Académique Documents

Professionnel Documents

Culture Documents

CRS Self Certification Form Entity

Transféré par

Salman ArshadCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

CRS Self Certification Form Entity

Transféré par

Salman ArshadDroits d'auteur :

Formats disponibles

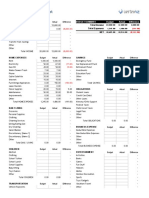

CRS Tax Residency Self-Certification Form Customer ID

for Entity (CRS–E) ______________

_

Please read these instructions carefully before completing the form

Chapter XIIA of Income Tax Rules, 2002 and Regulations based on the OECD Common Reporting Standard (CRS) require Al Meezan

Investment Management Limited to collect and report certain information about an account holder’s tax residency. If the account

holder’s tax residence is located outside Pakistan and/or United States of America (USA), we may be legally obliged to pass on the

information in this form and other financial information with respect to your financial accounts to Federal Board of Revenue (FBR)

and they may exchange this information with tax authorities of another jurisdiction or jurisdictions pursuant to intergovernmental

agreements to exchange financial account information.

Where the Account Holder is a Passive NFE, or an Investment Entity located in a Non-Participating Jurisdiction managed by another

Financial Institution, please also complete “CRS Tax Residency Self Certification Form for Controlling Persons”. You can find

summaries of defined terms in the Glossary of Terms provided at page 3 of this form.

Please complete this form if account holder is entity i.e. legal person or a legal arrangement, such as a company, corporation,

organisation, partnership, trust, foundation, NGO, NPO, etc.

This form will remain valid unless there is a change in circumstances relating to information, such as the account holder’s tax status

or other information that makes this form incorrect or incomplete. In that case you must notify us and provide an updated self-

certification.

Legal Name of Entity Country of Incorporation or Organisation

PART 1 ENTITY TYPE

Please tick ONE box only in this part.

1.1 Financial Institution

A Depository Institution, Custodial Institution or Specified Insurance Company (e.g. Bank, Life Insurance Co., etc.)

An Investment Entity (Investment Co, Mutual Fund, Asset Management Co, Brokerage House, etc.)

B If you have ticked box A or B, please proceed to Part 4

1.2 Active Non-Financial Entity – Active NFE

Active NFE – A company/corporation whose shares are regularly traded on one or more established

A securities markets

Active NFE – Related entity of a company/corporation whose shares are regularly traded on one or more

B established securities markets

Active NFE – A Government Entity, an International Organisation (e.g. United Nations or NATO) or a Central

C Bank

If you have ticked box A, B or C, please proceed to Part 4

Active NFE – The entity is an Active NFE other than above

(for example a non-profit NFE, NGO, Trust or a Manufacturing/Trading/Service entity which derives more than 50% of gross

D income and assets from active income, like sales of goods and/or services)

If you have ticked box D, please proceed to Part 2

1.3 Passive Non-Financial Entity – Passive NFE

Passive NFE

A (i.e. more than 50% of its gross income from Passive Income, for instance: Interest, dividend, return on investments)

An Investment Entity incorporated/located in a Non-CRS Participating Jurisdiction and managed by another

B Financial Institution

If you have ticked box A or B in section 1.3, please provide the name of all Controlling Persons of the entity,

proceed to Part 2 and also complete “CRS Tax Residency Self Certification Form for Controlling Persons”.

Name of Controlling Person(s)____________________________________________________________________

____________________________________________________________________________________________

CRS Self Certification Form (07-2017) Page 1 of 2

CRS Tax Residency Self-Certification Form

for Entity (CRS–E)

PART 2 CRS – DECLARATION OF TAX RESIDENCY

Is entity a tax resident of Pakistan or/and USA ONLY?

Yes (Proceed to Part 4)

No (Proceed to Part 3)

PART 3 COUNTRY OF RESIDENCE FOR TAX PURPOSE

Please complete the following table indicating (i) the country where the Account Holder is resident for tax purposes and (ii)

the Account Holder’s Taxpayer Identification Number (TIN) or functional equivalent for each country indicated. Please refer

to the OECD website for more information on tax residency http://www.oecd.org/tax/automatic-exchange/crs-

implementation-and-assistance/tax-residency/

If Tax Identification Number (TIN) is not available, please tick () the appropriate box with reason A, B or C as defined

below and provide Supporting Evidence:

Reason A - The country/jurisdiction where the Account Holder is resident does not issue TINs to its residents

