Académique Documents

Professionnel Documents

Culture Documents

Setting Aside A Statutory Demand

Transféré par

Tony Karl NicholsonDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Setting Aside A Statutory Demand

Transféré par

Tony Karl NicholsonDroits d'auteur :

Formats disponibles

1.

Setting aside a statutory demand - PPSA issues

The recent case of Blue Water Resort Limited v Marac Finance Limited (HC

Christchurch, CIV 2008-409-1184, 20 August 2008, Christiansen AJ) concerned an

application to set aside a statutory demand.

In the case Blue Water Resort Limited ("Blue Water") applied to set aside a

statutory demand issued by Marac Finance Limited ("Marac"). The amount

demanded by Marac was claimed to arise pursuant to a debt that was assigned to

Marac from a third party under a settlement agreement. The third party had lent

funds to a group involved in property development, with these funds secured by

guarantees from several companies, including Blue Water.

Blue Water presented the Court with two lines of argument in its application to set

aside the statutory demand. Firstly, they challenged the legal effect of the

assignment relied upon by Marac on the basis that it was not an absolute assignment

of debt, but instead that it was an assignment by way of charge. In support of this

argument Blue Water referred the Court to the assignment agreement. The wording

used in this agreement stated that the assignor was assigning and transferring by

way of mortgage all of its interests and rights in obligations in a settlement

agreement to Marac. On this basis Blue Water argued that Marac could not demand

payment of the debt from Blue Water and could only require that it receive any

payment by Blue Water to the assignors, pursuant to their security. Secondly, Blue

Water argued that Marac's right to payment arose in connection with an interest in

land (which was then assigned to Marac) and therefore the Personal Property

Securities Act 1999 ("PPSA") should not apply by virtue of the application of s23(e)

(ii) PPSA.

Marac took the view that the statutory demand was issued by virtue of rights it

acquired under the PPSA and that the assignment created a deemed security interest

under s17(1)(b) PPSA.

Associate Judge Christiansen thought it reasonably arguable that the right to

payment assigned to Marac arose in connection with an interest in land, thereby

preventing the PPSA from applying. However his Honour accepted that it if this were

not the case, and if Marac did have a deemed security interest, then it was still

arguable whether Marac could enforce its security interest under the PPSA.

Furthermore, his Honour referred to s105(b)(i) PPSA which provides that Part 9 PPSA

(which deals with the rights and obligations of a secured party when enforcing

security) does not apply to a security interest created, or provided for, by a transfer

of an account receivable or chattel paper. His Honour accepted that this section

meant that prima facie, Marac could not enforce its security interest. However, as

the assignment was expressed to be by way of mortgage rather than an absolute

transfer his Honour considered there to be uncertainty about whether the section

applied to the current case.

Without deciding the issue, his Honour's view was that to interpret s105(b)(i) in a

way that limited its application to absolute transfers only, and to exclude any

application to in substance security interests in the form of non-absolute transfers,

would be contrary to the PPSA's policy of regulating according to substance rather

than the form of the transaction.

In light of this view his Honour concluded that, at best, it can be conceded that

Marac may have had the right to enforce its security interest by virtue of s105(b)(i),

if you took the view that s105(b)(i) did not apply to the current case. However he

still considered it reasonably arguable that Marac might not be able to enforce.

Given that it was reasonably arguable Marac might not have been able to enforce,

and the fact that it was not possible to fully assess the claim given the limited

information before the Court, his Honour found that Blue Water had an arguable

case for a defence to Marac's claim under the PPSA, and accordingly set aside the

statutory demand.

