Académique Documents

Professionnel Documents

Culture Documents

Fineotex Chemical LTD (FINCHE) : Fast Growing Complete Textile Solution Player

Transféré par

CA Manoj GuptaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Fineotex Chemical LTD (FINCHE) : Fast Growing Complete Textile Solution Player

Transféré par

CA Manoj GuptaDroits d'auteur :

Formats disponibles

Management Meet Note

March 23, 2018

Rating Matrix

Rating : Unrated Fineotex Chemical Ltd (FINCHE) | 57

Target : NA

Target Period

Potential Upside

:

:

NA

NA Fast growing complete textile solution player

We recently met Sanjay Tibrewala, Executive Director of Fineotex

Key Financials (Consolidated)

Chemical, to understand the overall nuances, salient characteristics of

(| Crore) FY14 FY15 FY16 FY17

the speciality chemical space in the textile industry, Fineotex’ s market

Net Sales 86.7 102.0 109.9 128.1

EBITDA 9.0 16.5 28.2 30.2

position and prospects, going forward. Fineotex has 22,000 tonne

Net Profit 6.5 12.9 17.6 20.6 capacity across two facilities in India (15,500 tonne) and Malaysia (6,500

EPS (|) 0.6 1.2 1.6 1.9 tonne). It manufactures over 400 different products with established

presence across the entire textile value chain ranging from pre-treatment,

Valuation Summary dying, printing and finishing processes thereby making it a one-stop shop

(x) FY14 FY15 FY16 FY17 for any textile solution. Fineotex has successfully penetrated a typically

P/E 97.6 49.1 36.1 30.8

niche market with a sticky customer profile that was formerly governed

EV / EBITDA 64.0 35.1 20.5 19.2

by dominant MNC players. The company sells its product under its own

P/BV 9.8 8.3 6.9 6.0

RoNW (%) 10.0 16.9 19.2 19.5

brand “Fineotex” since 2005, tapping into its rich four-decade old

RoIC (%) 29.0 53.0 64.9 66.7 experience and through smart strategic acquisition of Biotex, an

RoCE (%) 15.9 24.6 30.0 29.4 innovative speciality chemical manufacturer (2011). Biotex, through its

indigenous research, has developed a unique non-poisonous product

Stock Data called “Aquastrike VCF”– mosquito killer liquid, commercialised in some

Particular Amount

Asian countries and is awaiting approvals elsewhere. It has strong

Market Capitalization | 634 crore

potential and provides option value to the stock. In FY17, Fineotex

Total Debt (FY17) | 1 crore

Cash (FY17) | 57 crore

recorded sales of | 128 crore, EBITDA of | 30 crore with corresponding

EV | 579 crore EBITDA margins at 23.6% and PAT after minority interest at | 20.6 crore.

52 week H/L (|) 106 / 24 Biotex a value buy and instrumental in growing Fineotex brand

Equity capital | 22.3 crore

In 2011, the company made a value buy through a 60% acquisition in

Face value |2

FII Holding (%) 0.1

Biotex for ~| 8.5 crore. It is spearheaded by Dr Cedric Veniat, a

DII Holding (%) 0.1 technocrat with over 25 years of experience in speciality chemicals

industries. Apart from providing multifold returns on its investment,

Price Movement Biotex’ technological edge has enabled Fineotex to compete against

global textile auxiliary giants like Archroma, Clariant, Huntsman, etc.

12,000 120

Currently, Fineotex accounts for ~8% market share (2017) in the Indian

10,000 100

textile auxiliary chemical market (pegged at ~| 1500) crore with almost all

80

8,000 textile majors like Arvind, Grasim, Birla, Raymond, etc, as their clients.

60

6,000

40

Prudent management, robust growth, impressive return ratios matrix!

