Académique Documents

Professionnel Documents

Culture Documents

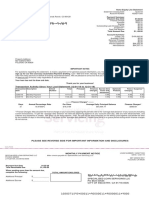

Santander Holdings USA, Inc.

Transféré par

Pendi AgarwalCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Santander Holdings USA, Inc.

Transféré par

Pendi AgarwalDroits d'auteur :

Formats disponibles

Santander Holdings USA, Inc.

__________________________________________________________________________________________

Santander Holdings USA, Inc. Key Employees

Name Job Title

Jason Kulas Director

Fast Facts

Headquarters Address 75 State Street, Boston, 02109, United Alan Fishman Director

States

Senior Executive Vice

Brian Gunn President, Chief Risk

Telephone + 1 617 3467200 Officer

Managing Director, Head -

Fax N/A Cameron Letters Corporate and

Commercial Banking

Website www.santanderbank.com/us Catherine Keating Director

Ticker Symbol, Stock Exchange N/A

Number of Employees 15,150 Company Overview

Fiscal Year End December Santander Holdings USA, Inc. (SHUSA) is a

provider of financial products and services. The

Revenue (in US$ million) 10,474 company primarily operates through its two

major subsidiaries, Santander Bank, N.A.

(Santander Bank) and Santander Consumer

USA Holdings Inc. (SCUSA). Santander Bank

offers a range of retail and corporate banking

products and services, including checking

SWOT Analysis accounts, savings accounts, certificates of

deposits, auto loans, personal loans, mortgages,

Strengths Weaknesses insurance products, debit and credit cards,

business loans, term loans, online banking and

Association with Banco Santander Weak Bottom-line Performance merchant services. SCUSA provides vehicle

finance and personal lending products. The

company operates through a network of retail

Broad Product and Service Portfolio

branches and ATMs in the US. SHUSA is a

subsidiary of Banco Santander S.A. SHUSA is

Increase in Total Deposits headquartered in Boston, Massachusetts, the

US.

Sound Capital Adequacy

Key Competitors

Opportunities Threats

Ally Financial Inc. (Ticker: ALLY)

Booming Mortgage Market in the US Changing Rules and Regulations

BB&T Corporation (Ticker: BBT)

Growing US Economy Fluctuations in Interest Rates

Citizens Financial Group, Inc.

Positive Outlook for the US Card

Increase in Compliance Costs

Payments Channel Consumer Portfolio Services, Inc. (Ticker: CPSS)

Fifth Third Bancorp (Ticker: FITB)

___________________________________________________________________________________________

Santander Holdings USA, Inc. - SWOT Profile Page 1

Santander Holdings USA, Inc.

__________________________________________________________________________________________

TABLE OF CONTENTS

1 Santander Holdings USA, Inc. - Business Analysis .................................................................................... 4

1.1 Santander Holdings USA, Inc. - Company Overview.............................................................................................4

1.2 Santander Holdings USA, Inc. - Business Description ..........................................................................................4

1.3 Santander Holdings USA, Inc. - Major Products and Services ..............................................................................5

2 Santander Holdings USA, Inc. - Recent Developments ............................................................................. 7

3 Santander Holdings USA, Inc. - SWOT Analysis ..................................................................................... 10

3.1 Santander Holdings USA, Inc. - SWOT Analysis - Overview ..............................................................................10

3.2 Santander Holdings USA, Inc. - Strengths ...........................................................................................................10

3.3 Santander Holdings USA, Inc. - Weaknesses .....................................................................................................10

3.4 Santander Holdings USA, Inc. - Opportunities .....................................................................................................11

3.5 Santander Holdings USA, Inc. - Threats ..............................................................................................................11

4 Santander Holdings USA, Inc. - Company Statement .............................................................................. 12

5 Santander Holdings USA, Inc. - History ................................................................................................... 17

6 Santander Holdings USA, Inc. - Key Employees...................................................................................... 20

7 Santander Holdings USA, Inc. - Key Employee Biographies .................................................................... 22

8 Santander Holdings USA, Inc. - Locations and Subsidiaries .................................................................... 23

8.1 Santander Holdings USA, Inc. - Head Office .......................................................................................................23

8.2 Santander Holdings USA, Inc. - Other Locations and Subsidiaries .....................................................................23

9 Appendix ................................................................................................................................................. 26

9.1 Methodology .........................................................................................................................................................26

9.2 Disclaimer.............................................................................................................................................................26

___________________________________________________________________________________________

Santander Holdings USA, Inc. - SWOT Profile Page 2

Santander Holdings USA, Inc.

__________________________________________________________________________________________

LIST OF TABLES

Table 1: Santander Holdings USA, Inc. - Major Products and Services ............................................................ 5

Table 2: Santander Holdings USA, Inc. - History ............................................................................................ 17

Table 3: Santander Holdings USA, Inc. - Key Employees............................................................................... 20

Table 4: Santander Holdings USA, Inc. - Key Employee Biographies ............................................................. 22

Table 5: Santander Holdings USA, Inc. - Subsidiaries .................................................................................... 23

Table 6: Santander Holdings USA, Inc. - Locations ........................................................................................ 24

___________________________________________________________________________________________

Santander Holdings USA, Inc. - SWOT Profile Page 3

Santander Holdings USA, Inc.

__________________________________________________________________________________________

1 Santander Holdings USA, Inc. - Business Analysis

1.1 Santander Holdings USA, Inc. - Company Overview

Santander Holdings USA, Inc. (SHUSA) is a provider of financial products and services. The company primarily operates

through its two major subsidiaries, Santander Bank, N.A. (Santander Bank) and Santander Consumer USA Holdings Inc.

(SCUSA). Santander Bank offers a range of retail and corporate banking products and services, including checking

accounts, savings accounts, certificates of deposits, auto loans, personal loans, mortgages, insurance products, debit and

credit cards, business loans, term loans, online banking and merchant services. SCUSA provides vehicle finance and

personal lending products. The company operates through a network of retail branches and ATMs in the US. SHUSA is a

subsidiary of Banco Santander S.A. SHUSA is headquartered in Boston, Massachusetts, the US.

1.2 Santander Holdings USA, Inc. - Business Description

SHUSA offers a range of financial products and services through its two subsidiaries, Santander Bank and SCUSA.

Santander Bank focuses on providing retail and corporate banking products and services. SCUSA provides vehicle

finance and personal lending products. As of December 31 2015, SHUSA operated through a network of 675 retail

branches, and 2,100 ATMs in the US.

The company operates through five business divisions: Retail Banking; Auto Finance and Business Banking; Real Estate

and Commercial Banking; Global Corporate Banking; and Santander Consumer USA Inc. (SC).

Under the Retail Banking division, the company offers a range of retail banking products and services, as well as

residential mortgages. Its offerings include demand and interest-bearing demand deposit accounts, certificate of deposits,

money market and savings accounts, retirement savings products, home equity loans, credit cards and lines of credit. It

also offers business banking and small business loans to individuals. Furthermore, it offers insurance products, mutual

funds, annuities and managed monies. The company offers retail banking products and services though its branch

locations across the country. In FY2015, the Retail Banking division reported a net interest income of US$691.4 million,

accounting for 10.6% of the company‟s total net interest income.

The Auto Finance and Business Banking division offers indirect consumer leasing, and commercial loans to dealers. It

also provides financing for municipal equipment and commercial vehicles. The division also includes business activity in

relation to Santander Bank‟s intercompany agreements with SC. In FY2015, the Auto Finance and Alliances division

reported a net interest income of US$252.5 million, accounting for 3.9% of the company‟s total net interest income.

