Académique Documents

Professionnel Documents

Culture Documents

HFF 990 2014

Transféré par

Teddy Wilson0 évaluation0% ont trouvé ce document utile (0 vote)

21 vues22 pagesHeavenly Fathers Foundation - IRS 990 (2014)

Titre original

HFF-990-2014

Copyright

© © All Rights Reserved

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentHeavenly Fathers Foundation - IRS 990 (2014)

Droits d'auteur :

© All Rights Reserved

0 évaluation0% ont trouvé ce document utile (0 vote)

21 vues22 pagesHFF 990 2014

Transféré par

Teddy WilsonHeavenly Fathers Foundation - IRS 990 (2014)

Droits d'auteur :

© All Rights Reserved

Vous êtes sur la page 1sur 22

rom990-PF

Ss

or Section 4947(a)(1) Trust Treated as Pr

norte Souce

Return of Private Foundation

ate Foundation

> Donot enter social security numbers on this form as it may be made public.

> Information about Form 990-PF and its instructions fs at www.irs.gov/formS90pf.

[efile GRAPHIC print DO NOT PROCESS [As Filed Data — | DLN: 93491222002865]

Me No 1545-0052

2014

Open to Public

een

For calendar year 2014, or tax year beginning 01-01-2014 sand ending 12-31-2014

oo

TF eprover aNNCaON Hae

Telephone nanber (ase marocons)

250) 6x77

IFexerptionappieation pening, check here & FH

‘GCheck ail that apply Timtatreturn [Intel return of former pubic chanty | 4, Foregn omonaotons, check hee re

egos eee > coca,

Whack type of organization FY Section 504 (€K3) exempt private foundation Delp rtm te

[section 4947(a)(1) nonexempt chantable trust_[ Other taxable pnvate foundation

T Fair market value of all assets at end | JAccounting method TM Cash To accrual | F ithe foundation sma 60-month termination

cry i feces Seceanmannee

intros toons he Se EET

fomngiectananas apeapanrer | escsonz | wnemeinen | canine | Caan

sete atin it Cat = sm S|

sae colar

be Grn ret

2 |, Topnataainnetincome thom Part ne 2) sara

B | 15 Pension plans, employes benefits -

E | 160 Legal fees (attach schedule).

Tonner professional fees (attach schedule)

|18 roxes (attach schedule) (see instructions)

E [20 occupancy

= |21 Travel, conferences, and meetings -

B24 etatopertng and agri epee

5 Addtmes 13 through23.. . . . « ao 396,154] 364337 364,337 2,500

26 Total eenes and dase, ns 24a

1 Scar of vena over expe an daturenents sano

einer ce epee 8) aT

<_hejstednet ene seve tr) a

For Paperwork Reduction Act Notice, see instructions, Cat No 1289%

Form 990-PF (2014)

Form 990-PF (2014) Page 2

DENIER satance sheets ite onc of yeorsnwunts ony tae wars) ao oak Va] fe) Fae RV

Fe Cash arr nire ree eee

Accounts receweble

Less llowance for doubt accounts

4 Pledges recevvable

Less allowance for doubt accounts

6 Recenvables due from oficers, rectors, trustees, and other

disquatied persons (attach schedule) (se instructions)

7 Othernotes and loans receivable attach schedule)

Less allowance for doubt accounts

B| 9 rrapnt expenses and dated hanes os ss

|10a tnvestments—U S and state government obligations (attach schedule) 250931] Toa] Tense

Investments corporate stock (attach schedule}. vw ssw ws Tea] rien] anna

12. Invastnante—tan, bulge, and equipment basis

Less. accumulated deprecation (attach schedule) ®

12. tmvestments-mortgage lens

13 tnvestments-other (attach schedule)

14° Land, buldings, nd equipment basis

Less” accumulated depreciation (attach schedule) ®

15 other assets (describe ® lg 7aanly eral ate

16 ‘Total enets (to be completed by al flers—see the

oa

omine

| 20 Loans trom oficers, rectors, trustee, and other disqualied persons

Bax moranoes and other note payable tach shel

22 Otherlabities (descnbe )

23 _ Total abitin (odd ines 17 ough 2B) 7

Foundations tht follow SFAS 117, check here PT

3] ant complete tines 28 through 26 and tins 30 and 31,

Blea unrestncted 2. ee

Glas Temporaniyrestncted | se eee

lp ee

23] roundations that donot follow SFAS 117, check here FF

| and compete lines 27 through 3.

