Académique Documents

Professionnel Documents

Culture Documents

Employees Declaration For Income

Transféré par

hareesh13hTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Employees Declaration For Income

Transféré par

hareesh13hDroits d'auteur :

Formats disponibles

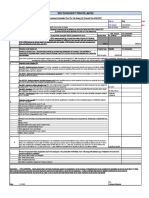

EMPLOYEES DECLARATION FOR INCOME-TAX DEDUCTION ON SALARY FY 2018-2019

Employee Code ……………………….. Name of Employee:-…………………………………………………………….. DOJ………………………. Location ………………………..

Name of the Company ……………………………………………………..PAN (Mandatory) ……………………………………………….Contact No: ……………………………………

st

I certify that during the year ending 31 March 2019 the following amount/s has/have/will be/been paid by me directly out of my income chargeable to tax

and that appropriate deductions may please be allowed while calculating taxable Income under the head salary.

I. HOUSE RENT ALLOWANCE

This is to declare that I am presently staying in a rent accommodation paying a rent of RS /- per month,(from to as per copy of

Lease Agreement attached. The house is owned by

Mr./Mrs. …………..……………………………………………………. Address …………………………………………………………………………………………………………….

PAN of Landlord ……………………………………….. (if rent Exceeds Rs. 15000/-pm or 1.8 L Per annum) …………………… Metro …………………. Non Metro

Month Rent Paid Date of rent Month Rent Paid Date of rent Month Rent Paid Date of rent

Paid Paid Paid

Copy of Lease

Agreement

Apr- 2018 Aug - 2018 Dec- 2018

May- 2018 Sep - 2018 Jan- 2019

Jun- 2018 Oct - 2018 Feb- 2019

July- 2018 Nov - 2018 Mar- 2019

II. Housing Loan

Mandatory Requirement: Please enclose the EMI Payment Schedule or Provisional Certificate issued by the Housing Financial Institution or bank for F.Y. 2018- 2019and

proof of occupation of the house.

Please provide Date of Completion ____/____/____ Date of Occupation ____/____/____

From 1st April, 2018 to 31st March, 2019: (Without Provisional Certificate this figure will not be considered)

Principal Amount Interest Amount Paid to Financial Institutions PAN No. of Lender Date of Possesion

III. DEDUCTIONS UNDER CHAPTER VI-A: (Condition Apply)

DEDUCTION UNDER SEC. 80C :( Maximum of Rs. 1,50,000/- any of the following heads)

Name of the Savings Scheme Amount(Rs.)

Life insurance Premium (Premium paid to a max. of 10% of capital sum assured in a year

Investment in Mutual Fund-ELSS Equity Linked Saving Scheme

Investment Public Provident Fund (PPF)/ National Saving Certificates (NSCs)

Tuition Fees (Max 2 Children)

Any Other Please Specify

Sr. No. U/S Sec. Nature of Payment Paid/ Deposited Max. Deduction (Rs.)

A) 80D-Self Medical Insurance Premium Paid 15,000/-

B) 80D- Parents 15,000/-(if Sr. Citizen Rs.

20,000)

C) 80 DD Medical Treatment of Handicapped Dependent 50,000/- (If disability above

80% than 1 lac)

D) 80DDB Expenses on Medical Treatment on certain disease. 40,000/-(If Sr. Citizen than

60,000)

E) 80 E Payment of Interest towards loan taken for higher studies No Limit

F) 80 U Income of totally blind or physically handicapped person 50,000/- (If disability above

80% than 1 lac)

I Declare that the information given is true and correct to my knowledge and belief. I undertake to notify in writing any changes, but not later than 31st Dec 2018 to claim

relief from tax deduction. Further I Undertake to hold the company and its Officers other employees indemnified from all consequences, monetary and otherwise, arising out

of any incorrect and/or incomplete information provided by me here in above.

Date: Signature of the employee Checked By Approved BY

Vous aimerez peut-être aussi

- Tax filing title generatorDocument1 pageTax filing title generatorAkshay AcchuPas encore d'évaluation

- The ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationDocument1 pageThe ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationLantPas encore d'évaluation

- WLT Proof Form - 2022Document2 pagesWLT Proof Form - 2022Jebis DosPas encore d'évaluation

- De Smet Engineers & Contractors India Private Limited Investment Declaration Form For Financial Year 2019 - 2020Document5 pagesDe Smet Engineers & Contractors India Private Limited Investment Declaration Form For Financial Year 2019 - 2020Lakshmanan SPas encore d'évaluation

- Investment Declaration Form For FY - 2017-18Document2 pagesInvestment Declaration Form For FY - 2017-18arunPas encore d'évaluation

