Académique Documents

Professionnel Documents

Culture Documents

Rbceiv, Ed: Iii. Effectivity: F

Transféré par

James Salviejo PinedaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Rbceiv, Ed: Iii. Effectivity: F

Transféré par

James Salviejo PinedaDroits d'auteur :

Formats disponibles

"lnqr. 'bn,l;,,:-.

r

rtrcci}$)'g

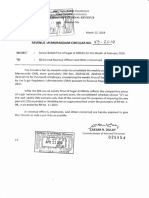

REPUBLIC OF THE PHILIPPINES

3: lg

P'u

_{

DEPARTMENT OF FiNANCE

JAN o82ot8LlhEf.

BUREAU OF INTERNAT REVENUE

Quezon City RBCEIV,Ed

3}fP1q

December 22,2017

REVENUE MEMoRANDUM oRDER No. l- l0l8

SUBJECT : Creation of Alphanumeric Tax Code (ATC) for Sweetened Beverages

TO : All Collection Agents, Revenue District Officers and Other Internal Revenue

Officers Concerned

I. OBJECTIVE:

To facilitate the proper identification of tax collection from Sweetened Beverages pursuant to

Republic Act No. 10963, othenryise known as Tax Reform for Acceleration and lnclusion (TRAIN), and in

ccnnecrion witn the Bureau's Tax Forms Enhancement Program, the followinE ATCs are nereb;, created:

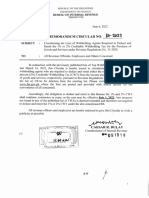

AT€ :Description ''f,ax:Rate :Legal:Basis :BIR,Form

Tax on Sweetened Beverages Per liter RA No.10963 2200-s/0605

1. Using purely caloric and non-caioric

sweetenei-

XBOl O a. Sweetened Juice Drinks P6.00

XBO20 o. Sweetened Tea P5.00

XBO3O :, Carbonated Beverages P6.00

XBO4O i. Flavoreci Water P6.00

XBO5O e. Energy and Sports Drinks P6.00

N DUOU f. Powdered Drinks not classifieci as DA AN

Milk, Juice, Tea and Coffee

XBOTO g. Cereal and Grain Beverages P6.00

XBOSO h. Other Non-alcoholic Beverages P6.00

that contain added Sugar

XBO9O Using purely high fructose corn P12.00

syrup

XBl OO Using purely coconut sap sugar and Exempt

purely Stevicl Glycosides

IL REPEALING CLAUSE:

This Revenue Memorandum Order (RMO) revises portions of all other issuances inconsistent

herewith.

IIi. EFFECTIVITY: f _- f ',>E

This RMC shali take effeci immediately'.

/\E,4-'/ /

CAESAR R. DULAY

Commissioner of internal Revenue

Dfl

u-) s 12 4 6'0

Vous aimerez peut-être aussi

- Preferential TaxationDocument7 pagesPreferential TaxationJane100% (1)

- Tax Clearance BNDocument1 pageTax Clearance BNNora Goguanco PamplonaPas encore d'évaluation

- SCI 121 Disaster Readiness and Risk ReductionDocument163 pagesSCI 121 Disaster Readiness and Risk ReductionLEONIEVEVE L LIMBAGAPas encore d'évaluation

- Scientific American - Febuary 2016Document84 pagesScientific American - Febuary 2016Vu NguyenPas encore d'évaluation

- RR 11 2018 - Annex C - Withholding Agent Sworn DeclarationDocument1 pageRR 11 2018 - Annex C - Withholding Agent Sworn DeclarationJames Salviejo Pineda100% (1)

- Cost and Financial Accounting in Forestry: A Practical ManualD'EverandCost and Financial Accounting in Forestry: A Practical ManualPas encore d'évaluation

- 2019 Sample Articles of Incorporation Natural PersonDocument4 pages2019 Sample Articles of Incorporation Natural PersonMykey MoranPas encore d'évaluation

- Violation of Due ProcessDocument14 pagesViolation of Due ProcessJames Salviejo PinedaPas encore d'évaluation

