Académique Documents

Professionnel Documents

Culture Documents

Fact Sheet

Transféré par

fahmiyusufDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Fact Sheet

Transféré par

fahmiyusufDroits d'auteur :

Formats disponibles

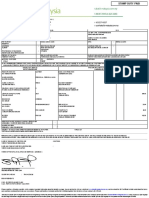

MONTHLY FUND FACT SHEET

FACTSHEET PRODUCED BY PT PNM INVESTMENT MANAGEMENT

31 Maret 2016

PNM Ekuitas Syariah

Fund Type : Equity Fund

n About the Fund Manager n Investment Objective

PT PNM Investment Management is a fund management The fund’s objective is to achieve optimum long term asset

company 100% owned by PT Permodalan Nasional Madani growth through investment in equities which comply with sharia

(Persero). One of the company mission is to promote asset rule and guidance (fatwa). The fund is actively managed.

redistribution in Indonesia through mutual funds. At

present, PT PNM Investment Management manages 9 mutual

funds: PNM Amanah Syariah, PNM Dana Bertumbuh (fixed

income fund), PNM Syariah (balanced fund), PNM Dana

Tunai, PNM Pasar Uang Syariah, PNM Money Market USD

(money market fund), PNM Ekuitas Syariah, PNM Saham n Asset Allocation

Agresif and PNM Saham Unggulan (equity fund). In

Minimum Equity 80%

September 2008, the Investor Magazine voted reksa dana

PNM Ekuitas Syariah as the top equity sharia-based fund Maximum 20% in Fixed Income and Money Market

based on its superior 1-year risk adjusted return, and PNM

Ekuitas Syariah ranked as Top 3 equity based fund category Maximum 20% in Cash

from Bisnis Indonesia in 2009. In September 2009, the Investor

Magazine granted PNM Ekuitas Syariah in the top three best

sharia-based equity fund.

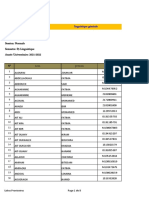

n Performance and Portfolio Breakdown

Total Return over Last 3 Year (IDR) Portfolio Breakdown Top Five Stock Holdings

PNM Ekuitas Syariah : 31.14% Bond 0.24% Astra International 15.51%

Jakarta Islamic Index : 74.81% Equity 98.95% Telekomunikasi Indonesia 14.73%

Best Month Sep-13 : 11.94% Money Market - Unilever Indonesia 12.68%

W Aug-15 : -15.97% Cash 1.46% Adhi Karya 4.82%

Waskita Karya 4.38%

NAV Growth (31 Dec. 2015 = 100) 8.0%

M-O-M Performance

115

110 6.0%

105

4.0%

100

95 2.0%

90 0.0%

PNM Ekuitas Syariah Benchmark

85

-2.0%

Performance in IDR as of 31/3/2016 Since

1 Mo 3 Mos 6 Mos 1 Year YTD Inception

PNM Ekuitas Syariah 2.83% 8.58% 6.54% -21.09% 8.58% 31.14%

Jakarta Islamic Index 1.69% 8.18% 17.37% -10.37% 8.18% 74.81%

n General Information

Launch Date : 01 August 2007 Annual Management Fee : 2.00%

Fund Size @ 31/3/2016 : IDR 27.93 Bio Initial Charges : 3.00%

Minimum Investment : IDR 500.000,- Price (NAV) : IDR 1,311.40

Fund Currency : IDR Redemption Charge : 1.00%

Switching Charge : 0.50%

The Information and charts in this document were prepared from data deemed to be accurate, but we do not guarantee its accuracy. Mutual fund does not

guarantee returns and assumes investment risk. Past performance of the fund is not a guarantee of this future performance and participation unit price

can go down as well as up and you may loose principal investment. This report is produce for information purposes only, and not to be taken as an offer to

sell or a solicitation to buy the fund and is not intended to create any rights or obligations. Investors should read prospectus and information describe in

this report may not be suitable for all Investors and you are advised to seek independent financial advice before making any investment decisions.

