Académique Documents

Professionnel Documents

Culture Documents

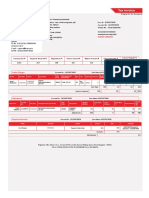

Income Statement of Raymonds

Transféré par

Shashank Patel0 évaluation0% ont trouvé ce document utile (0 vote)

5 vues2 pagesThe income statement shows the revenues and expenses of Raymonds over the past 5 years. Total operating revenues increased year-over-year except for a small decline from 2016 to 2017. Total expenses also increased each year except for a slight decrease from 2016 to 2017. As a result, profit after tax declined from 2016 to 2017 but was up in prior years.

Description originale:

bookkk

Titre original

Book1

Copyright

© © All Rights Reserved

Formats disponibles

XLSX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentThe income statement shows the revenues and expenses of Raymonds over the past 5 years. Total operating revenues increased year-over-year except for a small decline from 2016 to 2017. Total expenses also increased each year except for a slight decrease from 2016 to 2017. As a result, profit after tax declined from 2016 to 2017 but was up in prior years.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme XLSX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

5 vues2 pagesIncome Statement of Raymonds

Transféré par

Shashank PatelThe income statement shows the revenues and expenses of Raymonds over the past 5 years. Total operating revenues increased year-over-year except for a small decline from 2016 to 2017. Total expenses also increased each year except for a slight decrease from 2016 to 2017. As a result, profit after tax declined from 2016 to 2017 but was up in prior years.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme XLSX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

