Académique Documents

Professionnel Documents

Culture Documents

Commercial Vehicles - February 2018

Transféré par

rammar147Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Commercial Vehicles - February 2018

Transféré par

rammar147Droits d'auteur :

Formats disponibles

INDIAN AUTOMOBILE INDUSTRY – Commercial Vehicles

Low base because of demonetisation continues to drive strong growth in CV sales in January 2018

ICRA RESEARCH SERVICES

ICRA Research Services | Monthly Update February 2018

Corporate Ratings

Anjan Deb Ghosh

+91 22 2433 1074

aghosh@icraindia.com

Contacts:

Subrata Ray

+91 22 2433 1086

subrata@icraindia.com

Domestic Volume Growth Trends in January 2018:

Domestic CV sales grew by 39.7% on account of low base of Jan-2017

Demonetisation moved had significantly impacted CV sales between Dec-2016 to Feb-2017

M&HCV (Truck) sales expanded by 23% on YoY basis on back of low base

LCV (Trucks) continued to register healthy growth (up 63%) on YoY basis

Bus sales grew by just 3.2% in January 2018 because of weak order inflows from SRTUs

February 13, 2018

ICRA Research Services

Summary

Industry Sales Trends – January 2018

Low base because of demonetization as well as strong demand in select segments continues to drive CV demand

The domestic Commercial Vehicle (CV) industry led by truck segment has been on a recovery phase since the beginning of Q2 FY 2018. In 10m FY 2018, the domestic CV sales have

grown by 17.9% primarily driven by healthy growth in the LCV (Truck) and M&HCV (Truck) segment, while bus sales have contracted sharply on back of weak SRTU orders. The stellar

volume growth during the last few months is also driven by inventory clearance by OEMs ahead of mandatory roll-out of HVAC/blower in heavy-duty trucks from January 2018.

Consequently, there could be sequential moderation in volumes in Feb-18 on account of pre-buying activity because of BS-IV norms in February and March 2017.

Within the CV space, the M&HCV (Truck) has grown by 17.3% in volume terms aided by pent-up demand post GST implementation, stricter implementation of overloading norms as

well as healthy demand for tippers (from construction sector) and HCVs (from select industries like car carriers, petroleum products, container traffic). Likewise, the LCV (Truck)

segment has also witnessed a strong growth of 27.5% in volume terms driven by replacement cycle, improving financing environment and pick-up rural demand. While truck sales

have picked-up sharply, demand for bus has weakened considerably (down 16.7% YTD) owing to weak orders from both SRTUs and private segment. TML has gained market share in

LCV as well as M&HCV space aided by addressing gaps its product portfolio.

Exhibit 1: Trend in Domestic Commercial Vehicle Sales

Industry Volumes FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 10m FY 2017 10m FY2018

M&HCV Trucks 221,776 161,909 195,918 258,488 255,267 195,794 229,570

LCV Trucks 476,695 389,434 337,377 334,371 360,839 287,876 366,943

Buses 94,740 81,508 81,653 92,845 98,126 76,219 63,484

Total 793,211 632,851 614,948 685,704 714,232 559,889 659,997

Growth (%) – YoY

M&HCV Trucks -25.9% -27.0% 21.0% 31.9% (1.2%) 17.3%

LCV Trucks 15.9% -18.3% -13.4% -0.9% 7.9% 27.5%

Buses -4.1% -14.0% 0.2% 13.7% 5.7% (16.7%)

