Académique Documents

Professionnel Documents

Culture Documents

May07 PDF

Transféré par

omkassTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

May07 PDF

Transféré par

omkassDroits d'auteur :

Formats disponibles

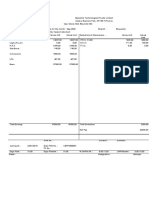

Infinx Services Pvt Ltd

Pay Slip for the month of May-2017

Employee Code : INFX01554 Payable Days : 28.00

Name : Mr. Amit Kasare LWP : 3.00

Department : Pre-Authorization Mahape Arrear Days : 0.00

Designation : Trainee Bank Ac No. : CHEQUE

PAN : CATPK0572L PF No. : MH/42842/4388

Esi No. : 3413433433 UAN No. : 100931033955

Date Of Joining : 12 Sep 2016

Earnings Deductions

Description Rate Monthly Arrear Total Description Amount

Consolidated Salary 3600.00 3252.00 0.00 3252.00 PF 390.00

HRA 1800.00 1626.00 0.00 1626.00 ESI 222.00

Conveyance Allowance 1600.00 1445.00 0.00 1445.00 PROF. TAX 200.00

Education Allowance 200.00 181.00 0.00 181.00

Special Allowance 3800.00 3432.00 0.00 3432.00

Shift Allowance 1800.00 0.00 1800.00

Canteen Allowance 1000.00 903.00 0.00 903.00

GROSS EARNINGS 12000.00 12639.00 0.00 12639.00 GROSS DEDUCTIONS 812.00

Net Pay : 11,827.00

Net Pay in words : INR Eleven Thousand Eight Hundred Twenty Seven Only

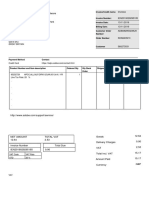

Income Tax Worksheet for the Period April 2017 - March 2018(Proposed Investments)

Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA Calculation(NON-METRO)

Consolidated Salary 42132.00 0.00 42132.00 Investments u/s 80C Exempted Qualifying Rent Paid 0.00

HRA 21066.00 0.00 21066.00 PROVIDENT FUND 5056.00 150000.00 From 01/04/2017

Conveyance Allowance 18725.00 18725.00 0.00 To 31/03/2018

Education Allowance 2341.00 2341.00 0.00 1. Actual HRA 21066.00

Special Allowance 44472.00 0.00 44472.00 2. 40% or 50% of Basic 16853.00

Shift Allowance 3700.00 0.00 3700.00 3. Rent - 10% Basic 0.00

Canteen Allowance 11703.00 0.00 11703.00 Least of above is exempt 0.00

Taxable HRA 21066.00

Gross 144139.00 21066.00 123073.00 Total of Investments u/s 80C 5056.00 150000.00 TDS Deducted Monthly

Deductions U/S 80C 5056.00 150000.00 Month Amount

Previous Employer Taxable Income 0.00 Total of Ded Under Chapter VI-A 5056.00 150000.00 April-2017 0.00

Professional Tax 2500.00 May-2017 0.00

Under Chapter VI-A 5056.00 Tax Deducted on Perq. 0.00

Any Other Income 0.00 Total 0.00

Taxable Income 0.00

Total Tax 0.00

Marginal Relief 0.00

Tax Rebate 0.00

Surcharge 0.00

Tax Due 0.00

Educational Cess 0.00

Net Tax 0.00

Tax Deducted (Previous Employer) 0.00

Tax Deducted on Perq. 0.00

Tax Deducted on Any Other Income. 0.00

Tax Deducted Till Date 0.00

Tax to be Deducted 0.00

Tax/Month 0.00 Total of Any Other Income 0.00

Tax on Non-Recurring Earnings 0.00

Tax Credit Amount (87A) 0.00

Tax Deduction for this month 0.00

..................................................... Cut Here .....................................................

Personal Note: This is a system generated payslip, does not require any signature.

