Académique Documents

Professionnel Documents

Culture Documents

Transforming Procure To Pay

Transféré par

Horacio MirandaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Transforming Procure To Pay

Transféré par

Horacio MirandaDroits d'auteur :

Formats disponibles

INFOGRAPHIC REPORT

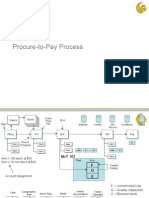

Transforming

Procure-to-Pay:

Align Finance and Procurement to boost

efficiency and improve the bottom line

© sharedserviceslink.com Ltd and SAP Ariba 2016. No copy or visual can be used in part, as a phrase or in whole without the written permission of

sharedserviceslink.com Ltd. The concept of this product belongs to sharedserviceslink.com Ltd and cannot be re-created by a third party for the

purpose of an event, article, report or any other written product, without written consent made available by sharedserviceslink.com Ltd.

An efficient Procure-to-Pay (P2P) process is the engine behind any high

performing organization. When finance and procurement are aligned

through a holistic, end-to-end P2P process, organizations can find new

ways to create savings and open doors to profit-driving opportunities.

sharedserviceslink and SAP Ariba conducted a study with over 150

finance and shared services professionals to better understand the

state of Payables and P2P and identify opportunities for improvement.

This report is the third and final section of the research report and

focuses on how to improve the alignment between finance and

procurement through an efficient P2P process, and the difference it

can make.

About our respondents

45%

6%

37%

Western

Europe 9%

3 %

North

America

Asia

Eastern

Europe

Middle East

and Africa

What is your annual revenue? (In USD)

Less than

$1 billion

More than

$10 billion

19%

41% 5 %

$1 billion -

$2 billion

22%

13% $2 billion -

$5 billion

$5 billion -

$10 billion

How many invoices do you

process annually?

Less than

100,000

More than

1 million

23% 22%

21%

34%

500,000 – 100,000 –

1 million 500,000

Respondents are from large companies. 81% of respondents have

more than $1bn revenue, and 78% of respondents process over

100,000 invoices annually.

How aligned would you say Finance

and Procurement are?

54%

18% 20%

3% 5%

Not aligned Rarely aligned Somewhat Mostly Very aligned

there is no we work aligned aligned we share same

collaboration separately, but we collaborate we share organizational

between Finance collaborate on certain most goals goals, KPIs and

and Procurement when needed projects and most KPIs leadership

Not aligned Well aligned

While 54% of respondents say they are somewhat aligned, 21% are not

well aligned and only 25% were mostly or very aligned.

Which of the following pain points do

you have in P2P?

Handling invoice exceptions 80%

Responding to internal

inquiries (Procurement/vendor

set up team) about specific 58%

vendors/invoices/payments

High volume of supplier

inquiries via email/phone 57%

Poor master vendor data 51%

Difficult vendor on

boarding process 37%

Keying invoices into your ERP 37%

Handling payment rejections 14%

The majority of respondents (80%) struggle with invoice exceptions.

What are your top three priorities

to improve your P2P process?

Standardize processes globally 58%

Automate P2P Processes 46%

Onboard more suppliers

to e-invoicing 35%

Improve PO compliance 33%

Implement a supplier

portal/ supplier self-service 33%

Implement e-invoicing 27%

Automate workflow 18%

Implement scanning technology

15%

Consolidate ERP systems

13%

The top two priorities, standardization and automation, are key to

solving many of the issues companies are facing when Finance and

Procurement operate in silos.

Survey respondents generally have low levels of alignment

between Finance and Procurement. Only 25% say they are well

aligned (mostly or very aligned), and 21% say they are rarely or

not aligned.

The symptoms of poor alignment, including high rates of invoice

exceptions and time spent answering internal process related

questions, are felt by the majority of respondents. Many are

prioritizing process standardization and automation, which will

help relieve these pain points.

Here we examine the correlation between process ownership,

alignment and one of the key indicators of alignment, Purchase

Order (PO) rates.

We also look into what technology respondents are using and

looking to use to improve their P2P process.

