Académique Documents

Professionnel Documents

Culture Documents

Markets and Commodity Figures: Total Market Turnover Statistics

Transféré par

Tiso Blackstar Group0 évaluation0% ont trouvé ce document utile (0 vote)

20 vues3 pagesBonds - May 16 2018

Titre original

150518 Bonds

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentBonds - May 16 2018

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

20 vues3 pagesMarkets and Commodity Figures: Total Market Turnover Statistics

Transféré par

Tiso Blackstar GroupBonds - May 16 2018

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 3

Markets and Commodity figures

15 May 2018

Total Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Deals Nominal Consideration Deals Nominal Consideration

Current Day 973 43.73 bn Rbn 46.71 656 73.84 bn Rbn 72.63

Week to Date 1 963 70.21 bn Rbn 75.46 948 119.04 bn Rbn 116.82

Month to Date 13 582 409.61 bn Rbn 435.18 3 130 405.29 bn Rbn 402.46

Year to Date 113 859 3 563.47 bn Rbn 3 729.72 28 174 3 600.89 bn Rbn 3 661.02

Foreign Client Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Party Deals Nominal Consideration Deals Nominal Consideration

Buy 89 4.84 bn Rbn 5.12 17 1.49 bn Rbn 1.39

Current Day Sell 120 6.09 bn Rbn 6.63 25 4.15 bn Rbn 3.92

Net -31 -1.25 bn Rbn -1.51 -8 -2.66 bn Rbn -2.53

Buy 181 10.07 bn Rbn 10.62 26 2.35 bn Rbn 2.26

Week to Date Sell 195 10.83 bn Rbn 11.99 53 9.94 bn Rbn 9.03

Net -14 -0.76 bn Rbn -1.37 -27 -7.58 bn Rbn -6.78

Buy 894 46.00 bn Rbn 48.52 138 15.76 bn Rbn 14.67

Month to Date Sell 954 60.20 bn Rbn 64.24 215 41.51 bn Rbn 42.26

Net -60 -14.20 bn Rbn -15.71 -77 -25.75 bn Rbn -27.59

Buy 7 899 445.35 bn Rbn 466.58 1 324 155.76 bn Rbn 148.60

Year to Date Sell 7 325 440.29 bn Rbn 464.99 1 852 548.10 bn Rbn 592.74

Net 574 5.06 bn Rbn 1.58 -528 -392.34 bn Rbn -444.14

Index Levels

Code Index Yield Index Previous Return MTD Return YTD

ALBI20 8.883%

All Bond Index Top 617.675

20 Composite 624.602 -2.09% 5.05%

GOVI 8.928%Split - 613.938

ALBI20 Issuer Class GOVI 621.168 -2.15% 4.66%

OTHI 8.750%

ALBI20 Issuer Class Split - 633.957

OTHI 640.001 -1.91% 6.13%

CILI15 2.525%

Composite Inflation 257.198

Linked Index Top 15 257.396 0.43% 1.77%

ICOR 3.404%

CILI15 Issuer Class 282.471

Split - ICOR 282.614 0.58% 4.29%

IGOV 2.485%

CILI15 Issuer Class 256.022

Split - IGOV 256.227 0.42% 1.68%

ISOE 3.135%

CILI15 Issuer Class 256.664

Split - ISOE 256.579 0.71% 2.43%

MMI JSE Money Market Index

0 238.276 238.229 0.29% 2.79%

ALBI Constituent Bonds

Bond Issuer Maturity MTM Previous YTD Low YTD High

R159 REPUBLIC OF SOUTH

Jan 2020

AFRICA 7.345% 7.190% 6.58% 7.35%

R203 REPUBLIC OF SOUTH

Feb 2020

AFRICA 8.585% 8.430% 7.69% 8.59%

ES18 ESKOM HOLDINGS

MarLIMITED

2021 7.560% 7.410% 6.87% 7.59%

R204 REPUBLIC OF SOUTH

Jan 2023

AFRICA 9.025% 8.870% 8.35% 9.03%

R207 REPUBLIC OF SOUTH

Feb 2023

AFRICA 9.260% 9.105% 8.57% 9.26%

R208 REPUBLIC OF SOUTH

Feb 2023

AFRICA 7.885% 7.730% 7.24% 7.94%

ES23 ESKOM HOLDINGSAprLIMITED

2026 9.755% 9.605% 9.17% 9.85%

DV23 DEVELOPMENT DecBANK

2026

OF SOUTHERN

8.475% AFRICA 8.325% 7.88% 8.64%

R2023 REPUBLIC OF SOUTH

Jan 2030

AFRICA 8.895% 8.745% 8.28% 9.19%

ES26 ESKOM HOLDINGSFebLIMITED

2031 8.975% 8.825% 8.36% 9.25%

R186 REPUBLIC OF SOUTH

Mar 2032

