Académique Documents

Professionnel Documents

Culture Documents

CIR vs Central Luzon Drug Corporation Tax Credit Treatment

Transféré par

Louise Bolivar DadivasDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

CIR vs Central Luzon Drug Corporation Tax Credit Treatment

Transféré par

Louise Bolivar DadivasDroits d'auteur :

Formats disponibles

Commissioner of Internal Revenue vs.

Central Luzon Drug Corporation

G.R. No. 148512/June 26, 2006

FACTS:

1. Central Luzon Drug Corporation (CLDC) a retailer of medicines and other pharmaceutical products, opened 3

drugstores as a franchisee under the business name and style of Mercury Drug in 1995.

2. 01/1995-12/1995: CIR granted a 20% discount on the sale of medicines to qualified senior citizens amounting

to P219,778. (based on Sec. 4(a) of R.A. No. 7432)

3. Revenue Regulations No. 2-94; implementing R.A. No. 7432: the discount given to senior citizens shall be

deducted by the establishment from its gross sales for value-added tax and other percentage tax purposes

4. CLDC deducted the total amount of P219,778 from its gross income for the taxable year 1995. For said taxable

period, CLDC reported a net loss of P20,963 in its corporate income tax return. As a consequence, it did not pay

income tax for 1995.

5. 12/27/1996: CLDC filed a claim for refund in the amount of P150,193 which represents the tax credit allegedly

due to CLDC R.A. No. 7432.

6. 03/18/1998: CIR was not able to decide the claim for refund on time. CLDC filed a Petition for Review with the

CTA

7. 04/24/2000: CTA dismissed the petition

even if the law treats the 20% sales discounts granted to senior citizens as a tax credit, the same cannot

apply when there is no tax liability or the amount of the tax credit is greater than the tax due.

The tax credit will only be to the extent of the tax liability. No refund can be granted as no tax was

erroneously, illegally and actually collected based on the provisions of Section 230, now Section 229, of

the Tax Code.

The law does not state that a refund can be claimed by the private establishment concerned as an

alternative to the tax credit.

8. 08/03/2000: CLDC filed with the CA a Petition for Review

9. CA: Section 229 of the Tax Code does not apply in this case. The 20% discount given to senior citizens which is

treated as a tax credit pursuant to Sec. 4(a) of R.A. No. 7432 is considered just compensation and may be carried

over to the next taxable period if there is no current tax liability.

ISSUE: Whether or not the 20% sales discount granted by CLDC to qualified senior citizens pursuant to Sec. 4(a) of R.A.

No. 7432 may be claimed as a tax credit or as a deduction from gross sales in accordance with Sec. 2(1) of Revenue

Regulations No. 2-94? TAX CREDIT

HELD:

R.A. No. 7432 should be treated as tax credits, not deductions from income. The provision explicitly employed

the word tax credit. Nothing in the provision suggests for it to mean a deduction from gross sales. To construe it

otherwise would be a departure from the clear mandate of the law.

Thus, the 20% discount required by the Act to be given to senior citizens is a tax credit not a deduction from the

gross sales of the establishment concerned.

The definition of tax credit found in Section 2(1) of Revenue Regulations No. 2-94 is erroneous as it refers to tax

credit as the amount representing the 20% discount that shall be deducted by the said establishment from their

gross sales for value added tax and other percentage tax purposes. This definition is contrary to what our

lawmakers had envisioned with regard to the treatment of the discount granted to senior citizens. When the law

says that the cost of the discount may be claimed as a tax credit, it means that the amount when claimed shall be

treated as a reduction from any tax liability. (the law cannot be amended by a mere regulation)

Sec. 229 of the Tax Code does not apply to cases that fall under Sec. 4 of R.A. No. 7432 because the former

provision governs exclusively all kinds of refund or credit of internal revenue taxes that were erroneously or

illegally imposed and collected pursuant to the Tax Code while the latter extends the tax credit benefit to the

private establishments concerned even before tax payments have been made.

