Académique Documents

Professionnel Documents

Culture Documents

Bonds

Transféré par

Tiso Blackstar Group0 évaluation0% ont trouvé ce document utile (0 vote)

11 vues3 pagesBonds

Titre original

220518 Bonds

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentBonds

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

11 vues3 pagesBonds

Transféré par

Tiso Blackstar GroupBonds

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 3

Markets and Commodity figures

22 May 2018

Total Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Deals Nominal Consideration Deals Nominal Consideration

Current Day 1 394 42.53 bn Rbn 44.71 669 77.91 bn Rbn 78.14

Week to Date 2 816 89.28 bn Rbn 94.78 958 124.83 bn Rbn 123.22

Month to Date 20 447 647.12 bn Rbn 687.27 4 649 592.51 bn Rbn 587.76

Year to Date 120 724 3 800.99 bn Rbn 3 981.81 29 693 3 788.11 bn Rbn 3 846.32

Foreign Client Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Party Deals Nominal Consideration Deals Nominal Consideration

Buy 86 6.38 bn Rbn 6.64 28 3.64 bn Rbn 3.66

Current Day Sell 84 6.19 bn Rbn 6.43 25 3.43 bn Rbn 3.30

Net 2 0.19 bn Rbn 0.21 3 0.20 bn Rbn 0.35

Buy 140 9.49 bn Rbn 10.07 46 5.80 bn Rbn 5.65

Week to Date Sell 158 11.90 bn Rbn 12.38 47 8.45 bn Rbn 7.87

Net -18 -2.41 bn Rbn -2.31 -1 -2.65 bn Rbn -2.23

Buy 1 366 74.03 bn Rbn 77.70 215 24.61 bn Rbn 23.24

Month to Date Sell 1 482 98.19 bn Rbn 104.12 305 57.55 bn Rbn 57.38

Net -116 -24.16 bn Rbn -26.42 -90 -32.95 bn Rbn -34.14

Buy 8 371 473.37 bn Rbn 495.76 1 401 164.60 bn Rbn 157.17

Year to Date Sell 7 853 478.28 bn Rbn 504.88 1 942 564.14 bn Rbn 607.86

Net 518 -4.91 bn Rbn -9.12 -541 -399.54 bn Rbn -450.69

Index Levels

Code Index Yield Index Previous Return MTD Return YTD

ALBI20 8.913%

All Bond Index Top 616.677

20 Composite 611.507 -2.25% 4.88%

GOVI 8.962%Split - 612.675

ALBI20 Issuer Class GOVI 607.281 -2.35% 4.44%

OTHI 8.768%

ALBI20 Issuer Class Split - 633.768

OTHI 629.255 -1.94% 6.10%

CILI15 2.600%

Composite Inflation 255.870

Linked Index Top 15 255.789 -0.09% 1.24%

ICOR 3.487%

CILI15 Issuer Class 281.718

Split - ICOR 281.623 0.31% 4.02%

IGOV 2.559%

CILI15 Issuer Class 254.667

Split - IGOV 254.587 -0.11% 1.15%

ISOE 3.235%

CILI15 Issuer Class 256.048

Split - ISOE 255.962 0.47% 2.19%

MMI JSE Money Market Index

0 238.587 238.542 0.42% 2.93%

ALBI Constituent Bonds

Bond Issuer Maturity MTM Previous YTD Low YTD High

R159 REPUBLIC OF SOUTH

Jan 2020

AFRICA 7.315% 7.420% 6.58% 7.42%

R203 REPUBLIC OF SOUTH

Feb 2020

AFRICA 8.440% 8.545% 7.69% 8.63%

ES18 ESKOM HOLDINGS

MarLIMITED

2021 7.555% 7.660% 6.87% 7.66%

R204 REPUBLIC OF SOUTH

Jan 2023

AFRICA 9.055% 9.175% 8.35% 9.18%

R207 REPUBLIC OF SOUTH

Feb 2023

AFRICA 9.280% 9.400% 8.57% 9.40%

R208 REPUBLIC OF SOUTH

