Académique Documents

Professionnel Documents

Culture Documents

Statement of Value Added: FY 31 Dec 2014 Rm'000 FY 31 Dec 2015 Rm'000

Transféré par

Che TaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Statement of Value Added: FY 31 Dec 2014 Rm'000 FY 31 Dec 2015 Rm'000

Transféré par

Che TaDroits d'auteur :

Formats disponibles

Annual Report 2015

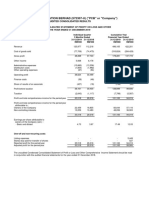

Statement of Value Added

FY 31 Dec FY 31 Dec

2014 2015

Value Added RM’000 RM’000

Net interest income 9,703,703 11,114,145

Income from Islamic Banking Scheme operations 3,271,211 3,938,637

Net earned insurance premiums 3,946,068 4,196,699

Other operating income 5,540,439 5,772,867

Net insurance benefits and claims incurred, net fee and commission expenses, change in expense liabilities

and taxation of life and takaful fund (3,930,819) (3,784,427)

Overhead expenses excluding personnel expenses, depreciation and amortisation (3,529,338) (3,879,647)

Allowances for impairment losses on loans, advances, financing and other debts, net (400,392) (1,683,557)

Allowances for impairment losses on financial investments, net (70,440) (329,022)

Share of profits in associates and joint ventures 163,125 211,246

Value added available for distribution 14,693,557 15,556,941

FY 31 Dec FY 31 Dec

2014 2015

Distribution of Value Added RM’000 RM’000

To employees:

Personnel expenses 5,019,296 5,765,147

To the Government:

Taxation 2,200,540 2,165,160

To providers of capital:

Dividends paid to shareholders 4,939,066 5,358,939

Non-controlling interests 194,588 150,449

To reinvest to the Group:

Depreciation and amortisation 562,678 640,246

Retained profits 1,777,389 1,477,000

Value added available for distribution 14,693,557 15,556,941

Vous aimerez peut-être aussi

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineD'EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LinePas encore d'évaluation

- 8167-W 2017 PPB IsDocument3 pages8167-W 2017 PPB IsVijay KumarPas encore d'évaluation

- Balance Sheet Summary Cash Flow Summary: (AED M) 2014 2015 (AED M) 2014Document18 pagesBalance Sheet Summary Cash Flow Summary: (AED M) 2014 2015 (AED M) 2014Mohammad ElabedPas encore d'évaluation

- Financial Statement ACIFL 31 March 2015 ConsolidatedDocument16 pagesFinancial Statement ACIFL 31 March 2015 ConsolidatedNurhan JaigirdarPas encore d'évaluation

- TPG - Annual Report 2020 Income Statemnt 1Document2 pagesTPG - Annual Report 2020 Income Statemnt 1Pei Ling Ch'ngPas encore d'évaluation

- CHB Sep19 PDFDocument14 pagesCHB Sep19 PDFSajeetha MadhavanPas encore d'évaluation

- Financial Statement 7EDocument9 pagesFinancial Statement 7ENurin SyazarinPas encore d'évaluation

- Seven Up Bottling Co PLC: For The Ended 31 March, 2014Document4 pagesSeven Up Bottling Co PLC: For The Ended 31 March, 2014Gina FelyaPas encore d'évaluation

- Bursa Malaysia Berhad (30632-P) (Incorporated in Malaysia) : 15 July 2015Document35 pagesBursa Malaysia Berhad (30632-P) (Incorporated in Malaysia) : 15 July 2015Fakhrul Azman NawiPas encore d'évaluation

- National Foods Balance Sheet: 2013 2014 Assets Non-Current AssetsDocument8 pagesNational Foods Balance Sheet: 2013 2014 Assets Non-Current Assetsbakhoo12Pas encore d'évaluation

- en PDFDocument49 pagesen PDFJ. BangjakPas encore d'évaluation

- PRC2019 FSDocument4 pagesPRC2019 FSDonaldDeLeonPas encore d'évaluation

- Hand Protection PLCDocument8 pagesHand Protection PLCasankaPas encore d'évaluation

- Particulars (INR in Crores) FY2015A FY2016A FY2017A FY2018ADocument5 pagesParticulars (INR in Crores) FY2015A FY2016A FY2017A FY2018AhbyhPas encore d'évaluation

- Quarterly Report 20200930Document18 pagesQuarterly Report 20200930Ang SHPas encore d'évaluation

- Deleum Q2 2019Document43 pagesDeleum Q2 2019DiLungBanPas encore d'évaluation

- Annual Report 2019Document4 pagesAnnual Report 2019Rahman GafarPas encore d'évaluation

- Income StatementDocument4 pagesIncome StatementJudith DelRosario De RoxasPas encore d'évaluation