The tax credit that is contemplated under the Act is a form of just compensation not a remedy for taxes that were

erroneously or illegally assessed and collected. Prior payment of any tax liability is not a precondition before a

taxable entity can benefit from the tax credit. The credit may be availed of upon payment of the tax due, if any.

Where there is no tax liability or where a private establishment reports a net loss for the period, the tax credit can

be availed of and carried over to the next taxable year.

Unlike in Sec. 229 of the Tax Code wherein the remedy of refund is available to the taxpayer, Sec. 4 of the law

speaks only of a tax credit, not a refund.

Vous aimerez peut-être aussi

- 08 Manila Gas Corporation Vs CIRDocument2 pages08 Manila Gas Corporation Vs CIRCharmaine Ganancial SorianoPas encore d'évaluation

- Salenga v CA ruling on CDC coverage and retirement benefitsDocument1 pageSalenga v CA ruling on CDC coverage and retirement benefitsAshley CandicePas encore d'évaluation

- 6.3 Villegas v. Hiu Chiong Tsai Hao PoDocument7 pages6.3 Villegas v. Hiu Chiong Tsai Hao PoGlenn Robin FedillagaPas encore d'évaluation

- Mutuality of ContractsDocument19 pagesMutuality of ContractsChris InocencioPas encore d'évaluation

- Casuela Vs Office of The OmbudsmanDocument12 pagesCasuela Vs Office of The OmbudsmanAlvin HalconPas encore d'évaluation

- Cases Consti 2 MorganDocument192 pagesCases Consti 2 Morganjeanette hijadaPas encore d'évaluation

- Ing Banking Vs Cir DigestDocument2 pagesIng Banking Vs Cir DigestJuan AntonioPas encore d'évaluation

- People V GajoDocument12 pagesPeople V GajoTeodoro Jose BrunoPas encore d'évaluation

- GR No. 149636 - June 8, 2005 Double Taxation FWT - GRTDocument4 pagesGR No. 149636 - June 8, 2005 Double Taxation FWT - GRTMonica SorianoPas encore d'évaluation

- IV 5 SEVILLA v. CA: Principal-Agent RelationshipDocument2 pagesIV 5 SEVILLA v. CA: Principal-Agent RelationshipRaymund CallejaPas encore d'évaluation

- Stat Con CasesDocument57 pagesStat Con CasesHusayn TamanoPas encore d'évaluation

- Compilation of Crim Pro CasesDocument35 pagesCompilation of Crim Pro Casespashminn24Pas encore d'évaluation

- SSS Vs City of BacolodDocument3 pagesSSS Vs City of BacolodcharmssatellPas encore d'évaluation

- G.R. No. 207342 - Govt of Hongkong v. MunozDocument4 pagesG.R. No. 207342 - Govt of Hongkong v. MunozChristine Rose Bonilla LikiganPas encore d'évaluation

- AGENCY - Modes of Extinguishment of Agency - BADRON, Mohammad NurDocument2 pagesAGENCY - Modes of Extinguishment of Agency - BADRON, Mohammad NurgongsilogPas encore d'évaluation

- Case Digest - Rabuco v. Villegas, G.R. Nos. L-24661, LDocument3 pagesCase Digest - Rabuco v. Villegas, G.R. Nos. L-24661, LRichelle FabellonPas encore d'évaluation

- Corporation Law: JGA Medina Bus. Org II, Philippine Law SchoolDocument14 pagesCorporation Law: JGA Medina Bus. Org II, Philippine Law Schoolaprilaries78Pas encore d'évaluation

- Civ Pro Cases 3Document94 pagesCiv Pro Cases 3PeperoniiPas encore d'évaluation

- Right to Repurchase PropertyDocument4 pagesRight to Repurchase PropertyXsche XschePas encore d'évaluation

- CIR Vs Manning, GR L-28398, Aug. 6, 1975Document8 pagesCIR Vs Manning, GR L-28398, Aug. 6, 1975Dario G. TorresPas encore d'évaluation

- GR No 147788 Cruz Vs BancomDocument9 pagesGR No 147788 Cruz Vs BancomAnabelle Talao-UrbanoPas encore d'évaluation