Income Statement of Raymonds

17-Mar 16-Mar 15-Mar 14-Mar 13-Mar

Total Operating Revenues 5,391.32 5,131.36 4,837.26 4,001.99 3,494.89

Other Income 117.94 106.91 95.18 72.65 73.87

Group Share In Joint Ventures 0 463.33 495.36 545.98 574.27

Total Revenue 5,509.26 5,701.60 5,427.79 4,620.63 4,143.03

EXPENSES

Cost Of Materials Consumed 1,112.28 1,284.63 1,358.45 1,342.57 1,252.35

Purchase Of Stock-In Trade 1,340.83 1,206.52 1,070.94 566.29 373.67

Operating And Direct Expenses 740.93 844.38 845.86 829.23 776.04

Changes In Inventories Of FG,WIP And

Stock-In Trade -95.64 -102.3 -94.85 -111.33 -45.24

Employee Benefit Expenses 753.54 725.08 662.71 554.15 553.32

Finance Costs 178.03 183.45 200.39 196.83 190.58

Depreciation And Amortisation Expenses 156.88 164.25 161.88 195.79 189.04

Other Expenses 1,234.58 1,198.74 1,062.70 887.08 787.62

Total Expenses 5,421.44 5,504.75 5,268.08 4,460.62 4,077.39

Profit/Loss Before Exceptional,

ExtraOrdinary Items And Tax 87.82 196.85 159.72 160.01 65.64

Exceptional Items -10.05 -34.94 0.03 -35.39 -28.96

Profit/Loss Before Tax 77.77 161.91 159.75 124.61 36.68

Tax Expenses-Continued Operations

Current Tax 34.34 62.64 45.65 36.54 22.96

Less: MAT Credit Entitlement 0 23.02 22.77 1.99 -0.89

Deferred Tax -12.5 32.47 19.69 -5.06 1.4

Tax For Earlier Years 0 0.04 1.31 0.26 -0.3

Total Tax Expenses 21.84 72.13 43.88 29.76 24.95

Profit/Loss After Tax And Before

ExtraOrdinary Items 55.93 89.78 115.87 94.86 11.73

Profit/Loss From Continuing Operations 55.93 89.78 115.87 94.86 11.73

Profit/Loss For The Period 55.93 89.78 115.87 94.86 11.73

Minority Interest -4.5 0.81 -6.77 -2.64 1.51

Share Of Profit/Loss Of Associates -25.92 1.46 3.72 15.42 15.5

Consolidated Profit/Loss After MI And

Associates 25.52 92.05 112.81 107.63 28.73

OTHER ADDITIONAL INFORMATION

EARNINGS PER SHARE

Basic EPS (Rs.) 4 15 18 18 5

Diluted EPS (Rs.) 4 15 18 18 5

DIVIDEND AND DIVIDEND PERCENTAGE

Equity Share Dividend 22.16 0 18.41 12.28 6.14

Tax On Dividend 0 0 3.77 2.09 1

Horizontal Analysis Vertical Analysis

2017-16 2015-16 2017 2016 2015

5.07 6.08

10.32 12.32

-100.00 -6.47

-3.37 5.04

-13.42 -5.43 20.63 25.03 28.08

11.13 12.66 24.87 23.51 22.14

-12.25 -0.17 13.74 16.46 17.49

-6.51 7.85 -1.77 -1.99 -1.96

3.93 9.41 13.98 14.13 13.70

-2.95 -8.45 3.30 3.58 4.14

-4.49 1.46 2.91 3.20 3.35

2.99 12.80 22.90 23.36 21.97

-1.51 4.49 100.56 107.28 108.91

-55.39 23.25 1.63 3.84 3.30

-71.24 -116566.67 -0.19 -0.68 0.00

-51.97 1.35 1.44 3.16 3.30

0.00 0.00 0.00

-45.18 37.22 0.64 1.22 0.94

-100.00 1.10 0.00 0.45 0.47

-138.50 64.91 -0.23 0.63 0.41

-100.00 -96.95 0.00 0.00 0.03

-69.72 64.38 0.41 1.41 0.91

-37.70 -22.52 1.04 1.75 2.40

-37.70 -22.52 1.04 1.75 2.40

-37.70 -22.52 1.04 1.75 2.40

-655.56 -111.96 -0.08 0.02 -0.14

-1875.34 -60.75 -0.48 0.03 0.08

-72.28 -18.40 0.47 1.79 2.33

Vous aimerez peut-être aussi

- Cipla P&L ExcelDocument9 pagesCipla P&L ExcelNeha LalPas encore d'évaluation

- Dabur ValuationDocument41 pagesDabur Valuationashwini patilPas encore d'évaluation

- Fortis HealthDocument18 pagesFortis HealthvishalPas encore d'évaluation

- FM Project2Document20 pagesFM Project2Triptasree GhoshPas encore d'évaluation

- Company Finance Profit & Loss (Rs in CRS.) : Company: State Bank of India Industry: Banks - Public SectorDocument4 pagesCompany Finance Profit & Loss (Rs in CRS.) : Company: State Bank of India Industry: Banks - Public Sectorprasadkh90Pas encore d'évaluation

- Tottenham Case PDF FreeDocument19 pagesTottenham Case PDF Freemaham nazirPas encore d'évaluation

- Institute Program Year Subject Project Name Company Competitor CompanyDocument37 pagesInstitute Program Year Subject Project Name Company Competitor CompanyEashaa SaraogiPas encore d'évaluation

- Invesment LabDocument16 pagesInvesment Labtapasya khanijouPas encore d'évaluation

- AMTEK PNL-G4CorDocument7 pagesAMTEK PNL-G4CorAyush KapoorPas encore d'évaluation

- BEML LTDDocument18 pagesBEML LTDVishalPandeyPas encore d'évaluation

- Technofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialDocument57 pagesTechnofunda Investing Excel Analysis - Version 1.0: Watch Screener TutorialParth DanagayaPas encore d'évaluation

- Britannia Industries LTDDocument4 pagesBritannia Industries LTDMEENU MARY MATHEWS RCBSPas encore d'évaluation

- Accounts CA 1Document19 pagesAccounts CA 1Neha NehaPas encore d'évaluation

- Karur Vysya BankDocument18 pagesKarur Vysya BankVishalPandeyPas encore d'évaluation

- COMPANY/FINANCE/PROFIT AND LOSS/175/Nestle IndiaDocument1 pageCOMPANY/FINANCE/PROFIT AND LOSS/175/Nestle IndiabhuvaneshkmrsPas encore d'évaluation

- Summary BenchmarkDocument28 pagesSummary BenchmarkADPas encore d'évaluation

- P&L AvtDocument4 pagesP&L AvtNamit BaserPas encore d'évaluation

- Pincon SpiritDocument10 pagesPincon SpiritdishasumitPas encore d'évaluation

- Zen TechnologiesDocument10 pagesZen Technologieschandrajit ghoshPas encore d'évaluation

