Académique Documents

Professionnel Documents

Culture Documents

HFF 990 2015

Transféré par

Teddy Wilson0 évaluation0% ont trouvé ce document utile (0 vote)

96 vues21 pagesHeavenly Fathers Foundation - IRS 990 (2015)

Titre original

HFF-990-2015

Copyright

© © All Rights Reserved

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentHeavenly Fathers Foundation - IRS 990 (2015)

Droits d'auteur :

© All Rights Reserved

0 évaluation0% ont trouvé ce document utile (0 vote)

96 vues21 pagesHFF 990 2015

Transféré par

Teddy WilsonHeavenly Fathers Foundation - IRS 990 (2015)

Droits d'auteur :

© All Rights Reserved

Vous êtes sur la page 1sur 21

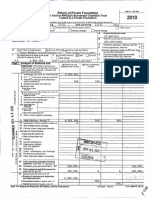

[efile GRAPHIC print DO NOT PROCESS [As Filed Data _| DLN: 93491228006166]

rom990-PF PNB No 1545-0052

: 2015

rrr

Return of Private Foundation

or Section 4947(a)(1) Trust Treated as Private Foundation

> Do not enter social security numbers on this form as it may be made public.

> Information about Form 990-PF and its instructions te at wvw.irs.gov/form990pf.

nea en

For calendar year 2015, or tax year beginning 01-01-2015 sand ending 12-31-2015

Tame of uneaton T epTover aNNCaION Hae

(17 950-2600

TOTS, AaTE OF OVER, CST, a TIPO TOE POR STE | trexempton sorieaton penta, check here T=

[Final return Tlamended return = . i

[address change [Name change 2 er thect here ond attach ampueton

Check ype forganaton P Sechon SOI (c\S)exaret prvate hundaton ———] € hte undated

(Section 4947 (a1) nonexempt chantable trust_[ Other taxable private foundation beeline et clcddhbae ae

Weecounting method Cask T Aceral

‘of year (from Part IL, col. (c), Hee MG Ecce eee under secton 507(b)(1)(B), check here aaree

imeises 156.3666 (Gar colin (4) must Bon ER BE)

TEES] Analysis of Revenue and Expenses @,

(Th tl of amounts cots), (ahd (3) oy not es nietiwestment | Adyuted net | Dstursements

Imes epain ssn ei a oe | eM msar™ | ca Mace™ | estas

cath sw orl)

7 Contributions, ais, grants, ete received (oRach

schedule)

2 check [F ifthe foundation 1s not required to attach

3. Interest on savings and temporary cash investments 6155 649,285

4 Dividends and interest from secunties . ss 3003.47 3086.54

Sa Gross rents

b Net rental income or (loss)

g | 6 Net gain or (loss) from sale of assets not on line 10

2

3 | © Gross sales price for all assets online 6a

& | 7 Caper gainnet income (trom Part IV, tine 2) «

@ Net short-term capital gain

9 Income modifications

102 Gross sales less returns and

allowances

b Less Cost of gods sold

‘€ Gross profit or (loss) (attach scheauley

hk Otherincome (attach schedule). . 778.33

lk TotalAddiines 3 theough22_. . : ear BES]

43 Compensation afoffcers, avectors, trustees, ete

14 Otheremployee salanes and wages.

45 Pension plans, employee benefits

16a Legal fees (attach schedule).

b Accounting fees (attach schedule). o

€ Other professional fees (attach schedule)

a7 interest

48 Taxes (attach schedule) (see instructions)

19 Depreciation (attach schedule) and depletion . |;

20 Occupancy «

21 Travel, conferences, and meetings.

22 Printing and publications - ae

23 Otherexpenses (attach schedule). en

24 Total operating and administrative expenses.

Add limes 13 through23. 6 ee ee ee ee oe sry 257.167 °

25 Contributions, ifs, grants pads. se ee 7; 760805

26 Total expenses and disbursaments.A id lines 24 and

2 subtract ine 26 Fomine 12

2 Excess of revenue over expenses and disbursements

Net investment income if negstve, enter -0-)

€__Adjusted net incomeyitnegative,enter-O-)

For Paperwork Reduction Act Notice, see instructions. (Cat No 32289x Form 990-PF (2015)

Operating and Administrative Expenses:

Form 990-PF (2015) Page 2

TERED catance sheets Siri ercnise armas) Tar nacion) [te bet ae |G) Bak abe [fl For Raabe

1 Ceshcronterestbesang ss ee

2 Savings and temporary cash investments. sv ee Tar] a aaa

Accounts recewvable®

ee

4 Pledges receivable

Less sllonance for doubt accounts

ee

Recewables due from oftcers, directors, trustees, and ather

disqualified persons (attach schedule) awe mstructions)- «=. «

7 other notes and loans receivable attach schedule) ee

Less allowance for dott accounts

| ® loventores orssiecruse. ve ev ee eee

S| 2 prepa expenses and deferred charges sv ae

fice sovetmoca- and atte goverment bone (tach Tia Ti Tia

Investments corporate stock (attach schedule) Tae Tawa Tawa

Investments-corporate bonds (attach schedule) © eve se 25,0055 rome 20,288,085

11 Investments-fang, buildings, and equipment asia

Less accumulated depreciation (attach schedule)

12 Investments mortgage loans.

13. Investmentswother(ettechachedsle). vs

14 Land, bulaings, and equipment basis

Less. accumulated depreciation (attach schedule)

15. other assets (seserbe ® ) sees aot acooms

16 Total asetsto be completed by al fer=—aee the

instructions Also, see page 1 tem 1) sears] 159 576.364 15957668,

17 Accounts payable end accrued expenses ss sw

cma

oe cae

Z| 20 Loans om ottcers,crectors, trustees, an other disqusiied persons

S| a1 Mortgages and othernotes payable (attach schedule)... s+

22 othertiabities (describe P. )

23 _ Tota lablitls(ad lines 17 tough #8) ve 7

Foundations thet follow SFAS 117, check hee P=

3| ‘and complete lines 24 through 26 and lines 30 and 31.

