Académique Documents

Professionnel Documents

Culture Documents

Provides A Quality Education in A Christ-Centered Institution

Transféré par

Mej AgaoDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Provides A Quality Education in A Christ-Centered Institution

Transféré par

Mej AgaoDroits d'auteur :

Formats disponibles

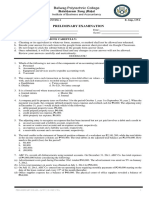

CHRISTIAN COLLEGES OF SOUTHEAST ASIA

Rosario Bldg., Don Julian Rodriguez Avenue, Ma-a, Davao City

Provides a Quality Education in a Christ-centered Institution

Bachelor of Science in Accountancy

TUTORIAL: Diagnostic Test

Tutors: Agao, Decena, Gonato, Saguidan

Name: __________________________________ Strand: _____________

REMINDER: No cheating. The purpose of this test is to measure and

evaluate your knowledge in accounting. GOD BLESS FUTURE CPA!

INSTRUCTION: Use a separate sheet of paper for your answer. You can write

your solution on the test paper.

1. Which of these are not included as a separate item in the basic accounting equation?

a. Assets b. Revenues c. Liabilities d. Stockholder’s Equity

2. The account format that displays debits, credits, balances, and headings.

a. General Journal b. Ledger c. T-account d. General Ledger

3. Asset accounts have what type of balance?

a. Debit b. Credit c. Contra d. all of the above

4. Which of the following increases equity?

a. Expenses b. Withdrawals c. Treasury Stock d. Revenue

5. A contra asset account has what type of balance?

a. Debit b. Credit c. Contra d. all of the above

6. Accrued income is:

a. Income already received but not yet earned.

b. Income already earned but not yet received or collected.

c. Income long overdue.

d. Income already earned and collected.

7. Accrued expenses is:

a. Expense already paid but not yet incurred.

b. Expenses long time not paid.

c. Expense already incurred but not yet paid.

d. Expense incurred and paid.

8. The decrease in the usefulness of fixed tangible assets with the passage of time except

land is:

a. Obsolescence b. depreciation c. appreciation d. depletion

9. Unearned income is:

a. Income already earned but not yet received.

b. Income not yet earned and received.

c. Income received before goods or services are performed

d. Income already earned and received.

10.Entries made at the end of the period which bring the account up to date are:

a. Adjusting entries

b. Updating entries

c. Reversing entries

d. All of the above

PROBLEM SOLVING

Princess formed a management consulting firm specializing in cost management systems.

Below are the transactions that occurred during the initial month of operation.

August 2, Princess invested P25,00 cash in the newly formed business.

August 3 hired an administrative assistant, to be paid P3,000 per month. Leased office space

at the rate of P1,000 per month. Signed a contract with Grace to deliver consulting services

valued at P7,500.

August 8 purchased (and immediately used office supplies on account for P750.

August 9 Received P2,500 from Grace for work performed to date.

August 15 paid P1,200 for travel costs associated with consultation work.

August 16 provided services on account to Mej for P3,000

August 17 paid P1,500 to administrative assistant for salary.

August 23 billed Jessel for P4,000 consulting engagement performed.

August 25 Princess withdrew cash from her company worth P1,000.

August 26 collected 50% of the amount due for billing on June 23.

August 27 purchased computer furniture for P4,000, paying P1,000 down.

August 27 paid P750 on the open account relating to June 8 purchase.

August 28 completed the Grace job and billed the remaining amount.

August 30 paid P1,500 to administrative assistant for salary.

August 30 paid rent for August, P1,000.

Princess consulting uses the following accounts for journalizing:

Cash Princess, Capital Rent Expense

Accounts Receivable Princess, Withdrawals Travel Expense

Equipment Revenues Supplies Expense

Accounts Payable Salary Expense

Required:

Journalize the listed transactions.

Post the transactions to the appropriate T-accounts.

Prepare a trial balance as of August 30.