SHUSA‟s Real Estate and Commercial Banking division provides commercial real estate loans, commercial loans, multi-

family loans, and the bank's related commercial deposits. It also offers deposits and financing for government

organizations, and niche product financing for specific industries, such as mortgage warehousing and oil and gas. In

FY2015, the Real Estate and Commercial Banking division reported a net interest income of US$460.4 million, accounting

for 7.1% of the company‟s total net interest income.

Under Global Corporate Banking division, SHUSA offers banking and financing services to global commercial and

institutional customers with more than US$500 million in annual revenues. In FY2015, the Global Banking and Markets &

Large Corporate Banking division reported net interest income of US$219.3 million, accounting for 3.4% of the company‟s

total net interest income.

The SC division offers vehicle finance and unsecured consumer lending products. It indirectly originates retail installment

contracts, mainly through manufacturer-franchised dealers in relation with their sale of used and new vehicles to retail

consumers. It also provides auto financing products and services to Chrysler dealers and customers under the brand

Chrysler Capital. Its offerings include consumer retail installment contracts and leases, as well as dealer loans for

inventory, real estate, working capital, construction, and revolving lines of credit. The division also offers vehicle loans

through a web-based direct lending program; services recreational, automobile and marine vehicle portfolios for other

lenders; and purchases vehicle retail installment contracts from other lenders. In FY2015, the SC division reported a net

interest income of US$4,862.9 million, accounting for 75% of the company‟s total net interest income.

___________________________________________________________________________________________

Santander Holdings USA, Inc. - SWOT Profile Page 4

Santander Holdings USA, Inc.

__________________________________________________________________________________________

1.3 Santander Holdings USA, Inc. - Major Products and Services

SHUSA provides financial products and services in the US. The company's key products and services include:

Table 1: Santander Holdings USA, Inc. - Major Products and Services

Global Banking and Markets:

Loans

Syndicated Loans

Tax Equity

Derivatives

Debt Capital Markets Products

Equity Capital Markets Products

Small Business Banking:

Business Checking

Money Market Deposit Accounts

Business Loans

Credit Lines

Consumer Banking:

Checking Accounts

Savings Accounts

Money Market Accounts

Certificate of Deposits

Individual Retirement Accounts

Mortgages

Home Equity Loans

Home Equity Lines of Credit

Credit Cards

Auto Loans

Personal Loans

Insurance Products

Auto Finance:

Floor Plan Line of Credit

Dealership Mortgage

Commercial Loans

Deposit Products

Commercial Equipment and Vehicle Finance

Specialty Banking:

Oil and Gas Reserve Based Lending

Asset-Based Lending

Mortgage Warehouse Lending

___________________________________________________________________________________________

Santander Holdings USA, Inc. - SWOT Profile Page 5

Santander Holdings USA, Inc.

__________________________________________________________________________________________

Table 1: Santander Holdings USA, Inc. - Major Products and Services

Global Banking and Markets:

Commercial Banking and Real Estate:

Commercial Real Estate Loans

Global Banking and Markets:

Transaction Banking

Project Finance

Mergers & Acquisitions

Acquisition Finance

Foreign Exchange

Debt Capital Markets Services

Equity Capital Markets Services

Small Business Banking:

Real Estate Financing

Merchant Services

Cash Management Services

Consumer Banking Services:

Investments

Specialty Banking:

Government Banking

Healthcare Institution Banking

Higher Education Institution Banking

Commercial Banking and Real Estate:

Middle Market Banking

Business Banking

Multi-Family Financing

Cash Management

Trade Finance

Interest Rate Risk Management

Source: Timetric

___________________________________________________________________________________________

Santander Holdings USA, Inc. - SWOT Profile Page 6

Santander Holdings USA, Inc.

__________________________________________________________________________________________

2 Santander Holdings USA, Inc. - Recent Developments

Santander Bank appoints senior vice president and head of mortgage sales

Date : 21 Mar 2017

Santander Bank has announced the appointment of John Costa as senior vice president and head of mortgage

sales.Based in Santander's Villanova, PA office, John is responsible for sales growth in all mortgage channels across

Santander's US northeast footprint. He joins Santander from Embrace Home Loans where, as a Retail Lending Executive,

he was responsible for driving growth and profitability across the distributed retail channel while leading teams of branch

managers and retail loan officers. John's earlier experience was earned at Weichert Financial Services where he was

Head of Sales; Sutherland Global Services where he served as Business Development Director; and PHH Mortgage

where he held several management positions of increasing responsibility during his twelve-year tenure with the

company.Stephen Adamo, Santander's US Head of Home Loans, said, "John's extensive experience and

accomplishments in business to business and business to consumer sales as well as his background in business

development make him especially qualified to lead mortgage sales for Santander. Santander is focused on growth in

mortgage lending and we are excited to have him join our team to lead this expansion."

Santander Bank opens two new branches in Brooklyn

Date : 28 Feb 2017

Santander Bank announced the opening of two new branches in Brooklyn located on 893 Flatbush Avenue and 190 East

98th Street, bringing the number of Santander branches in Brooklyn to more than twenty.The Bank will hold a grand

opening celebration and ribbon cutting later today at its 893 Flatbush Avenue branch where Santander executives will

present checks totaling $12,000 to two community-based non-profit organizations – Brooklyn A and Haitian-American

Business Network (HABNET). Santander looks forward to hosting a grand opening event and ribbon cutting at its 190

East 98th Street branch on March 6.“With these new branches, we are pleased to now have a presence in the East

Flatbush and Brownsville neighborhoods and introduce the Santander brand and our competitive products and services to

the residents and business owners of these vibrant Brooklyn communities,” said Elsie Leon-Cruz, region president for

Santander‟s Metro New York/Northern New Jersey region. “Brooklyn is an important market to us and supporting leading

non-profit organizations that contribute so much to this diverse community is a priority for Santander.”Brooklyn A works to

advance social and economic justice through neighborhood-based legal representation and advocacy. They assist

individuals, families, businesses, and non-profit organizations and will use Santander‟s $10,000 grant to support its

Community and Economic Development Program. HABNET, fosters higher business standards and encourages trade

between Haitian diaspora communities and countries around the world and will use Santander‟s $2,000 gift to support the

growth of CaribbeanAmerican businesses in New York City.Leon-Cruz added, “Whether it‟s advocating for housing, health

care or education for low-income individuals or promoting entrepreneurship and civic engagement in underserved,

immigrant communities, Brooklyn A and Haitian-American Business Network share our commitment to improving the

quality of life for Brooklyn residents.” Santander‟s new Brooklyn branches feature a modern interior design aimed at

improving the customer experience with an open layout and comfortable meeting “nooks” with sliding glass doors where

customers can meet privately with our bankers to discuss their financial needs.The branches also have a “help bar” that

provides a casual gathering area for waiting and quick conversations. A 24-hour zone with deposit-taking ATMs is also

available at both branches for customer use after bank hours. The branch managers and their teams are available

Monday through Wednesday from 9 a.m. to 5 p.m., Thursday and Friday from 9 a.m. to 6 p.m. and Saturdays from 9 a.m.

to 2 p.m. to assist existing customers as well as those who would like to learn more about Santander‟s products and

services.

