Académique Documents

Professionnel Documents

Culture Documents

P1 3402-1 PDF

Transféré par

Ryan PelitoTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

P1 3402-1 PDF

Transféré par

Ryan PelitoDroits d'auteur :

Formats disponibles

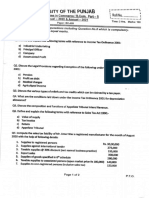

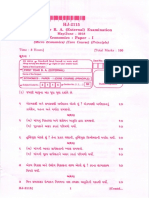

ReSA

The Review Schoo! of Accountancy

ITel. No. 735-9807 & 734-3989

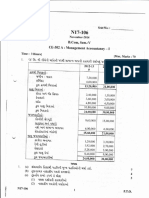

PRACTICAL ACCOUNTING 1 C. Ube,rital C. Espenilla/C. Macariola

Opbrating Segr.nent, Discontinued Oneration and Non-current Asset Held-for-Sale

l. lluddy (lontpan,v and ils divisions are engaged solcly in manufilcturing operalions. l'he following data pertains

CI

to lhc itrdustrics in which opcralions wcrcr conduclcd .tirr thc year endcd Dec. 31, 20 l6:

.lqg$ett1s l&neutc ]ie'l Itslglue-li o11l Qpggline Profit Idcnlitlablr: Assets

outside:$ u'ithin

A I tt,000,000 2,000,000 ?e. 3,600,000 40,000,000

r] t3^000,000 3.000,000 ); 2,800,000 36.000,000

C 5,000.0(x) 7.00().000 . 2.400,000 2lt.000,000

t) 4,.500,000 1.5(n.000 t 1,200,000 t' 16,000,000

i, -5,400.00() 3.600.000 '.r I,400,000 14.000,000

l, tr01uaq0 - ----

()-:---:

_ 6IL0-000 6.000.000

'lotal ,189!q,()(10 l7.l(x).o(x) i--l, it 1200_0.00q .1.4.9-Q-9"0."0.._q:9

. u!

Using thc qttanlitativc tlrrcslrrkl. lxrw marly rcporlablc scgnlcrrts does lludrty Comptrny have'i

a) six c) lour

ft) fivc rl) threc

t 2. (lpcrating proiit and loss ligurcs lbr thc scven scglnents r"rl'Mobile Clornpany arc as ltrll6ws:

$!stii$r4 ()psru4iqglplit (fpgruurg&.:.s

K 14,000.000

,I. 2,0(){).O(X}

I\4 8.{)fi).00{ |

N 2,.500,000 ,

o n00,000

I) 900.0(x)

()

'lirtal ?-a0a,a00

2422A0,9!!t \,! ' 130q0qo

Ljsing thc cluantitativc thrcshold, which ot'thc abovc operating scgrncnts are reportable

basccl on the operating

prolit or loss cri{erion?

a. scgrllenls K, L, N4 and P K, M, and N

b. segrnents N. O and Q

$d. scgrucnts

nonc is rcpoflablc

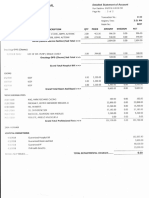

3' on 'Ianuary l,2016, Power Ccuupany approved a plan lo clispose ol'a business scgmcn'I. lt is cxpccte<l

that thc

salc will ()ccur on April 30,2017. on l)ecelnber 31,2016, th" valuc of iet assets of thc segrncnt was

"o.rying

I'4.000'00t| and the net rec()vera6lc am<>unt was I)3,600,000. Durirrg 2016, thc c{)mpany

paid eurployecs

sevcrance and rclocation c()sls of P200.000 as a dircct rcsult ol'thc disc<intinuing

opcrations. "l'hc revcnue.s ancl

cxpcnscs o['thc discontinuing segmcnt during 2016 were: hrc6me tax ratc is 35%.

ltevenues Ixpenses

.Ianuary I to I)cccrnbcr 3l ... 4,400,000 5,800,000

I "low nrtrch will bc rcported as loss l'rom ordinary activitie s ol'the discrxrtinuccl segmcnt during 20 l 6?

a. I'}l,(X)0,000 c. p1,400,000

b. P1,300,000 $ rz,0oo,ooo

': !. On Scptcmbe r 1,2016, Polo Compatry approved a lbnnal plan rir scll a business scgnrenl. 'l'he sale

will occur in

Marclr 20 17. 'I'he scgment hacl a prolit beltrre tax o{'I'}1,400,00 during rhe entirc yeir of 2016, the cnrrying

valuc

ol'tJrc segmcltt was l'}lt'000,000 and the recoverablc amounr was P7,i00,000. During the ycar 2017

thc siglrcnt

has yct to bc disposed ol'. t'hroughout the year 2017 rhe scgmcnt had a prolit U"to." io* ot'p400,000: .I.he

carrving value rl1'thc scgr]relrl as ol'l)cccrnbcr 31.2017 is P8.400,000. Income tax ratc is 35%.