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Stock-Trak Project 2013Document4 pagesStock-Trak Project 2013viettuan91Pas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- BS Irronmongry 2Document32 pagesBS Irronmongry 2Peter MohabPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Healthpro Vs MedbuyDocument3 pagesHealthpro Vs MedbuyTim RosenbergPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- A View About The Determinants of Change in Share Prices A Case From Karachi Stock Exchange (Banking)Document17 pagesA View About The Determinants of Change in Share Prices A Case From Karachi Stock Exchange (Banking)(FPTU HCM) Phạm Anh Thiện TùngPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Fiscal Deficit UPSCDocument3 pagesFiscal Deficit UPSCSubbareddyPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- IAS 41 - AgricultureDocument26 pagesIAS 41 - AgriculturePriya DarshiniPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Vtiger Software For CRMDocument14 pagesVtiger Software For CRMmentolPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

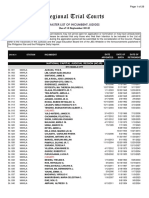

- Regional Trial Courts: Master List of Incumbent JudgesDocument26 pagesRegional Trial Courts: Master List of Incumbent JudgesFrance De LunaPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Company ProfileDocument13 pagesCompany ProfileDauda AdijatPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Net Zero Energy Buildings PDFDocument195 pagesNet Zero Energy Buildings PDFAnamaria StranzPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Skripsi - Perencanaan Lanskap Pasca Tambang BatubaraDocument105 pagesSkripsi - Perencanaan Lanskap Pasca Tambang Batubarahirananda sastriPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Sample Business ProposalDocument10 pagesSample Business Proposalvladimir_kolessov100% (8)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Sbi Code of ConductDocument5 pagesSbi Code of ConductNaved Shaikh0% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Economy Is DeadDocument17 pagesEconomy Is DeadAna SoricPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Delivering The Goods: Victorian Freight PlanDocument56 pagesDelivering The Goods: Victorian Freight PlanVictor BowmanPas encore d'évaluation

- Circle Rates 2009-2010 in Gurgaon For Flats, Plots, and Agricultural Land - Gurgaon PropertyDocument15 pagesCircle Rates 2009-2010 in Gurgaon For Flats, Plots, and Agricultural Land - Gurgaon Propertyqubrex1100% (2)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- How To Trade When The Market ZIGZAGS: The E-Learning Series For TradersDocument148 pagesHow To Trade When The Market ZIGZAGS: The E-Learning Series For TradersDavid ChalkerPas encore d'évaluation

- Smart Home Lista de ProduseDocument292 pagesSmart Home Lista de ProduseNicolae Chiriac0% (1)

- Belt and Road InitiativeDocument17 pagesBelt and Road Initiativetahi69100% (2)

- Readymade Plant Nursery in Maharashtra - Goa - KarnatakaDocument12 pagesReadymade Plant Nursery in Maharashtra - Goa - KarnatakaShailesh NurseryPas encore d'évaluation

- What Is Zoning?Document6 pagesWhat Is Zoning?M-NCPPCPas encore d'évaluation

- Posting Journal - 1-5 - 1-5Document5 pagesPosting Journal - 1-5 - 1-5Shagi FastPas encore d'évaluation

- 2017 Metrobank - Mtap Deped Math Challenge Elimination Round Grade 2 Time Allotment: 60 MinDocument2 pages2017 Metrobank - Mtap Deped Math Challenge Elimination Round Grade 2 Time Allotment: 60 MinElla David100% (1)

- Involvement of Major StakeholdersDocument4 pagesInvolvement of Major StakeholdersDe Luna BlesPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Script For Performance Review MeetingDocument2 pagesScript For Performance Review MeetingJean Rose Aquino100% (1)

- GL July KoreksiDocument115 pagesGL July KoreksihartiniPas encore d'évaluation

- Oil Opportunities in SudanDocument16 pagesOil Opportunities in SudanEssam Eldin Metwally AhmedPas encore d'évaluation

- Metropolitan Transport Corporation Guindy Estate JJ Nagar WestDocument5 pagesMetropolitan Transport Corporation Guindy Estate JJ Nagar WestbiindduuPas encore d'évaluation

- Monsoon 2023 Registration NoticeDocument2 pagesMonsoon 2023 Registration NoticeAbhinav AbhiPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- InvoiceDocument2 pagesInvoiceiworldvashicmPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)