IFC Invests $175 Million in Banco ABC Brasil to Help Finance Renewable Energy Projects and Support Small and

Medium Enterprises

Date : 22 Dec 2016

IFC, a member of the World Bank Group, is providing a $175 million financing package to Banco ABC Brasil, to support

projects that will help mitigate climate change effects. The financing will also support the increase of access to finance for

small and medium enterprises (SMEs).IFC‟s financing package includes a four-year $50 million loan with IFC‟s own

account, and a two-year $125 million syndicated loan. The syndicated lenders are ABN Amro, HSBC, National Bank of

Abu Dhabi, Santander, and Standard Chartered.Investing in renewable energy ranks high among IFC‟s priorities, since it

promotes the diversification of Brazil‟s energy matrix and decreases reliance on nonrenewable sources. Moreover, it helps

generate jobs and support the country‟s economic development. With IFC‟s support, Banco ABC Brasil will invest in

projects that promote the use of renewable energy and energy efficiency, in order to reduce greenhouse gas emissions.

The financing may also be used in green building investments.With this IFC financing, Banco ABC Brasil will also grant

new loans to SMEs, thus contributing to job maintenance and creation in Brazil. SMEs are essential for the country‟s

socioeconomic growth, accounting for circa 52% of formal jobs and for approximately 27% of Brazil‟s GDP (Sebrae data,

2014).“This financing reinforces the importance of our partnership with IFC. With the support of the syndicated lenders,

our partnership will enable Banco ABC Brasil to develop important segments of our business strategy,” says Luiz Antonio

___________________________________________________________________________________________

Santander Holdings USA, Inc. - SWOT Profile Page 7

Santander Holdings USA, Inc.

__________________________________________________________________________________________

de Assumpção Neto, Banco ABC Brasil executive in charge of relations with national and foreign financial institutions.“The

private sector plays a key role in promoting solutions for climate change mitigation as well as to support SMEs,” adds

Marcelo Castellanos, IFC Executive responsible for Financial Institutions in Latin America and the Caribbean. “We are

glad to renew our partnership with Banco ABC Brasil and help them support both the growth of SMEs and the

development of the renewable energy and energy efficiency sectors.”Since 2005, IFC has invested $1.2 billion in climate-

related projects in Brazil. IFC‟s global strategy for renewable energy focuses on investing in technologies and new

business models to reduce the cost of renewables, making them more accessible and with a wider presence in emerging

markets. Globally, since 2005, IFC has invested approximately $25 billion in long-term financing for renewable energy,

energy efficiency sustainable agriculture, green building and adaptation of the private sector to climate change. IFC

closed the 2016 fiscal year with climate-related global investments of $3.3 billion, including 82 projects in 33 countries.

Santander InnoVentures secures further USD 100 million for fintech investment

Date : 19 Jul 2016

Santander InnoVentures, the London based fintech venture capital fund of Santander Group, has announced that it has

secured a further USD 100 million in funding from the Group‟s balance sheet.Launched in 2014, the fund is now set to

deploy a total of USD 200 million (up from the $100m originally allocated) in minority stakes in financial technology

startups. This new commitment highlights Santander‟s goal of remaining at the forefront of innovation in the financial

services industry, and builds on the bank‟s „Fintech 2.0‟ philosophy of collaboration and partnership with small and start-

up companies.Ana Botín, Group executive chairman of Banco Santander, said: “A deeper investment in our Fintech fund

represents Santander's success in investing in disruptive new technologies that will help our transformation towards being

the best bank for our customers - in the simple personal and fair way they expect and deserve today. The fund‟s base in

the UK has allowed it to benefit from London‟s position as a fintech hub, while talent-spotting our investments on a global

basis. Santander remains committed to the UK and excited about its Fintech enterprises.”Peter Jackson, senior executive

vice president and head of Innovation at Santander, said: “The fund is an essential part of Santander‟s broader innovation

strategy. The success of the work Mariano and the team are doing is confirmed by this second round of funding. Our $200

million total investment, demonstrates the group‟s commitment to innovation, and to the role of InnoVentures as a catalyst

for transformation, by finding and partnering with technology companies that allows us to bring the next generation of

services to our customers, globally.”Since inception in 2014, the fund has already invested globally in a series of market-

leading fintech startups: Socure (digital identity), SigFig (wealth management), Ripple, Digital Asset, Elliptic (blockchain),

Kabbage (companies financing), Cyanogen (mobile ecosystems), MyCheck and iZettle (payments).Managing partner

Mariano Belinky said: “This commitment allows the fund to continue expanding the work we are doing across geographies

and investment themes. It will help us expand our portfolio to exciting geographies like Latin America and explore more

opportunities across Europe. It will also allow us to explore new and exciting themes around artificial intelligence, machine

learning, cognitive computing, digital banking and others that allow us to further improve Santander‟s value proposition to

its customers.”Santander InnoVentures‟ participation with its portfolio companies goes beyond traditional financial venture

capital involvement. The fund provides capital but also access to the scale of Santander Group as a global financial

institution, operating in 10 core markets in Europe and the Americas and serving more than 120 million customers.

Additionally, InnoVentures portfolio companies get access to the Group‟s experts in areas such as regulation, operations

and technology.

Santander InnoVentures announces investment in digital identify verification firm Socure

Date : 23 Jun 2016

At MoneyConf in Madrid, Santander InnoVentures, the fintech venture capital fund of Santander Group, announced its

strategic investment in Socure – an industry leader focused on real-time digital identity verification solutions.Socure,

headquartered in New York, utilises trusted data from the digital footprint of consumers, including social media, to

accurately and efficiently confirm the identity of consumers in real-time. Socure is primarily used within financial

institutions for activities such as the opening of new bank accounts or the issuing of credit/debit cards. The technology has

further applications across fraud prevention and compliance, ensuring firms meet requirements of directives such as anti-

money laundering (AML) regulations. Current Socure customers and partners include Kabbage and StashInvest, and

partners Feedzai.Mariano Belinky, Managing Partner at Santander InnoVentures, said: "Identity verification is a crucial

step in any banking process and is an issue challenging many consumer-facing businesses - there's a huge opportunity

for innovation in this space, in line with the evolution of digital identity and the issues around it, and we believe Socure are

at the forefront of it."Belinky continued: "Socure also has enormous potential for tackling the issue of financial inclusion in

emerging markets, where citizens may be excluded from the banking system simply because they lack traditional credit

records used for identity verification. In this situation, the Socure ID+ technology goes beyond conventional identity

verification methods, opening new possibilities in untapped markets and segments. More broadly, Socure offers us the

opportunity to better understand our customers, and better predict their needs."Sunil Madhu, Founder and CEO of Socure

said: "With this latest funding announcement, we're extremely excited to continue our work in tackling the issues

associated with identity fraud, while continuing to improve access to the financial system for the un-banked and under-

banked, whether in established economies or emerging markets. With the track record and the global capability of Grupo

Santander behind them, we felt Mariano and the team were a perfect fit as a VC partner that can help us grow

globally."Meanwhile, the senior executive vice president of Strategy at Grupo Santander, Víctor Matarranz, explained

today that the bank is accelerating its digital transformation through partnerships with technology companies that are

global pioneers in several financial solutions that contribute to the progress of people and companies, and make their lives

easier.Matarranz, who participated today in the MoneyConf financial technology conference held in Madrid, highlighted

___________________________________________________________________________________________

Santander Holdings USA, Inc. - SWOT Profile Page 8

Santander Holdings USA, Inc.

__________________________________________________________________________________________

the advantages of combining the agility and disruptive mentality of fintech companies with the international reach of banks

such as Santander, which has more than 120 million customers in Europe and America, a robust infrastructure,

guaranteed deposits and extensive experience in risk and regulation. "We believe the flexibility of fintech companies, and

experience and soundness of banks such as Santander form the perfect partnership, good for startups and good for

banks like Santander, as it helps us accelerate our digital transformation," said Matarranz in his keynote at MoneyConf,

sponsored by Banco Santander.