I I<rlrtruclr will ht' rcporlcd as inconrc liorn orclinary activities ol'the discontinued segmerrl. nct 6l.tax in2Ol7,]

O l'260,()0{) c. p520,()oo

b. t,455.000 d. I)tt45.000

34A2

Vous aimerez peut-être aussi

- Business Taxation March 2022Document4 pagesBusiness Taxation March 2022Mateen PathanPas encore d'évaluation

- P1 3402-2 PDFDocument1 pageP1 3402-2 PDFRyan PelitoPas encore d'évaluation

- Accountin - , I.t,: ,., ResaDocument1 pageAccountin - , I.t,: ,., ResaRyan PelitoPas encore d'évaluation

- New Medical Policy - Non-Executives AAIDocument10 pagesNew Medical Policy - Non-Executives AAIhari krishPas encore d'évaluation

- 1 Insttnl Dev in MINFAL WRT WTO Page (1-125)Document41 pages1 Insttnl Dev in MINFAL WRT WTO Page (1-125)Farhat Abbas DurraniPas encore d'évaluation

- Abstract of Minor Bridge at KM 3+960Document5 pagesAbstract of Minor Bridge at KM 3+960Gobinder Singh VirdeePas encore d'évaluation

- Financial Staements Duly Authenticated As Per Section 134 (Including Boards Report, Auditors Report and Other Documents) - 29112018Document36 pagesFinancial Staements Duly Authenticated As Per Section 134 (Including Boards Report, Auditors Report and Other Documents) - 29112018DSddsPas encore d'évaluation

- Ncwa - VDocument84 pagesNcwa - VManager SystemPas encore d'évaluation

- Article 5Document2 pagesArticle 5extracutesiannPas encore d'évaluation

- Management Accountancy-1 Sem-5 (GU-NOV-2014)Document16 pagesManagement Accountancy-1 Sem-5 (GU-NOV-2014)Ripesh PrajapatiPas encore d'évaluation

- Time Extension Notice (Wind Power Project)Document1 pageTime Extension Notice (Wind Power Project)Chami LiyanagePas encore d'évaluation

- Img 20180513 0006 PDFDocument1 pageImg 20180513 0006 PDFthia ۦۦPas encore d'évaluation

- Fundamentals of Statistics - IV (Ce-302-B)Document6 pagesFundamentals of Statistics - IV (Ce-302-B)Navin1186Pas encore d'évaluation

- Img 0002Document1 pageImg 0002Ahamed IrfanPas encore d'évaluation

- Cpar P2 07.28.13 PDFDocument6 pagesCpar P2 07.28.13 PDFJean PaladaPas encore d'évaluation

- Extract of AgreementDocument2 pagesExtract of AgreementNitin GuptaPas encore d'évaluation

- WhatsApp Image 2022-07-26 at 09.51.17Document2 pagesWhatsApp Image 2022-07-26 at 09.51.17Ary PostPas encore d'évaluation

- Phạm Thị Uyên.ktth 2-192002754Document9 pagesPhạm Thị Uyên.ktth 2-192002754Phạm UyênPas encore d'évaluation

- CE 14 406 - Surveying - II, April 2016Document2 pagesCE 14 406 - Surveying - II, April 2016Hilna HilnaPas encore d'évaluation

- Latihan Soal CCC & Inventory ManajemenDocument2 pagesLatihan Soal CCC & Inventory ManajemenGloria VivianPas encore d'évaluation

- Working: ComprehensiveDocument10 pagesWorking: Comprehensiveapi-253275095Pas encore d'évaluation

- Caiet de SarciniDocument1 pageCaiet de SarciniTRMmdPas encore d'évaluation

- TimberDocument3 pagesTimberLKP GhPas encore d'évaluation

- Situatii Financiare 2018 Is IprocomDocument6 pagesSituatii Financiare 2018 Is IprocomMaria CîrnațPas encore d'évaluation