Reason B - The Account Holder is otherwise unable to obtain a TIN or equivalent number (Please provide reasons if this is

selected)

Reason C - No TIN is required. (Note: Only select this reason, along-with evidence, if the domestic law of the relevant country

does not require the collection of the TIN issued by such country)

Tick () ONE only (If TIN is not available)

Country(ies) of Tax Residence TIN or Equivalent

Reason A Reason B Reason C

1

If Reason B selected, please explain in the following box(es) why entity is unable to obtain a TIN or Functional Equivalent

1

PART 4 DECLARATION AND SIGNATURE

We/I understand that the information supplied by us/me is covered by the full provisions of the terms and conditions

governing the Account Holder’s relationship with Al Meezan Investment Management Limited setting out how Al Meezan

Investment Management Limited may use and share the information supplied by us/me. We/I acknowledge that the

information contained in this form and information regarding the Account Holder and any Reportable Account(s) may be

provided to the tax authorities of the country/jurisdiction in which this account(s) is/are maintained and exchanged with tax

authorities of another country/jurisdiction or countries/jurisdictions in which the Account Holder may be tax resident

pursuant to intergovernmental agreements to exchange financial account information.

We/I declare that all statements made in this declaration are, to the best of our/my knowledge and belief, correct and

complete. We/I undertake to submit a suitably updated Form within 30 days of any change in circumstances which affects

the tax residency status or where any information contained herein to become incorrect.

Company Secretary/Authorized Signatories

Name: ________________________________ Signature: ____________________________________

Name: ________________________________ Signature: ____________________________________

CRS Self Certification Form (07-2017) Page 2 of 2

CRS Tax Residency Self-Certification Form

for Entity (CRS–E) - Guidelines

GLOSSARY OF TERMS

These are selected summaries of defined terms provided to assist you with the completion of this form. Further details can be found within the

OECD Common Reporting Standard and the associated Commentary to the CRS at the

http://www.oecd.org/tax/transparency/automaticexchangeofinformation.htm

Account Holder

The “Account Holder” is the person listed or identified as the holder of a Financial Account by the Financial Institution that maintains the account.

Active NFE

An NFE is an Active NFE if it meets any of the summarised criteria listed below:

Active NFEs by reason of income and assets (i.e. if the Entity’s gross income more than 50 % derives from other than passive income, for

instance sales of goods and/or services; and assets of more than 50 % held by the entity relates to other than passive assets, for instance assets

related to the sales of goods and/or services.

Publicly traded NFEs - the stock of the entity or a related entity is regularly traded on an established securities market

Governmental Entities, International Organisations or their wholly owned Entities

Holding companies that are members of a non-financial group

Start-ups NFEs - the entity is not yet operating a business and has no prior operating history (the first 2 years)

Entities that are liquidating or emerging from bankruptcy

Treasury centres that are members of a non-financial group

Non-profit NFE which meets all of the following requirements:

1) it is established and operated in its jurisdiction of residence exclusively for religious, charitable, scientific, artistic, cultural, athletic, or

educational purposes; or it is established and operated in its jurisdiction of residence and it is a professional organisation, business league,

chamber of commerce, labour organisation, agricultural or horticultural organisation, civic league or an organisation operated exclusively for

the promotion of social welfare;

2) it is exempt from income tax in its jurisdiction of residence;

3) it has no shareholders or members who have a proprietary or beneficial interest in its income or assets;

4) the applicable laws of the NFE’s jurisdiction of residence or the NFE’s formation documents do not permit any income or assets of the NFE to

be distributed to, or applied for the benefit of, a private person or non-charitable Entity other than pursuant to the conduct of the NFE’s

charitable activities, or as payment of reasonable compensation for services rendered, or as payment representing the fair market value of

property which the NFE has purchased; and

5) The applicable laws of the NFE’s jurisdiction of residence or the NFE’s formation documents require that, upon the NFE’s liquidation or

dissolution, all of its assets be distributed to a Governmental Entity or other non-profit organisation, or escheat to the government of the

NFE’s jurisdiction of residence or any political subdivision.