Se ined

[25 Temporeniy restreted

[26 Permanentiyrestreteds vv ee

Z| Foundations that donot foiow SFAS 17, check here Pe FZ

=] and complete tines 27 through 31.

B| 27 Capral stock, ust principal, or current funds 1700.0 17,0000

Blas reie-inor capita surplus, er land, bid and equipment a

20 Retsinad earings, accumulated mcome, endowment, or ther nds Tiassa re

B|s0 total net assets or fund balances(see mstcictons) ows Teearear| Tare

31 _Totellinblities and net aasote/fundbalancestsee instructions) «+ weaanear| 159576364

P ‘Analysis of Changes in Net Assets or Fund Balances

1 Total net assets or find balances at Beginning of year—Part I, column (ey ine 0 (mune agree

wth endofyear igure reported on pnoryears c€tUn) ve ee te ee ee Lh 160,436,072

2 Enteramount om PaRL/IMe 278 we ee eB 503924

3 Other nerenses nat included nine 2 (itemize) 3

4 Addins 12,0003 ie 158 40,796

5 Decreases not ncluded nine 2 (temize) @ [s 10,364426

6__Totalnet assets orfund balances at end of year ine ¢ minus ine 5)=Parti, column) ne 30_.| 6 750,576,360

Form 990-PF (2015)

Form 990-PF (2015) Page 3

EXMEG] Capital Gains and Losses for Tax on Investment Income

List and describe the kinds) of propery old 9 ea estate, Towsequred] pate acqured] Date sla

(ay 2 ttary brek narenouse,orcommon stack, 200 the MLC Co) [ay BRUNE cy (mo, day 99] (4) (mo. Say 9)

Ta Publely Tedea Secures P wors.o7-01 | 2015-10-08

b Publicly Traded Secures r 3083-07-01 | 2035-07-05

4

aces aarins Gepreciaton alowed Cost or other bane Gam ar (ons)

he da (f) (or atlowable) (9) plus expense of sale Ch) (2) plus (f) minus (9)

: 3a aas,aig 40,160,179 SERIE

D a7.5a3, 763] 73,896 405 apas.a78

4

‘Complete only for assets shaving gain in column (R) and owned by the foundation on 12/33/60

Gains (Col (hy gain minus

CF My as 0f 32/33/69 Gy as of 12/31/68 uo overcol U.tfany Losses (rom col (h)

Z

Qualification Under Section 4940(e) For Reduced Tax on Net Tavestment 1ncome

inves,

11Enter the appropriate amount in each column for each year, see instructions before making any entries

the foundation does not qualify under section 4940(e) Do not complete this part

ase pod Years Caenar © 9, Detnbioon ato

ecpemot year Center| assed qualtyng dstnbuoons | Net vale of nocartatle use assts eee

2014 7333825 769,310,058 0.04686

2013 5,214,090) 148,198,493 003518

2042 4,204,617, 117,988,208 003643,

zor 309,576 75,473,901, 0.00395,

2010

2 Vetabfiinet,coumn(@. ee eee ee ee eee LB o1za4i6

3 Average distribution ratio forthe 5-year base period—divide the total online 2 by 5, or by

the number of years the foundation nas been mexistence ifless than § years 3 0.030605

4 Enterthe net value of nonchanttable-use assets for 2015 from Part X,line 5... . [a 150,873,752

5 Multiply ined byline3. ee ee P 4,862,331,

6 Enter 1% of net investment income (1% ofPartI,line278). - = +... + + [6 74,094

7 Addlines $866. ee eel 236,425

8 Enterqualifying distributions fromPartXIL,line4. os ee ee ee ee LO 7,603,995

Lfline @ 12 equal to or greater than line 7, check the Dox n Part VI, line 1b, and complete that part using a ity taxrate Gee

the Part VI nsteuetions

Form 990-PF (2015)

Form 990-PF (2015)

Excise Tax Based on Investment Income (Section 4940(a), 4940(b), 4940(e), or 4948—see page 18 of the instructions)

Page

‘ia Exempt operating foundations descnibeg im section 4940(@)2), check here Pe [-

and enter "N/A" on ine £

Date ofruling or determination latter

(attach copy of letter f necessary—ses instructions)

bb Domestic foundations that meet the section 49.40(e) requirements in Part V, check

here P Fand enter 1% of Parti,line27B . . + A Popo eas

© All other domestic foundations enter 2% of line 27b Exempt foreign organizations enter 4% of

Parti, ine 12, col (9)

2 Tax under section S11 (domestic section 4947(a)(1) trusts and taxable foundations only Others

enter 0°) 2

a) Adiimestend2 lee 74094

4 Subtitle A (income) tax (domestic section 4947(a)(1) trusts and taxable foundations only Others

enter -0-)

5 Tax based on investment income.Subtract line 4 fomline 3 Ifzero rless,enter-0-- . . . . [os 74,094

6 Credits Payments

82015 estimated tax payments and 2014 overpayment credited to 2015 | 6a 112,800

bb Exempt foreign organizations—tax withheld atsource. . - - - . . | 6b

€ Tex poid with application for extension of tne to file (Form 8968)... | 6e.