- 2013 Ce 101 - Financial Accountancy 1Document12 pages2013 Ce 101 - Financial Accountancy 1ajay sutharPas encore d'évaluation

- Chapter 6 PDFDocument18 pagesChapter 6 PDFmuath wardatPas encore d'évaluation

- BC 401 PII Past PapersDocument30 pagesBC 401 PII Past PaperssherazPas encore d'évaluation

- Is Is: of IndiaDocument5 pagesIs Is: of IndiaKanchan GundalPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Manila City - Ordinance No. 8330 s.2013Document5 pagesManila City - Ordinance No. 8330 s.2013Franco SenaPas encore d'évaluation

- Exercise Demand Estimation Production Theory SolutionsDocument12 pagesExercise Demand Estimation Production Theory SolutionsJai ToneExcelPas encore d'évaluation

- Leltcgwde: +E (IdtnrDocument12 pagesLeltcgwde: +E (IdtnrAsif HanifPas encore d'évaluation

- Accounts PT 1Document8 pagesAccounts PT 1vyshnaviPas encore d'évaluation

- Wa0004Document13 pagesWa0004Ha M ZaPas encore d'évaluation

- Solution To Pri: Ociobe 2018Document4 pagesSolution To Pri: Ociobe 2018maria ronoraPas encore d'évaluation

- Design: of AlgorithmsDocument3 pagesDesign: of Algorithmspankaja_ssu3506Pas encore d'évaluation

- Ilr"I'Rnj: AnswirillDocument6 pagesIlr"I'Rnj: AnswirillsaluPas encore d'évaluation

- 'Ffi W Ffi Ffi: Sectors Trigonometric Functions Trigonometric WithDocument25 pages'Ffi W Ffi Ffi: Sectors Trigonometric Functions Trigonometric WithMin KangPas encore d'évaluation

- Linear LCS: ApplicationsDocument2 pagesLinear LCS: ApplicationsmabhatPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Revised Fee Notification 2022Document4 pagesRevised Fee Notification 2022Hasnain razaPas encore d'évaluation

- Determine The Value of X: Exercise 1Document6 pagesDetermine The Value of X: Exercise 1pham thienPas encore d'évaluation

- BEAM September 2014Document4 pagesBEAM September 2014Ah WenPas encore d'évaluation

- RTGS PDFDocument2 pagesRTGS PDFZahidur RahmanPas encore d'évaluation

- Business Taxation Past PapersDocument2 pagesBusiness Taxation Past Paperskamranrj3100Pas encore d'évaluation

- Sertifikat 310S Dia. 6mm X 6mtrDocument1 pageSertifikat 310S Dia. 6mm X 6mtrSiddiq Ari NugrahaPas encore d'évaluation

- TempVacancy 220230103042811716Document5 pagesTempVacancy 220230103042811716Amit Kumar K Junior Assistant, IIT (BHU) VaranasiPas encore d'évaluation

- ot Lil, l0-ll) : of Dvance UctionDocument14 pagesot Lil, l0-ll) : of Dvance UctionRoshniPas encore d'évaluation

- A) C) D) C) L) A) B) C) D) C) D B) C) D) C) : (M Eha (Par (M (Xallui (.GyDocument3 pagesA) C) D) C) L) A) B) C) D) C) D B) C) D) C) : (M Eha (Par (M (Xallui (.GyRohit GaratePas encore d'évaluation

- расписание 3 курсаDocument30 pagesрасписание 3 курсаStudent55Pas encore d'évaluation

- Ii /IL: I) Il) ./L) /',//C'E./UCTIO)Document15 pagesIi /IL: I) Il) ./L) /',//C'E./UCTIO)RoshniPas encore d'évaluation

- Work CertificateDocument1 pageWork CertificateMd Abdur Rahim HossainPas encore d'évaluation

- Fyba External Economics Paper - 1 (CC) (Principal) Hj-2115Document4 pagesFyba External Economics Paper - 1 (CC) (Principal) Hj-2115It's tejPas encore d'évaluation

- Img 20160714 0008Document1 pageImg 20160714 0008Alyssa Marie Marcelo BergantiñosPas encore d'évaluation

- Amul Business ModelDocument8 pagesAmul Business ModelSʜʌʜwʌj HʋsʌɩŋPas encore d'évaluation

- Errors and Accounting ChangesDocument8 pagesErrors and Accounting ChangesAndrew Benedict PardilloPas encore d'évaluation