AFRICA 9.070% 8.915% 8.46% 9.39%

R2030 REPUBLIC OF SOUTH

Sep 2033

AFRICA 10.565% 10.410% 9.96% 10.76%

R213 REPUBLIC OF SOUTH

Feb 2035

AFRICA 9.215% 9.055% 8.61% 9.58%

R2032 REPUBLIC OF SOUTH

Mar 2036

AFRICA 9.235% 9.080% 8.62% 9.52%

ES33 ESKOM HOLDINGSJanLIMITED

2037 9.300% 9.145% 8.69% 9.68%

R209 REPUBLIC OF SOUTH

Jan 2040

AFRICA 9.385% 9.230% 8.76% 9.77%

R2037 REPUBLIC OF SOUTH

Feb 2041

AFRICA 9.370% 9.215% 8.73% 9.74%

R214 REPUBLIC OF SOUTH

Apr 2042

AFRICA 10.760% 10.605% 10.13% 11.05%

R2044 REPUBLIC OF SOUTH

Jan 2044

AFRICA 9.425% 9.270% 8.80% 9.82%

R2048 REPUBLIC OF SOUTH

Feb 2048

AFRICA 9.400% 9.245% 8.76% 9.77%

Other Rates

Code Description Rate Previous YTD Low YTD High

SAFEX SAFEX Overnight Deposit Rate6.310% 6.310% 6.31% 6.56%

JIBAR1 JIBAR 1 Month 6.675% 6.675% 6.63% 6.92%

JIBAR3 JIBAR 3 Month 6.900% 6.900% 6.87% 7.16%

JIBAR6 JIBAR 6 Month 7.400% 7.400% 7.38% 7.60%

RSA 2 year retail bond 7.50% 0 0 0

RSA 3 year retail bond 7.75% 0 0 0

RSA 5 year retail bond 8.25% 0 0 0

RSA 3 year inflation linked retail

3.00%

bond 0 0 0

RSA 5 year inflation linked retail

3.25%

bond 0 0 0

RSA 10 year inflation linked retail

3.50%

bond 0 0 0

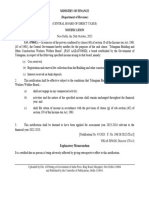

Nominal Bond Curves (NACS)

9.62

9.12

8.62

8.12

7.62

7.12 Zero

6.62 Par/Swap

6.12

5.62

5.12

4.62

2015 2020 2026 2031 2037 2042 2048 2053 2059

DATA DISCLAIMER

To the extent allowed by law, JSE Limited (the JSE) does not (expressly, tacitly or implicitly) guarantee or warrant the availability,

sequence, accuracy, completeness, reliability or any other aspect of any of the data (Data), or that any Data is up to date.

To the extent allowed by law, neither the JSE nor any of its directors, officers, employees, contractors, agents or representatives are

liable in any way to the reader or to any other natural or juristic person (Person) for any loss or damage as a result of (i) the display

of any Data in this bulltetin, or (ii) any Data being unavailable in this bulletin at any time and for any reason, or (iii) any delay,

inaccuracy, error, or omission in relation to any Data, or (iv) any actions taken or not taken by or on behalf of any Person in reliance

on any Data. The JSE is entitled to terminate the production of any Data at any time, without notice and without liability to any Person.

These figures are supplied by parties external to Business Day. Business Day will not warrant the accuracy of the figures.

Vous aimerez peut-être aussi

- International Macroeconomics: A Modern ApproachD'EverandInternational Macroeconomics: A Modern ApproachPas encore d'évaluation

- Bonds - March 6 2018Document6 pagesBonds - March 6 2018Tiso Blackstar GroupPas encore d'évaluation

- Bonds - May 29 2018Document3 pagesBonds - May 29 2018Tiso Blackstar GroupPas encore d'évaluation

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupPas encore d'évaluation

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupPas encore d'évaluation

- Bonds - April 25 2018Document3 pagesBonds - April 25 2018Tiso Blackstar GroupPas encore d'évaluation

- Bonds - April 13 2018Document6 pagesBonds - April 13 2018Tiso Blackstar GroupPas encore d'évaluation

- Bonds - May 10 2018Document3 pagesBonds - May 10 2018Tiso Blackstar GroupPas encore d'évaluation