What % of invoices are PO vs Non-PO?

Overall average

Non PO

33%

67%

PO

% of PO invoices

24%

16 % 17% 17%

13%

13%

0%

Less than 50-59% 60-69% 70-79% 80-89% 90-99% 100%

50%

Overall, respondents have 67% of invoices under purchase order

(PO). 41% have 80% or more of their invoices under purchase order.

61%of companies that are well 34%of companies that are not

aligned (‘mostly aligned’ or ‘very well aligned ('rarely aligned' or

aligned’) have more than 80% of 'not aligned') have more than

invoice under PO. 80% of invoice under PO.

Are you actively looking to

improve your invoice processing?

46%

35%

11% 8%

Our invoice Improving We want to We are looking to

processing is invoice improve, improve our invoice

high quality processing but don’t processing, and

and we aren’t isn’ta priority yet have have budget

looking to right now budget to do so

change it

81% of respondents want to improve their invoice processing.

35% have already secured the budget to do so.

Which of the following technology do

you use in the P2P process?

Use currently Looking to use in the future

e-procurement

58%

30%

e-invoicing 48%

38%

Contract

management tools

46%

23%

An end-to-end 30%

P2P solution

49%

e-procurement and e-invoicing are the most popular tools used currently,

and the biggest area of growth is in end-to-end P2P solutions.

Do you have global process owners?

42%

34%

15%

9%

No, we do No, but we are Yes, we have Yes, we have

not have looking to process owners for end-to-end

process implement the distinct global

owners process owners processes process

soon (For procurement, owners

AP, but not P2P)

76% of respondents have process owners, however most have process

owners for distinct processes, not truly end-to-end process owners.

Only 9% of respondents don’t have process owners on their radar.

45% of companies that are well 25% of those that are not well

aligned ('mostly aligned' or 'very aligned ('rarely aligned' or 'not

aligned') have end-to-end aligned') have end-to-end

process owners. process owners.

Summary

• Finance and Procurement teams are showing insufficient alignment:

only 20% of respondents are “mostly aligned” on goals and KPIs

and a mere 5% actually share goals and KPIs. Only 34% of

respondents have end-to-end global process owners.

• Handling invoice exceptions is the top pain point in the P2P process

for 80% of respondents, and over half struggle with high volumes of

internal and supplier inquiries.

• Only 41% of respondents have more than 80% of their invoices

under PO; but that percentage goes up to 61% when considering

respondents in the well aligned category.

• The top priority for respondents is to standardize and automate the

overall P2P process. 80% of respondents state they are actively

looking at improving their invoicing process.

The survey clearly shows the problems caused by a disconnected P2P

process and the lack of collaboration internally (between Procurement

and Accounts Payable teams primarily) and with suppliers. That

situation leads to the high number of invoice exceptions and

internal/external inquiries our respondents are experiencing.

Therefore, organizations spend too much time managing transactions,

and less time on more strategic activities.

Based on our research, we identified three ways you can unlock P2P

efficiency and drive alignment between finance and procurement.

1. Get to the root cause of invoice

exceptions

For many, the phrase invoice exception is a misnomer. If they were truly

exceptions, they would affect only 1-10% of transactions. However many

find that exception handling represents 30-60% of invoice volume. It’s

important to first understand the scope of the problem, then get to the

root of the issues.

• Analytics tools can help you identify repeat offenders who don’t raise

POs, those that raise retrospective POs and can help you identify

where Goods Received Notes aren’t recorded properly.

• Once you understand where exceptions come from, you can

communicate how much non-compliant behavior actually costs the

business. When you can show a non-compliant invoice costs

significantly more to process, you should start to see behavior change.

• Many organizations have high PO rates, but the non-compliant

invoices still cause problems. To address this, start reporting on

invoices that don’t comply. You can ignore the 97% compliant

invoices, and instead report on the 3% and find ways to reduce them.

