Académique Documents

Professionnel Documents

Culture Documents

Application Form - Annexure A PDF

Transféré par

Sunil KumarTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Application Form - Annexure A PDF

Transféré par

Sunil KumarDroits d'auteur :

Formats disponibles

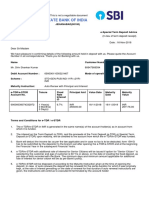

Application Form for SBI Debit Cards

The Branch Manager, Date: D D M M Y Y Y Y

State Bank of India,

____________________________ Branch

Dear Sir/Madam,

I would like to apply for SBI Debit Card issuance. The details are as under:

New Reissuance

Please tick the variant and Card network you wish to apply Domestic International

MasterCard RuPay Visa

Contactless (Available only on MasterCard/Visa International variants)

Name

(Name as you would like it to be on the Debit Card - Maximum upto 25 letters)

Address

Town/City

State

Country

PIN

Email

Mobile

Account Details:

Primary Account Account Type Savings Current

Secondary Account-1 Account Type Savings Current

Secondary Account-2 Account Type Savings Current

I hereby acknowledge that I have read and understood the terms and conditions as provided overleaf and I agree to the same.

Place: ______________________________ Signature: _______________________________________

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------ ------------------------------------------

For official usage:

Maker Checker

Ref. No. ________________________ Date:______________________ Verified and approved

Signature: _________________________________________________ Signature: __________________________ Date:___________________

TERMS & CONDITIONS k) International Transactions:

The Terms and Conditions under which the SBI Debit Card has been issued are mentioned below for your guidance. International Transactions at ATMs or POS terminals/e-Commerce should be carried out by the

a) Terms used here: Cardholder strictly in accordance with FEMA/Exchange Control Regulations in force from time to time.

Bank means State Bank of India. The Cardholder should fulfil and abide by all the guidelines issued by the Reserve Bank of India and the

Card means SBI Debit Card issued to customer. Government of India regarding international use of the Card and foreign currency transactions. In the

Cardholder means customer who has been issued SBI Debit Card. event of failure to do so, the cardholder will be solely responsible for the consequences as per the extant

PIN mean a 4-digit number allotted to the cardholder which can be generated by the customer through IVR, regulations.

SMS, SBI ATMs and internet banking. Conversion of the foreign currency amount will be done at rates decided by the various parties involved.

OTP is a 6-digit number to be used as sent to the cardholder’s registered mobile number for carrying out The Bank shall not be responsible for the rate of conversion or fluctuation in the exchange rate and

transitions or availing services securely. particulars, such rate of conversion shall be binding upon the customer.

b) Card The debit in the Cardholder's account will be in Indian Rupees. For every international transaction there

The Card is the property of the Bank and shall be returned unconditionally and immediately to the Bank are certain service charges associated, which has to be recovered from the cardholder’s account. Please

upon request by the Bank. visit https://bank.sbi for the updated service charges.

The Bank reserves the right to cancel the Card and stop its operations unilaterally without assigning any l) Transaction Costs: The Cardholder's account is liable to be debited with the additional cost for

reason. transaction(s) made at ATMs owned by the banks other than the SBI beyond the permissible limits. Please

The Card is non- transferable. visit https://bank.sbi for the updated limits.

c) PIN/OTP: The Cardholder acknowledges, represents and warrants that the PIN/OTP provides access to the m) Governing Law and Jurisdiction: Bank and Cardholder agree that any legal action or proceedings

designated account and that the Cardholder accepts the sole responsibility for use, confidentiality and arising out of Terms shall be brought in the courts or tribunals at Mumbai in India and irrevocably

protection of the PIN/OTP, as well as for all mandates and information changes entered in to the account using submitting themselves to the jurisdiction of that court or tribunal.

such PIN/OTP. The Cardholder shall not record the PIN/OTP in any form so as to protect the PIN/OTP from n) Fees and Charges:

falling into the hands of a third party. The Cardholder grants express authority to Bank for carrying out The annual fees for the Card will be debited to the primary account linked with the Card on

transactions and instructions authenticated by the PIN/OTP and shall not revoke the same. Bank has no application/renewal at the Bank's prevailing rate. The fees are not refundable.

obligation to verify the authenticity of the transaction instruction sent or purported to have been sent from the The cardholder shall maintain at all times such minimum balance in the designated account, as Bank may