- AFAR Problems PrelimDocument11 pagesAFAR Problems PrelimLian Garl100% (8)

- SWOT Analysis Microtel by WyndhamDocument10 pagesSWOT Analysis Microtel by WyndhamAllyza Krizchelle Rosales BukidPas encore d'évaluation

- H16 Preferential Taxation PDFDocument7 pagesH16 Preferential Taxation PDFJoshlyne MijaresPas encore d'évaluation

- DCF ModelDocument14 pagesDCF ModelTera BytePas encore d'évaluation

- Carpio V ValmonteDocument2 pagesCarpio V ValmonteErvin John Reyes100% (2)

- Percentage Taxation2Document5 pagesPercentage Taxation2Ahleeya Ramos100% (3)

- Ra 10884Document4 pagesRa 10884Kevin BonaobraPas encore d'évaluation

- Annex B-1 RR 11-2018 Sworn Statement of Declaration of Gross Sales and ReceiptsDocument1 pageAnnex B-1 RR 11-2018 Sworn Statement of Declaration of Gross Sales and ReceiptsEliza Corpuz Gadon89% (19)

- Agile Marketing Reference CardDocument2 pagesAgile Marketing Reference CardDavid BriggsPas encore d'évaluation

- RR No. 8-2018Document27 pagesRR No. 8-2018deltsen100% (1)

- PCU CalculationDocument2 pagesPCU CalculationMidhun Joseph0% (1)

- Revised Rules of CTADocument46 pagesRevised Rules of CTAjason_escuderoPas encore d'évaluation

- RMO No.16-2018Document1 pageRMO No.16-2018Cliff DaquioagPas encore d'évaluation

- RMC No 2-2016Document1 pageRMC No 2-2016Lianda RomePas encore d'évaluation

- RMC No. 117-2020-MergedDocument15 pagesRMC No. 117-2020-Mergednathalie velasquezPas encore d'évaluation

- RMC No. 131-2020Document1 pageRMC No. 131-2020nathalie velasquezPas encore d'évaluation

- RMC No. 27-2022Document1 pageRMC No. 27-2022Shiela Marie MaraonPas encore d'évaluation

- RMC 66-2021 Announces The Availability of BIR Form Nos. 1702Q January 2018 (ENCS) in The eFPS and 1702Qv2008C in The eBIRFormsDocument2 pagesRMC 66-2021 Announces The Availability of BIR Form Nos. 1702Q January 2018 (ENCS) in The eFPS and 1702Qv2008C in The eBIRFormsMiming BudoyPas encore d'évaluation

- RMC No. 134-2019Document1 pageRMC No. 134-2019cris gerard trinidadPas encore d'évaluation

- BIR RMC No. 61-2020Document1 pageBIR RMC No. 61-2020pollyPas encore d'évaluation

- RMO No.5-2019Document2 pagesRMO No.5-2019Jhenny Ann P. SalemPas encore d'évaluation

- Rmo No.47-2019Document2 pagesRmo No.47-2019Sid CandelariaPas encore d'évaluation

- RMC No. 88-2021Document1 pageRMC No. 88-2021Jogenn Karla GagarinPas encore d'évaluation

- Irr Lo: Revenue Memorandum YD 8Document1 pageIrr Lo: Revenue Memorandum YD 8Larry Tobias Jr.Pas encore d'évaluation

- RMC No 19-2019 PDFDocument2 pagesRMC No 19-2019 PDFRobea Marie GaspayPas encore d'évaluation

- Tw. - NSRZ: 1ffi - $&Ffi.'Ri A.T4Document1 pageTw. - NSRZ: 1ffi - $&Ffi.'Ri A.T4Lenin Rey PolonPas encore d'évaluation

- RMC No. 7-2021Document1 pageRMC No. 7-2021nathalie velasquezPas encore d'évaluation

- Zojd: A Key Cy Revenue EmployeesDocument1 pageZojd: A Key Cy Revenue EmployeesCliff DaquioagPas encore d'évaluation

