Académique Documents

Professionnel Documents

Culture Documents

Philippine Dairy Update

Transféré par

Andrius MarkeviciusDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Philippine Dairy Update

Transféré par

Andrius MarkeviciusDroits d'auteur :

Formats disponibles

PHILIPPINE DAIRY UPDATE

January – December 2008

• The dairy supply situation for 2008 is characterized by increasing local milk

production and exports and decreasing imports of milk and milk

products.

The net supply stood at 229.36 million kg and was 13 percent lower than

the previous year’s net supply of 264.82 million kg. Local production and

exports grew by 2.83% and 6.22% respectively while imports declined

by 11.66 percent.

• For year 2008, imports of milk and dairy products declined by around 12

percent (down to 254.29 million kg from 287.86 million kg). In terms of value,

it increased by a higher rate of 9.13 percent (total dairy import bill of

US$712.00 million from US$652.45 million in 2007 indicating an increase in

unit import cost of 23.53 percent in dollar terms and 19.04 percent in pesos.

(appreciation of the peso by 3.64%)

Milk powder constitutes the bulk of imports, this year it accounted for 67

percent from the previous level of 65 percent. Skimmed milk powder that

comprised 31percent of milk imports in 2007 was still at the same level of 31

percent of total milk imports in 2008. However, of the milk powder, only

whole milk powder posted an uptrend of around 20%.

This was due to global exports of whole milk powder rose in 2008. And this is

expected to increase again in 2009 as global milk supplies expand. According

to FAO, whole milk powder remains the key milk product exported by surplus

milk producing regions to growing developing country markets. The largest

whole milk powder exporter noted is from the European Union. More

deliveries are expected also from New Zealand, Australia and Argentina.

A high degree of price uncertainty was noted in May, -particularly with

weather related production problems in the key exporting countries of

Australian and New Zealand, which affected their exportable supplies in early

2008. However, by July 2008, international dairy product markets started to

weaken. This tendency accelerated as a result of increasing milk product

availabilities on the international market, appreciation of the United States

Dollar and, in particular, the general downturn of the global economy.

The impact of the recent contamination of milk supply in China is so far

unclear, but it likely contributed to the reduction of demand for milk

products. However, it must be noted that dairy product prices still are some

20 percent above their trend average, and production costs remain high.

Of the dairy product imports, whole milk powder, as well as condensed milk,

butter and butterfat and cheese all recorded increases in import levels.

Evaporated milk recorded the highest decrease among imported dairy

products at 89 percent in volume, followed by cream at 31 percent, curd at

25 percent, whey powder at 21 percent and other milk products posted

decreases in import volume. (Please refer to dairy industry statistics as Annex

1)

Ready to drink (RTD) was down at 17 percent in volume and higher by

14percent in value. It accounted still for 14% of dairy import volume (same

as 14% share in ’07). The increase in local production, accompanied by

a decrease in imports of liquid milk by 17percent, resulted in the

increase in share of local production to total liquid milk supply of

27% from the previous year level of 23%. So that, from one out of

five glasses of liquid milk being supplied locally, we are now at more

than one out of four glasses of liquid milk supply.

• In terms of sources and value share, New Zealand accounted 47 percent to

total dairy import bill. Due to Australia’s limited product exports and higher

prices, USA ranked now as second supplier followed by Australia with 22

percent and 13percent share respectively.

Total tariff collected from dairy imports amounted to US$11.96 million or

approximately Php531.86 million.

• The commercial milk importer/processors who re-export of re-processed milk

products to other Asian countries continued to be a robust activity in the

processed milk sector.

Whole milk powder and ice cream products were the big exports during the

period resulting to a higher level of exports registering a total export volume

of 38.74 million kilograms valued at US$165.70 million or 18percent more

than the previous period exports worth US$140.69 million. The big re-export

item is still whole milk powder at 93 percent share to total dairy exports.

Indonesia was the top market of Phil. dairy products, accounting for more

than 43 percent of the entire export volume. Next was Malaysia that took

27percent of the total. For the first time, South Africa was included and

ranked fourth with other countries of destination that include Thailand and

Vietnam with shares of 6%, 13% and 2% respectively.

• Local dairy producers sustained growth of 2.83% this year with actual

volume of 13.81 million liters or equivalent to 37,836 liters per day

production.

The Bureau of Agricultural Statistics disclosed that the consistent dairy output

expansion was due to in particular, the volume of cow’s milk from the dairy

cooperative farms grew.

