Académique Documents

Professionnel Documents

Culture Documents

Hindustan Coca-Cola Beverages PVT LTD B-91 Mayapuri Industrial Area Phase-I New Delhi

Transféré par

Utkarsh KadamTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Hindustan Coca-Cola Beverages PVT LTD B-91 Mayapuri Industrial Area Phase-I New Delhi

Transféré par

Utkarsh KadamDroits d'auteur :

Formats disponibles

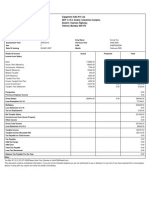

Hindustan Coca-Cola Beverages Pvt Ltd

B-91 Mayapuri Industrial Area

Phase-I

New Delhi

Income Tax Computation Statement

Employee Code 145 Employee Name Alexender D Souza

Employee PAN AJHPD3335R Gender Male Company TAN DELH04006C

Date of Birth 26-FEB-1968 Assessment Year 2018-2019 Company PAN AAACH3005M

Date of Joining 22-FEB-1999 Financial Year 2017-2018 Month March-2018

Heads Of Income Actual Projected Total

Income from Salary

Basic 585662.00 0.00 585662.00

House Rent Allowance 292831.00 0.00 292831.00

Conveyance 292831.00 0.00 292831.00

Leave Encashment 61266.00 0.00 61266.00

Bonus(Qsip) 48811.00 0.00 48811.00

Gratuity 583614.00 0.00 583614.00

Leave Travel Allowance- 61793.00 0.00 61793.00

Incentive 34890.00 0.00 34890.00

Supplementary 62117.00 0.00 62117.00

Unclaimed Benefit 17500.00 0.00 17500.00

Exgratia 1767255.00 0.00 1767255.00

Perquisites 9790.00

Previous Employer Income 0.00

Gross Salary 3808570.00 0.00 3818360.00

Less Exemption U/s 10 662480.00

NetSalary (After Section 10 Exemption) 3155880.00

Less Deduction U/s 16 0.00

Tax on Employment 2500.00

Net Taxable Salary 3153380.00

Income/(Loss) from House Property -200000.00

Income from Other Sources 0.00

Gross Total Income 2953380.00

Less Deduction U/s VI A 171045.00

Taxable Income 2782335.00

Taxable Income (Rounded Off) 2782340.00

Tax Payable on Total Income 647202.35

Less Relief U/s 87 A 0.00

Tax Payable 647202.00

Add Surcharge 0.00

Add Cess 19416.00

Total Tax Payable 666618.00

Less Relief U/s 89 75007.00

Total Tax Payable(Rounded Off) 591613.00

Less

Tax Deducted Till February 2018 120627.00

Tax Deducted Current Month 470986.00

Total Tax Deducted 591613.00

Balance Tax Payable 0.00

Note:

Wed Mar 21 19:36:14 IST 2018Please Send Your Queries to info@excelityglobal.com

This document contains confidential information. If you are not the intended recipient,you are not authorized to use or disclose it in any form.If you have received this in error,please

destroy it along with any copies and notify the sender immediately.

Income Tax Computation Statement

Employee Code 145 Employee Name Alexender D Souza Employee PAN AJHPD3335R

Exemption U/s 10 Amount Perquisites Amount

Conveyance 17600.00 Frmea 9790.00

Gratuity 583614.00 Total 9790.00

Leave Encashment 61266.00

Total 662480.00

Deduction under Chapter VI A Declared Actual

SEC80C

Housing Loan - Principal Re-payment 140516.00 159113.00

Life Insurance Premium 46940.00 78930.00

Provident Fund 0.00 70279.00

Public Provident Fund 0.00 3100.00

Unit Linked Insurance Plan 2000.00 16000.00

SEC80D

Medical Insurance with a Senior Citizen 22409.00 21045.00

Other Income / (Losses)

Section Description Declared Actual

Sec 24(b) Interest on Housing Loan - Self Occupied (200000.00) (200000.00)

Rent Paid Details Company Lease Accommodation

From Date To Date Rent/Month Metro From Date To Date Rent/Month Metro

Previous Employment Details

Components Amount

Note:

This document contains confidential information. If you are not the intended recipient,you are not authorized to use or disclose it in any form.If you have received this in error,please

destroy it along with any copies and notify the sender immediately.