Controlling Person

Controlling Person (or Beneficial Owner as defined in AML/CFT Regulations and Recommendation 10 of the Financial Action Task Force

Recommendations) means a natural person who exercise control over an Entity. Where that entity is treated as a Passive NFE then a Financial

Institution is required to determine whether or not these Controlling Persons are Reportable Persons. In case of Limited Company/Corporation,

Directors and individual (natural persons) shareholder holding 20% or above stake will be treated as Controlling Person. If legal person holds 20%

or above stake in an entity, Financial Institutions are required to identify and obtain information of individuals (natural persons) holding shares

equal to 20% or above of that legal person. Members of Governing Body/ Board of Trustees/ Executive Committee will be treated as Controlling

Person in case of NGO, NPO, Charity, Trust, Club, Society, Association, etc. In case of Partnership, all partners will be treated as Controlling

Persons.

Financial Institution

The term “Financial Institution” means a Custodial Institution, a Depository Institution, a Specified Insurance Company, or an Investment Entity as

defined below:

Custodial Institution: Any Entity that holds, as a substantial portion of its business, financial assets for the account of others.

Depository Institution: Any Entity that accepts deposits in the ordinary course of a banking or similar business.

Specified Insurance Company: Any Entity that is a life insurance company (or the holding company of an insurance company) that issues, or is

obligated to make payments with respect to, a Cash Value Insurance Contract or an Annuity Contract.

Investment Entity: The term Investment Entity includes two types of Entities: (i) Any Entity that conducts as a business one or more of the

following activities or operations for or on behalf of a customer:

Trading in money market instruments (cheques, bills, certificates of deposit, derivatives, etc.); foreign exchange; exchange, interest rate

and index instruments; transferable securities; or commodity futures trading;

Individual and collective portfolio management; or

Otherwise investing, administering, or managing funds or money on behalf of other persons.

(ii) The second type of Investment Entity (“Investment Entity managed by another Financial Institution”) is any Entity the gross income of which is

primarily attributable to investing, reinvesting, or trading in Financial Assets where the Entity is managed by another Entity that is a Depository

Institution, a Custodial Institution, a Specified Insurance Company, or the first type of Investment Entity.

Participating Country/Jurisdiction

Participating country/jurisdiction means a Jurisdiction/country (i) with which an agreement is in place pursuant to which there is an obligation in

place to provide the certain information, and (ii) which is identified in a published list to be made available on FBR’s web portal.

CRS Self Certification Form (07-2017) Page 1 of 2

CRS Tax Residency Self-Certification Form

for Entity (CRS–E) - Guidelines

Passive NFE

Under the CRS a “Passive NFE” means any NFE that is not an Active NFE. An Investment Entity located in a Non-Participating Jurisdiction and

managed by another Financial Institution is also treated as a Passive NFE for purposes of the CRS.

Related Entity

An Entity is a “Related Entity” of another Entity if either Entity controls the other Entity, or the two Entities are under common control. For this

purpose control includes direct or indirect ownership of more than 50% of the vote and value in an Entity.

Reportable Account

The term Reportable Account means an account held by one or more Reportable Persons or by a Passive NFE with one or more Controlling

Persons that is a Reportable Person.

Reportable Country/Jurisdiction

Reportable Country/Jurisdiction means all countries other than Pakistan and the United States of America.

Reportable Person

A Reportable Person is defined as a Reportable Jurisdiction Person, other than:

a company/ corporation the stock of which is regularly traded on one or more established securities markets;

any company/ corporation that is a Related Entity of a corporation described in above bullet;

a Governmental Entity;

an International Organisation;

a Central Bank; or

a Financial Institution (except for an Investment Entity located in a Non-Participating Jurisdiction and managed by another Financial

Institution).

Resident for tax purposes

Generally, an Entity will be resident for tax purposes in a jurisdiction if, under the laws of that jurisdiction (including tax conventions), it pays or

should be paying tax therein by reason of his domicile, residence, place of management or incorporation, or any other criterion of a similar

nature, and not only from sources in that jurisdiction. An Entity such as a partnership, limited liability partnership or similar legal arrangement

that has no residence for tax purposes shall be treated as resident in the jurisdiction in which its place of effective management is situated. For

additional information on tax residence, please talk to your tax adviser or refer OECD website link mentioned in Part 3 of this form.

TIN (including Functional Equivalent)

TIN means Taxpayer Identification Number or any other functional equivalent. A TIN is a unique combination of letters or numbers assigned by a

country/jurisdiction to an individual or an Entity and used to identify the individual or Entity for the purposes of administering the tax laws of such

country/jurisdiction.