Vous aimerez peut-être aussi

- OE0036Document1 pageOE0036kumud kalaPas encore d'évaluation

- April2018 PDFDocument1 pageApril2018 PDFomkassPas encore d'évaluation

- May Salary PDFDocument1 pageMay Salary PDFomkassPas encore d'évaluation

- Jan18 PDFDocument1 pageJan18 PDFomkassPas encore d'évaluation

- April 2017Document1 pageApril 2017omkassPas encore d'évaluation

- Mar18 PDFDocument1 pageMar18 PDFomkassPas encore d'évaluation

- April Salary PDFDocument1 pageApril Salary PDFomkassPas encore d'évaluation

- Personal Note: This Is A System Generated Payslip, Does Not Require Any SignatureDocument1 pagePersonal Note: This Is A System Generated Payslip, Does Not Require Any SignatureShakti NaikPas encore d'évaluation

- Employee DataDocument1 pageEmployee DataDinesh RPas encore d'évaluation

- July 2017Document1 pageJuly 2017omkass100% (1)

- Employee DataDocument1 pageEmployee DataomkassPas encore d'évaluation

- March Salary PDFDocument1 pageMarch Salary PDFomkassPas encore d'évaluation

- Employee DataDocument1 pageEmployee DataomkassPas encore d'évaluation

- June Salry PDFDocument1 pageJune Salry PDFomkassPas encore d'évaluation

- Dec07 PDFDocument1 pageDec07 PDFomkassPas encore d'évaluation

- 157salaryslip g5sxl3g6Document1 page157salaryslip g5sxl3g6Shakti NaikPas encore d'évaluation

- Earnings Deductions: Eicher Motors LimitedDocument1 pageEarnings Deductions: Eicher Motors LimitedR SEETHARAMANPas encore d'évaluation

- Nov 2017Document1 pageNov 2017omkassPas encore d'évaluation

- Personal Note: This Is A System Generated Payslip, Does Not Require Any SignatureDocument1 pagePersonal Note: This Is A System Generated Payslip, Does Not Require Any SignatureShakti NaikPas encore d'évaluation

- Pay Slip For The Month of October-2017Document1 pagePay Slip For The Month of October-2017omkassPas encore d'évaluation

- VishalDocument1 pageVishalgig.sachinrajakPas encore d'évaluation

- Pay Slip For The Month of December-2017Document1 pagePay Slip For The Month of December-2017omkassPas encore d'évaluation

- SalarySlipwithTaxDetails PDFDocument1 pageSalarySlipwithTaxDetails PDFRahul mishraPas encore d'évaluation

- You Have Opted For Old Tax RegimeDocument2 pagesYou Have Opted For Old Tax RegimeRamsheed Ashraf100% (1)

- SalarySlipwithTaxDetailsDocument1 pageSalarySlipwithTaxDetailsmbdeepu8Pas encore d'évaluation

- Jan SlipDocument1 pageJan Slipherlyn8762Pas encore d'évaluation

- P2385 Nov2023Document2 pagesP2385 Nov2023ManiPas encore d'évaluation

- CB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedDocument3 pagesCB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedsathyaPas encore d'évaluation

- Manimaran Oct Payslip ShriramDocument2 pagesManimaran Oct Payslip ShriramManiPas encore d'évaluation

- Noveltech Feeds Private Limited: Earnings DeductionsDocument1 pageNoveltech Feeds Private Limited: Earnings DeductionsPrakash LamaniPas encore d'évaluation

- Feb PayslipDocument1 pageFeb Payslipnegishilpa051Pas encore d'évaluation

- Salary SlipDocument1 pageSalary SlipPhagun BehlPas encore d'évaluation

- Description Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationDocument2 pagesDescription Gross Exempt Taxable Deduction Under Chapter VI-A Taxable HRA CalculationRakesh6nairPas encore d'évaluation

- Manimaran Oct Payslip ShriramDocument2 pagesManimaran Oct Payslip ShriramManiPas encore d'évaluation

- Salary SlipDocument1 pageSalary SlipPhagun BehlPas encore d'évaluation

- Employee DataDocument2 pagesEmployee DataJitender singhPas encore d'évaluation

- Manimaran Nov Payslip ShriramDocument2 pagesManimaran Nov Payslip ShriramManiPas encore d'évaluation

- Manimaran Nov Payslip ShriramDocument2 pagesManimaran Nov Payslip ShriramManiPas encore d'évaluation

- Ravi MukharjeeDocument2 pagesRavi MukharjeeDivesh RaiPas encore d'évaluation

- P2385 Nov2023Document2 pagesP2385 Nov2023ManiPas encore d'évaluation

- Luminous Power Technologies Private Limited: Earnings DeductionsDocument1 pageLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kPas encore d'évaluation

- E010072 Payslip 01-JanDocument1 pageE010072 Payslip 01-JanhariprasadhpPas encore d'évaluation