- CASE #12 Manzanaris v. People G.R. No. L-64750 Principle: Actus Non Facit Reum, Nisi Mens Sit ReaDocument3 pagesCASE #12 Manzanaris v. People G.R. No. L-64750 Principle: Actus Non Facit Reum, Nisi Mens Sit ReaCarmel Grace KiwasPas encore d'évaluation

- JURISDICTION - Inding Vs SandiganbayanDocument1 pageJURISDICTION - Inding Vs SandiganbayanEdrich John100% (1)

- Araullo V Aquino DECISIONDocument9 pagesAraullo V Aquino DECISIONDean CainilaPas encore d'évaluation

- Case Digests For Loc Gov Local TaxationDocument7 pagesCase Digests For Loc Gov Local TaxationChristelle EleazarPas encore d'évaluation

- ILDEFONSO LACHENAL Vs EMILIO SALAS - PauloDocument1 pageILDEFONSO LACHENAL Vs EMILIO SALAS - PauloPaulo VillarinPas encore d'évaluation

- Republic vs. City of Parañaque PDFDocument24 pagesRepublic vs. City of Parañaque PDFKKCDIALPas encore d'évaluation

- F. CIR vs. Solidbank Corp., G.R. No. 148191, Nov. 25, 2003Document3 pagesF. CIR vs. Solidbank Corp., G.R. No. 148191, Nov. 25, 2003Rhenee Rose Reas SugboPas encore d'évaluation

- Serrano Vs GallantDocument3 pagesSerrano Vs GallantAgnesPas encore d'évaluation

- 26 - in Re PadillaDocument2 pages26 - in Re PadillaNec Salise ZabatPas encore d'évaluation

- BPI Leasing V Court of Appeals G.R. 127624Document5 pagesBPI Leasing V Court of Appeals G.R. 127624Dino Bernard LapitanPas encore d'évaluation

- Abakada Guro Party List V.ermitaDocument21 pagesAbakada Guro Party List V.ermitaMarjun Milla Del RosarioPas encore d'évaluation

- Edgar Ledonio Vs Capitol Devt CorpDocument13 pagesEdgar Ledonio Vs Capitol Devt CorpGennard Michael Angelo AngelesPas encore d'évaluation

- Corporation Must Yield to Court OrderDocument3 pagesCorporation Must Yield to Court OrdermaggiPas encore d'évaluation

- Cyanimid Phils vs. CADocument2 pagesCyanimid Phils vs. CAlorenbeatulalianPas encore d'évaluation

- Court Upholds Foreclosure Despite Family Home Exemption ClaimDocument2 pagesCourt Upholds Foreclosure Despite Family Home Exemption ClaimRey Almon Tolentino Alibuyog100% (1)

- Part H 2 - CIR vs. Philippine Associated Smelting and Refining CorpDocument2 pagesPart H 2 - CIR vs. Philippine Associated Smelting and Refining CorpCyruz TuppalPas encore d'évaluation

- CALTEX (PHILIPPINES), INC., Petitioner, vs. The Intermediate Appellate Court and Asia PACIFIC AIRWAYS, INC., RespondentsDocument5 pagesCALTEX (PHILIPPINES), INC., Petitioner, vs. The Intermediate Appellate Court and Asia PACIFIC AIRWAYS, INC., RespondentspatrickPas encore d'évaluation

- R62 InterpleaderDocument6 pagesR62 InterpleaderKarla Mae Dela PeñaPas encore d'évaluation

- Court Upholds Jurisdiction in Debt Recovery Case Despite ObjectionsDocument3 pagesCourt Upholds Jurisdiction in Debt Recovery Case Despite ObjectionsAnonymous 33LIOv6LPas encore d'évaluation

- Bank Not Liable for Non-Compliance with Letter of Credit TermsDocument4 pagesBank Not Liable for Non-Compliance with Letter of Credit TermsCleinJonTiuPas encore d'évaluation

- Beso vs. Daguman, 323 SCRA 566Document9 pagesBeso vs. Daguman, 323 SCRA 566Miley LangPas encore d'évaluation

