Académique Documents

Professionnel Documents

Culture Documents

P5 4

Transféré par

ramaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

P5 4

Transféré par

ramaDroits d'auteur :

Formats disponibles

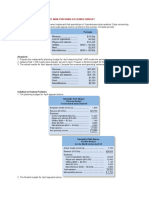

P5-4

Columbus Company

Cost of Goods Sold Statement

October 31, 20..

Direct Materials

Materials and supplies, October 01 40,700

Purchase 24,800

Materials available for use 65,500

less : Materials and supplies, October 31 31,750

Supplies used 3,950

Direct Materials Used 29,800

Direct Labor 18,600

Applied Factory Overhead 27,450

Manufacturing Cost 75,850

Add : Work In Process, october 01 4,070

79,920

Less : Work In Process, october 31 4,440

Cost of Goods Manufacture 75,480

Add : finished Goods, October 01 9,800

85,280

Less : finished Goods, October 31 9,250

Cost of Goods Sold 76,030

Columbus Company

Income Statement

October 31, 20..

Sales 144,900

Less : Sales Return and allowance 1,300

Net Sales 143,600

Cost Of Goods Sold 76,030

Gross Profit 67,570

Operating Expense

Marketing Expense 25,050

Depreciation - Building 30

Depreciation -office equipment 16 25,096

Administrative Expense 19,700

Depreciation - Building 20

Depreciation -office equipment 24 19,744

Income From Operating 22,730

Amount of overapplied or underapplied factory overhead :

Actual factory overhead :

Factory overhead 20,100

Indirect materials 3,950

Depreciation—building 150

Depreciation—machinery and equipment 800

Indirect labor 4,400

29,400

Applied factory overhead 27,450

Underapplied factory overhead 1,950

Vous aimerez peut-être aussi

- Activity Preparing Journal EntriesDocument5 pagesActivity Preparing Journal EntriesJomir Kimberly DomingoPas encore d'évaluation

- Designer Rags Makes Evening Dresses The Following Information WDocument1 pageDesigner Rags Makes Evening Dresses The Following Information WAmit PandeyPas encore d'évaluation

- Problem 5-2, 5-5Document5 pagesProblem 5-2, 5-5Indra Budi SetiyawanPas encore d'évaluation

- 1 Intermediate Accounting IFRS 3rd Edition-554-569Document16 pages1 Intermediate Accounting IFRS 3rd Edition-554-569Khofifah SalmahPas encore d'évaluation

- Homework1 E3 10Document4 pagesHomework1 E3 10Jade NguyenPas encore d'évaluation

- 1-3-Ulo D ExerciseDocument5 pages1-3-Ulo D ExerciseJames Darwin TehPas encore d'évaluation

- Intermediate Accounting SolmanDocument14 pagesIntermediate Accounting SolmanAlarich CatayocPas encore d'évaluation

- Dissolution of Partnership Firm Accounting ProblemsDocument5 pagesDissolution of Partnership Firm Accounting ProblemsPrageeth Roshan WeerathungaPas encore d'évaluation

- Basic Concepts and Job Order Cost CycleDocument15 pagesBasic Concepts and Job Order Cost CycleGlaiza Lipana Pingol100% (2)

- Jhonah Joyce B Lumba ACC111(962) VAT Activity ReportDocument1 pageJhonah Joyce B Lumba ACC111(962) VAT Activity ReportJhoyce LumbaPas encore d'évaluation

- Foxwood Company Data For 2014Document2 pagesFoxwood Company Data For 2014Vermuda VermudaPas encore d'évaluation

- Chapter 13 CASH FLOWDocument2 pagesChapter 13 CASH FLOWKezia N. ApriliaPas encore d'évaluation

- Port Folio Number - 2007-MASDocument8 pagesPort Folio Number - 2007-MASAndreaPas encore d'évaluation

- Review Problem 1: Variance Analysis Using A Flexible Budget: RequiredDocument12 pagesReview Problem 1: Variance Analysis Using A Flexible Budget: RequiredGraieszian LyraPas encore d'évaluation

- Chapter 2 Exercises SolutionsDocument13 pagesChapter 2 Exercises Solutionsdeniz turkbayragi100% (1)

- Exercises: Managerial Accounting Concepts and PrinciplesDocument8 pagesExercises: Managerial Accounting Concepts and PrinciplesJosh MorrisPas encore d'évaluation

