Académique Documents

Professionnel Documents

Culture Documents

Gomez v. Palomar

Transféré par

Marcella Maria KaraanCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Gomez v. Palomar

Transféré par

Marcella Maria KaraanDroits d'auteur :

Formats disponibles

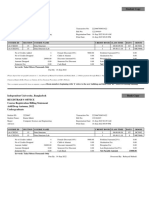

BENJAMIN P. GOMEZ v.

ENRICO PALOMAR, in his capacity as Postmaster true that only postal authorities can be guilty of violating it by accepting mails

General, HON. BRIGIDO R. VALENCIA, in his capacity as Secretary of Public without the payment of the anti-TB stamp.

Works and Communications, and DOMINGO GOPEZ, in his capacity as Acting However, the Court still held that petitioner's choice of remedy is correct

Postmaster of San Fernando, Pampanga because this suit was filed not only with respect to the letter which he mailed on

G.R. No. L-23645. October 29, 1968. CASTRO September 15, 1963, but also with regard to any other mail that he might send in

the future

FACTS 2. WoN the statute is violative of the equal protection clause - NO

RA 1635, amended by RA 2631, required that from August 19 to September 30, Petitioner argued that the statute constitutes mail users into a class for the

all mail matter shall bear semi-postal stamps of different denominations with face purpose of the tax while leaving untaxed the rest of the population and that even

value showing the regular postage charge plus an additional amount of 5 among postal patrons the statute discriminatorily grants exemption to

centavos. These semi-postal stamps will help raise funds for the Philippine newspapers and offices performing governmental functions.

Tuberculosis Society. The Court held that the 5-centavo charge levied by Republic Act 1635, as

o no such additional charge of 5 centavos shall be imposed on amended, is in the nature of an excise tax, laid upon the exercise of a privilege,

newspapers namely, the privilege of using the mails. As such the objections levelled against it

o The additional proceeds shall constitute a special fund and be must be viewed in the light of applicable principles of taxation.

deposited with the National Treasury to be expended by the Philippine the legislature has the inherent power to select the subjects of taxation and to

Tuberculosis Society in preventing and eradicating tuberculosis. grant exemptions. The power is "of wide range and flexibility." In the field of

The respondent Postmaster General, with the approval of the respondent taxation, more than in other areas, the legislature possesses the greatest

Secretary of Public Works and Communications, issued 4 administrative freedom in classification. The reason for this is that traditionally, classification

orders implementing the law. has been a device for fitting tax programs to local needs and usages in order to

o During the period from August 19 to September 30 each year starting in achieve an equitable distribution of the tax burden.

1958, no mail matter of whatever class, and whether domestic or As explained in Commonwealth v. Life Assurance Co.: While the principle that

foreign, posted at any Philippine Post Office and addressed for delivery there must be a reasonable relationship between classification made by the

in this country or abroad, shall be accepted for mailing unless it bears legislation and its purpose is undoubtedly true in some contexts, it has no

at least one such semi-postal stamp showing the additional value of 5 application to a measure whose sole purpose is to raise revenue ... So long as

centavos intended for the Philippine Tuberculosis Society. the classification imposed is based upon some standard capable of reasonable

o Mails posted during the said period starting in 1958, which are found in comprehension, be that standard based upon ability to produce revenue or some

street or post-office mail boxes without the required semi-postal stamp, other legitimate distinction, equal protection of the law has been afforded.

shall be returned to the sender the classification of mail users is not without any reason. It is based on ability to

o Government and its Agencies and Instrumentalities Performing pay, let alone the enjoyment of a privilege, and on administrative convenience.

Governmental Functions are exempted In the allocation of the tax burden, Congress must have concluded that the

On September 15, 1963, petitioner Benjamin P. Gomez mailed a letter at the contribution to the anti-TB fund can be assured by those whose who can afford

post office in San Fernando, Pampanga. Because this letter did not bear the the use of the mails.

special anti-TB stamp required by the statute, it was returned to the petitioner. o The classification is likewise based on considerations of administrative

petitioner brought suit for declaratory relief in CFI Pampanga to test the convenience. “Consideration of practical administrative convenience

constitutionality of the statute, as well as the implementing administrative orders and cost in the administration of tax laws afford adequate ground for

issued, contending that it violates the equal protection clause of the Constitution imposing a tax on a well recognized and defined class." In the case of

as well as the rule of uniformity and equality of taxation. the anti-TB stamps, undoubtedly, the single most important and

