Académique Documents

Professionnel Documents

Culture Documents

ArmHoldings 1Q08Update 04july2008 1

Transféré par

ResearchOracleTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

ArmHoldings 1Q08Update 04july2008 1

Transféré par

ResearchOracleDroits d'auteur :

Formats disponibles

Tel.

+44 (0)20 7232 3090 Traded on

AIM, London

Fax +44 (0)20 7232 3099 Stock Exchange

www.iirgroup.com Regulated and

LSE: IIR authorised by

ARM Holdings PLC 04 July 2008

Update Report – 1Q 08 Results

Strong growth momentum expected in FY 2009

Common HOLD Direct access to the full report free of charge at

Fundamental research indicates a 9% upside in the common stock over the next 6-12 months. We

have calculated the target price based on fundamental factors, using a weighted average of target

Stock http://www.iirgroup.com/researchoracle/viewreport/show/20197

prices obtained using DCF and comparative valuation methodologies. We have taken a 6-12 month

investment horizon for this stock, as the semiconductor industry in which the company operates is

Ticker: ARM.L highly cyclical and therefore trends can be captured more accurately with a shorter investment

horizon.

Target price: GBp92.39

Current price: GBp85.00 We reiterate the common stock from a HOLD with a 6-12 month target price of GBp92.39.

ADR BUY The ADR is expected to appreciate approximately 20% over the next 6-12 months as the 9%

fundamental upside is augmented by approximately 11 percentage point upside attributable purely to

the anticipated appreciation of Sterling against the US dollar.

Ticker: ARMH

Target price: US$6.10 We upgrade the ADR (1 ADR = 3 common shares) from a HOLD to a BUY with a 6-12 month target

Current price: US$5.07 price of US$6.10.

Supervisor: Shilpen Shah Investment horizon - short term actionable trading strategies

Analyst: Abhilasha Jha This report addresses the needs of strategic investors with a long term investment horizon of 6-12 months. If this

Editor: Heloise Capon report is provided to you by your broker under the Global Settlement, you may now also access (free of charge) the

Global Research Director: short term trading outlook that we publish from time to time for this issuer, looking at the coming 5-30 days for

Satish Betadpur, CFA readers with a shorter trading horizon. These are available online only at www.researchoracle.com

Next news due:

2Q 08 results, 30 July 2008

Report summary

ARM Holdings PLC’s (ARM) 1Q 08 results exceeded our expectations, with total revenues growing 5.5%

q-o-q in 1Q 08. Considering overall uncertainty and seasonality in Royalty revenues, Management

expects total revenues in US dollar terms to remain flat or lower sequentially in 2Q 08. We expect ARM

to experience moderate total revenue growth in FY 2008 despite current industry slowdown as a result

of uncertain global macroeconomic conditions and reduced consumer spending. The Semiconductor

Industry Association (SIA) has forecast cell phone unit shipments to grow approximately 12% y-o-y in

2008, while microprocessor shipments are expected to grow at approximately 10% over the same

period. As a leader in the smartphone market, ARM is expected to benefit from growth in these

segments in the form of increased licensing activity and robust royalty revenues, as its customers ship

more products incorporating ARM technology. We anticipate FY 2009 to be a stronger year for the

semiconductor industry, and expect industry growth to benefit ARM through increasing licensing

activity and robust royalty revenues. Our margin estimates for FY 2008 and FY 2009 remain

unchanged for the company. Although we are optimistic about the long term growth prospects of the

company in view of its strong leadership position in the market, and higher revenue contribution from

the Physical IP Division (PIPD) segment, we retain a cautious outlook in the near term.

Currency impact for US investors

The impact by itself of the anticipated currency movements on the ADR (now US$5.07) over 6-12

months, without considering changes in the share price, is broadly positive and is expected to be:

Over 6 months: US$4.85

Over 12 months: US$5.61

Page 1 Refer to page 5 for footnotes

Vous aimerez peut-être aussi

- WNS NewsAlert 11july2008 1Document1 pageWNS NewsAlert 11july2008 1ResearchOraclePas encore d'évaluation

- Nissan 4QANDFY2008Update 11jul08 1Document1 pageNissan 4QANDFY2008Update 11jul08 1ResearchOraclePas encore d'évaluation

- XLCapital NewsAlert 11july2008 1Document1 pageXLCapital NewsAlert 11july2008 1ResearchOraclePas encore d'évaluation