Vous aimerez peut-être aussi

- FactsheetDocument1 pageFactsheetROSSIPas encore d'évaluation

- Shinhan Balance Fund - Agustus - 2023 - enDocument1 pageShinhan Balance Fund - Agustus - 2023 - enwongjuliusPas encore d'évaluation

- Schroder Syariah Balanced FundDocument1 pageSchroder Syariah Balanced FundYollandaPas encore d'évaluation

- Shinhan Supreme Balance FundDocument1 pageShinhan Supreme Balance FundhhhahaPas encore d'évaluation

- IDR Equity Syariah Fund - AIA Fund Fact Sheet Jan 2020Document1 pageIDR Equity Syariah Fund - AIA Fund Fact Sheet Jan 2020Siti NurhayatiPas encore d'évaluation

- Ffs-Jambaf Jan2021Document2 pagesFfs-Jambaf Jan2021Johan CahyantoPas encore d'évaluation

- Jarvis Balanced Fund Desember 2020Document2 pagesJarvis Balanced Fund Desember 2020rinasiahaanPas encore d'évaluation

- FFS Jambaf Okt23Document4 pagesFFS Jambaf Okt23Fri Wardara van HoutenPas encore d'évaluation

- Archipelago Equity Growth FactsheetDocument1 pageArchipelago Equity Growth FactsheetDaniel WijayaPas encore d'évaluation

- Shinhan Balance Fund JANUARY 2022Document1 pageShinhan Balance Fund JANUARY 2022cuan claluPas encore d'évaluation

- Pinnacle Enhanced Sharia ETF (XPES) : March 2020Document1 pagePinnacle Enhanced Sharia ETF (XPES) : March 2020Kamal FirmansyahPas encore d'évaluation

- FFS Jambaf Mar2021Document2 pagesFFS Jambaf Mar2021Johan CahyantoPas encore d'évaluation

- Nimaf PDFDocument1 pageNimaf PDFMuhammad MudassirPas encore d'évaluation

- HWPF FactsheetDocument3 pagesHWPF Factsheethello.easygiftsPas encore d'évaluation

- Fund Fact Sheet Money Market Libra Dana Safa 31july2019Document2 pagesFund Fact Sheet Money Market Libra Dana Safa 31july2019Zahirin AdnanPas encore d'évaluation

- NAFA Pension Fund November 2016Document1 pageNAFA Pension Fund November 2016chqaiserPas encore d'évaluation

- Shinhan Balance Fund Factsheet PDFDocument1 pageShinhan Balance Fund Factsheet PDFjoecool87Pas encore d'évaluation

- JUNE 2020: Dana DinamikDocument3 pagesJUNE 2020: Dana DinamikNURAIN HANIS BINTI ARIFFPas encore d'évaluation

- Pinnacle FTSE Indonesia ETF (XPFT) : March 2020Document1 pagePinnacle FTSE Indonesia ETF (XPFT) : March 2020Dynand PLNPas encore d'évaluation

- Fund Fact Sheet - March 2019Document20 pagesFund Fact Sheet - March 2019Afthon Ilman Huda Isyfi100% (1)

- PNB Peso Fixed Income Fund PDFDocument3 pagesPNB Peso Fixed Income Fund PDFJj PahudpodPas encore d'évaluation

- MIEF-factsheet 230320 152602Document3 pagesMIEF-factsheet 230320 152602ryanbud96Pas encore d'évaluation

- HDFC Opportunities FundDocument1 pageHDFC Opportunities FundManjunath BolashettiPas encore d'évaluation

- MASIF FactsheetDocument3 pagesMASIF Factsheethello.easygiftsPas encore d'évaluation

- SAMShariaEquityFund 1402 PDFDocument1 pageSAMShariaEquityFund 1402 PDFMuhammad RafifPas encore d'évaluation

- Cipta Dana Cash: Asset ManagementDocument1 pageCipta Dana Cash: Asset ManagementFerrari .f488Pas encore d'évaluation

- FactsheetDocument2 pagesFactsheetMighfari ArlianzaPas encore d'évaluation

- Hpam Ultima Ekuitas 1Document2 pagesHpam Ultima Ekuitas 1Serly MarcelinaPas encore d'évaluation

- Fund Manager'S Report (Islamic Funds) January 2017: AMC Rating: AM2 by JCR-VISDocument8 pagesFund Manager'S Report (Islamic Funds) January 2017: AMC Rating: AM2 by JCR-VISmuhammad taufikPas encore d'évaluation

- Pinnacle Indonesia Large Cap ETF (XPLC) : March 2020Document1 pagePinnacle Indonesia Large Cap ETF (XPLC) : March 2020putu dediPas encore d'évaluation

- Mdeic (Idr) 1801 Ajmi Eng PDFDocument1 pageMdeic (Idr) 1801 Ajmi Eng PDFVaxlr StovPas encore d'évaluation

- Diversified JulyDocument1 pageDiversified JulyPiyushPas encore d'évaluation

- Fund Fact Sheet June 2020Document21 pagesFund Fact Sheet June 2020Devi TinawatiPas encore d'évaluation