[27 cepa stock, trust rip orcurent hinds e700 arom

8] 2m Pads orcapital surplus, orang, bldg, and equipment fund

2 20. Retained earnings, accumulated income, endowment, or oer funds aman Ta

B]s0 Total net asets or fund blances (see instructions) Tease] ren657]

31 Total ables and nat asete/fond balances (see structions) = Teearzar] esas

EEE Analysis of Changes in Net Assets or Fund Balances

1 Total net assets a fund balances at begining af year—Part Il columa (a) ine 30 (must agree

wth and-ot-yeer gure reporeedonpnoryears atime vee eee ew te dB 166,992412

Scenics 0 ls 3,297,012

3 oOtherincreases not included nine 2 (itemize) 3

s Decreases not included in tine 2 (itemize) D> Ss 5 1,752,552

6 __Totalnetassetsorfund balances at end of year (ine 4 mus Ine S)-ParTi column ine 30_[ 6 160,436,872

Form 990-PF (2014)

Form 990-PF (2014)

Capital Gains and Losses for Tax on Investment Income

Page 3

(a) List and descnbe the kind{s) of property sold (e 9 , realestate, Coy Row araured|(c) Date acquired| (4) Date sold

story brek warenause, orcammon stock, 200 sha MLC CO) popurchase [mo dey. ve) | (me day. ¥")

ia Pubiely Teded Secures a woeo7-01 | Fore10-05

Publicly Traded Secunties P 3013-07-08_| 2044-07-08

4

ican as TH Depreciation aiowes | (a) Cost arother basis (Gon or foesy

(erellowable) lus expense of sale (e)puss (minus 6)

a5 236,554 43,752,729 1.404285

30,575,847 35,502,930 4,992,937

‘Complete only for assets shaving gain in column (R) and owned by the foundation on 12/33/69

(Gains (Col (hy gain minus

@) Adustea basis (ho Excess of ol (i) col (k), but not less than -0-)or

OVE Pl ees cuted as of 12/31/69, over col O),tany Losses (Irom col (h))

. 4,992,837

o

; : Taain also enter in Par, hne 7

2 Capital gain net income of (net capital loss) Wlloss),enter-0-imParci, ime? | | Aer

3. Net shortterm capital gain or (loss) as defined n sections 1222(5) and (8)

1f gain also enter in Part ine 8, column (c) (see instructions) If (loss), enter -0

inPartt,iine8 eee teas a. ; eee

(EEE cu wn Under Section 4940(e) for Reduced Tax on Net Investment Income.

(For optional use by domestic private foundations subject to the section 4940(a) tax on net investment income }

1 section 4940(d)(2) applies, leave this part blank

\Wias the foundation liable forthe section 4942 tax on the distributable amount of any year inthe base period? T ves F No

Ves," the foundation does not qualify under section 4940(e) Da nat complete this part

1LEnter the eppropriete amount in each column for each year, see instructions before making any entries

tase pod Yes Calear © ©, Drintaton ao

scrapes gerecalente,, | saute quattag dsirtatons | Wet vai of nominees assets eo a)

2013 54090 148 198493 003518

2012 4,294,617, 337,506,204 0.03643,

zor 309,576 75,473,901, 0.00395,

2008

2 Tetaloflinet,column(@ 7 LP 007556

3 Average aistrbution ratic forthe 5-year base period—divide the total online 2 by 5, or by

the number of years the foundation has been in existence ifiess than 5 years zea 02519

4 Enter the net value of nonchantable-use assets for 2014 from PartX,line 5... = . [a 169,310,058

S Multiply ines byIINE3. ee ee ee ee ee LS 4,264,243

6 Enter 1% of net investment income (1% of Part Iie 278. 2 ee es LO 105,298

7 Addines Sand. 2 2 ee eee ee 2,369,561,

8 Enterqualifying distributions fomPartXiLjinea. 2 2 ee ee LO 2,039,127

If tine 81s equal to or greater then line 7, check the box in Pert VI, line 1b, and complete that part using a Awe taxrate See

the Part Viimstructions

Form 990-PF (2014)

Form 990-PF (2014) Page

Excise Tax Based on Investment Income (Section 4940(a), 4940(b), 4940(e), or 4948—see page 18 of the instructions)

Ia Exempt operating foundations described in section #940 0N2), check here B Pand enter N/A"

nine 2

Date of ruling or determination letter (attach copy of latter if necesary-see

instructions)

bb Domestic foundations that meet te section 4940(e) requirements n Part V, check 1 105,298

here Be fFand enter of Pari lne 278

€ Allother domestic foundations anter 2% ofline 27b Exempt fram organizations enter 4% of

Partisine 12, cal ©)

2 Tak uideransbon 511 (mest sestn 454798) tan nel oudatons ely other

4S see tx omen secon 48470) tune ante andor ont othr

5 Tax based on investment income, Subtract hne 4frombine 3 Itzeroorless,enter-0-. . 2. 6 10558

6 Cresits/Payments

{2014 estimated tox payments and 2013 overpayment creited ro 201 | 6a e318

Exempt foreign organzations tox wthheld at source oy

€ Taxpaid wth application for extension oftime to fle (Fom 8868). ee 72,509

sieve eramuia ts cesnas cy einai ee la

7 Total credits and payments Adélines 68 through 6 z rssate

8 Enter any penalty for underpayment of estimated tax Check here fy sfForm 2220 1s attached @ [8 365

9 Taxdoe. Ifthe total ofimes $ and te morethan ine 7,enteramount owed. ss. ® @

10° Overpayment. fine 71s more than the total oflines $ and 8, enterthe amount overpaid, [30 Tease

