Académique Documents

Professionnel Documents

Culture Documents

Contract noteXP0622 PDF

Transféré par

AnkitSharmaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Contract noteXP0622 PDF

Transféré par

AnkitSharmaDroits d'auteur :

Formats disponibles

CONTRACT NOTE CUM TAX INVOICE

(Tax Invoice under Section 31 of GST Act)

Digitally signedORIGINAL

by DS ZERODHA 3

FOR RECIPIENT

Date: 2018.04.27 03:48:24 IST

Reason: "Regulatory"

Location: "Zerodha, Bangalore"

#153/154 , 4TH CROSS,JP NAGAR 4TH PHASE, DOLLARS COLONY, BANGALORE, KARNATAKA, 560078

Phone:080 4040 2020, Fax :,Website :www.zerodha.com

SEBI REGISTRATION NO: INZ000031633

NAME OF COMPLIANCE OFFICER : Venu Madhav K.S , PHONE NO : 080-40402020 , EMAIL ID : complaints@zerodha.com

DEALING OFFICE ADDRESS : #153/154 , 4th Cross JP Nagar 4th Phase, Dollars Colony Bangalore Karnataka - 560078

Phone No: +91 80 4040 2020

CONTRACT NOTE NO.: CNT-18/19-2839461 NSE-EQ BSE-EQ

TRADE DATE 26/04/2018 SETTLEMENT NO 2018079

SETTLEMENT DATE 26/04/2018

Name of the Client ANKITSHARMA

Address of the Client 71/254 SHYOPUR ROADSECTOR 71 PRATAP NAGAR,JAIPUR,RAJASTHAN,302033,India,

PAN of Client GOTPS3077G

UCC of Client XP0622

Trading Back office code* XP0622

NSE-EQ NSE-F&O NSE-CFX BSE-EQ BSE-F&O

*Trading/ Back Office Code (If Different from UCC) XP0622

Sir/Madam,

I / We have this day done by your order and on your account the following transactions:

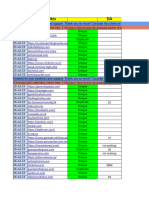

Order No Order Trade No Trade Security/ Buy(B)/ Quantity Gross Brokerage Net Rate Closing Net Total Remarks

Time Time Contract Sell(S) Rate/Trade per Unit per unit Rate per (Before

description Price Per (Rs) (Rs) Unit(only Levies)

unit (Rs) for (Rs)

Derivatives)

(Rs)

NSE-EQ

1300000001373330 10:15:58 75471419 10:15:58 TATASTEEL B 50 585.75 585.7500 (29287.50)

1300000000704592 09:36:01 75215210 09:36:01 TATASTEEL S 10 589.55 589.5500 5895.50

1300000000704592 09:36:01 75215211 09:36:01 TATASTEEL S 25 589.50 589.5000 14737.50

1300000000704592 09:36:01 75215212 09:36:01 TATASTEEL S 15 589.50 589.5000 8842.50

Sub Total: 0 188.00

1200000003319068 11:32:24 51379589 11:32:24 PNB S 200 92.20 92.2000 18440.00

1200000002130674 10:17:38 50849366 10:17:38 PNB B 154 91.55 91.5500 (14098.70)

1200000002130674 10:17:38 50849367 10:17:38 PNB B 46 91.55 91.5500 (4211.30)

Sub Total: 0 130.00

1100000002059597 10:39:49 26366114 11:37:32 HINDALCO B 105 234.50 234.5000 (24622.50)

1100000002059597 10:39:49 26366115 11:37:32 HINDALCO B 145 234.50 234.5000 (34002.50)

1100000000792514 09:31:28 25293447 09:31:28 HINDALCO S 250 237.50 237.5000 59375.00

Sub Total: 0 750.00

1000000000598056 09:29:47 170063 09:29:47 DLF S 1 220.45 220.4500 220.45

1000000000598056 09:29:47 170064 09:29:47 DLF S 199 220.35 220.3500 43849.65

1000000000451521 09:24:18 118144 09:24:18 DLF B 200 221.25 221.2500 (44250.00)

Sub Total: 0 (179.90)

Net Total: 888.10

NSE-EQ NSE-F&O NSE-CFX BSE-EQ BSE-F&O NET TOTAL

PAY IN/ PAY OUT OBLIGATION 888.10 888.10

Taxable value of Supply (Brokerage) (30.18) (30.18)

Exchange Transaction Charges (9.81) (9.81)

Clearing Charges

CGST (@9% of Brok & Trans Charges) (0.00)

SGST (@9% of Brok & Trans Charges) (0.00)

IGST (@18% of Brok & Trans Charges) (7.20) (7.2)

Securities Transaction Tax (38.00) (38.0)

SEBI Turnover Fees (0.45) (0.45)

Stamp Duty (9.05) (9.05)

Net amount receivable by Client / (payable by Client) 793.41 793.41

Details of trade-wise levies shall be provided on request.