4 Backup withholding erroneously withheld... Loe

7 Total credits and payments Addlines 6athrough64. =. 2 2 1 2 ee 112,800

‘@ Enter any penalty for underpayment of estimated tax Check here [~ \fForm 2220 1s attached

9 Tax duedfthe total of ines 5 end 6 1s more than line 7, enter amount owed... 2

40 Overpayment.ifline 7 = more than the total ofines 5 and 6, enterthe amount overpaid... & | 40 30,706

11__Enter the amount of ine 10 to be Credited to 2018 estimated tax 2e.706 Refunded > [an

Statements Regarding Activities

‘8 During the tax year, did the foundation attempt to influence any national, tate, or local legislation or di

‘t participate or intervene in any political campaign? oe es

bid spend more than $100 during the year (either directly or incirectly) for political purposes (see Instructions

ordinate eee o Gogo eo aa

Ifthe answer is "Yee" to a of Ab, attach a detailed description ofthe activities and copies of any materiale

published or distributed by the feundation in cannection with the activities.

Did the foundation file Form 1120-POL for this year?

41 Entar the amount (any) oftax on pltical expenditures (section 4955) imposed dur the year

(2) on the foundation > § (2) on foundation managers Be §

Entertherembursement any) pid bythe foundation dunng the year for political expenditure tax posed

on foundation managers B §

2. Hs the foundation engaged in any activites tat have not previously been reported tothe IRS? vs

1 °¥e," attach a detailed description of the acts.

3 Haste foundation made any changes, not previously reported to the IRS, in te governing instrument, atiles

af incorporation, or byl, er other simar instruments? 1f "es," attach a confermed copy othe changes =

4d the foundation have unrelated business gross income of$1,000 ormore dunngthe year?. ws v= + =

5 Was tere a liuideton termination, dissolution, or substentel contraction dung the Yate? eee ee

1 "Ye," tach the statement required by General Instruct T.

6 Arethe requirements of section 508(e) (relating to sections 4941 through 4945) satisfied esther

2 by language nthe geverning mstument or

{By state legislation that efectvey omends the governing mstrument so that no mandatory directions

ne ire Ne

7 oid the foundation have atleast $5,000 m assets at any time dunng the year? "Yes," complete Fart I, cl. (c

ee Ne lve

fa Enter the states to which the foundation reports or wth which ts repstered (ee structions)

bie SS

b tthe ananer "Yes" tone 7, has the foundation farahed& apy of Farm 980-PF to he Atorney

General fr designate) of exch state as required by General Instruction G? If "Na" attach explanation [ab | ves]

9 Is the foundation cioming status as » prvate operating feundation within the meaning of section 49420X3)

or £94245) for calandar year 2015 or the taxable year beginning n 2015 (se instructions for Par XIV)?

Ti vepeeiacat ny lee Ne

10 oid any persons become substantial contnbutors dung the tax yer? 1f "es" attach a schedule isting ther names

Form 990-PF (2015)

Form 990-PF (2015) Page S

Statements Regarding Activities (continued)

IL At ny tne dug the year, the foundation, decty of ndeci, om a convoed eTURY win he a

insauin becian siciiaisifsveh ceschschacaslommnnicama | ee et [raat] ine

32. Did the foundation make a distribution to a donor advises fund aver which the foundation ora disqualified person had

advisory privileges? If "Yes," attach statement (see instructions} See ee [aa No

13 1d the foundation comply withthe public inspection requirements for its annual returns and exemption application? [43 | Yes

Website address PA/A

14 The books are in care of PStaci Wks ‘Telephone no (817) 850-3600

Located at 25 County Road 166 Caco TX z1p-+4 76437.

45 Section 4947(a)(t) nonexempt chantable trusts filing Form 990-PF in lieu of Form 4081 —Check here... 2 2 2

land enter the amount of ox-exempt interest received or acerued during the year. 5 « > [as

46 At any time dunng calendar year 2035, di the foundation have an interest in ora signature or other authority over

1 bank, secunties, or other fnancial account ina foreign country?

‘See instructions for exceptions and filing requirements for FinCEN Form 134, Report of Foreign Bank and Financial

Recounts (FBAR) If "Yee", enterthe name ofthe foreign country Pe

FEMAWIELY statements Regarding Activities for Which Form 4720 May Be Required

File Form 4720 if any item is checked in the "Yes" column, unless an exception applies.

4% During the year di the foundation (either directly or indirectly)

(1) Engage inthe sale or exchange, or leasing of property with a disqualified person? T ves F No

(2) Borrow money from, lend money to, or othermse extend credit to (or accept i rom)

2 disqualited person? T ves F Ne

(2) Furnish goods, services, oF facilities to (or accept them from) a disqualified person? T ves F No

(4) Pay compensation to or pay or reimburse the expenses of, a disqualified person? P ves F Ne

(5) Transfer any income or assets to a disqualified person (or make any of either available

forthe benefit oruse of disqualiied person)? vv ee ee ee ee ee ee P08 No

(6) Agree to pay money or property to a gavernment offical? (Exception. Check "No"

ifthe foundation agreed to make a grant to orto employ the oficial fr @ period

after termination of government service, fteeminating within 90 days). 2 ss ss + Per Ne

bb Ifany answeris "Yes" to 1a(1)-(6), did anyof the acts fall to qualify under the exceptions described in Regulations

Section 53 4941(4}-3 or ma current notice regarding disaster assistance (see instructions)?