- SouthernCopper NewsAlert 11jul2008 1Document1 pageSouthernCopper NewsAlert 11jul2008 1ResearchOraclePas encore d'évaluation

- O2Micro 1Q08Update 11july2008 1Document1 pageO2Micro 1Q08Update 11july2008 1ResearchOraclePas encore d'évaluation

- FocusMedia 1Q08Update 11july2008 1Document1 pageFocusMedia 1Q08Update 11july2008 1ResearchOraclePas encore d'évaluation

- Noble 1Q08Update 11jul2008 1Document1 pageNoble 1Q08Update 11jul2008 1ResearchOraclePas encore d'évaluation

- Infosys 1Q09Alert 11july2008 1Document1 pageInfosys 1Q09Alert 11july2008 1ResearchOraclePas encore d'évaluation

- SMIC 1Q08Update 11july2008 1Document1 pageSMIC 1Q08Update 11july2008 1ResearchOraclePas encore d'évaluation

- Advantest NewsAlert 11july2008 1Document1 pageAdvantest NewsAlert 11july2008 1ResearchOraclePas encore d'évaluation

- Repsol 1Q08Update 11jul2008 1Document1 pageRepsol 1Q08Update 11jul2008 1ResearchOraclePas encore d'évaluation

- GrupoAeroCentroNorte NewsAlert 11july2008 1Document1 pageGrupoAeroCentroNorte NewsAlert 11july2008 1ResearchOraclePas encore d'évaluation

- NationalGrid FY2008Update 10july2008 1Document1 pageNationalGrid FY2008Update 10july2008 1ResearchOraclePas encore d'évaluation

- ACE 1Q08Update 11jul2008 1Document1 pageACE 1Q08Update 11jul2008 1ResearchOraclePas encore d'évaluation

- Roundup 10 July 2008Document2 pagesRoundup 10 July 2008ResearchOraclePas encore d'évaluation

- SiliconwarePrecisionIndustries 1Q08Update 10july2008 1Document1 pageSiliconwarePrecisionIndustries 1Q08Update 10july2008 1ResearchOraclePas encore d'évaluation

- Covidien 2q08update 11jul08 1Document1 pageCovidien 2q08update 11jul08 1ResearchOraclePas encore d'évaluation

- TokioMarine (Formerlymillea) FY2008Update 10july2008 1Document1 pageTokioMarine (Formerlymillea) FY2008Update 10july2008 1ResearchOraclePas encore d'évaluation

- UnileverPLC 1Q08Update 10jul08 1Document1 pageUnileverPLC 1Q08Update 10jul08 1ResearchOraclePas encore d'évaluation

- UnileverNV 1Q08Update 10jul08 1Document1 pageUnileverNV 1Q08Update 10jul08 1ResearchOraclePas encore d'évaluation

- NTT FY2008Update 10july2008 1Document1 pageNTT FY2008Update 10july2008 1ResearchOraclePas encore d'évaluation

- Mitsui FY2008Update 10july08 1Document1 pageMitsui FY2008Update 10july08 1ResearchOraclePas encore d'évaluation

- BancoBradesco 1Q08Update 10jul2008 1Document1 pageBancoBradesco 1Q08Update 10jul2008 1ResearchOraclePas encore d'évaluation

- EnduranceSpecialty NewsAlert 10july2008 1Document1 pageEnduranceSpecialty NewsAlert 10july2008 1ResearchOraclePas encore d'évaluation

- GrupoAeroPacifico NewsAlert 10july2008 1Document1 pageGrupoAeroPacifico NewsAlert 10july2008 1ResearchOraclePas encore d'évaluation

- Baidu 1Q08Update 10july2008 1Document1 pageBaidu 1Q08Update 10july2008 1ResearchOraclePas encore d'évaluation

- AngiotechPharmaceuticalInc NewsAlert 10jul08 1Document1 pageAngiotechPharmaceuticalInc NewsAlert 10jul08 1ResearchOraclePas encore d'évaluation

- Companhia de Bebidas Das Americas 1Q08Update 10jul08 1Document1 pageCompanhia de Bebidas Das Americas 1Q08Update 10jul08 1ResearchOraclePas encore d'évaluation

- XLCapital NewsAlert 09july2008 1Document1 pageXLCapital NewsAlert 09july2008 1ResearchOraclePas encore d'évaluation

- Votorantim Celolose 1Q08Update 09jul08 1Document1 pageVotorantim Celolose 1Q08Update 09jul08 1ResearchOraclePas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Vstecs UpsDocument2 pagesVstecs Upserick ramosPas encore d'évaluation