Transactions mentioned in this contract note cum bill shall be governed and subject to the Rules, Bye-laws and Regulations and Circulars of the

respective Exchanges on which trades have been executed and Securities and Exchange Board of India from time to time. The Exchanges provide

Complaint Resolution, Arbitration and Appellate arbitration facilities at the Regional Arbitration Centres (RAC). The client may approach its nearest

centre, details of which are available on respective Exchange's website. Please visit www.bseindia.com for BSE, www.mcx-sx.com for MCX-SX,

www.nseindia.com for NSE and www.useindia.com for USE.

Propreitary trading disclosure: Pursuant to SEBI Circular Number SEBI/MRD/SEC/Cir-42/2003 dated November 19, 2003 &

SEBI/HO/CDMRD/DMP/CIR/P/2016/49 dated April 25, 2016 Zerodha & Zerodha Commodities Pvt. Ltd. discloses to its clients about its policies on

proprietary trades. Zerodha & Zerodha Commodities Pvt. Ltd. does proprietary trading in the cash and derivatives segment at NSE, BSE, and

MCX,NCDEX respectively.

Note:The share of the listed stock exchange/depository shall only be dealt by fit and proper persons as per regulation 19 and 20 of SECC Regulations,

https://goo.gl/Lxbahh

Zerodha is collecting Stamp duty and Securities Transaction tax as a pure agent of the investor and hence the same is not considered in taxable value of

supply for charging GS Transaction tax as a pure agent of the investor and hence the same is

Date: Yours faithfully,

Place: BANGALORE For ZERODHA

MR. NITHIN KAMATH (Authorised Signatory)

PAN of Trading Member AAAFZ6602R

GSTIN of trading Member 29AAAFZ6602R1ZG

Description of Service Brokerage and related securities and commodities

services including commodity exchange services

Accounting code of services 997152

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- 1108 - 5 Company Present RecordDocument4 pages1108 - 5 Company Present RecordAnkitSharmaPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Dear Sir,: Images/h85/hbd/9428961984542/ayualam Tejas - Catalog - Eng PDFDocument1 pageDear Sir,: Images/h85/hbd/9428961984542/ayualam Tejas - Catalog - Eng PDFAnkitSharmaPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- E-CL - Hanmac Total SystemDocument3 pagesE-CL - Hanmac Total SystemAnkitSharmaPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Free Guest Post SitesDocument47 pagesFree Guest Post SitesAnkitSharmaPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Email FormatDocument2 pagesEmail FormatAnkitSharmaPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- FormatDocument3 pagesFormatAnkitSharmaPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- ECL - Sejin Tube TechDocument2 pagesECL - Sejin Tube TechAnkitSharmaPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- 16 - Boram C&H Co.,LtdDocument4 pages16 - Boram C&H Co.,LtdAnkitSharmaPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Email - NeedsDocument1 pageEmail - NeedsAnkitSharmaPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Product Catalog DDASAROOMDocument2 pagesProduct Catalog DDASAROOMAnkitSharmaPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Form - Silver Fox CoDocument48 pagesForm - Silver Fox CoAnkitSharmaPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Letter of Invitation - 2019 Hong Kong Mega Show !: at The Centre of Global Sourcing in Asia, Every OctoberDocument2 pagesLetter of Invitation - 2019 Hong Kong Mega Show !: at The Centre of Global Sourcing in Asia, Every OctoberAnkitSharmaPas encore d'évaluation

- Letter of Invitation - 2019 Hong Kong Mega Show !: at The Centre of Global Sourcing in Asia, Every OctoberDocument2 pagesLetter of Invitation - 2019 Hong Kong Mega Show !: at The Centre of Global Sourcing in Asia, Every OctoberAnkitSharmaPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Script For Asia Shows 2019 Tele-InvitingDocument15 pagesScript For Asia Shows 2019 Tele-InvitingAnkitSharmaPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Future Science Education Center Co.,LtdDocument17 pagesFuture Science Education Center Co.,LtdAnkitSharmaPas encore d'évaluation

- Form - Cnkcosmedical Co., Ltd.Document16 pagesForm - Cnkcosmedical Co., Ltd.AnkitSharmaPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Corporate Treasurer Report QuestionnaireDocument6 pagesCorporate Treasurer Report QuestionnaireAnkitSharmaPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1091)

- JD-Virtual Customer Service-Amazon IndiaDocument3 pagesJD-Virtual Customer Service-Amazon IndiaAnkitSharmaPas encore d'évaluation

- 1642 - List069616 - Data Verification - 22052017PProject 2. (1) 111Document172 pages1642 - List069616 - Data Verification - 22052017PProject 2. (1) 111AnkitSharmaPas encore d'évaluation