Determine the amount of the following items as of August 30:

- Cash:

- Accounts Receivables:

- Equipment:

- Accounts Payable:

- Princess, Capital:

- Princess, Withdrawals:

- Revenues:

- Salary Expense:

- Rent Expense:

- Travel Expense:

- Supplies Expense:

- Total Assets:

- Total Liabilities:

- Total Owner’s Equity:

- Net Profit/(Loss):

Vous aimerez peut-être aussi

- Bsba - Bacc-1 - Midterm Exam - ADocument3 pagesBsba - Bacc-1 - Midterm Exam - AMechilePas encore d'évaluation

- Cambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersD'EverandCambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersÉvaluation : 2 sur 5 étoiles2/5 (4)

- Chapter 01 02 Selected MCQsDocument7 pagesChapter 01 02 Selected MCQsLe Hong Phuc (K17 HCM)Pas encore d'évaluation

- Orca Share Media1605010109407 6731900321930361605Document37 pagesOrca Share Media1605010109407 6731900321930361605MARY JUSTINE PAQUIBOTPas encore d'évaluation

- Community College of Gingoog CityDocument2 pagesCommunity College of Gingoog CityJeffrey Lois Sereño MaestradoPas encore d'évaluation

- C. Side Represented by Increases in The Account BalanceDocument19 pagesC. Side Represented by Increases in The Account Balancealyanna alanoPas encore d'évaluation

- IcebreakerDocument5 pagesIcebreakerRyan MagalangPas encore d'évaluation

- General Instructions: Read Carefully All The Instructions. Write All Your Answers in CAPITAL LETTERS OnlyDocument2 pagesGeneral Instructions: Read Carefully All The Instructions. Write All Your Answers in CAPITAL LETTERS OnlyRegine BaterisnaPas encore d'évaluation

- Adjusting Entry QuizDocument3 pagesAdjusting Entry Quizaccounting probPas encore d'évaluation

- Day 4 Post TestDocument2 pagesDay 4 Post TestcassiopieabPas encore d'évaluation

- Bài tập ôn tập chapter 4 Ms.TrangDocument8 pagesBài tập ôn tập chapter 4 Ms.TrangNgọc Trung Học 20Pas encore d'évaluation

- Adjusting EntriesDocument7 pagesAdjusting EntriesRyou ShinodaPas encore d'évaluation

- Answer SheetDocument5 pagesAnswer Sheetnahu a dinPas encore d'évaluation

- Accounting For non-CPADocument7 pagesAccounting For non-CPAJim OctavoPas encore d'évaluation

- Compilation of IFA QuestionsDocument67 pagesCompilation of IFA QuestionsBugoy CabasanPas encore d'évaluation

- NYIF Accounting Module Quiz 4 With AnswersssDocument3 pagesNYIF Accounting Module Quiz 4 With AnswersssShahd Okasha0% (1)

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument20 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionFebby Grace Villaceran Sabino0% (2)

- đề kiểm tra nguyên lý kế toán 1 2Document5 pagesđề kiểm tra nguyên lý kế toán 1 2Lê Thanh HuyềnPas encore d'évaluation

- EQuestionsDocument11 pagesEQuestionsLala BoraPas encore d'évaluation

- Name - Course & Yr. - Schedule - Score - Test I. Multiple Choice. Encircle The Letter of The Best Answer in Each of The Given Question/sDocument11 pagesName - Course & Yr. - Schedule - Score - Test I. Multiple Choice. Encircle The Letter of The Best Answer in Each of The Given Question/sAtty CpaPas encore d'évaluation

- Soal UTS SMT 1 AkP (12-10-21)Document22 pagesSoal UTS SMT 1 AkP (12-10-21)Bayu PrasetyoPas encore d'évaluation

- ACC100.101 Preliminary Examination - For PostingDocument5 pagesACC100.101 Preliminary Examination - For PostingRAMOS, Aliyah Faith P.Pas encore d'évaluation

- Analyzing, Recording, Posting and Trial Balance: Normal Balance of AccountsDocument6 pagesAnalyzing, Recording, Posting and Trial Balance: Normal Balance of AccountsMich Binayug100% (1)

- Accounting 1 Questionnaire For The Fourth Quarterly ExaminationDocument8 pagesAccounting 1 Questionnaire For The Fourth Quarterly ExaminationRJ DimaanoPas encore d'évaluation

- GlobalisationDocument9 pagesGlobalisationMark Joseph TadeoPas encore d'évaluation

- Chapter 4-Individual Work Recorded For StudentsDocument2 pagesChapter 4-Individual Work Recorded For StudentsNikki Estores GonzalesPas encore d'évaluation