- Atria Institute of TechnologyDocument3 pagesAtria Institute of TechnologykiranPas encore d'évaluation

- Investment Declaration Form F.Y 2023-24Document4 pagesInvestment Declaration Form F.Y 2023-24Aditi Suryavanshi100% (1)

- Investment Declaration Form - 2022-2023Document3 pagesInvestment Declaration Form - 2022-2023Bharathi KPas encore d'évaluation

- Investment PlanDocument1 pageInvestment PlanNitin AgarwalPas encore d'évaluation

- Income Tax Proof Submission GuidelinesDocument11 pagesIncome Tax Proof Submission Guidelinesdeepakraj610Pas encore d'évaluation

- IT Declaration Form 2019-20Document1 pageIT Declaration Form 2019-20KarunaPas encore d'évaluation

- Summary Charts Deduction Chapter ViaDocument4 pagesSummary Charts Deduction Chapter ViaUttam Gagan18Pas encore d'évaluation

- Investment and tax saving proofs for 2017-18Document5 pagesInvestment and tax saving proofs for 2017-18vishalkavi18Pas encore d'évaluation

- Employee Tax Declaration - AY 2019-20Document1 pageEmployee Tax Declaration - AY 2019-20mathuPas encore d'évaluation

- Investment proof submission guidelinesDocument40 pagesInvestment proof submission guidelinesSundar PabbareddyPas encore d'évaluation

- Arrina Education Services Pvt. LTD.: Investment Declaration Form (FY 2012-2013)Document2 pagesArrina Education Services Pvt. LTD.: Investment Declaration Form (FY 2012-2013)JITEN2050Pas encore d'évaluation

- IT Declaration Form FY 2018-19Document3 pagesIT Declaration Form FY 2018-19sgshekar3050% (2)

- Employee Tax Declaration - FY 22-23-DBMPDocument3 pagesEmployee Tax Declaration - FY 22-23-DBMPthetrilight2023Pas encore d'évaluation

- Investment Declaration Form - 2021-22Document3 pagesInvestment Declaration Form - 2021-22rajamani balajiPas encore d'évaluation

- Employees Provisional Savings (EPS) Form For Calculation of TDS To Be Deducted For The Financial Year 2021-2022Document3 pagesEmployees Provisional Savings (EPS) Form For Calculation of TDS To Be Deducted For The Financial Year 2021-2022neeta rautelaPas encore d'évaluation

- Investment Declaration Form - FY 2022-23Document7 pagesInvestment Declaration Form - FY 2022-23varaprasadPas encore d'évaluation

- Income Tax Declaration Form FY 22023 24 AY2024 25Document1 pageIncome Tax Declaration Form FY 22023 24 AY2024 25mrleftyftwPas encore d'évaluation

- AIL-Investment Declaration Form 2013-2014Document2 pagesAIL-Investment Declaration Form 2013-2014G A PATELPas encore d'évaluation

- (Company Name) : Income Tax Declaration Form For Fy 2022-23Document3 pages(Company Name) : Income Tax Declaration Form For Fy 2022-23Jude Philip WilfredPas encore d'évaluation

- Investment Declaration Form 2012-13 PDFDocument1 pageInvestment Declaration Form 2012-13 PDFnovalhemantPas encore d'évaluation

- IT PPT For F.Y 2023-24Document24 pagesIT PPT For F.Y 2023-24pritesh.ks1409Pas encore d'évaluation

- BUFIN ITDeclarationFormDocument2 pagesBUFIN ITDeclarationFormdpfsopfopsfhopPas encore d'évaluation

- Old Tax Regime of The FY 2019-20 New Tax Regime of FY The 2020-21Document4 pagesOld Tax Regime of The FY 2019-20 New Tax Regime of FY The 2020-21Suhas BPas encore d'évaluation

- Guidelines For Investment Proof Submission 2018-19Document7 pagesGuidelines For Investment Proof Submission 2018-19AsifPas encore d'évaluation

- Income Tax Rate 2010Document6 pagesIncome Tax Rate 2010Vishal JwellPas encore d'évaluation

- Employee Tax Declaration - AY 2019-20Document4 pagesEmployee Tax Declaration - AY 2019-20mathuPas encore d'évaluation

- Income tax filing deadline reminderDocument2 pagesIncome tax filing deadline remindermakamkkumarPas encore d'évaluation

- Declaration Format For Salary For FY 2017-18 A.Y 2018-19Document1 pageDeclaration Format For Salary For FY 2017-18 A.Y 2018-19Sudeep Singh78% (9)