4,000 20 Fineotex’ growth has been impressive with consolidated sales, EBITDA

2,000 0 and PAT growing at a CAGR of 13.9%, 49.5% and 47.0%, respectively, in

FY14-17. The robust bottomline growth is a result of EBITDA margin

Jan-15

Apr-15

Jul-15

Oct-15

Jan-16

Apr-16

Jul-16

Sep-16

Dec-16

Mar-17

Jun-17

Sep-17

Dec-17

Mar-18

expansion from 10.4% in FY14 to 23.6% in FY17 thereby percolating to

Price (R.H.S) Nifty (L.H.S)

impressive return ratios with average RoCE and RoICs of 25% and 53%,

respectively, in FY14-17. As of FY17, Fineotex has an unlevered balance

Research Analysts sheet with surplus cash of | 56 crore. The company has a capital efficient

business model with ~4.7x as asset turnover and controlled net working

Chirag J Shah

shah.chirag@icicisecurities.com capital cycle of ~70 days. At the CMP, on FY17 numbers, it is quoting at

31x P/E, 19x EV/EBITDA and 6x P/BV.

Shashank Kanodia, CFA

shashank.kanodia@icicisecurities.com Exhibit 1: Financial Summary (consolidated)

(| Crore) FY14 FY15 FY16 FY17 9MFY18

Net Sales 86.7 102.0 109.9 128.1 100.9

EBITDA 9.0 16.5 28.2 30.2 21.5

Net Profit 6.5 12.9 17.6 20.6 19.7

EPS (|) 0.6 1.2 1.6 1.9 2.4

P/E (x) 97.6 49.1 36.1 30.8 24.10

Price / Book (x) 9.8 8.3 6.9 6.0 4.9

EV/EBITDA (x) 64.0 35.1 20.5 19.2 20.2

RoCE (%) 15.9 24.6 30.0 29.4 22.5

RoIC (%) 29.0 53.0 64.9 66.7 41.2

RoE (%) 10.0 16.9 19.2 19.5 21.1

Source: Company, ICICIdirect.com Research; *9MFY18 Valuation & Return Ratios on annualised numbers

ICICI Securities Ltd | Retail Equity Research

Key financials

Consolidated revenues have grown at a CAGR of 12.0% in FY15-17 to

| 128 crore in FY17. Revenues in 9MFY18 were at | 101 crore.

Exhibit 2: Revenue trend (consolidated)

140 128

120 110

102 101

100

As of FY17, the standalone entity delivered revenues of

| 75.7 crore, up 10.5% YoY while the Malaysian subsidiary 80

| crore

revenues came in at | 52.4 crore, up 26.6% YoY 60

40

20

-

FY15 FY16 FY17 9MFY18

Source: Company, ICICIdirect.com Research

Declining EBITDA margins from peak levels of 25.7% in FY16 to 21.3% in

9MFY18 can be mainly attributed to stress faced by the subsidiary due to

a weakening Malaysian currency. EBITDA margins at the standalone

entity held steady above 25% during the FY16-9MFY18 period.

Exhibit 3: EBITDA & EBITDA margins (consolidated) trend

25.7

35 30

23.6

30 16.2 21.3 25

25

20

20

| crore

During 9MFY18, the standalone entity EBITDA came in at 15

%

| 17.2 crore, up 33.2% YoY with corresponding EBITDA 15

30

28

margins at 26.2% (up 240 bps YoY) while EBITDA of the 10

21

10

Malaysian subsidiary came in at | 4.3 crore, down 37.3%

16

YoY with corresponding EBITDA margins at 12.2% (down 5 5

840 bps YoY)

- -

FY15 FY16 FY17 9MFY18

EBITDA EBITDA Margin (%)

Source: Company, ICICIdirect.com Research

Healthy EBITDA margins and ~5x asset turnover in FY15-17 resulted in

impressive return ratios with FY17 RoE & RoCE coming in at 29.4% &

19.5%, respectively. PAT has grown at a healthy CAGR of 26.4% in FY15-

17 largely tracking healthy topline growth and EBITDA margin expansion.

