Académique Documents

Professionnel Documents

Culture Documents

California State Audit Report Scope and Objectives

Transféré par

Harold HugginsCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

California State Audit Report Scope and Objectives

Transféré par

Harold HugginsDroits d'auteur :

Formats disponibles

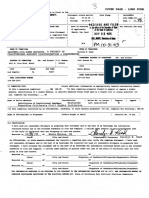

2015-107 AUDIT SCOPE AND OBJECTIVES

University of California

Budget, Enrollment, and Executive Compensation

The audit by the California State Auditor (state auditor) will provide independently developed

and verified information related to the University of California’s (UC) budget process, its

nonresident student enrollment, and executive compensation, and will include, but not be

limited to, the following:

1. Review and evaluate the laws, rules, and regulations significant to the audit objectives.

2. Review and evaluate the recommendations for rebenching and the process by which the UC

developed the rebenching initiative. Determine how the UC developed the weighted basis

for distributing per-student funding, including to what extent the UC consulted with

stakeholders such as undergraduate and graduate students when developing rebenching

recommendations.

3. Review and evaluate the UC’s progress in the implementation of its “Rebenching and

Funding Streams Initiatives” as well as any other initiatives that impact per-student and

campus funding. To the extent possible, determine if the UC is on track to achieve its goal of

leveling per-student funding by 2018.

4. Determine how much of state support funding is included in rebenching and identify how

the UC is using or distributing state support funding that is not included in rebenching.

5. Determine whether the UC is sufficiently addressing per-student funding inequities at the

campuses, particularly those campuses identified in the state auditor’s July 2011 audit

report as having received the least funding but having the highest proportion of

underrepresented students.

6. Review and evaluate the UC’s methods for determining resident and nonresident

enrollment targets at its campuses. Identify how the UC determined the amount it charges

nonresident students and assess how the amount compares to other comparable

universities.

7. For the past 10 fiscal years, identify the trend and projections in nonresident enrollment and

associated tuition. To the extent possible, determine the impact of nonresident enrollment

on per-student funding, California resident student access to the UC campuses, and revenue

received by the UC and the campuses, including how any changes to admission standards

have impacted a resident student’s access to the campus of his or her choice.

8. Determine the level of outreach, including outreach to students in underrepresented

communities and, to the extent possible, its impact on enrollment for nonresident versus

California resident students for the past 10 fiscal years. In addition, determine the ethnic

and racial background of the enrolled students.

California State Auditor’s Office

2/26/2015

9. For the most recent five fiscal years, review and evaluate how the UC and the campuses are

using the nonresident student tuition revenue.

10. For the most recent five fiscal years, review the compensation packages for the top

executive and management personnel at the UC and each campus. Determine if any trends

exist in the compensation packages identified, and to the extent possible, compare the UC’s

compensation packages to other public and private universities.

11. Evaluate the sufficiency of any changes made or corrective actions taken by the UC in

response to recommendations in the state auditor’s July 2011 audit report, including the

status of any outstanding recommendations.

12. Review and assess any other issues that are significant to the audit.

California State Auditor’s Office

2/26/2015

Vous aimerez peut-être aussi

- Dun & Bradstreet Business Information Report - COUNCIL For EDUCATION, TheDocument3 pagesDun & Bradstreet Business Information Report - COUNCIL For EDUCATION, TheHarold HugginsPas encore d'évaluation

- FOIA LetterDocument4 pagesFOIA LetterHarold HugginsPas encore d'évaluation

- Dun & Bradstreet Business Information Report - COUNCIL For EDUCATION, TheDocument3 pagesDun & Bradstreet Business Information Report - COUNCIL For EDUCATION, TheHarold HugginsPas encore d'évaluation

- NACIQI Transcripts Feb 8 2018 1 CEDDocument12 pagesNACIQI Transcripts Feb 8 2018 1 CEDHarold HugginsPas encore d'évaluation

- R AND State: FileiiDocument9 pagesR AND State: FileiiHarold HugginsPas encore d'évaluation

- UC Dropout Rate Analysis 17-09-2017Document33 pagesUC Dropout Rate Analysis 17-09-2017Harold HugginsPas encore d'évaluation

- Public RecordsDocument4 pagesPublic RecordsHarold HugginsPas encore d'évaluation

- Fair Political Practices Commission: Stipulation For Entry of JudgmentDocument13 pagesFair Political Practices Commission: Stipulation For Entry of JudgmentHarold HugginsPas encore d'évaluation

- Court OrderDocument2 pagesCourt OrderHarold HugginsPas encore d'évaluation

- Executive Summary:: The Student Loan Insurance Center (SLIC) A Subsidiary of The Council For Education (CFORED)Document44 pagesExecutive Summary:: The Student Loan Insurance Center (SLIC) A Subsidiary of The Council For Education (CFORED)Harold HugginsPas encore d'évaluation

- 1 United States Tax Court 3 4 5 6 The Council For Educaton, Docket No.17890-11X 7 PetitionerDocument5 pages1 United States Tax Court 3 4 5 6 The Council For Educaton, Docket No.17890-11X 7 PetitionerHarold HugginsPas encore d'évaluation