- Ubs Cash PDFDocument2 pagesUbs Cash PDFPeterPas encore d'évaluation

- HDFC Discovery FundDocument1 pageHDFC Discovery FundHarsh SrivastavaPas encore d'évaluation

- Factsheet - Feb 2023Document2 pagesFactsheet - Feb 2023Vinh NguyenPas encore d'évaluation

- Manulife Asian Small Cap Equity Fund MASCEF - 201908 - EN PDFDocument2 pagesManulife Asian Small Cap Equity Fund MASCEF - 201908 - EN PDFHetanshPas encore d'évaluation

- Discovery Fund April 23Document1 pageDiscovery Fund April 23Satyajeet AnandPas encore d'évaluation

- Schroder Dana Prestasi Plus: Fund FactsheetDocument1 pageSchroder Dana Prestasi Plus: Fund FactsheetGiovanno HermawanPas encore d'évaluation

- Niddf PDFDocument1 pageNiddf PDFMuhammad MudassarPas encore d'évaluation

- Pinnacle Strategic Equity Fund Factsheet (1) - CONTOHDocument1 pagePinnacle Strategic Equity Fund Factsheet (1) - CONTOHirfanPas encore d'évaluation

- TA Global Technology Fund (TAGTF) - MYR ClassDocument7 pagesTA Global Technology Fund (TAGTF) - MYR ClassJ&A Partners JANPas encore d'évaluation

- Fund Allocation Investment Objective: Pami Equity Index Fund, IncDocument1 pageFund Allocation Investment Objective: Pami Equity Index Fund, IncRamil MontealtoPas encore d'évaluation

- Risk Measures: Risk Analysis Distribution of ReturnsDocument7 pagesRisk Measures: Risk Analysis Distribution of ReturnsJBPS Capital ManagementPas encore d'évaluation

- December Fund-Factsheets-Individual1Document2 pagesDecember Fund-Factsheets-Individual1Navneet PandeyPas encore d'évaluation

- About Parag Parikh Flexi Cap Fund: Foreign Equity InvestmentDocument10 pagesAbout Parag Parikh Flexi Cap Fund: Foreign Equity InvestmentTunirPas encore d'évaluation

- APRIL 2018: Dinasti Equity FundDocument2 pagesAPRIL 2018: Dinasti Equity FundAhmad RafiqPas encore d'évaluation

- RPCF May 2014 (English)Document1 pageRPCF May 2014 (English)Anonymous fS6Znc9Pas encore d'évaluation

- IDR Equity Syariah Fund - AIA Fund Fact Sheet - Jan 2024.pdf - Coredownload.inlineDocument1 pageIDR Equity Syariah Fund - AIA Fund Fact Sheet - Jan 2024.pdf - Coredownload.inlineLukman ChenPas encore d'évaluation

- Cac 40 20180329Document3 pagesCac 40 20180329Anirban BanerjeePas encore d'évaluation

- FSISectoralFund MonthlyDocument1 pageFSISectoralFund MonthlyVPas encore d'évaluation

- FFS SMMFDocument1 pageFFS SMMFben tomPas encore d'évaluation

- NBP Islamic Mahana Amdani Fund (Nimaf)Document1 pageNBP Islamic Mahana Amdani Fund (Nimaf)Afnan TariqPas encore d'évaluation

- Invesco India Caterpillar PortfolioDocument1 pageInvesco India Caterpillar PortfolioAnkurPas encore d'évaluation

- Mandiri Investa Equity MovementDocument1 pageMandiri Investa Equity MovementulalaPas encore d'évaluation

- Pinnacle Enhanced Liquid ETF (XPLQ) : Fund Information About PinnacleDocument1 pagePinnacle Enhanced Liquid ETF (XPLQ) : Fund Information About PinnacleWlliam BarrethPas encore d'évaluation

- Jarvis Balance Fund - FFS-JUN21Document2 pagesJarvis Balance Fund - FFS-JUN21Triwibowo B NugrohoPas encore d'évaluation

- NBP Funds: NBP Aitemaad Mahana Amdani Fund (NAMAF)Document1 pageNBP Funds: NBP Aitemaad Mahana Amdani Fund (NAMAF)Sajid rasoolPas encore d'évaluation

- NAFA Stock Fund October 2016Document1 pageNAFA Stock Fund October 2016jeb38293Pas encore d'évaluation

- Handbook of Singapore — Malaysian Corporate FinanceD'EverandHandbook of Singapore — Malaysian Corporate FinanceTan Chwee HuatPas encore d'évaluation