- Bonds - April 18 2018Document3 pagesBonds - April 18 2018Tiso Blackstar GroupPas encore d'évaluation

- Bonds - July 9 2020Document3 pagesBonds - July 9 2020Lisle Daverin BlythPas encore d'évaluation

- Bonds - August 16 2018Document3 pagesBonds - August 16 2018Tiso Blackstar GroupPas encore d'évaluation

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupPas encore d'évaluation

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupPas encore d'évaluation

- Bonds - April 2 2020Document3 pagesBonds - April 2 2020Lisle Daverin BlythPas encore d'évaluation

- Bonds - May 17 2018Document3 pagesBonds - May 17 2018Tiso Blackstar GroupPas encore d'évaluation

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupPas encore d'évaluation

- Bonds - April 23 2020Document3 pagesBonds - April 23 2020Lisle Daverin BlythPas encore d'évaluation

- Bonds PDFDocument3 pagesBonds PDFTiso Blackstar GroupPas encore d'évaluation

- Bonds - February 27 2018Document3 pagesBonds - February 27 2018Tiso Blackstar GroupPas encore d'évaluation

- Bonds - July 18 2022Document3 pagesBonds - July 18 2022Lisle Daverin BlythPas encore d'évaluation

- Bonds - May 18 2021Document3 pagesBonds - May 18 2021Lisle Daverin BlythPas encore d'évaluation

- Bonds - September 28 2022Document3 pagesBonds - September 28 2022Lisle Daverin BlythPas encore d'évaluation

- Bonds - February 21 2018Document3 pagesBonds - February 21 2018Tiso Blackstar GroupPas encore d'évaluation

- Bonds - February 26 2019Document3 pagesBonds - February 26 2019Tiso Blackstar GroupPas encore d'évaluation

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupPas encore d'évaluation

- Bonds - August 14 2018Document3 pagesBonds - August 14 2018Tiso Blackstar GroupPas encore d'évaluation

- Bonds - March 29 2018Document6 pagesBonds - March 29 2018Tiso Blackstar GroupPas encore d'évaluation

- Bonds - August 15 2018Document3 pagesBonds - August 15 2018Tiso Blackstar GroupPas encore d'évaluation

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupPas encore d'évaluation

- Bonds - July 8 2020Document3 pagesBonds - July 8 2020Lisle Daverin BlythPas encore d'évaluation

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupPas encore d'évaluation

- Bonds - July 13 2022Document3 pagesBonds - July 13 2022Lisle Daverin BlythPas encore d'évaluation

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupPas encore d'évaluation

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupPas encore d'évaluation

- Bonds - April 26 2018Document6 pagesBonds - April 26 2018Tiso Blackstar GroupPas encore d'évaluation

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupPas encore d'évaluation

- Bonds - April 20 2018Document6 pagesBonds - April 20 2018Tiso Blackstar GroupPas encore d'évaluation

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupPas encore d'évaluation

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupPas encore d'évaluation

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupPas encore d'évaluation

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupPas encore d'évaluation

- Bonds - May 13 2021Document3 pagesBonds - May 13 2021Lisle Daverin BlythPas encore d'évaluation

- Bonds - September 18 2019Document3 pagesBonds - September 18 2019Tiso Blackstar GroupPas encore d'évaluation

- Bonds - October 16 2018Document3 pagesBonds - October 16 2018Tiso Blackstar GroupPas encore d'évaluation

- Bonds - May 30 2018Document3 pagesBonds - May 30 2018Tiso Blackstar GroupPas encore d'évaluation

- Bonds - May 12 2021Document3 pagesBonds - May 12 2021Lisle Daverin BlythPas encore d'évaluation

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupPas encore d'évaluation

- Bonds - November 9 2022Document3 pagesBonds - November 9 2022Lisle BlythPas encore d'évaluation

- Bonds - March 15 2022Document3 pagesBonds - March 15 2022Lisle Daverin BlythPas encore d'évaluation

- Bonds - February 14 2018Document3 pagesBonds - February 14 2018Tiso Blackstar GroupPas encore d'évaluation

- Bonds - May 3 2018Document6 pagesBonds - May 3 2018Tiso Blackstar GroupPas encore d'évaluation

- Bonds - November 15 2022Document3 pagesBonds - November 15 2022Lisle Daverin BlythPas encore d'évaluation

- Bonds - December 6 2017Document3 pagesBonds - December 6 2017Tiso Blackstar GroupPas encore d'évaluation

- Bonds - April 27 2020Document3 pagesBonds - April 27 2020Lisle Daverin BlythPas encore d'évaluation