Cardholder other than by means of verification of the Cardholder's PIN/OTP. The Card, therefore, should remain stipulate from time to time.

in Cardholder's possession and should not be handed over to anyone else. The Card is issued on the condition Bank reserves the right at any time to charge the cardholder for the issue or reissue of a Card and/or any

that the Bank bears no liability for the unauthorized use of the Card. This responsibility is fully that of the fees/charges for the transactions carried out by the cardholder on the Card. Please visit https://bank.sbi

Cardholder. Further the bank will not be responsible for any loss either direct or indirect on account of ATM for updated service charges.

failure/malfunctioning. o) Others

d) Loss of Card The Bank reserves the right to introduce new facilities or remove existing facilities as and when

The Cardholder should immediately block the Card through the available channels (i.e., through SMS, warranted, without assigning any reasons thereof.

internet banking, SBI Anywhere mobile app, SBI Quick mobile application, SBI Branch, etc.). The Bank may, at its discretion, refuse any application for the Card without assigning any reason. Fees

The Cardholder is responsible for the security of the Card and shall take all steps towards ensuring the charged (if any) for the use of the Card are not refundable under any circumstances.

safekeeping thereof. Further, in the event, Bank determines that the aforementioned steps are not The Bank has the right to withdraw the privilege attached to the Card and to call upon the Cardholder

complied with, financial liability on the lost or stolen Card would rest with the Cardholder. to surrender the Card through the merchant establishments, or their representatives or any other

Fresh Card will be issued in replacement of lost/damaged Card at a fee. representative of the Bank, without assigning any reason.

e) Debit to customer's account Use of the Card shall be terminated without notice, upon receiving intimation of the death, bankruptcy

The Bank has the authority of the Cardholder to debit the designated account of the Cardholder for all or insolvency of the Cardholder or on receipt of a letter from any one of the joint account holders

withdrawals and payments effected by or purported to be effected by the Cardholder using the Card, as changing the operative clause, receipt of an attachment order from a Competent court or revenue

evidenced by the Bank's records, which will be conclusive and binding on the Cardholder. authority or from RBI due to violation of FEMA/Exchange Control Regulations, or for other valid

The Cardholder expressly authorises the Bank to debit the designated account with service charges (if any) reasons or when the whereabouts of the Cardholder become unknown to the Bank due to any cause

notified by the Bank from time to time. Please visit https://bank.sbi for the updated service charges. attributable to the Cardholder.

f) Transactions: The transactions record generated by an ATM or POS terminal/e-Commerce will be binding on The ATM service is for withdrawing cash against the balance that is already available in your account.

the Cardholder and it will be conclusive unless verified otherwise and corrected by the Bank. The verified and It is therefore the Cardholder's obligation to maintain sufficient balance in the designated account to

corrected amount will be binding on the Cardholder. meet cash withdrawals and service charges.

g) Closing of Accounts: The Cardholder wishing to close the designated account and surrender the Card will The Bank at its absolute discretion may amend the Terms and. Conditions governing ATM services.

first have to give application in writing and surrender the Card along with the application. Please visit https://bank.sbi or SBI 24 x 7 help line numbers for the updated service charges.

h) Validity of Card: The validity of the Card is printed on the face of the Card. The Card is valid through to the

Note: The Bank reserves the right to introduce new facilities or remove existing facilities as and when

last date of the month of expiry.

warranted without assigning any reason for the same. However cardholder will be duly advised. Please visit

i) Renewal of Card: The Bank will automatically renew free of cost the Card on the expiry and will send the

https://bank.sbi for the updated service charges.

Card to the customer’s registered address.

j) Contact Centre: For more information and help, please call SBI's 24X7 helpline number i.e. 1800-11-2211

(toll-free), 1800-425-3800 (toll-free) or +9180-26599990. Toll free numbers are accessible from all landlines and

mobile phones in the country.

