Académique Documents

Professionnel Documents

Culture Documents

Wca Case

Transféré par

Aum RaoDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Wca Case

Transféré par

Aum RaoDroits d'auteur :

Formats disponibles

ASSESSMENT OF BANK GUARANTEE LIMIT

Hi-Power Electrical Industries

a. Existing B G Limit 950.00

b. Outstanding BGs as on 31.10.2011 776.57

c. BG limit available (a-b) 173.43

d. BGs likely to be reversed during the year 41.00

e. BG limit available for the year (c+d) 214.43

f. BGs required for new contracts for which tenders are required to be 0.00

(Normally @ 5% of contract amount) (Not required)

g. Performance BGs at 10% for execution of new contracts expected to 1000.00

received during the year (Rs. 250 Crores assuming the strike rate of 40%)

h. Advance Payment Guarantees @ 5% retention money 500.00

i. Total additional BG requirement {(f+g+h)-e} 1285.57

CONTRACTORS ASSESSMENT

A

1 Total value of Work Contracts awarded 1000

2 Value of Work in hand 800

3 Value of work completed in next 12 months 800

4 Value of work to be completed every month on average basis 70

B

1 Value of material required for 12 months 800

2 Receivables for 12 months 200

3 Advances payments to be made for purchases 100

4 Expenses for month 50

Total B (1+2+3+4) 1150

C

Advance payment received 100

Credit Purchases 400

Total C (1+2) 500

D

Working Capital Required (B-C) 650

E

Out of this, amount to be met from own resources and other borrowings 162.50

OD limit required from Bank: (D-E) 487.50

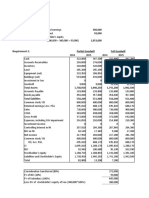

BALANCE SHEET

NAME OF BORROWER A/C No

LIABILITIES

Mar-16 Mar-17 2018 Prov2019 Proj

Paid-up Capital 200.00 250.00

Reserves & Surplus 150.00 180.00

General Reserves

Depreciation Reserve

Sub Total 350.00 430.00 0.00 0.00

TERM LIABILITIES

TL from Banks/AFI 176.00 226.00

Other deferred 120 120.00

Service Line & Security Depos

Deferred Tax Liability

Unsecured loans 80.00 20.00

Total Term Liabilities 376.00 366.00 0.00 0.00

CURRENT LIABILITIES

Borrowings from our Bank 130 250.00

Borrowings from Other Banks

Borrowings from Others

Total Borrowings 130.00 250.00 0.00 0.00

Sundry Creditors for Goods 120.00 140.00

Sundry Creditors for Others

Total Creditors 120.00 140.00 0.00 0.00

Provision for Taxes/Others 12.00 15.00

Instalments payable in 12 m 24.00 24.00

Deposits from Public/PF

Excess of Assets over Liability

Other Current Liabilities 40.00 38.00

Rent Deposits

Total Current Liabilities 326.00 467.00 0.00 0.00

TOTAL LIABILITIES 1052.00 ### 0.00 0.00

NAME OF BORROWER

PROFIT & LOSS ACCOUNT

EXPENDITURE

Mar-16 Mar-17 2018 Prov2019 Proj

R.M Purchased(inclg stores & spares)500.00 600

Add: Op. stock of R.M 50.00 100.00

Sub Total: 550.00 700.00 0.00 0.00

Less: Cl. Stock of R.M 300.00 200.00

R.M Consumed 250.00 500.00 0 0

Power & Fuel 200.00 150.00

Direct Labour 100.00 120.00

Repairs & Maintenance 40.00 30.00

Other Business Expenses 10 20.00

Depreciation 20 22.00

Sub Total: 620.00 842.00 0.00 0.00

Add: Op. W.I.P

Sub Total: 620.00 842.00 0 0

Less: Cl. W.I.P

Cost of Production 620.00 842.00 0.00 0.00

Add: Op. stock of F.G

Sub Total: 620.00 842.00 0.00 0.00

Less: Cl. Stock of F.G 200 150.00

Cost of Sales 420.00 692.00 0.00 0.00

Selling, General & Admin Exp.