2. Standardize and digitize your P2P

process to streamline processing

and improve control

The amount of time your organization spends on fielding invoice status

queries can be significant. Standardizing and digitizing your P2P

process will promote straight-through invoice processing and supplier

self-service, and improve control. Additionally, this will free up Accounts

Payable to tackle more strategic activities such as improving cash flow

and working capital metrics.

• To effectively align Finance and Procurement, make sure your

processes are as ’closed loop” as possible. When your suppliers can

invoice directly off POs (as in PO-Flip), or from a contract without a

PO, you have more control over spending.

• E-invoicing not only drives costs savings from a transactional

perspective, it can enable you to secure early payment discounts,

and these cost savings can be much larger than the operational

savings. Be sure to build this into the business case for your P2P

automation initiatives.

3. Align the KPIs and objectives of

Finance and Procurement

For many, there are cultural ”walls” around Finance and Procurement.

However, for an efficient end-to-end process, these departments need

to work hand-in-glove to be as streamlined as possible.

• The effort you put into creating a collaborative culture between

Finance and Procurement is well worth it. Having shared KPIs,

vision and leadership will all help drive alignment.

• Make sure that Finance and Procurement work together on projects

and don’t have different agendas. This is crucial for enabling

technology such as e-invoicing. A key reason e-invoicing initiatives

fail is because it was driven by Finance, and Procurement wasn’t

involved. E-invoicing is a supplier-based program, so make sure

that you have support from Procurement.

• Many companies have process owners for distinct processes only

(AP or Procurement instead of an end-to-end P2P process owner).

This can work, but only if the AP and Procurement process owners

collaborate effectively. Having global process owners is preferred

as it will drive better, and quicker, results.

About SAP Ariba

SAP® Ariba® is the marketplace for digital business, creating

frictionless exchanges between millions of buyers and suppliers

across the entire source-to-pay process. Our market-leading

solutions enable companies to simplify collaboration with their

trading partners, make smarter business decisions and extend their

collaborative business processes with an open technology platform.

More than two million companies use SAP Ariba solutions to connect

and collaborate around nearly one trillion in commerce on an

annual basis. To learn more about the company’s offerings and the

transformation they are driving, visit

www.ariba.com/solutions/financial-supply-chain-management

© sharedserviceslink.com Ltd and SAP Ariba 2016. No copy or visual can be used in part, as a phrase or in whole without the written permission of

sharedserviceslink.com Ltd. The concept of this product belongs to sharedserviceslink.com Ltd and cannot be re-created by a third party for the

purpose of an event, article, report or any other written product, without written consent made available by sharedserviceslink.com Ltd.

Vous aimerez peut-être aussi

- P2P Test Scenario ListDocument5 pagesP2P Test Scenario Listnani2003Pas encore d'évaluation

- Disney Pixar Case AnalysisDocument4 pagesDisney Pixar Case AnalysiskbassignmentPas encore d'évaluation

- SAP Ariba Other Test ScriptsDocument8 pagesSAP Ariba Other Test ScriptsGanesh Kumar Gopinatha RaoPas encore d'évaluation

- Order To Cash ProcessDocument22 pagesOrder To Cash Processjrchoate100% (3)

- P2P - Oracle Procure To Pay Life Cycle Training ManualDocument45 pagesP2P - Oracle Procure To Pay Life Cycle Training ManualCA Vara Reddy100% (1)

- GRIR Leading Practices v3Document5 pagesGRIR Leading Practices v3Shabnam MacanmakerPas encore d'évaluation

- PDFDocument5 pagesPDFMa Josielyn Quiming0% (1)

- Abm Fabm2 Module 8 Lesson 1 Income and Business TaxationDocument19 pagesAbm Fabm2 Module 8 Lesson 1 Income and Business TaxationKrisha Fernandez100% (3)

- Supplier Guide For Ariba Commerce AutomationDocument20 pagesSupplier Guide For Ariba Commerce AutomationMadhavan PratapPas encore d'évaluation

- Procure To Pay Cycle Process and Configuration From FI EndDocument14 pagesProcure To Pay Cycle Process and Configuration From FI Endganesanmani1985Pas encore d'évaluation