Total -2.0% -20.2% -2.8% 11.5% 4.2% 17.9%

Source: SIAM Data, ICRA research

Outlook: Domestic CV industry sales expected to recover post GST implementation

Having witnessed strong recovery over the past two quarters, ICRA estimates FY 2018 to end with a growth of 10-12% in volume sales. The increased thrust on infrastructure projects

as visible in the recent budget, higher demand from consumption-driven sectors and e-commerce logistic service providers, especially for LCVs and ICVs and potential implementation

of fleet modernization or scrappage program will continue to support demand for CVs into FY 2019. However, we expect the growth momentum would see some moderation,

especially in the M&HCV segment owing sizeable capacity addition, especially in tonnage terms during FY 2018. Accordingly, we expect M&HCV Trucks to register a growth of 2-4% in

volume terms in FY 2019. Nonetheless, if Government’s plans (although delayed) on phasing out old diesel vehicles through proposed vehicle modernization program materialize,

growth could be higher. ICRA believes that the LCV segment is on a structural uptrend and has witnessed swift recovery with improvement in liquidity situation. In the near-term,

replacement-led demand (following almost three years of declining sales) and expectation of stronger demand from consumption-driven sectors and E-commerce would remain key

growth drivers for the segment. Accordingly, ICRA expects the LCV (Truck) segment to register a growth of 9-11% in FY 2019. In the bus segment, the growth is expected to recover in

FY 2019 aided by expectation of replacement-led demand following a year of sharp contraction in bus sales.

ICRA Research Services

CORPORATE OFFICE

Building No. 8, 2nd Floor, Tower A; DLF Cyber City, Phase II; Gurgaon 122 002

Tel: +91 124 4545300; Fax: +91 124 4545350

Email: info@icraindia.com, Website: www.icra.in

REGISTERED OFFICE

th

1105, Kailash Building, 11 Floor; 26 Kasturba Gandhi Marg; New Delhi 110001

Tel: +91 11 23357940-50; Fax: +91 11 23357014

Branches: Mumbai: Tel.: + (91 22) 24331046/53/62/74/86/87, Fax: + (91 22) 2433 1390 Chennai: Tel + (91 44) 2434 0043/9659/8080, 2433 0724/ 3293/3294, Fax + (91

44) 2434 3663 Kolkata: Tel + (91 33) 2287 8839 /2287 6617/ 2283 1411/ 2280 0008, Fax + (91 33) 2287 0728 Bangalore: Tel + (91 80) 2559 7401/4049 Fax + (91 80) 559

4065 Ahmedabad: Tel + (91 79) 2658 4924/5049/2008, Fax + (91 79) 2658 4924 Hyderabad: Tel +(91 40) 2373 5061/7251, Fax + (91 40) 2373 5152 Pune: Tel + (91 20)

2552 0194/95/96, Fax + (91 20) 553 9231

© Copyright, 2018 ICRA Limited. All Rights Reserved.

All information contained herein has been obtained by ICRA from sources believed by it to be accurate and reliable. Although reasonable care has been taken to ensure

that the information herein is true, such information is provided 'as is' without any warranty of any kind, and ICRA in particular, makes no representation or warranty,

express or implied, as to the accuracy, timeliness or completeness of any such information. Also, ICRA or any of its group companies, while publishing or otherwise

disseminating other reports may have presented data, analyses and/or opinions that may be inconsistent with the data, analyses and/or opinions in this publication. All

information contained herein must be construed solely as statements of opinion, and ICRA shall not be liable for any losses incurred by users from any use of this

publication or its contents.

ICRA Research Services

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Financing:: 1. Role of Shareholders As StakeholdersDocument2 pagesFinancing:: 1. Role of Shareholders As Stakeholdersrammar147Pas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- WCPT9 Scientific Program Madrid 2022Document52 pagesWCPT9 Scientific Program Madrid 2022rammar147Pas encore d'évaluation

