Académique Documents

Professionnel Documents

Culture Documents

Milwaukee - Office - 1/1/2008

Transféré par

Russell KlusasDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Milwaukee - Office - 1/1/2008

Transféré par

Russell KlusasDroits d'auteur :

Formats disponibles

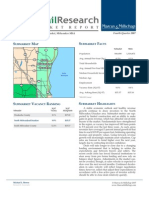

Down 3 Places 2008 Rank: 41 2007 Rank: 38 Milwaukee

Tenants and Investors Targeting

Properties in Downtown Milwaukee

Employment Trends

T

he Milwaukee office market is expected to face a year of mixed

performance in 2008 as employers trim payrolls and developers Nonfarm Office-Using

3%

accelerate deliveries of new space. The employment outlook is mixed;

office-using jobs associated with the local manufacturing industries will

Year-over-Year Change

decline this year, though losses will be largely offset by solid gains in the 2%

educational and health services sector, stimulating demand for medical

office space. Much of the demand for office space will be centered in the 1%

Downtown Milwaukee submarket, as a growing number of companies are

moving their headquarters into the city center. Manpower and Infinity, for 0%

example, both recently signed large leases for space downtown, signaling

that Milwaukee’s office rebirth will begin in the city’s core. As such, owners -1%

in some submarkets, including Brookfield and North Suburban, will increase 04 05 06 07 08**

concessions to attract and maintain their current tenant base. In West

Waukesha County, however, conditions will remain tight, providing area Office Supply and Demand

owners significant leverage when negotiating new leases. 2.0 Completions Absorption 20%

Vacancy

After slowing considerably in 2007, investment activity for local office

Square Feet (millions)

1.5 18%

assets has reached a sustainable pace. Much of the market’s appeal comes

Vacancy Rate

from initial yields in the high-7 percent range, a healthy premium over the

national average. Additionally, tenancies in the market have remained 1.0 16%

somewhat steady over the past several years due to builders’ general

reluctance to bring speculative office space to the metro. Institutional 0.5 14%

investors will maintain their focus on higher-quality assets that are priced

below replacement costs, particularly those with long-term leases in place. 0.0 12%

Given the metro’s relatively low prices and significant supply of Class B 04 05 06 07 08**

office product, large buyers can expand their portfolios quickly. Local buyers

will compete for Class B listings with institutions and syndicators in the Rent Trends

coming year, which should support some gains in valuations. Asking Rent Effective Rent

$20

2008 Market Outlook

Rent per Square Foot

$18

◆ 2008 NOPI Rank: 41, Down 3 Places. Forecasts for net job losses kept

Milwaukee near the bottom of this year’s ranking. $16

◆ Employment Forecast: Employers will trim 600 positions from payrolls $14

in 2008, a 0.1 percent decrease. Office users are expected to eliminate 200

jobs by year end, also a decline of 0.1 percent.

$12

04 05 06 07 08**

◆ Construction Forecast: Office construction will accelerate to 900,000

square feet in 2008, boosting stock by 3.1 percent. Last year, only 136,000

square feet of competitive office space came online. Sales Trends

$110

◆ Vacancy Forecast: The combination of job losses and accelerated con-

Median Price per Square Foot

struction activity will push vacancy up 70 basis points to 14.3 percent

this year. In 2007, vacancy improved 60 basis points. $105

◆ Rent Forecast: Asking rents will reach $19.52 per square foot by year- $100

end 2008, while effective rents advance to $16.02 per square foot, both

gains of 2.8 percent. $95

◆ Investment Forecast: Investors may want to consider infill properties in

$90

Downtown Milwaukee, where the metro’s revitalization will be 03 04 05 06 07*

centered and the redevelopment of brownfields makes new construction

costly to developers. * Estimate ** Forecast

Market Forecast Employment: 0.1% ▼ Construction: 562% ▲ Vacancy: 70 bps ▲ Asking Rents: 2.8% ▲

2008 Annual Report page 29

Vous aimerez peut-être aussi

- Single Tenant - RSC Euipment Rental - Dubuque IADocument51 pagesSingle Tenant - RSC Euipment Rental - Dubuque IARussell KlusasPas encore d'évaluation

- Capital Alert - 9/5/2008Document1 pageCapital Alert - 9/5/2008Russell KlusasPas encore d'évaluation

- Capital Alert - 8/22/2008Document1 pageCapital Alert - 8/22/2008Russell KlusasPas encore d'évaluation