- Procure To Pay Best PracticesDocument7 pagesProcure To Pay Best PracticesSwati Pareta100% (1)

- Supplier Enablement PDFDocument20 pagesSupplier Enablement PDFabhiPas encore d'évaluation

- SAP Ariba SourcingDocument2 pagesSAP Ariba Sourcingsidhant19930% (1)

- Procurement Cloud - Procure To PayDocument31 pagesProcurement Cloud - Procure To PayVishwa100% (3)

- SAP p2p End To End ProcessesDocument87 pagesSAP p2p End To End ProcessesSarosh100% (1)

- P2P PresentationDocument21 pagesP2P PresentationAnjana VarnwalPas encore d'évaluation

- Sap s4 Hana Procure To Pay Process (p2p)Document100 pagesSap s4 Hana Procure To Pay Process (p2p)Muhammad Kashif Shabbir100% (1)

- Vendor Registration Simplification - V1 7Document22 pagesVendor Registration Simplification - V1 7Kishor HandePas encore d'évaluation

- Blue Nile GooodDocument67 pagesBlue Nile GooodKamil Jagieniak100% (1)

- BUSS 207 Quiz 3 - SolutionDocument3 pagesBUSS 207 Quiz 3 - Solutiontom dussekPas encore d'évaluation

- Procure To Pay CycleDocument13 pagesProcure To Pay Cyclebogasrinu100% (1)

- Procure To Pay CycleDocument9 pagesProcure To Pay CycleRajashree DasPas encore d'évaluation

- Procure To Pay P2P Toolkit 1637020987Document22 pagesProcure To Pay P2P Toolkit 1637020987AideDuarteSantiagoPas encore d'évaluation

- SAP Procure To PayDocument2 pagesSAP Procure To PayKarim Derouiche100% (1)

- Procure To Pay (SAP MM)Document8 pagesProcure To Pay (SAP MM)PavilionPas encore d'évaluation

- P2P O2cDocument9 pagesP2P O2cGurram SrihariPas encore d'évaluation

- Procure To Pay Best Practices 140520062029 Phpapp01Document51 pagesProcure To Pay Best Practices 140520062029 Phpapp01Rai Prashant Kumar RaiPas encore d'évaluation

- The New Benchmark For World Class Procure To Pay Process EfficiencyDocument10 pagesThe New Benchmark For World Class Procure To Pay Process EfficiencyZycusIncPas encore d'évaluation

- Basic Procure To PayDocument4 pagesBasic Procure To PaynigaryansPas encore d'évaluation

- Procure To Pay Basic Process FlowDocument3 pagesProcure To Pay Basic Process Flowfernando_salazar_27Pas encore d'évaluation

- Procure To Pay ProcessDocument54 pagesProcure To Pay ProcessSunil KumarPas encore d'évaluation

- Procure To Pay Lifecycle - MarkedDocument15 pagesProcure To Pay Lifecycle - MarkedYogesh SalviPas encore d'évaluation

- Optimize Procure To Pay Processes ImproveDocument18 pagesOptimize Procure To Pay Processes Improvenkjersey100% (2)

- 010 Esker White Paper Accounts Payable SAP-USDocument15 pages010 Esker White Paper Accounts Payable SAP-USaaditya01Pas encore d'évaluation

- Oracle Sourcing ProcessDocument3 pagesOracle Sourcing ProcessPadmanabha NarayanPas encore d'évaluation

- B1 90 TB1000 02 01 PDFDocument16 pagesB1 90 TB1000 02 01 PDFdabrandPas encore d'évaluation

- Sap - Ariba and S4hanaDocument1 pageSap - Ariba and S4hanagirishalluruPas encore d'évaluation

- Fundamentals of Procure To PayDocument254 pagesFundamentals of Procure To Paysweetshene100% (3)

- Oracle Process FlowDocument22 pagesOracle Process Flowjohn366Pas encore d'évaluation

- 1.3 SAP Procure To Pay ProcessDocument11 pages1.3 SAP Procure To Pay ProcessChathura Gunarathne100% (3)