CRS Self Certification Form (07-2017) Page 2 of 2

Vous aimerez peut-être aussi

- Attention Limit of One (1) Employer Identification Number (EIN) Issuance Per Business DayDocument3 pagesAttention Limit of One (1) Employer Identification Number (EIN) Issuance Per Business Daypreston_40200350% (2)

- Employer Identification Number (EIN) Application / RegistrationDocument3 pagesEmployer Identification Number (EIN) Application / RegistrationLedger Domains LLC100% (1)

- Power of AttorneyDocument6 pagesPower of AttorneyNandkumar Chinai100% (1)

- Your Guide To Automobile Insurance: For Michigan ConsumersDocument31 pagesYour Guide To Automobile Insurance: For Michigan ConsumersSaleemPas encore d'évaluation

- 2019 AICPA Released Questions FAR Blank Answer KeyDocument50 pages2019 AICPA Released Questions FAR Blank Answer KeyGift ChaliPas encore d'évaluation

- 1040 Exam Prep: Module I: The Form 1040 FormulaD'Everand1040 Exam Prep: Module I: The Form 1040 FormulaÉvaluation : 1 sur 5 étoiles1/5 (3)

- Money Market InstrumentsDocument46 pagesMoney Market InstrumentsAadi1187100% (3)

- Fss 4Document2 pagesFss 4craz8gtPas encore d'évaluation

- Financial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersD'EverandFinancial Analysis 101: An Introduction to Analyzing Financial Statements for beginnersPas encore d'évaluation

- AMF 102 Financial Accounting BookDocument152 pagesAMF 102 Financial Accounting Bookkeenodiid100% (1)

- Fatca Non Individual Form Annexure IIDocument6 pagesFatca Non Individual Form Annexure IIabhijit_bhandurge5011Pas encore d'évaluation

- CRS Individual Account Self-Cert Form v2015-12 CBI RBI AsiaDocument6 pagesCRS Individual Account Self-Cert Form v2015-12 CBI RBI AsiaJoris RectoPas encore d'évaluation

- CRS Self Certification Form For IndividualsDocument6 pagesCRS Self Certification Form For IndividualsSergeyPas encore d'évaluation

- CRS Entity (Organization)Document7 pagesCRS Entity (Organization)Muhammad HarisPas encore d'évaluation

- CRS Tax Residency Self Certification Form For Controlling Persons (CRS-CP)Document2 pagesCRS Tax Residency Self Certification Form For Controlling Persons (CRS-CP)Salman ArshadPas encore d'évaluation

- Fatca/Crs Self Certification / Declaration For Legal EntityDocument7 pagesFatca/Crs Self Certification / Declaration For Legal Entitymathankumar66Pas encore d'évaluation

- FATCA CORP English - Bank Muscat 1Document17 pagesFATCA CORP English - Bank Muscat 1reema-algheshyanPas encore d'évaluation

- FATCA CRS Self-Certification FormDocument11 pagesFATCA CRS Self-Certification FormdtPas encore d'évaluation

- FATCA Declaration Non Individuals Retail FinalDocument7 pagesFATCA Declaration Non Individuals Retail FinalMOHAN SPas encore d'évaluation

- FATCA Form (Entity)Document5 pagesFATCA Form (Entity)Azrina Umairah AniqPas encore d'évaluation

- FATCA and CRS Self Certification FormDocument10 pagesFATCA and CRS Self Certification FormsudemanPas encore d'évaluation

- Account Holder: AEOI Self-Certification For An Entity Account HolderDocument5 pagesAccount Holder: AEOI Self-Certification For An Entity Account HolderNigil josephPas encore d'évaluation

- FATCA Declaration HUFDocument7 pagesFATCA Declaration HUFDrAjay SinghPas encore d'évaluation

- CRS Individual Self-Certification FormDocument6 pagesCRS Individual Self-Certification FormsamPas encore d'évaluation

- Non IndividualsDocument11 pagesNon IndividualsAther AliPas encore d'évaluation

- CRS Self Certification Form IndividualDocument5 pagesCRS Self Certification Form IndividualSalman ArshadPas encore d'évaluation

- The UAE Economic Substance Regulations Notification GuidanceDocument12 pagesThe UAE Economic Substance Regulations Notification Guidanceabdelrahman zyadaPas encore d'évaluation

- Identification of Account Holder: PARTDocument2 pagesIdentification of Account Holder: PARTMuhammad HarisPas encore d'évaluation