- Wa0023.Document2 pagesWa0023.ManiPas encore d'évaluation

- Jan PayslipDocument1 pageJan Payslipnegishilpa051Pas encore d'évaluation

- P2385 Nov2023Document2 pagesP2385 Nov2023ManiPas encore d'évaluation

- SettlementReportDocument1 pageSettlementReportBhanuranjan S BPas encore d'évaluation

- SettlementReportDocument1 pageSettlementReportBhanuranjan S BPas encore d'évaluation

- Sify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-600113Document1 pageSify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-600113JOOOOOPas encore d'évaluation

- Latha R (KT083) - PayslipDocument1 pageLatha R (KT083) - Paysliprangaswamy8194Pas encore d'évaluation

- Payslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Document1 pagePayslip For The Month of Jul 2019: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)praveen kumarPas encore d'évaluation

- H2coms C001 Ani2387 202305Document1 pageH2coms C001 Ani2387 202305chagusahoo170Pas encore d'évaluation

- Sunil Kumar (DELS0210)Document1 pageSunil Kumar (DELS0210)SUNIL KUMARPas encore d'évaluation

- Tasleem MayDocument2 pagesTasleem MayManthan ShahPas encore d'évaluation

- SalarySlipwithTaxDetailsDocument2 pagesSalarySlipwithTaxDetailsVivek ViviPas encore d'évaluation

- Corona Remedies PVT LTD: Pay Slip For The Month of Apr - 2019Document1 pageCorona Remedies PVT LTD: Pay Slip For The Month of Apr - 2019Emmanuel melvinPas encore d'évaluation

- Jul 2023Document1 pageJul 2023Praveen SainiPas encore d'évaluation

- Pay Slip For The Month of October-2017Document1 pagePay Slip For The Month of October-2017omkassPas encore d'évaluation

- July 2017Document1 pageJuly 2017omkass100% (1)

- Nov 2017Document1 pageNov 2017omkassPas encore d'évaluation

- Pay Slip For The Month of December-2017Document1 pagePay Slip For The Month of December-2017omkassPas encore d'évaluation

- Employee DataDocument1 pageEmployee DataomkassPas encore d'évaluation

- Employee DataDocument1 pageEmployee DataomkassPas encore d'évaluation

- Accounting For Insurance Contracts Deferred Tax and Earnings Per ShareDocument2 pagesAccounting For Insurance Contracts Deferred Tax and Earnings Per ShareJanine CamachoPas encore d'évaluation

- Busines EthicsDocument253 pagesBusines Ethicssam.genenePas encore d'évaluation

- Cash and Cash EquivalentDocument2 pagesCash and Cash EquivalentJovani Laña100% (1)

- Executive Summary: Source of Commission: PMA Date of Commission: 16 March 2009 Date of Rank: 16 March 2016Document3 pagesExecutive Summary: Source of Commission: PMA Date of Commission: 16 March 2009 Date of Rank: 16 March 2016Yanna PerezPas encore d'évaluation

- Engine Oil, Global Service-Fill Diesel Engine and Regional Service-Fill Spark-Ignited Engine, SAE 0W-30, 5W-30, 0W-40, 5W-40Document9 pagesEngine Oil, Global Service-Fill Diesel Engine and Regional Service-Fill Spark-Ignited Engine, SAE 0W-30, 5W-30, 0W-40, 5W-40Akmal NizametdinovPas encore d'évaluation

- Case Name Topic Case No. ǀ Date Ponente Doctrine: USA College of Law Sobredo-1FDocument1 pageCase Name Topic Case No. ǀ Date Ponente Doctrine: USA College of Law Sobredo-1FAphrPas encore d'évaluation

- Supreme Court: Republic of The PhilippinesDocument13 pagesSupreme Court: Republic of The PhilippinesellaPas encore d'évaluation

- AWS QuestionnaireDocument11 pagesAWS QuestionnaireDavid JosephPas encore d'évaluation

- 04 Dam Safety FofDocument67 pages04 Dam Safety FofBoldie LutwigPas encore d'évaluation

- Iecq 03-2-2013Document14 pagesIecq 03-2-2013RamzanPas encore d'évaluation

- Vitanzos April Mae E. Long Quiz ApDocument5 pagesVitanzos April Mae E. Long Quiz ApMitch MinglanaPas encore d'évaluation

- EF4C HDT3 Indicators GDP IIP CSP20 PDFDocument41 pagesEF4C HDT3 Indicators GDP IIP CSP20 PDFNikhil AgrawalPas encore d'évaluation