- Public Policy Report: UC Student Default Python Model: The Council For Education (CED)Document20 pagesPublic Policy Report: UC Student Default Python Model: The Council For Education (CED)Harold HugginsPas encore d'évaluation

- T. - Memo. 2013-283: SERVED DEC 16 2013Document30 pagesT. - Memo. 2013-283: SERVED DEC 16 2013Harold HugginsPas encore d'évaluation

- Motion To Amend OrderDocument128 pagesMotion To Amend OrderHarold HugginsPas encore d'évaluation

- IRS LetterDocument6 pagesIRS LetterHarold HugginsPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- 6398 14990 1 PBDocument8 pages6398 14990 1 PBKent Ky GillaPas encore d'évaluation

- Solved Suppose That The Velocity of Circulation of Money Is VDocument1 pageSolved Suppose That The Velocity of Circulation of Money Is VM Bilal SaleemPas encore d'évaluation

- News/procurement-News: WWW - Sbi.co - inDocument15 pagesNews/procurement-News: WWW - Sbi.co - inssat111Pas encore d'évaluation

- Ljubljana European Green Capital 2016Document56 pagesLjubljana European Green Capital 2016Kann_dandy17Pas encore d'évaluation

- ShapiroDocument34 pagesShapiroTanuj ShekharPas encore d'évaluation

- Schema Elctrica Placa Baza Toshiba A500-13wDocument49 pagesSchema Elctrica Placa Baza Toshiba A500-13wnicmaxxusPas encore d'évaluation

- Sap On Cloud PlatformDocument2 pagesSap On Cloud PlatformQueen VallePas encore d'évaluation

- High-Definition Multimedia Interface SpecificationDocument51 pagesHigh-Definition Multimedia Interface SpecificationwadrPas encore d'évaluation

- Invidis Yearbook 2019Document51 pagesInvidis Yearbook 2019Luis SanchezPas encore d'évaluation

- Mine Gases (Part 1)Document15 pagesMine Gases (Part 1)Melford LapnawanPas encore d'évaluation

- Low Cost HousingDocument5 pagesLow Cost HousingReigna SantillanaPas encore d'évaluation

- Security Enhancement in 2016 SQL ServerDocument21 pagesSecurity Enhancement in 2016 SQL ServerAtul SharmaPas encore d'évaluation

- Barnett V Chelsea and Kensington Hospital Management CommitteeDocument3 pagesBarnett V Chelsea and Kensington Hospital Management CommitteeArpit Soni0% (1)

- 20151201-Baltic Sea Regional SecurityDocument38 pages20151201-Baltic Sea Regional SecurityKebede MichaelPas encore d'évaluation

- RECRUITMENT AGENCIES IN U.A.E. (Here Is A List Containing 150+ Names)Document22 pagesRECRUITMENT AGENCIES IN U.A.E. (Here Is A List Containing 150+ Names)raajc12380% (5)

- The Van Conversion Bible - The Ultimate Guide To Converting A CampervanDocument170 pagesThe Van Conversion Bible - The Ultimate Guide To Converting A CampervanPil100% (3)

- 1.1 Cruz v. DENR PDFDocument7 pages1.1 Cruz v. DENR PDFBenBulacPas encore d'évaluation

- PETRO TCS Engineering Manual 682Document44 pagesPETRO TCS Engineering Manual 682paulm3565Pas encore d'évaluation

- Occupational Stress Questionnaire PDFDocument5 pagesOccupational Stress Questionnaire PDFabbaskhodaei666Pas encore d'évaluation

- Job Description: Extensive ReadingDocument12 pagesJob Description: Extensive ReadingNatalia VivonaPas encore d'évaluation

- Heirs of Tancoco v. CADocument28 pagesHeirs of Tancoco v. CAChris YapPas encore d'évaluation

- OL2068LFDocument9 pagesOL2068LFdieselroarmt875bPas encore d'évaluation

- Chapter 3 SampleDocument12 pagesChapter 3 Samplesyarifah53Pas encore d'évaluation

- Sec 11Document3 pagesSec 11Vivek JhaPas encore d'évaluation

- Demand Letter Template 39Document3 pagesDemand Letter Template 39AIG1 LOGISTICPas encore d'évaluation

- Tamil Nadu Industrial Establishments (Conferment of Permanent Status To Workman Act, 1981Document12 pagesTamil Nadu Industrial Establishments (Conferment of Permanent Status To Workman Act, 1981Latest Laws TeamPas encore d'évaluation

- Odontogenic CystsDocument5 pagesOdontogenic CystsBH ASMRPas encore d'évaluation

- Ultra Wideband TechnologyDocument21 pagesUltra Wideband TechnologyAzazelPas encore d'évaluation

- Process Plant Layout and Piping DesignDocument4 pagesProcess Plant Layout and Piping Designktsnl100% (1)

- Determination of Sales Force Size - 2Document2 pagesDetermination of Sales Force Size - 2Manish Kumar100% (3)