- Bonds - May 12 2020Document3 pagesBonds - May 12 2020Lisle Daverin BlythPas encore d'évaluation

- Bonds - April 28 2020Document3 pagesBonds - April 28 2020Lisle Daverin BlythPas encore d'évaluation

- Bonds - August 25 2020Document3 pagesBonds - August 25 2020Lisle Daverin BlythPas encore d'évaluation

- Bonds - May 18 2018Document3 pagesBonds - May 18 2018Tiso Blackstar GroupPas encore d'évaluation

- Bonds - April 4 2018Document3 pagesBonds - April 4 2018Tiso Blackstar GroupPas encore d'évaluation

- Shoprite Food Index 2023Document19 pagesShoprite Food Index 2023Tiso Blackstar GroupPas encore d'évaluation

- Ramaphosa's Letter To MkhwebaneDocument1 pageRamaphosa's Letter To MkhwebaneTiso Blackstar GroupPas encore d'évaluation

- Arena Holdings Pty LTD - BBBEE Certificate - 2023Document2 pagesArena Holdings Pty LTD - BBBEE Certificate - 2023Tiso Blackstar GroupPas encore d'évaluation

- Anti Corruption Working GuideDocument44 pagesAnti Corruption Working GuideTiso Blackstar GroupPas encore d'évaluation

- Ramaphosa's Letter To MkhwebaneDocument1 pageRamaphosa's Letter To MkhwebaneTiso Blackstar GroupPas encore d'évaluation

- Letter From Reuel Khoza Chairman of The Eskom Board 1999Document2 pagesLetter From Reuel Khoza Chairman of The Eskom Board 1999Tiso Blackstar GroupPas encore d'évaluation

- Collective InsightDocument10 pagesCollective InsightTiso Blackstar GroupPas encore d'évaluation

- Open Letter To President Ramaphosa - FinalDocument3 pagesOpen Letter To President Ramaphosa - FinalTiso Blackstar GroupPas encore d'évaluation

- Statement From The SA Tourism BoardDocument1 pageStatement From The SA Tourism BoardTiso Blackstar GroupPas encore d'évaluation

- Ramaphosa's Letter To MkhwebaneDocument1 pageRamaphosa's Letter To MkhwebaneTiso Blackstar GroupPas encore d'évaluation

- Letter From Reuel Khoza Chairman of The Eskom Board 1999Document2 pagesLetter From Reuel Khoza Chairman of The Eskom Board 1999Tiso Blackstar GroupPas encore d'évaluation

- JP Verster's Letter To African PhoenixDocument2 pagesJP Verster's Letter To African PhoenixTiso Blackstar GroupPas encore d'évaluation

- Sanlam Stratus Funds - June 1 2021Document2 pagesSanlam Stratus Funds - June 1 2021Lisle Daverin BlythPas encore d'évaluation

- FairbairnDocument2 pagesFairbairnTiso Blackstar GroupPas encore d'évaluation

- BondsDocument3 pagesBondsTiso Blackstar GroupPas encore d'évaluation

- JudgmentDocument30 pagesJudgmentTiso Blackstar GroupPas encore d'évaluation

- Tobacco Bill - Cabinet Approved VersionDocument41 pagesTobacco Bill - Cabinet Approved VersionTiso Blackstar GroupPas encore d'évaluation

- LibertyDocument1 pageLibertyTiso Blackstar GroupPas encore d'évaluation

- Collective Insight September 2022Document14 pagesCollective Insight September 2022Tiso Blackstar GroupPas encore d'évaluation

- BondsDocument3 pagesBondsTiso Blackstar GroupPas encore d'évaluation

- The ANC's New InfluencersDocument1 pageThe ANC's New InfluencersTiso Blackstar GroupPas encore d'évaluation

- Critical Skills List - Government GazetteDocument24 pagesCritical Skills List - Government GazetteTiso Blackstar GroupPas encore d'évaluation

- Forward Rates - June 30 2022Document2 pagesForward Rates - June 30 2022Tiso Blackstar GroupPas encore d'évaluation

- Forward Rates - June 28 2022Document2 pagesForward Rates - June 28 2022Tiso Blackstar GroupPas encore d'évaluation

- Fuel Prices - June 30 2022Document1 pageFuel Prices - June 30 2022Tiso Blackstar GroupPas encore d'évaluation

- Forward Rates - June 29 2022Document2 pagesForward Rates - June 29 2022Tiso Blackstar GroupPas encore d'évaluation

- Fuel Prices - June 28 2022Document1 pageFuel Prices - June 28 2022Tiso Blackstar GroupPas encore d'évaluation