Our local milk production is derived from dairy herd that had increased by 7%

(31,791 head). Of this herd, dairy cattle registered an increase of 9% (to

15,073 head). There was also a significant increase of 69 percent in the

number of dairy goats (to 3,207 head). Carabao inventory totaled to 13,511

head. By animal source, 63% of the volume of milk production was cow’s

milk, 36% carabao’s milk and less than 1% goat’s milk.

Of the total milk output of 13.81 million liters, NDA-assisted projects'

accounted for around 70percent or a total 9.67 million liters. Milk production

increased from 25,458 liters per day to 26,483 liters per day.

• Dairy recorded a 5.26% increase in gross earnings of P411.95 million

as a result of higher production.

• The dairy sector accounted for 0.04% and 0.23% of total agricultural and

livestock production value (at current prices) of Php1,162.34 billion and

Php180.98 billion respectively. NDA-PMSD3/11/09

Philippine Dairy Industry, 2007 and 2008

CY 2007 CY 2008

Livestock population # 10,079,313 10,077,347

Total dairy herd 29,265 31,791

Total dams and does 13,982 15,033

Producers

· Number of farm families 14,405 15,212

· Number of primary 317 347

cooperatives and institutions

In million In Million Liters In million In Million Liters or

kilograms or ‘000MT(LME) kilograms ‘000MT(LME)

Net Supply of Milk Products 264.62 1,469.30 229.36 1,333.67

Local milk production 13.23 13.23 13.81 13.81

Net imports of milk products 251.39 1,456.07 215.55 1,319.86

Exports of milk products 36.47 283.80 38.74 298.85

Total imports 287.86 1,739.87 254.29 1,618.71

Volume of skim milk powder imports 89.81 720.24 78.16 626.87

Volume of other imports in powder 97.48 767.12 92.62 731.18

form

Volume of UHT imports 45.21 44.28 37.53 36.63

Volume of other dairy imports 55.36 208.23 45.98 224.03

% Share of Supply

Net Supply of Milk Products 100 100 100 100

Local milk production 5 1 6 1

Net imports of milk products 95 99 94 99

Number of dairy processors and 138 117

importers

Volume of imports accounted for by top 58% 55%

three processors

Volume of imports supplied by top two 53% 58%

country sources

Basic Sources: NSO Foreign Trade Statistics 2008, BAS 2008 statistics , NDA-PMSD Philippine Dairy Update 2008

# - includes cattle, carabao and goats Note: LME – liquid

milk equivalent

(Livestock population/inventory -as of Dec. 31 MT – metric tons)

* - revised by BAS; 2008 figures - ** prelim.

NDA-PMSD3/11/09

Source: National Dairy Authority (NDA) website

www.nda.gov.ph

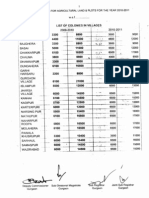

Selected list of major players in the dairy industry:

1. Magnolia Inc,

A subsidiary of San Miguel Corporation

40 San Miguel Avenue, Mandaluyong City

1550 Metro Manila, Philippines

Tel. (+632) 632-2000

2. Universal Robina Corporation

Fl. 43, Robinsons Equitable PCI Bank Tower, ADB Avenue,

corner Poveda St., Pasig, Metro Manila, Philippines

Tel. +63-633-7631

Fax +63-633-9207

Ms. Ivy Cayayan

Investor Relations Director

3. Nestle Philippines, Inc.

Nestle Center, 31 Plaza Drive, Rockwell Center Makati City

Mr. John Martin Miller

Chairman & CEO

4. Alaska Milk Corporation

6/F Corinthian Plaza, 121 Paseo de Roxas,

Makati City

Tel. 02 840-4500

Fax 02 894-4929

5. Kraft Foods (Philippines) Inc.

8378 Dr. A. Santos Avenue,Sukat Paranaque City, MNL

Tel (632) 826.5546/(632) 826.9006

Fax (632) 820.2294

6. RFM Corporation

RFM Corporate Center, Pioneer St. cor. Sheridan St.