- P7-11 (Income Effects of Receivables Transactions) Sandburg Company Requires Additional Cash For ItsDocument3 pagesP7-11 (Income Effects of Receivables Transactions) Sandburg Company Requires Additional Cash For ItsDella Putri Reba UtamyPas encore d'évaluation

- CHAPTER 4 Assignment Answer KeyDocument30 pagesCHAPTER 4 Assignment Answer KeyCatherine OrdoPas encore d'évaluation

- D. Depends On The Significance of The Amount.: Cost Accounting Comprehensive Examination 1Document14 pagesD. Depends On The Significance of The Amount.: Cost Accounting Comprehensive Examination 1Ferb CruzadaPas encore d'évaluation

- Hercules Poirot WorksheetDocument6 pagesHercules Poirot WorksheetvaldaPas encore d'évaluation

- Pandora Acquires Sophocles CompanyDocument4 pagesPandora Acquires Sophocles CompanyAstria Arha DillaPas encore d'évaluation

- Understanding Manufacturing Cost ConceptsDocument3 pagesUnderstanding Manufacturing Cost ConceptsAndreiPas encore d'évaluation

- CH 06Document4 pagesCH 06vivien100% (1)

- Problems: 2-58. Cost ConceptsDocument16 pagesProblems: 2-58. Cost ConceptsChristy HabelPas encore d'évaluation

- CH 6 (WWW - Jamaa Bzu - Com)Document8 pagesCH 6 (WWW - Jamaa Bzu - Com)Bayan Sharif100% (2)

- True or False Costing QuizDocument5 pagesTrue or False Costing Quizretchiel love calinogPas encore d'évaluation

- Equivalent Units Weighted Average MethodDocument4 pagesEquivalent Units Weighted Average MethodLydia SamosirPas encore d'évaluation

- Exercise 5-25 Activity Levels and Cost Drivers: RequiredDocument20 pagesExercise 5-25 Activity Levels and Cost Drivers: RequiredDilsa JainPas encore d'évaluation

- Week 4 Practice Questions 1Document17 pagesWeek 4 Practice Questions 1Gabriel Abdillah100% (1)

- Chapter 4 - Inventories Problems ExplainedDocument11 pagesChapter 4 - Inventories Problems ExplainedElaineSmithPas encore d'évaluation

- P1-1 P1-2 Jaja Bearings Company PPG CompanyDocument4 pagesP1-1 P1-2 Jaja Bearings Company PPG CompanyPrincesipiePas encore d'évaluation

- Module 1 ExamDocument4 pagesModule 1 ExamTabatha Cyphers100% (2)

- Chapter 23 HomeworkDocument10 pagesChapter 23 HomeworkTracy LeePas encore d'évaluation

- 1-2 - Assignment - Current and Contingent LiabilitiesDocument6 pages1-2 - Assignment - Current and Contingent LiabilitiesOliviane Theodora Wenno0% (1)

- Chapter 15 Amended With AnswersDocument6 pagesChapter 15 Amended With AnswersIbn FaridPas encore d'évaluation

- Funds and Other Investment ActivitiesDocument7 pagesFunds and Other Investment Activitiesjoong wanPas encore d'évaluation

- HW 2. Problems Cash and Cash Equivalents - StudentDocument2 pagesHW 2. Problems Cash and Cash Equivalents - StudentAngelo TipaneroPas encore d'évaluation

- Quizzer Acctg2Document1 pageQuizzer Acctg2elminvaldez0% (1)

- Chapter 10 Intermediate Final RevisionDocument8 pagesChapter 10 Intermediate Final Revisionmagdy kamelPas encore d'évaluation

- 25Document11 pages25Zaheer Ahmed SwatiPas encore d'évaluation

- Pre-Test 5Document3 pagesPre-Test 5BLACKPINKLisaRoseJisooJenniePas encore d'évaluation

- P2 09Document8 pagesP2 09Mark Levi CorpuzPas encore d'évaluation

- AFAR 2 Online Class - Ch. 13Document26 pagesAFAR 2 Online Class - Ch. 13Von Andrei MedinaPas encore d'évaluation

- Hite Company Has Developed The Following Standard Costs For Its Product For 2009Document6 pagesHite Company Has Developed The Following Standard Costs For Its Product For 2009Ghaill CruzPas encore d'évaluation

- Nama Cornelius Cakra Adiwijaya NIM 041911333209Document3 pagesNama Cornelius Cakra Adiwijaya NIM 041911333209Cornelius cakraPas encore d'évaluation