- Internal: LT Of' in The OfDocument1 pageInternal: LT Of' in The Oflantern san juanPas encore d'évaluation

- RMC 2020 No. 16 Availability of Oflline eBIR Forms Version 7.6Document2 pagesRMC 2020 No. 16 Availability of Oflline eBIR Forms Version 7.6Bien Bowie A. CortezPas encore d'évaluation

- BIR RMO No. 6-2021Document5 pagesBIR RMO No. 6-2021Earl PatrickPas encore d'évaluation

- Revenue Ctrcular: MemorandumDocument12 pagesRevenue Ctrcular: Memorandumnathalie velasquezPas encore d'évaluation

- RMC No. 46-2022Document1 pageRMC No. 46-2022Reena Rose BernabePas encore d'évaluation

- RMC 2020 No. 3 Availability of The Revised BIR Form 1702Q PDFDocument2 pagesRMC 2020 No. 3 Availability of The Revised BIR Form 1702Q PDFBien Bowie A. CortezPas encore d'évaluation

- RR 9-2018 Tax On StockDocument2 pagesRR 9-2018 Tax On StockRomer LesondatoPas encore d'évaluation

- RMC No. 8-2022Document1 pageRMC No. 8-2022Shiela Marie MaraonPas encore d'évaluation

- RMC No. 92-102-2020Document5 pagesRMC No. 92-102-2020nathalie velasquezPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- RMC No. 112-2020Document1 pageRMC No. 112-2020Tina Reyes-BattadPas encore d'évaluation

- RMC No 58-2019Document1 pageRMC No 58-2019lara.zestoPas encore d'évaluation

- OM No. 2018-01-01Document2 pagesOM No. 2018-01-01mark liezerPas encore d'évaluation

- Lirnu Ilfilicomqquret?irywl: 1ffao''-'! ) RDocument1 pageLirnu Ilfilicomqquret?irywl: 1ffao''-'! ) RAngelica AllanicPas encore d'évaluation

- RMC No. 28-2019Document2 pagesRMC No. 28-2019AmberlyPas encore d'évaluation

- cmc-131-2021-FDA Updates and List of VAT-Exempt ProductsDocument50 pagescmc-131-2021-FDA Updates and List of VAT-Exempt ProductsCHUBZ0902Pas encore d'évaluation

- RMC 9-2018Document1 pageRMC 9-2018chris mendoPas encore d'évaluation

- RMC 9-2018 - Mandatory Requirements For All Economic Zone Developers or Operators PEZA For The Processing of ECARDocument1 pageRMC 9-2018 - Mandatory Requirements For All Economic Zone Developers or Operators PEZA For The Processing of ECARzooeyPas encore d'évaluation

- flg-20 ?RT: Republic Philippines Department of Finance InternalDocument1 pageflg-20 ?RT: Republic Philippines Department of Finance InternalJayvee OlayresPas encore d'évaluation

- RMC No 72-2015Document1 pageRMC No 72-2015GooglePas encore d'évaluation

- RMC No. 124-2019Document1 pageRMC No. 124-2019Melody Lim DayagPas encore d'évaluation

- LCN June 2020Document26 pagesLCN June 2020Tanvir Ahmad SheikhPas encore d'évaluation

- RMO No. 64-2016 PDFDocument1 pageRMO No. 64-2016 PDFGabriel EdizaPas encore d'évaluation

- Img 20230216 0008Document1 pageImg 20230216 0008Christina RodriguezPas encore d'évaluation

- Atp Sample PDFDocument1 pageAtp Sample PDFejay nielPas encore d'évaluation

- RMC No. 118-2021-2Document1 pageRMC No. 118-2021-2AbbeyPas encore d'évaluation

- RMC No. 80-2022Document1 pageRMC No. 80-2022S&R Tax and Accounting ServicesPas encore d'évaluation

- Tax Tor In: Return MineralDocument1 pageTax Tor In: Return MineralLhance BabacPas encore d'évaluation