Source: Timetric

___________________________________________________________________________________________

Santander Holdings USA, Inc. - SWOT Profile Page 9

Santander Holdings USA, Inc.

__________________________________________________________________________________________

3 Santander Holdings USA, Inc. - SWOT Analysis

3.1 Santander Holdings USA, Inc. - SWOT Analysis - Overview

SHUSA is a financial services holding company based in the US. Association with Banco Santander, a broad product and

service portfolio, sound capital adequacy and increase in total deposits are its key strengths, even as its weak bottom line

performance remains a major area of concern. In the future, increases in compliance costs, fluctuations in interest rates,

and changing rules and regulations could affect SHUSA‟s business, operating results and financial condition. However,

the growing US economy, booming mortgage market in the US and positive outlook for the US card payments channel

could present ample growth opportunities to the company.

3.2 Santander Holdings USA, Inc. - Strengths

Strengths - Broad Product and Service Portfolio

SHUSA‟s broad product and service portfolio enables the company to cater to the diversified requirements of its

customers, and in turn create various sources of generating its income. The company offers a wide range of retail and

corporate banking products and services. Its product and service portfolio includes checking accounts, savings accounts,

certificates of deposits, auto loans, personal loans, mortgages, insurance products, debit and credit cards, business loans,

term loans, online banking and merchant services. SCUSA also provides vehicle finance, small business line of credit,

equipment leasing and financing, wholesale lending, oil and gas finance, foreign exchange services, treasury

management services and export and import trade services. Such a broad product and service portfolio of the company

mitigates risks associated with concentrated product offerings, and in turn, further enhances its top-line performance.

Strengths - Association with Banco Santander

The company‟s association with Banco Santander further enhances its brand image and market position. SHUSA is a

subsidiary of Banco Santander, one of the largest banks in Spain and Europe. Banco Santander offers a wide range of

financial products and services in the fields of retail banking, wholesale banking, asset management and insurance

worldwide. It primarily operates in Spain, the UK, Portugal, Poland, Germany, Chile, Mexico, Brazil and the US. At the end

of FY2015, Banco Santander had 13,030 branches and 121 million customers across the globe. As part of Banco

Santander, the company benefits from financial strength and stability, which gives it a significant competitive advantage.

Strengths - Sound Capital Adequacy

Sound capital adequacy enables the company to meet regulatory capital requirements vis-a-vis its risk-weighted assets

and to address stress tests conducted by national banking regulators. The good capital management enabled the

company to strengthen its capital position. The company was required to maintain a common equity tier 1 (CET1) capital

ratio of at least 4.5%, a Tier 1 capital ratio of at least 6%, a total capital ratio of at least 8%, and a leverage ratio of at least

4% under Federal Reserve norms. The company reported the common equity tier 1 (CET1) capital ratio of 11.95%, tier 1

capital ratio of 13.51%, total capital ratio of 15.33%, and leverage ratio of 11.57% during FY2015, thus meeting the

regulatory requirements. The prudent capital management of the company strengthened its capital, which in turn will

enable it to withstand periods of financial stress.

Strengths - Increase in Total Deposits

An increase in total deposits of the company reflects strong customer sentiments and better returns on cash deposits.

SHUSA has exhibited increase in its total deposits. The company‟s total deposits increased by 6.9%, from US$56,114.2

million in FY2015, to reach US$52,474.0 million during FY2014. The growth in total deposits was due to an increase in

money market accounts by 13.1%, CDs by 16.4%, savings by 2.4% and non interest-bearing accounts by 3% over

FY2014, as well as better economic conditions. Such an increase in total deposits strengthens the company‟s financial

position and expands its lending capabilities.

3.3 Santander Holdings USA, Inc. - Weaknesses

Weaknesses - Weak Bottom-line Performance

In FY2015, the bank reported a weak bottom line performance, which is an area of concern. The company reported an

operating loss of US$3,075.1 million in FY2015, compared to an operating profit of US$2,916.8 million in FY2014. In

addition, the company reported net loss of US$1,454.6 million in FY2015, compared to net profit of US$2,457.6 million in

FY2014. The loss was principally due to the impairment on goodwill. Such a decrease in income levels may affect its

ability to pursue growth and expansion plans.

___________________________________________________________________________________________

Santander Holdings USA, Inc. - SWOT Profile Page 10

Santander Holdings USA, Inc.

__________________________________________________________________________________________

3.4 Santander Holdings USA, Inc. - Opportunities

Opportunities - Booming Mortgage Market in the US

The booming mortgage market in the US offers significant opportunities to the company. The US is the most active

mortgage market in the world, and has exhibited substantial growth in the recent past. According to the the Mortgage

Bankers Association (MBA), commercial and multifamily mortgage originations are expected to reach US$1,558 billion in

2016, compared to US$1,222 billion in 2015. These forecasts are on the back of the fact that the US economy continues

on its current path of stronger growth, job gains and declining unemployment. This is likely to enhance the demand for

mortgage products and services offered by the company, in turn driving its top-line performance.

Opportunities - Growing US Economy

The company stands to benefit from the growing economy in the US. According to the International Monetary Fund (IMF),

the GDP growth rate of the US stood at 2.4% in 2015, and is expected to reach 2.5% in 2017. Positive growth in the

economy keeps a balance between exports and imports in the country, further bolsters individual consumption and

investment, and strengthens government spending. Such economic growth is likely to enable favorable market conditions

in the country. SHUSA, which offers financial products and services in the US, is likely to benefit from such positive

economic growth.

Opportunities - Positive Outlook for the US Card Payments Channel

The company stands to benefit from the positive outlook for the US card payments channel. According to in-house

research, the channel is expected to reach 107.0 billion transactions in 2019, in terms of transaction volume. In terms of

value, the channel is forecast to reach US$7,082.5 billion in 2019. Growth is expected to be driven by more stable

economic conditions, an increase in disposable income and the popularity of mobile commerce and online retail. SHUSA,

a provider of debit and credit cards, is well placed to benefit from this.

3.5 Santander Holdings USA, Inc. - Threats

Threats - Increase in Compliance Costs

An increase in compliance costs may impact the bank‟s operations. Compliance costs are expected to increase further,

and may adversely affect the bank‟s operations. The recent financial crisis has led to increased compliance costs and

additional regulations. The compliance burden on companies has probably been increased in an attempt by the

government to prevent future crises. The Basel Committee on Banking Supervision, the Senior Supervisors Group, the

Institute of International Finance and the US Treasury have issued reports reflecting the changes in the regulatory

process and risk management practices. The Federal Reserve has also issued new regulations for mortgage origination

to guard consumers. This may result in an enhanced regulatory environment and exert extra pressure on companies,

which are already working on improving their own governance processes.

Threats - Fluctuations in Interest Rates

Fluctuations in interest rates may have a material adverse effect on the company's operational performance. Interest rates

are highly sensitive to monetary policies of government, domestic and international, economic and political conditions, and

other factors beyond its control. An increase in interest rates increases the return on the company's assets and vice versa.

During the rate hikes, changes in liquidity can affect the company's net interest income, as well as the value of company's

equity. International banks operating in emerging countries with weak currencies face higher risks due to a hike in interest

rates. Companies with correspondent bank status with other foreign banks are exposed to higher levels of risk, as they

need to hold foreign currencies on behalf of their clients. Increase in market interest rates may decrease unrealized

capital gains on fixed income securities of the company's investment portfolio. However, the decline in market interest

rates may have an adverse impact on the company's investment income. The defaults in the company's investment

portfolio may lead to operating losses, and reduce its reserves and surplus.