11__Enterthe amount ofline 10 ta be cried to 2018 estimated tox 2035 _Retunded > [an

Statements Regarding Activities

fn During the ax year, did the foundation attempt to infuence ony national sate, orTocal epilation ord Yes [No

vt partcpate or intervene many political campaign? ee

b idit send more than $100 dunng the year (her directly or ndrecty) for police! purposes (ese Instructions

eter ae

1 the answer is "es" ob, attach deta descpton ofthe activites and copes of any matrals

published or distributed by the foundation in conection withthe atts

€ Did the foundation fle Form 142O-POLFortMEYERP. we ee ee |__|

4 Enterthe amount (fany) oftax on polical expenditures (section 4985) imposed during the year

G) on the foundation § (2) on foundation managers §

Enter th ranbursemant (any) pd bythe foundation dering the year for polical expenditure tax mnposad

an foundation managers Be $

2 Hes the foundation engaged in any acts Hat have nt previously been reported to the IRS? 2 No

11 es, ettachodetoieddescntin ef the acts.

3. Has the foundation made any changes, not previously reported tothe IRS, inte governing instrument, articles

of incorporation, or byana, or other simar instruments? 1f "Yes, "attach conformed cny ofthe changes 3 No

4a oid he foundation have unrelated business gross come of $1,000 or more during the yea? ene

bb 1F*¥e5; hos ified a tax return on Form 990 fortis year? ve eve ve ee tv ee + [ap Ne

5 Was there a hquidatio, terminator, dissolution or substantial contraction dunmg the year? swe ss. No

1 "Ye," tach the statement requ by General Instruction T.

6 Are the requrements of section 508(e) (relating to sectons 4941 through 4545) satsed erther

by language m the governing nstument or

{By state legislation that effectively amends the governing instrument so that no mandatory directions,

that confict wi the state lweremain m the governnginstrument? ve we ee ee ee LO No

7. Did he foundation have atleast $5,000 m assets at any time dunng te yea? ZF "Yes,"complete Part, (©,

be

bb ftheonawersa "Yeo" fone 7, has the foundation furnished a copy ofForm 990-PF tothe Aviomey

General (r designate) of exch state as required by General instruction G? If“, "attach explanation a» | ves

9 ste foundation claming status as a private operating foundation within the meaning of section 49420X3)

or 4942()(5)frcalenda year 2014 orth taxable year beginning n 2024 (se instructons for Par XIV)?

1 7¥e5," compet Part 0 2 No

10. id any persons become substantial contnbutors dunng the tex year? 1f "Yes," attcho schedule isting ther names

and aderesses. Detect retort ete tee teen tte ess [49] | ne

Form 990-PF (2014)

Form 990-PF (2014) Page 5

‘Statements Regarding Activities (continued)

41 Atany time dunng the year, did the foundation, directly or indirectly, own @ controlled entity wahin the

meaning of section 512(b\13)? If*¥es," attach schedule (see instructions)... sv ee ee ee ee at No

32. Did the foundation make a distribution to a donor advises fund aver which the foundation ora ciequalifieg person had

advisory privileges? If"Yes," attach statement (eee instructions) ee ee ee ee ee Lah No

13 Did the foundation comply withthe public inspection requirements for its annual returns and exemption application? [43 | Yes

Website addrese N/A

14 The books are in care of PStaci Wks Telephone no P(254)631-4727

Located at 25 county Road 166 Caco TX z1p-+4 76437

15 Section 4947(a)(t) nonexempt chantable trusts filing Form 990-PF inlieu of Form 4041—Checkhere- ee

‘and enter the amount of ox-enempt interest received or acerued during the year... . sh | a5

16 At ny tne dung calendar year 2014, dhe foundation have an nterestin oa signature or atherauthoty over [es | We

a bank securtes or other nancial account na foreign cour? is [ [ne

aetcunts (E888) THeVee™ ener the am af te Treg Coury

Statements Regarding Activities for Which Form 4720 May Be Required

ile Form 47201 any item's checked inthe "Yes" colurm, ules an exception apes: cs

18 Dunng te yer did the foundation (ether erty or necty)

(a) engage the sale or exchange, or lesing ot property wt isqaies person? ves FF no

(2) sorrowmoney rom lend money to, or thermse extend ere to (or acept trom)

2 dnqualited perso? vee no

(3) Famsn goods, services ofits tor accent them om) a isualite person? vee F no

(4) Pay compensotin to, oreo remburse the expenses of» eiquslife person? ves F no

{G) Transfer any income or essts toa disueliied person (ormake any of eter avaiable

forthe bent or use ofa sesualfed persone wt enw yw ws ee eee Pes Fite

(6 Agree to pay money or propery toa government offral (Exception. Check *No*

the foundation agreed to meke a grant to orto employ the afte fr peg

tier ermiaton of government serie, terminating thn 30 87s ese see Yes Fe

any answers "Yes" toTa(1) (6), cd amyof the act foto ually under the exceptions described n Regulations