- Investment Scenario - : (A) FDI EQUITY INFLOWS (Equity Capital Components)Document1 pageInvestment Scenario - : (A) FDI EQUITY INFLOWS (Equity Capital Components)rammar147Pas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- A Coupled CFD Monte Carlo Method For Simulating Complex Aerosol Dynamics in Turbulent FlowsDocument14 pagesA Coupled CFD Monte Carlo Method For Simulating Complex Aerosol Dynamics in Turbulent Flowsrammar147Pas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Case Jonah Creighton: Ethics and Value Based LeadershipDocument16 pagesCase Jonah Creighton: Ethics and Value Based Leadershiprammar147Pas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- 2022 Rent Receipt 2Document1 page2022 Rent Receipt 2rammar147Pas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Volume 5 Issue 4 Paper 3Document6 pagesVolume 5 Issue 4 Paper 3Niku BandiPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Volume 5 Issue 4 Paper 3Document6 pagesVolume 5 Issue 4 Paper 3Niku BandiPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- ITC Product MixDocument47 pagesITC Product MixMohit Malviya67% (3)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Satyam CaseDocument4 pagesSatyam Caserammar147Pas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Financing:: 1. Role of Shareholders As StakeholdersDocument2 pagesFinancing:: 1. Role of Shareholders As Stakeholdersrammar147Pas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Leveraging: Case StudyDocument1 pageLeveraging: Case Studyrammar147Pas encore d'évaluation

- Case Study 1Document11 pagesCase Study 1Jaspal Singh100% (1)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Shielding CalculationDocument17 pagesShielding Calculationrammar147Pas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Flux Calculation Due To Non Uniform SourceDocument4 pagesFlux Calculation Due To Non Uniform Sourcerammar147Pas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Case Study 1Document11 pagesCase Study 1Jaspal Singh100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Dose Due To Cylindrical SourceDocument9 pagesDose Due To Cylindrical Sourcerammar147Pas encore d'évaluation

- Dose Due To Cylindrical SourceDocument9 pagesDose Due To Cylindrical Sourcerammar147Pas encore d'évaluation

- Dose Due To Cylindrical SourceDocument9 pagesDose Due To Cylindrical Sourcerammar147Pas encore d'évaluation

- Special RelativityDocument53 pagesSpecial RelativityAndrew Florit100% (2)

- Supersymmetry ReportDocument49 pagesSupersymmetry Reportrammar147Pas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Flux Calculation Due To Non Uniform SourceDocument4 pagesFlux Calculation Due To Non Uniform Sourcerammar147Pas encore d'évaluation

- 13 PPTGGDocument78 pages13 PPTGGأحمدآلزهوPas encore d'évaluation

- Semiconductor PN JunctionDocument19 pagesSemiconductor PN Junctionrammar147Pas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Fmradio 1111 PDFDocument7 pagesFmradio 1111 PDFVikiVikiPas encore d'évaluation

- Mco 07Document4 pagesMco 07rammar147Pas encore d'évaluation

- 1 - 0 Answers Progress: To Check YourDocument26 pages1 - 0 Answers Progress: To Check YourvimalbakshiPas encore d'évaluation

- Introduction To MarketingDocument18 pagesIntroduction To Marketingsabyasachi samalPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Power DomiLED InGaN DWZB UJG (3J8L) Catalogue-V1Document15 pagesPower DomiLED InGaN DWZB UJG (3J8L) Catalogue-V1Kuba KozerskiPas encore d'évaluation

- Question & Answer - Module 1 NACEDocument6 pagesQuestion & Answer - Module 1 NACEraghuvarma0% (1)

- Devlopment and Analysis of Natural Banana Fiber CompositeDocument3 pagesDevlopment and Analysis of Natural Banana Fiber CompositeEditor IJRITCCPas encore d'évaluation

- Demand Control Ventilation Benefits For Your Building: White Paper SeriesDocument6 pagesDemand Control Ventilation Benefits For Your Building: White Paper Serieshb_scribPas encore d'évaluation

- Informacion Tecnica Valvula Motora Gas de AltaDocument8 pagesInformacion Tecnica Valvula Motora Gas de AltaGuille MVPas encore d'évaluation

- TB 213 Engineering Guide On Earthing Systems in Power Stations - PeiDocument6 pagesTB 213 Engineering Guide On Earthing Systems in Power Stations - Peifgdfgdf0% (1)