- TYRODocument9 pagesTYROShubhamPas encore d'évaluation

- 141121120000amiop CRS IndivisualDocument5 pages141121120000amiop CRS Indivisualdesignify101Pas encore d'évaluation

- CRS 421019577252Document5 pagesCRS 421019577252Saad KhanPas encore d'évaluation

- Fatca Crs Self Certification FormDocument6 pagesFatca Crs Self Certification FormMohammed FaisalPas encore d'évaluation

- Business Banking Entity Self Certification FormDocument4 pagesBusiness Banking Entity Self Certification Formyogeshahire166Pas encore d'évaluation

- FATCA CRS Self Certification Client FormDocument4 pagesFATCA CRS Self Certification Client FormMax muster WoodPas encore d'évaluation

- Bank AL Habib Limited: CRS Individual / Proprietorship Tax ResidencyDocument2 pagesBank AL Habib Limited: CRS Individual / Proprietorship Tax ResidencyMitti da PalwaanPas encore d'évaluation

- Customer ID /account No - : One Input Is MandatoryDocument9 pagesCustomer ID /account No - : One Input Is MandatoryDhavalPas encore d'évaluation

- Fatca Declaration Active Trade Channel IslandsDocument6 pagesFatca Declaration Active Trade Channel IslandsLosaPas encore d'évaluation

- Self CertificationDocument6 pagesSelf CertificationGuocheng MaPas encore d'évaluation

- User Manuadfgl Application PDFDocument15 pagesUser Manuadfgl Application PDFVengat VenkitasamyPas encore d'évaluation

- Fatca Business TickedDocument3 pagesFatca Business TickedGeorgePas encore d'évaluation

- RBL Fatca Crs Declaration EntitiesDocument2 pagesRBL Fatca Crs Declaration EntitiesAyush BankaPas encore d'évaluation

- Remittance Certificate ChecklistDocument8 pagesRemittance Certificate ChecklistAnuj GuptaPas encore d'évaluation

- Financial Institution (FI)Document7 pagesFinancial Institution (FI)Razali ZakariaPas encore d'évaluation

- Customer Declaration Form Entity 1Document3 pagesCustomer Declaration Form Entity 1KjPas encore d'évaluation

- Crs-E Entities Self Cert Form ChinaDocument3 pagesCrs-E Entities Self Cert Form China18693077205Pas encore d'évaluation

- FNB Business Compulsory Tax Information Form: To Do ListDocument21 pagesFNB Business Compulsory Tax Information Form: To Do ListJack Mosia100% (1)

- Annexure 1 FATCA-CRS Annexure For Individual AccountsDocument6 pagesAnnexure 1 FATCA-CRS Annexure For Individual AccountsbusuuuPas encore d'évaluation

- NA Form 08-2011Document2 pagesNA Form 08-2011PITA44Pas encore d'évaluation

- FACTA-CRS Non Individual Declaration FormDocument1 pageFACTA-CRS Non Individual Declaration FormGSTMS ANSARIPas encore d'évaluation

- General Instruction (S) : Self-Certification Form - IndividualDocument4 pagesGeneral Instruction (S) : Self-Certification Form - IndividualMuhammadPas encore d'évaluation

- Form DGT 1Document5 pagesForm DGT 1halimPas encore d'évaluation

- Formulario Ads BreakDocument2 pagesFormulario Ads BreakApoyo A La Cultura PicoteraPas encore d'évaluation

- rc1 15eDocument5 pagesrc1 15erouzbeh1797Pas encore d'évaluation

- Fw8eci PDFDocument1 pageFw8eci PDFAnonymous qaI31HPas encore d'évaluation

- FATCA - Non-Individuals SEP 2023Document2 pagesFATCA - Non-Individuals SEP 2023srikanthPas encore d'évaluation

- Guidance On Economic Substance Report GuidanceDocument18 pagesGuidance On Economic Substance Report Guidanceabdelrahman zyadaPas encore d'évaluation

- Fatca Form (1) (1) 1118-1266-5014-2191-0731-1231Document4 pagesFatca Form (1) (1) 1118-1266-5014-2191-0731-1231Harsh NarwarePas encore d'évaluation

- FATCA-CRS Declaration & Supplementary KYC Information: Declaration Form For EntitiesDocument6 pagesFATCA-CRS Declaration & Supplementary KYC Information: Declaration Form For Entitiesvikas9saraswatPas encore d'évaluation