Organizations relying on @ current notice regarding disaster assistance check heres». ss eo ET

€ Did the foundation engage ina pror year m any ofthe acts described in 1a, other than excepted acts,

that were not corrected before the frst day ofthe tax year beginning in20147, . . 2. 2 2 2 ee es | te No

2 Toxes on failure to distnbute income (section 4862) (does not app for years the foundation was a private

operating foundation defined in section 4942()(3) 0° 494205)

At the and oftax year 2014, did the foundation have any undistributed income (lines 6d

‘and 6e, Part XI11) for tax year(s) beginning before 20147... ev ev ee ee ees Yes NO

Ie*Yes, list the years 20__, 20__, 20,

bb Are there any years listed in 2a for which the foundation is not applying the provisions of section 4942(a)(2)

(relating to incorrect valuation of assets) to the year’s undistnbuted income? (If applying section 4942(a)(2)

So

tall years listed, answer "No" and attach statement-see instructions) 2s we ee ee 2» No

€ Ifthe provisions of section 4942(a)(2) are being applied to amy of the years listed in 2a, lst the years here

coe ues ogee gt

‘3a Did the foundation hold more than @ 2% direct or indirect interest in any business enterprise at

anytime during the years ve ee P08 NO

bb 1F*¥es," aid ithave excess business holdings in 2014 as a result of (4) any purchase by the foundation

or disqualified persons after May 26, 1969, (2) the lapse of the 5-year period (or longer period approved

by the Commissioner under section 4943(c)(7)) to dispose of holdings acquired by gift or bequest, or (3)

the lapse of the 10-, 15-, or 20-year frst phase holding period? (Use Schedule C, Farm 4720, to determine

Ut the foundation had excess business holdings in 2014). »

a

‘4aDid the foundation invest dung the year any amount in a manner that would eopardize its chantable purposes? No

b_ Did the foundation make any investment na pror year (out aRer December 31, 1969) that could jeopardize its

chantable purpose that had not been removed from jeopardy before the first day of the tax year beginning in 2014? | 4b No

Form 990-PF (2014)

Form 990-PF (2014) Page 6

Statements Regarding Activities for Which Form 4720 May Be Required (continued)

‘32 Dunng the year did the foundation pay er incur any amount to

(4) Carry on propaganda, or athermse attempt to influence legslation (section 4945(6)? vee F no

(2) Intuence the outcome of any specric public election (see section 4985), orto camry

on, diecty orindirectly, any voterregistration dnve?. wove ve vee ew es Yes FN

(6) Prowce »granto on mavidua for travel, study, or other similar purposes? vee F no

(2) Provide s grant to an organzation other han a charabe, ee organzationdesenbad

eames eee

(6) Prowdeforany purpose athe than religious, chantable, scien iterary, oF

sdscatonal purposes, forthe pravention of crusty te children eranimals?. .. 2. Yes FN

be tfany answers "Yeo" to $a(2)-(5), did any ofthe transactions foto gual under the exceptions described in

Organizations relying on a current notice regarding disaster assistance checkers... es eT

€ Ifthe answers "Ves" to question $0(4), does the foundation clam exemption from the

tax because it maintained expenlture responsibilty forthe grant? ves F No

1"¥e," tach the statement required by Regultons section 534945-5(2).

4 Did the foundation, dung the year, racer any finds, directly or ndiecty, te pay premiums on

ee

bid the foundation, unng the year pay premiums, decty oinarectiy on a personal benefit contract? |_| no

1 "¥es"to6, file Frm 8570,

7 Atany time dunng the tox year, wos the foundation a party toa prohibited tax shelter sransacton? "Yes FF No

tif yes, da the foundation recive any proceeds orhave any net come atinbutabl tothe transaction? wl | no

Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees,

and Contractors.

I List all officers, directors, trustees, foundation managers and thelr compensation (see instructions)

(yTitle, and average | (e) Compensation | _(@) Contributions] cay expense account

(a) Name and address. hours per week (Af not paid, enter | employee benefit plans cceteeaca

devoted to position 7) and deferred compensation

Saw Frrustee Ql

Cisco, TX 76437

‘Sacwiks Irrastee ol

425 County Road 168 jro0

Cisco, 1.76437

"2 Compensation of five highest-paid employees (other than those Induded on line 1—see instructions), f none, enter “NONE

(@) Contributions to

(b) Tile, and average

(a) Name and address ofeach employee | TRG andaverage | | employee benefit | (e) Expense account,

bald more than $50,000 oe plans ené deterred | other allownces

jevated to position crore

‘Total number of other employees padover $50,000... 7 7

Form 990-PF (2014)

Form 990-PF (2014)

Page7

Information About Officers, Directors, Trustees, Foundation Managers, Highly Paid Employees,

and Contractors (continued)

'3_ Five highest-paid independent contractors for professional services (see instructions). If none, enter “NONE”

(2) Name and address of each person paid more than $50,000 (W) Type of service

NONE

otal number of others recewving over $50,000 for professional services!