Feb 2023

AFRICA 7.915% 8.035% 7.24% 8.04%

ES23 ESKOM HOLDINGSAprLIMITED

2026 9.825% 9.945% 9.17% 9.95%

DV23 DEVELOPMENT DecBANK

2026

OF SOUTHERN

8.545% AFRICA 8.665% 7.88% 8.67%

R2023 REPUBLIC OF SOUTH

Jan 2030

AFRICA 8.960% 9.075% 8.28% 9.19%

ES26 ESKOM HOLDINGSFebLIMITED

2031 9.045% 9.155% 8.36% 9.25%

R186 REPUBLIC OF SOUTH

Mar 2032

AFRICA 9.135% 9.250% 8.46% 9.39%

R2030 REPUBLIC OF SOUTH

Sep 2033

AFRICA 10.595% 10.710% 9.96% 10.76%

R213 REPUBLIC OF SOUTH

Feb 2035

AFRICA 9.250% 9.365% 8.61% 9.58%

R2032 REPUBLIC OF SOUTH

Mar 2036

AFRICA 9.265% 9.380% 8.62% 9.52%

ES33 ESKOM HOLDINGSJanLIMITED

2037 9.340% 9.450% 8.69% 9.68%

R209 REPUBLIC OF SOUTH

Jan 2040

AFRICA 9.415% 9.525% 8.76% 9.77%

R2037 REPUBLIC OF SOUTH

Feb 2041

AFRICA 9.410% 9.520% 8.73% 9.74%

R214 REPUBLIC OF SOUTH

Apr 2042

AFRICA 10.800% 10.910% 10.13% 11.05%

R2044 REPUBLIC OF SOUTH

Jan 2044

AFRICA 9.460% 9.565% 8.80% 9.82%

R2048 REPUBLIC OF SOUTH

Feb 2048

AFRICA 9.435% 9.540% 8.76% 9.77%

Other Rates

Code Description Rate Previous YTD Low YTD High

SAFEX SAFEX Overnight Deposit Rate6.320% 6.320% 6.31% 6.56%

JIBAR1 JIBAR 1 Month 6.675% 6.675% 6.63% 6.92%

JIBAR3 JIBAR 3 Month 6.900% 6.900% 6.87% 7.16%

JIBAR6 JIBAR 6 Month 7.417% 7.408% 7.38% 7.60%

RSA 2 year retail bond 7.50% 0 0 0

RSA 3 year retail bond 7.75% 0 0 0

RSA 5 year retail bond 8.25% 0 0 0

RSA 3 year inflation linked retail

3.00%

bond 0 0 0

RSA 5 year inflation linked retail

3.25%

bond 0 0 0

RSA 10 year inflation linked retail

3.50%

bond 0 0 0

Nominal Bond Curves (NACS)

9.62

9.12

8.62

8.12

7.62

7.12 Zero

6.62 Par/Swap

6.12

5.62

5.12

4.62

2015 2020 2026 2031 2037 2042 2048 2053 2059

DATA DISCLAIMER

To the extent allowed by law, JSE Limited (the JSE) does not (expressly, tacitly or implicitly) guarantee or warrant the availability,

sequence, accuracy, completeness, reliability or any other aspect of any of the data (Data), or that any Data is up to date.

To the extent allowed by law, neither the JSE nor any of its directors, officers, employees, contractors, agents or representatives are

liable in any way to the reader or to any other natural or juristic person (Person) for any loss or damage as a result of (i) the display

of any Data in this bulltetin, or (ii) any Data being unavailable in this bulletin at any time and for any reason, or (iii) any delay,

inaccuracy, error, or omission in relation to any Data, or (iv) any actions taken or not taken by or on behalf of any Person in reliance

on any Data. The JSE is entitled to terminate the production of any Data at any time, without notice and without liability to any Person.

These figures are supplied by parties external to Business Day. Business Day will not warrant the accuracy of the figures.