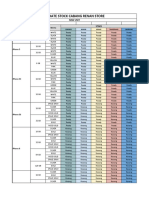

- Update Stock Cabang Renan Store: Tanggal Update: New Unit 27-02-21Document10 pagesUpdate Stock Cabang Renan Store: Tanggal Update: New Unit 27-02-21SANDI HAIKAL R.Pas encore d'évaluation

- RPi 3Document1 pageRPi 3Fahmi FisalPas encore d'évaluation

- Softbank ARMDocument42 pagesSoftbank ARMYongzheng TeowPas encore d'évaluation

- Sample M&A Pitch BookDocument19 pagesSample M&A Pitch BookAmit Rander79% (14)

- A13 Bionic Chip PDFDocument15 pagesA13 Bionic Chip PDFManikanta Sriram50% (2)

- ARM Annual Report 2012Document156 pagesARM Annual Report 2012Jedi5dPas encore d'évaluation

- SBC OdsDocument118 pagesSBC OdsFelipePas encore d'évaluation

- UntitledDocument129 pagesUntitledwardi0213Pas encore d'évaluation

- How To Turn Off or Reboot Iphone 12 or Any Other IphoneDocument3 pagesHow To Turn Off or Reboot Iphone 12 or Any Other IphoneARIS TRIYPas encore d'évaluation

- Acorn RISC Machine. The ARM Architecture Is The Most Widely UsedDocument16 pagesAcorn RISC Machine. The ARM Architecture Is The Most Widely UsedNagaraja RaoPas encore d'évaluation

- Imobile Importadora: Ic IphoneDocument7 pagesImobile Importadora: Ic IphoneJavier SanabriaPas encore d'évaluation

- Digimap Price: Sap Article Sapdescription Category Cicilan/Cc Cash/DebitDocument81 pagesDigimap Price: Sap Article Sapdescription Category Cicilan/Cc Cash/DebitJoon FatPas encore d'évaluation

- IC Zona Movil - Junio 2019 PDFDocument4 pagesIC Zona Movil - Junio 2019 PDFzombie zPas encore d'évaluation

- Unit 1-1Document29 pagesUnit 1-1Patrick Muñoz VargasPas encore d'évaluation

- Devices TableDocument20 pagesDevices TableAlexis PJPas encore d'évaluation

- Project Aardvark Acquisitions StrategyDocument22 pagesProject Aardvark Acquisitions StrategyAkshay ShaikhPas encore d'évaluation

- Pta Approved Model List 06072021Document156 pagesPta Approved Model List 06072021maahPas encore d'évaluation

- Aggregated app crash reportDocument18 pagesAggregated app crash reportMelissa DillonPas encore d'évaluation

- FACH Congestion Solution (Result) - RNC Wisma Mulia: Huawei NPI Team-15 JanDocument13 pagesFACH Congestion Solution (Result) - RNC Wisma Mulia: Huawei NPI Team-15 JanSandeepPas encore d'évaluation

- Complete List of iOS User-Agent StringsDocument8 pagesComplete List of iOS User-Agent StringsKlaus DieterPas encore d'évaluation

- PTA Approved GSMA TAC Model Devices ListDocument615 pagesPTA Approved GSMA TAC Model Devices ListConstantin Gîlca80% (5)

- Arm HoldingsDocument6 pagesArm HoldingsJoaquin FerrePas encore d'évaluation

- Homologación de teléfonos móvilesDocument277 pagesHomologación de teléfonos móvilesCamiloAlejandroRodríguezPas encore d'évaluation

- EcsmDocument22 pagesEcsmSameer NandagavePas encore d'évaluation

- Laporan Penjualan 01 - 01 - 2021 - 26 - 01 - 2021Document5 pagesLaporan Penjualan 01 - 01 - 2021 - 26 - 01 - 2021Rizky Ary septiyanPas encore d'évaluation

- EDA Graffiti PDFDocument279 pagesEDA Graffiti PDFmayurPas encore d'évaluation

- 5 - BKEC-168-Smart Drip Irrigation System Using Raspberry Pi and ArduinoDocument8 pages5 - BKEC-168-Smart Drip Irrigation System Using Raspberry Pi and ArduinoKarem Meza CapchaPas encore d'évaluation

- APC - February 2021 AUDocument116 pagesAPC - February 2021 AUSa Waji100% (1)

- IntroductionDocument53 pagesIntroductionTrọng QuảngPas encore d'évaluation