Threats - Changing Rules and Regulations

The company's businesses are regulated by various governmental and regulatory authorities. Changes in government

policy, legislation or regulatory interpretation may adversely affect the company's product range, distribution channels,

capital requirements, and consequently, reported results and financing requirements. These changes include possible

changes in statutory pension arrangements and policies, the regulation of selling practices and solvency requirements.

For instance, the changes in the Dodd-Franck Act in the US have impacted the financial services industry in the US,

which included significant changes in capital adequacy requirements, interchange fees, deposit insurance assessments,

mortgage lending practices, consumer protection and lending limits set by the Act. This is likely to impact the capital

reserves of the company, as it needs to comply with the set rules. The company's profitability is also influenced by the

changes in international regulatory capital initiative, Basel III, under which the regulatory authority raised the minimum

capital limits maintained by the company in order to protect its customers from bankruptcies. Therefore, the changes in

government policies and regulations may have a negative impact on the company's growth and expansion strategies.

___________________________________________________________________________________________

Santander Holdings USA, Inc. - SWOT Profile Page 11

Santander Holdings USA, Inc.

__________________________________________________________________________________________

4 Santander Holdings USA, Inc. - Company Statement

A statement from company's management discussion and analysis is given below. The following statement has been

taken from the company's 2015 10-K:

RESULTS OF OPERATIONS

The following discussion reviews the company's financial performance over the past three years from a consolidated

perspective. This review is analyzed in the following two sections: "Results of Operations for the Years Ended December

31, 2015 and 2014"; and "Results of Operations for the Years Ended December 31, 2014 and 2013." Each section

includes a detailed income statement and segment results review. Key consolidated balance sheet trends are discussed

in the "Financial Condition" section.

We have made certain corrections to previously disclosed amounts to correct for errors related to the allowance for credit

losses, TDRs, and the classification of subvention payments related to leased vehicles. Refer to Note 1 of the

Consolidated Financial Statements for additional information.

RESULTS OF OPERATIONS FOR THE YEAR ENDED DECEMBER 31, 2015 AND 2014

The company reported pre-tax loss of USUS$3.7 billion for the year ended December 31, 2015, compared to a pretax

income of US$4.5 billion for the year ended December 31, 2014. Factors contributing to these changes were as follows:

• Net interest income increased US$787.9 million for the year ended December 31, 2015, compared to the corresponding

period in 2014. This increase was primarily due to the increased interest income on loans, as a result of the growing RIC

and auto loan portfolio.

• The provision for credit losses increased to US$1.6 billion for the year ended December 31, 2015, compared to the

corresponding period in 2014. This increase was primarily due to the continued growth in the RIC and auto loan portfolio,

and the related provisions for these portfolios.

• Total non-interest income decreased by US$2.2 billion for the year ended December 31, 2015, compared to the

corresponding period in 2014. This decrease was primarily due to the one-time net gain recognized in the first quarter of

2014, related to the Change in Control.

• Total general and administrative expenses increased by US$967.8 million for the year ended December 31, 2015,

compared to the corresponding period in 2014. This increase was primarily due to increases in lease expense and

compensation and benefits throughout the year.

• Other expenses increased by US$4.2 billion for the year ended December 31, 2015, compared to the corresponding

period in 2014. The increase was primarily due to an impairment charge of goodwill of US$4.4 billion in the fourth quarter

of 2015.

• The income tax provision decreased by US$2.2 billion for the year ended December 31, 2015, compared to the

corresponding period in 2014. This decrease was due to the income tax provision on the gain on Change in Control that

occurred in 2014, and the creation of a tax benefit from the impairment of goodwill in 2015.

NON-GAAP FINANCIAL MEASURES

The company's non-generally accepted accounting principle ("GAAP") information has limitations as an analytical tool,

and therefore, should not be considered in isolation or as a substitute for analysis of our results or any performance

measures under GAAP as set forth in the company's financial statements. These limitations should be compensated for

by relying primarily on the company's GAAP results, and using this non-GAAP information only as a supplement to

evaluate the Company's performance.

The Company considers various measures when evaluating capital utilization and adequacy. These calculations are

intended to complement the capital ratios defined by banking regulators for both absolute and comparative purposes.

Because GAAP does not include capital ratio measures, the company believes that there are no comparable GAAP

financial measures to these ratios. These ratios are not formally defined by GAAP or codified in federal banking

regulations, and are therefore considered to be non-GAAP financial measures. Since analysts and banking regulators

may assess the company's capital adequacy using these ratios, the company believes they are useful to provide investors

the ability to assess its capital adequacy on the same basis. The company believes these non-GAAP measures are

important because they reflect the level of capital available to withstand unexpected market conditions. Additionally, the

presentation of these measures allows readers to compare certain aspects of the company's capitalization to other

organizations. However, because there are no standardized definitions for these ratios, the company's calculations may

not be directly comparable with those of other organizations, and the usefulness of these measures to investors may be

limited. As a result, the company encourages readers to consider its Consolidated Financial Statements in their entirety,

and not to rely on any single financial measure.

Interest Income on Investment Securities and Interest-Earning Deposits

Interest income on investment securities and interest-earning deposits increased by US$85.2 million for the year ended

December 31, 2015, compared to the corresponding period in 2014. The average balance of investment securities and

interest-earning deposits for the year ended December 31, 2015 was US$22.1 billion, with an average yield of 1.85%,

compared to an average balance of US$15.5 billion with an average yield of 2.20% for the corresponding period in 2014.

Overall, the increase in interest income on investment securities was primarily attributable to an increase of US$63.1

million in collateralized mortgage obligations ("CMOs") as the average balance increased to US$8.2 billion from US$4.6

billion for the year ended December 31, 2015 compared to the corresponding period in 2014.

Interest Income on Loans

___________________________________________________________________________________________

Santander Holdings USA, Inc. - SWOT Profile Page 12

Santander Holdings USA, Inc.

__________________________________________________________________________________________

Interest income on loans increased US$852.3 million for the year ended December 31, 2015, compared to the

corresponding period in 2014. The increase in interest income on loans was primarily due to the growth in originations of

the RIC and auto loans and unsecured loan portfolios. Interest income on the RIC and auto loans portfolio increased by

US$862.6 million for the year ended December 31, 2015, compared to the corresponding period in 2014. This was offset

by a decrease in interest on residential mortgage loans of US$96.7 million for the year ended December 31, 2015.

The average balance of total loans was US$80.4 billion with an average yield of 9.46% for the year ended December 31,

2015, compared to US$73.3 billion with an average yield of 9.21% for the corresponding period in 2014. The increase in

the average balance of total loans of US$7.1 billion was primarily due to the growth of the RIC and auto loan portfolio. The

average balance of RICs and auto loans – which comprised a majority of the increase – was US$24.7 billion, with an

average yield of 20.36% for the year ended December 31, 2015, compared to US$19.9 billion with an average yield of

20.97% for the corresponding period in 2014.

Interest Expense on Deposits and Related Customer Accounts

Interest expense on deposits and related customer accounts increased by US$51.1 million for the year ended December

31, 2015, compared to the corresponding period in 2014. The average balance of total interest-bearing deposits was

US$46.6 billion, with an average cost of 0.60% for the year ended December 31, 2015, compared to an average balance

of US$42.4 billion with an average cost of 0.49% for the corresponding period in 2014. The increase in interest expense

on deposits and customer-related accounts during the year ended December 31, 2015 was primarily due to the increase

in the volume of deposit accounts, along with an increase in average interest rates.