- Procure To Pay Business Process StepsDocument4 pagesProcure To Pay Business Process Stepsdvnprasad2Pas encore d'évaluation

- Procure To PayDocument14 pagesProcure To PaymeegunPas encore d'évaluation

- SD FullDocument68 pagesSD FullAnadi TiwariPas encore d'évaluation

- Financial AND Management Reporting SystemsDocument56 pagesFinancial AND Management Reporting SystemsEj BalbzPas encore d'évaluation

- P2p Risk by DeloitteDocument16 pagesP2p Risk by Deloittevijaya lakshmi Anna Srinivas100% (1)

- Procure To Pay ProcessDocument41 pagesProcure To Pay Processelixi67% (3)

- Logistics Invoice VerificationDocument58 pagesLogistics Invoice VerificationPhylax1100% (1)

- AP Slide DownloadDocument87 pagesAP Slide DownloadNguyen HoaPas encore d'évaluation

- SAP Ariba Buying and Invoicing OverviewDocument2 pagesSAP Ariba Buying and Invoicing Overviewpilgra100% (1)

- Procure To PayDocument18 pagesProcure To PayCeekay InweregbuPas encore d'évaluation

- MM-03 Inventory Management & Physical InventoryDocument38 pagesMM-03 Inventory Management & Physical InventoryDivyang PatelPas encore d'évaluation

- SAP MM Syllabus: This Document Is Prepared For MM Training. If Interested For MM Training in PuneDocument1 pageSAP MM Syllabus: This Document Is Prepared For MM Training. If Interested For MM Training in PuneAnupam DasPas encore d'évaluation

- BP.080 Detailed Process Design EntertainDocument28 pagesBP.080 Detailed Process Design EntertainSrinivas GirnalaPas encore d'évaluation

- BEST PRACTICE Rethink Transaction MatchingDocument28 pagesBEST PRACTICE Rethink Transaction MatchingvanlebeauPas encore d'évaluation

- Order Management Fundamentals PDFDocument448 pagesOrder Management Fundamentals PDFRadhika NaiduPas encore d'évaluation

- Procure To Pay Best PracticesDocument51 pagesProcure To Pay Best PracticesDmitry Borisov100% (1)

- 2021 Enterprise Resource Planning Buyer'S GuideDocument32 pages2021 Enterprise Resource Planning Buyer'S GuideAhmed100% (1)

- Business Processes in SAP S/4HANA Sales: Enterprise StructuresDocument6 pagesBusiness Processes in SAP S/4HANA Sales: Enterprise Structuresspsuman05Pas encore d'évaluation

- Tax and Charge Configuration: SAP Ariba Procurement SolutionsDocument132 pagesTax and Charge Configuration: SAP Ariba Procurement SolutionsspmotaPas encore d'évaluation

- P2P SOD List PDFDocument27 pagesP2P SOD List PDFfaridfarzanaPas encore d'évaluation

- Sap Fi Accounts ReceivableDocument66 pagesSap Fi Accounts ReceivableCARLOS MATIAS SANCHEZ BELTRANPas encore d'évaluation

- 04-Accounts Receivable PDFDocument111 pages04-Accounts Receivable PDFRory PinemPas encore d'évaluation

- Procure To Pay ReportsDocument45 pagesProcure To Pay ReportsOscar Jimenez Carazo100% (1)

- Inventory Management System A Complete Guide - 2019 EditionD'EverandInventory Management System A Complete Guide - 2019 EditionPas encore d'évaluation

- Ariba Network and SAP Fieldglass Integration GuideDocument22 pagesAriba Network and SAP Fieldglass Integration GuideHoracio MirandaPas encore d'évaluation

- Cargill Master Guide 122018pptxDocument81 pagesCargill Master Guide 122018pptxHoracio MirandaPas encore d'évaluation

- Ariba Network Registration Guide: © 2013 Ariba, Inc. All Rights ReservedDocument42 pagesAriba Network Registration Guide: © 2013 Ariba, Inc. All Rights ReservedHoracio MirandaPas encore d'évaluation