DOraanizations relying on @ current notice regarding disaster assistance check heres. «ss es PT

Did the foundation engage ina prior year im any ofthe acts described in 1a, otherthan excepted acts,

that were not corrected before the frst day ofthe tax year beginning n 20157. « ee

2 Taxes on failure to distribute income (section 4942) (does not apply for yeers the foundation was # private

‘operating foundation defined in section 494 2()(3) or 494 20)(5))

At the end of tax year 2015, aid the foundation have any undistributed income (lines 6d

and 6e, Part XI11) for tax year(s) beginning before 20157... Sos Fives FF No

If*Yes, list the years 20__, 20__, 20__, 20__

1b Are there any years listed in 2a for which the foundation rs nat applying the provisions of section 49442(a)(2)

(relating to incorrect valuation of assets) to the year's undistnbuted income? (if applying section 4942(a)(2)

to allyears listed, answer "No" and attach statement—see instructions Je ev ee ee ee

€ Ifthe provisions of section 4942(a)(2) are being applied to any of the years listed in 2a, list the years here

> 20__, 20__, 20. 20,

3a Did the foundation hald more than @ 2% direct or indirect interest in any business enterpnse at

anya Gigievert eee P ves F Ne

b Ir*¥es," aid have excess business holdings in 2015 as a result of (4) any purchase by the foundation

oF disqualifies persons after May 26, 1969, (2) the lapse of the 5-yeer period (or longer period approved

by the Commissioner under section 4943(c)(7)) to dispose of holdings acquired by gift or bequest, or (3)

the lapse of the 10-, 15-, or 20-year first phase holding peried?(Use Schedule C, Form 4720, to determine

If the foundotion had excess business holdings in 2015). . Pee

44a Did the foundation invest dung the year any amount n a manner that would jeopardize its chantable purposes?

1b Did the foundation make any investment na pnor year (out after December 31, 1969) that could jeopardize its

chantable purpose that had not been removed from jeopardy before the first day ofthe tex year beginning in 2015?

Form 990-PF (2015)

Form 990-PF (2015) Poge 6

FENRIS statements Regarding Activities for Which Form 4720 May Be Required (Continued)

‘52 _Dunng the year did the foundation pay or eur any amount to

(2) Carry on propaganda, or otherwise attempt to iuence legislation (section 4945(e))? T ves F Ne

(2) Influence the outcome of any specific pubic election (see section 4955), orto carry

fon, dieetly or indirectly, any voterregistration dnve?. 2. vv ee ee we ww ee Pes NO

(3) Provide a grant to an individual for travel, study, or other similar purposes? ves F No

(4) Provide a grant to an organization other than a charitable, ete , organization described

in section 4945(d)(4)(A)? (See instructions). «ee ee ee ee Yes NO

(5) Provide for any purpose other than religious, chantable, scientifi, literary, oF

‘educational purposes, of for the prevention of ervelty to children ar animals T ves F No

bb Ifany answer's "Yes" to Sa(1}-(5), did anyof the transactions fall to qualify under the exceptions descnbed in

Regulations section 53 4945 or ma current notice regarding disaster assistance (see instructions)? «

Organizations relying on @ current notice regarding disaster assistance check here... «s+ PT

€ Ifthe answers "Yes" to question Sa(4}), does the foundation claim exemption from the

tax because it maintained expenditure responsibilty forthe grant... 2 ee ws 2D ves F No

14 "Yes," etach the statement required by Regulations section 53.4945-5(d)

{62 Did the foundation, uring the year, receive any funds, directly or indirectly, to pay premiums on

fecal enete conemactes coreg ee ig ves ta

bid the foundation, during the year, pay premiums, directly or indirectly, on a personal benefit contract?

14"¥es" to 6b, file Form 8970

7a At any time dunng the tax year, was the foundation a party to a prohibited tax shelter transaction? [Yes F No

b_Ityes, did the foundation receive any proceeds or have any net income attnbutable to the transaction?

Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees,

and Contractors.

1_Ust all officers directors, trustees, foundation managers and thelr compensation (eee instructions).

Title and average | (2) compensationttt | Conentstons to Expense account,

(a) Name and address. hours perweek | not peid,enter | smoicyee benett plans | (e) other allowances,

oy aevotea to postion a) and deferred compensation

an ia eT reas 4]

125 County Roaa 168 Joo

Soaks Frases 9]

125 county Rona 168 joo

iseo,TX_ 76437

2 Compensation of five highest-paid employees (other than those included on line 1—see inetractions).If none, enter "NONE:

a Title, and average employee beneft xpense account

Name and aaaresssteach employee pas | "hour per week | (e)Compensaron | tmPovee benet | Expense account

tore than $20,000 (2 devotes positon es ae

one

Tetalnumbercfathr employees padover50000,

Form 990-PF (2015)

Form 990-PF (2015)

Page 7,

Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees,

and Contractors (continued)

'3_ Five highest-paid independent contractors for professional services (see instructions). If none, enter "NONE".

(@) Name and address of each person paid more than $50,000 (b) Type of service

‘Total number of others receiving over $50,000 for professional services.

EXGEEEN summary of Direct Charitable Activities

(© Compensation

‘Wanaabons and her banfeanes served, conferences convene, fsearh papers pecuced, ete Expenses

1

2

3

4

‘Summary of Program-Related Investments (see instructions)

Deserbe the te lagest program estod nvesuners made by the oundaton dung the fax year on hes 137d 2 mount

1

Aether programcrelated vestments See structions

3

‘Total Ada ines rough eae eee eee ee eee eee

Form 990-PF (2015)

Form 990-PF (2015) Pages

EEE Minimum investment Return

All domestic foundations must complete this part. Foreign foundations see instructions.