- FATCA Non IndividualDocument6 pagesFATCA Non IndividualMarneni Yallamanda RaoPas encore d'évaluation

- SBI SME CAForm - New PDFDocument20 pagesSBI SME CAForm - New PDFBang Manish BangPas encore d'évaluation

- Entity Tax Residency Self-Certification Form For FATCA and CRS PurposesDocument6 pagesEntity Tax Residency Self-Certification Form For FATCA and CRS PurposeskotharidevangiPas encore d'évaluation

- Identification Number and Certificationrequest For Taxpayer: Purpose of FormDocument6 pagesIdentification Number and Certificationrequest For Taxpayer: Purpose of FormJacqueline CostictPas encore d'évaluation

- Guidelines 1702-EX June 2013Document4 pagesGuidelines 1702-EX June 2013Julio Gabriel AseronPas encore d'évaluation

- SFL Controlling Person FormDocument2 pagesSFL Controlling Person FormSyed SaqlainPas encore d'évaluation

- Honda EngDocument79 pagesHonda EngNop100% (1)

- FX MBL 11octDocument1 pageFX MBL 11octSalman ArshadPas encore d'évaluation

- Foreign Exchange Rate Sheet: 129 Sheet No Date 17-Jul-19Document1 pageForeign Exchange Rate Sheet: 129 Sheet No Date 17-Jul-19Salman ArshadPas encore d'évaluation

- RemittanceMBL 17JUL PDFDocument1 pageRemittanceMBL 17JUL PDFSalman ArshadPas encore d'évaluation

- FX MBL 11octDocument1 pageFX MBL 11octSalman ArshadPas encore d'évaluation

- FX MBL 11octDocument1 pageFX MBL 11octSalman ArshadPas encore d'évaluation

- Currency Buying: Treasury DepartmentDocument1 pageCurrency Buying: Treasury DepartmentSalman ArshadPas encore d'évaluation

- FX MBL 11octDocument1 pageFX MBL 11octSalman ArshadPas encore d'évaluation

- FX MBL 29octDocument1 pageFX MBL 29octSalman ArshadPas encore d'évaluation

- FX MBL 30octDocument1 pageFX MBL 30octSalman ArshadPas encore d'évaluation

- Exchange Rate Sheet USD To PKR 31-Oct-18Document1 pageExchange Rate Sheet USD To PKR 31-Oct-18AtiquePas encore d'évaluation

- FX MBL 11octDocument1 pageFX MBL 11octSalman ArshadPas encore d'évaluation

- FX MBL 03decDocument1 pageFX MBL 03decSalman ArshadPas encore d'évaluation

- FX MBL 03decDocument1 pageFX MBL 03decSalman ArshadPas encore d'évaluation

- FX MBL 08novDocument1 pageFX MBL 08novSalman ArshadPas encore d'évaluation

- FX MBL 08novDocument1 pageFX MBL 08novSalman ArshadPas encore d'évaluation

- RMBL13NOVDocument1 pageRMBL13NOVSalman ArshadPas encore d'évaluation

- FX MBL 03decDocument1 pageFX MBL 03decSalman ArshadPas encore d'évaluation

- FX MBL 08novDocument1 pageFX MBL 08novSalman ArshadPas encore d'évaluation

- FXNOV13Document1 pageFXNOV13Salman ArshadPas encore d'évaluation

- RemittanceMBL 11DECDocument1 pageRemittanceMBL 11DECSalman ArshadPas encore d'évaluation

- Foreign Exchange Rate Sheet: 200 Sheet No Date 5-Nov-18Document1 pageForeign Exchange Rate Sheet: 200 Sheet No Date 5-Nov-18Salman ArshadPas encore d'évaluation

- Foreign Exchange Rate Sheet: 198 Sheet No Date 1-Nov-18Document1 pageForeign Exchange Rate Sheet: 198 Sheet No Date 1-Nov-18Salman ArshadPas encore d'évaluation

- RemittanceMBL 11DECDocument1 pageRemittanceMBL 11DECSalman ArshadPas encore d'évaluation

- RemittanceMBL 30OCTDocument1 pageRemittanceMBL 30OCTSalman ArshadPas encore d'évaluation

- Foreign Exchange Rate Sheet: 198 Sheet No Date 1-Nov-18Document1 pageForeign Exchange Rate Sheet: 198 Sheet No Date 1-Nov-18Salman ArshadPas encore d'évaluation