- Trailing QTR ResultsDocument1 pageTrailing QTR ResultsbhuvaneshkmrsPas encore d'évaluation

- SKF IndiaDocument12 pagesSKF IndiaKartik Maheshwari HolaniPas encore d'évaluation

- Mahindra Ratio Sesha SirDocument9 pagesMahindra Ratio Sesha SirAscharya DebasishPas encore d'évaluation

- Jindal SteelDocument18 pagesJindal SteelVishalPandeyPas encore d'évaluation

- PCBL ValuationDocument6 pagesPCBL ValuationSagar SahaPas encore d'évaluation

- Shreeji TranslogDocument10 pagesShreeji TranslogsemledeztcvyjnmmnuPas encore d'évaluation

- Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Trailing Best Case Worst CaseDocument9 pagesMar-15 Mar-16 Mar-17 Mar-18 Mar-19 Trailing Best Case Worst CaseYASH KOTHARIPas encore d'évaluation

- Company Name - Deepak Nitrite Soumya Upadhyay 110 EBIZ 2 Sujay Singhvi 112 EBIZ 2Document14 pagesCompany Name - Deepak Nitrite Soumya Upadhyay 110 EBIZ 2 Sujay Singhvi 112 EBIZ 2Sujay SinghviPas encore d'évaluation

- Narration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CaseDocument18 pagesNarration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CaseVishalPandeyPas encore d'évaluation

- Swadeshi PolytexDocument10 pagesSwadeshi Polytexshauryaslg1Pas encore d'évaluation

- Asian OilfieldDocument9 pagesAsian OilfieldCm ShegrafPas encore d'évaluation

- CEAT Financial Model - ProjectionsDocument10 pagesCEAT Financial Model - ProjectionsYugant NPas encore d'évaluation

- CEAT Financial Model - ProjectionsDocument10 pagesCEAT Financial Model - ProjectionsClasherPas encore d'évaluation

- 1 - Abhinav - Raymond Ltd.Document5 pages1 - Abhinav - Raymond Ltd.rajat_singlaPas encore d'évaluation

- RATIOS (Common Size Balance Sheet)Document4 pagesRATIOS (Common Size Balance Sheet)meenakshi vermaPas encore d'évaluation

- Federal BankDocument18 pagesFederal BankvishalPas encore d'évaluation

- FSA ASSIGNMENT-3 AnchalDocument4 pagesFSA ASSIGNMENT-3 AnchalAnchal ChokhaniPas encore d'évaluation

- Consolidated Balance Sheet of Cipla - in Rs. Cr.Document7 pagesConsolidated Balance Sheet of Cipla - in Rs. Cr.Neha LalPas encore d'évaluation

- Arvind LTD: Balance Sheet Consolidated (Rs in CRS.)Document8 pagesArvind LTD: Balance Sheet Consolidated (Rs in CRS.)Sumit GuptaPas encore d'évaluation

- Eveready Industries India Balance Sheet - in Rs. Cr.Document5 pagesEveready Industries India Balance Sheet - in Rs. Cr.Jb SinghaPas encore d'évaluation

- AFSA - Group 7 - Havells Vs BajajDocument103 pagesAFSA - Group 7 - Havells Vs BajajArnnava SharmaPas encore d'évaluation

- Avenue SuperDocument18 pagesAvenue SuperVishalPandeyPas encore d'évaluation

- Narration Sep-08 Sep-09 Sep-10 Sep-11 Sep-12 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CaseDocument18 pagesNarration Sep-08 Sep-09 Sep-10 Sep-11 Sep-12 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CasevishalPas encore d'évaluation

- Narration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CaseDocument8 pagesNarration Mar-09 Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Trailing Best Case Worst CaseAnuj SharmaPas encore d'évaluation

- Projections 11.03.2024 V2Document1 pageProjections 11.03.2024 V2ca.vitalconsultantsPas encore d'évaluation

- Hariyana ShipDocument10 pagesHariyana ShipJeniffer RayenPas encore d'évaluation

- Daksh Agarwal FSA&BV Project On Ratio Analysis of United BreweriesDocument42 pagesDaksh Agarwal FSA&BV Project On Ratio Analysis of United Breweriesdaksh.agarwal180Pas encore d'évaluation