1 Fairmarket value of assets not used (or held for use) directly in carrying out chantable, etc

purposes

8 Average monthly four market value of secuntiess 6. ee ee ee ee ee Lae 155,605,742

b Average of monthly cash balances... ee ee ee ee ee [a 1,687,407

€ Fairmarket value of ll other assets (see instructions). © 2 2 22 2 2 ee ee ee [ae 3

@ Total (addlines 18,bandeh ee ee ee ad 161,293,149

{© Reduction claimed for blockage or other factors reported on ines 1 and

tc (attach detailed explanation)... -- 2. +--+ Lae

2 Acquisition indebtedness applicable to line assets. ee ee LR

o tincthaitemine eal 161,293,148

4 Cash deemed held for charitable activities Enter 1 1/2% of ine 3 (for greater amount, s26

instructions) 2,419,397

5. Not value of noncharitable-use assets.Subtract line 4 from line 3 Enter here and on Part V, line 4 5 150,073,752

6 _ Minimum investment retuménter Ste ofling Sev ve ee ee 6 7,943,688

Distributable Amount

BEEIEST Goce instructions) (Section 4942())(3) and (3)(5) private operating foundations and certain f

check here ® [~ and do not complete this part.

foreign organizations

Si inenis tan vrs ec ec ane Tease

2a Taxon mvestmentincome 72015 fom Pan Visine 5. + «+ + + (2a a094

Income tax for 2015 (This doesnot clue he tax fom Pan VE Je «+ [

See eee 74,9094

3 itnnutaie amount before aqustrents Subtactine Zefum mee ve ee eee ee ee LS Tes 594

4 Recovenes ofamouns westedas qatfyngdstnbwionss vs see eee La

© Deacon Wom dtrovtabl sreune (eee mstuctons). es se vv ee be ee ee eo PS

7 _istbutale amounts susea subtract ne 6 fom ine 5 Enterhere angon PartXtth ine ts [7 Tees

FEED Qualitying vistributions (see nstructons)

Amounts pad (ncluding adronstratve expanses) accomplan chaiable, ac purpones =

expenses, contrbution, ats ate total for Part, colime(@hine 26+ vv ve vs ee «Le 71003995

b Prosramreated investments total fom PORTKB. ee te ee ee fat

2 Amounts pido acque assets sed (or el foruse) ety in carting out chatabe, ee

purposes.

3 Amounts set ase for specie chartble projects that susy the =

[ocean 8

4 Qualtying statins dines 1 trough 3b enter here and on PartV, ne Sy end are xt nes [La Tas 53

5 Foundations that quay ander section 4940(e) forthe reduced rat of taxon net investment

Income Enterdte ofPartijine 27b(see msttctions). vv vv vv ee ee ee LB 74994

© Adjusted uattying datriutionssubtactiine Sfomlie fe vw vv ee 5 725801

[Note:The amount on line 6 yall be used in Part V, column (b), n subsequent years when calculating whether the

the Section 4940 (e) reduction of tax in those years

‘Toundation qualifies for

Form 990-PF (2015)

Form 990-PF (2015) Page 9

SEH Undistributed Income (see structions)

@

@,

years priosto 2014

1. Distnbutable amount for 2025 from Pare XI, ine 7

2. undistabuted income, if any, a8 ofthe end of 2015

2 Enteramount for 2018 only... es

b Totalforpnor years 20__, 20__, 20__

3. Excess distnbutions carryover ifany, fo 2015

2 From20i0, 0. s+

b From 2031,

© From2012. .

4 From2013, 5 1 ss

@ From2014. 2...

f Totaloflines 3a throughe. . . ss =

4 Qualifying distributions for 2015 trom Part

XII, line 4 Dg 7,603,995

2 Applied to 2014, but not more than line 22

b Applied to undistnibuted income of prior years

(Election required—see structions). + > «

€ Treated as distnbutions out of corpus (Election

required=see instructions). vss

4 Applied to 2015 distabutable amount.

fe Remeining amount istnbuted out of corpus

5 Excess distributions carryover applied to 2015

(fan amount appears in column (4), the

‘same amount must be shown n column (3).)

6 Enter the net total of each columm as

Indicated below!

2 Corpus Add lines 3f,4c, and 4e Subtract ine S

bb Prior years undistributed income Subtract

line 4b ffomline 2Be os se ve ne ee

Enter the amount of pnor years’ undistributed

income for which a notice of deficiency has.

been tssued, or on which the section 4942(@)

tax has been previously assessed...

4 Subtract line 6¢ from line 6b Taxable amount

f¢ Undistributed income for 2024. Subtract line

43 from line 28 Taxable amount—see

f Undistabuted income for 2026 Subtract

lines 4@ and 5 from line 1 This amount must

derdistnbuted in 2015+ 0 vv a:

7 Amounts treated as distnbutions out of

corpus to satisfy requirements imposed by

section 170(6)(1)(F) 0 4942(g)(3) (Election may

be required - see instructions)

8 Excess distributions carryover trom 2010 nat

applied online 5 or line 7 (see instructions}...

9. Excess distributions carryover to 2016.

Subtractines JandS from line 63.2...

10 Analysis oftine §

Excess from 2013...

Excess from 2012.

b

© Excess from 2013...

4 Excess from 2014. 1.

Excess from 2015.

Form 990-PF (2015)

Form 990-PF (2015)

Fs

If the foundation has received a ruling or determination letter that its a private operating

foundation, and the ruling is effective for 2015, enter the date of the ruling. = (

‘Check box to indicate whether the organization 1s a prvate operating foundation described in section [”_4942()(3) or F” 49420X5)

Enterthe lesser of the adjusted net

sneome from Part or the minimum

investment retum from Part X for each

yearistede ees ee

95% oftine 28

Qualifying distnbutions from Part XI

line 4 foreach yearlisted

Amounts included inline 2e not used

directly for active conduct of exempt

eve ee te

Qualtving distnbutions made directly

for active conduct of exempt activities

Subtract ine 2d fromline 200. >

3 Complete 3a, b, ore for the

alternative test relied upon

“assets” alternative test—enter

(2) Value ofeit assets...

@) Value of assets qualifying

under section 494203 X60)

"Endowment" alternative test— enter 2/3,

‘of minimum investment return shown in

Part X, line 6 for each year listed.»