- COMELEC Plebiscite Ruling Upheld in Municipality Creation CaseDocument1 pageCOMELEC Plebiscite Ruling Upheld in Municipality Creation CaseMargie Marj GalbanPas encore d'évaluation

- CD - 4. Melecio Domingo V Hon GarlitosDocument1 pageCD - 4. Melecio Domingo V Hon GarlitosCzarina CidPas encore d'évaluation

- Buenviaje v. Sps. Salonga, G. R. No. 216023 (2016) - EstradaDocument4 pagesBuenviaje v. Sps. Salonga, G. R. No. 216023 (2016) - EstradaRevina EstradaPas encore d'évaluation

- 168 Gagui V DejeroDocument2 pages168 Gagui V DejeroRem SerranoPas encore d'évaluation

- RTC Judicial Notice Land ValuationDocument46 pagesRTC Judicial Notice Land ValuationKaira CarlosPas encore d'évaluation

- Philippine National Bank vs. Intermediate Appellate Court: - First DivisionDocument6 pagesPhilippine National Bank vs. Intermediate Appellate Court: - First DivisionDorky DorkyPas encore d'évaluation

- ABAKADA Guro Party List Vs Executive SecretaryDocument18 pagesABAKADA Guro Party List Vs Executive SecretaryrheaPas encore d'évaluation

- Philippine National Bank Vs CADocument6 pagesPhilippine National Bank Vs CAHamitaf LatipPas encore d'évaluation

- People vs. PangilinanDocument3 pagesPeople vs. PangilinanRobert YuPas encore d'évaluation

- Doctrine:: Spouses Dennis Orsolino and Melody Orsolino Vs Violeta Frany G.R. No. 193887 March 29, 2017Document2 pagesDoctrine:: Spouses Dennis Orsolino and Melody Orsolino Vs Violeta Frany G.R. No. 193887 March 29, 2017Monalie100% (1)

- Bambalan V MarambaDocument1 pageBambalan V MarambaNicole KalingkingPas encore d'évaluation

- G.R. No. 230443Document13 pagesG.R. No. 230443Ran Ngi100% (1)

- 6 Pineda v. Heirs of Eliseo Guevara PDFDocument13 pages6 Pineda v. Heirs of Eliseo Guevara PDFjuan dela cruzPas encore d'évaluation

- C Irv CT A and Fortune TobaccoDocument2 pagesC Irv CT A and Fortune TobaccoErika AlidioPas encore d'évaluation

- DIGESTED CASE No 4Document3 pagesDIGESTED CASE No 4Jed BentilloPas encore d'évaluation

- Cir V. Central Luzon Drug Corporation, GR No. 148512, 2006-06-26Document2 pagesCir V. Central Luzon Drug Corporation, GR No. 148512, 2006-06-26Crisbon ApalisPas encore d'évaluation

- CIR vs. Central Luzon Drug Corp GR. 159647 and CIR Vs Central Luzon Drug Corp. GR No. 148512Document4 pagesCIR vs. Central Luzon Drug Corp GR. 159647 and CIR Vs Central Luzon Drug Corp. GR No. 148512Kath Leen100% (1)

- CIR v. Central Luzon Drug CorpDocument2 pagesCIR v. Central Luzon Drug CorpSophia SyPas encore d'évaluation

- Labor Rev CasesDocument26 pagesLabor Rev CasesLouise Bolivar DadivasPas encore d'évaluation

- 08 Bank of America vs. CADocument2 pages08 Bank of America vs. CALouise Bolivar DadivasPas encore d'évaluation

- PsychologyCurriculum Checklist S.Y. 2013-2014Document2 pagesPsychologyCurriculum Checklist S.Y. 2013-2014Louise Bolivar DadivasPas encore d'évaluation

- Labor Rev CasesDocument26 pagesLabor Rev CasesLouise Bolivar DadivasPas encore d'évaluation

- Sema Vs Commission On Elections (Comelec)Document6 pagesSema Vs Commission On Elections (Comelec)Louise Bolivar DadivasPas encore d'évaluation

- SRCDocument21 pagesSRCLouise Bolivar DadivasPas encore d'évaluation

- Easements or ServitudesDocument3 pagesEasements or ServitudesLouise Bolivar DadivasPas encore d'évaluation