The lower court declared the statute and the orders unconstitutional; hence this influential consideration that led the legislature to select mail users as

appeal by the respondent postal authorities. subjects of the tax is the relative ease and convenienceof collecting the

tax through the post offices. The small amount of 5 centavos does not

ISSUES: justify the great expense and inconvenience of collecting through the

1. [PROCEDURAL] WoN declaratory relief is the proper remedy - YES regular means of collection. On the other hand, by placing the duty of

Respondents argued that declaratory relief is unavailing because this suit was collection on postal authorities the tax was made almost self-enforcing,

filed after the petitioner had committed a breach of the statute. with as little cost and as little inconvenience as possible.

Petitioner argued that the mailing of the letter in question did not constitute a o it is not accurate to say that the statute constituted mail users into a

breach of the statute because the statute appears to be addressed only to postal class. Mail users were already a class by themselves even before the

authorities enactment of the statue and all that the legislature did was merely to

The Court held that there had been a breach of the statute before the filing of select their class. Legislation is essentially empiric and RA 1635, as

this action (the mailing without the semi-postal stamp); it also held that it is not amended, no more than reflects a distinction that exists in fact.

Granted the power to select the subject of taxation, the State's power to grant

exemption must likewise be conceded as a necessary corollary. Tax exemptions

are too common in the law; they have never been thought of as raising issues

under the equal protection clause.

As the United States Supreme Court has said, the legislature may withhold the

burden of the tax in order to foster what it conceives to be a beneficent

enterprise. This is the case of newspapers which are exempt from the payment

of the additional stamp. As for the Government and its instrumentalities, their

exemption rests on the State's sovereign immunity from taxation. The State

cannot be taxed without its consent and such consent, being in derogation of its

sovereignty, is to be strictly construed.

The trial court held the law invalid on the ground that it singles out tuberculosis

to the exclusion of other diseases which, it is said, are equally a menace to

public health. But it is never a requirement of equal protection that all evils of the

same genus be eradicated or none at all. “If the law presumably hits the evil

where it is most felt, it is not to be overthrown because there are other instances

to which it might have been applied."

3. WoN it violates the rule of uniformity of taxation – NO

The eradication of a dreaded disease is a public purpose, but if by public

purpose the petitioner means benefit to a taxpayer as a return for what he pays,

then it is sufficient answer to say that the only benefit to which the taxpayer is

constitutionally entitled is that derived from his enjoyment of the privileges of

living in an organized society, established and safeguarded by the devotion of

taxes to public purposes. Any other view would preclude the levying of taxes

except as they are used to compensate for the burden on those who pay them

and would involve the abandonment of the most fundamental principle of

government — that it exists primarily to provide for the common good.

the money raised from the sales of the anti-TB stamps is spent for the benefit of

the Philippine Tuberculosis Society, a private organization, without appropriation

by law. But as the Solicitor General points out, the Society is not really the

beneficiary but only the agency through which the State acts in carrying out what

is essentially a public function. The money is treated as a special fund and as

such need not be appropriated by law.

Vous aimerez peut-être aussi

- Case Digest On Taxation Cases (General Principles)Document8 pagesCase Digest On Taxation Cases (General Principles)WEMD WRMDPas encore d'évaluation

- Gomez v. PalomarDocument1 pageGomez v. PalomarMadelle PinedaPas encore d'évaluation

- Philippine Bank of Communications tax refund caseDocument1 pagePhilippine Bank of Communications tax refund caseKkee DdooPas encore d'évaluation

- NPC LIABLE FOR DAMAGES FROM ANGAT DAM FLOODINGDocument2 pagesNPC LIABLE FOR DAMAGES FROM ANGAT DAM FLOODINGzeynPas encore d'évaluation

- Sanders Vs VeridianoDocument1 pageSanders Vs VeridianoWinly SupnetPas encore d'évaluation

- Arnado GR 210164Document3 pagesArnado GR 210164deuce scriPas encore d'évaluation

- Gotamco Case CirDocument2 pagesGotamco Case Cirnil qawPas encore d'évaluation

- Cebu RTC Had Jurisdiction to Issue Search Warrant for Alleged IPR Violation Despite AO 113-95Document8 pagesCebu RTC Had Jurisdiction to Issue Search Warrant for Alleged IPR Violation Despite AO 113-95Faye Michelle RegisPas encore d'évaluation

