Académique Documents

Professionnel Documents

Culture Documents

What Is Meant by A Cross Border Doctrine'

Transféré par

Star RamirezTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

What Is Meant by A Cross Border Doctrine'

Transféré par

Star RamirezDroits d'auteur :

Formats disponibles

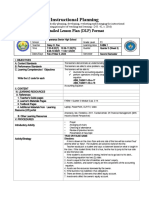

Ramirez, Ma. Aurea T.

July 7, 2016

Introduction to Tax and Income (HTAXAT3) 404 words

ACT141

WHAT IS MEANT BY A ‘CROSS BORDER DOCTRINE’ AND HOW DOES IT APPLY TO

CUSTOMS TERRITORY?

Under the Cross Border Doctrine, the ecozone is recognized, by legal fiction, as a 14

foreign territory. Thus, no VAT shall be imposed to form part of the cost of goods destined 17

for consumption outside the territorial border of the taxing authority. In turn, actual export of 15

goods and services from the Philippines to a foreign country must be free of the VAT. As for 18

the Destination Principle, it provides that the onus of taxation is the country where the 15

goods, property or services are destined, used or consumed. Those destined for use or 14

consumption within the Philippines shall be imposed with the 12-percent VAT. Thus, the 13

availment of VAT zero-percent rating on sales of services by VAT-registered persons in the 14

customs territory to PEZA-registered entities is limited to those performed within the 12

ecozone. (BDB Law’s “Tax Law For Business”) 7

Customs Territory shall mean the national territory of the Philippines outside of the 13

proclaimed boundaries of the ECOZONES except those areas specifically declared by other 12

laws and/or presidential proclamations to have the status of special economic zones and/or 13

free ports. (Sec. 1 (g), PEZA Rules and Regulations) 9

Application of Cross Border Doctrine to Customs Territory would be difficult to 12

understand without a thorough comprehension on its correlated matters and concepts. 11

Cognizance about Philippine Economic Zone Authority and Special Economic Zone is 11

essential. 1

PEZA - attached to the Department of Trade and Industry - is the Philippine 12

government agency tasked to promote investments, extend assistance, register, grant 10

incentives to and facilitate the business operations of investors in export-oriented 11

manufacturing and service facilities inside selected areas throughout the country proclaimed 11

by the President of the Philippines as PEZA Special Economic Zones. (www.peza.gov.ph) 12

Special Economic Zones (SEZ) – hereinafter referred to as the ECOZONES, are 11

selected areas with highly developed or which have the potential to be developed into agro- 15

industrial, Industrial tourist/recreational, commercial, banking, investment and financial 8

centers. An ECOZONE may contain any or all of the following: Industrial Estates (IEs), 14

Export Processing Zones (EPZs), Free Trade Zones, and Tourist/Recreational Centers. 10

(Sec. 4 (a), R.A. No. 7916) 6

From the above information, it is apparent that PEZA-registered ECOZONE 10

enterprises are 100% VAT free yet are subject to 5% special tax on gross income. On the 17

other hand, importers and enterprises within Customs Territory, even so PEZA-registered, 11

cannot be subjected to 0% VAT rating due to the rule implemented under the Cross Border 16

Doctrine that 12% of VAT rating should be imposed. 9

Vous aimerez peut-être aussi

- Excise Tax WowoweeDocument18 pagesExcise Tax WowoweeAmado Vallejo IIIPas encore d'évaluation

- Accrued Liabilities and Deferred Revenues ExplainedDocument22 pagesAccrued Liabilities and Deferred Revenues Explainedchesca marie penarandaPas encore d'évaluation

- Discontinuing OperationsDocument16 pagesDiscontinuing OperationsNeil Bryle Orilla NotarioPas encore d'évaluation

- IAS 24 Related Party DisclosuresDocument3 pagesIAS 24 Related Party DisclosuresAKPas encore d'évaluation

- Militis Invitation LettersDocument20 pagesMilitis Invitation LettersPaul Mart TisoyPas encore d'évaluation