“Support” alternative test—enter

(2) Total support other than gross

snvestmant income (interest,

Gividends, rants, payments

fon secunties loans (section

512(@X5)) orroyatties). =

(2) Support from general pubic

and 5 or more exempt

‘organizations a2 provided in

Section 43420)3)(8Ki- +

(3) Largest amount of support

from an exempt organization

(4) ross investment income

Private Operating Foundations (see instructions and Part VII-A, question 9)

-

Page 10

Prior 3 years

(2015,

zoe

[ORIEE]

212

(@) Tota

assets at any

Supplementary Information (complete this part only if the organization had $5,000 or more in

fe during the year~see instructions.)

1 Taformation Regarding Foundation Managers:

‘9 List any managers ofthe foundation who have contributed more than 2% of the total contributions received by the foundation

Before the close of any tax year (but only ifthey have contnbuted more than $5,000) (See section 507 (3)(2) )

‘See Additional Date Table

List any managers ofthe foundation who own 10% ormore ofthe stock ofa corporation oran equally large portion of he

‘ovmership of ® partnership or other entity) of which the foundation has » 10% or greater interest

2 Taformation Regarding Contribution, Grant, Gift, Loan, Scholarship, ete, Programs:

Check here PIF ithe foundation only makes contributions to preselected chartable organizations and does not accept

unsolicited requests for funds Ifthe foundation makes gis, grants, etc (see instructions) to individuals or ergantzations under

other conditions, complete items 2a, b,c, end d

2 The name, address, and telephone number or email address ofthe person to whom applications should be adaressed

'b The form in which applications should be submitted and information and matenas they should elude

Any submission deadtines

4 Any restrictions or limitations on awards, such as by geographicel areas, charitable fields, kinds of institutions, or other

factors

Form 990-PF (2015)

Form 990-PF (2015)

Supplementary Information(contmued)

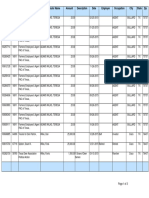

3 Grants and Contributions Paid During the Year or Approved for Future Payment

Page 42,

Tr recipient isan individual

seen showany relationship to | Foundation | purpose of grant or

‘any foundation manager | Status of ontribution rea

Name and address (home or business) | 27 foundstion manager | recipient

1 Pad during the year

See Schedule attached none s01(cx3) [See attached 7,603,995

Various, TX 76437

Total > ae 77503995

Aoproved for Tatre payment

‘See Schedule attachee hone lsoxrcy;s) [see schedule attached 136,100

Vartous,TX 76437

> 136,100

Form 990-PF (2015)

Form 990-PF (2015)

‘Analysis of Income-Producing Activities

Page 42

Enter gross amounts unless othermse indicated

Unrelates business income

©

elated or exempt

funetion imeome

@ © © @

1 Program service revenue pusiness cove] Amount | Exciusion code | Amount — | saguSE ng)

b

4

t

{9 Fees and contracts from government agencies.

2 Membership dues and assessments.

3 Interest on savings and tamporary cosh

4 Dividends and interest from securities.

'5 Net rental income or (loss) fom real estate

2 Debt-financed property.

b not debt-fnanced propery.

66 Net rental income or (loss) fom personal

property

7 Other investment income.

{8 Gain or (loss) from sales of assets other than

‘9 Net income or (loss) from spacial events

10 Gross proft or (loss) from sales of inventory

11 Other revenue a captal gans str 1 778233

b other svedment mom 1 502

4

12 Subtotal Add columns (B) (@) and (e)

33 TotaLadd line 12, columns (b}, (4), and (e).

(See worksheet inline 13 instructions to vent

Line No.

YF | instructions)

calcuitions }

Fey Te

Relationship of Activities to the Accomplishment of Exempt Purposes

Explain below how each activity for which income is reported n column (e) of Part XVI-A contributed importantly

the accomplishment ofthe foundation's exempt purposes (ether than by providing funds fer such purposes) (See

Form 990-PF (2015)

Form 990-PF (2015) Page 43,

Information Regarding Transfers To and Transactions and Relationships With

Noncharitable Exempt Organizations

1 Dist organzation det or rectly engage ay othe Totowa wi any ole ogancaten described m

ecuan 01 (e) arte Case (omer nan section S01 (eX) rganzatone) rim section $57, relating poles ves] No

oraamztions?

a Transfers om the reporting foundation to a ronchartable exempt organization of

(Cah nee tee ee fixe Pe

(2) omer asses ac] | vo

» otner transactions a

a cee eee eee palealn

(2) Purchases of assets rom a nonchanableexempterganaatons se ee ee ee ee ee ee fata De

ih temsleteinesteaipnim secmuranct 5 accolscalin

(4) Rembursementarngementir one frat Te

ee Ors

(eiPerormance of seaces or membership or undratsngSlictatons. a5c6)| | ve

« Shang oferives, equipment mating ists, athe asses, or pad employeess ee vv we ee ee ee + Pte [pe

4 Trine answers any ofthe aove e "Yee" complete te following schedle Celumn (t) should svays stow the far ark valve

atthe goods ther aasets,ovaeres gen by he repoamg foanaten tite wundeset ceed lee hen ir mantet eae

inany ranscton ar shvingeronsementshowimcoarn (a. value ete gous, her assets er semces received