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

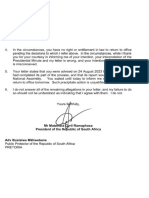

- Ramaphosa's Letter To MkhwebaneDocument1 pageRamaphosa's Letter To MkhwebaneTiso Blackstar GroupPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Shoprite Food Index 2023Document19 pagesShoprite Food Index 2023Tiso Blackstar GroupPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Arena Holdings Pty LTD - BBBEE Certificate - 2023Document2 pagesArena Holdings Pty LTD - BBBEE Certificate - 2023Tiso Blackstar GroupPas encore d'évaluation

- Letter From Reuel Khoza Chairman of The Eskom Board 1999Document2 pagesLetter From Reuel Khoza Chairman of The Eskom Board 1999Tiso Blackstar GroupPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Collective InsightDocument10 pagesCollective InsightTiso Blackstar GroupPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Ramaphosa's Letter To MkhwebaneDocument1 pageRamaphosa's Letter To MkhwebaneTiso Blackstar GroupPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Ramaphosa's Letter To MkhwebaneDocument1 pageRamaphosa's Letter To MkhwebaneTiso Blackstar GroupPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- JP Verster's Letter To African PhoenixDocument2 pagesJP Verster's Letter To African PhoenixTiso Blackstar GroupPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Anti Corruption Working GuideDocument44 pagesAnti Corruption Working GuideTiso Blackstar GroupPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Open Letter To President Ramaphosa - FinalDocument3 pagesOpen Letter To President Ramaphosa - FinalTiso Blackstar GroupPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- BondsDocument3 pagesBondsTiso Blackstar GroupPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Statement From The SA Tourism BoardDocument1 pageStatement From The SA Tourism BoardTiso Blackstar GroupPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Letter From Reuel Khoza Chairman of The Eskom Board 1999Document2 pagesLetter From Reuel Khoza Chairman of The Eskom Board 1999Tiso Blackstar GroupPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- JudgmentDocument30 pagesJudgmentTiso Blackstar GroupPas encore d'évaluation

- FairbairnDocument2 pagesFairbairnTiso Blackstar GroupPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- LibertyDocument1 pageLibertyTiso Blackstar GroupPas encore d'évaluation

- BondsDocument3 pagesBondsTiso Blackstar GroupPas encore d'évaluation

- Tobacco Bill - Cabinet Approved VersionDocument41 pagesTobacco Bill - Cabinet Approved VersionTiso Blackstar GroupPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Critical Skills List - Government GazetteDocument24 pagesCritical Skills List - Government GazetteTiso Blackstar GroupPas encore d'évaluation

- Collective Insight September 2022Document14 pagesCollective Insight September 2022Tiso Blackstar GroupPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Fuel Prices - June 28 2022Document1 pageFuel Prices - June 28 2022Tiso Blackstar GroupPas encore d'évaluation

- Sanlam Stratus Funds - June 1 2021Document2 pagesSanlam Stratus Funds - June 1 2021Lisle Daverin BlythPas encore d'évaluation

- Forward Rates - June 29 2022Document2 pagesForward Rates - June 29 2022Tiso Blackstar GroupPas encore d'évaluation

- Forward Rates - June 30 2022Document2 pagesForward Rates - June 30 2022Tiso Blackstar GroupPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The ANC's New InfluencersDocument1 pageThe ANC's New InfluencersTiso Blackstar GroupPas encore d'évaluation

- Forward Rates - June 28 2022Document2 pagesForward Rates - June 28 2022Tiso Blackstar GroupPas encore d'évaluation

- Fuel Prices - June 30 2022Document1 pageFuel Prices - June 30 2022Tiso Blackstar GroupPas encore d'évaluation

- PUBCORP (Midterms Reviewer)Document55 pagesPUBCORP (Midterms Reviewer)Mikey GoPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Jurnal Dennys Kumala Arnemy - FAKTOR-FAKTOR YANG MEMPENGARUHI PENERIMAAN OPINI AUDIT GOING CONCERN PADA PERUSAHAAN MANUFAKTUR (Studi Empiris pada Perusahaan Manufaktur yang Terdaftar di Bursa Efek Indonesia tahun 2013-2017)Document18 pagesJurnal Dennys Kumala Arnemy - FAKTOR-FAKTOR YANG MEMPENGARUHI PENERIMAAN OPINI AUDIT GOING CONCERN PADA PERUSAHAAN MANUFAKTUR (Studi Empiris pada Perusahaan Manufaktur yang Terdaftar di Bursa Efek Indonesia tahun 2013-2017)dennys arnemyPas encore d'évaluation