Vous aimerez peut-être aussi

- Indian Bank Debit Card Application Form 1Document2 pagesIndian Bank Debit Card Application Form 1Devil WorldPas encore d'évaluation

- SBI ATMDebit Card Application FormDocument2 pagesSBI ATMDebit Card Application Formlotusgoldy100% (1)

- Indusind Bank Customer-Request-FormDocument2 pagesIndusind Bank Customer-Request-FormShravani JayanthyPas encore d'évaluation

- Account Opening FormDocument2 pagesAccount Opening FormRAJVIR SINGH PUNIAPas encore d'évaluation

- Important Instructions For Filling Ach Mandate Form: HdfcbankltdDocument1 pageImportant Instructions For Filling Ach Mandate Form: HdfcbankltdFUTURE NEXTTIMEPas encore d'évaluation

- Resident To Nro Conversion FormDocument3 pagesResident To Nro Conversion FormAbhiruchiPas encore d'évaluation

- Debit Card Application Form: Dcaf3Document2 pagesDebit Card Application Form: Dcaf3Harpreet0gjgkbkv KaurPas encore d'évaluation

- Atm / Debit Card Application Form: Khumneicha G A O NG NDocument2 pagesAtm / Debit Card Application Form: Khumneicha G A O NG NLalrinpuii JoutePas encore d'évaluation

- Customer Request FormDocument2 pagesCustomer Request FormkysydsPas encore d'évaluation

- ATM CARD ApplicationDocument2 pagesATM CARD Applicationboggy XaiomiPas encore d'évaluation

- Atm Cum Debit Card Application FormDocument2 pagesAtm Cum Debit Card Application FormImran AhmadPas encore d'évaluation

- Commerce Topic 2Document16 pagesCommerce Topic 2Anonymous lVpFnX3Pas encore d'évaluation

- CC GiroDocument1 pageCC GirohjwhtfvttrvakjjchoPas encore d'évaluation

- HDFC RtgsDocument1 pageHDFC Rtgshanif4800Pas encore d'évaluation

- DownloadDocument6 pagesDownloadRájñîsh MôñdālPas encore d'évaluation

- IOB419201761616PM - Iob Rtgs Form PDFDocument2 pagesIOB419201761616PM - Iob Rtgs Form PDFpsgnanaprakash8686Pas encore d'évaluation

- Iob Rtgs FormDocument2 pagesIob Rtgs FormApuri Rammohan Reddy100% (1)

- Sign Up & DeclarationDocument4 pagesSign Up & DeclarationBiju KumarPas encore d'évaluation

- RTGSFormat1709722636 45107024084Document1 pageRTGSFormat1709722636 45107024084thirupathiindustries22Pas encore d'évaluation

- Kotak Mahindra Bank Rtgs Neft FormDocument1 pageKotak Mahindra Bank Rtgs Neft Formlandb1Pas encore d'évaluation

- General Standing Instruction Order Payment PDFDocument3 pagesGeneral Standing Instruction Order Payment PDFmiriam chewPas encore d'évaluation

- Asaan AccountopeningDocument7 pagesAsaan AccountopeningAbdullah IbrahimPas encore d'évaluation

- The Saraswat Co-Operative Bank Limited: National Electronic Funds Transfer (NEFT) Application FormDocument3 pagesThe Saraswat Co-Operative Bank Limited: National Electronic Funds Transfer (NEFT) Application Formpayal26Pas encore d'évaluation

- Indian Overseas Bank Application Form For Funds Transfer Under Rtgs Where ApplicableDocument2 pagesIndian Overseas Bank Application Form For Funds Transfer Under Rtgs Where ApplicableNagamuthu.SPas encore d'évaluation

- TBDDocument34 pagesTBDArjun VijPas encore d'évaluation

- NEFT RTGS FormDocument1 pageNEFT RTGS FormSalasar BuilderPas encore d'évaluation

- HDFC RTGS FormDocument1 pageHDFC RTGS FormjeeveshPas encore d'évaluation

- KDCC Bank ATM Debit Card ApplicationDocument4 pagesKDCC Bank ATM Debit Card ApplicationramPas encore d'évaluation

- Subject: SETTLEMENT OF HDFC Bank Credit Card # xxxxxxxxxxxx8614 Alternate Account Number (AAN) 0001014550008058618Document3 pagesSubject: SETTLEMENT OF HDFC Bank Credit Card # xxxxxxxxxxxx8614 Alternate Account Number (AAN) 0001014550008058618Noble InfoTechPas encore d'évaluation

- Term Deposit Related RequestsDocument2 pagesTerm Deposit Related Requestskumar281472Pas encore d'évaluation