Interest Expense on Borrowed Funds

Interest expense on borrowed funds increased by US$98.5 million for the year ended December 31, 2015, compared to

the corresponding period in 2014. The increase in interest expense on borrowed funds was due to a US$9.9 billion

increase in total average borrowings for the year ended December 31, 2015, compared to the corresponding period in

2014. This increase was primarily due to US$3.1 billion of new debt issued by SBNA and the company, and net US$2.5

billion of SC securitization activity. The average balance of total borrowings was US$44.4 billion, with an average cost of

2.13% for the year ended December 31, 2015, compared to an average balance of US$34.5 billion with an average cost

of 2.45% for the corresponding period in 2014.

Provision for Credit Losses

The provision for credit losses is based on credit loss experience, growth or contraction of specific segments of the loan

portfolio, and the estimate of losses inherent in the portfolio. The provision for credit losses for the year ended December

31, 2015 was US$4.1 billion, compared to US$2.6 billion for the corresponding period in 2014. The activity for the year

ended December 31, 2015 is primarily related to RIC and auto loan activity. The company's net charge-offs increased for

the year ended December 31, 2015, compared to the corresponding period in 2014. The ratio of net loan charge-offs to

average total loans was 3.3% for the year ended December 31, 2015, compared to 2.2% for the corresponding period in

2014.

Consumer loan net charge-offs as a percentage of average consumer loans increased to 6.1% for the year ended

December 31, 2015, compared to 4.0% for the year ended December 31, 2014. The increases in consumer loan net

charge-offs as a percentage of average consumer loans is primarily attributable to SC's personal unsecured loan

portfolios being reclassified as held-for-sale, as well as the lower of cost or fair value adjustments on certain RICs and

auto loans, which were reflected as charge-offs of US$451.0 million for the year ended December 31, 2015.

• During the third quarter of 2015, SC determined that it no longer intended to hold its personal unsecured lending assets

for investment. As a result, approximately USUS$1.9 billion of personal unsecured loans were transferred to held-for-sale,

net of a lower of cost or fair value adjustment of US$377.6 million.

• For the year ended December 31, 2015, the lower of cost or fair value adjustments associated with RIC and auto loan

sales was US$73.4 million. When adjusting for these lower of cost or fair value adjustments, SC's consumer loan net

charge-off rate did not change materially year-over-year. Future loan originations and purchases under SC's personal

lending platform will also be classified as held-for-sale.

Commercial loan net charge-offs as a percentage of average commercial loans, including multifamily loans, were less

than 0.3% for the year ended December 31, 2015, compared to less than 0.2% for the year ended December 31, 2014.

Total non-interest income decreased US$2.2 billion for the year ended December 31, 2015, compared to the

corresponding period in 2014. The decrease for the year ended December 31, 2015 was primarily due to the one-time

gain recognized in 2014, and was included in net gain recognized in earnings, related to the Change in Control.

Consumer Fees

Consumer fees increased by US$67.0 million for the year ended December 31, 2015, compared to the corresponding

period in 2014. This increase was primarily due to the US$84.7 million increase in loan servicing fees, which is largely

attributable to the Company's growing RIC and auto loan portfolio. This growth was offset by a decrease in insurance

service and consumer deposit fees.

Commercial Fees

Commercial fees consist of deposit overdraft fees, deposit ATM fees, cash management fees, letter of credit fees, and

loan syndication fees for commercial accounts. Commercial fees increased by US$2.2 million for the year ended

December 31, 2015, compared to the corresponding period in 2014. Mortgage banking income consisted of fees

associated with servicing loans not held by the Company, as well as originations, amortization, and changes in the fair

value of MSRs and recourse reserves. Mortgage banking income also included gains or losses on the sale of mortgage

loans, home equity loans, home equity lines of credit, and mortgage-backed securities ("MBS"). Gains or losses on

mortgage banking derivative and hedging transactions are also included in mortgage banking income.

___________________________________________________________________________________________

Santander Holdings USA, Inc. - SWOT Profile Page 13

Santander Holdings USA, Inc.

__________________________________________________________________________________________

Mortgage banking revenue decreased by US$96.6 million for the year ended December 31, 2015, compared to the

corresponding period in 2014. This change was primarily due to a decrease in the gain on sales of residential mortgage

loans and related securities, offset by an increase in the change in MSR fair value discussed in further detail below.

Since 2013, mortgage interest rates have remained stable, resulting in relative stability in mortgage banking fee

fluctuations from rate changes.

The following table details interest rates on certain residential mortgage loans for the bank, as of the dates indicated;

other factors, such as portfolio sales, servicing, and re-purchases, have continued to affect mortgage banking revenue.

Mortgage and multifamily servicing fees increased by US$0.9 million for the year ended December 31, 2015, compared to

the corresponding period in 2014. On December 31, 2015 and December 31, 2014, the company serviced mortgage and

multifamily real estate loans for the benefit of others, with a principal balance totaling US$858.2 million and US$2.9 billion

respectively.

Net gains on sales of residential mortgage loans and related securities decreased US$97.3 million for the year ended

December 31, 2015, compared to the corresponding period in 2014. For the year ended December 31, 2015, the

company sold US$2.5 billion of mortgage loans for a gain of US$47.6 million, compared to US$3.3 billion of loans sold for

a gain of US$144.9 million for the year ended December 31, 2014.

The company periodically sells qualifying mortgage loans to the Federal Home Loan Mortgage Corporation ("FHLMC"),

Government National Mortgage Association and Federal National Mortgage Association ("FNMA") in return for MBS

issued by those agencies. The company records these transactions as sales when the transfers meet all of the accounting

criteria for a sale. For those loans sold to the agencies for which the company retains the servicing rights, the company

recognizes the servicing rights at fair value. These loans are also generally sold with standard representation and

warranty provisions, which the company recognizes at fair value. Any difference between the carrying value of the

transferred mortgage loans and the fair value of MBS, servicing rights, and representation and warranty reserves is

recognized as a gain or loss on sale.

Net gains on sales of multifamily mortgage loans increased by US$3.9 million for the year ended December 31, 2015,

compared to the corresponding period in 2014. The increase was primarily due to a US$29.9 million release in the FNMA

recourse reserve for the year ended December 31, 2015. The release of FNMA recourse reserves was attributable to the

US$1.4 billion purchases of multifamily mortgages during the third quarter from FNMA.

The company previously sold multifamily loans in the secondary market to FNMA, while retaining servicing. In September

2009, the bank elected to stop selling multifamily loans to FNMA, and since that time, has retained all production for the

multifamily loan portfolio. Under the terms of the multifamily sales program with FNMA, the company retained a portion of

the credit risk associated with those loans. As a result of that agreement, the company retains a 100% first loss position

on each multifamily loan sold to FNMA under the program until the earlier to occur of: (i) the aggregate approved losses

on the multifamily loans sold to FNMA reaching the maximum loss exposure for the portfolio as a whole; or (ii) all of the

loans sold to FNMA under the program are fully paid off. On December 31, 2015 and December 31, 2014, the company

serviced loans with a principal balance of US$552.1 million and US$2.6 billion for FNMA respectively. These loans had a

credit loss exposure of US$34.4 million and US$152.8 million as of December 31, 2015 and December 31, 2014

respectively, and losses resulting from representation and warranty defaults, if any, would be in addition to the company's

credit loss exposure. The servicing asset for these loans has completely amortized.