- Case DigestsDocument10 pagesCase Digestsricky nebatenPas encore d'évaluation

- Villanueva Vs City of IloiloDocument7 pagesVillanueva Vs City of IloilocharmssatellPas encore d'évaluation

- Cir v. John Gotamco - SonsDocument2 pagesCir v. John Gotamco - SonsLEIGH TARITZ GANANCIALPas encore d'évaluation

- Court of Tax Appeals Jurisdiction and Constitutional Challenge to Tax LawsDocument10 pagesCourt of Tax Appeals Jurisdiction and Constitutional Challenge to Tax LawsJade Marlu DelaTorrePas encore d'évaluation

- Phil. Acetylene Co. Inc. VS Cir, GR No L-19707, Aug 17, 1967Document11 pagesPhil. Acetylene Co. Inc. VS Cir, GR No L-19707, Aug 17, 1967KidMonkey2299Pas encore d'évaluation

- Reinald Raven L. Guerrero Taxation Law 1 Surigao Consolidated Mining Co. vs. Collector of Internal Revenue FactsDocument1 pageReinald Raven L. Guerrero Taxation Law 1 Surigao Consolidated Mining Co. vs. Collector of Internal Revenue FactsSapere AudePas encore d'évaluation

- 2 Cayetano vs. MonsodDocument37 pages2 Cayetano vs. MonsodJnhPas encore d'évaluation

- JURISDICTION - Inding Vs SandiganbayanDocument1 pageJURISDICTION - Inding Vs SandiganbayanEdrich John100% (1)

- Spouses Genato v. ViolaDocument8 pagesSpouses Genato v. ViolaPam RamosPas encore d'évaluation

- Batangas Transportation CoDocument3 pagesBatangas Transportation CoNomi ImbangPas encore d'évaluation

- 18 Manila Electric Company vs. Province of LagunaDocument7 pages18 Manila Electric Company vs. Province of Lagunashlm bPas encore d'évaluation

- RMC No. 46-2008Document13 pagesRMC No. 46-2008Jourd MagbanuaPas encore d'évaluation

- 17.MARK-monserrat Vs CeronDocument2 pages17.MARK-monserrat Vs CeronbowbingPas encore d'évaluation

- Lico vs. COMELEC, September 29, 2015 PDFDocument21 pagesLico vs. COMELEC, September 29, 2015 PDFNapoleon Sango IIIPas encore d'évaluation

- Part One I. Quasi-DelictDocument54 pagesPart One I. Quasi-DelictArnel MangilimanPas encore d'évaluation

- MCIAA Vs Marcos Case DigestDocument3 pagesMCIAA Vs Marcos Case DigestLuigi JaroPas encore d'évaluation

- 134 CIR Vs CA SPOUSES MANLYDocument2 pages134 CIR Vs CA SPOUSES MANLYJJ ValeroPas encore d'évaluation

- Western Mindanao Corp Vs CIR DigestDocument1 pageWestern Mindanao Corp Vs CIR Digestminri721100% (1)

- City of Baguio Vs de Leon GR No. L-24756Document6 pagesCity of Baguio Vs de Leon GR No. L-24756KidMonkey2299Pas encore d'évaluation

- Tolentino V SecretaryDocument1 pageTolentino V SecretaryKate MontenegroPas encore d'évaluation

- Ational Tatistics Ffice: Republic Act 10172Document15 pagesAtional Tatistics Ffice: Republic Act 10172Frannie PastorPas encore d'évaluation

- Coral Bay Nickel Corp Vs CIRDocument14 pagesCoral Bay Nickel Corp Vs CIRMiley LangPas encore d'évaluation

- Sears, Roebuck & Co. v. Stiffel Co., 376 U.S. 225 (1964)Document7 pagesSears, Roebuck & Co. v. Stiffel Co., 376 U.S. 225 (1964)Scribd Government DocsPas encore d'évaluation

- Maceda vs. MacaraigDocument3 pagesMaceda vs. MacaraigCrystal Kate A Agot0% (1)