- Cuanan V. People G.R. No. 181999 183001 SEPTEMBER 2, 2009 FactsDocument1 pageCuanan V. People G.R. No. 181999 183001 SEPTEMBER 2, 2009 FactsVener MargalloPas encore d'évaluation

- Vat With TrainDocument16 pagesVat With TrainElla QuiPas encore d'évaluation

- Updted Rem 1 Cases Set 2Document314 pagesUpdted Rem 1 Cases Set 2Bediones JAPas encore d'évaluation

- Spec Com BQsDocument15 pagesSpec Com BQsMosarah AltPas encore d'évaluation

- VAT SyllabusDocument17 pagesVAT SyllabusMacky L. Delos ReyesPas encore d'évaluation

- Tax - Vat GuidenotesDocument13 pagesTax - Vat GuidenotesNardz AndananPas encore d'évaluation

- Preferential TaxDocument2 pagesPreferential TaxattymanekaPas encore d'évaluation

- Foreign Investment ActDocument4 pagesForeign Investment ActPBWGPas encore d'évaluation

- Amendments To Retail TradeDocument3 pagesAmendments To Retail TradeMarianne SibuloPas encore d'évaluation

- Tax 2Document99 pagesTax 2Francis PunoPas encore d'évaluation

- PPSAS 26 Impairment of Cash Generating AssetsDocument3 pagesPPSAS 26 Impairment of Cash Generating AssetsAr LinePas encore d'évaluation

- Joint and Solidary Obligations and Obli With Penal Clause PDFDocument70 pagesJoint and Solidary Obligations and Obli With Penal Clause PDFMecs Nid100% (1)

- Be It Enacted by The Senate and House of Representative of The Philippines in Congress AssembledDocument4 pagesBe It Enacted by The Senate and House of Representative of The Philippines in Congress AssembledHaydee Christine SisonPas encore d'évaluation

- LEASE DOCUMENT ANALYSISDocument45 pagesLEASE DOCUMENT ANALYSISMark Emann Baliza Magas100% (1)

- G.R. No. 174629 February 14, 2008Document5 pagesG.R. No. 174629 February 14, 2008hudor tunnelPas encore d'évaluation

- VAT Exempt TransactionsDocument4 pagesVAT Exempt TransactionsAndehl AguinaldoPas encore d'évaluation

- Executive Secretary vs. Southwing Heavy Industries, Inc., 482 SCRA 673, G.R. No. 164171, G.R. No. 164172, G.R. No. 168741 February 20, 2006Document52 pagesExecutive Secretary vs. Southwing Heavy Industries, Inc., 482 SCRA 673, G.R. No. 164171, G.R. No. 164172, G.R. No. 168741 February 20, 2006Lester AgoncilloPas encore d'évaluation

- SEC Code of Corporate Governance for Publicly-Listed CompaniesDocument7 pagesSEC Code of Corporate Governance for Publicly-Listed CompaniesJoyce Cagayat100% (1)

- AC17&18: Assurance Principles, AC17&18: Assurance Principles, Professional Ethics and Good Professional Ethics and Good Governance GovernanceDocument32 pagesAC17&18: Assurance Principles, AC17&18: Assurance Principles, Professional Ethics and Good Professional Ethics and Good Governance GovernanceMark Anthony Estrada TibulePas encore d'évaluation

- Ang Ladlad LGBT Party vs. ComelecDocument20 pagesAng Ladlad LGBT Party vs. ComelecZh RmPas encore d'évaluation

- Conditions foreign CPAs practice accountancy PhilippinesDocument3 pagesConditions foreign CPAs practice accountancy PhilippinesANGELU RANE BAGARES INTOLPas encore d'évaluation

- Module 7 Chapter 9 Input VATDocument7 pagesModule 7 Chapter 9 Input VATChris SumandePas encore d'évaluation

- Irr Eo 156Document13 pagesIrr Eo 156Jennifer AndoPas encore d'évaluation

- BASCO v. PAGCOR, G.R. No. 91649 (Digested Case)Document2 pagesBASCO v. PAGCOR, G.R. No. 91649 (Digested Case)Yeshua TuraPas encore d'évaluation