- RemittanceMBL 30OCTDocument1 pageRemittanceMBL 30OCTSalman ArshadPas encore d'évaluation

- RemittanceMBL 11DECDocument1 pageRemittanceMBL 11DECSalman ArshadPas encore d'évaluation

- RemittanceMBL 29OCTDocument1 pageRemittanceMBL 29OCTSalman ArshadPas encore d'évaluation

- FX MBL 17octDocument1 pageFX MBL 17octSalman ArshadPas encore d'évaluation

- SEED INUDSTRY SWOT AnalysisDocument107 pagesSEED INUDSTRY SWOT AnalysisABIN JOHNPas encore d'évaluation

- Discount MathematicsDocument3 pagesDiscount MathematicsKuntugan Bekbolat UliPas encore d'évaluation

- Meenakshi Mills Mad HCDocument21 pagesMeenakshi Mills Mad HCTushar ChoudharyPas encore d'évaluation

- Unknown PDFDocument206 pagesUnknown PDFLey SerranoPas encore d'évaluation

- Jamuna BankDocument35 pagesJamuna BankMd ShahnewazPas encore d'évaluation

- Midterm 1 Answer Key4283 FIN 701Document10 pagesMidterm 1 Answer Key4283 FIN 701midaksPas encore d'évaluation

- Financial Accounting NotesDocument7 pagesFinancial Accounting NotessrishaaPas encore d'évaluation

- Problem Set 2: FIN 401: Financial Management Syed Waqar AhmedDocument3 pagesProblem Set 2: FIN 401: Financial Management Syed Waqar AhmedJiteshPas encore d'évaluation

- EN - Registration Form International Patients - V20181227Document3 pagesEN - Registration Form International Patients - V20181227OlegseyPas encore d'évaluation

- 19 Personal Equity Retirement Account PERADocument4 pages19 Personal Equity Retirement Account PERALumingPas encore d'évaluation

- Government of Zambia Statutory - Instrument'No: 2'of2002 The Minimum Wages and Conditions of Eîi1Ployment ActDocument5 pagesGovernment of Zambia Statutory - Instrument'No: 2'of2002 The Minimum Wages and Conditions of Eîi1Ployment ActChristine SakalaPas encore d'évaluation

- Common Size Statement nestle-FRDocument4 pagesCommon Size Statement nestle-FRIvan Tan28100% (1)

- CH 07Document60 pagesCH 07时家欣100% (2)

- CVP Questions DCDocument20 pagesCVP Questions DCJahanzaib ButtPas encore d'évaluation

- Loan Wo Title Islamic Madam Ainul Lecture Notes PDFDocument3 pagesLoan Wo Title Islamic Madam Ainul Lecture Notes PDFFreya MehmeenPas encore d'évaluation

- Monthly Household Budget: IncomeDocument6 pagesMonthly Household Budget: IncomeMayur NarkarPas encore d'évaluation

- Scope and DelimitatonDocument3 pagesScope and DelimitatonTirso Jr.Pas encore d'évaluation

- Papaya Corp. - Hyperninflation Wala Pang Solution PDFDocument3 pagesPapaya Corp. - Hyperninflation Wala Pang Solution PDFLoremar Ellen Dacumos HalogPas encore d'évaluation

- FINMARKETS - Prelim ExamDocument7 pagesFINMARKETS - Prelim ExamArmalyn CangquePas encore d'évaluation

- Pay Roll SamDocument2 pagesPay Roll Samsamuel debebePas encore d'évaluation

- Financial Management 1 - Assessment 2 - v6.5Document6 pagesFinancial Management 1 - Assessment 2 - v6.5Thiago FlorianoPas encore d'évaluation

- Governmental Entities: Special Funds and Government-Wide Financial StatementsDocument76 pagesGovernmental Entities: Special Funds and Government-Wide Financial StatementsSri UtamiPas encore d'évaluation

- Chapter 8: Inventories: Name: Castillo, Angelica Joy GDocument1 pageChapter 8: Inventories: Name: Castillo, Angelica Joy GAngelica CastilloPas encore d'évaluation

- Taxation1 Bonilla OutlineDocument3 pagesTaxation1 Bonilla OutlineFranch GalanzaPas encore d'évaluation

- Accounting For Decision Making: Unit-Iii Accounting Principles & ConventionsDocument24 pagesAccounting For Decision Making: Unit-Iii Accounting Principles & ConventionsVishal ChandakPas encore d'évaluation