- Neft Rtgs FormDocument1 pageNeft Rtgs FormMohit Jalan100% (1)

- Bank of Baroda NEFT FORMDocument1 pageBank of Baroda NEFT FORMAshish ParmarPas encore d'évaluation

- ECS FormatDocument10 pagesECS FormatAnto JohnPas encore d'évaluation

- Individual Account Opening Form KeDocument5 pagesIndividual Account Opening Form Kekamararichard2Pas encore d'évaluation

- Terms and Conditions - Debit CardsDocument7 pagesTerms and Conditions - Debit CardsAshan SanPas encore d'évaluation

- Bank Mandate FormDocument1 pageBank Mandate Formsrm payable100% (2)

- Please Use The Checking and Savings Account Application ToDocument4 pagesPlease Use The Checking and Savings Account Application ToAttorney AnniePas encore d'évaluation

- Application Form For Issue of Canara Debit Card 27072017Document2 pagesApplication Form For Issue of Canara Debit Card 27072017John Athaide100% (1)

- Digital Nov 2021Document64 pagesDigital Nov 2021jagadish madiwalarPas encore d'évaluation

- Digital Channel Enrollment FormDocument2 pagesDigital Channel Enrollment Formmhkhanbd23Pas encore d'évaluation

- Zero Only: Application For Funds Transfer Under Rtgs/NeftDocument1 pageZero Only: Application For Funds Transfer Under Rtgs/NeftHemanth KumarPas encore d'évaluation

- Customer Request FormDocument2 pagesCustomer Request Formniharikarllameddy.kaPas encore d'évaluation

- Ad00100972 16112018071600 PDFDocument1 pageAd00100972 16112018071600 PDFBalmukund kumarPas encore d'évaluation

- Credit Card - Customer Detail Update Form PDFDocument1 pageCredit Card - Customer Detail Update Form PDFSajjad RehmanPas encore d'évaluation

- Internet BankingDocument2 pagesInternet BankingnccbrbPas encore d'évaluation

- Customer SI Debit Authorisation FormDocument1 pageCustomer SI Debit Authorisation FormDeepak ChinuPas encore d'évaluation

- Customer SI Debit Authorisation FormDocument1 pageCustomer SI Debit Authorisation FormDeepak ChinuPas encore d'évaluation

- FORMS - RTGS - NEFT Form - pdf-2Document1 pageFORMS - RTGS - NEFT Form - pdf-2rajiv87krishnaPas encore d'évaluation

- Conversion Form Customer Undertaking For Converting Existing Savings Account To Senior Citizen AccountDocument2 pagesConversion Form Customer Undertaking For Converting Existing Savings Account To Senior Citizen AccountIlyas SafiPas encore d'évaluation

- Sweep Out FacilityDocument3 pagesSweep Out FacilityDeepankar SinghPas encore d'évaluation

- Sign Up & DeclarationDocument3 pagesSign Up & DeclarationSuper SalesPas encore d'évaluation

- Kotak Mahindra Bank: Declaration/Request To Change Residential StatusDocument4 pagesKotak Mahindra Bank: Declaration/Request To Change Residential StatusAltamash DabirPas encore d'évaluation

- Casa Closure FormDocument1 pageCasa Closure FormAli SagarPas encore d'évaluation

- Bob RtgsDocument1 pageBob RtgsD J ParmarPas encore d'évaluation

- FD Form RevisedDocument2 pagesFD Form RevisedAshutosh TiwariPas encore d'évaluation

- Form 1: Nach Form - Credit CardsDocument2 pagesForm 1: Nach Form - Credit CardsdeepinderPas encore d'évaluation

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaD'EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaPas encore d'évaluation

- Summary of Ahmed Siddiqui & Nicholas Straight's The Anatomy of the SwipeD'EverandSummary of Ahmed Siddiqui & Nicholas Straight's The Anatomy of the SwipePas encore d'évaluation

- Review of Some Online Banks and Visa/Master Cards IssuersD'EverandReview of Some Online Banks and Visa/Master Cards IssuersPas encore d'évaluation

- United Architects of The Philippines: Uap Membership Registration FormDocument2 pagesUnited Architects of The Philippines: Uap Membership Registration FormDavePas encore d'évaluation

- EGYPTIAN LITERA-WPS OfficeDocument14 pagesEGYPTIAN LITERA-WPS OfficeLemoj CombiPas encore d'évaluation