- VAN ZUIDEN BROS., LTD. vs. GTVL MANUFACTURING INDUSTRIES, INC. (Foreign InvestmeDocument4 pagesVAN ZUIDEN BROS., LTD. vs. GTVL MANUFACTURING INDUSTRIES, INC. (Foreign InvestmeRob ParkerPas encore d'évaluation

- 143-Western Minolco Corp. v. CIR, Et. Al. 124 SCRA 121Document6 pages143-Western Minolco Corp. v. CIR, Et. Al. 124 SCRA 121Jopan SJPas encore d'évaluation

- Donor's Tax Liability for Shares Sold Below Book ValueDocument3 pagesDonor's Tax Liability for Shares Sold Below Book ValueYaneeza MacapadoPas encore d'évaluation

- THEORIES PAS 1 and PAS 8Document28 pagesTHEORIES PAS 1 and PAS 8PatrickMendozaPas encore d'évaluation

- Tax MCQDocument16 pagesTax MCQRosheil SamorenPas encore d'évaluation

- Section 4.110-4 of RR 16-05Document4 pagesSection 4.110-4 of RR 16-05fatmaaleahPas encore d'évaluation

- Partnership Agency and Trust (Article 1767-1827)Document1 pagePartnership Agency and Trust (Article 1767-1827)Cyra de LemosPas encore d'évaluation

- MV Don Martin, Et Al v. Hon. Secretary of FinanceDocument11 pagesMV Don Martin, Et Al v. Hon. Secretary of FinanceMau Antallan100% (1)

- WON A Corp Is Entitled To Moral DamagesDocument6 pagesWON A Corp Is Entitled To Moral DamagesShane Edrosolano100% (1)

- Banking Laws: A. The New Central Bank Act (R.A. NO. 7653)Document14 pagesBanking Laws: A. The New Central Bank Act (R.A. NO. 7653)Ahl Ja MarPas encore d'évaluation

- Corporate Income Tax Part 2Document8 pagesCorporate Income Tax Part 2Pilyang SweetPas encore d'évaluation

- Taxation Law Bar 2007-2013Document215 pagesTaxation Law Bar 2007-2013kent_009Pas encore d'évaluation

- Labor Law JurisprudenceDocument249 pagesLabor Law JurisprudenceMary.Rose RosalesPas encore d'évaluation

- Bir Itad Ruling No. Da-065-07Document23 pagesBir Itad Ruling No. Da-065-07Emil A. MolinaPas encore d'évaluation

- Assessment & AuditDocument17 pagesAssessment & AuditRam SewakPas encore d'évaluation

- B. Donor's (Gift) Tax Definition and NatureDocument12 pagesB. Donor's (Gift) Tax Definition and Naturemariyha PalangganaPas encore d'évaluation

- Quicknotes-Tax-MCQS - Book 1 and 2Document42 pagesQuicknotes-Tax-MCQS - Book 1 and 2Dianna MontefalcoPas encore d'évaluation

- Procedural Steps for Tax Assessment and ProtestDocument2 pagesProcedural Steps for Tax Assessment and ProtestErmawooPas encore d'évaluation

- RA 9160 Case Digests - CastañagaDocument7 pagesRA 9160 Case Digests - CastañagaJezreel CastañagaPas encore d'évaluation

- Sample Tax Question (Solution and Answer)Document18 pagesSample Tax Question (Solution and Answer)FRITZ JANN CERAPas encore d'évaluation

- Salient Features of The RCC (MZRVC)Document6 pagesSalient Features of The RCC (MZRVC)KristinePas encore d'évaluation

- Module 1 3 Notes PayableDocument8 pagesModule 1 3 Notes PayableFujoshi BeePas encore d'évaluation

- Samar-I Electric Cooperative, Petitioner, vs. Commissioner of Internal Revenue, Respondent.Document18 pagesSamar-I Electric Cooperative, Petitioner, vs. Commissioner of Internal Revenue, Respondent.Maria Nicole Vaneetee100% (1)