- In Exceedance To AWWA Standards Before It IsDocument2 pagesIn Exceedance To AWWA Standards Before It IsNBC 10 WJARPas encore d'évaluation

- ## JSA - 008 - Hydraulic Rig and Mobile Crane MarchingDocument2 pages## JSA - 008 - Hydraulic Rig and Mobile Crane MarchingAbhijit JanaPas encore d'évaluation

- Russo-Ottoman Politics in The Montenegrin-Iskodra Vilayeti Borderland (1878-1912)Document4 pagesRusso-Ottoman Politics in The Montenegrin-Iskodra Vilayeti Borderland (1878-1912)DenisPas encore d'évaluation

- Nypd AcronymDocument4 pagesNypd AcronymMr .X100% (1)

- Smedley - The History of The Idea of RaceDocument9 pagesSmedley - The History of The Idea of RaceGuavaCrispPas encore d'évaluation

- GA Tax GuideDocument46 pagesGA Tax Guidedamilano1Pas encore d'évaluation

- RIGHT AGAINST SELF INCRIMINATION-ReviewerDocument3 pagesRIGHT AGAINST SELF INCRIMINATION-ReviewerAnna Katrina QuanicoPas encore d'évaluation

- الضرائب المؤجلة بين قواعد النظام المحاسبي المالي والنظام الجبائي في الجزائر -دراسة حالة مؤسسةenpc سطيفDocument21 pagesالضرائب المؤجلة بين قواعد النظام المحاسبي المالي والنظام الجبائي في الجزائر -دراسة حالة مؤسسةenpc سطيفali lakridPas encore d'évaluation

- Posting and Preparation of Trial Balance 1Document33 pagesPosting and Preparation of Trial Balance 1iTs jEnInOPas encore d'évaluation

- 11 Physics Notes 09 Behaviour of Perfect Gas and Kinetic Theory of GasesDocument14 pages11 Physics Notes 09 Behaviour of Perfect Gas and Kinetic Theory of GasesAnu Radha100% (2)

- Shrimp Specialists V Fuji-TriumphDocument2 pagesShrimp Specialists V Fuji-TriumphDeaPas encore d'évaluation

- Invoice: VAT No: IE6364992HDocument2 pagesInvoice: VAT No: IE6364992HRajPas encore d'évaluation

- Terms and ConditionsDocument3 pagesTerms and ConditionsAkash Aryans ShrivastavaPas encore d'évaluation

- United States v. Guiseppe Gambino, Francesco Gambino, Lorenzo Mannino, Matto Romano, Salvatore Lobuglio, Salvatore Rina, Guiseppe D'amico, Salvatore D'amico, Francesco Cipriano, Pietro Candela, Salvatore Candela, Francesco Inzerillo, Joseph Larosa, Paolo D'amico, Rocco Launi, Fabrizio Tesi, Vittorio Barletta, Carmelo Guarnera, Sasha (Lnu), Giovanni Zarbano, Rosario Naimo, Emanuele Adamita and Giovanni Gambino, Salvatore Lobuglio and Salvatore D'Amico, 951 F.2d 498, 2d Cir. (1991)Document9 pagesUnited States v. Guiseppe Gambino, Francesco Gambino, Lorenzo Mannino, Matto Romano, Salvatore Lobuglio, Salvatore Rina, Guiseppe D'amico, Salvatore D'amico, Francesco Cipriano, Pietro Candela, Salvatore Candela, Francesco Inzerillo, Joseph Larosa, Paolo D'amico, Rocco Launi, Fabrizio Tesi, Vittorio Barletta, Carmelo Guarnera, Sasha (Lnu), Giovanni Zarbano, Rosario Naimo, Emanuele Adamita and Giovanni Gambino, Salvatore Lobuglio and Salvatore D'Amico, 951 F.2d 498, 2d Cir. (1991)Scribd Government DocsPas encore d'évaluation

- Rohmayati Pertemuan 8Document5 pagesRohmayati Pertemuan 8Mamah ZhakiecaPas encore d'évaluation

- Souper Bowl Student CaseDocument6 pagesSouper Bowl Student CaseRajabPas encore d'évaluation

- FCI Recruitment NotificationDocument4 pagesFCI Recruitment NotificationAmit KumarPas encore d'évaluation

- M1-06 - Resultant ForcesDocument9 pagesM1-06 - Resultant ForcesHawraa HawraaPas encore d'évaluation