- CSEC Integrated Science June 1991 P1Document8 pagesCSEC Integrated Science June 1991 P1Saintm101Pas encore d'évaluation

- 'Otl,'? JLT:.T#TT""$ '::": 'Ii-Il'":"Document8 pages'Otl,'? JLT:.T#TT""$ '::": 'Ii-Il'":"Recien SinghPas encore d'évaluation

- Cabrera 111Document14 pagesCabrera 111uroskPas encore d'évaluation

- Ion Beams for Materials AnalysisD'EverandIon Beams for Materials AnalysisR. Curtis BirdPas encore d'évaluation

- Loo, Ooo:, A. 24o, 7oa t92,2SO L Z: ' B. 2oo, 5g3 23a, 7a0 .. Ifi Ur"Document1 pageLoo, Ooo:, A. 24o, 7oa t92,2SO L Z: ' B. 2oo, 5g3 23a, 7a0 .. Ifi Ur"Ryan PelitoPas encore d'évaluation

- 1,,, A. o 61-Oo, Ooo c.200,000: Tirii.t'Document1 page1,,, A. o 61-Oo, Ooo c.200,000: Tirii.t'Ryan PelitoPas encore d'évaluation

- P1 3401-2 PDFDocument1 pageP1 3401-2 PDFRyan PelitoPas encore d'évaluation

- Far 34PW-2 PDFDocument1 pageFar 34PW-2 PDFRyan PelitoPas encore d'évaluation

- P1 3403-2 PDFDocument1 pageP1 3403-2 PDFRyan PelitoPas encore d'évaluation

- 3j-2Q!7. Iunds Iiot: ,,.rse. O1Document1 page3j-2Q!7. Iunds Iiot: ,,.rse. O1Ryan PelitoPas encore d'évaluation

- Far 34PW-6 PDFDocument1 pageFar 34PW-6 PDFRyan PelitoPas encore d'évaluation

- Far 34PW-9 PDFDocument1 pageFar 34PW-9 PDFRyan PelitoPas encore d'évaluation

- Far 34PW-1 PDFDocument1 pageFar 34PW-1 PDFRyan PelitoPas encore d'évaluation

- P1 3403-3 PDFDocument1 pageP1 3403-3 PDFRyan PelitoPas encore d'évaluation

- Prt6,8oo Li (I, Ffi: Ffihouldthecompanyreport?c) P206,800?/rJ.I,,,:Jl, JDocument1 pagePrt6,8oo Li (I, Ffi: Ffihouldthecompanyreport?c) P206,800?/rJ.I,,,:Jl, JRyan PelitoPas encore d'évaluation

- 'iil'ff: Ii:: 2eo, Ooo t5'7,3L3 " 161,104 164,895)Document1 page'iil'ff: Ii:: 2eo, Ooo t5'7,3L3 " 161,104 164,895)Ryan PelitoPas encore d'évaluation

- P1 3401-1Document1 pageP1 3401-1Ryan PelitoPas encore d'évaluation

- Ap 34PW-1 PDFDocument1 pageAp 34PW-1 PDFRyan PelitoPas encore d'évaluation

- Ap 34PW2-2 PDFDocument1 pageAp 34PW2-2 PDFRyan PelitoPas encore d'évaluation

- Ap 34PW2-1 PDFDocument1 pageAp 34PW2-1 PDFRyan PelitoPas encore d'évaluation

- Ap 34PW2-4Document1 pageAp 34PW2-4Ryan PelitoPas encore d'évaluation

- Ap 34PW-2 PDFDocument1 pageAp 34PW-2 PDFRyan PelitoPas encore d'évaluation

- Ap 34PW2-3 PDFDocument1 pageAp 34PW2-3 PDFRyan PelitoPas encore d'évaluation

- Reyes TacandongDocument1 pageReyes TacandongRyan PelitoPas encore d'évaluation

- Frequency Polygon: Class Limits Class Boundari Es F X CFDocument2 pagesFrequency Polygon: Class Limits Class Boundari Es F X CFRyan PelitoPas encore d'évaluation

- Market ProjDocument5 pagesMarket ProjRyan PelitoPas encore d'évaluation

- SculptureDocument2 pagesSculptureRyan PelitoPas encore d'évaluation

- Ac Pas 8Document9 pagesAc Pas 8Ryan PelitoPas encore d'évaluation

- Ac Pas 8Document9 pagesAc Pas 8Ryan PelitoPas encore d'évaluation

- NOS 65-200-90x60-30KWD PDFDocument2 pagesNOS 65-200-90x60-30KWD PDFDao The ThangPas encore d'évaluation