- Banglai Namaz ShikkhaDocument12 pagesBanglai Namaz ShikkhaMira HasanPas encore d'évaluation

- Tax Manager, Northleaf Capital PartnersDocument2 pagesTax Manager, Northleaf Capital PartnersalysomjiPas encore d'évaluation

- Apex Mining V Southeast Mindanao Gold Mining EscraDocument44 pagesApex Mining V Southeast Mindanao Gold Mining EscraEd ManzanoPas encore d'évaluation

- Equity Detail of UniversitiesDocument5 pagesEquity Detail of UniversitiesThe Wonders EdgePas encore d'évaluation

- Central Systems: Installation, Operation and MaintenanceDocument32 pagesCentral Systems: Installation, Operation and MaintenancelatrancaPas encore d'évaluation

- Labor Cases ListDocument2 pagesLabor Cases ListAubrey AquinoPas encore d'évaluation

- Form 7Document2 pagesForm 7Wing TabarPas encore d'évaluation

- List of Accredited Tourism Enterprises - NCRDocument3 pagesList of Accredited Tourism Enterprises - NCRRonald50% (2)

- The Association of Microbiologists of India (AMI) (Estb 1938) (Celebrating 75 Years of Excellence in Promoting Microbiology) (2018-2019)Document3 pagesThe Association of Microbiologists of India (AMI) (Estb 1938) (Celebrating 75 Years of Excellence in Promoting Microbiology) (2018-2019)Harsh vardhanPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Ass 2Document4 pagesAss 2Asim HussainPas encore d'évaluation

- History of Insurance Business in BangladeshDocument3 pagesHistory of Insurance Business in BangladeshBishawnath Roy67% (3)

- TM Case List and Reporters 2016Document4 pagesTM Case List and Reporters 2016Daryl Noel TejanoPas encore d'évaluation

- I NI ME: Autocad Syllabus COD E Chapters Remar KSDocument13 pagesI NI ME: Autocad Syllabus COD E Chapters Remar KSpradeepkallurPas encore d'évaluation

- ch02 Beams10e TBDocument22 pagesch02 Beams10e TBbabycatine100% (3)

- Mahasti MotamedDocument2 pagesMahasti Motamedapi-121345256Pas encore d'évaluation

- 5 Major Sources of Rural Credit in IndiaDocument5 pages5 Major Sources of Rural Credit in IndiaParimita Sarma0% (1)

- FB - JPM Research Report - Oct 2012Document17 pagesFB - JPM Research Report - Oct 2012ishfaque10Pas encore d'évaluation

- INGs Agile TransformationDocument10 pagesINGs Agile Transformationparnaz88Pas encore d'évaluation

- Important Facts Regarding The Epp8 SME GrantDocument2 pagesImportant Facts Regarding The Epp8 SME GrantMuhamad Azlan ShahPas encore d'évaluation

- Corporate Behavioural Finance Chap06Document14 pagesCorporate Behavioural Finance Chap06zeeshanshanPas encore d'évaluation

- Law of ContractDocument12 pagesLaw of ContractSenelwa AnayaPas encore d'évaluation

- Global Auto Parts and Accessories Market Analysis and Forecast (2013 - 2018)Document15 pagesGlobal Auto Parts and Accessories Market Analysis and Forecast (2013 - 2018)Sanjay MatthewsPas encore d'évaluation

- Chap 8 - Responsibility AccountingDocument51 pagesChap 8 - Responsibility AccountingKrisdeo Pardillo67% (3)

- August - September 2008 Issue 95Document116 pagesAugust - September 2008 Issue 95cf34Pas encore d'évaluation

- MSG Claim Against Inglewood Over Clippers ArenaDocument144 pagesMSG Claim Against Inglewood Over Clippers ArenaSam GnerrePas encore d'évaluation

- Nokia Growing Cash MountainDocument2 pagesNokia Growing Cash MountainSu_Neil100% (4)

- PolicySchedule 22140031190160379064 161948448Document2 pagesPolicySchedule 22140031190160379064 161948448amitPas encore d'évaluation