Vous aimerez peut-être aussi

- Serv Let ControllerDocument2 pagesServ Let ControllerANAND RADHAWALPas encore d'évaluation

- IIT-D EV BrochureDocument2 pagesIIT-D EV BrochureKarthick FerruccioPas encore d'évaluation

- Incometaxstatement2009 2010Document2 pagesIncometaxstatement2009 2010api-3725541Pas encore d'évaluation

- Capgemini Technology Services India LimitedDocument2 pagesCapgemini Technology Services India LimitedFlawsome FoodsPas encore d'évaluation

- Servlet ControllerDocument2 pagesServlet ControllerRJPas encore d'évaluation

- Wa0023.Document2 pagesWa0023.ManiPas encore d'évaluation

- Manimaran Oct Payslip ShriramDocument2 pagesManimaran Oct Payslip ShriramManiPas encore d'évaluation

- Manimaran Nov Payslip ShriramDocument2 pagesManimaran Nov Payslip ShriramManiPas encore d'évaluation

- Nov2023Document2 pagesNov2023ManiPas encore d'évaluation

- Manimaran Oct Payslip ShriramDocument2 pagesManimaran Oct Payslip ShriramManiPas encore d'évaluation

- P2385 Nov2023Document2 pagesP2385 Nov2023ManiPas encore d'évaluation

- P2385 Nov2023Document2 pagesP2385 Nov2023ManiPas encore d'évaluation

- Oct2022Document2 pagesOct2022Rishi KumarPas encore d'évaluation

- Cartradeexchange Solutions Private LimitedDocument2 pagesCartradeexchange Solutions Private LimitedAJEET KUMARPas encore d'évaluation

- Oct2023Document2 pagesOct2023ManiPas encore d'évaluation

- Deloitte Consulting India Private LimitedDocument2 pagesDeloitte Consulting India Private LimitedChinni SreenivasPas encore d'évaluation

- Servlet ControllerDocument2 pagesServlet ControllerAnkit AroraPas encore d'évaluation

- P2385 Nov2023Document2 pagesP2385 Nov2023ManiPas encore d'évaluation

- Payslip 2023 2024 4 200000000029454 IGSLDocument1 pagePayslip 2023 2024 4 200000000029454 IGSLMohit Sagar0% (1)

- Manimaran Nov Payslip ShriramDocument2 pagesManimaran Nov Payslip ShriramManiPas encore d'évaluation

- Altruist Customer Management India PVT LTD: Personal DetailsDocument1 pageAltruist Customer Management India PVT LTD: Personal DetailsSampathKPPas encore d'évaluation

- Paywithtaxslip 102324 PDFDocument1 pagePaywithtaxslip 102324 PDFamitshrivastava154218Pas encore d'évaluation

- 31 Jan 2024Document2 pages31 Jan 2024vikzPas encore d'évaluation

- 0 GPIND TMCGOFFOCT2022 V2 Gpinit01Document2 pages0 GPIND TMCGOFFOCT2022 V2 Gpinit01lakb5304Pas encore d'évaluation

- May Pay SlipDocument1 pageMay Pay SlipAnkit100% (1)

- Shriram Payslip MayDocument2 pagesShriram Payslip MayGanesh SahuPas encore d'évaluation

- FF PayslipDocument1 pageFF PayslipYviie VAPas encore d'évaluation

- Income Tax Calculation For The Period 01/04/2021 To 07/07/2021Document4 pagesIncome Tax Calculation For The Period 01/04/2021 To 07/07/2021Srinath AllaPas encore d'évaluation

- Payslip For The Month of January 2023: CRM Services India Private LimitedDocument1 pagePayslip For The Month of January 2023: CRM Services India Private Limitednaman porwalPas encore d'évaluation