- Lesson 2 (Basic Accounting Equation)Document47 pagesLesson 2 (Basic Accounting Equation)GRADE TEN EMPATHYPas encore d'évaluation

- Basic Acctg MCQDocument12 pagesBasic Acctg MCQJohn AcePas encore d'évaluation

- Review of The Accounting ProcessDocument5 pagesReview of The Accounting Processrufamaegarcia07Pas encore d'évaluation

- Acc 311 - Exam 1 - Form A BlankDocument12 pagesAcc 311 - Exam 1 - Form A BlankShivam GuptaPas encore d'évaluation

- 1st AccDocument6 pages1st AccChristine PerezPas encore d'évaluation

- Question SetDocument3 pagesQuestion SetmyuploadsPas encore d'évaluation

- Acctg11 CN 3000 TQ Midterm Exam 1ST Sem 2021-2022Document5 pagesAcctg11 CN 3000 TQ Midterm Exam 1ST Sem 2021-2022Jaya RamirezPas encore d'évaluation

- Practice Questions 1 (AIS)Document8 pagesPractice Questions 1 (AIS)UroobaShiekhPas encore d'évaluation

- Midterms Reviewer 2007Document7 pagesMidterms Reviewer 2007Edison San JuanPas encore d'évaluation

- Adjusting Entries PracticeDocument11 pagesAdjusting Entries Practiceback4peacePas encore d'évaluation

- Exercises Chapter 1 & 2Document4 pagesExercises Chapter 1 & 2Kiko Doragon Inoue TsubasaPas encore d'évaluation

- Quiz No. 1 Accounting PrinciplesDocument4 pagesQuiz No. 1 Accounting PrinciplesElla Feliciano100% (1)

- ACT15 Prelim ExamDocument8 pagesACT15 Prelim ExamPaw VerdilloPas encore d'évaluation

- AJE QuizDocument4 pagesAJE QuizJohn cookPas encore d'évaluation

- AssignmentDocument8 pagesAssignmentNegil Patrick DolorPas encore d'évaluation

- Far 1 Module Task 2Document7 pagesFar 1 Module Task 2Jekah AnnePas encore d'évaluation

- FA (2010) MidtermDocument16 pagesFA (2010) MidtermRishi BigghePas encore d'évaluation

- ReiceivablesDocument27 pagesReiceivablesrivaceline100% (3)

- Midterm Examination in Basic AccountingDocument3 pagesMidterm Examination in Basic AccountingCarlo100% (1)

- Mid Term POA - Test 01Document8 pagesMid Term POA - Test 01Trang Ca CaPas encore d'évaluation

- Final WorkshopDocument7 pagesFinal WorkshopMagnus Blicker LarsenPas encore d'évaluation

- Act Module4 Cashflow Fabm 2 5.Document11 pagesAct Module4 Cashflow Fabm 2 5.DOMDOM, NORIEL O.Pas encore d'évaluation

- Answer Key Activity 12, 13, & 14Document5 pagesAnswer Key Activity 12, 13, & 14Yor MilizéPas encore d'évaluation

- FY 2019-2020 adjusting entries quizDocument7 pagesFY 2019-2020 adjusting entries quizAngeliePas encore d'évaluation

- New TQDocument7 pagesNew TQrosereginePas encore d'évaluation

- Finals - QuestionsDocument3 pagesFinals - QuestionsClarence RevadilloPas encore d'évaluation

- Midterm Examination-Basic AccountingDocument3 pagesMidterm Examination-Basic AccountingArianne Claire Sisles0% (2)

- Adjusting EntriesDocument7 pagesAdjusting Entrieshello hayaPas encore d'évaluation

- Entrepreneurship - Quarter 2 Week 9Document8 pagesEntrepreneurship - Quarter 2 Week 9SHEEN ALUBAPas encore d'évaluation

- Accounting Basics: Inputs, Outputs and Financial StatementsDocument7 pagesAccounting Basics: Inputs, Outputs and Financial StatementsKiko Doragon Inoue TsubasaPas encore d'évaluation