- 2016 Nestle ExtratedDocument7 pages2016 Nestle ExtratednesanPas encore d'évaluation

- Balance Sheet: 2016 2017 2018 Assets Non-Current AssetsDocument6 pagesBalance Sheet: 2016 2017 2018 Assets Non-Current AssetsAhsan KamranPas encore d'évaluation

- Sun Limited Abridged Financial Statements: The Group's Audited Results For The Year Ended 30 June 2017 Are As FollowsDocument1 pageSun Limited Abridged Financial Statements: The Group's Audited Results For The Year Ended 30 June 2017 Are As FollowsYash HardowarPas encore d'évaluation

- Bangladesh q3 Report 2020 Tcm244 556009 enDocument8 pagesBangladesh q3 Report 2020 Tcm244 556009 entdebnath_3Pas encore d'évaluation

- Unaudited Financial Statements For The Period Ended 30 September, 2021Document2 pagesUnaudited Financial Statements For The Period Ended 30 September, 2021Fuaad DodooPas encore d'évaluation

- Quarterly Report 20191231Document21 pagesQuarterly Report 20191231Ang SHPas encore d'évaluation

- CHB Jun19 PDFDocument14 pagesCHB Jun19 PDFSajeetha MadhavanPas encore d'évaluation

- Quarterly Analysis: Analysis of Variation in Interim Results and Final AccountsDocument1 pageQuarterly Analysis: Analysis of Variation in Interim Results and Final Accounts.Pas encore d'évaluation

- NIB Financial Statements 2017Document12 pagesNIB Financial Statements 2017rahim Abbas aliPas encore d'évaluation

- Awasr Oman and Partners SAOC - FS 2020 EnglishDocument42 pagesAwasr Oman and Partners SAOC - FS 2020 Englishabdullahsaleem91Pas encore d'évaluation

- A Wholly-Owned Subsidiary of Philippine National Oil CompanyDocument4 pagesA Wholly-Owned Subsidiary of Philippine National Oil CompanyLolita CalaycayPas encore d'évaluation

- Panasonic Malaysia - 4Q 19 - Bursa (PMMA) FinalDocument12 pagesPanasonic Malaysia - 4Q 19 - Bursa (PMMA) FinalGan ZhiHanPas encore d'évaluation

- Beg A Cheese 2016Document4 pagesBeg A Cheese 2016杨子偏Pas encore d'évaluation

- Unilever Annual Report and Accounts 2016 Tcm244 498880 enDocument1 pageUnilever Annual Report and Accounts 2016 Tcm244 498880 enMuntasir Alam EmsonPas encore d'évaluation

- Expenses FormatDocument6 pagesExpenses FormatdetailsPas encore d'évaluation

- Unaudited Condensed Consolidated Income Statement: Misc BerhadDocument20 pagesUnaudited Condensed Consolidated Income Statement: Misc BerhadAzizi JaisPas encore d'évaluation

- Bubble and Bee Lecture TemplateDocument2 pagesBubble and Bee Lecture TemplateMavin JeraldPas encore d'évaluation

- IHC Financial Statments For Period Ended 30 September 2020 - English PDFDocument40 pagesIHC Financial Statments For Period Ended 30 September 2020 - English PDFHafisMohammedSahibPas encore d'évaluation

- Quarterly Report 20180331Document15 pagesQuarterly Report 20180331Ang SHPas encore d'évaluation

- CHB Dec18Document15 pagesCHB Dec18Sajeetha MadhavanPas encore d'évaluation

- Bursa Q1 2015v6Document19 pagesBursa Q1 2015v6Fakhrul Azman NawiPas encore d'évaluation

- Financial Statements Notes On The Financial StatementsDocument95 pagesFinancial Statements Notes On The Financial StatementsEvariste GaloisPas encore d'évaluation

- RFL Bond Report q1 Fy 2015Document6 pagesRFL Bond Report q1 Fy 2015husnuozyegiinPas encore d'évaluation

- 1Q 20 - Bursa (PMMA) FinalDocument12 pages1Q 20 - Bursa (PMMA) FinalGan ZhiHanPas encore d'évaluation

- Consolidated Income Statement: For The Year Ended 31 December 2019Document8 pagesConsolidated Income Statement: For The Year Ended 31 December 2019Salman SajidPas encore d'évaluation

- HBL FSAnnouncement 3Q2016Document9 pagesHBL FSAnnouncement 3Q2016Ryan Hock Keong TanPas encore d'évaluation

- Airasia Quarter ReportDocument34 pagesAirasia Quarter ReportChee Meng TeowPas encore d'évaluation

- Awasr Oman Partners 2019Document44 pagesAwasr Oman Partners 2019abdullahsaleem91Pas encore d'évaluation