- Fifry: Funds AvaiiiibleDocument3 pagesFifry: Funds AvaiiiibleRabindranath TagorePas encore d'évaluation

- RMC No 73-2015Document1 pageRMC No 73-2015GooglePas encore d'évaluation

- RR No. 9-2016 PDFDocument1 pageRR No. 9-2016 PDFJames SusukiPas encore d'évaluation

- RRR RRR: EiiterpnisesDocument31 pagesRRR RRR: EiiterpnisesJames SusukiPas encore d'évaluation

- Bank B No. 16-30Document1 pageBank B No. 16-30Wills TolingPas encore d'évaluation

- RE ON If. : - Ilipinas Kaoa W .. NanalapiDocument3 pagesRE ON If. : - Ilipinas Kaoa W .. NanalapiKaren Colada LecetivoPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Dilg Memorandum Circular No. 2024-041Document4 pagesDilg Memorandum Circular No. 2024-041Bienvenido TamondongPas encore d'évaluation

- RMO No. 18-2021Document4 pagesRMO No. 18-2021Earl PatrickPas encore d'évaluation

- JasniDocument5 pagesJasniHermanPas encore d'évaluation

- SPT SeptemberDocument1 pageSPT SeptemberkaseT KusutPas encore d'évaluation

- 2019MCNo07 1 PDFDocument19 pages2019MCNo07 1 PDFJames Salviejo PinedaPas encore d'évaluation

- RR No 1-2019 PDFDocument3 pagesRR No 1-2019 PDFJames Salviejo PinedaPas encore d'évaluation

- RR 11 2018 - Annex C - Withholding Agent Sworn DeclarationDocument1 pageRR 11 2018 - Annex C - Withholding Agent Sworn DeclarationJames Salviejo PinedaPas encore d'évaluation

- RR No. 4-2019Document7 pagesRR No. 4-2019donsPas encore d'évaluation

- Case Finals CorpoDocument4 pagesCase Finals CorpoAlyssa GomezPas encore d'évaluation

- Case Finals CorpoDocument4 pagesCase Finals CorpoAlyssa GomezPas encore d'évaluation

- Internal Revenue: Republic of Pfiilippines DepartmentDocument1 pageInternal Revenue: Republic of Pfiilippines DepartmentJohn RoePas encore d'évaluation

- Briefer - RA 10884 (Balanced Housing Program Amendments Act)Document2 pagesBriefer - RA 10884 (Balanced Housing Program Amendments Act)Maru PabloPas encore d'évaluation

- Annex C - RR 4-2019Document1 pageAnnex C - RR 4-2019James Salviejo PinedaPas encore d'évaluation

- RMC No 54-2014Document3 pagesRMC No 54-2014lktlawPas encore d'évaluation

- Revenue Memorandum Circular No. 24-2018 Subject:: Bureau of Internal RevenueDocument6 pagesRevenue Memorandum Circular No. 24-2018 Subject:: Bureau of Internal RevenuePaul GeorgePas encore d'évaluation

- Review of Documentary Stamp TaxDocument25 pagesReview of Documentary Stamp TaxJames Salviejo PinedaPas encore d'évaluation

- RMC 54-2014 - VAT Refund Clarification Under S112 NIRC Full TextDocument1 pageRMC 54-2014 - VAT Refund Clarification Under S112 NIRC Full TextJames Salviejo PinedaPas encore d'évaluation

- Cpdprogram Realestate 122817Document177 pagesCpdprogram Realestate 122817PRC BoardPas encore d'évaluation

- CTA Circular No 01-2013Document2 pagesCTA Circular No 01-2013James Salviejo PinedaPas encore d'évaluation

- CTA Circular No 01-2013Document5 pagesCTA Circular No 01-2013phoebelazPas encore d'évaluation

- 2016 CITIZENS CHARTER As of 20161117 PDFDocument349 pages2016 CITIZENS CHARTER As of 20161117 PDFJames Salviejo PinedaPas encore d'évaluation