- Here are the answers to the multiple choice questions:1. a2. a 3. b4. c5. b6. a7. b8. a9. c 10. c11. a12. a13. c14. b15. c16. c17. a18. dDocument5 pagesHere are the answers to the multiple choice questions:1. a2. a 3. b4. c5. b6. a7. b8. a9. c 10. c11. a12. a13. c14. b15. c16. c17. a18. dElias TesfayePas encore d'évaluation

- SynthesisDocument19 pagesSynthesisMej AgaoPas encore d'évaluation

- Payroll and HR CaseDocument4 pagesPayroll and HR CaseMej AgaoPas encore d'évaluation

- Stages of Management Consulting Engagement-Part IDocument12 pagesStages of Management Consulting Engagement-Part IMej Agao100% (3)

- Substantive Test of Intangible Assets, Prepaid Expenses (Autosaved)Document38 pagesSubstantive Test of Intangible Assets, Prepaid Expenses (Autosaved)Mej AgaoPas encore d'évaluation

- Six pillars and eight elements of good corporate governance and CSRDocument5 pagesSix pillars and eight elements of good corporate governance and CSRMej AgaoPas encore d'évaluation

- Memorandum of Agreement Maam MonaDocument2 pagesMemorandum of Agreement Maam MonaYamden OliverPas encore d'évaluation

- Aec 2101 Production Economics - 0Document4 pagesAec 2101 Production Economics - 0Kelvin MagiriPas encore d'évaluation

- Knowledge, Attitude and Practice TowardsDocument19 pagesKnowledge, Attitude and Practice TowardsCory Artika ManurungPas encore d'évaluation

- LU3 Regional PlanningDocument45 pagesLU3 Regional PlanningOlif MinPas encore d'évaluation

- Cover NoteDocument1 pageCover NoteSheera IsmawiPas encore d'évaluation

- NBL Export-Import ContributionDocument41 pagesNBL Export-Import Contributionrezwan_haque_2Pas encore d'évaluation

- Rent Agreement - (Name of The Landlord) S/o - (Father's Name of TheDocument2 pagesRent Agreement - (Name of The Landlord) S/o - (Father's Name of TheAshish kumarPas encore d'évaluation

- Eco Bank Power Industry AfricaDocument11 pagesEco Bank Power Industry AfricaOribuyaku DamiPas encore d'évaluation

- Armstrong April Quarterly 2022Document108 pagesArmstrong April Quarterly 2022Rob PortPas encore d'évaluation

- Efektivitas Pengaruh Kebijakan Moneter Dalam Kinerja Sektor PerbankanDocument14 pagesEfektivitas Pengaruh Kebijakan Moneter Dalam Kinerja Sektor PerbankanBagus MahatvaPas encore d'évaluation

- Cobrapost II - Expose On Banks Full TextDocument13 pagesCobrapost II - Expose On Banks Full TextFirstpost100% (1)

- Zimbabwe Stock Exchange Pricelist: The Complete List of ZSE Indices Can Be Obtained From The ZSE Website: WWW - Zse.co - ZWDocument1 pageZimbabwe Stock Exchange Pricelist: The Complete List of ZSE Indices Can Be Obtained From The ZSE Website: WWW - Zse.co - ZWBen GanzwaPas encore d'évaluation

- Monitoring Local Plans of SK Form PNR SiteDocument2 pagesMonitoring Local Plans of SK Form PNR SiteLYDO San CarlosPas encore d'évaluation

- Banking and Economics AbbreviationsDocument9 pagesBanking and Economics AbbreviationsShekhar BeheraPas encore d'évaluation

- Building Economics Complete NotesDocument20 pagesBuilding Economics Complete NotesManish MishraPas encore d'évaluation

- BY Sr. Norjariah Arif Fakulti Pengurusan Teknologi Dan Perniagaan, Universiti Tun Hussein Onn Malaysia 2 December 2013Document31 pagesBY Sr. Norjariah Arif Fakulti Pengurusan Teknologi Dan Perniagaan, Universiti Tun Hussein Onn Malaysia 2 December 2013Ili SyazwaniPas encore d'évaluation

- Chris Cole Artemis Vega - Grants Interest Rate Observer Oct232012 - FINAL - v8Document34 pagesChris Cole Artemis Vega - Grants Interest Rate Observer Oct232012 - FINAL - v8augtour4977100% (1)