- NP SCBNL Fourth Quarter Two Thousand Seventy Six Seventy Seven ResultsDocument23 pagesNP SCBNL Fourth Quarter Two Thousand Seventy Six Seventy Seven ResultsMaahi MaharjanPas encore d'évaluation

- FY2023 SGX Format-FINALDocument35 pagesFY2023 SGX Format-FINALjonathan.zy95Pas encore d'évaluation

- National College of Business Administration & Economics Front Lane Campus (FLC)Document7 pagesNational College of Business Administration & Economics Front Lane Campus (FLC)Abdul RehmanPas encore d'évaluation

- AMARILODocument8 pagesAMARILOIngrid Molina GarciaPas encore d'évaluation

- Renuka Foods PLC: Interim Financial Statements - For The Period Ended 31 December 2021Document11 pagesRenuka Foods PLC: Interim Financial Statements - For The Period Ended 31 December 2021hvalolaPas encore d'évaluation

- FPCL AccountsDocument38 pagesFPCL AccountsMuhammad BurairPas encore d'évaluation

- Bursa Q3 2015 FinalDocument16 pagesBursa Q3 2015 FinalFakhrul Azman NawiPas encore d'évaluation

- TML q4 Fy 21 Consolidated ResultsDocument6 pagesTML q4 Fy 21 Consolidated ResultsGyanendra AryaPas encore d'évaluation

- Notes To The Income Statement: 8 RevenueDocument8 pagesNotes To The Income Statement: 8 RevenueShivankit BishtPas encore d'évaluation

- National Central Cooling Company PJSCDocument24 pagesNational Central Cooling Company PJSCMohamed NaieemPas encore d'évaluation

- 2nd Quarterly Announcement As at 31 July 2017Document15 pages2nd Quarterly Announcement As at 31 July 2017YouJianPas encore d'évaluation

- Cocoaland Holdings Berhad: (Incorporated in Malaysia)Document15 pagesCocoaland Holdings Berhad: (Incorporated in Malaysia)Sajeetha MadhavanPas encore d'évaluation

- Annual Report2018 PDFDocument282 pagesAnnual Report2018 PDFadnanPas encore d'évaluation

- Annual Report - PadiniDocument23 pagesAnnual Report - PadiniCheng Chung leePas encore d'évaluation

- Template - Eng & BM - May 2018Document147 pagesTemplate - Eng & BM - May 2018Che TaPas encore d'évaluation

- Headings of Letters (General)Document1 pageHeadings of Letters (General)Che TaPas encore d'évaluation

- Legal Fees - CKHTDocument2 pagesLegal Fees - CKHTChe TaPas encore d'évaluation

- BBKI4103Document7 pagesBBKI4103Che TaPas encore d'évaluation

- 2015 2016-2020 Maybank: Our Performance The Financials Basel Ii Pillar 3Document1 page2015 2016-2020 Maybank: Our Performance The Financials Basel Ii Pillar 3Che TaPas encore d'évaluation

- Financial Statements: Our PerformanceDocument1 pageFinancial Statements: Our PerformanceChe TaPas encore d'évaluation

- Simplified Group Statements of Financial Position: Rm708.3 Rm640.3Document1 pageSimplified Group Statements of Financial Position: Rm708.3 Rm640.3Che TaPas encore d'évaluation

- Multiple Bar Chart For Frequency of School Leavers Per Blood TypeDocument2 pagesMultiple Bar Chart For Frequency of School Leavers Per Blood TypeChe TaPas encore d'évaluation

- Highlights of 2015Document1 pageHighlights of 2015Che TaPas encore d'évaluation

- Moneylending Agreement (Secured Loan)Document5 pagesMoneylending Agreement (Secured Loan)Che TaPas encore d'évaluation

- Air Asia Airlines Company Company BackgroundDocument5 pagesAir Asia Airlines Company Company BackgroundChe TaPas encore d'évaluation

- Maybank Annual ReportDocument1 pageMaybank Annual ReportChe TaPas encore d'évaluation

- Delivering Our Asean Vision TogetherDocument1 pageDelivering Our Asean Vision TogetherChe TaPas encore d'évaluation

- Moneylending Agreement (Secured Loan)Document5 pagesMoneylending Agreement (Secured Loan)Che TaPas encore d'évaluation

- Undertaking As To Partial ReleaseDocument3 pagesUndertaking As To Partial ReleaseChe TaPas encore d'évaluation

- Calculation ExampleDocument4 pagesCalculation ExampleChe TaPas encore d'évaluation

- 40872Document7 pages40872Che TaPas encore d'évaluation

- Consent Form IndividualDocument1 pageConsent Form IndividualChe TaPas encore d'évaluation

- BBUS2103 Assignment Answer2Document22 pagesBBUS2103 Assignment Answer2Che TaPas encore d'évaluation