- San Beda TaxDocument130 pagesSan Beda TaxLeiBee OngPas encore d'évaluation

- Supreme Court's Efficient Use of Paper RuleDocument2 pagesSupreme Court's Efficient Use of Paper RuleAlvin Dela CruzPas encore d'évaluation

- Supreme Court upholds protection orders for abused wifeDocument9 pagesSupreme Court upholds protection orders for abused wifeMarifel LagarePas encore d'évaluation

- Jaime N. Soriano, Et Al. vs. Secretary of FinanceDocument1 pageJaime N. Soriano, Et Al. vs. Secretary of FinanceVel June100% (1)

- Four siblings not liable as partnershipDocument4 pagesFour siblings not liable as partnershipKrister VallentePas encore d'évaluation

- Pimentel Vs Aguirre - G.R. No. 132988. July 19, 2000Document18 pagesPimentel Vs Aguirre - G.R. No. 132988. July 19, 2000Ebbe DyPas encore d'évaluation

- Affidavit of Support for Travel VisaDocument1 pageAffidavit of Support for Travel VisaRaymund Christian Ong AbrantesPas encore d'évaluation

- City of Manila vs. Coca-Cola Bottlers Phils., G.R. No.181845, August 4, 2009Document2 pagesCity of Manila vs. Coca-Cola Bottlers Phils., G.R. No.181845, August 4, 20090506sheltonPas encore d'évaluation

- BP Blg 135 tax rates challengedDocument1 pageBP Blg 135 tax rates challengedHomer Simpson100% (1)

- PRESUMPTION OF GUILT UNDER FISHERIES DECREEDocument11 pagesPRESUMPTION OF GUILT UNDER FISHERIES DECREEcharmssatellPas encore d'évaluation

- SBRC Inquiry Into Alleged Unlawful Enrichment BlockedDocument4 pagesSBRC Inquiry Into Alleged Unlawful Enrichment BlockedElle BanigoosPas encore d'évaluation

- Cir v. Cebu PortlandDocument1 pageCir v. Cebu PortlandShalini Kristy S DalisPas encore d'évaluation

- 33 JM Tuason & Co. v. Court of AppealsDocument2 pages33 JM Tuason & Co. v. Court of AppealsVeen Galicinao FernandezPas encore d'évaluation

- CASE #10 Reagan V Commissioner of Internal RevenueDocument1 pageCASE #10 Reagan V Commissioner of Internal RevenueEarl TheFingerroll Reyes100% (1)

- Iloilo vs. SMART DigestDocument3 pagesIloilo vs. SMART DigestKing BadongPas encore d'évaluation

- Saudi Arabian Airlines (Saudia) vs. Rebesencio 746 SCRA 140, January 14, 2015Document14 pagesSaudi Arabian Airlines (Saudia) vs. Rebesencio 746 SCRA 140, January 14, 2015chrisPas encore d'évaluation

- Tax Digest 1Document32 pagesTax Digest 1Marvin CeledioPas encore d'évaluation

- Bpi VS CaDocument1 pageBpi VS CaJezelle Gay AgustinPas encore d'évaluation

- Digests Tax I (2003)Document57 pagesDigests Tax I (2003)Berne Guerrero92% (13)

- Tio Vs VRB DigestDocument2 pagesTio Vs VRB Digestjimart10Pas encore d'évaluation

- Constitutionality of Philippine Law Requiring Anti-TB Stamps on MailDocument2 pagesConstitutionality of Philippine Law Requiring Anti-TB Stamps on MailcharmdelmoPas encore d'évaluation

- Gomez v. PalomarDocument3 pagesGomez v. PalomarBinkee VillaramaPas encore d'évaluation

- Gomez Vs PalomarDocument3 pagesGomez Vs PalomarJerico GodoyPas encore d'évaluation

- Gomez Vs PalomarDocument2 pagesGomez Vs PalomarCelinka Chun100% (1)

- Gomez Vs PalomarDocument2 pagesGomez Vs PalomarKim Lorenzo CalatravaPas encore d'évaluation

- Anti-TB Stamp Law UpheldDocument3 pagesAnti-TB Stamp Law UpheldChaDiazPas encore d'évaluation

- Gomez Vs PalomarDocument2 pagesGomez Vs PalomarKent Ugalde50% (2)

- Gomez v. PalomarDocument3 pagesGomez v. PalomarRukmini Dasi Rosemary GuevaraPas encore d'évaluation