- Efficient Use of Paper Rule A.M. No. 11-9-4-SCDocument3 pagesEfficient Use of Paper Rule A.M. No. 11-9-4-SCRodney Atibula100% (3)

- Revenue Regulation No 13-2012Document3 pagesRevenue Regulation No 13-2012Wilfredo MolinaPas encore d'évaluation

- Revenue Regulation No 13-2012Document3 pagesRevenue Regulation No 13-2012Wilfredo MolinaPas encore d'évaluation

- Revenue Regulation No 13-2012Document3 pagesRevenue Regulation No 13-2012Wilfredo MolinaPas encore d'évaluation

- Motion For InhibitionDocument4 pagesMotion For InhibitionLouise Bolivar DadivasPas encore d'évaluation

- Revenue Regulation No 13-2012Document3 pagesRevenue Regulation No 13-2012Wilfredo MolinaPas encore d'évaluation

- 29 G.R. No. 165881 April 19, 2006 Villamaria, JR Vs CADocument9 pages29 G.R. No. 165881 April 19, 2006 Villamaria, JR Vs CArodolfoverdidajrPas encore d'évaluation

- 20 PNB vs. RodriguezDocument2 pages20 PNB vs. RodriguezLouise Bolivar DadivasPas encore d'évaluation

- Bank Conservator Cannot Revoke Perfected ContractDocument2 pagesBank Conservator Cannot Revoke Perfected ContractLouise Bolivar DadivasPas encore d'évaluation

- (Balane) +art +854Document4 pages(Balane) +art +854johnbyronjakesPas encore d'évaluation

- Phillip MorrisDocument2 pagesPhillip MorrisJosephine Dominguez RojasPas encore d'évaluation

- (Balane) +art +854Document4 pages(Balane) +art +854johnbyronjakesPas encore d'évaluation

- Cases !@#Document19 pagesCases !@#Louise Bolivar DadivasPas encore d'évaluation

- 1 Smith Kline vs. CADocument2 pages1 Smith Kline vs. CALouise Bolivar DadivasPas encore d'évaluation

- Yu Eng Cho v. Pan American Airways Digest For AgencyDocument2 pagesYu Eng Cho v. Pan American Airways Digest For AgencychaynagirlPas encore d'évaluation

- Grino vs. CSC: FactsDocument2 pagesGrino vs. CSC: FactsLouise Bolivar DadivasPas encore d'évaluation

- IPIPIPDocument11 pagesIPIPIPLouise Bolivar DadivasPas encore d'évaluation

- The Philosophy of Intellectual PropertyDocument73 pagesThe Philosophy of Intellectual PropertyHeru Nur Rahman SiswohudoyoPas encore d'évaluation

- 38 Bayan Muna Vs MendozaDocument3 pages38 Bayan Muna Vs MendozaDavid Antonio A. EscuetaPas encore d'évaluation

- Agency ReviewerDocument20 pagesAgency ReviewerJingJing Romero92% (72)

- CasesDocument2 pagesCasesLouise Bolivar DadivasPas encore d'évaluation

- ConstiDocument3 pagesConstiLouise Bolivar DadivasPas encore d'évaluation

- NoticeOfLiability To USA Agents Mrs. Alvarado PDFDocument16 pagesNoticeOfLiability To USA Agents Mrs. Alvarado PDFMARSHA MAINESPas encore d'évaluation

- 8Document123 pages8Charmaine Reyes FabellaPas encore d'évaluation

- Conflict of Laws Reviewer - ParasDocument3 pagesConflict of Laws Reviewer - ParasNaethan Jhoe L. CiprianoPas encore d'évaluation

- Application FOR Customs Broker License Exam: U.S. Customs and Border ProtectionDocument1 pageApplication FOR Customs Broker License Exam: U.S. Customs and Border ProtectionIsha SharmaPas encore d'évaluation

- 50 Apo Fruits Corp V Land Bank of The PhilippinesDocument5 pages50 Apo Fruits Corp V Land Bank of The PhilippinesRae Angela GarciaPas encore d'évaluation