- Capital Alert - 8/29/2008Document1 pageCapital Alert - 8/29/2008Russell KlusasPas encore d'évaluation

- Capital Markets - 8/15/2008Document2 pagesCapital Markets - 8/15/2008Russell KlusasPas encore d'évaluation

- Single Tenant - RSC - Mankato MNDocument19 pagesSingle Tenant - RSC - Mankato MNRussell KlusasPas encore d'évaluation

- The Platinum Building: Offering MemorandumDocument37 pagesThe Platinum Building: Offering MemorandumRussell KlusasPas encore d'évaluation

- Milwaukee - Office - 8/7/08Document4 pagesMilwaukee - Office - 8/7/08Russell KlusasPas encore d'évaluation

- CapAlertPDF 072508Document1 pageCapAlertPDF 072508Russell KlusasPas encore d'évaluation

- National - Industrial Market - 1/1/2008Document4 pagesNational - Industrial Market - 1/1/2008Russell KlusasPas encore d'évaluation

- Indianapolis - Office - 8/7/08Document4 pagesIndianapolis - Office - 8/7/08Russell KlusasPas encore d'évaluation

- Capital Alert - 7/12/2008Document1 pageCapital Alert - 7/12/2008Russell KlusasPas encore d'évaluation

- Chicago - Office - 8 8 08Document4 pagesChicago - Office - 8 8 08Russell Klusas100% (1)

- National - Industrial - 1/1/2008Document46 pagesNational - Industrial - 1/1/2008Russell KlusasPas encore d'évaluation

- DesMoines Submarket - Retail - 10/1/2007Document2 pagesDesMoines Submarket - Retail - 10/1/2007Russell KlusasPas encore d'évaluation

- National - Industrial - 9/1/2007Document4 pagesNational - Industrial - 9/1/2007Russell KlusasPas encore d'évaluation

- Chicago - South Cook County Submarket - Industrial - 1/1/2008Document2 pagesChicago - South Cook County Submarket - Industrial - 1/1/2008Russell KlusasPas encore d'évaluation

- Chicago - Industrial - 1/1/2008Document1 pageChicago - Industrial - 1/1/2008Russell KlusasPas encore d'évaluation

- Milwaukee - Waukesha County Submarket - Retail - 10/1/2007Document2 pagesMilwaukee - Waukesha County Submarket - Retail - 10/1/2007Russell KlusasPas encore d'évaluation

- Milwaukee - Industrial - 4/1/2008Document2 pagesMilwaukee - Industrial - 4/1/2008Russell KlusasPas encore d'évaluation

- Chicago - Southwest Submarket - Retail - 1/1/2008Document2 pagesChicago - Southwest Submarket - Retail - 1/1/2008Russell KlusasPas encore d'évaluation

- Milwaukee - Retail Construction - 4/1/2008Document3 pagesMilwaukee - Retail Construction - 4/1/2008Russell Klusas100% (1)

- Milwaukee - North Submarket - Retail - 10/1/2007Document2 pagesMilwaukee - North Submarket - Retail - 10/1/2007Russell KlusasPas encore d'évaluation

- Milwaukee - Retail - 4/1/2008Document4 pagesMilwaukee - Retail - 4/1/2008Russell KlusasPas encore d'évaluation

- Chicago - South Submarket - Retail - 7/1/2007Document2 pagesChicago - South Submarket - Retail - 7/1/2007Russell KlusasPas encore d'évaluation

- National - Retail - 1/1/2008Document66 pagesNational - Retail - 1/1/2008Russell KlusasPas encore d'évaluation

- Chicago - Far South Submarket - Retail - 7/1/2007Document2 pagesChicago - Far South Submarket - Retail - 7/1/2007Russell KlusasPas encore d'évaluation

- Indianapolis - Retail Construction - 4/1/2008Document4 pagesIndianapolis - Retail Construction - 4/1/2008Russell Klusas100% (1)

- Chicago - Lombard Addison Submarket - Retail - 4/1/2007Document2 pagesChicago - Lombard Addison Submarket - Retail - 4/1/2007Russell KlusasPas encore d'évaluation

- Milwaukee - South Milwaukee County Submarket - Retail - 10/1/2007Document2 pagesMilwaukee - South Milwaukee County Submarket - Retail - 10/1/2007Russell KlusasPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Secured Transactions - LoPucki Casebook ProblemsDocument72 pagesSecured Transactions - LoPucki Casebook ProblemsEmmanuel Ulubiyo97% (36)