- Adecco India Private Limited: Payslip For The Month of October 2022Document1 pageAdecco India Private Limited: Payslip For The Month of October 2022VeereshPammarPas encore d'évaluation

- 100000000494378Document1 page100000000494378Dalbir SinghPas encore d'évaluation

- UntitledDocument1 pageUntitledAnkush SinghPas encore d'évaluation

- Salary SlipDocument1 pageSalary SlipPhagun BehlPas encore d'évaluation

- Salary Slip Oct PacificDocument1 pageSalary Slip Oct PacificBHARAT SHARMAPas encore d'évaluation

- SEP2023 STFC PaySlipDocument2 pagesSEP2023 STFC PaySlipJHP CreationsPas encore d'évaluation

- Xoriantlive 28051007Document1 pageXoriantlive 28051007susilaPas encore d'évaluation

- Apr 23Document1 pageApr 23Amit ShindePas encore d'évaluation

- Payslip 2018 2019 3 2380 SVATANTRADocument1 pagePayslip 2018 2019 3 2380 SVATANTRAsunil.srfcPas encore d'évaluation

- Payslip For The Month of November 2020: Cms It Services Private LimitedDocument2 pagesPayslip For The Month of November 2020: Cms It Services Private LimitedKrishna AryanPas encore d'évaluation

- Salary SlipDocument1 pageSalary SlipPhagun BehlPas encore d'évaluation

- Original: Pay Slip For The Month of January-2020Document1 pageOriginal: Pay Slip For The Month of January-2020Nihar RanjanPas encore d'évaluation

- March 2023 Jagadeesh - SuraDocument1 pageMarch 2023 Jagadeesh - SuraJagadeesh SuraPas encore d'évaluation

- JuneDocument1 pageJunenishankithkumarPas encore d'évaluation

- Sify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-600113Document1 pageSify Technologies Limited - India 2nd Floor, Tidel Park No:4, Rajiv Gandhi Salai, Taramani, Chennai-600113JOOOOOPas encore d'évaluation

- VishalDocument1 pageVishalgig.sachinrajakPas encore d'évaluation

- Payslip TS11702.Document1 pagePayslip TS11702.Sandy MPas encore d'évaluation

- EMP1314Document1 pageEMP1314Laxmi JaiswalPas encore d'évaluation

- May Salary PDFDocument1 pageMay Salary PDFomkassPas encore d'évaluation

- Payslilp: Afcons Infrastructure LTDDocument1 pagePayslilp: Afcons Infrastructure LTDAnkitPas encore d'évaluation

- Salary Slip NovDocument1 pageSalary Slip NovviphainhumPas encore d'évaluation

- SRL Limited: Payslip For The Month of FEBRUARY 2019Document1 pageSRL Limited: Payslip For The Month of FEBRUARY 2019mkumarsejPas encore d'évaluation

- Payslip Sep2023Document2 pagesPayslip Sep2023ALIPas encore d'évaluation

- CB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedDocument3 pagesCB23352 - SalarySlipwithTaxDetails (3) - Unlocked-MergedsathyaPas encore d'évaluation

- June Salry PDFDocument1 pageJune Salry PDFomkassPas encore d'évaluation

- SepDocument1 pageSepBachu RameshPas encore d'évaluation

- Pricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementDocument15 pagesPricewaterhousecoopers Service Delivery Center (Bangalore) PVT LTD Income Tax Computation StatementRajat SinghPas encore d'évaluation

- Ewac Alloys Limited: Uan No Aadhar NoDocument1 pageEwac Alloys Limited: Uan No Aadhar NoNapoleon DasPas encore d'évaluation

- PaySlip Jan 2024Document2 pagesPaySlip Jan 2024sanchitnayak21Pas encore d'évaluation

- 157salaryslip g5sxl3g6Document1 page157salaryslip g5sxl3g6Shakti NaikPas encore d'évaluation

- DRM W BB Acting For and On Behalf of The President of India Invites E-Tenders Against Tender No CR-DRMWBB-2020-27-5 ClosingDocument3 pagesDRM W BB Acting For and On Behalf of The President of India Invites E-Tenders Against Tender No CR-DRMWBB-2020-27-5 ClosingUtkarsh KadamPas encore d'évaluation