‘Summary of Direct Charitable Activities

(© compensation

Ee eg Expenses

7

2

:

Summary of Program: Related Investments [see msiruchons

Deere te is EO pv te meses rife nar drm Ye on Wes} OE nea

1

Aether programcrelated investments See structions

3

‘Tota, Ada ines i through 3 aces eee

Form 990-PF (2014)

Form 990-PF (2014)

Minimum Investment Return (All domestic foundations must complete this part. Foreign foundations,

see instructions.

Page 8

7 Farmarket va of sts nt oad ad for ue) Uecirn ering ot aman we

avenge meal tr mara oie of secu : fee

f caageer eave ae peers

Se eee ce ;

a teeat(eddinen tend) 3 iets

« reductonclomedior blockage oretherfeior read on es 1 nd

aie ae dena or ee eee tation | as d

S eee ie eee

eebembrenions iets

4 Cashdeemmd held tr chertabe acts Enter 1/2 ofan 3 (orgrenter mount ee

eee |, ae

eee ee te Tessreas8

7 acearcee eee ene a

Tistibutable Amount (oe Tatrucuors) (Secon TSUHST and UY) pavale operating foundaTanS ra

cavum foveuh avganaus check hte > and do ot compkte tie art)

an re See

bo Teton nvtsonerticnmt be 20:4 om PaRVE a es es | an 105289

Income ayor2014 (Tvs dee notmelde the ex tom Paw Vt e+ [a

o) (amiauctnie ea coamen loncome 0 a sasnaes

{ec oe Ey

eerie 8 ie

7 _Chtntablesmount os acusteg Subtect ine 6 om ine 5 terns anon Part ttbine ts =. [7 Seams

Qualitying Distributions (see mtrucvons)

Aros pd (vchdig tomate speees] 0 STOnpIAY COUT, PUD

ee |e oe

see te

2° meas psd ceqre ees ured (ohare) vey ctr out chat,

2 Amounts save especie ehartabie projet satya

oer en

i clarematamaeresei 9

4 qnttygetblne, Asie to though 3 ntarare anon Pre, tna yond Port tae [Ca as

5 Feudsvons tha uly ude secu 940(e rine reduce te atone nvesten

ee 105.290

+ cn narmcesmermine 6 0 ibe ies

[Note:The amount online 6 wll be used in Part V, column (b), in subsequent years when calculating whether the foundation qualifies for

the section 4940(e) reduction of tax in those years

Form 990-PF (2014)

Form 990-PF (2014)

Undistributed Income (see structions)

Page 9

Distrbutable amount for 2024 from Pare XI, line 7

Undistnbuted income, fany, a8 of the end of 2014

Enter amount for 2013 only. . = + +

Total for prior years 20__, 20__, 20.

@

corpus

@.

[years priorto 2013

©. @.

2013 2014

Excess distributions carryover, any, to 2014

Fromsnneiesaeeeaeaia

Feom2010. . ss ss

ramsoti

Fom2013, . 1 1. ss

Total of ines 3a throughe. . sss

Qualifying aistnbutions for 2014 from Part

XII, lines 1,039,127

‘Applied to 2013, but not more than line 23

[Applied to undistributed income of prior years

(Election required—see instructions). = + + «

Treated a8 distnbutions out of corpus (Election

required~see structions). we ss ss

Applied to 2014 distributable amount... =

Remaining amount distributed out of corpus

Excess distributions carryaver applied to 2014

(fan amount pears in column (4), the

{Same amount must be show in calurin(3).)

Enter the net total of each column as

indicated below:

Corpus Add lines 31,4¢, and 4e Subtract ine 5

Prior years’ undistnbuted income Subtract

line 46 fom line 20

Enter the amount of prior years’ undistnbutes

tncome for which a notice of deficiency has.

been issued, oron which the section 494 2(a)

taxhas been previously assessed... ss

‘Subtract line 6¢ from line 6b Taxable amount

Undistnbuted income for 2013 Subtract line

43 from line 22, Taxable amount—see

instructions see ee et ee

Undistnbuted income for 2034 Subtract

tines 44-and 5 from line 1 Thvs amount must

bedistnbuted in 20157 vv ve ee sa

Amounts treated as distributions out of

corpus to satisfy requirements imposed by

Section 170(b)(1)(F) of 494 2(@)(3) (Election may

be required see instructions). . + +--+

Excess distributions carryover from 2009 nat

applied online 5 or line 7 {see structions)...

Excess distributions carryover to 2015.

‘Subtract lines 7 and 8 from line 69

Analysis of line 9

Excess from 2010.

Excess from 2013. 1

Excess from 2012. 1 |

Excess from 2013.»

Excess from 2014. 1.)

Form 990-PF (2014)

Form 990-PF (2014) Page 10

Private Operating Foundations (see instruchons and Part VIA, queston 9)

foundation andthe rulings etectve for 2014 enter the date ofthe rua.

‘Check box to indicate whether the organization 1s a pnvate operating foundation descnbed in section _4942)(3) or [_49420N5)

.