Ba Te the foundation directly or ndirectly affliated wth, or related fo, one or more tax-exempt organizations

descnbed n section 501(c) of the Code (other than section S01(c)(3)) orinsection 5277... =... ss. «Yes FFNo

bb If-Yes;" complete the following schedule

(e) tame of ganzaton (6) Type of onpnaten (ep Descpton of retort

Under penalties af pequy, I declare Hat Rave examined tha rem including accompanying schedules andatalemenis, alo

the bost of my knonledge and bei, ti re, correct, and compete. Declration of preparer other han taxpayer) = besed on sl

sgn | Imermaton ofwrich preparer has any krowedge

sign

rere Ae (ae

Sionature officer or trustee Date Te

Bave neck Feel

Pentstype preparers name | Prevorers Sianature

entre prepare rere ig employed ser Posaisee7

Paid [Fimaname > Fens We

Preparer \Victork Munson CPA

Use rarsamea

5050 N Central Expny Sute S60 Oalls, TX 75208 Prone sp ia) 257-2970

Form 990-PF (2015)

Form 990PF Part XV Line 1a - List any managers of the foundation who have contributed more than 2% of

the total contributions received by the foundation before the close of any tax year (but only if they have

contributed more than $5,000).

Dan H Wilks:

‘Staci Wike

[As Filed Data —]

TY 2015 Accounting Fees Schedule

Name: Heavenly Fathers Foundation

EIN: 27-6987913

Software ID: 15000324

Software Version: 2015v2.0

Category ‘Amount Net Investment Adjusted Net | Disbursements for

Income Income Charitable

Purposes

‘Accounting fees 5.450 0 0 °

[efile GRAPHIC print — DO NOT PROCESS TAs Filed Data-[ DIN: 9349122800616]

TY 2015 Other Assets Schedule

Name: Heavenly Fathers Foundation

EIN: 27-6987913

Software ID: 15000324

Software Version: 2015v2.0

Description ‘Beginning of Year- | End of vear-Book | End of Year Fair

Book Valve Value Market Value

Alternative investments 894,780 12,679,688 12,679,688

‘Organization cost net of amortization 1210 605, 605

[efile GRAPHIC print DO NOT PROCESS [As Filed Data | DLN: 93491228006166]

TY 2015 Other Decreases Schedule

Name: Heavenly Fathers Foundation

EIN: 27-6987913

Software ID: 15000324

Software Version: 2015v2.0

Description ‘Amount

Decrease in unrealized gain 10,364,428

[efile GRAPHIC print — DO NOT PROCESS TAs Filed Data-[ DIN: 9349122800616]

TY 2015 Other Expenses Schedule

Name: Heavenly Fathers Foundation

EIN: 27-6987913

Software ID: 15000324

Software Version: 2015v2.0

Description Revenue and Expenses] Net Investment | Adjusted Net Income | Disbursements for

per Books. Income Charitable Purposes

‘Amortization expense 605

‘Amortization of Bond prem/aise 3372 447 “7

Brokerage fees 231,152 233,512, 233,512

Federal income tx 125,345

Foreign tax withheld on divigendineame 15,091 89,497 89,497

Miscellaneous investment exp @ BNY 33,711 33,711

[efile GRAPHIC print — DO NOT PROCESS TAs Filed Data-[ DIN: 9349122800616]

TY 2015 Other Income Schedule

Name: Heavenly Fathers Foundation

EIN: 27-6987913

Software ID: 15000324

Software Version: 2015v2.0

Description Revenue And Net Investment | Adjusted Net Income

Expenses Per Books Income

Capital gains aistr 778,213 734,669 734,669

‘Other investment come 4582 43,970 43,970

[Heavenly Fathers Foundation 7

For 990.9= (2012) Par XV Supplementary Information (continued)

015,

1

i

crated connate Pd Ong eV o Approved fo Fue Pest

i

|

I

*

repent an naive

| show any relationship || Foundation

Recipent ‘ny foundation manager" status of

Name an Adress orsvbstantia contabutor_| |_reoment

BOF APSI/AOS

Purpose of grantor

‘contnbston

age 22

[sad eunng the year f

IMountan Top church \

1492 W interstate 20,

Jesco, 7x 76437-5827

ew Horn q

Jas trst

aus | —

2

i

La

Jabiene, 1.79605

~.]

a

pasts and Peas tt

menor Far scan

07 Parsgate Drive

upate, is 38801

[serenty House

hsasw ana

|anene, 79601

sous |

z

I

ease coum scene ine |

ls7S man 1

easton, rx 7648

crossed Church

[226.9 Fronee St 1

Jasper, cOexe11 '

1905 Highway 206

Josco, 175437

[cisco Semiar Nutribon Program

po sox 308,

losco. 1x 76837,

|asersgate Ennchment Center souier

[ro Box 120s

|srownwood, 1.76868

Family Sere Center

lsor avenues

lrownwood, x 76601

catary Chapel of Thousand Oaks 1 chuten

2697 Lavery court, sure 10

Newbury Park, 91320

Ja2W Dvsion st

Javtngton, Tx 7601

lubertyCounset

po ox 520774

loriondo, 1 32654

sonics

are |

‘working capital needs |

Fases& 17 new stat

New Buling

a

ee

peal

i

Drug prevention rograms’

Fund uninsured indus

Siero pastor sly

‘Open Door proves

Sstnes forester

Renovate buidings

© promote communty muistnes,

Energon Sheer Sees

fundasing bane |

~ counseior sary |

~ iso00

602,300

4,820,000

14900,000

1026931

25,000

24,750

00,000

136,100

0,000

20.000

4500

35,000

0,000

20,000

69.739

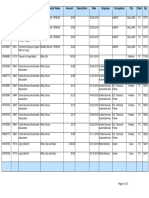

[resent raters Foundatan 1] al

form 280-2012) rar xv Sippkimertar informatio fconinuee)

i

cra an centsbstens ad ug the Year or Approve Fue Pmt

eeapent anneal

show anyrebtonshie 9 Foundoton

So asses oo fee

HameangAséress || orsubstamalcombutor | reeoient_| entnouton, “mount

Ferrie ae eee '

[comminty Biiestady-e-teens | Sage ty es nie 3000

facts sonon : is oe . :

eastand 7438 eg a ee ee

[cscoroosranny outes

las6 winter 20

lsco, 768378837

i.