- Axis Service Charges of Foreign ExchangeDocument9 pagesAxis Service Charges of Foreign ExchangeHimesh ShahPas encore d'évaluation

- Chapter 2-GST Part B - Value of SupplyDocument7 pagesChapter 2-GST Part B - Value of SupplyPooja D AcharyaPas encore d'évaluation

- Crypto A Succesfull Application of BlockchainDocument19 pagesCrypto A Succesfull Application of BlockchainYousef abachirPas encore d'évaluation

- CR Ma 21Document22 pagesCR Ma 21Sharif MahmudPas encore d'évaluation

- Time Value of MoneyDocument7 pagesTime Value of MoneyNida KhanPas encore d'évaluation

- Assignment 2 MBA 502 Econ Analysis - 2014Document4 pagesAssignment 2 MBA 502 Econ Analysis - 2014Thushan AmarasenaPas encore d'évaluation

- What Is EMD in Contract Work - Google SearchDocument3 pagesWhat Is EMD in Contract Work - Google SearchRanjanPas encore d'évaluation

- Valuing Banks: A New Corporate Finance ApproachDocument261 pagesValuing Banks: A New Corporate Finance Approachvadavada67% (3)

- Rural Finance and Micro FinanceDocument32 pagesRural Finance and Micro FinanceThe Cultural CommitteePas encore d'évaluation

- Exercise 2Document3 pagesExercise 2Gilang PurwoPas encore d'évaluation

- Form 1040-V: What Is Form 1040-V How To Prepare Your PaymentDocument2 pagesForm 1040-V: What Is Form 1040-V How To Prepare Your PaymentGary KrimsonPas encore d'évaluation

- Global Market Outlook - Trends in Real Estate Private EquityDocument20 pagesGlobal Market Outlook - Trends in Real Estate Private EquityYana FominaPas encore d'évaluation

- Customer Request and Complaint Form: Please Tick Relevant Request Service Request NumberDocument1 pageCustomer Request and Complaint Form: Please Tick Relevant Request Service Request NumberDesikanPas encore d'évaluation

- Momo Statement ReportDocument2 pagesMomo Statement ReportHolybabyPas encore d'évaluation

- BDO Pay Ultimate GuideDocument8 pagesBDO Pay Ultimate Guidejulius004Pas encore d'évaluation

- Substation Tender DocumentDocument97 pagesSubstation Tender DocumentthibinPas encore d'évaluation

- Unit - 3Document25 pagesUnit - 3ShriHemaRajaPas encore d'évaluation

- Sneha Burud ASWDocument7 pagesSneha Burud ASWPrathmesh KulkarniPas encore d'évaluation

- Notification 93 2023Document1 pageNotification 93 2023tax.contactPas encore d'évaluation

- How To Trade Synthetic Indices. Simple Invest FXDocument14 pagesHow To Trade Synthetic Indices. Simple Invest FXuuguludavid77Pas encore d'évaluation

- Xavier Institute of Management: PGPBFS 2010-2011Document21 pagesXavier Institute of Management: PGPBFS 2010-2011Tanmay MohantyPas encore d'évaluation

- Accounts BasicsDocument144 pagesAccounts Basicsjdon100% (1)

- Agreement IBBA-HCIM - V20211026 SignedDocument16 pagesAgreement IBBA-HCIM - V20211026 SignedНизами КеримовPas encore d'évaluation

- Test Unit Two IntermediateDocument6 pagesTest Unit Two IntermediateBernát GulyásPas encore d'évaluation

- The Fall of The House of Credit PDFDocument382 pagesThe Fall of The House of Credit PDFRichard JohnPas encore d'évaluation

- External Debt Development and Management: Presentations On IndiaDocument22 pagesExternal Debt Development and Management: Presentations On IndiaYasser KhanPas encore d'évaluation

- Asset Rotation Fund: Tactical and FlexibleDocument2 pagesAsset Rotation Fund: Tactical and FlexibleEttore TruccoPas encore d'évaluation

- Uucms - Karnataka.gov - in ExamGeneral PrintExamApplicationDocument1 pageUucms - Karnataka.gov - in ExamGeneral PrintExamApplicationmdirfaniffu5Pas encore d'évaluation

- CHAPTER 18: Mutual Funds: Types and FeaturesDocument18 pagesCHAPTER 18: Mutual Funds: Types and Featureslily northPas encore d'évaluation

- The Internet of Money Volume Three A Collection of Talks by AndreasDocument198 pagesThe Internet of Money Volume Three A Collection of Talks by AndreasawenPas encore d'évaluation