Exhibit 4: RoCE & RoE trend Exhibit 5: PAT trend (consolidated)

35 30.0 29.4 25

30 24.6

20

25 19.1

20 15

| crore

%

15 19.2 19.5

16.9 17.9 10 21 20

10 18

13

5 5

-

FY15 FY16 FY17 9MFY18 -

RoCE (%) RoE (%) FY15 FY16 FY17 9MFY18

Source: Company, ICICIdirect.com Research Source: Company, ICICIdirect.com Research

ICICI Securities Ltd | Retail Equity Research Page 2

RATING RATIONALE

ICICIdirect.com endeavours to provide objective opinions and recommendations. ICICIdirect.com assigns

ratings to its stocks according to their notional target price vs. current market price and then categorises them

as Strong Buy, Buy, Hold and Sell. The performance horizon is two years unless specified and the notional

target price is defined as the analysts' valuation for a stock.

Strong Buy: >15%/20% for large caps/midcaps, respectively, with high conviction;

Buy: >10%/15% for large caps/midcaps, respectively;

Hold: Up to +/-10%;

Sell: -10% or more;

Pankaj Pandey Head – Research pankaj.pandey@icicisecurities.com

ICICIdirect.com Research Desk,

ICICI Securities Limited,

1st Floor, Akruti Trade Centre,

Road No. 7, MIDC,

Andheri (East)

Mumbai – 400 093

research@icicidirect.com

ICICI Securities Ltd | Retail Equity Research Page 3

ANALYST CERTIFICATION

We /I, Chirag Shah PGDBM; Shashank Kanodia CFA MBA (Capital Markets), Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this

research report accurately reflect our views about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific

recommendation(s) or view(s) in this report.

Terms & conditions and other disclosures:

ICICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and distribution of financial products. ICICI Securities

Limited is a Sebi registered Research Analyst with Sebi Registration Number – INH000000990. ICICI Securities is a wholly-owned subsidiary of ICICI Bank which is India’s largest private sector bank and has

its various subsidiaries engaged in businesses of housing finance, asset management, life insurance, general insurance, venture capital fund management, etc. (“associates”), the details in respect of which

are available on www.icicibank.com.

ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our associates might have investment banking

and other business relationship with a significant percentage of companies covered by our Investment Research Department. ICICI Securities generally prohibits its analysts, persons reporting to analysts

and their relatives from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover.

The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any notice. The report and information contained herein is strictly confidential and

meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without

prior written consent of ICICI Securities. While we would endeavour to update the information herein on a reasonable basis, ICICI Securities is under no obligation to update or keep the information current.

Also, there may be regulatory, compliance or other reasons that may prevent ICICI Securities from doing so. Non-rated securities indicate that rating on a particular security has been suspended

temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in circumstances where ICICI Securities might be acting in an advisory capacity to this

company, or in certain other circumstances.

This report is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its accuracy or completeness guaranteed. This

report and information herein is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial

instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat recipients as customers by virtue of their

receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific

circumstances. The securities discussed and opinions expressed in this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment

objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate

the investment risks. The value and return on investment may vary because of changes in interest rates, foreign exchange rates or any other reason. ICICI Securities accepts no liabilities whatsoever for any

loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the

risks associated before investing in the securities markets. Actual results may differ materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to

change without notice.

ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other assignment

in the past twelve months.

ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report for services in

respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction.

ICICI Securities or its associates might have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the companies mentioned

in the report in the past twelve months.

ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its associates or its analysts did not receive any

compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI Securities nor Research Analysts

and their relatives have any material conflict of interest at the time of publication of this report.

It is confirmed that Chirag Shah PGDBM; Shashank Kanodia CFA MBA (Capital Markets) Research Analysts of this report have not received any compensation from the companies mentioned in the report

in the preceding twelve months.

Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

ICICI Securities or its subsidiaries collectively or Research Analysts or their relatives do not own 1% or more of the equity securities of the Company mentioned in the report as of the last day of the month

preceding the publication of the research report.

Since associates of ICICI Securities are engaged in various financial service businesses, they might have financial interests or beneficial ownership in various companies including the subject

company/companies mentioned in this report.

It is confirmed that Chirag Shah PGDBM; Shashank Kanodia CFA MBA (Capital Markets), Research Analysts do not serve as an officer, director or employee of the companies mentioned in the report.

ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Neither the Research Analysts nor ICICI Securities have been engaged in market making activity for the companies mentioned in the report.

We submit that no material disciplinary action has been taken on ICICI Securities by any Regulatory Authority impacting Equity Research Analysis activities.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution,

publication, availability or use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such jurisdiction. The securities

described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come are required to inform themselves of and

to observe such restriction.

ICICI Securities Ltd | Retail Equity Research Page 4

Vous aimerez peut-être aussi

- Balance Sheet StructuresD'EverandBalance Sheet StructuresAnthony N BirtsPas encore d'évaluation

- Nocil LTD (Nocil) : Industry Leader Well Poised For Growth..Document6 pagesNocil LTD (Nocil) : Industry Leader Well Poised For Growth..greyistariPas encore d'évaluation

- IDirect Biocon Q3FY17Document16 pagesIDirect Biocon Q3FY17Jagadish TangiralaPas encore d'évaluation

- Clean Science & Technology LTD.: SubscribeDocument2 pagesClean Science & Technology LTD.: SubscribechiduPas encore d'évaluation

- Dhanuka Agritech Ltd-2QFY24 Results UpdateDocument4 pagesDhanuka Agritech Ltd-2QFY24 Results UpdatedeepaksinghbishtPas encore d'évaluation

- Fineotex Chemical LTD: Materials-Chemicals-Specialty ChemicalsDocument6 pagesFineotex Chemical LTD: Materials-Chemicals-Specialty ChemicalsP.B VeeraraghavuluPas encore d'évaluation

- ICICI Securities - Sell Rise Research On INOX IndiaDocument55 pagesICICI Securities - Sell Rise Research On INOX IndiarawatalokPas encore d'évaluation

- Rossari Biotech LTD: SubscribeDocument9 pagesRossari Biotech LTD: SubscribeDavid BassPas encore d'évaluation

- Hikal LTD: Crop Protection Propels Growth But Margins MissDocument10 pagesHikal LTD: Crop Protection Propels Growth But Margins MissRakesh KumarPas encore d'évaluation

- Rossari BiotechDocument8 pagesRossari Biotechzeeshan_iraniPas encore d'évaluation

- AngelBrokingResearch AdvancedEnzymeTechnologies IPONote 180716Document11 pagesAngelBrokingResearch AdvancedEnzymeTechnologies IPONote 180716durgasainathPas encore d'évaluation

- HDFC Sec Report On Vinati OrganicsDocument21 pagesHDFC Sec Report On Vinati Organicssujay85Pas encore d'évaluation

- Pidilite Industries: A Near-Monopoly With A 'Sticky' Business MoatDocument42 pagesPidilite Industries: A Near-Monopoly With A 'Sticky' Business MoatKaustubh SaksenaPas encore d'évaluation

- Ambika CottonDocument7 pagesAmbika CottonRohit BhatianiPas encore d'évaluation

- Marico Annual Report - FY16Document272 pagesMarico Annual Report - FY16Tushar PatilPas encore d'évaluation

- ITC Investment Thesis PDFDocument5 pagesITC Investment Thesis PDFAdarsh Poojary100% (1)

- Heranba Industries IPO Note ICICI DirectDocument12 pagesHeranba Industries IPO Note ICICI DirectVasim MerchantPas encore d'évaluation

- Mayur Uniquoters (MAYUNI: Leader in Synthetic Leather Industry..Document5 pagesMayur Uniquoters (MAYUNI: Leader in Synthetic Leather Industry..flexwalaPas encore d'évaluation