- SEC Case Jurisdiction Over Corporate AuthorityDocument2 pagesSEC Case Jurisdiction Over Corporate AuthorityMelgenPas encore d'évaluation

- Section 1. Section 27 of The National Internal Revenue Code of 1997, AsDocument55 pagesSection 1. Section 27 of The National Internal Revenue Code of 1997, AsVladimir Reyes100% (1)

- Acer Philippines. vs. CIRDocument27 pagesAcer Philippines. vs. CIRFarina R. SalvadorPas encore d'évaluation

- AOM No. 04 - InventoriesDocument3 pagesAOM No. 04 - InventoriesRagnar LothbrokPas encore d'évaluation

- Fria 2010Document128 pagesFria 2010Mary Joyce Cornejo100% (1)

- Income Tax - What Is Meant by A Cross Border Doctrine' and How Does It Apply To Customs Territory.Document1 pageIncome Tax - What Is Meant by A Cross Border Doctrine' and How Does It Apply To Customs Territory.Star RamirezPas encore d'évaluation

- Cir Vs ToshibaDocument23 pagesCir Vs ToshibamarkPas encore d'évaluation

- CIR vs. Toshiba Information Equipment (Phils.), Inc., 466 SCRA 211, G.R. No. 150154 August 9, 2005Document25 pagesCIR vs. Toshiba Information Equipment (Phils.), Inc., 466 SCRA 211, G.R. No. 150154 August 9, 2005Alfred GarciaPas encore d'évaluation

- MailDocument1 pageMailStar RamirezPas encore d'évaluation

- Check TemplateDocument1 pageCheck TemplateStar RamirezPas encore d'évaluation

- StartDocument8 pagesStartStar RamirezPas encore d'évaluation

- PhilosophersDocument2 pagesPhilosophersmarpelPas encore d'évaluation

- Diagnostic Test-EnglishDocument3 pagesDiagnostic Test-EnglishStar RamirezPas encore d'évaluation

- A COVALENT BOND Is Formed Between Atoms That Have The Same Electronegativity or Similar ElectronegativityDocument3 pagesA COVALENT BOND Is Formed Between Atoms That Have The Same Electronegativity or Similar ElectronegativityStar RamirezPas encore d'évaluation

- 146 155Document3 pages146 155Star Ramirez50% (2)

- Converse Vs VansDocument1 pageConverse Vs VansStar RamirezPas encore d'évaluation

- Samplar Company Statement of Financial Position December 31, 2016 Assets Liabilities and EquityDocument6 pagesSamplar Company Statement of Financial Position December 31, 2016 Assets Liabilities and EquityStar RamirezPas encore d'évaluation

- Confucianism, Also KnownDocument2 pagesConfucianism, Also KnownStar RamirezPas encore d'évaluation

- Chapter 1 Form and InterpretationDocument6 pagesChapter 1 Form and InterpretationStar RamirezPas encore d'évaluation

- Income Tax-Relate The Function of Bir With The Bir State PolicyDocument1 pageIncome Tax-Relate The Function of Bir With The Bir State PolicyStar RamirezPas encore d'évaluation

- Calculator 2Document1 pageCalculator 2Star RamirezPas encore d'évaluation

- Income Tax - What Is Meant by A Cross Border Doctrine' and How Does It Apply To Customs Territory.Document1 pageIncome Tax - What Is Meant by A Cross Border Doctrine' and How Does It Apply To Customs Territory.Star RamirezPas encore d'évaluation

- Income Tax - Tax ExemptionDocument1 pageIncome Tax - Tax ExemptionStar RamirezPas encore d'évaluation

- Cash Conversion CycleDocument20 pagesCash Conversion CycleStar RamirezPas encore d'évaluation

- TransferDocument1 pageTransferStar RamirezPas encore d'évaluation

- Managerial Accounting Sia PDFDocument176 pagesManagerial Accounting Sia PDFManpreet Singh61% (28)

- National Automated Clearing House)Document3 pagesNational Automated Clearing House)santhosh sPas encore d'évaluation