- Coffee Day EnterDocument10 pagesCoffee Day EnterHari KrishnaPas encore d'évaluation

- Narration Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Trailing Best Case Worst CaseDocument10 pagesNarration Mar-10 Mar-11 Mar-12 Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18 Mar-19 Trailing Best Case Worst Caseraj chopdaPas encore d'évaluation

- Balancesheet of Mukund CompanyDocument5 pagesBalancesheet of Mukund CompanyHusen AliPas encore d'évaluation

- Hathway CableDocument12 pagesHathway CableFIN GYAANPas encore d'évaluation

- JSW Energy: Horizontal Analysis Vertical AnalysisDocument15 pagesJSW Energy: Horizontal Analysis Vertical Analysissuyash gargPas encore d'évaluation

- Kalpataru PowerDocument18 pagesKalpataru PowerVishalPandeyPas encore d'évaluation

- Bank of IndiaDocument18 pagesBank of IndiaVishalPandeyPas encore d'évaluation

- Surajit SahaDocument30 pagesSurajit SahaAgneesh DuttaPas encore d'évaluation

- Lanco InfratechDocument18 pagesLanco InfratechvishalPas encore d'évaluation

- Finance Balance Sheet IND SRF LTD Year 202203 202103 202003 201903 201803Document39 pagesFinance Balance Sheet IND SRF LTD Year 202203 202103 202003 201903 201803Agneesh DuttaPas encore d'évaluation

- Financial PerformanceDocument2 pagesFinancial PerformanceShobha SureshPas encore d'évaluation

- Gujarat Mineral Development Corporation Standalone Balance Sheet (In Rs. CR.)Document128 pagesGujarat Mineral Development Corporation Standalone Balance Sheet (In Rs. CR.)Riya ShahPas encore d'évaluation

- Kapco LTD: For The Year Ended 2007Document10 pagesKapco LTD: For The Year Ended 2007Zeeshan AdeelPas encore d'évaluation

- JD - Retention MarketingDocument1 pageJD - Retention MarketingShashank PatelPas encore d'évaluation

- CAT 2019 Study PlanDocument16 pagesCAT 2019 Study PlanShashank PatelPas encore d'évaluation

- CAT 2019 Study PlanDocument16 pagesCAT 2019 Study PlanShashank PatelPas encore d'évaluation

- EY Repprt Future TV Industry India (2014) PDFDocument8 pagesEY Repprt Future TV Industry India (2014) PDFShashank PatelPas encore d'évaluation

- THREEDocument4 pagesTHREEShashank PatelPas encore d'évaluation

- Asdfghjkl LKJGFXZDocument12 pagesAsdfghjkl LKJGFXZShashank PatelPas encore d'évaluation

- Magic Bullet TheoryDocument3 pagesMagic Bullet TheoryShashank PatelPas encore d'évaluation

- Money ControlDocument4 pagesMoney ControlShashank PatelPas encore d'évaluation

- JSW SteelDocument34 pagesJSW SteelShashank PatelPas encore d'évaluation

- Asean Study PDFDocument72 pagesAsean Study PDFShashank PatelPas encore d'évaluation

- Mehta AutoCare Pvt. Ltd.Document30 pagesMehta AutoCare Pvt. Ltd.Shashank PatelPas encore d'évaluation

- Obsession For PerfectionDocument10 pagesObsession For PerfectionShashank PatelPas encore d'évaluation

- AnalysisSheet NewDocument635 pagesAnalysisSheet NewShashank PatelPas encore d'évaluation

- SalesDocument5 pagesSalesShashank PatelPas encore d'évaluation

- 3413.696 Internet +TVDocument7 pages3413.696 Internet +TVShashank PatelPas encore d'évaluation

- RevenueDocument2 pagesRevenueShashank PatelPas encore d'évaluation

- Israel Rabbit FarmDocument14 pagesIsrael Rabbit FarmMAVERICK MONROEPas encore d'évaluation

- Athol Furniture, IncDocument21 pagesAthol Furniture, Incvinoth kumar0% (1)

- Pouring Concrete 1floorDocument2 pagesPouring Concrete 1floorNimas AfinaPas encore d'évaluation