- QUIZ3Document6 pagesQUIZ3Jillian Mae Sobrino BelegorioPas encore d'évaluation

- Role of Accountants & Cost Accounting Concepts ExplainedDocument355 pagesRole of Accountants & Cost Accounting Concepts ExplainedNah HamzaPas encore d'évaluation

- Reviewer Midterm Accounting Exercises in Financial and Accouting ReportingDocument20 pagesReviewer Midterm Accounting Exercises in Financial and Accouting ReportingFiel Marie SateraPas encore d'évaluation

- Quiz 1: Intermediate Accounting Part 4 Multiple Choice QuestionsDocument3 pagesQuiz 1: Intermediate Accounting Part 4 Multiple Choice QuestionsPaula BautistaPas encore d'évaluation

- Master Budget Exercises for Planning and ControlDocument5 pagesMaster Budget Exercises for Planning and ControlLuigi Enderez BalucanPas encore d'évaluation

- Problem 6 16 2Document2 pagesProblem 6 16 2KC Hershey Lor100% (1)

- MAKSI - UI - LatihanKuis - Okt 2019Document8 pagesMAKSI - UI - LatihanKuis - Okt 2019aziezoel100% (1)

- Asset Acquisition Costs and Capitalized ValuesDocument8 pagesAsset Acquisition Costs and Capitalized ValuesPeter Elijah AntonioPas encore d'évaluation

- Chapter 17Document9 pagesChapter 17Maketh.ManPas encore d'évaluation

- Department of Accountancy: Inventory EstimationDocument2 pagesDepartment of Accountancy: Inventory EstimationAiza S. Maca-umbosPas encore d'évaluation

- INACC Problem 2-3Document3 pagesINACC Problem 2-3Luigi Enderez BalucanPas encore d'évaluation

- Absorption Costing Reconciliation StatementDocument4 pagesAbsorption Costing Reconciliation Statementali_sattar15Pas encore d'évaluation

- Drill12 Drill13 Manufacturing BusinesDocument6 pagesDrill12 Drill13 Manufacturing BusinesAngelo FelizardoPas encore d'évaluation

- Fma Assignment 3Document5 pagesFma Assignment 3Abdul AhmedPas encore d'évaluation

- PDF Learning Journal Manajemen Asn CompressDocument2 pagesPDF Learning Journal Manajemen Asn CompressramaPas encore d'évaluation

- 5a Comparative AnalyisDocument3 pages5a Comparative AnalyisramaPas encore d'évaluation

- 5a Comparative AnalyisDocument2 pages5a Comparative AnalyisramaPas encore d'évaluation

- Kunci Sukses Memahami Keterangan Waktu Dalam Bahasa Inggris (TENSES) Dengan Mudah - IBI PDFDocument1 pageKunci Sukses Memahami Keterangan Waktu Dalam Bahasa Inggris (TENSES) Dengan Mudah - IBI PDFramaPas encore d'évaluation

- Kunci Sukses Memahami Keterangan Waktu Dalam Bahasa Inggris (TENSES) Dengan Mudah - IBI PDFDocument1 pageKunci Sukses Memahami Keterangan Waktu Dalam Bahasa Inggris (TENSES) Dengan Mudah - IBI PDFramaPas encore d'évaluation

- Resume TSDDocument9 pagesResume TSDramaPas encore d'évaluation

- Nama: Rama Tri Sakria (27) Kelas: 3-31 D III AkuntansiDocument3 pagesNama: Rama Tri Sakria (27) Kelas: 3-31 D III AkuntansiramaPas encore d'évaluation

- P5-4, 6 Dan 8Document18 pagesP5-4, 6 Dan 8ramaPas encore d'évaluation

- P5-6 Dan P5-8Document13 pagesP5-6 Dan P5-8rama100% (1)

- P5-2 Dan 3Document5 pagesP5-2 Dan 3ramaPas encore d'évaluation

- P5-4, 6 Dan 8Document18 pagesP5-4, 6 Dan 8ramaPas encore d'évaluation

- Juarez Inc Job Order Cost Sheets (1) March 1 Job 621 Job 622Document3 pagesJuarez Inc Job Order Cost Sheets (1) March 1 Job 621 Job 622ramaPas encore d'évaluation