2a Enter the lesser of the adusted net Tax year Por 3 years

‘neame from Part [or the minimum (e) Total

en 2014 wits 2082 won a

tnvestment retum from Part X for each

year listed.

b 85% of ine 23 - . :

€ Qualifying distabutons fom Part x11,

ling 4 for each year listed -

4) Amounts included inline 2¢ not used

directly for active conduct of exempt

© Qualitying dietnbutions made directly

foractive conduct of exempt actwities

Subtract line 26 from line 2

3 Complete 3a,b, orc forthe

‘ltermative test relied upon

8 “Assets” alternative test—enter

(2) Value of ail assets

2) Value of assets qualifying

under section 494203 KEM)

b “Endowment” alternative test— enter 2/3

‘of minimum investment return shown in

Part x, line 6 for each year listed.

© “Support” alternative test—enter

(2) Total support other than gross

snvestment income (interest,

dividends, rents, payments

fon secunties loans (section

512(@)(5), or royalties)

(2) Support trom general public

and 5 or more exempt

‘organizations as provided in

Section 4942)(3)(8Ki}-

(2) Largest amount of support

from an exempt organization

(4) Gross investment income

‘Supplementary Information (Complete this part only if the organization had $5,000 or more in

assets at any time during the year—see instructions.)

1 Taformation Regarding Foundation Managers:

‘9 List any managers of the foundation who have contributed more than 2% ofthe total contributions received by the foundation

Before the close of ny tax year (but only ifthey nave contnbuted more than $5,000) (See section $07 (3)(2) )

See Additionel Data Table

B List any managers ofthe foundation who own 10% ormore ofthe stock ofa corporation ran equally large portion of he

‘ovmership of @ partnership or other entity) of which the foundation has 2 10% or greater interest

2 Taformation Regarding Contribution, Grant, Gift, Loan, Scholarship, ete, Programs

‘Check here PIF ifthe foundation only makes contributions to preselected charitable organizations and does not accept

Unsolicited requests for funds Ifthe foundation makes gits, grants, ete (see instructions) to individuale or organisations under

‘other conditions, complete items 24,5, , and d

‘9 The name, address, and telephone number or email address ofthe person to whom applications should be addressed

'b The form in which applications should be submitted and information and matenals they should mnclude

© Any submission deadlines

Any restrictions or limitations on awards, such as by geographical areas, charitable feds, kinds of institutions or other

factors

Form 990-PF (2014)

Form 990-PF (2014)

Supplementary Information (continued)

3 Grants and Contributions Paid During the Year or Approved for Future Payment

Page 42,

Tf recipient ie an individual

Recprent show any relationship to | Foundation | purpose of grant or

any foundation manager | $t2t¥s of Contribution Amount

Name and address (home or business) | 27 foundation manager | recipient

1 Pad during the year

See Schedule attached None soxicn3) [see attaches 8,031,627,

Various TX 76437

Tol) oa [KEYES

b Aeproved far future payment

See Schedule attached hone s0x(cx3) [see schedule attached 1,548,950

Various TX 76437

> FRSTETS)

Total.

Form 990-PF (2014)

Form 990-PF (2014)

Page 12

‘Analysis of Income-Producing Activities

Enter ross amounts uniessothermse indicated | Unrelated business income | Cred by tan Sz 1 oa @

1 Program service revenue

@

Business

O)

Amount

©

Exclusion code

@

Amount

Related or exempt

funetion income

(See

instructions )

{9 Fees and contracts from government agencies

2 Membership dues and assessments.

3 Interest on savings and temporary cosh

4 Dividends and interest from secunties.

'5 Net rental income or (loss) rom real estate

1 Debt-financed property.

b not debt-fnanced propery.

66 Net rental income or (loss) fom personal

property

7 Other investment income.

{8 Gain or (loss) from sales of assets other than

inventory

‘9 Net income or (loss) rom spacial events

10 Gross proft or (loss) from sales of inventory.

11 Other revenue captalgans str

4

32 Subtotal Add columns (B) (@), and (eh

13 Total. Ad tine 12, columns (6), (d), and (e).

(See worksheet inline 13 instructions to venty calculations

Relationship of Activities to the Accomplishment of Exempt Purposes

Explain below how each activity for which income 1s reported n column (e) of Part XVI-A contributed importantly

the accomplishment af the foundation's exempt purposes (ther than by providing funds for such purposes) (See

Line Ne.

instructions

Fey

These 795

Form 990-PF (2018)

Form 990-PF (2014) Page 43,

Information Regarding Transfers To and Transactions and Relationships With

Noncharitable Exempt Organizations

1 Did the organization directly or indirectly engage n any of the following with any other organization described im

section 501(c) ofthe Code (other than section $01 (c)(3) organizations) or in section 527, relating to politics! Yes | No

organizations?