- To Payment of Electricity Expenses For The Period of - As Per Billing Statement Hereto AttachedDocument6 pagesTo Payment of Electricity Expenses For The Period of - As Per Billing Statement Hereto AttachedShiela E. EladPas encore d'évaluation

- MNC012 Manajemen Pemasaran II PPT Sesi 4Document17 pagesMNC012 Manajemen Pemasaran II PPT Sesi 4Frizky PratamaPas encore d'évaluation

- Profit Maximization: B-Pure MonopolyDocument11 pagesProfit Maximization: B-Pure MonopolyChadi AboukrrroumPas encore d'évaluation

- Company First Name Last Name Job TitleDocument35 pagesCompany First Name Last Name Job Titleethanhunt3747Pas encore d'évaluation

- WEF A Partner in Shaping HistoryDocument190 pagesWEF A Partner in Shaping HistoryAbi SolaresPas encore d'évaluation

- Tubo FSDocument7 pagesTubo FSdemonjoePas encore d'évaluation

- What Is CreditDocument5 pagesWhat Is CreditKamil Aswad ElPas encore d'évaluation

- Investment Houses Securities BrokersDealersDocument35 pagesInvestment Houses Securities BrokersDealersbessmasanquePas encore d'évaluation

- Problem - PROFORMA BALANCE SHEET WITH CHOICE OF FINANCINGDocument6 pagesProblem - PROFORMA BALANCE SHEET WITH CHOICE OF FINANCINGJohn Richard Bonilla100% (4)

- Short Term FinancingDocument1 pageShort Term FinancingJouhara G. San JuanPas encore d'évaluation

- Thesis On MilkDocument80 pagesThesis On Milkvplou7Pas encore d'évaluation

- Cambria Tail Risk ETF: Strategy Overview Fund DetailsDocument2 pagesCambria Tail Risk ETF: Strategy Overview Fund Detailscena1987Pas encore d'évaluation

- AN - ARCHITECTURE - GUIDE - Vol 2Document137 pagesAN - ARCHITECTURE - GUIDE - Vol 2EL100% (1)

- Invoice Act May 2022Document2 pagesInvoice Act May 2022Pavan kumarPas encore d'évaluation

- What Might Happen in China in 2016Document9 pagesWhat Might Happen in China in 2016Henrique SartoriPas encore d'évaluation

- 2 Wheeler Automobile IndustryDocument9 pages2 Wheeler Automobile IndustryShankeyPas encore d'évaluation

- Icaew Cfab Mi 2018 Sample Exam 3Document30 pagesIcaew Cfab Mi 2018 Sample Exam 3Anonymous ulFku1v100% (2)

- SalconDocument136 pagesSalconJames WarrenPas encore d'évaluation

- Starting A Hedge FundDocument7 pagesStarting A Hedge FundTrey 'Sha' ChaversPas encore d'évaluation

- ENTREP - What Is A Value ChainDocument4 pagesENTREP - What Is A Value Chainandrei cabacunganPas encore d'évaluation

- Business OrganizationsDocument28 pagesBusiness OrganizationsRudraraju ChaitanyaPas encore d'évaluation

- Senka Dindic - CV EnglishDocument2 pagesSenka Dindic - CV EnglishAntonela ĐinđićPas encore d'évaluation

- 2014.3.12.dive Thru Resort - Employment Contract v.1Document6 pages2014.3.12.dive Thru Resort - Employment Contract v.1em quintoPas encore d'évaluation

- Chapter 10 Transaction Exposure: Multinational Business Finance, 14e (Eiteman)Document17 pagesChapter 10 Transaction Exposure: Multinational Business Finance, 14e (Eiteman)EnciciPas encore d'évaluation

- Session 2 (CH 1 - Introduction To Valuation)Document27 pagesSession 2 (CH 1 - Introduction To Valuation)Arun KumarPas encore d'évaluation

- Model ALM PolicyDocument9 pagesModel ALM Policytreddy249Pas encore d'évaluation

- Sem6 RatioAnalysisLecture 6 JuhiJaiswal 19apr2020Document8 pagesSem6 RatioAnalysisLecture 6 JuhiJaiswal 19apr2020Hanabusa Kawaii IdouPas encore d'évaluation