- Mayur Uniquoters (MAYUNI: Leader in Synthetic Leather Industry..Document5 pagesMayur Uniquoters (MAYUNI: Leader in Synthetic Leather Industry..Abhishek banikPas encore d'évaluation

- IDirect RallisIndia ICDocument35 pagesIDirect RallisIndia ICArun DubeyPas encore d'évaluation

- Medtronic Kanghui Introduction and Trauma PortfolioDocument23 pagesMedtronic Kanghui Introduction and Trauma PortfolioFernandoBonnetPas encore d'évaluation

- Natco Pharma LTD: Exports Overshadow Domestic Challenges..Document5 pagesNatco Pharma LTD: Exports Overshadow Domestic Challenges..Kiran KudtarkarPas encore d'évaluation

- India Pesticides Limited: Equitas Small Finance Bank Equitas Small Finance BankDocument19 pagesIndia Pesticides Limited: Equitas Small Finance Bank Equitas Small Finance BankGugaPas encore d'évaluation

- Nocil LTD: Retail ResearchDocument14 pagesNocil LTD: Retail ResearchDinesh ChoudharyPas encore d'évaluation

- Buy Bio Con LTDDocument6 pagesBuy Bio Con LTDshashi_svtPas encore d'évaluation

- V.I.P. Industries LTD.: On Acquisition SpreeDocument3 pagesV.I.P. Industries LTD.: On Acquisition SpreeShikha Shikha SPas encore d'évaluation

- Infosys (INFO IN) : Event UpdateDocument7 pagesInfosys (INFO IN) : Event UpdateanjugaduPas encore d'évaluation

- Deepak Nitrite: CMP: INR1,964 TP: INR1,887 (-4%) Margin Pressure Persists in A Volatile Inflationary EnvironmentDocument10 pagesDeepak Nitrite: CMP: INR1,964 TP: INR1,887 (-4%) Margin Pressure Persists in A Volatile Inflationary Environmentdipyaman patgiriPas encore d'évaluation

- IIFL Report For RefrenceDocument101 pagesIIFL Report For RefrenceaddadddddddddPas encore d'évaluation

- Clean Science and Technology LTD: SubscribeDocument12 pagesClean Science and Technology LTD: SubscribechiduPas encore d'évaluation

- Glenmark Pharmaceuticals Limited - Investor Presentation - Q3 FY24Document19 pagesGlenmark Pharmaceuticals Limited - Investor Presentation - Q3 FY24SHREYA NAIRPas encore d'évaluation

- Hiscox Interim Statement 2017Document17 pagesHiscox Interim Statement 2017saxobobPas encore d'évaluation

- State Ment of Cash FlowsDocument22 pagesState Ment of Cash Flowslakshay chawlaPas encore d'évaluation

- Pidilite Industries: Ceo TrackDocument10 pagesPidilite Industries: Ceo TrackRajesh KumarPas encore d'évaluation

- VB Report 2Document38 pagesVB Report 2Vandit BatlaPas encore d'évaluation

- Metropolis Healthcare LTD.: UnratedDocument17 pagesMetropolis Healthcare LTD.: Unratedalizah khadarooPas encore d'évaluation

- Kiri Industries - 2017 - HdfcsecDocument16 pagesKiri Industries - 2017 - HdfcsecHiteshPas encore d'évaluation

- Birla-Corporation-Limited 204 QuarterUpdateDocument8 pagesBirla-Corporation-Limited 204 QuarterUpdatearif420_999Pas encore d'évaluation

- Dixon Technologies Q1FY22 Result UpdateDocument8 pagesDixon Technologies Q1FY22 Result UpdateAmos RiveraPas encore d'évaluation

- Apcotex Industries: Abhishek BasumallickDocument6 pagesApcotex Industries: Abhishek BasumallickHemant DujariPas encore d'évaluation