- LO955 Batch Management 46CDocument356 pagesLO955 Batch Management 46CsamPas encore d'évaluation

- BBP Integration Model ImportV1.1Document3 pagesBBP Integration Model ImportV1.1Horacio MirandaPas encore d'évaluation

- Sap Simple Logistics TutorialDocument74 pagesSap Simple Logistics TutorialAswathyAkhosh96% (27)

- Transforming Procure To PayDocument1 pageTransforming Procure To PayHoracio MirandaPas encore d'évaluation

- BibliographyDocument4 pagesBibliographyMulher SoraPas encore d'évaluation

- Operating ExposureDocument33 pagesOperating ExposureAnkit GoelPas encore d'évaluation

- Module 4Document26 pagesModule 4Be Verly BalawenPas encore d'évaluation

- Process Costing Tutorial SheetDocument3 pagesProcess Costing Tutorial Sheets_camika7534Pas encore d'évaluation

- Form PDF 927448140281220Document7 pagesForm PDF 927448140281220Arvind KumarPas encore d'évaluation

- Working Capital Management at BEMLDocument20 pagesWorking Capital Management at BEMLadharav malikPas encore d'évaluation

- What Is Budget?Document23 pagesWhat Is Budget?pRiNcE DuDhAtRaPas encore d'évaluation

- Cases - Effective Small Business Management An Entrepreneurial Approach (10th Edition)Document22 pagesCases - Effective Small Business Management An Entrepreneurial Approach (10th Edition)RizkyArsSetiawan0% (1)

- Guidewire Services Consulting TransformationDocument4 pagesGuidewire Services Consulting TransformationagPas encore d'évaluation

- Sbi NeftformatDocument5 pagesSbi NeftformatPPCPL Chandrapur0% (1)

- DigitalDocument4 pagesDigitalideal assignment helper 2629Pas encore d'évaluation

- Unit 6 MANAGEMENT ACCOUNTINGDocument46 pagesUnit 6 MANAGEMENT ACCOUNTINGSANDFORD MALULUPas encore d'évaluation

- Introduction - IAPH - Patrick VerhoevenDocument13 pagesIntroduction - IAPH - Patrick VerhoevenThrillage BlackPas encore d'évaluation

- Larcade Arcana LT 2.3 Module 2 The Development of World PoliticsDocument2 pagesLarcade Arcana LT 2.3 Module 2 The Development of World PoliticsLarcade ArcanaPas encore d'évaluation

- Code of Business Ethics and ConductDocument7 pagesCode of Business Ethics and ConductShane NaidooPas encore d'évaluation

- Income DeterminationDocument82 pagesIncome DeterminationPaulo BatholomayoPas encore d'évaluation

- Important Theorertical QuestionsDocument3 pagesImportant Theorertical QuestionsKuldeep Singh GusainPas encore d'évaluation

- Mutual Fund SynopsisDocument8 pagesMutual Fund SynopsisAamit Bhardwaj50% (2)

- Kertas 2 - Information Transer - Set ADocument3 pagesKertas 2 - Information Transer - Set AtiyeesanPas encore d'évaluation

- Revised Corporation CodeDocument5 pagesRevised Corporation CodekeithPas encore d'évaluation

- Group 18 (Swiggy)Document2 pagesGroup 18 (Swiggy)Arun RaoPas encore d'évaluation

- Analisis Kependudukan - Proyeksi IndonesiaDocument43 pagesAnalisis Kependudukan - Proyeksi Indonesiaratna murtiPas encore d'évaluation

- Marketing Plan FernandezDocument8 pagesMarketing Plan FernandezRicamayGatabPas encore d'évaluation

- Mutual Fund PPT 123Document53 pagesMutual Fund PPT 123Sneha SinghPas encore d'évaluation

- EduHubSpot ITTOs CheatSheetDocument29 pagesEduHubSpot ITTOs CheatSheetVamshisirPas encore d'évaluation