Interest 30.00 37.00

Sub Total: 450.00 729.00 0.00 0.00

Operating Profit 550.00 371.00 0.00 0.00

Add: Non-operating Income 0.40

Sub Total: 550.00 371.40 0.00 0.00

Less: Non-operating Expenditure

Net Profit before Taxes 550.00 371.40 0.00 0.00

Provision for Taxes

Provision for Deferred Tax

Prior Period Receipt

Prior Period Charges

Net Profit After Tax 550.00 371.40 0.00 0.00

ALANCE SHEET

EXERCISE Cust. Id:

ASSETS 1

2019 Proj Mar-16 Mar-17 2018 Prov2019 Proj 2

Gross Block 450.00 440.00 3

Less: Depreciation 4

Net Block 450.00 440.00 0.00 0.00 5

Add: Capital Work in Progress 6

Total 450.00 440.00 0.00 0.00 7

NON CURRENT ASSETS

Security Deposits 20 30.00

Book debts > 6 months

Deferred Tax Asset 1

Margin on BG/LCs 2

Invetsments/Others 20.00 25.00 3

Sub Total 40.00 55.00 0.00 0.00 4

CURRENT ASSETS 5

Stock in Trade(Inventory) 6

a. Raw Material(Inclg spares) 7

b. Work In Progress 8

c. Finished Goods 200 250.00

Total Inventory 200.00 250.00 0.00 0.00

Book debts < 6 months 160.00 200.00 a

pre paid exp 15.00 22.00 b

Cash & Bank Balance 150.00 264.00 c

Short Term Loans & Advances d

Other Current Assets e

Total Current Assets 525.00 736.00 0.00 0.00

pre operative 7.00 2.00

Other intangibles(goodwi 30 30

Intangible Assets 37.00 32.00 0.00 0.00

TOTAL ASSETS 1052.00 1263.00 0.00 0.00

T & LOSS ACCOUNT

INCOME

2019 Proj Mar-16 Mar-17 2018 Prov2019 Proj

Gross Sales 1000.00 1100

Less: Excise Duty

Net Sales 1000.00 1100 0 0

Tangible Net Worth 313.00 398.00 0.00 0.00

Net Working Capital 199.00 269.00 0.00 0.00

Current Ratio 1.61 1.58 #DIV/0! #DIV/0!

TOL : TNW (Gearing) 2.24 2.09 #DIV/0! #DIV/0!

D : E Ratio 1.20 0.92 #DIV/0! #DIV/0!

Creditors Velocity 87.60 85.17 #DIV/0! #DIV/0!

Debtors Velocity 58.40 66.36 #DIV/0! #DIV/0!

Bank Borrowings to Sale 13.00 22.73 #DIV/0! #DIV/0!

Net Profit to Sales 55.00 33.76 #DIV/0! #DIV/0!

Op. Profit BIDT 600.00 430.00 0.00 0.00

Op. Profit to Sales 55.00 33.73 #DIV/0! #DIV/0!

Invetory Holding Level

R.M holding level 0 0 #DIV/0! #DIV/0!

W.I.P holding level 0 0 #DIV/0! #DIV/0!

F.G holding level 73 83 #DIV/0! #DIV/0!

Total Inveltory holdin le 73 83 #DIV/0! #DIV/0!

Inventory + Receivable/ 131.40 149.32 #DIV/0! #DIV/0!

R.M Cost to Sales 25.00 45.45 #DIV/0! #DIV/0!

Employee Cost to Sales 10.00 10.91 #DIV/0! #DIV/0!

Oth. Mfg. Exp. To Sales 1.00 1.82 #DIV/0! #DIV/0!

SGA Exp. To Sales 0.00 0.00 #DIV/0! #DIV/0!

Op. Profit BIDT/Op. Inco 1.09 1.16 #DIV/0! #DIV/0!

Growth in Sales 10.00 -100.00 #DIV/0!

Growth in Profits -32.47 -100.00 #DIV/0!