- RaDocument16 pagesRaJohn RoePas encore d'évaluation

- RR No 21-2018 PDFDocument3 pagesRR No 21-2018 PDFJames Salviejo PinedaPas encore d'évaluation

- RMO No.26-2018Document4 pagesRMO No.26-2018James Salviejo PinedaPas encore d'évaluation

- BB 2015-01Document2 pagesBB 2015-01James Salviejo PinedaPas encore d'évaluation

- RMC 12-2017Document1 pageRMC 12-2017James Salviejo PinedaPas encore d'évaluation

- 50 Hotelierstalk MinDocument16 pages50 Hotelierstalk MinPadma SanthoshPas encore d'évaluation

- DataBase Management Systems SlidesDocument64 pagesDataBase Management Systems SlidesMukhesh InturiPas encore d'évaluation

- 3.1-7 Printer Deployment - Copy (Full Permission)Document18 pages3.1-7 Printer Deployment - Copy (Full Permission)Hanzel NietesPas encore d'évaluation

- Add New Question (Download - PHP? SC Mecon&id 50911)Document9 pagesAdd New Question (Download - PHP? SC Mecon&id 50911)AnbarasanPas encore d'évaluation

- T53 L 13 Turboshaft EngineDocument2 pagesT53 L 13 Turboshaft EngineEagle1968Pas encore d'évaluation

- CRITERIA-GuideRail & Median BarriersDocument15 pagesCRITERIA-GuideRail & Median BarriersMartbenPas encore d'évaluation

- PRI SSC TutorialDocument44 pagesPRI SSC TutorialSantosh NarayanPas encore d'évaluation

- Design of Accurate Steering Gear MechanismDocument12 pagesDesign of Accurate Steering Gear Mechanismtarik RymPas encore d'évaluation

- Project Report EP-1Document9 pagesProject Report EP-1Nikita NawlePas encore d'évaluation

- Step Recovery DiodesDocument3 pagesStep Recovery DiodesfahkingmoronPas encore d'évaluation

- Nirma - Marketing PresentationDocument22 pagesNirma - Marketing PresentationJayRavasa100% (2)

- Indian Handmade Carpets EnglishDocument16 pagesIndian Handmade Carpets EnglishVasim AnsariPas encore d'évaluation

- VKC Group of Companies Industry ProfileDocument5 pagesVKC Group of Companies Industry ProfilePavithraPramodPas encore d'évaluation

- 032017Document107 pages032017Aditya MakwanaPas encore d'évaluation

- LS Series Hand Crimping ToolsDocument4 pagesLS Series Hand Crimping ToolsbaolifengPas encore d'évaluation

- CERES News Digest - Week 11, Vol.4, March 31-April 4Document6 pagesCERES News Digest - Week 11, Vol.4, March 31-April 4Center for Eurasian, Russian and East European StudiesPas encore d'évaluation

- 4 FAR EAST BANK & TRUST COMPANY V DIAZ REALTY INCDocument3 pages4 FAR EAST BANK & TRUST COMPANY V DIAZ REALTY INCDaniellePas encore d'évaluation

- Non-Hazardous Areas Adjustable Pressure Switch: 6900P - Piston SensorDocument2 pagesNon-Hazardous Areas Adjustable Pressure Switch: 6900P - Piston SensorDiana ArredondoPas encore d'évaluation

- Laser Security System For HomeDocument19 pagesLaser Security System For HomeSelvakumar SubramaniPas encore d'évaluation

- Guglielmo 2000 DiapirosDocument14 pagesGuglielmo 2000 DiapirosJuan Carlos Caicedo AndradePas encore d'évaluation

- ShinojDocument4 pagesShinojArish BallanaPas encore d'évaluation

- Joseph J. Fiumara v. Fireman's Fund Insurance Companies, 746 F.2d 87, 1st Cir. (1984)Document7 pagesJoseph J. Fiumara v. Fireman's Fund Insurance Companies, 746 F.2d 87, 1st Cir. (1984)Scribd Government DocsPas encore d'évaluation