- INKP - Annual Report - 2018 PDFDocument225 pagesINKP - Annual Report - 2018 PDFKhairani NisaPas encore d'évaluation

- PROJECT PROFILE ON SPINNING MILL (14400 SPINDLESDocument6 pagesPROJECT PROFILE ON SPINNING MILL (14400 SPINDLESAnand Arumugam0% (1)

- Chapter 7 Variable CostingDocument47 pagesChapter 7 Variable CostingEden Faith AggalaoPas encore d'évaluation

- New SSP SpreadsheetDocument20 pagesNew SSP SpreadsheetAdhitya Dian33% (3)

- Final Report For Print and CDDocument170 pagesFinal Report For Print and CDmohit_ranjan2008Pas encore d'évaluation

- The Young Karl Marx ReviewDocument2 pagesThe Young Karl Marx ReviewTxavo HesiarenPas encore d'évaluation

- Practice Problems For Mid TermDocument6 pagesPractice Problems For Mid TermMohit ChawlaPas encore d'évaluation

- Eco Handout Analyzes India's Demonetization and Black Money PoliciesDocument15 pagesEco Handout Analyzes India's Demonetization and Black Money Policiessonali mishraPas encore d'évaluation

- Chairman, Infosys Technologies LTDDocument16 pagesChairman, Infosys Technologies LTDShamik ShahPas encore d'évaluation

- Kobra 260.1 S4Document1 pageKobra 260.1 S4Mishmash PurchasingPas encore d'évaluation

- Steeler Shaftwall CH StudsDocument20 pagesSteeler Shaftwall CH Studsrodney_massiePas encore d'évaluation

- 609 Credit Repair FAQDocument14 pages609 Credit Repair FAQCarol71% (7)

- UberPOOL AddendumDocument4 pagesUberPOOL AddendumEfrRirePas encore d'évaluation

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)D'EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Évaluation : 4.5 sur 5 étoiles4.5/5 (5)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsD'EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsÉvaluation : 4 sur 5 étoiles4/5 (7)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)D'EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Évaluation : 4.5 sur 5 étoiles4.5/5 (12)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindD'EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindÉvaluation : 5 sur 5 étoiles5/5 (231)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyD'EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyÉvaluation : 5 sur 5 étoiles5/5 (1)

- Profit First for Therapists: A Simple Framework for Financial FreedomD'EverandProfit First for Therapists: A Simple Framework for Financial FreedomPas encore d'évaluation

- Financial Accounting For Dummies: 2nd EditionD'EverandFinancial Accounting For Dummies: 2nd EditionÉvaluation : 5 sur 5 étoiles5/5 (10)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanD'EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanÉvaluation : 4.5 sur 5 étoiles4.5/5 (79)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!D'EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Évaluation : 4.5 sur 5 étoiles4.5/5 (14)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantD'EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantÉvaluation : 4.5 sur 5 étoiles4.5/5 (146)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesD'EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesPas encore d'évaluation

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetD'EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetPas encore d'évaluation

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineD'EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlinePas encore d'évaluation

- Financial Accounting - Want to Become Financial Accountant in 30 Days?D'EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Évaluation : 5 sur 5 étoiles5/5 (1)

- Project Control Methods and Best Practices: Achieving Project SuccessD'EverandProject Control Methods and Best Practices: Achieving Project SuccessPas encore d'évaluation

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesD'EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesÉvaluation : 4.5 sur 5 étoiles4.5/5 (30)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItD'EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItÉvaluation : 5 sur 5 étoiles5/5 (13)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsD'EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsPas encore d'évaluation

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesD'EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesPas encore d'évaluation

- Basic Accounting: Service Business Study GuideD'EverandBasic Accounting: Service Business Study GuideÉvaluation : 5 sur 5 étoiles5/5 (2)

- The CEO X factor: Secrets for Success from South Africa's Top Money MakersD'EverandThe CEO X factor: Secrets for Success from South Africa's Top Money MakersPas encore d'évaluation

- Finance Basics (HBR 20-Minute Manager Series)D'EverandFinance Basics (HBR 20-Minute Manager Series)Évaluation : 4.5 sur 5 étoiles4.5/5 (32)

- Mysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungD'EverandMysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungÉvaluation : 4 sur 5 étoiles4/5 (1)