- Psychology From The Islamic PerspectiveDocument4 pagesPsychology From The Islamic PerspectivedujahPas encore d'évaluation

- The Crusades TimelineDocument5 pagesThe Crusades TimelineMohamed Mahmoud Abu HadeedPas encore d'évaluation

- Terracotta Figurines From ThajDocument29 pagesTerracotta Figurines From ThajshowatiPas encore d'évaluation

- Slave Rebellions & The Black Radical Tradition: SOC3703 Social Movements, Conflict & Change Week 14Document16 pagesSlave Rebellions & The Black Radical Tradition: SOC3703 Social Movements, Conflict & Change Week 14rozamodeauPas encore d'évaluation

- Qirad Meaning 'Surrender' Is Used To Refer To The Surrender of Capital, Hence TheDocument2 pagesQirad Meaning 'Surrender' Is Used To Refer To The Surrender of Capital, Hence TheSK LashariPas encore d'évaluation

- Personal Laws IIDocument12 pagesPersonal Laws IIAtulPas encore d'évaluation

- Swalath MashishiyyaDocument6 pagesSwalath MashishiyyaDmd YearningPas encore d'évaluation

- A Historical Perspective of Federalism in Malaysia and Its Effects On The Current System of Federalism Raja Nur Alaini BT Raja OmarDocument5 pagesA Historical Perspective of Federalism in Malaysia and Its Effects On The Current System of Federalism Raja Nur Alaini BT Raja Omarintan_2410Pas encore d'évaluation

- Ahmad FarooqDocument1 pageAhmad FarooqKhalid SaifPas encore d'évaluation

- Perubahan Perilaku Santri (Studi Kasus Alumni Pondok Pesantren Salafiyah Di Desa Langkap Kecamatan Besuki Kabupaten Situbondo)Document42 pagesPerubahan Perilaku Santri (Studi Kasus Alumni Pondok Pesantren Salafiyah Di Desa Langkap Kecamatan Besuki Kabupaten Situbondo)nanang arifPas encore d'évaluation

- BateelDocument23 pagesBateelEl Haimer SoufianPas encore d'évaluation

- Presentation On LahoreDocument19 pagesPresentation On LahoreAalia ZafarPas encore d'évaluation

- Nazra Syllabus Breakdown VI at 2022-23Document2 pagesNazra Syllabus Breakdown VI at 2022-23ilovebreadilyPas encore d'évaluation

- FI53Document8 pagesFI53DELTANETO SLIMANEPas encore d'évaluation

- Notes Imam GhazaliDocument31 pagesNotes Imam GhazaliMuhammadNaveedPas encore d'évaluation

- Muhammad Ali Dinakhel CVDocument6 pagesMuhammad Ali Dinakhel CVMuhammad Ali DinakhelPas encore d'évaluation

- Man (Qalb and Aql)Document3 pagesMan (Qalb and Aql)Omah NgajiPas encore d'évaluation

- Sustainable DevelopmentDocument15 pagesSustainable DevelopmentKhayrurrijalPas encore d'évaluation

- Family Project of Pratik RajDocument18 pagesFamily Project of Pratik RajAkash MishraPas encore d'évaluation

- Alfred Dajoh-Complete WorkDocument14 pagesAlfred Dajoh-Complete WorkAlfred DajohPas encore d'évaluation

- Cover Note 55c1c87Document2 pagesCover Note 55c1c87Relly AtongPas encore d'évaluation

- Daftar Hadir Hukum Acara Perdata B Selasa, 13 Oktober 2020Document2 pagesDaftar Hadir Hukum Acara Perdata B Selasa, 13 Oktober 2020aura maulidaPas encore d'évaluation

- Tamas by Sahni - Indian LitDocument7 pagesTamas by Sahni - Indian LitAJIT100% (3)

- The Iranian World From The Timurids To The Safavids (1370 - 1722)Document16 pagesThe Iranian World From The Timurids To The Safavids (1370 - 1722)insightsxPas encore d'évaluation

- Islam, Globalism and GlobalisationDocument3 pagesIslam, Globalism and GlobalisationIzzahPas encore d'évaluation

- Women and Religion 2nd EssayDocument5 pagesWomen and Religion 2nd EssayAnna Katherina LeonardPas encore d'évaluation

- Islamic Concept of The StateDocument17 pagesIslamic Concept of The StateBram HarunPas encore d'évaluation

- Attitudes Toward Amazigh Language and CultureDocument18 pagesAttitudes Toward Amazigh Language and CultureEl Mehdi Iazzi67% (3)

- Islamic CalendarDocument32 pagesIslamic CalendarGERMANCRICKET100% (1)