- Income Tax NitDocument6 pagesIncome Tax NitrensisamPas encore d'évaluation

- Section 80 Deduction ListDocument6 pagesSection 80 Deduction ListMURALIDHARA S VPas encore d'évaluation

- DocumentsRequirementGuidelines FinalDocument13 pagesDocumentsRequirementGuidelines Finalsumit4up6rPas encore d'évaluation

- Section 80 Deduction Table and Limits for FY 2018-19Document45 pagesSection 80 Deduction Table and Limits for FY 2018-19Shobhit KumarPas encore d'évaluation

- National Institute of Technology CalicutDocument7 pagesNational Institute of Technology CalicutraghuramaPas encore d'évaluation

- PARTICULARS FOR F.Y. 2023 - 24 Old FormateDocument3 pagesPARTICULARS FOR F.Y. 2023 - 24 Old Formateiwd.abhiPas encore d'évaluation

- Employee Investment Declaration Form For The Financial Year 2019-2020Document2 pagesEmployee Investment Declaration Form For The Financial Year 2019-2020Hinglaj SinghPas encore d'évaluation

- Income Tax Deductions Exemptions Section 80CDocument7 pagesIncome Tax Deductions Exemptions Section 80CsandeshPas encore d'évaluation

- Tax Decalaration 2023-24Document3 pagesTax Decalaration 2023-24thetrilight2023Pas encore d'évaluation

- 36 It Declaration Fy1011Document1 page36 It Declaration Fy1011nad1002Pas encore d'évaluation

- Othguide For Act Invt Proof Submission - FY 2021-22 - Guide For Act Invt Proof Submission - FY 2021-22Document19 pagesOthguide For Act Invt Proof Submission - FY 2021-22 - Guide For Act Invt Proof Submission - FY 2021-22Dhruv JainPas encore d'évaluation

- Annexure To Income Tax CircularDocument6 pagesAnnexure To Income Tax CircularDipti BhanjaPas encore d'évaluation

- On Employee Tax SavingDocument21 pagesOn Employee Tax SavingChaitanya MadisettyPas encore d'évaluation

- Employees Proof Submission Form (EPSF) - 2010-11Document1 pageEmployees Proof Submission Form (EPSF) - 2010-11amararenaPas encore d'évaluation

- DeductionsDocument11 pagesDeductionsguest1Pas encore d'évaluation

- Income Tax Declaration Form FY 22 23 AY 23 24Document2 pagesIncome Tax Declaration Form FY 22 23 AY 23 24kishorePas encore d'évaluation

- SSS - Employee - Investment - Declaration - Form12BB - FY 2022-23Document10 pagesSSS - Employee - Investment - Declaration - Form12BB - FY 2022-23gowtham DevPas encore d'évaluation

- Declaration Form 12BB 2022 23Document4 pagesDeclaration Form 12BB 2022 23S S PradheepanPas encore d'évaluation

- Form 12 BBSampleDocument2 pagesForm 12 BBSampleAbhishekChauhanPas encore d'évaluation

- Income Tax Rates (For Individuals, Hufs, Association of Persons, Body of Individuals) Assessment Year 2011-2012 Relevant To Financial Year 2010-2011Document6 pagesIncome Tax Rates (For Individuals, Hufs, Association of Persons, Body of Individuals) Assessment Year 2011-2012 Relevant To Financial Year 2010-2011jhancyPas encore d'évaluation

- Latest Income Tax Exemptions FY 2017-18 - AY 2018-19 - Tax DeductionsDocument90 pagesLatest Income Tax Exemptions FY 2017-18 - AY 2018-19 - Tax DeductionsTambi ThambiPas encore d'évaluation

- Tax Declaration FormatDocument1 pageTax Declaration FormatrameshbabumeelaPas encore d'évaluation

- It PPT For F.Y 2023-24Document24 pagesIt PPT For F.Y 2023-24iampnkjjnPas encore d'évaluation

- Month Basic DA Convey CCA HRA Bonus Medical LTA OtherDocument6 pagesMonth Basic DA Convey CCA HRA Bonus Medical LTA Othersmartb0yPas encore d'évaluation

- Income Tax Actual Proof Submission Form Fy 2021 - 2022Document3 pagesIncome Tax Actual Proof Submission Form Fy 2021 - 2022muralianand92Pas encore d'évaluation

- Frequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsDocument4 pagesFrequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsMayur khichiPas encore d'évaluation

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesD'EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesPas encore d'évaluation

- Cordon Off CalculationDocument2 pagesCordon Off Calculationhareesh13hPas encore d'évaluation