The company has established a liability related to the fair value of the retained credit exposure for multifamily loans sold to

FNMA. This liability represents the amount the company estimates it would have to pay a third party to assume the

retained recourse obligation. The estimated liability represents the present value of the estimated losses the portfolio is

projected to incur, based on internal specific information and an industry-based default curve with a range of estimated

losses. As of December 31, 2015 and December 31, 2014, the company had a liability of US$6.8 million and US$40.7

million respectively, related to the fair value of the retained credit exposure for multifamily loans sold to FNMA under this

program.

Net gains on hedging activities decreased by US$8.1 million for the year ended December 31, 2015, compared to the

corresponding period in 2014. This decrease was primarily due to the decrease in the mortgage loan pipeline valuation

and the company's hedging strategy in the current mortgage rate environment.

Net gains/losses from changes in MSR fair value increased by US$6.8 million for the year ended December 31, 2015,

compared to the corresponding period in 2014. The carrying values of the related MSRs at December 31, 2015 and

December 31, 2014 were US$147.2 million and US$145.0 million respectively. The MSR asset fair value increase for the

year ended December 31, 2015 was the result of increases in interest rates.

The company recognized US$24.7 million of principal reductions for the year ended December 31, 2015, compared to

US$22.0 million for the corresponding period in 2014. This increase was due to continued increases in prepayments and

mortgage refinancing as a result of the anticipation of rising interest rates in the near future.

Equity Method Investments (Loss)/Income, net

Equity method investments (loss)/income, net decreased by US$16.6 million for the year ended December 31, 2015,

primarily attributable to the Change in Control. In 2014, the company included one month of accounting for SC as an

equity method investment prior to the Change in Control. The company began accounting for SC as a consolidated

subsidiary beginning January 28, 2014. For further discussion, see Item 1 Business.

BOLI

BOLI income represents fluctuations in the cash surrender value of life insurance policies on certain employees. The bank

is the beneficiary and the recipient of the insurance proceeds. Income from BOLI decreased by US$2.4 million for the year

ended December 31, 2015, compared to the corresponding period in 2014.

Capital Markets Revenue

Capital markets revenue decreased US$14.3 million for the year ended December 31, 2015, compared to the

corresponding period in 2014. This decrease was primarily related to a decrease in derivative trading accounts for the

year ended December 31, 2015.

___________________________________________________________________________________________

Santander Holdings USA, Inc. - SWOT Profile Page 14

Santander Holdings USA, Inc.

__________________________________________________________________________________________

Lease Income

Lease income increased by US$679.4 million, on an average leased vehicle portfolio balance of US$7.6 billion for the

year ended December 31, 2015, compared to an average balance of US$4.4 billion for the corresponding period in 2014.

This increase was the result of the company's efforts to grow the lease portfolio.

As disclosed within Note 1 to the Consolidated Financial Statements, during this year, the company re-classified

subvention payments from an addition to lease income to a reduction to lease expense in the Consolidated Statements of

Operations for all periods presented.

Net Gain Recognized in Earnings

Net gains recognized in earnings decreased by US$2.4 billion for the year ended December 31, 2015, compared to the

corresponding period in 2014. The decrease for the year ended December 31, 2015 was primarily due to the one-time

gain the company recognized in connection with the Change in Control during the first quarter of 2014. For additional

information on the Change in Control, see Note 3 to the Consolidated Financial Statements.

The net gain for the year ended December 31, 2015 was primarily comprised of the sale of state and municipal securities

with a book value of US$421.5 million for a gain of US$12.1 million, the sale of corporate debt securities with a book value

of US$566.2 million for a gain of US$6.7 million, and the sale of asset-backed securities ("ABS") with a book value of

US$683.9 million for a loss of US$0.2 million, offset by other-than-temporary impairment ("OTTI") of US$1.1 million. The

net gain realized for the year ended December 31, 2014 was primarily comprised of the sale of state and municipal

securities, with a book value of US$89.0 million for a gain of US$5.2 million, the sale of corporate debt securities with a

book value of US$219.6 million for a gain of US$4.8 million, and the sale of MBS with a book value of US$579.4 million

for a gain of US$13.1 million.

Miscellaneous Income

Miscellaneous income decreased by US$364.2 million for the year ended December 31, 2015, compared to the

corresponding period in 2014. The decrease for the year ended December 31, 2015 was primarily due to a US$235.9

million decrease in fair value associated with the portfolio of loans that the company accounts for at the fair value option

("FVO"). The decrease was also attributable to a reclassification that the company made of their personal unsecured

loans from held-for-investment ("HFI") to held-for-sale ("HFS") in the third quarter of 2015 and credit losses attributed to

these portfolios. For further discussion please see Note 5. Total general and administrative expenses increased by

US$967.8 million for the year ended December 31, 2015 from the corresponding period in 2014. Factors contributing to

these increases were as follows:

• Compensation and benefits expenses increased by US$175.2 million for the year ended December 31, 2015 from the

corresponding period in 2014. The primary driver of this increase was the company's continued investment in personnel

through increased salary, benefits and headcount. During the third quarter, the company initiated a process to improve its

operating efficiency, specifically focused on organizational simplification. As a result of this process, the company incurred

a severance accrual of US$30.0 million for the year ended December 31, 2015.

• Occupancy and equipment expenses increased US$70.9 million for the year ended December 31, 2015 from the

corresponding period in 2014. This was primarily due to an increase in depreciation expense of US$40.0 million for the

year ended December 31, 2015, which accounted for 56.5% of the increase. This was partially attributable to the second

quarter of 2015. The bank closed 29 branches located throughout its footprint in order to gain operational efficiencies.

These closures resulted in accelerated depreciation expenses of US$7.6 million of related assets and a vacancy accrual

charge of US$6.4 million in the form of rent expense.

• Outside services increased by US$82.0 million for the year ended December 31, 2015 from the corresponding period in

2014. This increase was primarily due to increased consulting service fees that relate to regulatory-related initiatives,

including preparation for meeting the requirements of the IHC implementation rules. Consulting fees increased US$93.5

million for the year ended December 31, 2015 from the corresponding period in 2014. The increase was offset by a

decrease in outside processing services.

• Loan expenses increased by US$49.7 million for the year ended December 31, 2015 from the corresponding period in

2014. This increase was primarily due to an increase of US$68.4 million in collection expenses largely associated with the

growing RIC and auto loan portfolio. The increase was offset by a decrease in loan servicing expenses.

• Lease expense increased US$524.5 million for the year ended December 31, 2015 from the corresponding period in

2014. This increase was primarily due to the continued growth of the company's leased vehicle portfolio.

As disclosed within Note 1 to the Consolidated Financial Statements, during the year, the company re-classified

subvention payments from an addition to lease income to a reduction to lease expense in the Consolidated Statements of

Operations for all periods presented.

• Other administrative expenses increased US$22.8 million for the year ended December 31, 2015 from the

corresponding period in 2014. The increase was due to a US$27.4 million increase of legal fees and a US$24.8 million

increase in non-income related tax expenses that were both recognized throughout the year. This was offset by a

US$32.9 million decrease in employee expenses throughout the year. Total other expenses increased by US$4.2 billion

for the year ended December 31, 2015, compared to the corresponding period in 2014. The primary factors contributing to

the increase were:

• Amortization of intangibles increased US$8.2 million for the year ended December 31, 2015, compared to the

corresponding period in 2014. The increase was primarily due to a fourth quarter 2015 impairment of US$11.7 million of

the company's indefinite-lived trade name. For further discussion on the impairment of this indefinite-lived trade name,

please see Note 9 of the Consolidated Financial Statements.