TURNOVER METHOD

Project Year 2015-16 2016-17 2017-18 2018-19

Estimated Sales 1000.00 1100.00 0.00 0.00

25.00% Estimated Sales 250.00 275.00 0.00 0.00

5.00% Margin 50.00 55.00 0.00 0.00

NWC 199.00 269.00 0.00 0.00

PBF (2-3)/(2-4) whichever is less 51.00 6.00 0.00 0.00

MPBF requested by the party 80.00 80.00 120.00 120.00

MPBF Recommended 80.00 80.00 120.00 120.00

METHOD - II

Project Year 2015-16 2016-17 2017-18 2018-19

Total Current Assets 525.00 736.00 0.00 0.00

Current liabilities( less Bank 196.00 217.00 0.00 0.00

borrow)

WC Gap 329.00 519.00 0.00 0.00

Margin - 25.00% Current Assets 131.25 184.00 0.00 0.00

NWC 199.00 269.00 0.00 0.00

PBF (3-4) / (3-5) whichever is less 130.00 250.00 0.00 0.00

MPBF requested by the party 80.00 80.00 120.00 120.00

MPBF Recommended 80.00 80.00 120.00 120.00

DRAWING POWER/LIMIT - INVENTORIES

Total Inventory 250.00 0.00 0.00

Less: Unpaid stocks (Creditors for purchaes) 140.00 0.00 0.00

Value of paid stock (a-b) 110.00 0.00 0.00

Less: Stipulated margin on stocks as per sanction 62.5 0 0

DP/DL on stocks (c-d) 47.50 0.00 0.00

DRAWING POWER/LIMIT - BOOK DEBTS

2010-11 2011-12 2012-13

(2-3) 220.00 0.00 0.00

(2-4) 6.00 0.00 0.00

(3-4) 335.00 0.00 0.00

(3-5) 250.00 0.00 0.00

Vous aimerez peut-être aussi

- Ayigya Central Hospital-July 2023Document7 pagesAyigya Central Hospital-July 2023Abubakari Abdul MananPas encore d'évaluation

- Brainlight Technologies PVT - LTD: KathmanduDocument8 pagesBrainlight Technologies PVT - LTD: KathmanduMallik DCPas encore d'évaluation

- Review On Financial Statements AnalysisDocument2 pagesReview On Financial Statements AnalysisJohn Carl SoledadPas encore d'évaluation

- Cash Flow Statement Cash AnalysisDocument21 pagesCash Flow Statement Cash Analysisshrestha.aryxnPas encore d'évaluation

- Financial Analysis DashboardDocument11 pagesFinancial Analysis DashboardZidan ZaifPas encore d'évaluation

- Module 2 - Financial StatementsDocument6 pagesModule 2 - Financial Statementskemifawole13Pas encore d'évaluation

- Buscom SeatworkDocument3 pagesBuscom SeatworkTintin AquinoPas encore d'évaluation

- Illustrative Full Set of IFRS For SME Financial StatementsDocument16 pagesIllustrative Full Set of IFRS For SME Financial StatementsGirma NegashPas encore d'évaluation

- Financial Statements - 2020 - EXAMPLE - 1 - For ClassDocument7 pagesFinancial Statements - 2020 - EXAMPLE - 1 - For ClassBakir PeljtoPas encore d'évaluation

- Practice Questions - SOLUTIONSDocument7 pagesPractice Questions - SOLUTIONSShuting QinPas encore d'évaluation

- Managerial Accounting PPDocument42 pagesManagerial Accounting PPSaurav KumarPas encore d'évaluation

- Application Level Taxation II Nov Dec 2013Document3 pagesApplication Level Taxation II Nov Dec 2013MahediPas encore d'évaluation

- Instructions:: Apollo Preliminary Analytical Procedures Audit Mini-CaseDocument14 pagesInstructions:: Apollo Preliminary Analytical Procedures Audit Mini-CaseShefali GoyalPas encore d'évaluation

- Global & Creative Consultancy7475Document7 pagesGlobal & Creative Consultancy7475Mallik DCPas encore d'évaluation

