres ExhibitsHaemiwan FathonyPas encore d'évaluation

- 13 Accounting Cycle of A Service Business 2Document28 pages13 Accounting Cycle of A Service Business 2Ashley Judd Mallonga Beran60% (5)

- DocumentDocument2 pagesDocumenttharshini rajPas encore d'évaluation

- ICICI Project ReportDocument18 pagesICICI Project ReportTamanna RanaPas encore d'évaluation

- HDFC and Sbi ReportDocument45 pagesHDFC and Sbi ReportÂShu KaLràPas encore d'évaluation

- Standalone Financial Results For March 31, 2016 (Result)Document3 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Obstacle To Regulate HawalaDocument57 pagesObstacle To Regulate HawalaNitesh KumawatPas encore d'évaluation

- Business Finance - Midterm Exams Problem 3Document2 pagesBusiness Finance - Midterm Exams Problem 3Rina Lynne BaricuatroPas encore d'évaluation

- Wipro AR07 - 08Document132 pagesWipro AR07 - 08pkpraveenPas encore d'évaluation