- Indoco Remedies - Management Meet UpdateDocument6 pagesIndoco Remedies - Management Meet UpdateMalolanRPas encore d'évaluation

- Company Overview: Apollo Tricoat Tubes LTD Investment Thesis 8th June 2020Document3 pagesCompany Overview: Apollo Tricoat Tubes LTD Investment Thesis 8th June 2020Saurabh SinghPas encore d'évaluation

- Demo Automobile Comprehensive Report Q1.2019 PDFDocument126 pagesDemo Automobile Comprehensive Report Q1.2019 PDFEric PhanPas encore d'évaluation

- Golden Midcap Portfolio: June 1, 2021Document7 pagesGolden Midcap Portfolio: June 1, 2021Ram KumarPas encore d'évaluation

- Natco Pharma Ar 2020 21Document229 pagesNatco Pharma Ar 2020 21Amit Kumar bishoyiPas encore d'évaluation

- Lse DDDD 2018Document68 pagesLse DDDD 2018gaja babaPas encore d'évaluation

- HCL Technologies (HCLT IN) : Management Meet UpdateDocument14 pagesHCL Technologies (HCLT IN) : Management Meet UpdateSagar ShahPas encore d'évaluation

- ICICI Securities Tarsons Re Initiating CoverageDocument14 pagesICICI Securities Tarsons Re Initiating CoverageGaurav ChandnaPas encore d'évaluation

- PC - Cadila Co Update - May 2021 20210514005224 PDFDocument7 pagesPC - Cadila Co Update - May 2021 20210514005224 PDFAniket DhanukaPas encore d'évaluation

- Insecticides India LTD - Investor Presentation Aug 2018Document30 pagesInsecticides India LTD - Investor Presentation Aug 2018taha zafarPas encore d'évaluation

- Investment Idea: DIVI'S Laboratories 2021-09-13Document5 pagesInvestment Idea: DIVI'S Laboratories 2021-09-13vikalp123123Pas encore d'évaluation

- Financial Derivatives and Risk Management Interim ReportDocument5 pagesFinancial Derivatives and Risk Management Interim ReportPriyanka MajumdarPas encore d'évaluation

- Tatva Chintan Limited. F: SubscribeDocument7 pagesTatva Chintan Limited. F: Subscribeturbulence iitismPas encore d'évaluation

- Fine Organics AnalysisDocument2 pagesFine Organics AnalysisKS TeotiaPas encore d'évaluation

- Sumitomo Chemicals India LTD: Emerging MNC Proxy in Indian CPC Growth StoryDocument28 pagesSumitomo Chemicals India LTD: Emerging MNC Proxy in Indian CPC Growth StorySasidhar ThamilPas encore d'évaluation

- Section C - Group 04 - Biocon Ltd.Document17 pagesSection C - Group 04 - Biocon Ltd.Rishabh Goyal100% (1)

- Jubilant Life Sciences Research Report PDFDocument50 pagesJubilant Life Sciences Research Report PDFAbhiroop DasPas encore d'évaluation

- Wallfort - 29 April 2022Document24 pagesWallfort - 29 April 2022Utsav LapsiwalaPas encore d'évaluation

- CCL Products India: Better Product Mix Flavours ProfitabilityDocument11 pagesCCL Products India: Better Product Mix Flavours ProfitabilityAshokPas encore d'évaluation

- Itc (Itc In) : Analyst Meet UpdateDocument18 pagesItc (Itc In) : Analyst Meet UpdateTatsam Vipul100% (1)

- Two Way LookupDocument7 pagesTwo Way LookupCA Manoj GuptaPas encore d'évaluation

- Application 1Document3 pagesApplication 1CA Manoj GuptaPas encore d'évaluation

- Iicci PruDocument60 pagesIicci PruCA Manoj GuptaPas encore d'évaluation

- Domestic Mutual Funds Are Selling These Smallcaps and Midcaps in Hordes. Check Out Why - The Economic TimesDocument3 pagesDomestic Mutual Funds Are Selling These Smallcaps and Midcaps in Hordes. Check Out Why - The Economic TimesCA Manoj GuptaPas encore d'évaluation