- Accounts Solution Mock 2 12-11Document21 pagesAccounts Solution Mock 2 12-11Foundation Group tuitionPas encore d'évaluation

- Baf 422 Continous Assessment Test Class Assignment 20240328Document5 pagesBaf 422 Continous Assessment Test Class Assignment 20240328briankuria21Pas encore d'évaluation

- 99 A Benzeer Tanha Funfin FinalsDocument7 pages99 A Benzeer Tanha Funfin FinalsBenzeer TanhaPas encore d'évaluation

- ACCTG315 - Async Act 3 - Cariquitan, JustineDocument29 pagesACCTG315 - Async Act 3 - Cariquitan, JustinejustinePas encore d'évaluation

- Octane Service StationDocument8 pagesOctane Service StationKalyan Kumar83% (6)

- Audit Report of CYGNUS COR 2020Document20 pagesAudit Report of CYGNUS COR 2020Friends Law ChamberPas encore d'évaluation

- 1Document20 pages1Denver AcenasPas encore d'évaluation

- National Law Institute University: BhopalDocument3 pagesNational Law Institute University: BhopalMranal MeshramPas encore d'évaluation

- El Roic 2017Document4 pagesEl Roic 2017antics20Pas encore d'évaluation

- Instructions:: Apollo Preliminary Analytical Procedures Audit Mini-CaseDocument14 pagesInstructions:: Apollo Preliminary Analytical Procedures Audit Mini-CaseShefali GoyalPas encore d'évaluation

- Standard Balance Sheet JirjizDocument1 pageStandard Balance Sheet JirjizJirjiz RasheedPas encore d'évaluation

- Financial Management July 18, 2021Document7 pagesFinancial Management July 18, 2021Bhie JaneePas encore d'évaluation

- 8447809Document11 pages8447809blackghostPas encore d'évaluation

- Jet Airways UpdatedDocument18 pagesJet Airways UpdatedJoseph ThomasPas encore d'évaluation

- Unadjusted Trial BalanceDocument1 pageUnadjusted Trial BalanceMarieJoiaPas encore d'évaluation

- Ratio Analysis WorksheetDocument5 pagesRatio Analysis WorksheetAnish AroraPas encore d'évaluation

- Ho Branch ActivityDocument4 pagesHo Branch ActivityRiza Mae Alce100% (1)

- Learning Activity 5 - Financial PlanDocument6 pagesLearning Activity 5 - Financial PlanGeryca CarranzaPas encore d'évaluation

- 1b Final Accounts of Companies - StdtsDocument4 pages1b Final Accounts of Companies - StdtsGodson0% (1)

- Balance Sheet AUTO IND After q5Document29 pagesBalance Sheet AUTO IND After q5DARSH SADANI 131-19Pas encore d'évaluation

- Aphics Projected Balance SheetDocument3 pagesAphics Projected Balance SheetSourav DasPas encore d'évaluation

- Radec Mec7576Document5 pagesRadec Mec7576Mallik DCPas encore d'évaluation

- Fin Man Case Problems Financial Ratio AnalysisDocument5 pagesFin Man Case Problems Financial Ratio AnalysisCoreen Andrade50% (2)

- The Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingDocument8 pagesThe Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingArif UddinPas encore d'évaluation

- Solution Aman BHDDocument4 pagesSolution Aman BHDIZZAH ATHIRAH MOHD SALIMIPas encore d'évaluation

- External?file Income-StatementDocument2 pagesExternal?file Income-StatementAntonette JeniebrePas encore d'évaluation

- Class Discussion On Ratios 28022023Document2 pagesClass Discussion On Ratios 28022023lil telPas encore d'évaluation

- Rui Company FS FINALDocument20 pagesRui Company FS FINALNikkiPas encore d'évaluation

- Gross Balance of The Company "X" For Year 2019 Beginning Balance Business Transactions Ending BalanceDocument5 pagesGross Balance of The Company "X" For Year 2019 Beginning Balance Business Transactions Ending BalanceBakir PeljtoPas encore d'évaluation