- Employees Declaration For IncomeDocument1 pageEmployees Declaration For Incomehareesh13hPas encore d'évaluation

- Weldability of Tungsten and Its AlloysDocument8 pagesWeldability of Tungsten and Its Alloyss_m_taheriPas encore d'évaluation

- Cordon Off CalculationDocument4 pagesCordon Off Calculationhareesh13hPas encore d'évaluation

- ASME Sec IX TrainingDocument1 pageASME Sec IX Traininghareesh13hPas encore d'évaluation

- Astm C109 PDFDocument6 pagesAstm C109 PDFhareesh13hPas encore d'évaluation

- ASME Sec IXDocument1 pageASME Sec IXhareesh13hPas encore d'évaluation

- Asme BPVC Sec Ix Wleding-1Document3 pagesAsme BPVC Sec Ix Wleding-1hareesh13hPas encore d'évaluation

- Norm Presentation in Asnt SasDocument10 pagesNorm Presentation in Asnt Sas8miles123Pas encore d'évaluation

- As The Inspection Engineer in The BioDocument1 pageAs The Inspection Engineer in The Biohareesh13hPas encore d'évaluation

- AWS - Welding SymbolsDocument1 pageAWS - Welding SymbolsAli Saifullizan IsmailPas encore d'évaluation

- Final Class X and Xii Notice of Verification & Photocopies-2018 On 31.05.18Document3 pagesFinal Class X and Xii Notice of Verification & Photocopies-2018 On 31.05.18hareesh13hPas encore d'évaluation

- Bruker Toolbox, S1 TITAN and Tracer 5iDocument41 pagesBruker Toolbox, S1 TITAN and Tracer 5ihareesh13hPas encore d'évaluation

- Branch Pipe StandardsDocument2 pagesBranch Pipe Standardshareesh13hPas encore d'évaluation

- SNT TC 1a Q&A 1Document16 pagesSNT TC 1a Q&A 1hareesh13h100% (1)

- C 109 C 109M PrintableDocument6 pagesC 109 C 109M Printablehareesh13hPas encore d'évaluation

- Appln For Certificates PDFDocument1 pageAppln For Certificates PDFhareesh13hPas encore d'évaluation

- Astm C109 PDFDocument6 pagesAstm C109 PDFhareesh13hPas encore d'évaluation

- Notes PTDocument1 pageNotes PThareesh13hPas encore d'évaluation

- Final Class X and Xii Notice of Verification & Photocopies-2018 On 31.05.18Document3 pagesFinal Class X and Xii Notice of Verification & Photocopies-2018 On 31.05.18hareesh13hPas encore d'évaluation

- Local Heat Treatment ServiceDocument3 pagesLocal Heat Treatment Servicejperdigon9634Pas encore d'évaluation

- SNT TC 1a Q&A 1Document16 pagesSNT TC 1a Q&A 1hareesh13h100% (1)

- Pipe Thickness Table PDFDocument1 pagePipe Thickness Table PDFhareesh13hPas encore d'évaluation

- InterpretationDocument1 pageInterpretationhareesh13hPas encore d'évaluation

- Combining Wps and PQR - 1Document27 pagesCombining Wps and PQR - 1hareesh13hPas encore d'évaluation

- It is un believable See the next slides Pass it to your friends Have a wonderful dayDocument6 pagesIt is un believable See the next slides Pass it to your friends Have a wonderful dayhareesh13hPas encore d'évaluation

- Automobile Resume Template WordDocument1 pageAutomobile Resume Template Wordhareesh13hPas encore d'évaluation

- India A GlanceDocument57 pagesIndia A Glancevascribd100% (2)

- 2D CAD Fundamentals & ApplicationsDocument10 pages2D CAD Fundamentals & ApplicationsarijitlgspPas encore d'évaluation

- Tax Sentry Organizer 2016 PDFDocument9 pagesTax Sentry Organizer 2016 PDFAnonymous 3KHnP6s20YPas encore d'évaluation

- Avida Towers Aspira: An Exciting New Addition To Your Everyday AspirationDocument18 pagesAvida Towers Aspira: An Exciting New Addition To Your Everyday Aspirationkenneth MagarinPas encore d'évaluation

- Statement of Axis Account No:919010069168543 For The Period (From: 01-10-2020 To: 02-11-2020)Document2 pagesStatement of Axis Account No:919010069168543 For The Period (From: 01-10-2020 To: 02-11-2020)minniPas encore d'évaluation

- Tax Planning Strategies for Individuals and BusinessesDocument11 pagesTax Planning Strategies for Individuals and BusinessesManas MaheshwariPas encore d'évaluation