Mandaluyong City, Metro Manila

Tel: 637-9043

Fax: 631-5039

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Net Zero Energy Buildings PDFDocument195 pagesNet Zero Energy Buildings PDFAnamaria StranzPas encore d'évaluation

- The Relevance of Sales Promotion To Business OrganizationsDocument40 pagesThe Relevance of Sales Promotion To Business OrganizationsJeremiah LukiyusPas encore d'évaluation

- Rental AgreementDocument1 pageRental AgreementrampartnersbusinessllcPas encore d'évaluation

- Circle Rates 2009-2010 in Gurgaon For Flats, Plots, and Agricultural Land - Gurgaon PropertyDocument15 pagesCircle Rates 2009-2010 in Gurgaon For Flats, Plots, and Agricultural Land - Gurgaon Propertyqubrex1100% (2)

- Ekspedisi Central - Google SearchDocument1 pageEkspedisi Central - Google SearchSketch DevPas encore d'évaluation

- Latihan Soal PT CahayaDocument20 pagesLatihan Soal PT CahayaAisyah Sakinah PutriPas encore d'évaluation

- RM AllowanceDocument2 pagesRM AllowancekapsicumadPas encore d'évaluation

- BCG Executive Perspectives CEOs DilemmaDocument30 pagesBCG Executive Perspectives CEOs DilemmaagePas encore d'évaluation

- Manufactures Near byDocument28 pagesManufactures Near bykomal LPS0% (1)

- Arithmetic of EquitiesDocument5 pagesArithmetic of Equitiesrwmortell3580Pas encore d'évaluation

- Organic Farming in The Philippines: and How It Affects Philippine AgricultureDocument6 pagesOrganic Farming in The Philippines: and How It Affects Philippine AgricultureSarahPas encore d'évaluation

- Microsoft Word - CHAPTER - 05 - DEPOSITS - IN - BANKSDocument8 pagesMicrosoft Word - CHAPTER - 05 - DEPOSITS - IN - BANKSDuy Trần TấnPas encore d'évaluation

- EU Regulation On The Approval of L-Category VehiclesDocument15 pagesEU Regulation On The Approval of L-Category Vehicles3r0sPas encore d'évaluation

- Literature ReviewDocument14 pagesLiterature ReviewNamdev Upadhyay100% (1)

- Contract Costing 07Document16 pagesContract Costing 07Kamal BhanushaliPas encore d'évaluation

- Seller Commission AgreementDocument2 pagesSeller Commission AgreementDavid Pylyp67% (3)

- BiogasForSanitation LesothoDocument20 pagesBiogasForSanitation LesothomangooooPas encore d'évaluation

- CMACGM Service Description ReportDocument58 pagesCMACGM Service Description ReportMarius MoraruPas encore d'évaluation

- Accounting CycleDocument6 pagesAccounting CycleElla Acosta0% (1)

- Use CaseDocument4 pagesUse CasemeriiPas encore d'évaluation

- SKS Microfinance CompanyDocument7 pagesSKS Microfinance CompanyMonisha KMPas encore d'évaluation

- Measure of Eco WelfareDocument7 pagesMeasure of Eco WelfareRUDRESH SINGHPas encore d'évaluation

- Skripsi - Perencanaan Lanskap Pasca Tambang BatubaraDocument105 pagesSkripsi - Perencanaan Lanskap Pasca Tambang Batubarahirananda sastriPas encore d'évaluation

- India of My Dreams: India of My Dream Is, Naturally, The Same Ancient Land, Full of Peace, Prosperity, Wealth andDocument2 pagesIndia of My Dreams: India of My Dream Is, Naturally, The Same Ancient Land, Full of Peace, Prosperity, Wealth andDITSAPas encore d'évaluation

- Business Cycle Indicators HandbookDocument158 pagesBusiness Cycle Indicators HandbookAnna Kasimatis100% (1)

- Dog and Cat Food Packaging in ColombiaDocument4 pagesDog and Cat Food Packaging in ColombiaCamilo CahuanaPas encore d'évaluation

- Working Capital Appraisal by Banks For SSI PDFDocument85 pagesWorking Capital Appraisal by Banks For SSI PDFBrijesh MaraviyaPas encore d'évaluation

- Traffic Problem in Chittagong Metropolitan CityDocument2 pagesTraffic Problem in Chittagong Metropolitan CityRahmanPas encore d'évaluation

- Bill CertificateDocument3 pagesBill CertificateRohith ReddyPas encore d'évaluation

- India'S Tourism Industry - Progress and Emerging Issues: Dr. Rupal PatelDocument10 pagesIndia'S Tourism Industry - Progress and Emerging Issues: Dr. Rupal PatelAnonymous cRMw8feac8Pas encore d'évaluation