Académique Documents

Professionnel Documents

Culture Documents

LEAFLETS - Accounting For VAT

Transféré par

miho motoTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

LEAFLETS - Accounting For VAT

Transféré par

miho motoDroits d'auteur :

Formats disponibles

You must show the VAT claimed as a separate total in your These notes are for guidance only.

nly. They reflect the Law and the

purchase records. Department’s position at the time of publication. They do not

replace the Legislation or affect your Rights of Appeal about

The basic T- account transaction is as follows: your tax position.

Transaction (VAT Rate is 15%)

If in doubt, consult the Inland Revenue Department, VAT Accounting

for VAT

1. Section.

Business buys goods to sell for cash VAT Each leaflet covers just one topic. Other leaflets you may find

Inclusive - $3,000 + 450 VAT useful include:

2. What is VAT?

Business sells goods for cash - $6,000 + $900 Should I be registered for VAT?

VAT How to register for VAT?

3. After Registration

Business sells foods on credit - $5,000 + 750 VAT Basic Supply Rules

4.

Mixed Supply Rules

Business imports foods to sell on credit

Accounting for VAT

- $30,000 + $4,500 VAT

Reporting the VAT

Penalties and Offences under the VAT Act

VAT Legislative Overview

VAT and the Consumer

Filing VAT Returns

VAT Documents

Input Tax Deductions

VAT & Entertainment

Transitional Provisions

You can get further help and copies of forms and information

leaflets from the Inland Revenue Department in Castries, Vieux

Fort and Soufriere or The VAT Section, Manoel Street, Castries.

List of typical “business records” include:

• Annual accounts, including profit and loss accounts

• Bank statements and deposit slips

• Cashbooks and other account books

• Purchase invoices and copy sales invoices For further information contact us at:

• VAT Credit or debit notes

• Orders and delivery notes Tel: (758) 468 1420

• Purchase and sales books Email: vatcoordinator@vat.gov.lc

• Records of daily takings such as till rolls vatinfo@vat.gov.lc

• Import and export documents

Website: www.vat.gov.lc

• Business correspondence

• Your VAT account © Ministry of Finance

Inland Revenue Department

April 2012

Standard -rate Other rate Zero-rate Exempt

Total

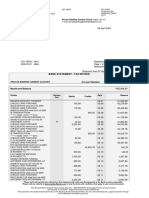

If you are a VAT registered business, you must keep records worksheet is used to record the summary of the daily sales, the For Total

each tax period, you must add up the VAT that you

of all the supplies you make and receive, and a summary of amount of VAT you have charged and the amount of VAT you can deduct as input VAT and transfer the total to your VAT

VAT charged and paid/payable for each tax period covered have been charged. A summary of the VAT transactions is then Account.

by your tax returns. transferred to the VAT Account. Sample 2 -Input Tax Worksheet

The VAT Account is a summary of output and input VAT for INVOICE/Custom INVOICE/ SUPPLIER'S TAXABLE

This summary is called the “VAT Account”. each tax period (monthly). DATE Entry TIN# SUPPLIER VALUE VAT TOTAL

INVOICE/Custom INVOICE/ SUPPLIER'S TAXABLE

The information in your VAT worksheet/ account will help you DATE Entry TIN# SUPPLIER VALUE VAT TOTAL

This leaflet tells you about these records, and how best to to complete your tax return at the end of each tax period.

keep them. Remember that there are penalties for failing to

keep proper VAT records a requirement of the VAT Act. Sample 1 - Output Tax worksheet Total

Date Invoice # Supplies / Sales Output tax Total

What records must I keep?

These

Total applicable totals should be transferred to the Tax account/ worksheet or return

Standard -rate Other rate Zero-rate Exempt

You must keep: VAT Account

Input Tax $ Output Tax $

Domestic purchases Supply of goods/services

Input Tax $ Output Tax $

A record of taxable goods and services you Imports Debit note issued

receive(purchase) or supply (sales) as part of your Total

Domestic

Debit note purchases

received Supply

Credit noteofreceived

goods/services

business—this includes supplies at the standard rate Imports

Credit note issued Debit

Bad debtnote issued

recovered

(15%), the lower rate (8%), and at the zero-rate; and Totals from this worksheet should be transferred to the VAT account / worksheet or return.