- Porinju Veliath Portfolio in Indian MarketDocument2 pagesPorinju Veliath Portfolio in Indian MarketCA Manoj GuptaPas encore d'évaluation

- Midcap Meltdown Singes Porinju's Portfolio 'Baffled' Fund Manager Seeks 'Patience' From ClientsDocument2 pagesMidcap Meltdown Singes Porinju's Portfolio 'Baffled' Fund Manager Seeks 'Patience' From ClientsCA Manoj GuptaPas encore d'évaluation

- Vakrangee - Manpasand Beverages - What's Cooking at Manpasand, Vakrangee, Atlanta - How To Spot Red Flags Early - The Economic TimesDocument3 pagesVakrangee - Manpasand Beverages - What's Cooking at Manpasand, Vakrangee, Atlanta - How To Spot Red Flags Early - The Economic TimesCA Manoj GuptaPas encore d'évaluation

- Substitute FuncitonDocument1 pageSubstitute FuncitonCA Manoj GuptaPas encore d'évaluation

- 01 Increases Increases Bullish: SL No Price What Is The Expectation?Document1 page01 Increases Increases Bullish: SL No Price What Is The Expectation?CA Manoj GuptaPas encore d'évaluation

- Investin G. Mutual Funds. Investin G Strateg Y. Automa Ted Investin G. Bonds & Fixed Income - Financi Al Analysi S. Econo MicsDocument1 pageInvestin G. Mutual Funds. Investin G Strateg Y. Automa Ted Investin G. Bonds & Fixed Income - Financi Al Analysi S. Econo MicsCA Manoj GuptaPas encore d'évaluation

- Count If Formula ExplainedDocument1 pageCount If Formula ExplainedCA Manoj GuptaPas encore d'évaluation

- How To Save Income Tax - Looking To Save Tax For FY 2017-18 - Here Are 6 Investments With Tax-Free Income - The Economic TimesDocument3 pagesHow To Save Income Tax - Looking To Save Tax For FY 2017-18 - Here Are 6 Investments With Tax-Free Income - The Economic TimesCA Manoj GuptaPas encore d'évaluation

- Tier 1 Capital: What Is The Difference Between Tier 1 Capital and Tier 2 Capital?Document4 pagesTier 1 Capital: What Is The Difference Between Tier 1 Capital and Tier 2 Capital?CA Manoj GuptaPas encore d'évaluation

- IFRS Implemenation CMSDocument14 pagesIFRS Implemenation CMSCA Manoj GuptaPas encore d'évaluation

- Syllabus - DtirmDocument2 pagesSyllabus - DtirmCA Manoj GuptaPas encore d'évaluation

- Engineering Economics: DepreciationDocument50 pagesEngineering Economics: DepreciationLeahlainne MinisterioPas encore d'évaluation

- Facebook Financial AnalysisDocument12 pagesFacebook Financial AnalysisKennedy Gitonga ArithiPas encore d'évaluation

- Quiz 1-Current LiabDocument11 pagesQuiz 1-Current LiabBadAssPas encore d'évaluation

- BFM Assignment 2: Submitted By: Adhiraj Rathore E-02 20020441015Document14 pagesBFM Assignment 2: Submitted By: Adhiraj Rathore E-02 20020441015Tabrej AlamPas encore d'évaluation

- New Microsoft Word DocumentDocument13 pagesNew Microsoft Word DocumentMax MudaliarPas encore d'évaluation

- 5-15 Resolution For Stock Issuance To Certain PersonsDocument2 pages5-15 Resolution For Stock Issuance To Certain PersonsDaniel100% (3)

- CH 2 AssignmentDocument1 pageCH 2 AssignmentSachpreet KaurPas encore d'évaluation