- MA-2012-Nico Vriend Het Informatiesysteem en Netwerk Van de VOCDocument105 pagesMA-2012-Nico Vriend Het Informatiesysteem en Netwerk Van de VOCPrisca RaniPas encore d'évaluation

- Pengantar Ilmu PolitikDocument12 pagesPengantar Ilmu PolitikAmandaTabraniPas encore d'évaluation

- United States v. Vincent Williams, 4th Cir. (2014)Document11 pagesUnited States v. Vincent Williams, 4th Cir. (2014)Scribd Government DocsPas encore d'évaluation

- Marketing ManagementDocument228 pagesMarketing Managementarpit gargPas encore d'évaluation

- Final Year Project Proposal in Food Science and TechnologyDocument11 pagesFinal Year Project Proposal in Food Science and TechnologyDEBORAH OSOSANYAPas encore d'évaluation

- DhakalDinesh AgricultureDocument364 pagesDhakalDinesh AgriculturekendraPas encore d'évaluation

- 2015 BT Annual ReportDocument236 pages2015 BT Annual ReportkernelexploitPas encore d'évaluation

- Business Forecasting: by ITH PhannyDocument2 pagesBusiness Forecasting: by ITH PhannysmsPas encore d'évaluation

- Isa 75.03 1992 PDFDocument14 pagesIsa 75.03 1992 PDFQuang Duan NguyenPas encore d'évaluation

- Deed of Restrictions (DOR) UpdatedDocument16 pagesDeed of Restrictions (DOR) Updatedmarj100% (1)

- Encyclopedia of Human Geography PDFDocument2 pagesEncyclopedia of Human Geography PDFRosi Seventina100% (1)

- Braintrain: Summer Camp WorksheetDocument9 pagesBraintrain: Summer Camp WorksheetPadhmennPas encore d'évaluation

- Department of Environment and Natural Resources: Niño E. Dizor Riza Mae Dela CruzDocument8 pagesDepartment of Environment and Natural Resources: Niño E. Dizor Riza Mae Dela CruzNiño Esco DizorPas encore d'évaluation

- Lyotard, Apathy in TheoryDocument10 pagesLyotard, Apathy in TheoryAshley WoodwardPas encore d'évaluation

- Profile - Sudip SahaDocument2 pagesProfile - Sudip Sahasudipsinthee1Pas encore d'évaluation

- Research Paper On RapunzelDocument8 pagesResearch Paper On RapunzelfvgcaatdPas encore d'évaluation

- Terminal Injustice - Ambush AttackDocument2 pagesTerminal Injustice - Ambush AttackAllen Carlton Jr.Pas encore d'évaluation

- GAAR Slide Deck 13072019Document38 pagesGAAR Slide Deck 13072019Sandeep GolaniPas encore d'évaluation

- Disbursement Register FY2010Document381 pagesDisbursement Register FY2010Stephenie TurnerPas encore d'évaluation

- A Review On The Political Awareness of Senior High School Students of St. Paul University ManilaDocument34 pagesA Review On The Political Awareness of Senior High School Students of St. Paul University ManilaAloisia Rem RoxasPas encore d'évaluation

- UntitledDocument256 pagesUntitledErick RomeroPas encore d'évaluation

- 6 Habits of True Strategic ThinkersDocument64 pages6 Habits of True Strategic ThinkersPraveen Kumar JhaPas encore d'évaluation

- Dayalbagh HeraldDocument7 pagesDayalbagh HeraldRavi Kiran MaddaliPas encore d'évaluation

- Veronica Guerin Interview With Anne FelloniDocument2 pagesVeronica Guerin Interview With Anne FelloniDeclan Max BrohanPas encore d'évaluation

- Eir TemplateDocument15 pagesEir Templatetran tuan100% (1)

- Bài Tập Tiếng Anh Cho Người Mất GốcDocument8 pagesBài Tập Tiếng Anh Cho Người Mất GốcTrà MyPas encore d'évaluation

- Chapter 6-Contracting PartiesDocument49 pagesChapter 6-Contracting PartiesNUR AISYAH NABILA RASHIMYPas encore d'évaluation

- Wa0256.Document3 pagesWa0256.Daniela Daza HernándezPas encore d'évaluation