- Eastern Telecommunications Philippines v. CIRDocument1 pageEastern Telecommunications Philippines v. CIRMarcella Maria KaraanPas encore d'évaluation

- PCCr solidary liability extinguished by releasesDocument1 pagePCCr solidary liability extinguished by releasesMarcella Maria KaraanPas encore d'évaluation

- Validity of The Waivers: CTA-First Division Partially Granted The Petition For ReviewDocument2 pagesValidity of The Waivers: CTA-First Division Partially Granted The Petition For ReviewMarcella Maria KaraanPas encore d'évaluation

- CIR v. Sony PhilippinesDocument1 pageCIR v. Sony PhilippinesMarcella Maria KaraanPas encore d'évaluation

- Nicolas v. CADocument1 pageNicolas v. CAMarcella Maria KaraanPas encore d'évaluation

- Pimentel v. AguirreDocument4 pagesPimentel v. AguirreMarcella Maria KaraanPas encore d'évaluation

- Pimentel v. AguirreDocument4 pagesPimentel v. AguirreMarcella Maria KaraanPas encore d'évaluation

- Cautela Praying That The Intestate CourtDocument2 pagesCautela Praying That The Intestate CourtMarcella Maria KaraanPas encore d'évaluation

- RUIZ v. CADocument2 pagesRUIZ v. CAMarcella Maria KaraanPas encore d'évaluation

- Mendoza v. COMELECDocument4 pagesMendoza v. COMELECMarcella Maria KaraanPas encore d'évaluation

- Chua v. PeopleDocument2 pagesChua v. PeopleMarcella Maria KaraanPas encore d'évaluation

- Nicolas v. CADocument1 pageNicolas v. CAMarcella Maria KaraanPas encore d'évaluation

- Dual Citizenship Not a Bar to Local OfficeDocument2 pagesDual Citizenship Not a Bar to Local OfficeMarcella Maria KaraanPas encore d'évaluation

- Chua v. PeopleDocument2 pagesChua v. PeopleMarcella Maria KaraanPas encore d'évaluation

- De Rossi v. NLRCDocument1 pageDe Rossi v. NLRCMarcella Maria KaraanPas encore d'évaluation

- Nava v. Peers Marketing CorpDocument1 pageNava v. Peers Marketing CorpMarcella Maria KaraanPas encore d'évaluation

- Cornejo v. SandiganbayanDocument2 pagesCornejo v. SandiganbayanMarcella Maria KaraanPas encore d'évaluation

- Nava v. Peers Marketing Corp.Document1 pageNava v. Peers Marketing Corp.Marcella Maria KaraanPas encore d'évaluation

- SC Ruled: The Denial of A Right To Have His Counsel Present at SuchDocument1 pageSC Ruled: The Denial of A Right To Have His Counsel Present at SuchMarcella Maria KaraanPas encore d'évaluation

- PCCr solidary liability extinguished by releasesDocument1 pagePCCr solidary liability extinguished by releasesMarcella Maria KaraanPas encore d'évaluation

- PCCr solidary liability extinguished by releasesDocument1 pagePCCr solidary liability extinguished by releasesMarcella Maria KaraanPas encore d'évaluation

- Potest Delegari Has Been Made To Adapt Itself To The Complexities ofDocument2 pagesPotest Delegari Has Been Made To Adapt Itself To The Complexities ofMarcella Maria KaraanPas encore d'évaluation

- Reaping The Fruits of Labor Mobility in The AECDocument14 pagesReaping The Fruits of Labor Mobility in The AECMarcella Maria KaraanPas encore d'évaluation

- UTP3-SW04-TP60 Datasheet VER2.0Document2 pagesUTP3-SW04-TP60 Datasheet VER2.0Ricardo TitoPas encore d'évaluation

- FSRH Ukmec Summary September 2019Document11 pagesFSRH Ukmec Summary September 2019Kiran JayaprakashPas encore d'évaluation

- Sysmex Xs-800i1000i Instructions For Use User's ManualDocument210 pagesSysmex Xs-800i1000i Instructions For Use User's ManualSean Chen67% (6)

- Inside Animator PDFDocument484 pagesInside Animator PDFdonkey slapPas encore d'évaluation

- Column Array Loudspeaker: Product HighlightsDocument2 pagesColumn Array Loudspeaker: Product HighlightsTricolor GameplayPas encore d'évaluation