- Bsheet Sawhney MotorsDocument1 pageBsheet Sawhney MotorsAkshita BhattPas encore d'évaluation

- v2 Assignment Due 26.3.2023Document24 pagesv2 Assignment Due 26.3.2023alisa rachelPas encore d'évaluation

- Ice NineDocument4 pagesIce NinePolene GomezPas encore d'évaluation

- Shail End RaDocument24 pagesShail End Rabharat khandelwalPas encore d'évaluation

- BRS EnterprisesDocument17 pagesBRS EnterprisesgpdharanPas encore d'évaluation

- Sample Working Papers-1Document11 pagesSample Working Papers-1misonim.ePas encore d'évaluation

- Annual Accounts - Wishlist Ltd.Document4 pagesAnnual Accounts - Wishlist Ltd.shreevarshashankarPas encore d'évaluation

- 2021 FAR Straight Problem - Hyc2Document2 pages2021 FAR Straight Problem - Hyc2Mariecris BatasPas encore d'évaluation

- Chapter 4 Virtual ClassDocument24 pagesChapter 4 Virtual ClassMariola AlkuPas encore d'évaluation

- Ce Quiz II (A+b+c)Document3 pagesCe Quiz II (A+b+c)Mohaiminur ArponPas encore d'évaluation

- Capital Budgeting - 2021Document7 pagesCapital Budgeting - 2021Mohamed ZaitoonPas encore d'évaluation

- Intercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Document31 pagesIntercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Abegail LibreaPas encore d'évaluation

- Case-Study-2 - Browning Manufacturing Company - Delaraga-Yocson - FranciscoDocument10 pagesCase-Study-2 - Browning Manufacturing Company - Delaraga-Yocson - Franciscoabigail franciscoPas encore d'évaluation

- Homework Answer (Quiz 1-2 Revision)Document7 pagesHomework Answer (Quiz 1-2 Revision)Kccc siniPas encore d'évaluation

- Unit 1 - QuestionsDocument4 pagesUnit 1 - QuestionsMohanPas encore d'évaluation

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineD'EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LinePas encore d'évaluation

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryD'EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- InterestingDocument5 pagesInterestingAum RaoPas encore d'évaluation

- Ratio Analysis Auto CalculationDocument8 pagesRatio Analysis Auto CalculationAum RaoPas encore d'évaluation

- Quotations of Ammembal Subba Rao PaiDocument2 pagesQuotations of Ammembal Subba Rao PaiAum RaoPas encore d'évaluation

- Merged BanksDocument1 pageMerged BanksAum RaoPas encore d'évaluation

- Quotations of Ammembal Subba Rao PaiDocument2 pagesQuotations of Ammembal Subba Rao PaiAum RaoPas encore d'évaluation

- BALANCE SHEETS Analysis Format SmallDocument3 pagesBALANCE SHEETS Analysis Format SmallAum RaoPas encore d'évaluation

- InterestingDocument5 pagesInterestingAum RaoPas encore d'évaluation

- InterestingDocument5 pagesInterestingAum RaoPas encore d'évaluation

- Subject: Telugu Tejam FactsDocument5 pagesSubject: Telugu Tejam FactsAum RaoPas encore d'évaluation

- Libya AIP Part1Document145 pagesLibya AIP Part1Hitham Ghwiel100% (1)

- DL Manual - Com Vs Controller Gs Driver p100 Operating ManualDocument124 pagesDL Manual - Com Vs Controller Gs Driver p100 Operating ManualThiago Teixeira PiresPas encore d'évaluation

- Chapter1 Intro To Basic FinanceDocument28 pagesChapter1 Intro To Basic FinanceRazel GopezPas encore d'évaluation

- Music Production EngineeringDocument1 pageMusic Production EngineeringSteffano RebolledoPas encore d'évaluation

- E-CRM Analytics The Role of Data Integra PDFDocument310 pagesE-CRM Analytics The Role of Data Integra PDFJohn JiménezPas encore d'évaluation

