Académique Documents

Professionnel Documents

Culture Documents

Consolidated GR No. 158489

Transféré par

Joshua ChavezCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Consolidated GR No. 158489

Transféré par

Joshua ChavezDroits d'auteur :

Formats disponibles

Filipinas Life Assurance Co. (now Ayala Life Assurance, Inc.) v.

Clemente Pedrosa, TeresitaPedrosa and Jennifer

Palacio

G.R. No. 159489, February 04, 2008Quisumbing, J.

FACTS:

Teresita Pedroso is a policyholder of a 20 -year endowment life insurance issued by Filipinas

LifeAssurance Co. Pedroso claims Renato Valle was her insurance agent since 1972 and Valle collectedher monthly

premiums. In the first week of January 1977, Valle told her that the Filipinas Life EscoltaOffice was holding a

promotional investment program for policyholders. It was offering 8% prepaidinterest a month for certain amounts

deposited on a monthly basis. Enticed, she initially investedand issued a post-dated check for P10,000. In return, Valle

issued Pedroso his personal check forP800 for the 8% prepaid interest and a Filipinas Life Agent receipt.

Pedroso called the Escolta office and talked to Francisco Alcantara, the administrative assistant, whoreferred her to

the branch manager, Angel Apetrior. Pedroso inquired about the promotional investment and Apetrior

confirmed that there was such a promotion. She was even told she couldpush through with the check she issued.

From the records, the check, with the endorsement of Alcantara at the back, was deposited in the account of

Filipinas Life with the Commercial Bank and Trust Company, Escolta Branch.

Relying on the representations made by Filipinas Life’s duly authorized representatives Apetrior andAlcantara, as well

as having known agent Valle for quite some time, Pedroso waited for the maturityof her initial investment. A

month after, her investment of P10,000 was returned to her after she made a written request for its refund.

To collect the amount, Pedroso personally went to the Escoltabranch where Alcantara gave her the P10,000 in cash.

After a second investment, she made 7 to 8more investments in varying amounts, totaling P37,000 but at a lower rate

of 5% prepaid interest amonth. Upon maturity of Pedroso’s subsequent investments, Valle would take back from

Pedroso thecorresponding agent’s receipt he issued to the latter.

Pedroso told respondent Jennifer Palacio, also a Filipinas Life insurance policyholder, about

theinvestment plan. Palacio made a total investment of P49,55 0 but at only 5% prepaid

interest.However, when Pedroso tried to withdraw her investment, Valle did not want to return some P17,000worth

of it. Palacio also tried to withdraw hers, but Filipinas Life, despite demands, refused to returnher money.

ISSUE:

WON Filipinas Life is jointly and severally liable with Apetrior and Alcantara on the claim of Pedroso and Palacio or

WON its agent Renato Valle is solely liable to Pedroso and Palacio.

HELD:

Pedroso and Palacio had invested P47,000 and P49,550, respectively. These were received by Valleand remitted to

Filipinas Life, using Filipinas Life’s official receipts. Valle’s authority to solicit andr e c e i v e i n v e s t m e n t s w a s

a l s o e s t a b l i s h e d b y t h e p a r t i e s . W h e n P e d r o s o a n d P a l a c i o s o u g h t confirmation, Alcantara, holding a

supervisory position, and Apetrior, the branch manager, confirmedthat Valle had authority. While it is true that a person dealing

with an agent is put upon inquiry andmust discover at his own peril the agent’s authority, in this case, Pedroso and

Palacio did exercisedue diligence in removing all doubts and in confirming the validity of the representations made by

Valle.

Filipinas Life, as the principal, is liable for obligations contracted by its agent Valle. By the contract of agency, a person binds himself to

render some service or to do something in representation or onbehalf of another, with the consent or authority of the

latter. The general rule is that the principal isresponsible for the acts of its agent done within the scope of

its authority, and should bear the d a m a g e c a u s e d t o t h i r d p e r s o n s . W h e n t h e a g e n t e x c e e d s

h i s a u t h o r i t y , t h e a g e n t b e c o m e s personally liable for the damage. But even when the agent exceeds his

authority, the principal is still solidarily liable together with the agent if the principal allowed the agent to act as

though the agent had full powers. The acts of an agent beyond the scope of his authority do not bind the principal,

unless the principal ratifies them, expressly or impliedly.