- Caf 6 PT QB Icap Caf 6 Question Bank Caf 6 Principles of TaxationDocument167 pagesCaf 6 PT QB Icap Caf 6 Question Bank Caf 6 Principles of TaxationRabiya AsifPas encore d'évaluation

- Solved The Following Budget Data Are For A Country Having Both PDFDocument1 pageSolved The Following Budget Data Are For A Country Having Both PDFM Bilal SaleemPas encore d'évaluation

- Hotstar Premium-WPS OfficeDocument233 pagesHotstar Premium-WPS OfficeHacker JackerPas encore d'évaluation

- Ebron, Dexter Jan Tago Gomez Bldg.,Fortich ST Sumpong Malaybalay City BUKIDNON, Northern Mindanao PhilippinesDocument3 pagesEbron, Dexter Jan Tago Gomez Bldg.,Fortich ST Sumpong Malaybalay City BUKIDNON, Northern Mindanao PhilippinesJan Karlyle Stefan EbronPas encore d'évaluation

- Poster Webinar SST 2024Document3 pagesPoster Webinar SST 2024Berry LauPas encore d'évaluation

- Public Beliefs About Tax FairnessDocument5 pagesPublic Beliefs About Tax Fairnessgure gurePas encore d'évaluation

- From, Mahesh R. Thakkar, 1201 / 1202, Antariksha, 12th FloorDocument3 pagesFrom, Mahesh R. Thakkar, 1201 / 1202, Antariksha, 12th FloorDavid JohnsonPas encore d'évaluation

- SBI01 MAR 2022 To 21 NOV 2022Document12 pagesSBI01 MAR 2022 To 21 NOV 2022Fascino WhitePas encore d'évaluation

- Chapter 8 VDocument28 pagesChapter 8 VAdd AllPas encore d'évaluation

- VAT-ADDED TAXDocument22 pagesVAT-ADDED TAXDiossaPas encore d'évaluation

- Berrien County, Michigan August 2, 2022 - UNOFFICIAL Candidate ListDocument6 pagesBerrien County, Michigan August 2, 2022 - UNOFFICIAL Candidate ListWXMIPas encore d'évaluation

- Skill Matrix AccountsDocument2 pagesSkill Matrix AccountsAfsal CkPas encore d'évaluation

- Notification BSFCSCL Asst Manager and Asst Accountant PostsDocument2 pagesNotification BSFCSCL Asst Manager and Asst Accountant PostsJeshiPas encore d'évaluation

- Act Print 46.HTMLDocument21 pagesAct Print 46.HTMLFaisalPas encore d'évaluation

- Taxation Law BarQA 2009-2017 PDFDocument195 pagesTaxation Law BarQA 2009-2017 PDFAjilPas encore d'évaluation

- Price Quotation AlnoDocument1 pagePrice Quotation AlnoChi PingPas encore d'évaluation

- 1600-PT 0322Document3 pages1600-PT 0322Mishelle RamosPas encore d'évaluation

- Erd.2.f.006 Application For Vat Zero Rating Certification Rev.05Document1 pageErd.2.f.006 Application For Vat Zero Rating Certification Rev.05ivee.upak032023Pas encore d'évaluation

- Income Tax Guide: Key Tax Concepts for Salaried IndividualsDocument19 pagesIncome Tax Guide: Key Tax Concepts for Salaried Individualsharry.anjh3613Pas encore d'évaluation

- E-Auctions - MSTC Limited-BelghoriaDocument8 pagesE-Auctions - MSTC Limited-BelghoriamannakauPas encore d'évaluation

- RVC Tuition Fee Payment and Refund Policy 2014Document10 pagesRVC Tuition Fee Payment and Refund Policy 2014Senitha MindulaPas encore d'évaluation

- Received With Thanks ' 5,682.94 Through Payment Gateway Over The Internet FromDocument2 pagesReceived With Thanks ' 5,682.94 Through Payment Gateway Over The Internet FromTaj Md SunnyPas encore d'évaluation

- Revolut-EUR-Statement-Aug 2020 - Feb 2021Document24 pagesRevolut-EUR-Statement-Aug 2020 - Feb 2021Muhammad AdeelPas encore d'évaluation

- IDBI BANK ZOMATO OFFERDocument1 pageIDBI BANK ZOMATO OFFERVipin SachdevaPas encore d'évaluation

- Paytm Statement Jul2022 8208151003Document4 pagesPaytm Statement Jul2022 8208151003Rajshlay KalasaitPas encore d'évaluation

- Income Tax 1 - 20223Document3 pagesIncome Tax 1 - 20223nimalpes21Pas encore d'évaluation