[eramieneto ute

[328 Dutes Comer vawsr0" | |

Jerson 20071

Fama Sous Rade andinteet frogammng. | $80000

Jss0Bkton br Sue 202

Jokers sprmgs,co sono?

cee of pe

[oss eeeaterlfscesion

sc0 cent viton She

- |

esc erst

esotaows | sous"! oatasitarneet stevie 8

fanaest gee ee || !

ose, 7407 ee le

line Gieons international oo ies 2000

Jocentuy hed

sates intestinal hrogimmingandacuston| 580000

oan gan cere, Sate 2277

stun om 3220

eae Flows ' < exh : _ soo

iss ar ore

= —_—-_—_—-

ae eae : .

sks Heraage Group ‘ae eae ee - oe

fousimerierow . z “

et ee | ;

aS ' : sl

. z = alae

> Aepovester tre payers all

ee ge eal

lswonscoimyciaresiocine| ~~ 7 necipicemis |

freemen pee oe [ee

eens, Tvs a I

rot a» ae

Form 90-05

Vous aimerez peut-être aussi

- 2021 States and Nation Policy Summit AgendaDocument4 pages2021 States and Nation Policy Summit AgendaTeddy WilsonPas encore d'évaluation

- Texas HHSC Request For ApplicationDocument104 pagesTexas HHSC Request For ApplicationTeddy WilsonPas encore d'évaluation

- WWHA V PaxtonDocument43 pagesWWHA V PaxtonTeddy WilsonPas encore d'évaluation

- Human Coalition - Texas Grant ContractDocument455 pagesHuman Coalition - Texas Grant ContractTeddy Wilson100% (1)

- DFPC Prayer List UpdatedDocument1 pageDFPC Prayer List UpdatedTeddy WilsonPas encore d'évaluation

- Capitol Riot Map 1.11.21Document1 pageCapitol Riot Map 1.11.21Teddy WilsonPas encore d'évaluation

- PP v. JegleyDocument148 pagesPP v. JegleyTeddy WilsonPas encore d'évaluation

- Wilks Family Campaign Contributions - Texas (2015)Document3 pagesWilks Family Campaign Contributions - Texas (2015)Teddy WilsonPas encore d'évaluation

- Wilks Family Campaign Contributions - Texas (2018)Document3 pagesWilks Family Campaign Contributions - Texas (2018)Teddy WilsonPas encore d'évaluation

- Return of Private FoundationDocument40 pagesReturn of Private FoundationTeddy WilsonPas encore d'évaluation

- Wilks Family Campaign Contributions - Texas (2016)Document9 pagesWilks Family Campaign Contributions - Texas (2016)Teddy WilsonPas encore d'évaluation

- PF Return of Private Foundation: ExpensesDocument20 pagesPF Return of Private Foundation: ExpensesTeddy WilsonPas encore d'évaluation

- Wilks Family Campaign Contributions - Texas (2017)Document7 pagesWilks Family Campaign Contributions - Texas (2017)Teddy WilsonPas encore d'évaluation

- HFF 990 2013Document124 pagesHFF 990 2013Teddy WilsonPas encore d'évaluation

- TTF 990 2013Document127 pagesTTF 990 2013Teddy WilsonPas encore d'évaluation

- HFF 990 2012Document35 pagesHFF 990 2012Teddy WilsonPas encore d'évaluation

- HFF 990 2016Document22 pagesHFF 990 2016Teddy WilsonPas encore d'évaluation

- Form 990-PF Return of Private FoundationDocument18 pagesForm 990-PF Return of Private FoundationTeddy WilsonPas encore d'évaluation

- TTF 990 2016Document25 pagesTTF 990 2016Teddy WilsonPas encore d'évaluation

- HFF 990 2014Document22 pagesHFF 990 2014Teddy WilsonPas encore d'évaluation

- TTF 990 2011Document43 pagesTTF 990 2011Teddy WilsonPas encore d'évaluation

- TTF 990 2014Document29 pagesTTF 990 2014Teddy WilsonPas encore d'évaluation

- TTF 990 2012Document39 pagesTTF 990 2012Teddy WilsonPas encore d'évaluation

- TTF 990 2015Document25 pagesTTF 990 2015Teddy WilsonPas encore d'évaluation

- Texas A2A Program FY2018 Q2 (Foundation For Life Annual Monitoring)Document3 pagesTexas A2A Program FY2018 Q2 (Foundation For Life Annual Monitoring)Teddy WilsonPas encore d'évaluation

- Texas A2A Program FY2018 Q1 (Pregnancy Care Center Huntsville - Facility Tour)Document2 pagesTexas A2A Program FY2018 Q1 (Pregnancy Care Center Huntsville - Facility Tour)Teddy WilsonPas encore d'évaluation

- Texas A2A Program FY2018 Q2 (Pregnancy Help Center of Lufkin Annual Monitoring)Document4 pagesTexas A2A Program FY2018 Q2 (Pregnancy Help Center of Lufkin Annual Monitoring)Teddy WilsonPas encore d'évaluation

- Texas A2A Program FY2017 Q4 (Foundation For Life Facility Tour)Document3 pagesTexas A2A Program FY2017 Q4 (Foundation For Life Facility Tour)Teddy WilsonPas encore d'évaluation

- Texas A2A Program FY2017 Q1 (Facility Tours)Document2 pagesTexas A2A Program FY2017 Q1 (Facility Tours)Teddy WilsonPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)