- Private & ConfidentialDocument2 pagesPrivate & ConfidentialChe TaPas encore d'évaluation

- Assignment Answer1Document10 pagesAssignment Answer1Che TaPas encore d'évaluation

- Gann Trading PointsDocument16 pagesGann Trading PointsKalidas Sundararaman100% (2)

- Cash Flow StatementDocument40 pagesCash Flow Statementtairakazida100% (3)

- Takeover Ukraine Agricultural LandDocument33 pagesTakeover Ukraine Agricultural LanddulescuxPas encore d'évaluation

- Piñero Resume - PublicDocument1 pagePiñero Resume - PublicJade PineroPas encore d'évaluation

- Financial Statements Analysis of VHCDocument20 pagesFinancial Statements Analysis of VHCAPas encore d'évaluation

- CH 04Document55 pagesCH 04cris lu salemPas encore d'évaluation

- Investinournewyork BillionairepandemicprofitDocument9 pagesInvestinournewyork BillionairepandemicprofitZacharyEJWilliamsPas encore d'évaluation

- Indemnity BondDocument2 pagesIndemnity Bondsamy754192% (13)

- Secreg - Gun Jumping Exam SheetDocument5 pagesSecreg - Gun Jumping Exam SheetRaj VashiPas encore d'évaluation

- MACDDocument2 pagesMACDJEAN MARCO CAJA ALVAREZPas encore d'évaluation

- Uttar Pradesh District Factbook - Aligarh DistrictDocument33 pagesUttar Pradesh District Factbook - Aligarh DistrictDatanet IndiaPas encore d'évaluation

- CMBE 2 - Lesson 4 ModuleDocument13 pagesCMBE 2 - Lesson 4 ModuleEunice AmbrocioPas encore d'évaluation

- Financial Reporting Paper 2.1 Dec 2023Document28 pagesFinancial Reporting Paper 2.1 Dec 2023Oni SegunPas encore d'évaluation

- GOPAL DAIRY PROJECT MBA Project Report Prince DudhatraDocument68 pagesGOPAL DAIRY PROJECT MBA Project Report Prince DudhatrapRiNcE DuDhAtRa86% (7)

- Netflix Case StudyDocument22 pagesNetflix Case StudyIvette Estefanía Ramírez YumblaPas encore d'évaluation

- Chapter 2 Literature ReviewDocument24 pagesChapter 2 Literature Reviewcoolpeer91Pas encore d'évaluation

- Compromise!: Health Insurance For UncompromisingDocument2 pagesCompromise!: Health Insurance For UncompromisingManjunatha GayakwadPas encore d'évaluation

- A Project Report On COMPARATIVE STUDY INDocument63 pagesA Project Report On COMPARATIVE STUDY INDeepanshuPas encore d'évaluation

- Business English Vocabulary: Word MeaningDocument39 pagesBusiness English Vocabulary: Word MeaningJonathasPas encore d'évaluation

- FakeDocument13 pagesFakePedroPas encore d'évaluation

- Engineering Economic Project Report - Shandy Raditya Syahron (1206229585)Document11 pagesEngineering Economic Project Report - Shandy Raditya Syahron (1206229585)Tito WPas encore d'évaluation

- OCBC Asia Credit - Offshore Marine Sector - Many Moving Parts (11 Mar 2015) PDFDocument14 pagesOCBC Asia Credit - Offshore Marine Sector - Many Moving Parts (11 Mar 2015) PDFInvest StockPas encore d'évaluation

- Taller 02 09 19 Ncp001 - InglesDocument2 pagesTaller 02 09 19 Ncp001 - InglesAnggie Alejandra hernandez ortegaPas encore d'évaluation

- Born To Be A Champion PDFDocument99 pagesBorn To Be A Champion PDFAna AvilaPas encore d'évaluation

- News Wire PPT - Taniya PandeyDocument7 pagesNews Wire PPT - Taniya Pandeytaniya pandeyPas encore d'évaluation

- Usufruct ReviewerDocument6 pagesUsufruct ReviewerAizaFerrerEbinaPas encore d'évaluation

- Wacc FormulasDocument3 pagesWacc FormulasvrrsvPas encore d'évaluation

- Summer Internship Report On DIGITAL BANKING - HDFC Bank Ltd.Document24 pagesSummer Internship Report On DIGITAL BANKING - HDFC Bank Ltd.Nayana ChuriwalaPas encore d'évaluation

- Feasibility Study of Furfuryl Alcohol ProductionDocument3 pagesFeasibility Study of Furfuryl Alcohol ProductionIntratec SolutionsPas encore d'évaluation

- IBPS Clerk Prelimsl Previous PaperDocument26 pagesIBPS Clerk Prelimsl Previous PapershakthiPas encore d'évaluation