Ratification

– adoption or confirmation by one person of an act performed on his behalf by another without authority

Even if Valle’s representations were beyond his authority as a debit/insurance agent, Filipinas Life thru Alcantara and

Apetrior expressly and knowingly ratified Valle’s acts. Filipinas Life benefited from the investments deposited by Valle in the account of

Filipinas Life.

Vous aimerez peut-être aussi

- AssetsDocument2 pagesAssetsJoshua ChavezPas encore d'évaluation

- 6Document2 pages6Joshua ChavezPas encore d'évaluation

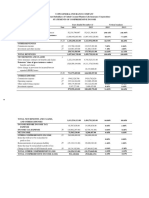

- December 31 Note 2014 2013Document1 pageDecember 31 Note 2014 2013Joshua ChavezPas encore d'évaluation

- 8Document2 pages8Joshua ChavezPas encore d'évaluation

- Years Ended December 31 Increase (Decrease) Note 2014 2013 Amount PercentageDocument2 pagesYears Ended December 31 Increase (Decrease) Note 2014 2013 Amount PercentageJoshua ChavezPas encore d'évaluation

- Company Backround: Ucpb General Insurance Company Inc.Document12 pagesCompany Backround: Ucpb General Insurance Company Inc.Joshua ChavezPas encore d'évaluation

- Years Ended December 31 Vertical Analysis Note 2014 2013 2014 20.13Document2 pagesYears Ended December 31 Vertical Analysis Note 2014 2013 2014 20.13Joshua ChavezPas encore d'évaluation

- 2Document1 page2Joshua ChavezPas encore d'évaluation

- Years Ended December 31 Note 2014 2013Document1 pageYears Ended December 31 Note 2014 2013Joshua ChavezPas encore d'évaluation

- Obligation of The AgentDocument1 pageObligation of The AgentJoshua ChavezPas encore d'évaluation

- Financial Ratio Analysis For Ucpb General Insurance Company, IncDocument1 pageFinancial Ratio Analysis For Ucpb General Insurance Company, IncJoshua ChavezPas encore d'évaluation

- UCPB GEN Brief HistoryDocument3 pagesUCPB GEN Brief HistoryJoshua ChavezPas encore d'évaluation

- Joshua Chavez ResumeDocument2 pagesJoshua Chavez ResumeJoshua ChavezPas encore d'évaluation

- Obligation of The Agent (Explanation)Document3 pagesObligation of The Agent (Explanation)Joshua Chavez100% (1)

- Accounting LiquidationDocument2 pagesAccounting LiquidationJoshua ChavezPas encore d'évaluation

- Everybody Must Be EqualDocument3 pagesEverybody Must Be EqualJoshua ChavezPas encore d'évaluation

- AB Photo ArtsDocument1 pageAB Photo ArtsJoshua Chavez100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Module 2 - Good Manners Right ConductDocument4 pagesModule 2 - Good Manners Right ConductMa. Carmina JosuePas encore d'évaluation

- Front PageDocument10 pagesFront Pagemd.jewel rana100% (1)

- Extinguishment of AgencyDocument20 pagesExtinguishment of Agencyamsula_1990Pas encore d'évaluation

- Refugee Survival Guide 2009Document57 pagesRefugee Survival Guide 20091MilnZimVoices100% (1)

- CaseDigest☺ G.R. No. 189328 February 21,2011 PEOPLE OF THE PHILIPPINES vs. ARNOLD PELIS G.R. No. 191721 January 12, 2011 PEOPLE OF THE PHILIPPINES vs. ROGELIO DOLORIDO y ESTRADA G.R. No. 181701 January 18, 2012 PEOPLE OF THE PHILIPPINES vs. EDUARDO DOLLENDO AND NESTOR MEDICE, NESTOR MEDICEDocument5 pagesCaseDigest☺ G.R. No. 189328 February 21,2011 PEOPLE OF THE PHILIPPINES vs. ARNOLD PELIS G.R. No. 191721 January 12, 2011 PEOPLE OF THE PHILIPPINES vs. ROGELIO DOLORIDO y ESTRADA G.R. No. 181701 January 18, 2012 PEOPLE OF THE PHILIPPINES vs. EDUARDO DOLLENDO AND NESTOR MEDICE, NESTOR MEDICEJsa GironellaPas encore d'évaluation