- всё необходимое для изучения английского языкаDocument9 pagesвсё необходимое для изучения английского языкаNikita Chernyak100% (1)

- Federal Complaint of Molotov Cocktail Construction at Austin ProtestDocument8 pagesFederal Complaint of Molotov Cocktail Construction at Austin ProtestAnonymous Pb39klJPas encore d'évaluation

- Brick TiesDocument15 pagesBrick TiesengrfarhanAAAPas encore d'évaluation

- Customer Perceptions of Service: Mcgraw-Hill/IrwinDocument27 pagesCustomer Perceptions of Service: Mcgraw-Hill/IrwinKoshiha LalPas encore d'évaluation

- SCA ALKO Case Study ReportDocument4 pagesSCA ALKO Case Study ReportRavidas KRPas encore d'évaluation

- Circular Flow of Process 4 Stages Powerpoint Slides TemplatesDocument9 pagesCircular Flow of Process 4 Stages Powerpoint Slides TemplatesAryan JainPas encore d'évaluation

- Reg FeeDocument1 pageReg FeeSikder MizanPas encore d'évaluation

- Antenna VisualizationDocument4 pagesAntenna Visualizationashok_patil_1Pas encore d'évaluation

- Panel Data Econometrics: Manuel ArellanoDocument5 pagesPanel Data Econometrics: Manuel Arellanoeliasem2014Pas encore d'évaluation

- AsiaSat 7 at 105Document14 pagesAsiaSat 7 at 105rahman200387Pas encore d'évaluation

- DLL - The Firm and Its EnvironmentDocument5 pagesDLL - The Firm and Its Environmentfrances_peña_7100% (2)

- Kami Export - BuildingtheTranscontinentalRailroadWEBQUESTUsesQRCodes-1Document3 pagesKami Export - BuildingtheTranscontinentalRailroadWEBQUESTUsesQRCodes-1Anna HattenPas encore d'évaluation

- The Berkeley Review: MCAT Chemistry Atomic Theory PracticeDocument37 pagesThe Berkeley Review: MCAT Chemistry Atomic Theory Practicerenjade1516Pas encore d'évaluation

- GATE ECE 2006 Actual PaperDocument33 pagesGATE ECE 2006 Actual Paperkibrom atsbhaPas encore d'évaluation

- Forensic Science From The Crime Scene To The Crime Lab 2nd Edition Richard Saferstein Test BankDocument36 pagesForensic Science From The Crime Scene To The Crime Lab 2nd Edition Richard Saferstein Test Bankhilaryazariaqtoec4100% (25)

- Complete Guide To Sports Training PDFDocument105 pagesComplete Guide To Sports Training PDFShahana ShahPas encore d'évaluation

- SEO-Optimized Title for Python Code Output QuestionsDocument2 pagesSEO-Optimized Title for Python Code Output QuestionsTaru GoelPas encore d'évaluation

- Guiding Childrens Social Development and Learning 8th Edition Kostelnik Test BankDocument16 pagesGuiding Childrens Social Development and Learning 8th Edition Kostelnik Test Bankoglepogy5kobgk100% (27)

- QuickTransit SSLI Release Notes 1.1Document12 pagesQuickTransit SSLI Release Notes 1.1subhrajitm47Pas encore d'évaluation

- 8.1 Interaction Diagrams: Interaction Diagrams Are Used To Model The Dynamic Aspects of A Software SystemDocument13 pages8.1 Interaction Diagrams: Interaction Diagrams Are Used To Model The Dynamic Aspects of A Software SystemSatish JadhaoPas encore d'évaluation

- NewspaperDocument11 pagesNewspaperКристина ОрёлPas encore d'évaluation

- Artist Biography: Igor Stravinsky Was One of Music's Truly Epochal Innovators No Other Composer of TheDocument2 pagesArtist Biography: Igor Stravinsky Was One of Music's Truly Epochal Innovators No Other Composer of TheUy YuiPas encore d'évaluation

- Astera Data Integration BootcampDocument4 pagesAstera Data Integration BootcampTalha MehtabPas encore d'évaluation

- 5511Document29 pages5511Ckaal74Pas encore d'évaluation

- International Certificate in WealthDocument388 pagesInternational Certificate in Wealthabhishek210585100% (2)