- Cepe BomDocument8 pagesCepe BomRomeo AtienzaPas encore d'évaluation

- Dupont Tyvek BrochureDocument4 pagesDupont Tyvek BrochureAugustin MacoveiPas encore d'évaluation

- WTP 3032 Painting WorksDocument9 pagesWTP 3032 Painting WorksWan AnisPas encore d'évaluation

- Kitchen Mood BoardDocument9 pagesKitchen Mood BoardKelly CantaraPas encore d'évaluation

- Interbond 600 PDFDocument4 pagesInterbond 600 PDFTrịnh Minh KhoaPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Welcome Newcomer To SLPDocument10 pagesWelcome Newcomer To SLPnxgenoePas encore d'évaluation

- M1 Installation ManualDocument72 pagesM1 Installation ManualGary IrvingPas encore d'évaluation

- Practical Action How To Make Stabilised Earth BlocksDocument14 pagesPractical Action How To Make Stabilised Earth BlocksPeter W Gossner100% (1)

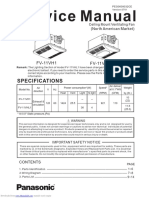

- Panasonic Bathroom Fan Heater Combo Service ManualDocument15 pagesPanasonic Bathroom Fan Heater Combo Service ManualddPas encore d'évaluation

- (PDF) UAP Doc 401-402Document17 pages(PDF) UAP Doc 401-402stanflynnPas encore d'évaluation

- CN 7001 Advanced Concrete Technology1Document3 pagesCN 7001 Advanced Concrete Technology1Karthik NatesanPas encore d'évaluation

- Alfa Laval Separator Course Specification PDFDocument9 pagesAlfa Laval Separator Course Specification PDFGerald Campañano100% (2)

- BoM For TransformerDocument24 pagesBoM For TransformeritsmercyadavPas encore d'évaluation

- Industrial Training Report: Department of Mechanical EngineeringDocument32 pagesIndustrial Training Report: Department of Mechanical EngineeringParul Chhabra67% (3)

- R3G310AJ3861 DigitalDocument11 pagesR3G310AJ3861 DigitalmucorPas encore d'évaluation

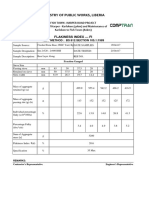

- Ministry of Public Works, Liberia: Flakiness Index - FiDocument2 pagesMinistry of Public Works, Liberia: Flakiness Index - FikwamePas encore d'évaluation

- Scada Specification Rdso DocumentDocument35 pagesScada Specification Rdso DocumentbhaskarjalanPas encore d'évaluation

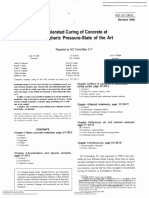

- ACI 517 2 1992 Accelerated Curing of Concrete at Atmospheric Pressure PDFDocument17 pagesACI 517 2 1992 Accelerated Curing of Concrete at Atmospheric Pressure PDFHaniAminPas encore d'évaluation

- Parts List FerraraDocument8 pagesParts List Ferraramark_59Pas encore d'évaluation

- Switched Reluctance Motor 17 I TaeDocument114 pagesSwitched Reluctance Motor 17 I TaeAnonymous zzfx7mz3Pas encore d'évaluation

- VK-P Series Tsi Transducer Model Vk-143P Transducer Instruction ManualDocument53 pagesVK-P Series Tsi Transducer Model Vk-143P Transducer Instruction Manualravi_fdPas encore d'évaluation

- Excavator Sop PDFDocument1 pageExcavator Sop PDFhengky achmadPas encore d'évaluation

- Candidate Registration DetailsDocument229 pagesCandidate Registration Detailsphone2hirePas encore d'évaluation

- (Paper) Jack Down Construction MethodDocument6 pages(Paper) Jack Down Construction MethodShaileshRastogiPas encore d'évaluation