- People Vs Ramos, 39 SCRA 236Document9 pagesPeople Vs Ramos, 39 SCRA 236Tacoy Dolina100% (1)

- CCNV Vs Reid - DigestedDocument3 pagesCCNV Vs Reid - DigestedRoosevelt GuerreroPas encore d'évaluation

- Hague Intercountry AdoptionDocument3 pagesHague Intercountry AdoptionJeremee SoriaPas encore d'évaluation

- AP 10 ReviewerDocument4 pagesAP 10 ReviewerLuisAdrianAmpuanPas encore d'évaluation

- Social Justice Society Vs Atienza DigestDocument2 pagesSocial Justice Society Vs Atienza DigestGretch Mary100% (1)

- Verifying AffidavitDocument7 pagesVerifying AffidavitPrincessmurage0% (1)

- Ingredients of Section 34 of IPCDocument3 pagesIngredients of Section 34 of IPCanonymousPas encore d'évaluation

- Evidence CapraDocument87 pagesEvidence CapraGuillermo FrênePas encore d'évaluation

- MODULE 1 Civil DraftingDocument5 pagesMODULE 1 Civil DraftingishikaPas encore d'évaluation

- 1st Internship ReportDocument11 pages1st Internship Reportsneha khanPas encore d'évaluation

- SentencingDocument7 pagesSentencingSarah HemmerlingPas encore d'évaluation

- Form 0035-Conveyance in TrustDocument3 pagesForm 0035-Conveyance in TrustDiana Santos91% (11)

- Presented by NRA Member Jason AbstonDocument15 pagesPresented by NRA Member Jason AbstonJason Sarah AbstonPas encore d'évaluation

- Governance of CEOs in GOCCsDocument13 pagesGovernance of CEOs in GOCCseg_abadPas encore d'évaluation

- Sandoval Shipyards Vs PmmaDocument1 pageSandoval Shipyards Vs PmmaMelford LapnawanPas encore d'évaluation

- Sunil Kumar Kurapati v. U.S. Bureau of Citizenship and Immigration Services, 11th Cir. (2014)Document13 pagesSunil Kumar Kurapati v. U.S. Bureau of Citizenship and Immigration Services, 11th Cir. (2014)Scribd Government DocsPas encore d'évaluation

- People Vs RoxasDocument1 pagePeople Vs RoxasGemma F. TiamaPas encore d'évaluation

- Illinois Judge Charles Reynard Screwed Alan Beaman and Donna Gaston Pt. 1Document10 pagesIllinois Judge Charles Reynard Screwed Alan Beaman and Donna Gaston Pt. 1Christopher KingPas encore d'évaluation

- Punjab Education Foundation Contract Appointment Rules 2005 PDFDocument4 pagesPunjab Education Foundation Contract Appointment Rules 2005 PDFWaqarPas encore d'évaluation

- Title 9 Liberty and SecurityDocument23 pagesTitle 9 Liberty and SecurityglaiPas encore d'évaluation

- Badrinath Srinivasan PDFDocument30 pagesBadrinath Srinivasan PDFshreyashkarPas encore d'évaluation

- Cases Pt. 1 PDFDocument243 pagesCases Pt. 1 PDFDon King MamacPas encore d'évaluation

- Ugalde Vs YassiDocument10 pagesUgalde Vs YassiLizzie GeraldinoPas encore d'évaluation

- Comment Formal Offer (Wanson)Document2 pagesComment Formal Offer (Wanson)zea cashiePas encore d'évaluation

- En Banc ruling on constitutionality of Fair Election Act provisionDocument7 pagesEn Banc ruling on constitutionality of Fair Election Act provisionJoyce Manuel100% (1)