- 2020 - Form16 - PART B AnnexureDocument3 pages2020 - Form16 - PART B AnnexureUtkarsh KadamPas encore d'évaluation

- Curriculam VitaeDocument1 pageCurriculam VitaeUtkarsh KadamPas encore d'évaluation

- Active Ingredient in DetergentDocument2 pagesActive Ingredient in DetergentUtkarsh KadamPas encore d'évaluation

- AHHPJ9907H - 2020 - Form16 - PART A.pdf Anuj KumarDocument2 pagesAHHPJ9907H - 2020 - Form16 - PART A.pdf Anuj KumarUtkarsh KadamPas encore d'évaluation

- Nilesh Sawant ResumeDocument2 pagesNilesh Sawant ResumeUtkarsh KadamPas encore d'évaluation

- Kulswami 1Document1 pageKulswami 1Utkarsh KadamPas encore d'évaluation

- SssssDocument1 pageSssssUtkarsh KadamPas encore d'évaluation

- Kulswami 2Document1 pageKulswami 2Utkarsh KadamPas encore d'évaluation

- CrrudeDocument1 pageCrrudeUtkarsh KadamPas encore d'évaluation

- CASE ToasterDocument2 pagesCASE ToasterUtkarsh KadamPas encore d'évaluation

- Nitin Intraday Fav StocksDocument271 pagesNitin Intraday Fav StocksUtkarsh KadamPas encore d'évaluation

- Curriculum Vitae: Digambar Ganpat Madavi Contact No:-7588475032Document2 pagesCurriculum Vitae: Digambar Ganpat Madavi Contact No:-7588475032Utkarsh KadamPas encore d'évaluation

- Jawahar Lal NehruDocument1 pageJawahar Lal NehruUtkarsh KadamPas encore d'évaluation

- Nifty Using Gann LOW Nifty 93 7002.5 Gann Angle Degree Degree Factor ResistanceDocument3 pagesNifty Using Gann LOW Nifty 93 7002.5 Gann Angle Degree Degree Factor ResistanceUtkarsh KadamPas encore d'évaluation

- Sign Your AppDocument18 pagesSign Your AppUtkarsh KadamPas encore d'évaluation

- Nifty Future Fun LevelsDocument1 pageNifty Future Fun LevelsUtkarsh KadamPas encore d'évaluation

- Audit DataDocument2 pagesAudit DataUtkarsh KadamPas encore d'évaluation

- Dear SirDocument1 pageDear SirUtkarsh KadamPas encore d'évaluation

- House KarakasDocument1 pageHouse KarakasUtkarsh KadamPas encore d'évaluation

- CA500Document3 pagesCA500Muhammad HussainPas encore d'évaluation

- Questions To Client On SAP HCMDocument19 pagesQuestions To Client On SAP HCMeurofighterPas encore d'évaluation

- Vinegar Intake Reduces Body Weight Body Fat Mass and Serum Triglyceride Levels in Obese Japanese SubjectsDocument8 pagesVinegar Intake Reduces Body Weight Body Fat Mass and Serum Triglyceride Levels in Obese Japanese SubjectsZaphan ZaphanPas encore d'évaluation

- Web Script Ems Core 4 Hernandez - Gene Roy - 07!22!2020Document30 pagesWeb Script Ems Core 4 Hernandez - Gene Roy - 07!22!2020gene roy hernandezPas encore d'évaluation

- Wax Depilation ManualDocument17 pagesWax Depilation ManualAmit Sharma100% (1)

- Primary Tooth Pulp Therapy - Dr. Elizabeth BerryDocument52 pagesPrimary Tooth Pulp Therapy - Dr. Elizabeth BerryMihaela TuculinaPas encore d'évaluation

- - 50 Đề Thi Học Sinh Gioi Lớp 12Document217 pages- 50 Đề Thi Học Sinh Gioi Lớp 12Nguyễn Thanh ThảoPas encore d'évaluation