- Proposed Lease Agreement Monarch ClubDocument9 pagesProposed Lease Agreement Monarch ClubCalvawell MuzvondiwaPas encore d'évaluation

- Henry Litam Vs EspirituDocument2 pagesHenry Litam Vs EspirituRoman Kushpatrov50% (2)

- Slums Case StudyDocument20 pagesSlums Case StudyKoushali BanerjeePas encore d'évaluation

- FAR - CHAPTER 10 NotesDocument6 pagesFAR - CHAPTER 10 NotesikiPas encore d'évaluation

- Depra HSJSNSNDocument2 pagesDepra HSJSNSNkumiko sakamotoPas encore d'évaluation

- S016 - Dinesh Kumar - Assignment 3Document3 pagesS016 - Dinesh Kumar - Assignment 3kirtiPas encore d'évaluation

- Proposal To Lease Commercial SpaceDocument2 pagesProposal To Lease Commercial SpaceMunashe Kombora75% (4)

- Other Bank Functions Estrella, Jin Paula CDocument6 pagesOther Bank Functions Estrella, Jin Paula CJin EstrellaPas encore d'évaluation

- Sample Question Papers For Certificate Course On Ind AS: The Institute of Chartered Accountants of IndiaDocument36 pagesSample Question Papers For Certificate Course On Ind AS: The Institute of Chartered Accountants of IndiaChristen CastilloPas encore d'évaluation

- Sales ReviewerDocument53 pagesSales ReviewerroansalangaPas encore d'évaluation

- Araneta V PaternoDocument5 pagesAraneta V PaternopurplebasketPas encore d'évaluation

- Supply GSTDocument16 pagesSupply GSTMehak Kaushikk100% (1)

- BA Finance Corp. v. Court of AppealsDocument6 pagesBA Finance Corp. v. Court of AppealsCarlota Nicolas VillaromanPas encore d'évaluation

- Corrigendum-Gua MDO PDFDocument80 pagesCorrigendum-Gua MDO PDFJitendra KumarPas encore d'évaluation

- Revised IFRS 16 Lease Math 1, 2Document8 pagesRevised IFRS 16 Lease Math 1, 2Feruz Sha Rakin100% (1)

- Concept-Commodatum ReviewerDocument7 pagesConcept-Commodatum ReviewerHi Law SchoolPas encore d'évaluation

- Car Lease Agreement Format - FY 2020 - 21Document2 pagesCar Lease Agreement Format - FY 2020 - 21Ganesh Newarkar100% (1)

- The Period of The RuleDocument24 pagesThe Period of The RuleKoustubh MohantyPas encore d'évaluation

- Agrarian Law and Social Legis Case Digests (2019-2020)Document6 pagesAgrarian Law and Social Legis Case Digests (2019-2020)Ara LimPas encore d'évaluation

- Property (Arts. 414-465)Document22 pagesProperty (Arts. 414-465)Nur OmarPas encore d'évaluation

- Law ReviewerDocument21 pagesLaw Reviewerabigail ann100% (1)

- Agency Trust and PartnershipDocument38 pagesAgency Trust and PartnershipCarlo John C. RuelanPas encore d'évaluation

- Stone Mountain Park RFPDocument266 pagesStone Mountain Park RFPTyler EstepPas encore d'évaluation

- 5100 Hundred Rupees: Indea Non JudicialDocument4 pages5100 Hundred Rupees: Indea Non JudicialLol AnPas encore d'évaluation

- Open Sea Cage Culture APDocument22 pagesOpen Sea Cage Culture APPurna Chand AnumoluPas encore d'évaluation

- FS71 Park Homes FcsDocument16 pagesFS71 Park Homes FcstradehousePas encore d'évaluation

- Far Volume 1, 2 and 3 TheoryDocument17 pagesFar Volume 1, 2 and 3 TheoryKimberly Etulle CelonaPas encore d'évaluation

- Class 4 HW MaterialDocument44 pagesClass 4 HW MaterialZihao ChenPas encore d'évaluation

- (Corp) 21 - Gregorio Araneta, Inc. V Tuason de Paterno - ParafinaDocument3 pages(Corp) 21 - Gregorio Araneta, Inc. V Tuason de Paterno - ParafinaAlecParafinaPas encore d'évaluation