- Multiple Choice On Cash Flow StatementDocument7 pagesMultiple Choice On Cash Flow StatementLongtan JingPas encore d'évaluation

- BK Stat 05Document2 pagesBK Stat 05Mentesenot AnetenhPas encore d'évaluation

- Analisis Manfaat Informasi Akuntansi Pada Ukm Di Wilayah TanggulanginDocument10 pagesAnalisis Manfaat Informasi Akuntansi Pada Ukm Di Wilayah TanggulanginRizqan AnshariPas encore d'évaluation

- (Company Name) : Profit and Loss StatementDocument8 pages(Company Name) : Profit and Loss StatementRonald GarciaPas encore d'évaluation

- Ia2 ReviewerDocument7 pagesIa2 ReviewerAiden MagnoPas encore d'évaluation

- Using Coke-Cola and Pepsico To Demonstrate Optimal Capital Structure TheoryDocument13 pagesUsing Coke-Cola and Pepsico To Demonstrate Optimal Capital Structure TheoryNooray MalikPas encore d'évaluation

- Lecture 8-1-19032016 INPUT Mixed Method Levered UnleveredDocument16 pagesLecture 8-1-19032016 INPUT Mixed Method Levered UnleveredLeroy AlicandroPas encore d'évaluation

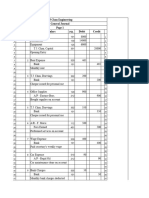

- (7.2) Continue With TJ Chan Engineering (Worksheet and Classified Balance Sheet)Document11 pages(7.2) Continue With TJ Chan Engineering (Worksheet and Classified Balance Sheet)clumzeegaming8Pas encore d'évaluation

- Quiz LeasesDocument2 pagesQuiz LeasesCyra de LemosPas encore d'évaluation

- Quizbee Practice IntaccDocument21 pagesQuizbee Practice IntaccCharles Kevin MinaPas encore d'évaluation

- Enterpreneurship Finance Exercises 4-6Document6 pagesEnterpreneurship Finance Exercises 4-6Trang TranPas encore d'évaluation

- ACC1701 Mock Test - Sep 2018Document9 pagesACC1701 Mock Test - Sep 2018kik leePas encore d'évaluation

- Chapter 17 Questions V1Document4 pagesChapter 17 Questions V1KaRin MerRoPas encore d'évaluation

- IFS-Primary Market - Note Prepared by Dr.R.R.YelikarDocument33 pagesIFS-Primary Market - Note Prepared by Dr.R.R.YelikarBablu JamdarPas encore d'évaluation

- Chapter 1 (Intro)Document18 pagesChapter 1 (Intro)Siti AishahPas encore d'évaluation

- Financial Management Q&ADocument8 pagesFinancial Management Q&AGracianne Santos- JulitoPas encore d'évaluation

- Activation of Additional SegmentsDocument1 pageActivation of Additional SegmentsArun KumarPas encore d'évaluation

- Utopia Corporation Law Reviewer 2008Document171 pagesUtopia Corporation Law Reviewer 2008Tristan Lindsey Kaamiño AresPas encore d'évaluation

- Account Details Account SummaryDocument130 pagesAccount Details Account SummaryDahiru AbbaPas encore d'évaluation

- FAR 02 - Conceptual Framework For Financial ReportingDocument11 pagesFAR 02 - Conceptual Framework For Financial ReportingJohn Bohmer Arcillas PilapilPas encore d'évaluation

- Basics of Stock Market PDFDocument14 pagesBasics of Stock Market PDFNitesh YadavPas encore d'évaluation

- 08january2024 India DailyDocument38 pages08january2024 India Dailypradeep kumarPas encore d'évaluation

- LAW 485 - Academic Writing On Directors and Company Secretary and AuditorsDocument27 pagesLAW 485 - Academic Writing On Directors and Company Secretary and AuditorsNormala HamzahPas encore d'évaluation