___________________________________________________________________________________________

Santander Holdings USA, Inc. - SWOT Profile Page 15

Santander Holdings USA, Inc.

__________________________________________________________________________________________

• Deposit insurance premiums expenses increased US$1.2 million for the year ended December 31, 2015, compared to

the corresponding period in 2014. This variance was caused by a change in FDIC insurance premium rates and the

assessment base for the bank.

• There were no losses on debt extinguishment during the year ended December 31, 2015, compared to US$127.1 million

of losses in the year ended December 31, 2014. This expense was primarily related to early termination fees incurred by

the company, in association with the 2014 termination of legacy FHLB advances.

There was no impairment charges recorded on capitalized software during 2015. In the second quarter of 2014, an

impairment of capitalized software charge of US$97.5 million was recorded due to the restructuring of the Company's

capitalized software. For the year ended December 31, 2015, the company recorded an impairment of goodwill in the

amount of US$4.4 billion. For further discussion on this matter, see the section of the MD&A captioned "Goodwill".

• The Company incurred an investment expense on affordable housing projects of US$156,000 for the year ended

December 31, 2015. This expense was directly related to low income housing tax credit ("LIHTC") investments. This is

attributed to the adoption of Accounting Standards Update ("ASU") 2014-01. See Note 1 to the Consolidated Financial

Statements for additional information.

Income Tax Provision

An income tax benefit of US$671.5 million was recorded for the year ended December 31, 2015, compared to an income

tax provision of US$1.6 billion for the corresponding period in 2014. This resulted in effective tax rates of 17.9% for the

year ended December 31, 2015, compared to 34.8% for the corresponding period in 2014.

The lower income tax provision in 2015 was primarily due to two drivers. In 2015, the company recognized an impairment

of the goodwill with respect to its investment in SC, which reduced the company's deferred tax liability for the excess

carrying value over its tax basis in the investment. The company recognized a tax benefit of US$982.9 million for the

reduction in the deferred tax liability. In 2014, the company recognized a tax expense of US$917.5 million (approximately

US$841.7 million of which was deferred) on a book gain of US$2.4 billion related to the Change in Control. The book gain

was primarily due to the excess of fair value over the carrying value of the assets on SC's books at the time of the Change

in Control. The US$841.7 million of deferred tax liability would be recognized upon the company's disposition of its interest

in SC or if the goodwill associated with the Change in Control becomes impaired.

The lower effective tax rate for the year ended December 31, 2015 was driven primarily by two components. The first was

the 2015 impairment of goodwill related to the company's investment in SC in the amount of US$4.4 billion, which put the

company in a consolidated pretax loss position. The company is not able to recognize a tax benefit for the impairment. In

addition, the company increased the reserve for income taxes under a dispute with the United States for certain financing

transactions by US$104.2 million. Both of these items reduce the overall effective tax rate on a pretax base, which is a

loss.

The company's effective tax rate in future periods will be affected by the results of operations allocated to the various tax

jurisdictions in which the Company operates, any change in income tax laws or regulations within those jurisdictions, and

interpretations of income tax regulations that differ from the company's interpretations by tax authorities that examine tax

returns filed by the company or any of its subsidiaries.

___________________________________________________________________________________________

Santander Holdings USA, Inc. - SWOT Profile Page 16

Santander Holdings USA, Inc.

__________________________________________________________________________________________

5 Santander Holdings USA, Inc. - History

Table 2: Santander Holdings USA, Inc. - History

Year Event type Description

In February, Santander Bank announced the opening of two new branches in

2017 Corporate Changes/Expansions

Brooklyn, New York, the US.

Santander Bank won the Best Digital Platform award from Innovation Enterprise,

2015 Corporate Awards

a business-to-business multi-channel media brand.

2015 New Products/Services Santander Bank launched a new account opening screening process.

Santander Bank entered into a memorandum of agreement with the U.S.

2015 Contracts/Agreements Department of Commerce‟s International Trade Administration (ITA) to raise

awareness in the US business community about international trade.

Santander Bank was honored with the Best Digital Platform award by Innovation

2015 Corporate Awards

Enterprise.

Santander Bank introduced its Santander Select personalized banking service at

2014 New Products/Services

its branch in 330 Madison Avenue in New York City.

Santander Bank introduced its Santander Select personalized banking service at

2014 New Products/Services

its branches in One Beacon Street and 61 Arlington Street in Boston.

Santander Bank entered into an agreement with Ocean County College for its

2014 Contracts/Agreements Santander Universities division to offer funding to support programs for low-

income Lakewood High School students.

Santander Bank entered into an agreement with Albright College for its

2014 Contracts/Agreements Santander Universities division to offer funding to support the Santander Study

Abroad Awards Fund.

Santander Bank entered into an agreement with Borough of Manhattan

Community College of The City University of New York for its Santander

2014 Contracts/Agreements

Universities division to provide scholarships to low- to moderate-income

students.

The company's subsidiary, Santander Bank was named 2014 Best Bank in

2014 Corporate Awards

Western Europe, Spain, Mexico and Argentina by Euromoney Magazine.

The company‟s subsidiary, SCUSA, was listed on the New York Stock

2014 Stock Listings/IPO

Exchange.

2014 Corporate Changes/Expansions Santander Bank established three new branches in Philadelphia.

Sovereign Bank introduced Sovereign Bank Mobile App, a new consumer

2013 New Products/Services banking application to offer mobile banking services to its customers on Apple

and Android devices.

2013 Corporate Changes/Expansions Soveriegn Bank, N.A. changed its name to Santander Bank, N.A.

2013 New Products/Services Santander Bank introduced checking account.

___________________________________________________________________________________________

Santander Holdings USA, Inc. - SWOT Profile Page 17

Santander Holdings USA, Inc.

__________________________________________________________________________________________

Table 2: Santander Holdings USA, Inc. - History

Year Event type Description

Santander Bank entered into a three-year agreement with Wheelock College for

2013 Contracts/Agreements

its Santander Universities division.

Santander Bank was awarded with Best in Checking award for its extra20

2013 Corporate Awards checking program by consumer finance blog, NerdWallet, in its 2013 Best in

Banking roundup.

Sovereign-Santander entered into a multi-year agreement with the New England

2012 Contracts/Agreements Revolution making Sovereign-Santander the Official Bank of the New England

Revolution.

2012 Corporate Changes/Expansions Sovereign Bank, N.A. opened a branch at Monaco Towers in Jersey City.

Sovereign Bank, N.A. partnered with LevelUp to launch LevelUp‟s First in Mobile

Wallet promotion. This new promotion rewards customers who link their

2012 New Products/Services Sovereign Debit MasterCard to their LevelUp account. LevelUp's promotion

allows Sovereign to directly incentivize consumers to use their Sovereign Debit

MasterCard.

Sovereign Bank, N.A. launched Sphere, the new Sovereign Visa Signature

2012 New Products/Services Credit Card. Sphere was Sovereign‟s first credit card since becoming a part of

Santander and was branded with the Sovereign/Santander dual logo.

The company‟s subsidiary, Sovereign Bank entered into three year agreement

2011 Contracts/Agreements with the Massachusetts Maritime Academy to expand the academy‟s

international outreach initiatives.

The company entered into a partnership agreement with Columbia University

2011 Contracts/Agreements

and Yale University to provide financial support to the two universities.

The company‟s subsidiary, Sovereign Bank introduced new debit card products

2011 New Products/Services

through an agreement with MasterCard.