- Germany's Three-Pillar Banking SystemDocument7 pagesGermany's Three-Pillar Banking Systemmladen_nbPas encore d'évaluation

- Autoclave 2Document52 pagesAutoclave 2SILVANA ELIZABETH ROMO ALBUJAPas encore d'évaluation

- Assignment Business EnvironmentDocument9 pagesAssignment Business EnvironmentVikram MayuriPas encore d'évaluation

- Scientific American - Febuary 2016Document84 pagesScientific American - Febuary 2016Vu NguyenPas encore d'évaluation

- Capitol Medical Center, Inc. v. NLRCDocument14 pagesCapitol Medical Center, Inc. v. NLRCFidel Rico NiniPas encore d'évaluation

- NGOs in Satkhira PresentationDocument17 pagesNGOs in Satkhira PresentationRubayet KhundokerPas encore d'évaluation

- Saarthi Education Jija Mata Colony, Near Paithan Gate A Bad. Cont: 8694947070 / 5050Document8 pagesSaarthi Education Jija Mata Colony, Near Paithan Gate A Bad. Cont: 8694947070 / 5050Roshan KumarPas encore d'évaluation

- Organization of Brigada Eskwela Steering and Working CommitteesDocument2 pagesOrganization of Brigada Eskwela Steering and Working CommitteesCherry Lou RiofrirPas encore d'évaluation

- NumaConcert ManualDocument96 pagesNumaConcert ManualPippo GuarneraPas encore d'évaluation

- Upload 1 Document To Download: Ergen DedaDocument3 pagesUpload 1 Document To Download: Ergen DedakPas encore d'évaluation

- Stress and Strain - Axial LoadingDocument18 pagesStress and Strain - Axial LoadingClackfuik12Pas encore d'évaluation

- CH 3 Revision Worksheet 2 Class 6 CSDocument1 pageCH 3 Revision Worksheet 2 Class 6 CSShreyank SinghPas encore d'évaluation

- Pa 28 151 161 - mmv1995 PDFDocument585 pagesPa 28 151 161 - mmv1995 PDFJonatan JonatanBernalPas encore d'évaluation

- International Business EnvironmentDocument5 pagesInternational Business EnvironmentrahulPas encore d'évaluation

- Deep Sea Electronics PLC: DSE103 MKII Speed Switch PC Configuration Suite LiteDocument14 pagesDeep Sea Electronics PLC: DSE103 MKII Speed Switch PC Configuration Suite LiteMostafa ShannaPas encore d'évaluation

- SMPLEDocument2 pagesSMPLEKla AlvarezPas encore d'évaluation

- War As I Knew ItDocument2 pagesWar As I Knew ItShreyansPas encore d'évaluation

- 50 Hotelierstalk MinDocument16 pages50 Hotelierstalk MinPadma SanthoshPas encore d'évaluation

- Statics: Vector Mechanics For EngineersDocument25 pagesStatics: Vector Mechanics For EngineersProkopyo BalagbagPas encore d'évaluation

- TM9-238 Deepwater Fording of Ordnance Materiel PDFDocument35 pagesTM9-238 Deepwater Fording of Ordnance Materiel PDFdieudecafePas encore d'évaluation

- Longley Rice PropagationDocument11 pagesLongley Rice Propagationy_m_algbaliPas encore d'évaluation

- Huzaima ResultDocument2 pagesHuzaima ResultSaif Ali KhanPas encore d'évaluation

- Road To Recovery: Moving To A New NormalDocument10 pagesRoad To Recovery: Moving To A New NormalFOX5 VegasPas encore d'évaluation

- MC 33199Document12 pagesMC 33199Abbode HoraniPas encore d'évaluation

- Setup LogDocument221 pagesSetup LogCarlos MendezPas encore d'évaluation

- 2023-2024 Draft Benzie County Budget BookDocument91 pages2023-2024 Draft Benzie County Budget BookColin MerryPas encore d'évaluation

- Risk in Poject FinanceDocument20 pagesRisk in Poject FinanceShahid KhanPas encore d'évaluation

- Orthopanton Villa System MedicalDocument61 pagesOrthopanton Villa System MedicalOscarOcañaHernándezPas encore d'évaluation

- Surface News - 20130704 - Low Res PDFDocument9 pagesSurface News - 20130704 - Low Res PDFYoko GoldingPas encore d'évaluation