Debit note received

Bad debt Credittaken

Goods note for

received

non-business

A separate record of any exempt supplies that you Credit note issued

Adjustments for errors etc

Bad debt recovered

Adjustments for errors etc

make or receive.

How do I record my purchases?

Bad debt Goods taken for non-business

You do not have to keep these records in any set way. But, Total Input taxfor

Adjustments allowable

errors etc Total output tax for errors etc

Adjustments

they must be complete and up-to-date, and the figures INVOICE/Custom INVOICE/ SUPPLIER'S TAXABLE Less Input tax allowable

that you use to complete your VAT return must be easy to Your

DATE suppliers’ tax invoices

Entry TIN# will SUPPLIER

show you all theVAT

VALUE details you

TOTAL Tax payable/creditable

Total Input tax allowable Total output tax

find. Usually, your normal business records can be adapted need. Make a summary of the invoices in the same order as

Less Input tax allowable

to give this information. If you find this difficult, ask for you keep or file them. You can make a list of the invoices as

Tax payable/creditable

help from Inland Revenue Department, VAT you receive them, or you may be able to adapt your

Section. cashbook to serve as a summary of purchases.

Total

You may find it useful to number the invoices and record the

How do I record my sales (supplies)? same numbers against the entries in your summary.

What about credit and debit notes?

Input Tax $ Output Tax $

You may make a summary of your tax invoices, and must Your summary must show separate totals at each rate of VAT

Domestic purchases Supply of goods/services

keep copies of them. Your summary should be in the same for: These must show similar details as for a tax invoice, except

Imports Debit note issued

order as your invoices, and show separate totals at each that instead of “tax invoice” they must show either “tax

rate of VAT for: • VATDebit

onnoteimports

received (if any) Credit note received

credit note” or “tax debit note” and the value of the supply

• VAT on your sales(supplies) (Cash/ Credit) • VATCredit

that noteyou

issued have been charged

Bad debt on business purchases

recovered

shown on the original tax invoice, the corrected value, the

• Value of your sales excluding VAT collected • Cost

Badof

debtyour purchases excluding VAT for paid

Goods taken non-business

difference, and the tax charges which relate to that

• Any exempt sales Adjustments for errors etc Adjustments for errors etc difference. In addition, they must contain a brief

You must also keep a separate record of any business

explanation of the circumstances giving rise to the issuing

If you provide any goods or services at no charge, or take purchases on which you cannot deduct input tax:- these are

Total Input tax allowable Total output tax of the note and sufficient information to identify the

any goods from your stock for private use, you must also called “non-deductible inputs” Less

forInput

example:

tax allowable original supply—such as the original tax invoice number.

record: Tax payable/creditable

• What the goods or services were • Passenger vehicles, spare parts, and repair and

• The date you took the goods from stock maintenance service (except if the vehicle is used How do I record my imports?

• The rate and amount of VAT chargeable exclusively for business purposes or you trade in vehicle

• The value of the goods or services excluding the VAT sales)

chargeable • Entertainment VAT is normally payable at the time you import goods or

• Fees and subscription for social and recreational clubs remove them from a warehouse. If you are VAT registered,

At the end of each period, you must add up the VAT shown to claim the VAT you paid on imported goods, you must

in all these records and transfer it to your VAT Account as have official evidence of the amounts involved—such as a

output tax. For most operations, it is advisable that a daily copy of the entry or other customs document.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- PFRS Adopted by SEC As of December 31, 2011 PDFDocument27 pagesPFRS Adopted by SEC As of December 31, 2011 PDFJennybabe PetaPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Philippines Regions: LuzonDocument7 pagesPhilippines Regions: Luzonmiho motoPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Philippines RegionsDocument7 pagesPhilippines Regionsmiho motoPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- Concepts of Agrarian Reform PDFDocument16 pagesConcepts of Agrarian Reform PDFmiho motoPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Philippines RegionsDocument7 pagesPhilippines Regionsmiho motoPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- TAX REMEDIES by Sababan Reviewer 2008 EdDocument11 pagesTAX REMEDIES by Sababan Reviewer 2008 Edolaydyosa95% (20)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Bank Challan Form PDFDocument1 pageBank Challan Form PDFNekib AliPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Understanding and Using Quick Books Tax CodesDocument6 pagesUnderstanding and Using Quick Books Tax CodesColin GoudiePas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Aeropostale Checkout ConfirmationDocument3 pagesAeropostale Checkout ConfirmationBladimilPujOlsChalasPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- Warehouse KPIs TypesDocument19 pagesWarehouse KPIs TypesIldefonso OchoaPas encore d'évaluation