1 Transfers from the reporting foundation to @ nonchantable exempt organization of

(ay cash. saa No

(2) omer assets. (2) No

bb other transactions

(2) Sales of assets to a noncharitable exampt organization. - [soc] No

(2) Purchases of assets from a nonchantable exempt organization. {x02 No

(3) Rental offciities, equipment, or other assets. a3) No

(4) Reimbursement arrangements. a No

(5) Loans or loan guarantees. 5) No

(6) Performance of services or membership or fundrarsing soliitations 6) No

Sharing of facilites, equipment, mauling lists, other assets, or paid employees. ae No

4 Ifthe answer to any of the above is "Yes," complete the following schedule Column (b) should alvays show the fair market value

ofthe goods, other assets, of services given by the reporting foundation If the foundation received less than fair market value

In any transaction or sharing arrangement, show im column (d) the value of the goods, other assets, or services received

(2) urene | (Amount woed | (e) Name of wnctartable exempt oeanzanon | (a) Oescrpon of warstes, wansactons ad shanagarangaments

2a Is the foundation directly or indirectly affliated wih, or related to, one or more tax-exempt organizations

desenbed in section 501(c) of the Code (other than section 501 (c)(3)) orin section 5277, Pres Fro

bb If-Yes;" complete the folowing schedule

{e) tame of ganzaton (6) Type of ompenaten (ep Descopton of rtarah

Under penatuies of penury, 1 declare tat Ihave examined tha returm, cluding accompanying schedules and statements and to

the best of my knowledge and bei, vs true, correct, and complete. Declaration of preprer (other than taxpeyet) = based on al

___ | information af nich preparer has any krowedge

Sign ETS TT

Her) . ors.

Sianature of ofceror trustee pete

Date creck Woah

PanerType preparers name | Prepares signature

Victor Munson employed eI pou2isse7

Paid Firm's name Firms EEN

Preparer] Victork uncon CPA

Mee rexoadanere

only ae

6060 N Central Expmy Suite S60. alas, Tx 75208 Prone tp (aia) 237-2920

Form 990-PF (2014)

Form 990PF Part XV Line 1a - List any managers of the foundation who have contributed more than 2% of

the total contributions received by the foundation before the close of any tax year (but only if they have

contributed more than $5,000).

Dan H Wilks:

‘Staci Wike

[As Filed Data — J

TY 2014 Accounting Fees Schedule

Name: Heavenly Fathers Foundation

EIN: 27-6987913

Software ID: 14000265

Software Version: 2014v5.0

Category ‘Amount Net Investment Adjusted Net | Disbursements for

Income Income Charitable

Purposes

‘Accounting fees 7.850 0 0 °

[efile GRAPHIC print — DO NOT PROCESS TAs Filed Data — J

TY 2014 Other Assets Schedule

Name: Heavenly Fathers Foundation

EIN: 27-6987913

Software ID: 14000265

Software Version: 2014v5.0

Description ‘Beginning of Year- | End of vear-Book | End of Year Fair

Book Valve Value Market Value

Alternative investments 7,091,356 8,894,780 3,894,780,

‘Organization cost net of amortization 1815 1210 1210

[efile GRAPHIC print DO NOT PROCESS [As Filed Data — | DLN: 93491222002865]

TY 2014 Other Decreases Schedule

Name: Heavenly Fathers Foundation

EIN: 27-6987913

Software ID: 14000265

Software Version: 2014v5.0

Description ‘Amount

Decrease in unrealized gain 1,752,552

[efile GRAPHIC print DO NOT PROCESS [As Filed Data — |

TY 2014 Other Expenses Schedule

Name: Heavenly Fathers Foundation

EIN: 27-6987913

Software ID: 14000265

Software Version: 2014v5.0

Description Revenue and Expenses] Net Investment | Adjusted Net Income | Disbursements for

per Books. Income Charitable Purposes

‘Amortization expense 605

‘Amortization of Bond prem/aise aaa 423, 423

Brokerage fees 247,540 242,985 242,985,

Chantable sponsorship 7,500 7.500

Federal income tx 113,000

Foreign tax withheld on divigendineame 16,521 78,447 78,447

Miscellaneous investment exp @ BNY 42,482 42,482

[efile GRAPHIC print — DO NOT PROCESS TAs Filed Data — J

TY 2014 Other Income Schedule

Name: Heavenly Fathers Foundation

EIN: 27-6987913

Software ID: 14000265

Software Version: 2014v5.0

Description Revenue And Net Investment | Adjusted Net Income

Expenses Per Books Income

Capital gains aistr 867,821 678,825 678,826

‘Other investment come 15222 52,516 52,516

Heavenly Father's Foundation asoriz/3i/2014

Form 980-PF (2012) Part XV. Supplementary Information [eontinued)