- Waqf Registration Form 1Document2 pagesWaqf Registration Form 1SalamPas encore d'évaluation

- Universal Food Corp. v. CADocument2 pagesUniversal Food Corp. v. CAAiress Canoy CasimeroPas encore d'évaluation

- Email Opinion - Diloy - 4S 1Document2 pagesEmail Opinion - Diloy - 4S 1FelyDiloyPas encore d'évaluation

- BIR Ruling No. 291-12 Dated 04.25.2012 PDFDocument5 pagesBIR Ruling No. 291-12 Dated 04.25.2012 PDFJerwin DavePas encore d'évaluation

- Memorial On Behalf of PetitionerDocument24 pagesMemorial On Behalf of PetitioneruzairPas encore d'évaluation

- Workings of Debt Recovery TribunalsDocument25 pagesWorkings of Debt Recovery TribunalsSujal ShahPas encore d'évaluation

- People of The Philippines Vs - Eddie ManansalaDocument2 pagesPeople of The Philippines Vs - Eddie ManansalaDennis Jay A. Paras100% (2)

- Spouses Lopez V Atty. LimotDocument2 pagesSpouses Lopez V Atty. LimotMariz EnocPas encore d'évaluation

- Applying or Changing Your Tax RegistrationDocument6 pagesApplying or Changing Your Tax RegistrationSamPas encore d'évaluation

- Federal Pay Slip for Margaret Taiwo GiwaDocument1 pageFederal Pay Slip for Margaret Taiwo GiwaHalleluyah HalleluyahPas encore d'évaluation

- Transpo DIGESTDocument5 pagesTranspo DIGESTJesterPas encore d'évaluation

- Caridad Ongsiako, Et. Al Vs Emilia Ongsiako, Et. Al (GR. No. 7510, 30 March 1957, 101 Phil 1196-1197)Document1 pageCaridad Ongsiako, Et. Al Vs Emilia Ongsiako, Et. Al (GR. No. 7510, 30 March 1957, 101 Phil 1196-1197)Archibald Jose Tiago ManansalaPas encore d'évaluation

- Quasi Judicial Funtion of Administrative BodiesDocument18 pagesQuasi Judicial Funtion of Administrative BodiesSwati KritiPas encore d'évaluation

- R A 9154 (Intro)Document12 pagesR A 9154 (Intro)David JuanPas encore d'évaluation

- Plaintiff-Appellee Vs Vs Defendants Appellant Acting Attorney-General Reyes Monico R. MercadoDocument4 pagesPlaintiff-Appellee Vs Vs Defendants Appellant Acting Attorney-General Reyes Monico R. MercadochristimyvPas encore d'évaluation

- Property MatrixDocument2 pagesProperty MatrixDia MaePas encore d'évaluation

- Vasai Housing Federation AppendicesDocument6 pagesVasai Housing Federation AppendicesPrasadPas encore d'évaluation

- Rural Banks ActDocument2 pagesRural Banks ActveehneePas encore d'évaluation

- Labour Law DismissalDocument35 pagesLabour Law DismissalnokwandaPas encore d'évaluation

- Home design ltd shareholders dispute resolutionDocument5 pagesHome design ltd shareholders dispute resolutionCarl MunnsPas encore d'évaluation

- Student Activity Permit Approval ProcessDocument1 pageStudent Activity Permit Approval ProcessJorge Erwin RadaPas encore d'évaluation

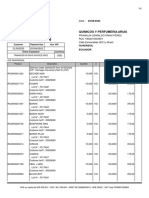

- Factura ComercialDocument6 pagesFactura ComercialKaren MezaPas encore d'évaluation

- Calendar - 2016 08 12Document2 pagesCalendar - 2016 08 12Elden Cunanan BonillaPas encore d'évaluation

- San Beda College of Law: Entralized AR PerationsDocument3 pagesSan Beda College of Law: Entralized AR Perationschef justicePas encore d'évaluation

- Sec 3 CompilationDocument6 pagesSec 3 CompilationMatthew WittPas encore d'évaluation