- 30356-Article Text-56848-1-10-20210201Document14 pages30356-Article Text-56848-1-10-20210201Mel FaithPas encore d'évaluation

- 13 Ed Gulski PraesentationDocument45 pages13 Ed Gulski Praesentationcarlos vidalPas encore d'évaluation

- 006R5-WMS-JI-MI-MAU-ACS-II-23 Working Method - Pile CapDocument20 pages006R5-WMS-JI-MI-MAU-ACS-II-23 Working Method - Pile CapEko Budi HartantoPas encore d'évaluation

- Dearcán Ó Donnghaile: ProfileDocument2 pagesDearcán Ó Donnghaile: Profileapi-602752895Pas encore d'évaluation

- AD Oracle ManualDocument18 pagesAD Oracle ManualAlexandru Octavian Popîrțac100% (2)

- Dolor Postoperatorio y Efectos Secundarios de La Uvulo Palstia Con Radiofrecuencia en Roncopatia Primaria.Document5 pagesDolor Postoperatorio y Efectos Secundarios de La Uvulo Palstia Con Radiofrecuencia en Roncopatia Primaria.Alejandro RuizPas encore d'évaluation

- 08 163 4 JPL ScheickDocument50 pages08 163 4 JPL ScheickSaqib Ali KhanPas encore d'évaluation

- 134.4902.06 - DM4170 - DatasheetDocument7 pages134.4902.06 - DM4170 - DatasheetVinicius MollPas encore d'évaluation

- Study On Optimization and Performance of Biological Enhanced Activated Sludge Process For Pharmaceutical Wastewater TreatmentDocument9 pagesStudy On Optimization and Performance of Biological Enhanced Activated Sludge Process For Pharmaceutical Wastewater TreatmentVijaya GosuPas encore d'évaluation

- R. Raghunandanan - 6Document48 pagesR. Raghunandanan - 6fitrohtin hidayatiPas encore d'évaluation

- The List InditexDocument126 pagesThe List InditexRezoanul Haque100% (2)

- EarthmattersDocument7 pagesEarthmattersfeafvaevsPas encore d'évaluation

- EC Type-Examination Certificate: Reg.-No.: 01/205/5192.02/18Document11 pagesEC Type-Examination Certificate: Reg.-No.: 01/205/5192.02/18Orlando Ortiz VillegasPas encore d'évaluation

- Level 9 - Unit 34Document7 pagesLevel 9 - Unit 34Javier RiquelmePas encore d'évaluation

- 09B Mechanical Properties of CeramicsDocument13 pages09B Mechanical Properties of CeramicsAhmed AliPas encore d'évaluation

- WEEK 3 LAB EXERCISE - Cell Structures and Functions - UY-OCODocument4 pagesWEEK 3 LAB EXERCISE - Cell Structures and Functions - UY-OCOBianca LouisePas encore d'évaluation

- Business-Plan (John Lloyd A Perido Grade 12-Arc)Document4 pagesBusiness-Plan (John Lloyd A Perido Grade 12-Arc)Jaypher PeridoPas encore d'évaluation

- UNICEF Annual Report - Water 2018Document20 pagesUNICEF Annual Report - Water 2018Ross WeistrofferPas encore d'évaluation

- Well Being Journal December 2018 PDFDocument52 pagesWell Being Journal December 2018 PDFnetent00100% (1)

- Marantz - dv-4200 DVD Player PDFDocument60 pagesMarantz - dv-4200 DVD Player PDFH.V KayaPas encore d'évaluation

- Plumber (General) - II R1 07jan2016 PDFDocument18 pagesPlumber (General) - II R1 07jan2016 PDFykchandanPas encore d'évaluation

- CW Catalogue Cables and Wires A4 En-2Document1 156 pagesCW Catalogue Cables and Wires A4 En-2Ovidiu PuiePas encore d'évaluation

- Contoh Perhitungan DDD Excell - IRNADocument8 pagesContoh Perhitungan DDD Excell - IRNAMaya DamanikPas encore d'évaluation