- Guidelines For Doing Business in Grenada & OECSDocument14 pagesGuidelines For Doing Business in Grenada & OECSCharcoals Caribbean GrillPas encore d'évaluation

- Subeeka Akbar Advance NutritionDocument11 pagesSubeeka Akbar Advance NutritionSubeeka AkbarPas encore d'évaluation

- SHS G11 Reading and Writing Q3 Week 1 2 V1Document15 pagesSHS G11 Reading and Writing Q3 Week 1 2 V1Romeo Espinosa Carmona JrPas encore d'évaluation

- Springs: All India Distributer of NienhuisDocument35 pagesSprings: All India Distributer of NienhuisIrina DroliaPas encore d'évaluation

- Peanut AllergyDocument4 pagesPeanut AllergyLNICCOLAIOPas encore d'évaluation

- Ticket: Fare DetailDocument1 pageTicket: Fare DetailSajal NahaPas encore d'évaluation

- The Anti-PaladinDocument9 pagesThe Anti-PaladinBobbyPas encore d'évaluation

- Docket - CDB Batu GajahDocument1 pageDocket - CDB Batu Gajahfatin rabiatul adawiyahPas encore d'évaluation

- Department of Education: Raiseplus Weekly Plan For Blended LearningDocument3 pagesDepartment of Education: Raiseplus Weekly Plan For Blended LearningMARILYN CONSIGNAPas encore d'évaluation

- Tata NanoDocument25 pagesTata Nanop01p100% (1)

- SCIENCE 11 WEEK 6c - Endogenic ProcessDocument57 pagesSCIENCE 11 WEEK 6c - Endogenic ProcessChristine CayosaPas encore d'évaluation

- Previews 1633186 PreDocument11 pagesPreviews 1633186 PreDavid MorenoPas encore d'évaluation

- Caroline Coady: EducationDocument3 pagesCaroline Coady: Educationapi-491896852Pas encore d'évaluation

- The Marriage of Figaro LibrettoDocument64 pagesThe Marriage of Figaro LibrettoTristan BartonPas encore d'évaluation

- Celula de CargaDocument2 pagesCelula de CargaDavid PaezPas encore d'évaluation

- Study and Interpretation of The ScoreDocument10 pagesStudy and Interpretation of The ScoreDwightPile-GrayPas encore d'évaluation

- Fortnite Task Courier Pack 1500 V Bucks - BuscarDocument1 pageFortnite Task Courier Pack 1500 V Bucks - Buscariancard321Pas encore d'évaluation

- Thermodynamics WorksheetDocument5 pagesThermodynamics WorksheetMalcolmJustMalcolmPas encore d'évaluation

- Final SEC Judgment As To Defendant Michael Brauser 3.6.20Document14 pagesFinal SEC Judgment As To Defendant Michael Brauser 3.6.20Teri BuhlPas encore d'évaluation

- Porter's 5-Force Analysis of ToyotaDocument9 pagesPorter's 5-Force Analysis of ToyotaBiju MathewsPas encore d'évaluation

- Entrepreneurship - PPTX Version 1 - Copy (Autosaved) (Autosaved) (Autosaved) (Autosaved)Document211 pagesEntrepreneurship - PPTX Version 1 - Copy (Autosaved) (Autosaved) (Autosaved) (Autosaved)Leona Alicpala67% (3)

- Agrinome For Breeding - Glossary List For Mutual Understandings v0.3 - 040319Document7 pagesAgrinome For Breeding - Glossary List For Mutual Understandings v0.3 - 040319mustakim mohamadPas encore d'évaluation

- 6int 2008 Dec ADocument6 pages6int 2008 Dec ACharles_Leong_3417Pas encore d'évaluation

- Ships Near A Rocky Coast With Awaiting Landing PartyDocument2 pagesShips Near A Rocky Coast With Awaiting Landing PartyFouaAj1 FouaAj1Pas encore d'évaluation

- MSCM Dormitory Housing WEB UpdateDocument12 pagesMSCM Dormitory Housing WEB Updatemax05XIIIPas encore d'évaluation