- Barge Container PDFDocument6 pagesBarge Container PDFAndreea MunteanuPas encore d'évaluation

- Building Manaement SystemDocument131 pagesBuilding Manaement SystemhemantPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Deepak Saini: Account Relationship SummaryDocument20 pagesDeepak Saini: Account Relationship SummaryDeepak SainiPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Online Receipts PrintDocument1 pageOnline Receipts PrintSagarPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- NTS - Candidate (Portal)Document2 pagesNTS - Candidate (Portal)arshad ahmadPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Gautam Engineers Limited: Schedule Sources of FundsDocument37 pagesGautam Engineers Limited: Schedule Sources of Fundsravibhartia1978Pas encore d'évaluation

- Tally Practical QuestionDocument18 pagesTally Practical QuestionBarani Dharan78% (326)

- Madhupayroll - Sap HR - HCM Indian Payroll Schemas and PCRDocument7 pagesMadhupayroll - Sap HR - HCM Indian Payroll Schemas and PCRMurali MohanPas encore d'évaluation

- UBL Internship Report InsightsDocument38 pagesUBL Internship Report InsightsshakeelPas encore d'évaluation

- Tally Document For Set 2Document4 pagesTally Document For Set 2Chandu123 ChanduPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- SEO-optimized title for BEST Undertaking customer care electric billDocument2 pagesSEO-optimized title for BEST Undertaking customer care electric billJignesh Gala33% (3)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Incometax Automatic Calculator With Form-16 For 2017-18 EDNNET Version 8.3Document30 pagesIncometax Automatic Calculator With Form-16 For 2017-18 EDNNET Version 8.3ragvijPas encore d'évaluation

- Packing and Packaging in LogisticsDocument26 pagesPacking and Packaging in Logisticsali3800100% (1)

- IRCTC Booking Confirmation for Train 22948 on 05-Aug-2019 from KIUL to STDocument1 pageIRCTC Booking Confirmation for Train 22948 on 05-Aug-2019 from KIUL to STSamar DasPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- 6 April 2023Document7 pages6 April 2023mapondaglodiPas encore d'évaluation

- RBI Draft Guidelines on Prepaid Payment InstrumentsDocument11 pagesRBI Draft Guidelines on Prepaid Payment InstrumentsAshutoshPas encore d'évaluation

- Bank Deposit Slip TitleDocument1 pageBank Deposit Slip TitleMuhammad Musharib Islam KhanPas encore d'évaluation

- Renewal ReceiptDocument2 pagesRenewal ReceiptAmanSharmaPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Benefit of GST: It Eliminates The Cascading Effect of Tax That Happened EarlierDocument3 pagesBenefit of GST: It Eliminates The Cascading Effect of Tax That Happened EarlierArushi VermaPas encore d'évaluation

- Complaint Against Kansas Attorney Sean Allen McElwain - December 25th, 2018Document8 pagesComplaint Against Kansas Attorney Sean Allen McElwain - December 25th, 2018Conflict GatePas encore d'évaluation

- Deptals 2Document6 pagesDeptals 2jenylyn acostaPas encore d'évaluation

- Route 10 Route 10: Waterfall Express To North Wollongong, Wollongong Wollongong, North Wollongong Express To WaterfallDocument5 pagesRoute 10 Route 10: Waterfall Express To North Wollongong, Wollongong Wollongong, North Wollongong Express To WaterfallBarzeen Mehr AfareenPas encore d'évaluation

- Bpmarineacademy - in Bpmarine Printc - Aspx Trnid 31738794&bookinid 31738794&refno 31738794&trctid 20200222164814555&getid 298917 PDFDocument2 pagesBpmarineacademy - in Bpmarine Printc - Aspx Trnid 31738794&bookinid 31738794&refno 31738794&trctid 20200222164814555&getid 298917 PDFaparajita upadhyaya100% (1)

- OCS Salary 22Document6 pagesOCS Salary 22Mangal SinghPas encore d'évaluation

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument27 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any SignaturemohitchakarnagarPas encore d'évaluation

- Caribbean Flip Flops Inventory Clerk ScheduleDocument18 pagesCaribbean Flip Flops Inventory Clerk ScheduleKristinePas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)