2014 Page 11

3 Grants and Contributions Paid Dunng the Year or Approved for Future Payment

recipient san dreds,

showany elatonshipte Foundation

ecient any foundation manager status of Purpose of grantor

Name and Address or substantial contributor __reaprent contnbuton __ Amount

“Paid dung the year

Mountain Top Church chur Donationsand 1,199,563.37

1498 W interstate 20 working capital needs

isco, 1K 76437-5517 New Buldina 3,000,000.00

New Horizon Ministries sous Rases 17 new staff 1,000,000.00

61025. 7st

Abilene, 779605

Pastors and Pews sox(e}3 18Conferences 1,138,750.00

“Ammercan Family Assocation The Response LAconference 75,000.00

307 Packsgate Drive

‘Tuptle, MS 38801,

Serenty House Sones Drug prevention programs 240,250.00

3546 N. 2nd Fund uninsured individuals 100,000 00

AAblene, 79602 Building cost overuns 237,000.00

Eastland County Csi Center, ne 5013 Hire 2newstaff, 136,100.00,

a75€Man

Estland , T1768

Crossroads Church church GGenwaod pastor salary 90,000.00

726W. France St for one year

Aspen, cO ai611

The Open Door 50n()3 Fandrassingbanquet_ 20,000.00

1906 Highway 205 Breckenridge building 75,000.00

(sc0, TH 76437

isco Senor Nutetion Program souls Selanesfor Duector 33,000.00

PO Box 308

(isco, TH 76437

‘Aldersgate Ennchment Center S01[e)3 Renovate multiputpose bulling 25,000.00,

PO ox 1406

Brownwood, Tx 76804

Family Service Center S01(c)3 Donation fortoystocounselhuds 1,128.50,

901 Averve 8

Srownwood, TX 76801,

{ut Miams S0l[e)3 Donations to promote minstry 118,500.00,

0 Box 701362

Dallas, 175370

‘Arlington Life Center

32. Dissiont.

Aetmaton, TX 76011

Luberty Counsel

PO Box 54074

Orlando, #132858

Communty ible Study -e-Teens

4001 South Seaman

Eastland, 176448

‘isco Food Panrty

1498 W interstate 20

isco, 1176837-5517

Tevas Reghtto Lie

‘9800 Centre Parkway, #200

Houston, 1% 77036

Fast Bopust Church Eastin

405 5. Seaman St

Eastland, 1X 75446

Fellowship of Chstina Athletes

POBox 6605

‘Alene, TX 79608,

National Christian Foundation South Fonda

‘5110 N Federal Hv. Second Floor

Lauderdale, F. 33308

Passion Life

70 box 862223

Marietta, GA 30062

oodfellows

1498 120 West

(seo, 1178637

No umnte

1302 Qvenve N

(sco, 175437

oven Artris

4550 Post Oak Place Or 1307

Houston, 7477027

India Partners

Monterey Church of Chast

111 62nd st

Lubbock, 179424

Total

». Approved for future payment

souls

songs

soute)s

‘church

sous

cures

soute)3

sox(e)s

soite)2

sous

sou(ea

song

Church

Emergency Shelter Serces

Financial suppart

‘Bibles, conference

Grant for food

Donation

Sponsored kids toa Chrstian film

Salary fornew director

Donations

Chine ant-abortion campaign

Donation fr needy at Chnstmas

For Meals and gifts to families

with special needs children

Donation

Mision inp to india

15,000.00,

250,000.00

8450.00

5,000.00,

50,000.00,

41384.00

25,000.00

50,000.00

125,000.00,

10,000.00,

90.00

300.00

3,500.00

051,626.57

Eastland County Crs Canter, Ine

STSE Main

Eastland, 176448

Serenity House

3546 N. 2nd

Alniene, TX79601

Ccsto Senor Nutrition Program

080x308

(sc0, TH 76487

New Horaons

6202, 7enst

Abilene, 773605

Tota

soue)3

soule)3

s0ne}3

sonfe)3

Hire 2 now staff, - 2015

remodel office space 2016

Cisco Drug education 2015,

Eastland Cy Drug E2015

Parker Cty Drug €4-2015,

Salaries for Director 2015

ire 17 new staff 2035

raises to move fom

50 kids now to 70 ids

ab

136,100.00

136,10000

66,730.00

75,000.00

100,000.00

35,000.00

000,000.00

Tas 35000

Foon 990-0F|

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Capitol Riot Map 1.11.21Document1 pageCapitol Riot Map 1.11.21Teddy WilsonPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

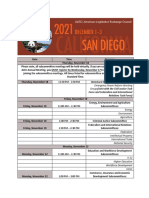

- 2021 States and Nation Policy Summit AgendaDocument4 pages2021 States and Nation Policy Summit AgendaTeddy WilsonPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Human Coalition - Texas Grant ContractDocument455 pagesHuman Coalition - Texas Grant ContractTeddy Wilson100% (1)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- PF Return of Private Foundation: ExpensesDocument20 pagesPF Return of Private Foundation: ExpensesTeddy WilsonPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Return of Private FoundationDocument40 pagesReturn of Private FoundationTeddy WilsonPas encore d'évaluation

- Texas A2A Program FY2018 Q2 (Pregnancy Help Center of Lufkin Annual Monitoring)Document4 pagesTexas A2A Program FY2018 Q2 (Pregnancy Help Center of Lufkin Annual Monitoring)Teddy WilsonPas encore d'évaluation

- Texas A2A Program FY2017 Q4 (YTD Totals)Document7 pagesTexas A2A Program FY2017 Q4 (YTD Totals)Teddy WilsonPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)