- Havell's Group Company ProfileDocument94 pagesHavell's Group Company ProfileMohit RawatPas encore d'évaluation

- Global Business PlanDocument47 pagesGlobal Business PlanMay Hnin WaiPas encore d'évaluation

- AIS Prelim ExamDocument4 pagesAIS Prelim Examsharielles /Pas encore d'évaluation

- Introduction To Oil Company Financial Analysis - CompressDocument478 pagesIntroduction To Oil Company Financial Analysis - CompressRalmePas encore d'évaluation

- 12BIỂU MẪU INVOICE-PACKING LIST- bookboomingDocument7 pages12BIỂU MẪU INVOICE-PACKING LIST- bookboomingNguyễn Thanh ThôiPas encore d'évaluation

- MEFADocument4 pagesMEFABangi Sunil KumarPas encore d'évaluation

- Performance Based IncentivesDocument25 pagesPerformance Based IncentivesSaritha PuttaPas encore d'évaluation

- Donors TaxDocument4 pagesDonors TaxRo-Anne LozadaPas encore d'évaluation

- Sample Assignment 1-1Document20 pagesSample Assignment 1-1Nir IslamPas encore d'évaluation

- Islamic Core Banking Solution OverviewDocument16 pagesIslamic Core Banking Solution OverviewnadeemuzairPas encore d'évaluation

- Dabba WalaDocument16 pagesDabba Walarobin70929Pas encore d'évaluation

- PS3 SolutionDocument8 pagesPS3 Solutionandrewlyzer100% (1)

- Basics of AppraisalsDocument20 pagesBasics of AppraisalssymenPas encore d'évaluation

- India's FTZs - A List of Major Export Processing ZonesDocument10 pagesIndia's FTZs - A List of Major Export Processing ZoneshemantisnegiPas encore d'évaluation

- College Accounting Competency Appraisal Course ProblemsDocument9 pagesCollege Accounting Competency Appraisal Course ProblemsFelixPas encore d'évaluation

- DPDHL 2017 Annual ReportDocument172 pagesDPDHL 2017 Annual ReportrajabPas encore d'évaluation

- Assignment Classification Table: Topics Brief Exercises Exercises ProblemsDocument125 pagesAssignment Classification Table: Topics Brief Exercises Exercises ProblemsYang LeksPas encore d'évaluation

- Mandvi Ibibo Tax InvoiceDocument2 pagesMandvi Ibibo Tax InvoiceSumit PatelPas encore d'évaluation

- DLP Fundamentals of Accounting 1 - Q3 - W3Document5 pagesDLP Fundamentals of Accounting 1 - Q3 - W3Daisy PaoPas encore d'évaluation

- Chapter 7 - Accepting The Engagement and Planning The AuditDocument9 pagesChapter 7 - Accepting The Engagement and Planning The Auditsimona_xoPas encore d'évaluation

- Assignment Ishan SharmaDocument8 pagesAssignment Ishan SharmaIshan SharmaPas encore d'évaluation

- Buyer Seller RelationDocument16 pagesBuyer Seller RelationMirza Sher Afgan BabarPas encore d'évaluation

- BBA618 - Goods & Service Tax - CASE STUDIES - UNIT-2Document2 pagesBBA618 - Goods & Service Tax - CASE STUDIES - UNIT-2Md Qurban HussainPas encore d'évaluation

- An Agile Organization in A Disruptive EnvironmentDocument14 pagesAn Agile Organization in A Disruptive EnvironmentPreetham ReddyPas encore d'évaluation

- SK and LYDO M&E Templates 2022Document11 pagesSK and LYDO M&E Templates 2022Joemar CaprancaPas encore d'évaluation

- NAQDOWN PowerpointDocument55 pagesNAQDOWN PowerpointsarahbeePas encore d'évaluation

- ECONTWO: EXERCISE 1 KEYDocument6 pagesECONTWO: EXERCISE 1 KEYIrvinne Heather Chua GoPas encore d'évaluation

- MaheshkhaliDocument4 pagesMaheshkhalimail2ferdoushaqPas encore d'évaluation