- E2 6Document1 pageE2 6ramaPas encore d'évaluation

- App eDocument14 pagesApp emorry123Pas encore d'évaluation

- Pas 18 RevenueDocument1 pagePas 18 RevenuerandyPas encore d'évaluation

- Break-Even Analysis Administración de la producciónDocument3 pagesBreak-Even Analysis Administración de la producciónFryda GarciaPas encore d'évaluation

- True/False: Variable Costing: A Tool For ManagementDocument174 pagesTrue/False: Variable Costing: A Tool For ManagementKiannePas encore d'évaluation

- Nama: Destria Ayu Atikah NPK: 11190000098 Tugas: Workshop Akuntansi Keuangan Lanjutan (TM 4) Abesn: 13Document3 pagesNama: Destria Ayu Atikah NPK: 11190000098 Tugas: Workshop Akuntansi Keuangan Lanjutan (TM 4) Abesn: 13destria ayu atikahPas encore d'évaluation

- Assignment Help Guide SheetDocument11 pagesAssignment Help Guide SheetShakil KhanPas encore d'évaluation

- Wa0045.Document7 pagesWa0045.Pieck AckermannPas encore d'évaluation

- Accounts Gibson Keller Debit CreditDocument4 pagesAccounts Gibson Keller Debit CreditMcKenzie WPas encore d'évaluation

- 3.6 Solutions To Classwork Questions On Working CapitalDocument42 pages3.6 Solutions To Classwork Questions On Working CapitalA001AADITYA MALIKPas encore d'évaluation

- Holding Co. QuestionsDocument77 pagesHolding Co. Questionsअक्षय गोयलPas encore d'évaluation

- 1915103-Accounting For ManagementDocument22 pages1915103-Accounting For Managementmercy santhiyaguPas encore d'évaluation

- Accounting Hawk - MADocument21 pagesAccounting Hawk - MAClaire BarbaPas encore d'évaluation

- CHAPTER 8 Analyzing Financial Statements and Creating ProjectionsDocument13 pagesCHAPTER 8 Analyzing Financial Statements and Creating Projectionscharrygaborno100% (1)

- Tangy Candy Company premium plan journal entries and financial statement analysisDocument4 pagesTangy Candy Company premium plan journal entries and financial statement analysisAlexis KingPas encore d'évaluation

- Introduction Genting Malaysia BerhadDocument55 pagesIntroduction Genting Malaysia BerhadSharonz MuthuveeranPas encore d'évaluation

- Company Overview - Davis IndustriesDocument4 pagesCompany Overview - Davis IndustriesdeepikaPas encore d'évaluation

- Group Project Financial Ratios AnalysisDocument9 pagesGroup Project Financial Ratios AnalysisWan Amir Islam100% (1)

- BHELDocument43 pagesBHELsayan GuhaPas encore d'évaluation

- StalasaDocument23 pagesStalasajessa mae zerdaPas encore d'évaluation

- trắc nghiệm part 2Document39 pagestrắc nghiệm part 2HankhnilPas encore d'évaluation

- Since 1977: Inventory CostsDocument8 pagesSince 1977: Inventory CostsCV CVPas encore d'évaluation

- FARAP-4403 (Inventories)Document14 pagesFARAP-4403 (Inventories)Dizon Ropalito P.Pas encore d'évaluation

- Presentation On Recycling of PlasticDocument22 pagesPresentation On Recycling of PlasticTushar YadavPas encore d'évaluation

- UrcDocument15 pagesUrcKarlo PradoPas encore d'évaluation

- ABM Module 4Document6 pagesABM Module 4Xyxy LofrancoPas encore d'évaluation

- Finacc PolymediaDocument5 pagesFinacc PolymediaFrancisco MarvinPas encore d'évaluation

- 256 - MCO-5 - ENG D18 - CompressedDocument3 pages256 - MCO-5 - ENG D18 - CompressedTushar SharmaPas encore d'évaluation

- AICPA Newly Released FAR Simulations Task 543 - 01Document8 pagesAICPA Newly Released FAR Simulations Task 543 - 01jklein2588100% (1)

- Revenue and Profit Maximization of A Competitive Firm: Module - 8Document12 pagesRevenue and Profit Maximization of A Competitive Firm: Module - 8Debarshi GhoshPas encore d'évaluation

- Prepare Adjusting EntriesDocument21 pagesPrepare Adjusting EntriesBethylGo100% (1)

- IFRS Starter KitDocument20 pagesIFRS Starter Kitmdkumarz4526Pas encore d'évaluation