- JD-Virtual Customer Service-Amazon IndiaDocument3 pagesJD-Virtual Customer Service-Amazon IndiaAnkitSharmaPas encore d'évaluation

- Damar TantraDocument25 pagesDamar TantraAnkitSharmaPas encore d'évaluation

- Bs Is Ratios - Azwan Family - SolutionDocument3 pagesBs Is Ratios - Azwan Family - SolutionNatasya ShahrulafizalPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Student Loan Forgiveness For Frontline Health WorkersDocument20 pagesStudent Loan Forgiveness For Frontline Health WorkersKyle SpinnerPas encore d'évaluation

- Question and AnswersDocument13 pagesQuestion and AnswersBeebee ZainabPas encore d'évaluation

- Kuwait TodayDocument10 pagesKuwait Todayamelia tyshkovPas encore d'évaluation

- Human Resource Management in Bangladesh - Exim BankDocument57 pagesHuman Resource Management in Bangladesh - Exim BankShohidullah Kaiser100% (2)

- Pure and Conditional Obligation.Document2 pagesPure and Conditional Obligation.Lauren Obrien83% (12)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- NSTP Community Profile OutlineDocument10 pagesNSTP Community Profile OutlinePrincess Anne DuazoPas encore d'évaluation

- Dual Trust DiagramDocument23 pagesDual Trust DiagramA & L BrackenregPas encore d'évaluation

- Economics Problems 100202064251 Phpapp01Document27 pagesEconomics Problems 100202064251 Phpapp01Hashma KhanPas encore d'évaluation

- Economic Reforms Since 1991Document12 pagesEconomic Reforms Since 1991Sampann KumarPas encore d'évaluation

- Checklist of Requirements For The BacDocument3 pagesChecklist of Requirements For The BacSan Blas PaoayPas encore d'évaluation

- Jessspsu 22Document8 pagesJessspsu 22Shreenivas Sambath KumarPas encore d'évaluation

- Reynaldo S. Nicolas - Devices Affecting Control Under The Corporation CodeDocument35 pagesReynaldo S. Nicolas - Devices Affecting Control Under The Corporation CodesaverjanePas encore d'évaluation

- The Dividend Policies of Private Firms - Insights Into Smoothing, Agency Costs, and Information AsymmetryDocument60 pagesThe Dividend Policies of Private Firms - Insights Into Smoothing, Agency Costs, and Information AsymmetryhhhhhhhPas encore d'évaluation

- UIRC Facts BookletDocument3 pagesUIRC Facts BookletRahulSatijaPas encore d'évaluation

- SwapsDocument15 pagesSwapsleo_lac3Pas encore d'évaluation

- Accounting SyllabiDocument2 pagesAccounting SyllabiJyotirmaya MaharanaPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Chapter 5Document2 pagesChapter 5Ynna RaymondPas encore d'évaluation

- Final Case Study 0506Document25 pagesFinal Case Study 0506Namit Nahar67% (3)

- SMM Tuition Point - Accounting Basics and Interview Questions AnswersDocument34 pagesSMM Tuition Point - Accounting Basics and Interview Questions AnswersGarima Gupta33% (3)

- ENCANTADIA Company Worksheet For Year Ended Dec. 31, 2018Document8 pagesENCANTADIA Company Worksheet For Year Ended Dec. 31, 2018kent starkPas encore d'évaluation

- TAXATION Agriculture IncomeDocument7 pagesTAXATION Agriculture IncomeLalitadityaLalitPas encore d'évaluation

- Target 3 Stock and DividendDocument5 pagesTarget 3 Stock and DividendAjeet YadavPas encore d'évaluation

- Study On Npa With Special Reference To ICICI Bank, by Swaroop DhariwalDocument102 pagesStudy On Npa With Special Reference To ICICI Bank, by Swaroop Dhariwalswaroopdhariwal83% (30)

- Mentoring Session 4, Day 3: 27 May 2021 Expiry Day & Trading IdeasDocument25 pagesMentoring Session 4, Day 3: 27 May 2021 Expiry Day & Trading Ideaslakshmipathihsr64246Pas encore d'évaluation

- Example Synthesis EssayDocument2 pagesExample Synthesis Essaye_gwen_buchanan25% (4)

- Payoff Schedule Payoff Chart: NIFTY at Expiry Net PayoffDocument2 pagesPayoff Schedule Payoff Chart: NIFTY at Expiry Net PayoffAKSHAYA AKSHAYAPas encore d'évaluation

- Homework - Week 1 AnswersDocument9 pagesHomework - Week 1 AnswersDamalie IzaulaPas encore d'évaluation

- Standard Chart of AccountsDocument4 pagesStandard Chart of AccountsMihai FildanPas encore d'évaluation

- Castillo V PascoDocument2 pagesCastillo V PascoSui50% (2)